Eiris Guide to Responsible Banking 2 0

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Irish Economy Watch AIB Treasury Economic Research Unit

Irish Economy Watch AIB Treasury Economic Research Unit Thursday 19 November 2020 Mar-20 Apr-20 May-20 Jun-20 Jul-20 Aug-20 Sep-20 Oct-20 Manufacturing PMI edged higher to 50.3 in October as the MANUFACTURING survey points to broadly stable AIB Manufacturing PMI 45.1 36.0 39.2 51.0 57.3 52.3 50.0 50.3 but subdued business conditions in the sector OECD Leading Indicator 98.8 93.4 94.1 97.6 99.2 99.4 99.6 99.7 Traditional industrial production Industrial Production (Ex-Modern) 112.7 86.5 82.6 93.7 110.8 109.5 110.6 #N/A moved higher in September as Production (Ex-Modern) : 3mma YoY% 1.7 -10.0 -17.7 -21.2 -14.2 -5.3 -0.7 #N/A output rebounded by 25.9% in 3mth / 3mth % seas. adj. 2.4 -9.6 -16.3 -22.9 -6.6 11.4 25.9 #N/A Q3. YoY growth rate at –0.7% SERVICES / RETAIL Services PMI stayed in contraction but improved to 48.3 AIB Services PMI 32.5 13.9 23.4 39.7 51.9 52.4 45.8 48.3 in October. Weak demand was evident from a decline in new CSO Services Index (Value) 124.4 98.1 101.0 114.1 114.5 115.1 121.1 #N/A business, with firms linking this - YoY % -0.4 -21.8 -19.3 -10.5 -10.6 -9.1 -4.0 #N/A to Covid-19 restrictions - 3mth / 3mth % seas. -

You Can View the Full Spreadsheet Here

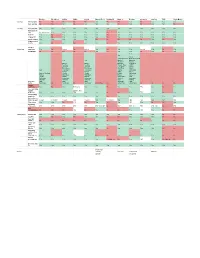

Barclays First Direct Halifax HSBC Lloyds Monzo (Free) Nationwide Natwest Revolut Santander Starling TSB Virgin Money Savings Savings pots No No No No No Yes No No Yes No Yes Yes Yes Auto savings No No Yes No Yes Yes Yes No Yes No Yes Yes No Banking Easy transfer yes Yes yes Yes yes Yes Yes Yes Yes Yes Yes Yes Yes New payee in app Need debit card Yes Yes Yes Yes Yes No Yes Yes Yes Yes Yes Yes New SO Yes No Yes Yes Yes Yes No Yes Yes Yes Yes Yes Yes change SO Yes No Yes Yes Yes Yes No Yes Yes Yes Yes Yes Yes pay in cheque Yes Yes Yes Yes Yes No No No No No Yes No Yes share account details Yes No yes No yes Yes No Yes Yes Yes Yes Yes Yes Analyse Budgeting spending Yes No limited No limited Yes No Yes Yes Limited Yes No Yes Set Budget No No No No No Yes No Yes Yes No Yes No Yes Yes Yes Amex Allied Irish Bank Bank of Scotland Yes Yes Bank of Barclays Scotland Danske Bank of Bank of Barclays First Direct Scotland Scotland Danske Bank HSBC Barclays Barclays First Direct Halifax Barclaycard Barclaycard First Trust Lloyds Yes First Direct First Direct Halifax M&S Bank Halifax Halifax HSBC Monzo Bank of Scotland Lloyds Lloyds Lloyds Nationwide Halifax M&S Bank M&S Bank Monzo Natwest Lloyds MBNA MBNA Nationwide RBS Nationwide Nationwide Nationwide NatWest Santander NatWest NatWest NatWest RBS Starling Add other RBS RBS RBS Santander TSB banks Santander No Santander No Santander Not on free No Ulster Bank Ulster Bank No No No No Instant notifications Yes No Yes Rolling out Yes Yes No Yes Yes TBC Yes No Yes See upcoming regular Balance After payments -

Allied Irish Bank (GB) Comes Top Again in Comprehensive UK Banking Survey 27Th November 2000

Allied Irish Bank (GB) comes top again in comprehensive UK banking survey 27th November 2000 Allied Irish Bank (GB) has today been named Best Business Bank for the fourth consecutive time in the Forum of Private Business’s (FPB) comprehensive survey into the strength of service offered by banks to private businesses. The FPB report, Private Businesses and Their Banks 2000, is a biennial survey of tens of thousands of British businesses and shows that Allied Irish Bank (GB) has maintained its No. 1 position over other major UK banks since 1994. Aidan McKeon, General Manager of Allied Irish Bank (GB) and Managing Director AIB Group (UK) p.l.c., commented: "While we are delighted to win this award for the fourth time, we are far from complacent. We continue to listen closely to our customers and to invest in the cornerstones of our business: recruiting, training and retaining quality people; building 'true’ business relationships; and ongoing commitment to maintaining short lines of decision making. At the same time, we are exploiting technology to make our service as customer- responsive and efficient as possible." Allied Irish Bank (GB), one of the forerunners in relationship banking, scores highest in the survey for knowledge and understanding. The bank also scored highly on efficiency, reliability and customer satisfaction. Mr. McKeon continued: "We recognise that business customers have particular needs and concerns and we are always striving to ensure that our customers receive a continually improved service. We shall look carefully at this survey and liaise with our customers to further strengthen our service." Stan Mendham, Chief Executive of the FPB commented: "The FPB congratulates Allied Irish Bank (GB) on being voted Best Business Bank in Britain for the fourth time. -

Annual-Financial-Report-2009.Pdf

Contents 4 Chairman’s statement 255 Statement of Directors’ responsibilities in relation to the Accounts 6 Group Chief Executive’s review 256 Independent auditor’s report 8 Corporate Social Responsibility 258 Additional information 12 Financial Review 276 Principal addresses - Business description 278 Index - Financial data - 5 year financial summary - Management report - Capital management - Critical accounting policies - Deposits and short term borrowings - Financial investments available for sale - Financial investments held to maturity - Contractual obligations - Off balance sheet arrangements 59 Risk Management - Risk Factors - Framework - Individual risk types - Supervision and regulation 106 Corporate Governance - The Board & Group Executive Committee - Directors’ Report - Corporate Governance statement - Employees 119 Accounting policies 136 Consolidated income statement 137 Balance sheets 139 Statement of cash flows 141 Statement of recognised income and expense 142 Reconciliations of movements in shareholders’ equity 146 Notes to the accounts 1 Forward-Looking Information This document contains certain forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 with respect to the financial condition, results of operations and business of the Group and certain of the plans and objectives of the Group. In particular, among other statements, certain statements in the Chairman’s statement, the Group Chief Executive’s review, and the Financial Review and Risk Management sections, with regard to management objectives, trends in results of operations, margins, risk management, competition and the impact of changes in International Financial Reporting Standards are forward-looking in nature.These forward-looking statements can be identified by the fact that they do not relate only to historical or current facts. -

The Ritz London, 16Th November 2016 by Invitation Only Confidential – Not for Distribution

® The Ritz London, 16th November 2016 By Invitation Only The AI Finance Summit is the world’s first and only high-level conference exploring the impact of Artificial Intelligence on the financial services industry. The invitation-only event, brings together CxOs from the world’s leading banks, insurance companies, asset management organisations, brokers. The event takes place at London’s most prestigious address, The Ritz, on the 16th of November and features world-class speakers presenting exclusive case studies shedding light into how the 4th industrial revolution will affect specifically affect the financial services industry. DRAFT AGENDA 16tH November 2016, The Ritz London 08:30 Registration, Breakfast refreshments & Networking 09:15 A welcome unlike any other… and Chair’s Opening Remarks 09:20 State of Play opening keynote: the 4th industrial revolution in financial services Where are financial services currently at with artificial intelligence, what technologies in particular are being used, how quickly is it being adopted, and what areas are leading the adoption of new intelligent technologies? These are are some of the pivotal questions answered in the scene-setting opening keynote to the AI Finance Summit. 09:45 Introducing a new era of risk management in investment banking The use of artificial intelligence within the world of investment banking is a phenomenon which is going to propel the industry in more ways than one. This talk will discuss how the advent of AI technologies, focusing on machine learning and cognitive computing, will drastically enhance risk management processes and achieve levels of accuracy previously unseen in the industry 10:10 Customer Experience/ Relations Management through AI platforms AI is revolutionizing customer service across every industry, with financial services already a pioneer in adoption. -

Investor Presentation

Investor Presentation HY 2020 Our Investment Case 1 2 3 4 Our distinctive The scale and A well-positioned Our operational business model & quality of our development expertise & clear strategy portfolio pipeline customer insight Increasing our focus 22.5m sq ft of Development pipeline Expertise in on mixed use places high quality assets aligned to strategy managing and leasing our assets based on our customer insight Growing London Underpinned by our Provides visibility campuses and resilient balance sheet on future earnings Residential and refining and financial strength Drives incremental Retail value for stakeholders 1 British Land at a glance 1FA, Broadgate £15.4bn Assets under management £11.7bn Of which we own £521m Annualised rent 22.5m sq ft Floor space 97% Occupancy Canada Water Plymouth As at September 2019 2 A diverse, high quality portfolio £11.7bn (BL share) Multi-let Retail (26%) London Campuses (45%) 72% London & South East Solus Retail (5%) Standalone offices (10%) Retail – London & SE (10%) Residential & Canada Water (4%) 3 Our unique London campuses £8.6bn Assets under management £6.4bn Of which we own 78% £205m Annualised rent 6.6m sq ft Floor space 97% Occupancy As at September 2019 4 Canada Water 53 acre mixed use opportunity in Central London 5 Why mixed use? Occupiers Employees want space which is… want space which is… Attractive to skilled Flexible Affordable Well connected Located in vibrant Well connected Safe and promotes Sustainable and employees neighbourhoods wellbeing eco friendly Tech Close to Aligned to -

Time to Touch up the CV? Beeb Launches Search for New Director General

BUSINESS WITH PERSONALITY PLOUGHING AHEAD 30 YEARS LATER THE WIMBLEDON LOOK LAND ROVER DISCOVERY TO HEAD BACK TO HITS A LANDMARK P24 MERTON HOME P26 TUESDAY 11 FEBRUARY 2020 ISSUE 3,553 CITYAM.COM FREE HACKED OFF US ramps up China TREASURY TO spat with fresh Equifax charges SET OUT CITY BREXIT PLAN EXCLUSIVE Beyond Brexit, it will also consider “But there will be differences, not CATHERINE NEILAN the industry’s future in relation to least because as a global financial cen- worldwide challenges such as emerg- tre the UK needs to keep pace with @CatNeilan ing technologies and climate change. and drive international standards. THE GOVERNMENT will insist on the Javid sets out the government’s Our starting point will be what’s right right to diverge from EU financial plans to retain regulatory autonomy for the UK.” services regulation as part of a post- while seeking a “reliable equivalence He also re-committed to concluding Brexit trade deal with Brussels. process”, on which a “durable rela- “a full range of equivalence assess- Writing exclusively in City A.M. today, tionship” can be built. ments” by June of this year, in order to chancellor Sajid Javid says the “Of course, each side will only give the system sufficient stability City “will no longer be a rule- grant equivalence if it believes ahead of the end of transition. taker” and reveals that the other’s regulations are One senior industry figure told City ministers are working on compatible,” the chancel- A.M. that while a white paper was EMILY NICOLLE Zhiyong, Wang Qian, Xu Ke and Liu Le, a white paper setting lor writes. -

What's the Best Way to Get in Touch with My Banks?

INVESTIGATION | CONTACTING BANKS What’s the best way to get in touch with my bank? With more than 2,000 branches closing over the past decade, In part, banks and building societies have been cutting costs as a result of the financial has it become harder to access your bank, or do new contact crisis, or prioritising investment in technology methods compensate for the decline in face-to-face service? to get people banking in other ways. To better understand this shift in banking decade ago, if you wanted to pay in a The rapid rate of branch closure is a cause access, we surveyed 14 of the biggest current cheque or withdraw some money, all for concern for 57% of Which? members, account providers to find out how many A it would take was a short walk to your according to our survey of 1,356 people in branches they’d closed or opened between local high street bank branch. But today, the January 2014. However, with 89% of those we 2003 and 2013. We also asked about their same transaction at your nearest branch surveyed having access to online banking and branch network plans for 2014 and beyond. might require a 20-mile drive. 76% using telephone banking, it’s perhaps no HSBC closed the largest percentage – almost Given that the number of bank branches surprise that 42% believe that branch banking 30% were shut between the start of 2003 and on our high streets has almost halved since is becoming obsolete. But do the alternatives the end of 2013 – 458 branches in areas where the late 1980s, that’s hardly surprising. -

Information Memorandum ALLIED IRISH BANKS, P.L.C

Information Memorandum ALLIED IRISH BANKS, p.l.c. €5,000,000,000 Euro-Commercial Paper Programme Rated by Standard & Poor’s Credit Market Services Europe Limited and Fitch Ratings Ltd. Arranger UBS INVESTMENT BANK Issuing and Paying Agent CITIBANK Dealers AIB BARCLAYS BOFA MERRILL LYNCH CITIGROUP CREDIT SUISSE GOLDMAN SACHS INTERNATIONAL ING NOMURA THE ROYAL BANK OF SCOTLAND UBS INVESTMENT BANK The date of this Information Memorandum is 16 March 2016 Disclaimer clauses for Dealers, Issuing and Paying Agent and Arranger See the section entitled “Important Notice” on pages 1 to 4 of this Information Memorandum. IMPORTANT NOTICE This Information Memorandum (together with any supplementary information memorandum, and information incorporated herein by reference, the “Information Memorandum”) contains summary information provided by Allied Irish Banks, p.l.c. (the “Issuer” or “AIB”) in connection with a euro-commercial paper programme (the “Programme”) under which the Issuer acting through its office in Dublin or its London branch as set out at the end of this Information Memorandum may issue and have outstanding at any time euro-commercial paper notes (the “Notes”) up to a maximum aggregate amount of €5,000,000,000 or its equivalent in alternative currencies. Under the Programme, the Issuer may issue Notes outside the United States pursuant to Regulation S (“Regulation S”) under the United States Securities Act of 1933, as amended (the “Securities Act”). The Issuer has, pursuant to an amended and restated dealer agreement dated 16 March 2016 (the “Dealer Agreement”), appointed UBS Limited as arranger of the Programme (the “Arranger”), appointed Bank of America Merrill Lynch International Limited, Barclays Bank PLC, Citibank Europe plc, London Branch, Credit Suisse Securities (Europe) Limited, Goldman Sachs International, ING Bank N.V., Nomura International plc, The Royal Bank of Scotland plc and UBS Limited as dealers in respect of the Notes (together with Allied Irish Banks, p.l.c. -

AIB 2003 Cover 22/3/04 4:44 PM Page 1

AIB 2003 cover 22/3/04 4:44 PM Page 1 Allied Irish Banks, p.l.c. Annual Report and Accounts 2003 Report & Accounts 20032003 AIB Group Bankcentre PO BOX 452 Dublin 4 Ireland Tel. +353 (0) 1 660 0311 www.aibgroup.com This is the new-style report and accounts document from AIB. The Chairman’s statement is on pages 8/9 and the Group Chief Executive’s review starts on page 12. It includes for the first time statements on Corporate and Social Responsibility, on page 16, and AIB and its people, on page 17. For the latest information, please visit our websites listed opposite. 3 4 Contents 7 Financial highlights 8 Chairman’s statement 10 AIB Board/Executive Committee 12 Group Chief Executive’s review 15 AIB at a glance 16 Corporate and Social Responsibility 17 AIB and its people 19 Performance review 37 Financial review 48 Report of the Directors 50 Corporate Governance 54 Accounting policies 59 Consolidated profit and loss account 61 Consolidated balance sheet 62 Balance sheet Allied Irish Banks, p.l.c. 63 Consolidated cash flow statement 64 Reconciliation of movements in shareholders’ funds 64 Note of historical cost profits and losses 65 Notes to the accounts 140 Statement of Directors’ responsibilities in relation to the Accounts 141 Independent auditors’ report 143 Additional financial information 145 Accounts in sterling, US dollars and Polish zloty 146 Five year financial summary 148 Principal addresses 150 Additional information for shareholders 154 Financial calendar 155 Index 5 Forward-Looking Information. This document contains certain forward- looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 with respect to the financial condition, results of operations and business of the Group and certain of the plans and objectives of the Group. -

PLACES PEOPLE PREFER Annual Report and Accounts 2020

PLACES PEOPLE PREFER Annual Report and Accounts 2020 British Land plc Annual Report and Accounts 2020 Inside Key figures Strategic Report Underlying EPS IFRS loss after tax At a glance 2 Chairman’s statement 4 32.7p £(1,114)m Our purpose 6 2019: 34.9p 2019: £(320)m Case study: 1 Triton Square 8 Chief Executive’s review 10 Investment case 13 EPRA NAV per share Underlying Profit Business model 14 774p £306m Places 2019: 905p 2019: £340m Our portfolio 16 Strategic focus 22 Total accounting return IFRS net assets Strategic performance and KPIs 24 Development pipeline 26 (11.0)% £7,147m 2019: (3.3)% 2019: £8,689m People Customer and community stories 30 Stakeholder engagement and s172 32 IFRS EPS Dividend per share People and culture 34 (110.0)p 15.97p Employee-led networks 36 Sustainability 38 2019: (30.0)p 2019: 31.00p Task Force on Climate-Related Financial Disclosures (TCFD) 42 Senior unsecured Carbon intensity reduction GHG emissions 46 credit rating versus 2009 Non-financial reporting disclosure 47 A 73% Prefer 2019: A 2019: 64% Market insights 54 Performance review 56 Customer Bright Lights skills and Financial review 68 satisfaction employment programme Financial policies and principles 75 Managing risk 78 8.3 504 Principal risks 82 2019: 8.2/10 people supported with work Viability statement 88 2019: 389 Corporate Governance Report Chairman’s introduction 90 Board of Directors 92 Stakeholder engagement statement 96 Presentation of financial information Corporate Governance Report 98 The Group financial statements are prepared under IFRS where the Report of the Nomination Committee 104 Group’s interests in joint ventures and funds are shown as a single line item on the income statement and balance sheet and all subsidiaries are Report of the Audit Committee 108 consolidated at 100%. -

Nationwide Building Society

PROSPECTUS dated 11 September 2017 THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. If you are in doubt as to the action you should take in connection with this document or the proposals contained in it, you are recommended to seek your own personal financial advice immediately from your stockbroker, bank manager, solicitor, accountant or other independent financial adviser authorised under the Financial Services and Markets Act 2000, if you are taking advice in the United Kingdom, or from another appropriately authorised independent financial adviser if you are taking advice in a jurisdiction outside the United Kingdom. This document comprises a prospectus (the Prospectus) relating to Nationwide Building Society (the Society) and to the Society and its consolidated subsidiaries (Nationwide or the Group) prepared in accordance with the Prospectus Rules of the Financial Conduct Authority (the FCA) made under section 73A of the Financial Services and Markets Act 2000, as amended (the FSMA). The Prospectus will be made available to the public in accordance with the Prospectus Rules. Capitalised terms used in this Prospectus which are not otherwise defined have the meanings given to them in “Part XXII: Definitions”. NATIONWIDE BUILDING SOCIETY (incorporated in England and Wales under the UK Building Societies Act 1986, as amended, and regulated by the Prudential Regulation Authority and the Financial Conduct Authority with FCA Mutuals Public Register Number 355B) Issue of 5,000,000 Core Capital Deferred Shares of £1 each at an Issue Price of £159.00 per Core Capital Deferred Share (the Further CCDS) and admission of the Further CCDS to the Official List and to trading on the London Stock Exchange such Further CCDS to be consolidated and form a single series immediately upon issue with the 5,500,000 CCDS issued by the Society on 6 December 2013 (the Existing CCDS and, together with the Further CCDS, the CCDS) Joint Bookrunners Barclays BofA Merrill Lynch Citigroup J.P.