Earnings Release

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sony Kabushiki Kaisha

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 20-F n REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 or ¥ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended March 31, 2010 or n TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from/to or n SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report: Commission file number 1-6439 Sony Kabushiki Kaisha (Exact Name of Registrant as specified in its charter) SONY CORPORATION (Translation of Registrant’s name into English) Japan (Jurisdiction of incorporation or organization) 7-1, KONAN 1-CHOME, MINATO-KU, TOKYO 108-0075 JAPAN (Address of principal executive offices) Samuel Levenson, Senior Vice President, Investor Relations Sony Corporation of America 550 Madison Avenue New York, NY 10022 Telephone: 212-833-6722, Facsimile: 212-833-6938 (Name, Telephone, E-mail and/or Facsimile Number and Address of Company Contact Person) Securities registered or to be registered pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange on Which Registered American Depositary Shares* New York Stock Exchange Common Stock** New York Stock Exchange * American Depositary Shares evidenced by American Depositary Receipts. Each American Depositary Share represents one share of Common Stock. ** No par value per share. Not for trading, but only in connection with the listing of American Depositary Shares pursuant to the requirements of the New York Stock Exchange. -

Exective Appointments

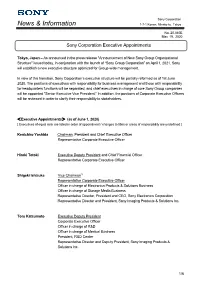

Sony Corporation News & Information 1-7-1 Konan, Minato-ku, Tokyo No. 20 -040E May 19, 2020 Sony Corporation Executive Appointments Tokyo, Japan – As announced in the press release "Announcement of New Sony Group Organizational Structure" issued today, in conjunction with the launch of “Sony Group Corporation” on April 1, 2021, Sony will establish a new executive structure optimized for Group-wide management. In view of this transition, Sony Corporation’s executive structure will be partially reformed as of 1st June 2020. The positions of executives with responsibility for business management and those with responsibility for headquarters functions will be separated, and chief executives in charge of core Sony Group companies will be appointed "Senior Executive Vice President." In addition, the positions of Corporate Executive Officers will be reviewed in order to clarify their responsibility to stakeholders. <Executive Appointments> (as of June 1, 2020) [ Executives of equal rank are listed in order of appointment / changes to titles or areas of responsibility are underlined ] Kenichiro Yoshida Chairman, President and Chief Executive Officer Representative Corporate Executive Officer Hiroki Totoki Executive Deputy President and Chief Financial Officer Representative Corporate Executive Officer Shigeki Ishizuka Vice Chairman*1 Representative Corporate Executive Officer Officer in charge of Electronics Products & Solutions Business Officer in charge of Storage Media Business Representative Director, President and CEO, Sony Electronics Corporation Representative Director and President, Sony Imaging Products & Solutions Inc. Toru Katsumoto Executive Deputy President Corporate Executive Officer Officer in charge of R&D Officer in charge of Medical Business President, R&D Center Representative Director and Deputy President, Sony Imaging Products & Solutions Inc. -

Annual Report 2013 201 3 年

Annual Report 2013 201 3 年 3 月期 アニュアルレポート 2013年 3月期 ソニー株式会社 Annual Report 2013 Business and CSR Review Contents For further information, including video content, please visit Sony’s IR and CSR websites. Letter to Stakeholders: 2 A Message from Kazuo Hirai, President and CEO 16 Special Feature: Sony Mobile 22 Special Feature: CSR at Sony Business Highlights Annual Report 26 http://www.sony.net/SonyInfo/IR/financial/ar/2013/ 28 Sony Products, Services and Content 37 CSR Highlights 55 Financial Section 62 Stock Information CSR/Environment http://www.sony.net/csr/ 63 Investor Information Investor Relations http://www.sony.net/SonyInfo/IR/ Annual Report 2013 on Form 20-F Effective from 2012, Sony has integrated its printed annual http://www.sony.net/SonyInfo/IR/library/sec.html and corporate social responsibility (CSR) reports into Financial Services Business one report that provides essential information on related (Sony Financial Holdings Inc.) developments and initiatives. http://www.sonyfh.co.jp/index_en.html 1 Letter to Stakeholders: A Message from Kazuo Hirai, President and CEO 2 BE MOVED Sony is a company that inspires and fulfills the curiosity of people from around the world, using our unlimited passion for technology, services and content to deliver groundbreaking new excitement and entertainment to move people emotionally, as only Sony can. 3 Fiscal year 2012, ended March 31, 2013, was my first year as President and CEO of Sony. It was a year full of change that enabled us to build positive momentum across the Sony Group. Since becoming President, I visited 45 different Sony Group sites in 16 countries, ranging from electronics sales offices to manufacturing facilities, R&D labs, and entertainment and financial services locations. -

Announcement of Executive Appointments and the New Management Team

April 26, 2019 Sony Financial Holdings, Inc. Announcement of Executive Appointments and the New Management Team Tokyo, April 26, 2019——At a Board of Directors’ meeting held today, Sony Financial Holdings Inc. (“SFH”) resolved candidates for election to the position of Directors and Audit & Supervisory Boad Members as stated below. These executive appointments are consistent with reinforcing the management structure to enhance the sustainable corporate value of the Sony Financial Group (“SFG”). We strengthen governance, centering on the Board of Directors at SFH, the holding company. The new executive appointments include outside directors, members of Sony Corporation’s management team, and people from SFH’s management team as directors of SFH. The presidents of the three main subsidiaries (Sony Life Insurance Co., Ltd., Sony Assurance Inc. and Sony Bank Inc.) are allowing them to dedicate themselves to the management of their businesses. Under the new management team, we aim to promote further growth among SFG’s individual businesses and manifest synergies across SFG. Following approval at the Ordinary Meeting of Shareholders, the election of the new management team is subject to the approval of the Board of Directors and the Audit & Supervisory Board, all of which are to be held on June 21, 2019. 1. Changes in Directors <As of June 21, 2019> (1) Resignation Name Current Position *The Position of President, Representative Director of Sony Tomoo Hagimoto Director Life Insurance Co., Ltd. continues. *The Position of President, Representative Director of Sony Atsuo Niwa Director Assurance Inc. continues. *The Position of President, Representative Director of Sony Yuichiro Sumimoto Director Bank Inc. -

Qas(Summary) (PDF 112KB)

Q&A (Summary) of Corporate Strategy Meeting for Fiscal 2018 Date: May 31, 2018 (Thursday), 15:30–17:00 (JST) Respondents*: Shigeru Ishii, President, Representative Director of Sony Financial Holdings Inc. Hiroaki Kiyomiya, Managing Director, Member of the Board of Sony Financial Holdings Inc. Tomoo Hagimoto, President, Representative Director of Sony Life Insurance Co., Ltd. Atsuo Niwa, President, Representative Director of Sony Assurance Inc. Yuichiro Sumimoto, President, Representative Director of Sony Bank Inc. * Respondents’ positions are as of the date of the meeting. Note: The original content has been revised and edited for ease of understanding. [Q&A] Q1: [SFH] It seems to me that connecting Sony Life, Sony Assurance and Sony Bank via APIs and account aggregation and forging ties with other financial institutions would be effective. What are your thoughts in this regard? A: We believe that sharing the Sony Life information accumulated by Lifeplanner sales employees and Sony Bank information would enable us to realize further sophisticated services. However, cooperation that involves personal information requires customer permission, so at this point rather than sharing the information we currently hold we are thinking of building a new platform. Q2: [SFH] In your medium-term plan, you have set the goal of consolidated adjusted ROE of more than 5%, which is your target for raising dividends. At what level do you aim to increase dividends, and around what level do you expect dividends to be in the final year of the plan? Rather than raising dividends by ¥2.5, might you be expected to raise them by ¥5 depending on profit levels? A: Our basic thoughts are to raise dividends by ¥2.5 per fiscal year, but if consolidated adjusted ROE is significantly higher than 5%, we might consider raising dividends by more than ¥2.5. -

Consolidated Financial Results for the Fiscal Year Ended March 31, 2019 and Outlook for the Fiscal Year Ending March 31, 2020

Financial Statements and Consolidated Financial Results for the Fiscal Year Ended March 31, 2019 And Outlook for the Fiscal Year Ending March 31, 2020 April 26, 2019 Sony Corporation Financial Statements (Unaudited) F-1 Consolidated Balance Sheets F-1 Consolidated Statements of Income (Fiscal year ended March 31) F-2 Consolidated Statements of Comprehensive Income (Fiscal year ended March 31) F-2 Consolidated Statements of Income (Three months ended March 31) F-3 Consolidated Statements of Comprehensive Income (Three months ended March 31) F-3 Consolidated Statements of Changes in Stockholders' Equity F-4 Consolidated Statements of Cash Flows F-5 Notes to Consolidated Financial Statements F-6 - Business Segment Information F-6 - Going Concern Assumption F-13 - Accounting Policies and Other Information F-13 Consolidated Results for the Fiscal Year Ended March 31, 2019 1 Outlook for the Fiscal Year Ending March 31, 2020 4 Business Segment Information 5 (Consolidated Results for the Fiscal year ended March 31, 2019 and Outlook for the Fiscal year ending March 31, 2020) Basic Views on Selection of Accounting Standards 10 All amounts are presented on the basis of Generally Accepted Accounting Principles in the U.S. (“U.S. GAAP”). Sony Corporation and its consolidated subsidiaries are together referred to as “Sony”. (Unaudited) Consolidated Financial Statements Consolidated Balance Sheets (Millions of yen) March 31 March 31 Change from ASSETS 2018 2019 March 31, 2018 Current assets: Cash and cash equivalents \ 1,586,329 \ 1,470,073 \ -116,256 -

Consolidated Financial Results for the Fiscal Year Ended March 31, 2005

6-7-35 Kitashinagawa Shinagawa-ku News & Information Tokyo 141-0001 Japan No: 05-025E 3:30 P.M. JST, April 27, 2005 Consolidated Financial Results for the Fiscal Year Ended March 31, 2005 Tokyo, April 27, 2005 -- Sony Corporation today announced its consolidated results for the fiscal year ended March 31, 2005 (April 1, 2004 to March 31, 2005). (Billions of yen, millions of U.S. dollars, except per share amounts) Year ended March 31 Change in 2004 2005 Yen 2005* Sales and operating revenue ¥7,496.4 ¥7,159.6 -4.5% $66,912 Operating income 98.9 113.9 +15.2 1,065 Income before income taxes 144.1 157.2 +9.1 1,469 Equity in net income of affiliated 1.7 29.0 +1,594.2 271 companies Net income 88.5 163.8 +85.1 1,531 Net income per share of common stock — Basic ¥95.97 ¥175.90 +83.3% $1.64 — Diluted 87.00 158.07 +81.7 1.48 * U.S. dollar amounts have been translated from yen, for convenience only, at the rate of ¥107=U.S.$1, the approximate Tokyo foreign exchange market rate as of March 31, 2005. Unless otherwise specified, all amounts are on the basis of Generally Accepted Accounting Principles in the U.S. (“U.S. GAAP”). Consolidated Results for the Fiscal Year Ended March 31, 2005 Sales and operating revenue (“sales”) decreased 4.5% compared with the previous fiscal year; on a local currency basis sales decreased 3%. (For all references herein to results on a local currency basis, see Note I on page 9.) This reflects both the establishment of Sony BMG Music Entertainment (“Sony BMG”) (please refer to note on Page 2) and a change in revenue recognition method at Sony Life Insurance Co., Ltd. -

Financial Highlights

Cover page design concept: Represents the fusion of Sony’s hardware, content and services into a united group positioned to advance to new heights. Contents Financial Highlights 2 Business Overview 4 Letter to Shareholders 6 Review of Operations 16 Board of Directors and Corporate Executive Officers 33 Financial Section 34 Supplemental Information 46 For more information about Sony’s financial information, corporate governance and CSR, please refer to the following websites. 2009 Annual Report on Form 20-F http://www.sony.net/SonyInfo/IR/library/sec.html Corporate Governance Structure http://www.sony.net/SonyInfo/IR/governance.html CSR Report http://www.sony.net/SonyInfo/Environment/index.html 1 Financial Highlights Consolidated Financial Results for the Fiscal Year Ended March 31, 2009 Sales and operating revenue ¥7,730.0 billion ( -12.9%) Operating loss ¥227.8 billion (—) Loss before income taxes ¥175.0 billion (—) Net loss ¥98.9 billion (—) *Percent change over prior year is shown in parentheses. Sales and operating revenue (sales) decreased 12.9% compared to the previous fiscal year and losses were recorded due to such factors as the slowdown of the global economy, the appreciation of the yen and the decline of the Japanese stock market. An operating loss of ¥227.8 billion was recorded, a deterioration of ¥703.1 billion year on year. Some of the significant factors that caused the year-on-year deterioration in operating income were an approximate ¥279.0 billion impact from the appreciation of the yen against the U.S. dollar and the euro, a ¥125.9 billion impact from deterioration in results at equity affiliates, including Sony Ericsson Mobile Communications AB (a mobile phone business joint venture), and a ¥53.8 billion deterioration in operating results in the Financial Services segment, mainly due to a significant decline in the Japanese stock market. -

FY2018 Corporate Strategy Meeting

Corporate Strategy Meeting May 22, 2018 Sony Corporation • Good morning. My name is Kenichiro Yoshida. In April, I was appointed President and CEO. Thank you for coming today. • I am the 11th President in our company’s 72-year history. • As you may know, Sony was founded by Masaru Ibuka and Akio Morita. • My predecessor, Mr. Hirai, and I are from a generation that did not work directly with our founders. Just once, however, I had an opportunity to talk closely with Mr. Morita. That was in New York, where I was assigned at the time, in September 1993, just two months before Mr. Morita suffered a brain hemorrhage. • Mr. Morita told me, “Up until now, Sony has learned many things from the United States. Some Japanese companies might even think that we have surpassed the U.S. But Sony needs to be humble and learn from the U.S. again.” • When I think back on this conversation, I believe the sense of urgency that Mr. Morita felt in 1993 was about the internet. In fact, the internet browser Netscape and the company Amazon both emerged just a year later in 1994. • In the following years, Sony achieved record profit in 1997, and the internet began to have a serious impact on Sony’s business as we entered the 21st century. • Now once again, I feel a sense of management urgency, a need for humility and the importance of a long-term view. 1 1. Business Portfolio 2. Corporate Direction 3. Initiatives of Each Business Segment 4. Financial Targets 5. -

Sony Corporation Founded

Sony Corporation Founded: May 7, 1946 Headquarters: 1-7-1 Konan, Minato-ku, Tokyo 108-0075, Japan President and CEO: Kazuo Hirai EVP and CFO: Kenichiro Yoshida Major Products Televisions LCD televisions Digital imaging Interchangeable single-lens cameras, compact digital cameras, video cameras Audio / Video Home audio, Blu-ray Disc™ players and recorders, memory-based portable audio devices Semiconductors Image sensors and other semiconductors Electronic components Batteries, recording media, data recording systems Professional solutions Broadcast and professional-use equipment Medical Medical-related equipment Locations of Major Offices and Research Centers (in Japan) : Tokyo, Kanagawa, Miyagi Consolidated net sales ¥7,767.3 billion (fiscal year ended March 2014) Stated capital ¥646.7 billion (as of March 31, 2014) Milestones of some Products & Technologies Television 1960 TV8-301 World's first direct-view portable transistor TV. Comprised of 23 transistors and 19 diodes, this model was developed based on Sony's extensive experience in radio technology. In an age when TVs were assumed to be living room fixtures, this device opened the door to personal television use. Additionally, this model offered three choices for power input. 1962 TV5-303 Developed with the aim of bringing TV entertainment to the automobile environment, this was the world's smallest and lightest monochrome TV, which enjoyed wide popularity under the nickname “micro TV.” The slogan for the device was “Transistors have Changed TV.” 1968 KV-1310 The first in Sony's exclusive line of Trinitron color TVs. This model offered approximately twice the brightness of TVs using conventional shadow-mask tubes. This was a milestone product establishing Sony's superiority in color TVs. -

Annual Report 2000 Year Ended March 31, 2000 TABLE of Contents Financial Highlights

Year Ended March 31, 2000 March Ended Year Annual Report 2000 Sony Corporation Annual Report 2000 TABLE OF contents Financial Highlights . 1 Management’s Discussion and Analysis of To Our Shareholders . 2 Financial Condition and Results of Operations . 39 A Tribute to Akio Morita . 8 Quarterly Financial and Stock Information . 59 Message From the Chief Executive Officer . 10 Five-Year Summary of Selected Financial Data . 60 Business Overview. 16 Composition of Sales and Operating Revenue by Business Review Business and Geographic Segment . 61 Electronics. 18 Consolidated Balance Sheets . 62 Game . 24 Consolidated Statements of Income . 64 Music . 26 Consolidated Statements of Cash Flows . 65 Pictures . 28 Consolidated Statements of Changes in Insurance . 30 Stockholders’ Equity . 66 Topics . 32 Notes to Consolidated Financial Statements . 68 Environmental Activities at Sony . 36 Report of Independent Accountants . 97 Management . 38 Investor Information . 98 New Directors, New Statutory Auditors, and Statutory Auditors . 99 CAUTIONARY STATEMENT WITH RESPECT TO FORWARD–LOOKING STATEMENTS Statements made in this annual report with respect to Sony’s current plans, estimates, strategies and beliefs and other state- ments that are not historical facts are forward–looking statements about the future performance of Sony. These statements are based on management’s assumptions and beliefs in light of the information currently available to it and therefore you should not place undue reliance on them. Sony cautions you that a number of important factors could cause actual results to differ materially from those discussed in the forward–looking statements. Such factors include, but are not limited to (i) general economic conditions in Sony’s markets, particularly levels of consumer spending; (ii) exchange rates, particularly between the yen and the U.S. -

Gaikai - Wikipedia Case 3:19-Cv-07027-WHA Document 28-2 Filed 10/14/19 Page 2 of 8 Not Logged in Talk Contributions Create Account Log In

Case 3:19-cv-07027-WHA Document 28-2 Filed 10/14/19 Page 1 of 8 EXHIBIT B Gaikai - Wikipedia Case 3:19-cv-07027-WHA Document 28-2 Filed 10/14/19 Page 2 of 8 Not logged in Talk Contributions Create account Log in Article Talk Read Edit View history Gaikai From Wikipedia, the free encyclopedia Main page Gaikai (外海, lit. "open sea", i.e. an expansive outdoor space) is an American company which provides technology for the streaming of high- Contents Gaikai Featured content end video games.[1] Founded in 2008, it was acquired by Sony Interactive Entertainment in 2012. Its technology has multiple applications, Current events including in-home streaming over a local wired or wireless network (as in Remote Play between the PlayStation 4 and PlayStation Vita), as Random article well as cloud-based gaming where video games are rendered on remote servers and delivered to end users via internet streaming (such as Donate to Wikipedia the PlayStation Now game streaming service.[2]) As a startup, before its acquisition by Sony, the company announced many partners using Wikipedia store [3] the technology from 2010 through 2012 including game publishers, web portals, retailers and consumer electronics manufacturers. On July Founded November 2008 Interaction 2, 2012, Sony announced that a formal agreement had been reached to acquire the company for $380 million USD with plans of establishing Headquarters Aliso Viejo, California, U.S. [4] Help their own new cloud-based gaming service, as well as integrating streaming technology built by Gaikai into PlayStation products, resulting Owner Sony [5] [6] About Wikipedia in PlayStation Now and Remote Play.