Equity Research

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SAP HANA® Services Products

® SAP HANA Services A research report U.S. 2018 comparing provider strengths, challenges and competitive differentiators Quadrant Report Customized report courtesy of: June 2018 Note: Only use before TOC ISG Provider Lens™ Quadrant Report | June 2018 Section Name About this Report Information Services Group, Inc. is solely responsible for the content of this report. ISG Provider Lens™ delivers leading-edge and actionable research studies, reports and consulting services focused on technology and service providers’ strengths and Unless otherwise cited, all content, including illustrations, research, conclusions, weaknesses and how they are positioned relative to their peers in the market. These assertions and positions contained in this report were developed by and are the sole reports provide influential insights accessed by our large pool of advisors who are property of Information Services Group, Inc. actively advising outsourcing deals as well as large numbers of ISG enterprise clients who are potential outsourcers. This report includes research from the ISG Provider Lens™ program, ongoing ISG Research programs, interviews with ISG advisors, briefings with services providers For more information, please email [email protected], call +1.203.454.3900, and analysis of publicly available market information from multiple sources. The data or visit ISG Provider Lens™. collected for this report represents information that was current as of April 20th, 2018. ISG recognizes that mergers and acquisitions may have taken place since that time; those changes are not reflected in this report. The lead author for this report is Douglas Pollei. The report was edited by Jan Erik Aase and John Burnell. The primary researchers were Shashank Rajmane ISG Research™ provides subscription research, advisory consulting and executive and Bhanwar Chauhan. -

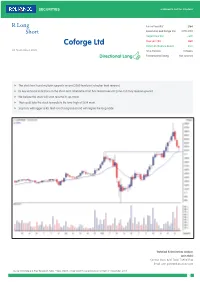

Coforge Ltd Potential Absolute Return 29% 03 November 2020 Time Horizon 9 Weeks Directional Long Fundamental Rating Not Covered

R Long Future Price (Rs)* 2164 Short Recommended Range (Rs) 2170-2150 Target Price (Rs) 2800 Stop Loss (Rs) 1880 Coforge Ltd Potential Absolute Return 29% 03 November 2020 Time Horizon 9 Weeks Directional Long Fundamental Rating Not covered f The stock has found multiple supports around 2080 level post a higher level reversal. f Its key technical indicators on the short-term timeframe chart has tested oversold zone and may reverse upward. f We believe the stock will soon resume its up-move. f That could take the stock towards its life-time-high of 2814 mark. f Stop loss will trigger at Rs 1880 (on closing basis) and will negate the long trade Technical & Derivatives Analyst: Jatin Gohil Contact: (022) 4215 7024/ 7498411546 Email: [email protected] Source: Bloomberg & RSec Research; Note: * Near Month- Single Stock Future price as on 12:15pm 3rd November, 2020 1 Recommendation Summary R Long Short Sr. Reco. Date Time Call Closure Recommendation Company Name Reco. Target Stop Call Status Current Return No Horizon date Price* Loss Price (%) Open Position 1 09-Sep-20 9 Weeks Short Bajaj Finance 3,413 2,550 3,770 Open 3456 -1.3% 2 20-Oct-20 10 Weeks Long Dabur 528 630 484 Open 516 -2.1% 3 21-Oct-20 6 Weeks Long M&M Financial 129 152 119 Open 126 -2.3% 4 30-Oct-20 6 Weeks Short JSW Steel 311 265 345 Open 314 0.9% 5 02-Nov-20 10 Weeks Long MFSL 615 800 545 Open 614 -0.1% Closed Positions 1 09-Oct-20 6 Weeks 28-Oct-20 Long Larsen & Toubro 900 1,065 842 Profit Booked 978 8.7% 2 15-Oct-20 6 Weeks 27-Oct-20 Long Kotak Bank 1,349 1,550 1,235 -

Coforge Ltd (NIITEC)

Coforge Ltd (NIITEC) CMP: | 2456 Target: | 2690 ( 10%) Target Period: 12 months HOLD October 23, 2020 Robust operating performance… Coforge Ltd (Coforge) registered healthy revenue growth, up 8.1% QoQ in constant currency terms, above our estimate of 7.0% QoQ growth. The revenue growth was broad based across verticals mainly led by insurance (up 13.5% QoQ) and BFS (up 10.2% QoQ). Digital revenues (including IP) also increased 18.7% QoQ. Further, Coforge has guided for revenue growth Particulars of 6% YoY organic growth in FY21E and 17.8% EBITDA margin in FY21E Particular Amount before Esop cost. Market Capi (| Crore) 15,116.7 Healthy deal pipeline, digital to drive growth Total Debt (| Crore) 4.8 Update Result Cash & Invests (| Crore) 917.1 Coforge is witnessing healthy traction in cloud, data and artificial intelligence EV (| Crore) 14,204.4 (AI). This has led to healthy growth in digital revenues. The company is driving this growth via partnerships with large players in cloud like Microsoft 52 week H/L 2813 / 739 Azure, Google cloud and AWS and partnering with product start-ups that Equity capital 62.5 can help it to drive new age technology growth. Hence, we expect the Face value 10.0 company to benefit from improved traction in digital technology, going forward. Further, we expect Coforge to witness healthy traction in the BFS Key Highlights and insurance vertical led by large deal wins and wallet share gain in travel segment. In addition, the company expects strong revenue growth in Dollar revenue to improve in coming quarters based on large deal won and healthcare vertical (as seen in this quarter). -

India Meets Britain Tracker 2020 17 © 2021 Grant Thornton UK LLP

India meets Britain Tracker The latest trends in Indian investment in the UK 2021 About our research Our Tracker, developed in collaboration with the Confederation of Indian Industry, identifies the top fastest-growing Indian companies in the UK as measured by percentage revenue growth year-on-year. The Tracker includes Indian-owned corporates with operations headquartered or with a significant base in the UK, with turnover of more than £5 million, year-on-year revenue growth of at least 10% and a minimum two-year track record in the UK, based on the latest published accounts filed as at 31 March 2021, where available. Turnover figures have been annualised where periods of less or more than 12 months have been reported1. In the UK, to reflect the pandemic challenges, companies were granted a three-month extension to the usual filing period. Indian companies that took advantage of this option may therefore not appear in this year’s research. Our report also highlights the top Indian employers – those companies that employ more than 1,000 people in the UK2. To compile the India meets Britain Tracker 2021, Grant Thornton analysed data from 850 UK- incorporated limited companies that are owned directly or indirectly, or controlled, by either an Indian-incorporated parent or an Indian citizen resident outside the UK3. 1 As our research relies on published and filed accounts, there is inevitably a time lag between the recording of the performance of the companies and the publication of this report. 2 Employment numbers may include employees -

Information Access for ALL

Information Access FOR ALL NCPEDP~ PHASIS UNIVERSAL DESIGN AWARDS 2016 The NCPEDP-Mphasis Universal Design Awards logo stands for the spirit of Freedom and Celebration. The person with disability appears to be throwing her/ his arms up in the air in celebration of the Awards and the hope they bring to so many. The dynamic oval form gives an illusion of constant motion suggesting that people can achieve whatever they want, regardless of the odds stacked against them. The orange colour further enhances this optimism of the new universal and inclusive world. The NCPEDP-Mphasis Universal Design Awards Conservative estimates put the population Persons with Disabilities She/ he may also be an individual who is of people with disabilities in India at 70- Awards in this category are given to involved in the cause independent of any 100 million. Only a minuscule percentage people with disabilities who have organisational support and has achieved of this population can be seen in the created an impact in accessibility and significant success in the core objective mainstream. The core reason for this is the Universal Design in any of the areas of gaining accessibility for people with basic lack of access. Accessibility not only such as built environment, transport disabilities. means access to physical spaces but also infrastructure, service provision, means access to information, technology, information and communication Companies/ Organisations transport, services, aids and appliances, technology (ICT), universally Awards in this category will be given to etc. Access, therefore, is an issue that cuts designed consumer products, those companies or organisations who across disabilities and sectors and forms mobility & independent living aids, have taken up the cause of accessibility the very basis of empowerment of people or assistive technology in their and Universal Design in any of the areas with disabilities. -

Salesforce Ecosystem Partners a Research Report U.S

Salesforce Ecosystem Partners A research report U.S. 2021 comparing provider strengths, challenges Quadrant Report and competetive differentiators. March 2021 Customized report courtesy of: ISG Provider Lens™ Quadrant Report | March 2021 Section Name About this Report Information Services Group Inc. is solely responsible for the content of this report. Un- ISG Provider Lens™ delivers leading-edge and actionable research studies, reports less otherwise cited, all content, including illustrations, research, conclusions, assertions and consulting services focused on technology and service providers’ strengths and and positions contained in this report were developed by, and are the sole property of weaknesses and how they are positioned relative to their peers in the market. These Information Services Group Inc. reports provide influential insights accessed by our large pool of advisors who are actively advising outsourcing deals as well as large numbers of ISG enterprise clients The research and analysis presented in this report includes research from the ISG who are potential outsourcers. Provider Lens™ program, ongoing ISG Research programs, interviews with ISG advisors, briefings with services providers and analysis of publicly available market information For more information about ISG Provider Lens™ studies, please email from multiple sources. The data collected for this report represents information that [email protected], call +1.203.454.3900, or visit ISG Provider Lens™. ISG believes to be current as of February 2021 for providers who actively participated as well as for providers who did not. ISG recognizes that many mergers and acquisitions have taken place since that time, but those changes are not reflected in this report. -

John Hancock Emerging Markets Fund

John Hancock Emerging Markets Fund Quarterly portfolio holdings 5/31/2021 Fund’s investments As of 5-31-21 (unaudited) Shares Value Common stocks 98.2% $200,999,813 (Cost $136,665,998) Australia 0.0% 68,087 MMG, Ltd. (A) 112,000 68,087 Belgium 0.0% 39,744 Titan Cement International SA (A) 1,861 39,744 Brazil 4.2% 8,517,702 AES Brasil Energia SA 14,898 40,592 Aliansce Sonae Shopping Centers SA 3,800 21,896 Alliar Medicos A Frente SA (A) 3,900 8,553 Alupar Investimento SA 7,050 36,713 Ambev SA, ADR 62,009 214,551 Arezzo Industria e Comercio SA 1,094 18,688 Atacadao SA 7,500 31,530 B2W Cia Digital (A) 1,700 19,535 B3 SA - Brasil Bolsa Balcao 90,234 302,644 Banco Bradesco SA 18,310 80,311 Banco BTG Pactual SA 3,588 84,638 Banco do Brasil SA 15,837 101,919 Banco Inter SA 3,300 14,088 Banco Santander Brasil SA 3,800 29,748 BB Seguridade Participacoes SA 8,229 36,932 BR Malls Participacoes SA (A) 28,804 62,453 BR Properties SA 8,524 15,489 BrasilAgro - Company Brasileira de Propriedades Agricolas 2,247 13,581 Braskem SA, ADR (A) 4,563 90,667 BRF SA (A) 18,790 92,838 Camil Alimentos SA 11,340 21,541 CCR SA 34,669 92,199 Centrais Eletricas Brasileiras SA 5,600 46,343 Cia Brasileira de Distribuicao 8,517 63,718 Cia de Locacao das Americas 18,348 93,294 Cia de Saneamento Basico do Estado de Sao Paulo 8,299 63,631 Cia de Saneamento de Minas Gerais-COPASA 4,505 14,816 Cia de Saneamento do Parana 3,000 2,337 Cia de Saneamento do Parana, Unit 8,545 33,283 Cia Energetica de Minas Gerais 8,594 27,209 Cia Hering 4,235 27,141 Cia Paranaense de Energia 3,200 -

Placement Analysis - 2019 Batch

Placement Analysis - 2019 Batch Highest Package Offered Average Package Offered Lowest Package Offered 12.0 LPA 4.0 LPA 3.0 LPA Total No of Companies Invited : 502 Total no of Students Placed : 1328 Top Companies with packages above 5 Lacs (CTC) S.No Company Name 1 TCS 2 SHELL TECHNOLOGIES 3 AVIZVA 4 OPTUM 5 Zycus 6 XEBIA IT 7 TEK SYSTEMS 8 SAPIENT 9 MANN INDIA 10 HYUNDAI 11 YAMAHA MOTOR 12 RELIANCE 13 REAL DATA 14 CVENT 15 Think n Learn 16 Tolexo 17 Google 18 Dyson 19 United Lex 20 WIPRO WASE 21 HSBC 22 Accolite 23 Novanet 24 Foresight 25 Blue Star 26 RMS 27 Samsung 28 Amazon 29 Keyence 30 Veris Top Payers /Dream Companies Company Name CTC (LPA) INDIAN AIR FORCE 12 GOOGLE 12 HSBC 12 SIRION LABS 12 NATIONAL INSTRUMENTS 12 SHELL TECHNOLOGIES 10 THINK N LEARN 10 ACCOLITE 10 VMWARE 9.12 TCS (CODEVITA) 7.5 HYUNDAI 7.5 NOVANET 7 ZYCUS 6.5 XEBIA IT 6 MANN INDIA TECHNOLOGIES 6 RELIANCE 6 REAL DATA 6 FORESIGHT 6 BLUE STAR 6 SAMSUNG 6 AMAZON 6 KEYENCE 6 WIPRO WASE 5.57 OPTUM 5.4 SAPIENT 5.3 AVIZVA 5.25 DYSON 5.07 YAMAHA 5 CVENT 5 TOLEXO 5 UNITED LEX 5 PFIZER 5 LAMBORGINI 5 Top Recruiters Company Name Final Placed ACCENTURE 309 TCS 120 WIPRO TECHNOLOGIES 70 THINK N LEARN 40 ICONMA 39 NEC TECHNOLOGIES 29 AMAZON 52 FLIPKART 25 RELIANCE 23 MANN INDIA TECHNOLOGIES 21 SOPRA STERIA 20 HEXAWARE 16 HCL TECHNOLOGIES 23 SAMSUNG 28 ERICSSON 15 NTT DATA 33 Top IT Companies: S.No Company Name 1 NEC 2 TATA TECHNOLOGIES 3 WIPRO 4 ACCENTURE 5 HEXAWARE 6 OPTUM 7 NIIT 8 GRAPECITY 9 TCS 10 MPHASIS 11 SAPIENT 12 NEWGEN 13 ACCENTURE 14 Gemalto 15 Google 16 Genpact -

ISB-Biocon Certificate Program in Business Analytics Profile Book 2013

ISB-Biocon Certificate Program in Business Analytics Profile Book 2013 - 14 Class Profile The programme attracts exceptionally talented and vibrant group of individuals from diverse industries. The class composition of the 2013-14 batch is given below. Education Background Work Experience Industry Clusters • BE/ B.Tech - 44% • MCA - 5% • 0-4 years - 23% • Analytic Firms - 21% • BFSI - 3% • BE/ B.Tech/ MBA - 17% • ME/ M.Tech - 3% • 4-8 years - 33% • Indian IT - 23% • Captives - 4% • M.Sc. (Maths) - 5% • Others Grad. - 3% • 8-12 years - 22% • MNC IT - 26% • KPO - 7% • Grad + MBA - 22% • Ph.D. - 1% • 12-18 years - 20% • Telecom - 6% • FMCG - 4% • Above 18 years - 2% • Auto - 35 • Real Estate - 3% 60% of the Batch have a BE/ B.Tech Degree 56% of the Batch lies between 0 - 8 years 71% of the batch comes from three clusters - 55% of the Batch has Post Graduate Degree Analytics Firms, Indian IT Companies & MNC IT Companies Abdul Afzal Abhishek Manjrekar Amandeep Singh Amit Pradhan SAP HANA Technical Architect, Attune Consulting Deputy Manager - Marketing (Strategy & Analysis) Portfolio Manager (IT), Ford Motor Company Sr. Group Manager / AVP - Quality, WNS Global Services H&R Johnson(India), Mumbai Responsible for managing portfolio of IT Projects aligned to Current Role Current Role Ford Customer Services Division. This includes delivery, general Current Role SAP HANA / BI competency head & financial management. Additionally responsible for setting Master Black Belt - Leading the Process Excellence, Analytics, and Initiation & Analysis of the Dealer Management Group, Mason up Analytics Practice for Ford in India & designing Analytics Quality Assurance for a clients in the Insurance vertical Previous Assignments Insurance Program, Business Process Re-Engineering, Green Tiles Competency Framework. -

Our Top Buys for Expected Multi-Cap Rebalancing the SEBI Circular for Revising Asset Allocation Norms of Multi-Cap Funds Is Wide

Our Top Buys for expected Multi-Cap rebalancing The SEBI Circular for revising asset allocation norms of multi-cap funds is widely expected to drive flows into mid and small cap stocks. However, the SEBI clarification suggests that portfolio rebalancing is only one of the options for the MF industry and it is open to industry representation on the revised norms. The capital markets regulator, SEBI, on Friday, revised the norms for holdings under multi-cap funds (SEBI Circular). Under the new norms, the multi-cap funds need to allocate – (i) at least 75% of AUM to equities (up from 65% earlier), and (ii) large, mid and small cap stocks should each have at least 25% of allocation by January 31, 2021. Since, currently the multi-cap fund (AUM of ~Rs1.5tn/US$21bn) holdings are tilted towards large cap stocks (~73% of AUM as of Aug-2020), it is widely anticipated that the mutual funds would have to rebalance the portfolios by increasing allocation to mid cap stocks (~17% of AUM as of Aug-2020) and small cap stocks (~6% of AUM as on Aug-2020). However, the clarification issued by SEBI (SEBI Clarification Circular) on Sunday evening also points out that portfolio rebalancing is one of the options available to mutual funds and the MF could consider options like merging with existing schemes. The clarification also suggests that SEBI is open to inputs from MF industry on the revised rules for multi-cap funds. In today’s trading session, the mid & small cap indices have surged ~2.5% & 5% higher, respectively. -

Mainframe Services & Solutions

Mainframe Services & Solutions A research report U.S. 2021 comparing provider strengths, challenges and competitive differentiators Quadrant Report Customized report courtesy of: April 2021 ISG Provider Lens™ Quadrant Report | April 2021 Section Name About this Report Information Services Group Inc. is solely responsible for the content of this report. ISG Provider Lens™ delivers leading-edge and actionable research studies, reports Unless otherwise cited, all content, including illustrations, research, conclusions, and consulting services focused on technology and service providers’ strengths and assertions and positions contained in this report were developed by, and are the sole weaknesses and how they are positioned relative to their peers in the market. These property of Information Services Group Inc. reports provide influential insights accessed by our large pool of advisors who are actively advising outsourcing deals as well as large numbers of ISG enterprise clients The research and analysis presented in this report includes research from the ISG who are potential outsourcers. Provider Lens™ program, ongoing ISG Research programs, interviews with ISG advisors, briefings with services providers, and analysis of publicly available market information For more information about our studies, please email [email protected], from multiple sources. The data collected for this report represents information that call +49 (0) 561-50697537, or visit ISG Provider Lens™ under ISG Provider Lens™. ISG believes to be current as of February 2021, for providers who actively participated as well as for providers who did not. ISG recognizes that many mergers and acquisitions have taken place since that time, but those changes are not reflected in this report. -

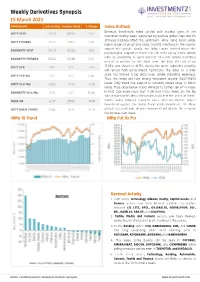

Weekly Derivatives Synopsis

Weekly Derivatives Synopsis 15 March 2021 PARTICULARS Last Closing Previous Week % Change Index Outlook Domestic benchmark index settled with modest gains in the NIFTY SPOT 15031 14938 0.62 truncated trading week, supported by positive global cues and US stimulus package lifted the sentiment, while rising bond yields, NIFTY FUTURES 15051 14953 0.66 higher crude oil prices and rising Covid-19 infections in the country capped the upside. Finally, the Nifty Future settled above the BANKNIFTY SPOT 35497 35228 0.76 psychological support of 15000 level at 15051 up by 0.66% (WoW) with an unwinding in open interest of 6.70% (WoW) indicating BANKNIFTY FUTURES 35522 35288 0.66 neutral to positive for the short term. The India VIX cool off by NIFTY PCR 1.02 1.12 -8.93 15.06% and closed at 21.71% during the week, expecting volatility will remain high going ahead. Technically, the index on a daily NIFTY PCR-VOL 1.00 1.00 0.00 scale has formed a big black body candle indicating weakness. Thus, the index will face strong resistance around 15300-15400 NIFTY OI(In Mn) 13.65 14.63 -6.70 levels. Daily trend line support is currently placed close to 14900 levels. Thus, close below 14900, will lead to further sell off in index. BANKNIFTY OI(In Mn) 3.19 2.67 19.48 In that case index could test 14700 and 14500 levels. On the flip side, if index holds 14900 then index could test the levels of 15300- INDIA VIX 21.71 25.56 -15.06 15400.