HCL Technologies (HCLTEC)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Work-Life Balance a Strategic Human Resource Policies and Practices Followed by Indian Organizations

IRA-International Journal of Management & Social Sciences ISSN 2455-2267; Vol.05, Issue 03 (2016) Pg. no. 427-435 Institute of Research Advances http://research-advances.org/index.php/RAJMSS Work-life Balance a Strategic Human Resource Policies and Practices followed by Indian Organizations Mrs. Pratibha Barik1, Dr. (Mrs.) B.B. Pandey2 1Research Scholar, Department of Management Studies, Guru Ghasidas Vishwavidyalaya, Koni (Bilaspur), India. 2Assistant Professor, Department of Management Studies, Guru Ghasidas Vishwavidyalaya, Koni (Bilaspur), India. Type of Review: Peer Reviewed. DOI: http://dx.doi.org/10.21013/jmss.v5.n3.p5 How to cite this paper: Barik, P., & Pandey, B. (2016). Work-life Balance a Strategic Human Resource Policies and Practices followed by Indian Organizations. IRA-International Journal of Management & Social Sciences (ISSN 2455-2267), 5(3), 427-435. doi:http://dx.doi.org/10.21013/jmss.v5.n3.p5 © Institute of Research Advances This work is licensed under a Creative Commons Attribution-Non Commercial 4.0 International License subject to proper citation to the publication source of the work. Disclaimer: The scholarly papers as reviewed and published by the Institute of Research Advances (IRA) are the views and opinions of their respective authors and are not the views or opinions of the IRA. The IRA disclaims of any harm or loss caused due to the published content to any party. 427 IRA-International Journal of Management & Social Sciences ABSTRACT The study examines the innovative work-life balance policies and practices implemented by various Indian Companies. As with the increase of women workforce, dual earner families and increase in nuclear families have generated the need for the employees to balance their work and personal life. -

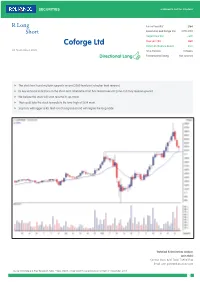

Coforge Ltd Potential Absolute Return 29% 03 November 2020 Time Horizon 9 Weeks Directional Long Fundamental Rating Not Covered

R Long Future Price (Rs)* 2164 Short Recommended Range (Rs) 2170-2150 Target Price (Rs) 2800 Stop Loss (Rs) 1880 Coforge Ltd Potential Absolute Return 29% 03 November 2020 Time Horizon 9 Weeks Directional Long Fundamental Rating Not covered f The stock has found multiple supports around 2080 level post a higher level reversal. f Its key technical indicators on the short-term timeframe chart has tested oversold zone and may reverse upward. f We believe the stock will soon resume its up-move. f That could take the stock towards its life-time-high of 2814 mark. f Stop loss will trigger at Rs 1880 (on closing basis) and will negate the long trade Technical & Derivatives Analyst: Jatin Gohil Contact: (022) 4215 7024/ 7498411546 Email: [email protected] Source: Bloomberg & RSec Research; Note: * Near Month- Single Stock Future price as on 12:15pm 3rd November, 2020 1 Recommendation Summary R Long Short Sr. Reco. Date Time Call Closure Recommendation Company Name Reco. Target Stop Call Status Current Return No Horizon date Price* Loss Price (%) Open Position 1 09-Sep-20 9 Weeks Short Bajaj Finance 3,413 2,550 3,770 Open 3456 -1.3% 2 20-Oct-20 10 Weeks Long Dabur 528 630 484 Open 516 -2.1% 3 21-Oct-20 6 Weeks Long M&M Financial 129 152 119 Open 126 -2.3% 4 30-Oct-20 6 Weeks Short JSW Steel 311 265 345 Open 314 0.9% 5 02-Nov-20 10 Weeks Long MFSL 615 800 545 Open 614 -0.1% Closed Positions 1 09-Oct-20 6 Weeks 28-Oct-20 Long Larsen & Toubro 900 1,065 842 Profit Booked 978 8.7% 2 15-Oct-20 6 Weeks 27-Oct-20 Long Kotak Bank 1,349 1,550 1,235 -

Value Strategy Note 04-05-2021

VALUE STRATEGY May 2021 (Data as on 30th April 2021. Inception date – 18th February 2003) INVESTMENT APPROACH KEY FEATURES & PORTFOLIO ATTRIBUTES Strategy Name: Value Strategy Large cap oriented portfolio with ~66% weightage Investment Objective: The Strategy aims to benefit from the long 17+ years track record with annualized return of 19.9% since term compounding effect on investments done in good businesses, inception (an alpha of 2.8% over Nifty 50 TRI) run by great business managers for superior wealth creation. Concentrated portfolio of 25 stocks with high earnings growth Description of types of securities: Listed Equity Basis of selection of Each of the portfolio companies are market leaders in their such types of securities as part of the investment approach: value respective segments based stock selection strategy Index agnostic: ~71% away from benchmark Nifty 50 Allocation of portfolio across types of securities: The strategy seeks to primarily invest in Equity and Equity-related instruments of large cap companies. However, the strategy has the flexibility to invest in PORTFOLIO ACTIONS IN LAST 6 MONTHS companies across the entire market capitalization spectrum Companies Added: Mahindra & Mahindra Ltd., Benchmark: Nifty 50 TRI United Spirits Ltd., Home First Finance company Ltd. Indicative tenure or investment horizon: Medium to Long term Companies Exited: ITC Ltd., Axis Bank Ltd., Bajaj Finserv Ltd. PERFORMANCE SINCE INCEPTION One lac invested in the strategy on 18th Feb 2003 would have grown to ` 27 lacs today against 18 lacs -

KVS Technologies

Need of the hours is Training to staff on Data Integrity, 21 CFR part 11 Compliance and Computer Systems validation. If they are trained fir why , what and when ? They help design better system, help perform better Review and approval mechanism. We can help you train your staff in best possible way to compliance. Cost per person is the lowest and Training is world class. We can organize two to four days class room session as per your choice. Most big and Medium Life science and IT companies are booking slots of multiple Training. Specialized training on Why Validation ? GAMP, 21 CFR Part 11, CSV, Data Integrity & Risk Assessment for your Staff. Basics to Advance. Why CEOS have to study Data Integrity and 21 CFR part 11 Compliance as well as Software Validation. After studying market Cap of IPCA, Wockhardt, Zydus, Dr Reddy's and Sun following is the conclusion Zydus Lost heavily in Market cap after warning IPCA stock prices are down since long Lupin Lost 400 Rs per share on adverse news of FDA Natco lost 85 Rs in a day per share Wockhardt Lost heavily. Cadila Pharma in remediation mode at Ankleshwar Plant. Emcure has adverse effect. SUN Also Loss huge amount Dr Reddy’s Lost Rs 1400 per share in a week resulting in a great loss of market cap. Selmer Research and GVK Bio things are real shock. Cost of Remediation action, Production loss is separate so Cost of Non Compliance is very high. About us. More than 10 year dedicated work in Software validation - Training and 30 experience with Automation. -

Cloud Transformation/ Operation Services & Xaas

Cloud Transformation/ A research report Operation Services & XaaS comparing provider strengths, challenges U.S. 2019 and competitive differentiators Quadrant Report Customized report courtesy of: November 2018 ISG Provider Lens™ Quadrant Report | November 2018 Section Name About this Report Information Services Group, Inc. is solely responsible for the content of this report. ISG Provider Lens™ delivers leading-edge and actionable research studies, reports and consulting services focused on technology and service providers’ strength and Unless otherwise cited, all content, including illustrations, research, conclusions, weaknesses and how they are positioned relative to their peers in the market. These assertions and positions contained in this report were developed by and are the sole reports provide influential insights accessed by our large pool of advisors who are property of Information Services Group, Inc. actively advising outsourcing deals as well as large numbers of ISG enterprise clients who are potential outsourcers. The research and analysis presented in this report includes research from the ISG Provider Lens™ program, ongoing ISG Research programs, interviews with ISG advisors, For more information about our studies, please email [email protected], briefings with services providers and analysis of publicly available market information call +49 (0) 561-50697537, or visit ISG Provider Lens™ under ISG Provider Lens™. from multiple sources. The data collected for this report represents information that ISG believes to be current as of September 2018, for providers who actively participated as well as for providers who did not. ISG recognizes that many mergers and acquisitions have taken place since that time but those changes are not reflected in this report. -

August 5, 2020 National Stock Exchange of India

Registered Office Address: Mindtree Limited Global Village, RVCE Post, Mysore Road, Bengaluru – 560059, Karnataka, India. Corporate identity Number (CIN): L72200KA1999PLC025564 E-mail : [email protected] Ref: MT/STAT/CS/20-21/111 August 5, 2020 BSE Limited National Stock Exchange of India Limited Phiroze Jeejeebhoy Towers, Exchange Plaza, Dalal Street, Bandra Kurla Complex, Bandra East, Mumbai 400 001. Mumbai 400 051. Dear Sirs, Subject: Press Release - Mindtree Appoints Venu Lambu as President of Global Markets This is to inform you that, the Company proposes to make a press release on the following topic: “Mindtree Appoints Venu Lambu as President of Global Markets” A copy of the press release to be distributed to the media is enclosed herewith. Please take the above intimation on records. Thanking you. Yours sincerely, for Mindtree Limited Vedavalli S Company Secretary Encl: as above _____________________________________________________________________________________ Mindtree Limited Global Village T + 91 80 6706 4000 RVCE Post, Mysore Road F +91 80 6706 4100 Bengaluru – 560059 W www.mindtree.com Mindtree Appoints Venu Lambu as President of Global Markets Veteran technology services executive will focus on accelerating revenue growth Warren (NJ) and Bangalore (India) – August 05, 2020 – Mindtree, the leading digital transformation and technology services company, today announced the appointment of Venu Lambu as President of Global Markets, a role strategically oriented towards accelerating Mindtree’s revenue growth. Based in London, Venu will be responsible for formulating strategic direction and business development for Mindtree businesses across all industry segments. “Venu has the ideal combination of leadership acumen, energy, and experience to help drive our aggressive plans to further scale the business,” said Debashis Chatterjee, Chief Executive Officer and Managing Director of Mindtree. -

Business Services HCL Technologies Limited

HCL Technologies Ltd. - Business Services │Company Profile HCL Technologies Limited pioneered third party BPO (Business Process Outsourcing) industry in India by launching HCL Business Services (formerly HCL BPO Services) in 2001. HCL Business Services provides 24X7, multi-channel and multi-lingual support in 8 European languages. Over 11,500 professionals operate out of 26 delivery centers across US, UK, APAC, Europe and America. HCL Business Services focuses on key industry segments such as Financial Services, Health Care Services, Telecom, Energy & Utility, Public Services, Manufacturing, Retail & CPG, Media and Publishing, and Logistics. In addition to providing vertical industry specific solutions, HCL Business Services provides the following cross industry horizontal solutions: Finance & Accounting Outsourcing, Human Resources Outsourcing, Customer Relationship Management, Knowledge Process Outsourcing, Technical Support Services and Supply Chain Management (SCM). HCL also pioneered the multi-country delivery and the platform business model. With over a decade of industry experience, and Fortune 500/Fortune Global 500 customers, HCL today pursues a revolutionary maturity level where a new form of BPO called ‘Transformational BPO’ is evolving which involves Full Process and Multi-Process outsourcing. This strategic decision to evolve from the traditional contact center model to the more holistic Business Services model is to effectively address the evolving requirements and expectations of BPO customers worldwide. HCL leverages its -

Coforge Ltd (NIITEC)

Coforge Ltd (NIITEC) CMP: | 2456 Target: | 2690 ( 10%) Target Period: 12 months HOLD October 23, 2020 Robust operating performance… Coforge Ltd (Coforge) registered healthy revenue growth, up 8.1% QoQ in constant currency terms, above our estimate of 7.0% QoQ growth. The revenue growth was broad based across verticals mainly led by insurance (up 13.5% QoQ) and BFS (up 10.2% QoQ). Digital revenues (including IP) also increased 18.7% QoQ. Further, Coforge has guided for revenue growth Particulars of 6% YoY organic growth in FY21E and 17.8% EBITDA margin in FY21E Particular Amount before Esop cost. Market Capi (| Crore) 15,116.7 Healthy deal pipeline, digital to drive growth Total Debt (| Crore) 4.8 Update Result Cash & Invests (| Crore) 917.1 Coforge is witnessing healthy traction in cloud, data and artificial intelligence EV (| Crore) 14,204.4 (AI). This has led to healthy growth in digital revenues. The company is driving this growth via partnerships with large players in cloud like Microsoft 52 week H/L 2813 / 739 Azure, Google cloud and AWS and partnering with product start-ups that Equity capital 62.5 can help it to drive new age technology growth. Hence, we expect the Face value 10.0 company to benefit from improved traction in digital technology, going forward. Further, we expect Coforge to witness healthy traction in the BFS Key Highlights and insurance vertical led by large deal wins and wallet share gain in travel segment. In addition, the company expects strong revenue growth in Dollar revenue to improve in coming quarters based on large deal won and healthcare vertical (as seen in this quarter). -

India Meets Britain Tracker 2020 17 © 2021 Grant Thornton UK LLP

India meets Britain Tracker The latest trends in Indian investment in the UK 2021 About our research Our Tracker, developed in collaboration with the Confederation of Indian Industry, identifies the top fastest-growing Indian companies in the UK as measured by percentage revenue growth year-on-year. The Tracker includes Indian-owned corporates with operations headquartered or with a significant base in the UK, with turnover of more than £5 million, year-on-year revenue growth of at least 10% and a minimum two-year track record in the UK, based on the latest published accounts filed as at 31 March 2021, where available. Turnover figures have been annualised where periods of less or more than 12 months have been reported1. In the UK, to reflect the pandemic challenges, companies were granted a three-month extension to the usual filing period. Indian companies that took advantage of this option may therefore not appear in this year’s research. Our report also highlights the top Indian employers – those companies that employ more than 1,000 people in the UK2. To compile the India meets Britain Tracker 2021, Grant Thornton analysed data from 850 UK- incorporated limited companies that are owned directly or indirectly, or controlled, by either an Indian-incorporated parent or an Indian citizen resident outside the UK3. 1 As our research relies on published and filed accounts, there is inevitably a time lag between the recording of the performance of the companies and the publication of this report. 2 Employment numbers may include employees -

1 AGENDA for 111Th UNIT APPROVAL Committees

111th UAC Meeting (29 .11.2019), VISAKHAPATNAM AGENDA FOR 111th UNIT APPROVAL COMMITTEEs MEETING FOR THE PRIVATE SEZs OF ANDHRA PRADESH REGION TO BE HELD ON 29.11.2019 AT 11.00 A.M. AT CONFERENCE HALL, ADMINISTRATIVE BUILDING, VISAKHAPATNAM SPECIAL ECONOMIC ZONE, DUVVADA, VISAKHAPATNAM. Sl. Agenda - PRIVATE SEZS in Andhra Pradesh Page No No. 1 Agenda Item No.01: Ratification of the minutes of the meeting held on 25.09.2019 2 2 Agenda Item No. 02: Proposal of M/s. HCL Technologies Ltd for setting up of a u nit in 2-4 M/s. HCL Technologies Ltd SEZ at Sy.No.20/3, Kesarapalli vill. NH 5, Gannavaram Mandal, Vijayawada, Andhra Pradesh 3 Agenda Item No.03: Request of M/s.Honour Lab Limited in PlotNo.4, Hetero infrastructure 4-5 Ltd-SEZ,. Nakkapally for inclusion of additional products in the LoA. 4 Agenda Item No.04: M/s. Natco Pharma Limited, a unit in Ramky Pharma SEZ, Parawada, 5-6 Visakhapatnam for inclusion of additional products in the LoA. 5 Agenda No. 05: Request of M/s. Biocon Limited, Co Developer of M/s Ramky Pharma City 6-7 SEZ, Parawada, Visakhapatnam for permission for procure material without payment of duty on the basis of approval of Authorized operations 1 111th UAC Meeting (29 .11.2019), VISAKHAPATNAM AGENDA FOR 111th UNIT APPROVAL COMMITTEEs MEETING FOR THE SEZs LOCATED IN PRIVATE SEZs OF ANDHRA PRADESH REGION TO BE HELD ON 29.11.2019 AT 11.00 A.M. AT CONFERENCE HALL, ADMINISTRATIVE BUILDING, VISAKHAPATNAM SPECIAL ECONOMIC ZONE, DUVVADA, VISAKHAPATNAM. -

John Hancock Emerging Markets Fund

John Hancock Emerging Markets Fund Quarterly portfolio holdings 5/31/2021 Fund’s investments As of 5-31-21 (unaudited) Shares Value Common stocks 98.2% $200,999,813 (Cost $136,665,998) Australia 0.0% 68,087 MMG, Ltd. (A) 112,000 68,087 Belgium 0.0% 39,744 Titan Cement International SA (A) 1,861 39,744 Brazil 4.2% 8,517,702 AES Brasil Energia SA 14,898 40,592 Aliansce Sonae Shopping Centers SA 3,800 21,896 Alliar Medicos A Frente SA (A) 3,900 8,553 Alupar Investimento SA 7,050 36,713 Ambev SA, ADR 62,009 214,551 Arezzo Industria e Comercio SA 1,094 18,688 Atacadao SA 7,500 31,530 B2W Cia Digital (A) 1,700 19,535 B3 SA - Brasil Bolsa Balcao 90,234 302,644 Banco Bradesco SA 18,310 80,311 Banco BTG Pactual SA 3,588 84,638 Banco do Brasil SA 15,837 101,919 Banco Inter SA 3,300 14,088 Banco Santander Brasil SA 3,800 29,748 BB Seguridade Participacoes SA 8,229 36,932 BR Malls Participacoes SA (A) 28,804 62,453 BR Properties SA 8,524 15,489 BrasilAgro - Company Brasileira de Propriedades Agricolas 2,247 13,581 Braskem SA, ADR (A) 4,563 90,667 BRF SA (A) 18,790 92,838 Camil Alimentos SA 11,340 21,541 CCR SA 34,669 92,199 Centrais Eletricas Brasileiras SA 5,600 46,343 Cia Brasileira de Distribuicao 8,517 63,718 Cia de Locacao das Americas 18,348 93,294 Cia de Saneamento Basico do Estado de Sao Paulo 8,299 63,631 Cia de Saneamento de Minas Gerais-COPASA 4,505 14,816 Cia de Saneamento do Parana 3,000 2,337 Cia de Saneamento do Parana, Unit 8,545 33,283 Cia Energetica de Minas Gerais 8,594 27,209 Cia Hering 4,235 27,141 Cia Paranaense de Energia 3,200 -

Everest Group's PEAK Matrix for Banking AO

TM Topic: Everest Group’s PEAK Matrix for Banking AO Service Providers Focus on HCL Technologies July 2015 Copyright © 2015 Everest Global, Inc. This document has been licensed for exclusive use and distribution by HCL Technologies Background and scope of the research Background of the research Rise of digital consumers, need for business agility, growing costs of regulatory compliance, and threat from non-banking competitors in areas such as payments were the key challenges faced by banks in 2014. Banks are aligning their technology priorities around cost containment, efficiency, risk & compliance management, and transformation. Banks continued to invest in development of specific applications for regulatory compliance, risk management, channel-specific initiatives (social, mobile, etc.), and customer analytics The service provider landscape is intensifying as providers ramp up their capabilities, invest in innovative technologies, form alliances, and acquire strategic targets to address the growing and complex application services needs of banks and financial institutions In this research, we analyze the capabilities of 30 leading AO service providers, specific to the global banking sector. These providers were mapped on the Everest Group Performance | Experience | Ability | Knowledge (PEAK) Matrix, which is a composite index of a range of distinct metrics related to each provider’s capability and market success. Additionally, Everest Group has also profiled the capabilities of these 30 service providers in detail including a comprehensive picture of their service suite, scale of operations, domain investments, delivery locations, and buyer satisfaction specific to banking AO services This document focuses on HCL Technologies’ banking AO experience and includes: Overview of the banking AO service provider landscape Everest Group’s assessment of HCL Technologies’ delivery capability and market success on PEAK matrix Detailed banking AO profile for HCL Technologies Copyright © 2015, Everest Global, Inc.