UK Banks Using Confirmation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

18 February 2019 Solvency and Diversification in Insurance Remain Key Strengths Despite Change in Structure

FINANCIAL INSTITUTIONS ISSUER IN-DEPTH Lloyds Banking Group plc 18 February 2019 Solvency and diversification in insurance remain key strengths despite change in structure Summary RATINGS In 2018, Lloyds Banking Group plc (LBG) altered its structure to comply with the UK's ring- Lloyds Banking Group plc Baseline Credit a3 fencing legislation, which requires large banks to separate their retail and SME operations, Assessment (BCA) and deposit taking in the European Economic Area (EEA) from their other activities, including Senior unsecured A3 Stable the riskier capital markets and trading business. As part of the change, LBG designated Lloyds Bank plc as the“ring-fenced” entity housing its retail, SME and corporate banking operations. Lloyds Bank plc It also assumed direct ownership of insurer Scottish Widows Limited, previously a subsidiary Baseline Credit A3 Assessment (BCA) of Lloyds Bank. The changes had little impact on the creditworthiness of LBG and Lloyds Adjusted BCA A3 Bank, leading us to affirm the deposit and senior unsecured ratings of both entities. Scottish Deposits Aa3 Stable/Prime-1 Widows' ratings were unaffected. Senior unsecured Aa3 Stable » LBG's reorganisation was less complex than that of most UK peers. The Lloyds Lloyds Bank Corporate Markets plc Banking Group is predominantly focused on retail and corporate banking, and the Baseline Credit baa3 required structural changes were therefore relatively minor. The group created a small Assessment (BCA) separate legal entity, Lloyds Bank Corporate Markets plc (LBCM), to manage its limited Adjusted BCA baa1 Deposits A1 Stable/Prime-1 capital markets and trading operations, and it transferred its offshore subsidiary, Lloyds Issuer rating A1 Stable Bank International Limited (LBIL), to LBCM from Lloyds Bank. -

Irish Economy Watch AIB Treasury Economic Research Unit

Irish Economy Watch AIB Treasury Economic Research Unit Thursday 19 November 2020 Mar-20 Apr-20 May-20 Jun-20 Jul-20 Aug-20 Sep-20 Oct-20 Manufacturing PMI edged higher to 50.3 in October as the MANUFACTURING survey points to broadly stable AIB Manufacturing PMI 45.1 36.0 39.2 51.0 57.3 52.3 50.0 50.3 but subdued business conditions in the sector OECD Leading Indicator 98.8 93.4 94.1 97.6 99.2 99.4 99.6 99.7 Traditional industrial production Industrial Production (Ex-Modern) 112.7 86.5 82.6 93.7 110.8 109.5 110.6 #N/A moved higher in September as Production (Ex-Modern) : 3mma YoY% 1.7 -10.0 -17.7 -21.2 -14.2 -5.3 -0.7 #N/A output rebounded by 25.9% in 3mth / 3mth % seas. adj. 2.4 -9.6 -16.3 -22.9 -6.6 11.4 25.9 #N/A Q3. YoY growth rate at –0.7% SERVICES / RETAIL Services PMI stayed in contraction but improved to 48.3 AIB Services PMI 32.5 13.9 23.4 39.7 51.9 52.4 45.8 48.3 in October. Weak demand was evident from a decline in new CSO Services Index (Value) 124.4 98.1 101.0 114.1 114.5 115.1 121.1 #N/A business, with firms linking this - YoY % -0.4 -21.8 -19.3 -10.5 -10.6 -9.1 -4.0 #N/A to Covid-19 restrictions - 3mth / 3mth % seas. -

You Can View the Full Spreadsheet Here

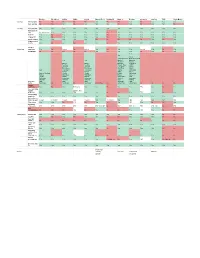

Barclays First Direct Halifax HSBC Lloyds Monzo (Free) Nationwide Natwest Revolut Santander Starling TSB Virgin Money Savings Savings pots No No No No No Yes No No Yes No Yes Yes Yes Auto savings No No Yes No Yes Yes Yes No Yes No Yes Yes No Banking Easy transfer yes Yes yes Yes yes Yes Yes Yes Yes Yes Yes Yes Yes New payee in app Need debit card Yes Yes Yes Yes Yes No Yes Yes Yes Yes Yes Yes New SO Yes No Yes Yes Yes Yes No Yes Yes Yes Yes Yes Yes change SO Yes No Yes Yes Yes Yes No Yes Yes Yes Yes Yes Yes pay in cheque Yes Yes Yes Yes Yes No No No No No Yes No Yes share account details Yes No yes No yes Yes No Yes Yes Yes Yes Yes Yes Analyse Budgeting spending Yes No limited No limited Yes No Yes Yes Limited Yes No Yes Set Budget No No No No No Yes No Yes Yes No Yes No Yes Yes Yes Amex Allied Irish Bank Bank of Scotland Yes Yes Bank of Barclays Scotland Danske Bank of Bank of Barclays First Direct Scotland Scotland Danske Bank HSBC Barclays Barclays First Direct Halifax Barclaycard Barclaycard First Trust Lloyds Yes First Direct First Direct Halifax M&S Bank Halifax Halifax HSBC Monzo Bank of Scotland Lloyds Lloyds Lloyds Nationwide Halifax M&S Bank M&S Bank Monzo Natwest Lloyds MBNA MBNA Nationwide RBS Nationwide Nationwide Nationwide NatWest Santander NatWest NatWest NatWest RBS Starling Add other RBS RBS RBS Santander TSB banks Santander No Santander No Santander Not on free No Ulster Bank Ulster Bank No No No No Instant notifications Yes No Yes Rolling out Yes Yes No Yes Yes TBC Yes No Yes See upcoming regular Balance After payments -

PRIVACY NOTICE Privacy Notice

PRIVACY NOTICE Privacy Notice Page 1. Who we are 3 2. The information we process 3 3. How we obtain information 4 4. Your rights 5 Table A – Your Rights 5 5. Changes to the way we use your information 6 6. How we use and share your information with other NatWest group companies 6 7. Sharing with third parties 6 8. Transferring information overseas 7 9. Marketing information 7 10. Communications about your account 7 11. Credit reference and fraud prevention agencies 7 12. How long we keep your information 8 13. Security 9 Schedule A – Schedule of Purposes of Processing A. Contractual necessity 10 B. Legal obligation 10 C. Legitimate interests of the bank 11 02 Privacy Notice 1. Who we are 1.1. This privacy notice (the ‘Privacy Notice’) applies to all personal information processing activities carried on by the businesses of the *Royal Bank of Scotland International Limited (RBS International). *RBS International also trades as NatWest International, Isle of Man Bank and Coutts Crown Dependencies. 1.2. RBS International is a data controller in respect of personal information that we process in connection with our business (including the products and services that we provide). In this notice, references to ‘we’, ‘us’ or ‘our’ are references to RBS International. 1.3. The Royal Bank of Scotland International Limited trades in Jersey, Guernsey and the Isle of Man as Coutts Crown Dependencies. The Royal Bank of Scotland International Limited Registered Office: P.O. BOX 64, Royal Bank House, 71 Bath Street, St. Helier, Jersey JE4 8PJ. Tel 00 44 1534 282345. -

Natwest, Lloyds Bank and Barclays Pilot UK's First Business Banking Hubs

NatWest, Lloyds Bank and Barclays pilot UK’s first business banking hubs NatWest, Lloyds Bank and Barclays have announced that they will pilot the UK’s first shared business banking hubs. The first hub will open its door in Perry Barr, Birmingham today. The pilot will also see five other shared hubs open across the UK in the coming weeks The hubs have been specifically designed to enable businesses that manage cash and cheque transactions to pay in large volumes of coins, notes and cheques and complete cash exchange transactions. They will be available on a trial basis to pre-selected business clients in each local area and will offer extended opening times (8am to 8pm) 7 days a week, providing business and corporate customers more flexibility to manage their day-to-day finances. The hubs will be branded Business Banking Hub and they have been designed to enable business customers from Natwest, Lloyds Bank and Barclays to conduct transactions through a shared facility. Commenting on the launch of the pilot, Deputy CEO of NatWest Holdings and CEO of NatWest Commercial and Private Banking Alison Rose said: “We have listened to what our business customers really want from our cash services. It is now more important than ever that we continue to offer innovative services, and we are creating an infrastructure that allows small business owners and entrepreneurs to do what they do best - run their business. I look forward to continued working with fellow banks to ensure the UK's businesses are getting the support they deserve." Commenting on the support this will provide businesses, Paul Gordon, Managing Director of SME and Mid Corporates at Lloyds Bank Commercial Banking said: “SMEs are the lifeblood of the UK economy. -

Banco Santander: Extending Financial Se Vices to Low-Income Communities in B Azil

CASE STUDY Banco Santander: Extending financial se vices to low-income communities in B azil Initi ti e Descriptio In September 2013, Santander Microcrédito joined the Business Call to Action with a commitment to serve 124,799 low-income consumers with microfinance services and to disburse up to US$490 million in microcredit loans by 2015. The goals of Santander Microcrédito are to: • Disburse R$540 million (US$230 million) in microcredit operations by the end of 2014; and R$600 million (US$260 million) in 2015; and • Attain 126,000 active microcredit clients by the end of 2014 and 131,000 additional clients Business Model Santander Microcredit is an example of how Banco in 2015. In Brazil, 52 million people and Santander Brasil contributes to approximately 25 million informal reducing social inequalities in entrepreneurs lack access to the for- the country. When we started mal banking system. Santander Brasil thinking about how to launch Microcredit, a company affiliated with the microcredit programme, we Banco Santander Brasil, was founded decided that it should be a in 2002 to offer microcredit operations model in which all involved to support business entrepreneurs parties could benefit. that could not access formal banking services. To this end, Santander Brasil Microcredit offers loans that con- tribute to employment and income generation for low-income people. Currently, Santander Microcredit The average monthly income in Brazil operates in more than 600 municipali- is US$6801 and 21 percent of the pop- ties (in 10 Brazilian states), and has 25 ulation live below the poverty line2. branch offices. -

Cross-Border Financial Institutions in the EU: Analysis of Total Assets and Ultimate Ownership

Directorate-General for Internal Policies Directorate A - Economic and Scientific Policy Policy Department A.: Economic and Scientific Policy and Quality of Life Unit Cross-Border Financial Institutions in the EU: Analysis of Total Assets and Ultimate Ownership Briefing Note IP/A/ECON/NT/2008-10 PE 408.550 Only published in English. Author: Josina KAMERLING Policy Department Economy and Science DG Internal Policies European Parliament Rue Wiertz 60 - ATR 00L046 B-1047 Brussels Tel: +32 (0)2 283 27 86 Fax: +32(0)2 284 69 29 E-mail: [email protected] Arttu MAKIPAA Policy Department Economy and Science DG Internal Policies European Parliament Rue Wiertz 60 - ATR 00L042 B-1047 Brussels Tel: +32 (0)2 283 26 20 Fax: +32(0)2 284 69 29 E-mail: [email protected] Manuscript completed in August 2008. The opinions expressed in this document do not necessarily represent the official position of the European Parliament. Reproduction and translation for non-commercial purposes are authorised provided the source is acknowledged and the publisher is given prior notice and receives a copy. Rue Wiertz – B-1047 Bruxelles - 32/2.284.43.74 Fax: 32/2.284.68.05 Palais de l‘Europe – F-67000 Strasbourg - 33/3.88.17.25.56 Fax: 33/3.88.36.92.14 E-mail: [email protected] IP/A/ECON/NT/2008-10 PE 408.550 Table of Contents 1. The Data on Financial Institutions in EU27 ......................................................................1 2. Largest Financial Institutions in Europe (Tables 1-5) .......................................................2 -

Allied Irish Bank (GB) Comes Top Again in Comprehensive UK Banking Survey 27Th November 2000

Allied Irish Bank (GB) comes top again in comprehensive UK banking survey 27th November 2000 Allied Irish Bank (GB) has today been named Best Business Bank for the fourth consecutive time in the Forum of Private Business’s (FPB) comprehensive survey into the strength of service offered by banks to private businesses. The FPB report, Private Businesses and Their Banks 2000, is a biennial survey of tens of thousands of British businesses and shows that Allied Irish Bank (GB) has maintained its No. 1 position over other major UK banks since 1994. Aidan McKeon, General Manager of Allied Irish Bank (GB) and Managing Director AIB Group (UK) p.l.c., commented: "While we are delighted to win this award for the fourth time, we are far from complacent. We continue to listen closely to our customers and to invest in the cornerstones of our business: recruiting, training and retaining quality people; building 'true’ business relationships; and ongoing commitment to maintaining short lines of decision making. At the same time, we are exploiting technology to make our service as customer- responsive and efficient as possible." Allied Irish Bank (GB), one of the forerunners in relationship banking, scores highest in the survey for knowledge and understanding. The bank also scored highly on efficiency, reliability and customer satisfaction. Mr. McKeon continued: "We recognise that business customers have particular needs and concerns and we are always striving to ensure that our customers receive a continually improved service. We shall look carefully at this survey and liaise with our customers to further strengthen our service." Stan Mendham, Chief Executive of the FPB commented: "The FPB congratulates Allied Irish Bank (GB) on being voted Best Business Bank in Britain for the fourth time. -

Annual-Financial-Report-2009.Pdf

Contents 4 Chairman’s statement 255 Statement of Directors’ responsibilities in relation to the Accounts 6 Group Chief Executive’s review 256 Independent auditor’s report 8 Corporate Social Responsibility 258 Additional information 12 Financial Review 276 Principal addresses - Business description 278 Index - Financial data - 5 year financial summary - Management report - Capital management - Critical accounting policies - Deposits and short term borrowings - Financial investments available for sale - Financial investments held to maturity - Contractual obligations - Off balance sheet arrangements 59 Risk Management - Risk Factors - Framework - Individual risk types - Supervision and regulation 106 Corporate Governance - The Board & Group Executive Committee - Directors’ Report - Corporate Governance statement - Employees 119 Accounting policies 136 Consolidated income statement 137 Balance sheets 139 Statement of cash flows 141 Statement of recognised income and expense 142 Reconciliations of movements in shareholders’ equity 146 Notes to the accounts 1 Forward-Looking Information This document contains certain forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 with respect to the financial condition, results of operations and business of the Group and certain of the plans and objectives of the Group. In particular, among other statements, certain statements in the Chairman’s statement, the Group Chief Executive’s review, and the Financial Review and Risk Management sections, with regard to management objectives, trends in results of operations, margins, risk management, competition and the impact of changes in International Financial Reporting Standards are forward-looking in nature.These forward-looking statements can be identified by the fact that they do not relate only to historical or current facts. -

Analisis De La Responsabilidad Social Corporativa Del Sector Bancario

Facultad de Ciencias Económicas y Empresariales ANÁLISIS DE LA RESPONSABILIDAD SOCIAL CORPORATIVA EN EL SECTOR BANCARIO ESPAÑOL Autor: María Sánchez Barbero Director: Laura Gismera Tierno MADRID | Abril 2020 RESUMEN/ABSTRACT Resumen La Responsabilidad Social Corporativa es una práctica en auge desde finales de los años 90 y su función principal es satisfacer a los grupos de interés –stakeholders- de las empresas que la aplican. La RSC busca cumplir con los intereses internos de las compañías y de la sociedad, mejorando así la imagen corporativa de la empresa. El sector bancario español lleva casi 20 años aplicando esta corriente empresarial hasta el punto que, las distintas entidades bancarias que conforman el sector, desarrollan modelos de RSC prácticamente idénticos. Este trabajo tiene como principal objetivo analizar la Responsabilidad Social Corporativa en el sector bancario español. En primer lugar, se expondrá una aproximación al concepto de Responsabilidad Social Corporativa, así como su evolución, las principales teorías sobre la materia y ciertos aspectos diferenciales y normativos con los que se identifica la RSC. Así mismo, se realizará un análisis de la evolución del sector bancario en los últimos años junto con las oportunidades y amenazas a las que se enfrenta el mismo. Finalmente, se analizará el modelo de RSC de cinco de las entidades bancarias más importantes a nivel nacional: Santander, BBVA, CaixaBank, Bankinter y Banco Sabadell. Palabras clave: Responsabilidad Social Corporativa (RSC), economía, entidades bancarias, stakeholders, interés, sostenibilidad, acción social. Abstract Corporate Social Responsibility has been a growing practice since the late 1990s and its main function is to satisfy the stakeholders of the companies that apply it. -

The Ritz London, 16Th November 2016 by Invitation Only Confidential – Not for Distribution

® The Ritz London, 16th November 2016 By Invitation Only The AI Finance Summit is the world’s first and only high-level conference exploring the impact of Artificial Intelligence on the financial services industry. The invitation-only event, brings together CxOs from the world’s leading banks, insurance companies, asset management organisations, brokers. The event takes place at London’s most prestigious address, The Ritz, on the 16th of November and features world-class speakers presenting exclusive case studies shedding light into how the 4th industrial revolution will affect specifically affect the financial services industry. DRAFT AGENDA 16tH November 2016, The Ritz London 08:30 Registration, Breakfast refreshments & Networking 09:15 A welcome unlike any other… and Chair’s Opening Remarks 09:20 State of Play opening keynote: the 4th industrial revolution in financial services Where are financial services currently at with artificial intelligence, what technologies in particular are being used, how quickly is it being adopted, and what areas are leading the adoption of new intelligent technologies? These are are some of the pivotal questions answered in the scene-setting opening keynote to the AI Finance Summit. 09:45 Introducing a new era of risk management in investment banking The use of artificial intelligence within the world of investment banking is a phenomenon which is going to propel the industry in more ways than one. This talk will discuss how the advent of AI technologies, focusing on machine learning and cognitive computing, will drastically enhance risk management processes and achieve levels of accuracy previously unseen in the industry 10:10 Customer Experience/ Relations Management through AI platforms AI is revolutionizing customer service across every industry, with financial services already a pioneer in adoption. -

2020 Annual Report Adaptation Makes Things Work

2020 Annual Report Adaptation makes things work GUERNSEY - JERSEY - ISLE OF MAN CEO’s Statement WELCOME If ever there was a year for business to adapt to changing circumstances, it was 2020. At a time when we needed to adapt to the rapidly changing environment, we still saw excellent growth in our lending volume and a continuation of very low levels of bad debt. So, despite the pandemic and all the difficulties it caused, I am delighted to record that we achieved a 9% increase in our lending volume. Annual Report 2020 1 CEO’s Statement Continued I would like to thank our dedicated and very loyal staff who have worked extremely hard to make this happen, especially since we had to make rapid provision for our local teams to work remotely. This report provides the highlights º We have continued to apply the same º With Grant Thornton’s continued º Both our Jersey and Isle of Man of our business for the calendar year strict lending criteria that we have oversight as our Auditors, there have operations are continuing to grow ending December 2020. As always, always used, to ensure the quality been no issues raised in any of their in line with expectations. With our we will provide a further update on of our lending. We will not at any quarterly reports, which serves retail partner networks expanding our performance for the fiscal year, point be looking to grow the size to demonstrate the security of the considerably, we have seen ending June 2021, at our annual of our lending activity by taking Loan Notes.