Gpoc 2019 Global Powers of Construction Gpoc Is an Annual Publication Produced by Deloitte Spain and Distributed Free of Charge

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Stock Market Reaction to Election Results: an Event Study Analysis

Facultat d’Economia i Empresa Memòria del Treball de Fi de Grau Stock Market reaction to Election Results: an Event Study Analysis Liliana Rebeca Dutra Duffy Grau de Administració d’Empreses Any acadèmic 2019-20 DNI de l’alumne: 41624155C Treball tutelat per Pau Balart Castro Departament d’Economia de l’empresa S'autoritza la Universitat a incloure aquest treball en el Repositori Autor Tutor Institucional per a la seva consulta en accés obert i difusió en línia, Sí No Sí No amb finalitats exclusivament acadèmiques i d'investigació Paraules clau del treball: Event study, shares, dummy variables, survey, regressions, abnormal returns... ABSTRACT The aim of this paper is to find the possible effect that estimation vote surveys have over the share prices of public companies listed in the Spanish stock market. To test this effect, we used the event study methodology. For the event study, daily data from 6 firms listed on the IBEX35 index are analyzed over the period of 1st January 2000 to 31st December 2015. Alongside the event study, another analysis has been conducted to test the economic literature that finds a positive relation between right-wing parties and the stock market. The results of this paper have not shown significant changes for the days surrounding the publication of estimation vote, known as event day. Although it can be observed a positive reaction to PP vote increases, confirming what the literature suggests. This indicates that the event indeed does affect the stock market depending on which party outcomes the other. The results also indicate that certain companies were more exposed to the political results than others. -

Acs, Servicios, Comunicaciones Y Energía, S.L

PROSPECTUS DATED 17 APRIL 2018 ACS, SERVICIOS, COMUNICACIONES Y ENERGÍA, S.L. (incorporated with limited liability in the Kingdom of Spain) €750,000,000 1.875 per cent. Green Notes due 2026 The issue price of the €750,000,000 1.875 per cent. Green Notes due 20 April 2026 (the Notes or the Green Notes) of ACS, Servicios, Comunicaciones y Energía, S.L. (the Issuer) is 99.435 per cent of their principal amount. Unless previously redeemed or cancelled, the Notes will be redeemed at their principal amount on 20 April 2026 (the Maturity Date). The Notes are subject to redemption in whole at their principal amount at the option of the Issuer at any time in the event of certain changes affecting taxation in the Kingdom of Spain. See “Terms and Conditions of the Notes—Redemption and Purchase”. In addition, if a Change of Control occurs and, during the Change of Control Period, a Rating Downgrade occurs, then each Noteholder may require the Issuer to redeem or, at the Issuer's option, purchase in whole or in part its Notes at their principal amount plus accrued and unpaid interest up to (but excluding) the date for such redemption or purchase, all as more fully set out under “Terms and Conditions of the Notes—Redemption and Purchase – Change of Control”. The Notes are subject to redemption in whole at their principal amount together with any accrued and unpaid interest up to (but excluding) the date fixed for such redemption which shall be no earlier than three months before the Maturity Date, as more fully set out under “Terms and Conditions of the Notes— Redemption and Purchase – Residual Maturity Call Option”. -

The New ACS Group Construction 1H/03 Revenues

Global Construction Conference November,November, 20032003 Index Highlights The new ACS Group Outlook for 2003 Conclusions 2 Highlights Strategic rationale of the merger Creation of a European leader • #1 in the most profitable market: Spain • Market leader in all businesses related to the development and management of infrastructures Excellent growth opportunities • Diversified portfolio of activities • Government Investment Plans Potential synergies from the merger Financial strength Industry’s reference stock • Market Capitalization > € 4.3 bn • Liquidity > € 20 mn daily 3 Highlights Creation of a market leader … # 1 in Spanish Construction # 1 in Industrial Services in Spain, Portugal & Latam # 1 in Waste Management in Spain # 1 in Ports and Logistics Services in Spain Core shareholder in the # 1 transport infrastructure concessions company worldwide (by # of concessions) 4 Highlights … of European size … Comp. EBIT 03e* € million 650 Margin on sales 6,0% 525 425 4,3% 3,3% 285 3,0% 250 1,9% 200 1,6% Sales 03e (€ bn) ACS Vinci Bouygues Skanska Ferrovial** Hochtieff Total Sales 10.8 17.5 21.5 14.9 7.0 12.3 Comp. Sales* 10.8 15.7 14.2 12.3 5.8 12.3 * Comparable data are estimated figures in those activities carried out by all companies:Construction, Services & Industrial. It does not include data from Concessions, Real Estate and other businesses. ** Ferrovial figures include CESPA & Amey full year data Source: Analysts’ Reports and Companies data 5 Highlights … and invested in Concessions Equity Investments in Concessions* € billion 3.0 1.7 1.0 Vinci Ferrovial ACS Main Cofiroute(85%), carparks, Cintra (60%), including Abertis (12%), highways, Assets airports & ASF (17%) ETR 407, carparks & airports airports & railroads Accounting Global consolidation Global consolidation Equity accounted method (except ASF: Equity acc.) * Source: Companies’ Reports. -

Forty Years of Democratic Spain: Political, Economic, Foreign Policy

Working Paper Documento de Trabajo Forty years of democratic Spain Political, economic, foreign policy and social change, 1978-2018 William Chislett Working Paper 01/2018 | October 2018 Sponsored by Bussiness Advisory Council With the collaboration of Forty years of democratic Spain Political, economic, foreign policy and social change, 1978-2018 William Chislett - Real Instituto Elcano - October 2018 Real Instituto Elcano - Madrid - España www.realinstitutoelcano.org © 2018 Real Instituto Elcano C/ Príncipe de Vergara, 51 28006 Madrid www.realinstitutoelcano.org ISSN: 1699-3504 Depósito Legal: M-26708-2005 Working Paper Forty years of democratic Spain Political, economic, foreign policy and social change, 1978-2018 William Chislett Summary 1. Background 2. Political scene: a new mould 3. Autonomous communities: unfinished business 4. The discord in Catalonia: no end in sight 5. Economy: transformed but vulnerable 6. Labour market: haves and have-nots 7. Exports: surprising success 8. Direct investment abroad: the forging of multinationals 9. Banks: from a cosy club to tough competition 10. Foreign policy: from isolation to full integration 11. Migration: from a net exporter to a net importer of people 12. Social change: a new world 13. Conclusion: the next 40 years Appendix Bibliography Working Paper Forty years of democratic Spain Spain: Autonomous Communities Real Instituto Elcano - 2018 page | 5 Working Paper Forty years of democratic Spain Summary1 Whichever way one looks at it, Spain has been profoundly transformed since the 1978 -

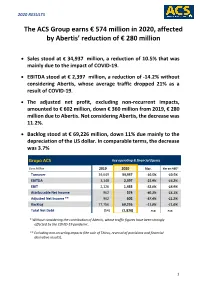

The ACS Group Earns € 574 Million in 2020, Affected by Abertis' Reduction

2020 RESULTS The ACS Group earns € 574 million in 2020, affected by Abertis’ reduction of € 280 million Sales stood at € 34,937 million, a reduction of 10.5% that was mainly due to the impact of COVID-19. EBITDA stood at € 2,397 million, a reduction of -14.2% without considering Abertis, whose average traffic dropped 21% as a result of COVID-19. The adjusted net profit, excluding non-recurrent impacts, amounted to € 602 million, down € 360 million from 2019, € 280 million due to Abertis. Not considering Abertis, the decrease was 11.2%. Backlog stood at € 69,226 million, down 11% due mainly to the depreciation of the US dollar. In comparable terms, the decrease was 3.7% Grupo ACS Key operating & financial figures Euro Million 2019 2020 Var. Var ex-ABE* Turnover 39,049 34,937 -10.5% -10.5% EBITDA 3,148 2,397 -23.9% -14.2% EBIT 2,126 1,433 -32.6% -18.9% Attributable Net Income 962 574 -40.3% -15.1% Adjusted Net Income ** 962 602 -37.4% -11.2% Backlog 77,756 69,226 -11.0% -11.0% Total Net Debt (54) (1,820) n.a. n.a. * Without considering the contribution of Abertis, whose traffic figures have been strongly affected by the COVID-19 pandemic. ** Excluding non-recurring impacts (the sale of Thiess, reversal of provisions and financial derivative results). 1 2020 RESULTS 1. Consolidated Results The Group’s 2020 ordinary net profit accounted for € 602 million, € 360 million less than the previous year. This decline is mainly due to the evolution of Abertis, whose traffic was heavily affected by the lockdown measures related to COVID- 19, reducing its contribution by € 280 million. -

THE TOP 225 INTERNATIONAL CONTRACTORS the Top 225 International Contractors Webhead to Come

THE TOP 225 INTERNATIONAL CONTRACTORS The Top 225 International Contractors Webhead to come STRABAG SE broke through on its tunnel boring on May 13, 2011, on the 6.3-mile #08 water tunnel under Niagara Falls, Ontario, for Ontario Power Generation. With Traditionally Strong Markets in Decline, Firms Look to Break Through in New Regions By Peter Reina and Gar y Tulacz The international contracting community has been enduring diffi cult economic headwinds during the past three years. However, even as the U.S. continues to fi ght off the prospect of a double-dip recession and European nations pull back from stimulus programs to stabilize the troubled euro, opportunities are bubbling for international contractors in developing countries, particularly those rich in resources. T H E TOP 225 INTERNATIONAL CONTRACTORS 4 6 Overview 4 8 Top 10 by region 51 How to read the tables 4 6 Market analysis 48 Backlog analysis 53 The Top 225 International 4 6 Hiring 4 9 Top 10 by market Contractors 5 8 4 7 International regions 5 0 Top Global CM/PM fi rms Index of International Contractors 61 4 7 Analysis of past decade 5 1 How the Top 225 International The Top 225 Global Contractors 6 6 47 Profi t/loss analysis Contractors shared the 2010 market Index of Global Contractors PHOTO COURTESY OF STRABAG OF COURTESY PHOTO enr.com August 29, 2011 ENR 45 ENR08292011TL_Top225Opener.indd 45 8/22/11 7:15:48 PM THE TOP 225 INTERNATIONAL CONTRACTORS General Building Transportation Market Analysis 83,026.4 (21.6%) 109,007.2 (28.4%) Petroleum 89,320.8 (23.3%) Industrial Power Other 20,948.0 (5.5%) 38,598.1 (10.1%) 15,749.3 (4.1%) Sewer Waste 6,389.3 (1.7%) Manufacturing 4652.6 (1.2%) Water 12,380.8 (3.2%) Hazardous Waste 630.2 (0.2%) Telecom 2,959.6 (0.8%) (Measured $ millions) Source: McGraw-Hill Construction Reasearch & Analytics/ENR. -

Explanatory Report Presented by the Board Of

[Free translation for information purposes] EXPLANATORY REPORT PRESENTED BY THE BOARD OF DIRECTORS OF ABERTIS INFRAESTRUCTURAS, S.A., EVALUATING THE COMPETENCY, EXPERIENCE AND MERITS OF THE DIRECTOR MR FRANCISCO JOSÉ ALJARO NAVARRO. ____________________________________________________________ The Board of Directors of Abertis Infraestructuras, S.A. is issuing this document for the purposes of informing the proposal to be submitted to the General Meeting of the appointment of a Director carried out by the Board, taking into account the statutory provisions. For the purposes of analyzing said appointment, the Board has taken into consideration the regime established on the Company Bylaws for the purpose of evaluating the skills, experience and merits of the proposed Director. In fact, having evaluated all the requirements relating to the proposed Director's good professional competence, appropriate skills and experience for exercising his duties as a director and readiness to enforce the good governance of the company, not to mention his capacity and professional career, the Board of Directors, based on a previous report from the Appointments and Remuneration Committee, resolved on 25th September 2018, that the Board endorses to submit to the General Meeting the appointment, as member of the Board of Directors to Francisco José Aljaro Navarro. The Board of Directors believes that Mr Francisco José Aljaro Navarro brings his outstanding experience and knowledge of the corporate sector to Abertis Infraestructuras, S.A. and that he will, without doubt, help in the taking of decisions within the Board. For the purposes of supplementing this information, attached to the present report is Mr Francisco José Aljaro Navarro CV. -

Annual Report ACS Group

Annual Report ACS Group WorldReginfo - cbeb9894-dea1-4332-ba71-eea719f0ff39 www.grupoacs.com Photo: Gijón Port WorldReginfo - cbeb9894-dea1-4332-ba71-eea719f0ff39 Activity Report of ACS Group 1 WorldReginfo - cbeb9894-dea1-4332-ba71-eea719f0ff39 Main Figures of the ACS Group Million of euros and operating data 2002 (1) 2003 (1) 2004 2005 2006 2007 Million of euros Turnover 4,420.2 8,825.1 10,817.9 12,113.9 14,067.2 21,311.7 Gross operating profit (EBITDA) 410.9 794.8 981.1 1,095.5 1,270.3 3,490.5 Net operating profit (EBIT) 305.3 573.5 723.9 817.4 971.6 2,486.5 Profit before tax 250.4 283.4 623.3 804.3 1,553.5 2,211.8 Attributable net profit 181.4 229.5 452.5 608.7 1,250.1 1,551.1 Cash-flow (*) 312.8 505.4 709.7 886.8 1,548.8 2,555.1 Dividends paid 38.4 46.1 96.8 137.6 211.7 441.1 Total investments 1,050.7 657.5 1,196.4 4,216.4 5,407.1 3,403.2 Total assets 4,914.5 11,226.3 12,399.6 17,712.5 25,182.7 49,593.4 Equity 1,003.9 1,895.7 2,019.2 2,635.5 3,256.4 10,441.0 Shareholders’ equity 980.4 1,796.4 1,905.4 2,480.9 3,115.7 4,653.8 Total net debt 594.5 1,230.6 1,423.9 4,264.6 8,746.3 16,574.5 Net debt with recourse 383.5 914.4 961.6 1,909.4 1,753.4 6,933.1 Non recourse financing 211.0 316.2 462.3 2,355.2 6,992.9 9,641.4 Order book 7,422.5 22,537.8 23,928.4 26,868.1 29,918.3 32,321.8 Number of employees 32,555 97,112 107,748 113,273 123,652 144,919 (*) Net profit + Depreciation + Change in provisions Data per share(2) 2002 (1) 2003 (1) 2004 2005 2006 2007 Euros Earnings 0.94 0.76 1.30 1.74 3.58 4.51 Gross dividend 0.24 0.27 0.39 0.60 1.25 -

Nomura-Greentech-Gen

Sustainable Technology and Infrastructure Monthly Market Update // January 2021 Performance of Key Market Indices1 280.0% 203.4% 240.0% 200.0% 160.0% 120.0% 80.0% 42.8% 40.0% 15.2% 0.0% 13.6% (40.0%) Jan-20 Mar-20 May-20 Jul-20 Sep-20 Nov-20 Jan-21 NASDAQ Clean Edge Green Energy MSCI World Index NASDAQ Composite S&P 500 1 Index Performance January Ending Versus January YTD CY 2019 52 Wk High 52 Wk Low MSCI World Index (1.1%) (1.1%) 14.1% (3.8%) 66.1% NASDAQ Composite 1.4% 1.4% 43.6% (4.1%) 90.5% S&P 500 (1.1%) (1.1%) 16.3% (3.7%) 66.0% NASDAQ Clean Edge Green Energy 13.8% 13.8% 182.4% (7.9%) 372.5% Denotes Nomura Notable Recent Transactions & Capital Raises Greentech Transaction Date Target Acquiror Transaction Description Naturgy, a Spanish multinational natural gas and electric utilities company, acquired Jan. 15 Hamel Renewables Naturgy Hamel Renewables, a solar and energy storage development platform in the U.S., for an Corporate M&A undisclosed amount Transactions Enphase, a supplier of microinverter-based solar-plus-storage systems, acquired Jan. 26 Sofdesk Enphase Sofdesk, a developer of a residential solar software platform, for an undisclosed amount Date Company Transaction Description esVolta, a U.S.-based developer, owner and operator of utility-scale energy storage projects across North Jan. 19 esVolta America, raised an undisclosed amount from Macquarie Green Investment Group Capital Raises Rivian, a U.S.-based developer of electric vehicles raised $2.7bn led by T. -

La Expansión DE LA MULTINACIONAL ESPAÑOLA: ESTRATEGIAS Y CAMBIOS ORGANIZATIVOS

LA EXPANSIÓN DE LA MULTINACIONAL ESPAÑOLA: ESTRATEGIAS Y CAMBIOS ORGANIZATIVOS Primer informe anual del Observatorio de la Con la colaboración de Empresa Multinacional Española (OEME) LA EXPANSIÓN DE LA MULTINACIONAL ESPAÑOLA: ESTRATEGIAS Y CAMBIOS ORGANIZATIVOS PRIMER INFORME ANUAL DEL OBSERVATORIO DE LA EMPRESA MULTINACIONAL ESPAÑOLA (OEME) Capítulo 1 010 El entorno macroeconómico de la expansión inversora española en el exterior Capítulo 2 026 Tendencias y factores de localización de la IED empresarial española en 1993-2007 Capítulo 3 076 De la internacionalización a la multinacionalización de la empresa: marcos teóricos para su análisis estratégico Capítulo 4 106 Análisis transversal de una muestra de empresas españolas en su proceso de internacionalización Capítulo 5 132 Financiación y resultados de los procesos de internacionalización Capítulo 6 148 La internacionalización del sector hotelero. El caso español Capítulo 7 166 Conclusiones CAPÍTULO 4 ANÁLISIS TRANSVERSAL DE UNA MUESTRA DE EMPRESAS ESPAÑOLAS EN SU PROCESO DE INTERNACIONALIZACIÓN Por Luis Vives y Xavier Mendoza Departamento de Política de Empresa de ESADE ANÁLISIS TRANSVERSAL DE UNA MUESTRA DE EMPRESAS ESPAÑOLAS EN SU PROCESO DE INTERNACIONALIZACIÓN Si evaluamos el grado y desarrollo de su internacionalización, España y las empresas españolas han conseguido un increíble desarrollo durante los últimos 20 años. España ha pasado de ser un país netamente receptor de inversión exterior directa (IED) a ser un país emisor, con un notable volumen de inversión exterior (como -

March 2020 Monthly Update

Sustainable Technology and Infrastructure Monthly Market Update // March 2020 Performance of Key Market Indices(1) 60.0% 40.0% 20.0% (0.0%) (0.4%) 0.0% (8.8%) (20.0%) (15.5%) (40.0%) Mar-19 May-19 Jul-19 Sep-19 Nov-19 Jan-20 Mar-20 NASDAQ Clean Edge Green Energy Dow Jones Industrial Average NASDAQ Composite S&P 500 (1) Index Performance March Ending Versus March YTD CY 2019 52 Wk High 52 Wk Low Dow Jones Industrial Average (13.7%) (23.2%) 22.3% (25.8%) 17.9% NASDAQ Composite (10.1%) (14.2%) 35.2% (21.6%) 12.2% S&P 500 (12.5%) (20.0%) 28.9% (23.7%) 15.5% NASDAQ Clean Edge Green Energy (23.4%) (19.2%) 40.7% (35.1%) 18.8% Notable Recent Transactions & Capital Raises Target Acquirer Transaction Description KKR’s infrastructure fund acquired Viridor, a U.K.-based recycling and residual waste business, for $4,860mm M&A Neste, a producer of renewable diesel from waste and residue raw Transactions materials, has agreed to acquire Mahoney Environmental, a collector and recycler of used cooking oil for an undisclosed amount Morgan Stanley Infrastructure Partners acquired Seven Seas Water, a provider of outsourced water treatment and wastewater treatment and reuse solutions for an undisclosed amount Nomura Greentech Advisory Transaction Company Transaction Description Impossible Foods, a developer of plant-based meat alternatives, raised a $500mm round Capital GFL Environmental, a Canadian waste management company offering non- Raises hazardous solid waste management, infrastructure, soil remediation and liquid waste management services, raised $2,200mm in its IPO on the Toronto stock exchange Via, an operator of an on-demand transit company designed to provide car pooling services, raised a $200mm round About Nomura Greentech Our mission is to empower companies and investors who are creating a more efficient and sustainable global infrastructure. -

Spain's Main Listed Companies Notch up Record Revenues Abroad

ARI 46/2018 10 April 2018 Spain’s main listed companies notch up record revenues abroad William Chislett | Associate Analyst, Elcano Royal Institute | @WilliamChislet3 Theme The companies that comprise the Ibex 35, the benchmark index of the Madrid Stock Exchange, generated a record 67.7% of their revenues abroad in 2017. Summary In less than 30 years, Spain’s main listed companies, ranging from construction and engineering groups to banks, have established a significant presence on the global corporate stage. Their international revenues, as a share of total income, have more than doubled and in recent years have offset the downturn in their domestic market. Analysis Background Corporate Spain was a late-comer to expanding abroad, beginning in earnest during the 1990s, following the country’s membership of the European Economic Community in 1986 that opened up the economy and gathered pace after Spain became a founding member of the euro zone in 1999. In less than 30 years, a bevy of Spanish companies and banks have built up a notable presence abroad. Their internationalisation began in Latin America, a natural choice given the cultural and linguistic affinities, and then moved to Europe, the US and more recently parts of Asia. Firms were also pulled by economic liberalisation and privatisation in many Latin American countries as this opened up sectors that were hitherto off-limits. The expansion abroad also came after a wave of mergers, restructurings and privatisations in Spain that increased the critical mass of companies and banks. Spain has nine companies in the latest Fortune Global 500 ranking of the world’s largest companies based on total revenues, one of which, Banco Santander, is in the top 100 (see Figure 1).