Consolidated Financial Results for the Fiscal Year Ended March 31, 2009

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sony Kabushiki Kaisha

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 20-F n REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 or ¥ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended March 31, 2010 or n TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from/to or n SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report: Commission file number 1-6439 Sony Kabushiki Kaisha (Exact Name of Registrant as specified in its charter) SONY CORPORATION (Translation of Registrant’s name into English) Japan (Jurisdiction of incorporation or organization) 7-1, KONAN 1-CHOME, MINATO-KU, TOKYO 108-0075 JAPAN (Address of principal executive offices) Samuel Levenson, Senior Vice President, Investor Relations Sony Corporation of America 550 Madison Avenue New York, NY 10022 Telephone: 212-833-6722, Facsimile: 212-833-6938 (Name, Telephone, E-mail and/or Facsimile Number and Address of Company Contact Person) Securities registered or to be registered pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange on Which Registered American Depositary Shares* New York Stock Exchange Common Stock** New York Stock Exchange * American Depositary Shares evidenced by American Depositary Receipts. Each American Depositary Share represents one share of Common Stock. ** No par value per share. Not for trading, but only in connection with the listing of American Depositary Shares pursuant to the requirements of the New York Stock Exchange. -

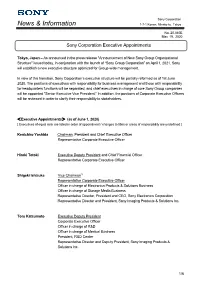

Exective Appointments

Sony Corporation News & Information 1-7-1 Konan, Minato-ku, Tokyo No. 20 -040E May 19, 2020 Sony Corporation Executive Appointments Tokyo, Japan – As announced in the press release "Announcement of New Sony Group Organizational Structure" issued today, in conjunction with the launch of “Sony Group Corporation” on April 1, 2021, Sony will establish a new executive structure optimized for Group-wide management. In view of this transition, Sony Corporation’s executive structure will be partially reformed as of 1st June 2020. The positions of executives with responsibility for business management and those with responsibility for headquarters functions will be separated, and chief executives in charge of core Sony Group companies will be appointed "Senior Executive Vice President." In addition, the positions of Corporate Executive Officers will be reviewed in order to clarify their responsibility to stakeholders. <Executive Appointments> (as of June 1, 2020) [ Executives of equal rank are listed in order of appointment / changes to titles or areas of responsibility are underlined ] Kenichiro Yoshida Chairman, President and Chief Executive Officer Representative Corporate Executive Officer Hiroki Totoki Executive Deputy President and Chief Financial Officer Representative Corporate Executive Officer Shigeki Ishizuka Vice Chairman*1 Representative Corporate Executive Officer Officer in charge of Electronics Products & Solutions Business Officer in charge of Storage Media Business Representative Director, President and CEO, Sony Electronics Corporation Representative Director and President, Sony Imaging Products & Solutions Inc. Toru Katsumoto Executive Deputy President Corporate Executive Officer Officer in charge of R&D Officer in charge of Medical Business President, R&D Center Representative Director and Deputy President, Sony Imaging Products & Solutions Inc. -

Employees 18

This document has been translated from the original document in Japanese (”Yukashouken Houkokusho”), which is legally required for Recruit Holdings as a listed company in Japan to support investment decisions by providing certain information about the Company for the fiscal year ended March 31, 2021 (“FY2020”), under Article 24, Paragraph 1 of the Financial Instruments and Exchange Act of Japan. The Japanese original document was filed to the Director-General of the Kanto Local Finance Bureau in Japan on June 18, 2021. Please refer to “Note Regarding Reference Translation” below as a general warning for this translation document. Document Name Annual Report translated from Yukashouken Houkokusho Filing Date June 18, 2021 Fiscal Year FY2020 (From April 1, 2020 to March 31, 2021) Company Name in English Recruit Holdings Co., Ltd. Title and Name of Hisayuki Idekoba Representative President, CEO and Representative Director of the Board Address of Head Office 8-4-17 Ginza, Chuo-ku, Tokyo, Japan (The above address is a registered headquarters. Actual headquarters operation is conducted in the Contact Location below) Telephone Number +81-3-6835-1111 Contact Person Junichi Arai Corporate Executive Officer Contact Location 1-9-2 Marunouchi, Chiyoda-ku, Tokyo, Japan Definition of Abbreviations In this document, the terms the “Company,” “Recruit Group,” “we,” and “our” refer to Recruit Holdings Co., Ltd. and its consolidated subsidiaries unless the context indicates otherwise. The “Holding Company” refers to Recruit Holdings Co., Ltd. (“Recruit Holdings”) on a standalone basis. The Company’s fiscal year starts on April 1 and ends on March 31 of each year. Accordingly, “FY2020” refers to the period from April 1, 2020 to March 31, 2021. -

The Significance of Anime As a Novel Animation Form, Referencing Selected Works by Hayao Miyazaki, Satoshi Kon and Mamoru Oshii

The significance of anime as a novel animation form, referencing selected works by Hayao Miyazaki, Satoshi Kon and Mamoru Oshii Ywain Tomos submitted for the degree of Doctor of Philosophy Aberystwyth University Department of Theatre, Film and Television Studies, September 2013 DECLARATION This work has not previously been accepted in substance for any degree and is not being concurrently submitted in candidature for any degree. Signed………………………………………………………(candidate) Date …………………………………………………. STATEMENT 1 This dissertation is the result of my own independent work/investigation, except where otherwise stated. Other sources are acknowledged explicit references. A bibliography is appended. Signed………………………………………………………(candidate) Date …………………………………………………. STATEMENT 2 I hereby give consent for my dissertation, if accepted, to be available for photocopying and for inter-library loan, and for the title and summary to be made available to outside organisations. Signed………………………………………………………(candidate) Date …………………………………………………. 2 Acknowledgements I would to take this opportunity to sincerely thank my supervisors, Elin Haf Gruffydd Jones and Dr Dafydd Sills-Jones for all their help and support during this research study. Thanks are also due to my colleagues in the Department of Theatre, Film and Television Studies, Aberystwyth University for their friendship during my time at Aberystwyth. I would also like to thank Prof Josephine Berndt and Dr Sheuo Gan, Kyoto Seiko University, Kyoto for their valuable insights during my visit in 2011. In addition, I would like to express my thanks to the Coleg Cenedlaethol for the scholarship and the opportunity to develop research skills in the Welsh language. Finally I would like to thank my wife Tomoko for her support, patience and tolerance over the last four years – diolch o’r galon Tomoko, ありがとう 智子. -

Annual Report 2013 201 3 年

Annual Report 2013 201 3 年 3 月期 アニュアルレポート 2013年 3月期 ソニー株式会社 Annual Report 2013 Business and CSR Review Contents For further information, including video content, please visit Sony’s IR and CSR websites. Letter to Stakeholders: 2 A Message from Kazuo Hirai, President and CEO 16 Special Feature: Sony Mobile 22 Special Feature: CSR at Sony Business Highlights Annual Report 26 http://www.sony.net/SonyInfo/IR/financial/ar/2013/ 28 Sony Products, Services and Content 37 CSR Highlights 55 Financial Section 62 Stock Information CSR/Environment http://www.sony.net/csr/ 63 Investor Information Investor Relations http://www.sony.net/SonyInfo/IR/ Annual Report 2013 on Form 20-F Effective from 2012, Sony has integrated its printed annual http://www.sony.net/SonyInfo/IR/library/sec.html and corporate social responsibility (CSR) reports into Financial Services Business one report that provides essential information on related (Sony Financial Holdings Inc.) developments and initiatives. http://www.sonyfh.co.jp/index_en.html 1 Letter to Stakeholders: A Message from Kazuo Hirai, President and CEO 2 BE MOVED Sony is a company that inspires and fulfills the curiosity of people from around the world, using our unlimited passion for technology, services and content to deliver groundbreaking new excitement and entertainment to move people emotionally, as only Sony can. 3 Fiscal year 2012, ended March 31, 2013, was my first year as President and CEO of Sony. It was a year full of change that enabled us to build positive momentum across the Sony Group. Since becoming President, I visited 45 different Sony Group sites in 16 countries, ranging from electronics sales offices to manufacturing facilities, R&D labs, and entertainment and financial services locations. -

Announcement of Executive Appointments and the New Management Team

April 26, 2019 Sony Financial Holdings, Inc. Announcement of Executive Appointments and the New Management Team Tokyo, April 26, 2019——At a Board of Directors’ meeting held today, Sony Financial Holdings Inc. (“SFH”) resolved candidates for election to the position of Directors and Audit & Supervisory Boad Members as stated below. These executive appointments are consistent with reinforcing the management structure to enhance the sustainable corporate value of the Sony Financial Group (“SFG”). We strengthen governance, centering on the Board of Directors at SFH, the holding company. The new executive appointments include outside directors, members of Sony Corporation’s management team, and people from SFH’s management team as directors of SFH. The presidents of the three main subsidiaries (Sony Life Insurance Co., Ltd., Sony Assurance Inc. and Sony Bank Inc.) are allowing them to dedicate themselves to the management of their businesses. Under the new management team, we aim to promote further growth among SFG’s individual businesses and manifest synergies across SFG. Following approval at the Ordinary Meeting of Shareholders, the election of the new management team is subject to the approval of the Board of Directors and the Audit & Supervisory Board, all of which are to be held on June 21, 2019. 1. Changes in Directors <As of June 21, 2019> (1) Resignation Name Current Position *The Position of President, Representative Director of Sony Tomoo Hagimoto Director Life Insurance Co., Ltd. continues. *The Position of President, Representative Director of Sony Atsuo Niwa Director Assurance Inc. continues. *The Position of President, Representative Director of Sony Yuichiro Sumimoto Director Bank Inc. -

Qas(Summary) (PDF 112KB)

Q&A (Summary) of Corporate Strategy Meeting for Fiscal 2018 Date: May 31, 2018 (Thursday), 15:30–17:00 (JST) Respondents*: Shigeru Ishii, President, Representative Director of Sony Financial Holdings Inc. Hiroaki Kiyomiya, Managing Director, Member of the Board of Sony Financial Holdings Inc. Tomoo Hagimoto, President, Representative Director of Sony Life Insurance Co., Ltd. Atsuo Niwa, President, Representative Director of Sony Assurance Inc. Yuichiro Sumimoto, President, Representative Director of Sony Bank Inc. * Respondents’ positions are as of the date of the meeting. Note: The original content has been revised and edited for ease of understanding. [Q&A] Q1: [SFH] It seems to me that connecting Sony Life, Sony Assurance and Sony Bank via APIs and account aggregation and forging ties with other financial institutions would be effective. What are your thoughts in this regard? A: We believe that sharing the Sony Life information accumulated by Lifeplanner sales employees and Sony Bank information would enable us to realize further sophisticated services. However, cooperation that involves personal information requires customer permission, so at this point rather than sharing the information we currently hold we are thinking of building a new platform. Q2: [SFH] In your medium-term plan, you have set the goal of consolidated adjusted ROE of more than 5%, which is your target for raising dividends. At what level do you aim to increase dividends, and around what level do you expect dividends to be in the final year of the plan? Rather than raising dividends by ¥2.5, might you be expected to raise them by ¥5 depending on profit levels? A: Our basic thoughts are to raise dividends by ¥2.5 per fiscal year, but if consolidated adjusted ROE is significantly higher than 5%, we might consider raising dividends by more than ¥2.5. -

Sony Financial Holdings Inc

Profi le Sony Financial Holdings Inc. (SFH) is a fi nancial holding company with three core subsidiaries: Sony Life Insurance Co., Ltd. (Sony Life), Sony Assurance Inc. (Sony Assurance) and Sony Bank Inc. (Sony Bank). Corporate Vision The Sony Financial Group seeks to become the most highly trusted fi nancial services group by cus- tomers. To this end, the Group will combine many different fi nancial functions (savings, investment, borrowing and protection) to provide high-value-added products and high-quality fi nancial services that meet every customer’s fi nancial needs. Corporate Philosophy Put the Customer First We will provide fi nancial products and services that satisfy customers by embracing their individual views, to ensure that we help them lead prosperous lives with fi nancial security. Give Back to Society We believe that a special commitment to the public good is demanded of a fi nancial services company. Conscious of this, we will realize our vision by upholding the highest level of ethics and a strong sense of purpose, and thereby give back to society. In addition, we will fulfi ll our responsibilities as a good corporate citizen and member of society. Strive for Originality We will constantly strive to come up with fresh ideas from basic principles as we pursue creativity and innovation, instead of merely following custom and convention. Foster an Open Corporate Culture We believe that every employee’s contribution is important to develop our ideal of a fi nancial services company. We will thus foster an open corporate culture where employees can freely express their individuality and demonstrate their abilities to the fullest. -

Annual R E P O Rt 2007

Annual R e p o r t 2007 2007 年 3 月 期 アニュアルレポート 2007年 3月期 ソニー株式会社 Printed in Japan Contents Financial Highlights Pictures: An Interview 2 21 with Top Management Letter to Shareholders: Collaboration in 4 A Message from 25 the Music Business Howard Stringer, CEO 8 “Sony United” 26 Business Overview Electronics: A Discussion Review of Operations 10 among Top Management 28 Electronics Game: An Interview Game 17 with Top Management 34 28 Sony United: Where Sony’s Revolution Begins Entertainment Financial Section 38 56 Table of Contents 43 Financial Services 57 A Message from the CFO 45 Research and Development 110 Stock Information Corporate Governance/ Stock Acquisition Rights 48 New Directors and 111 and Bond Information Corporate Executive Officers 52 Corporate Social Responsibility 112 Investor Information Cover pag e design c The representa oncept: tion of the ener gy created through “Sony Unit ed”—the collab oration of Sony’s many bus inesses, people and technolog ies 291 Financial Highlights Sony Corporation and Consolidated Subsidiaries Years ended March 31 Dollars in millions* Yen in millions Percent except per except per share amounts and number of employees change share amounts 2005 2006 2007 2007/2006 2007 FOR THE YEAR Sales and operating revenue . ¥7,191,325 ¥7,510,597 ¥ 8,295,695 +10.5.% $70,303 Operating income. 145,628 226,416 71,750 –68.3. 608 Income before income taxes . 157,207 286,329 102,037 –64.4. 865 Income taxes . 16,044 176,515 53,888 –69.5. 457 Equity in net income of affiliated companies . -

Consolidated Financial Results for the Fiscal Year Ended March 31, 2019 and Outlook for the Fiscal Year Ending March 31, 2020

Financial Statements and Consolidated Financial Results for the Fiscal Year Ended March 31, 2019 And Outlook for the Fiscal Year Ending March 31, 2020 April 26, 2019 Sony Corporation Financial Statements (Unaudited) F-1 Consolidated Balance Sheets F-1 Consolidated Statements of Income (Fiscal year ended March 31) F-2 Consolidated Statements of Comprehensive Income (Fiscal year ended March 31) F-2 Consolidated Statements of Income (Three months ended March 31) F-3 Consolidated Statements of Comprehensive Income (Three months ended March 31) F-3 Consolidated Statements of Changes in Stockholders' Equity F-4 Consolidated Statements of Cash Flows F-5 Notes to Consolidated Financial Statements F-6 - Business Segment Information F-6 - Going Concern Assumption F-13 - Accounting Policies and Other Information F-13 Consolidated Results for the Fiscal Year Ended March 31, 2019 1 Outlook for the Fiscal Year Ending March 31, 2020 4 Business Segment Information 5 (Consolidated Results for the Fiscal year ended March 31, 2019 and Outlook for the Fiscal year ending March 31, 2020) Basic Views on Selection of Accounting Standards 10 All amounts are presented on the basis of Generally Accepted Accounting Principles in the U.S. (“U.S. GAAP”). Sony Corporation and its consolidated subsidiaries are together referred to as “Sony”. (Unaudited) Consolidated Financial Statements Consolidated Balance Sheets (Millions of yen) March 31 March 31 Change from ASSETS 2018 2019 March 31, 2018 Current assets: Cash and cash equivalents \ 1,586,329 \ 1,470,073 \ -116,256 -

Annual Report April 1, 2018–March 31, 2019 Contents

2019 Annual Report April 1, 2018–March 31, 2019 Contents 1 Introduction 52 Corporate Section 1 Sony Financial Group’s Mission, 52 Corporate Profile Vision & Values 53 Profiles of Group Companies 2 History 54 Stock Information 4 Financial and Non-financial Highlights 6 Message from the President 56 Reference Materials 11 Sustainability Initiatives 56 Review of Operations / Organizational Chart of Business Operations 12 Strategy and Review 57 Financial Highlights 12 Sony Financial Group 58 SFH Consolidated Financial Statements 16 Sony Life 66 Segment Information 20 Sony Assurance 68 Other Financial Data 24 Sony Bank 70 Relationship with Parent Company, 28 Nursing Care Business Sony Corporation 71 Financial Data Book Contents 30 Initiatives to Strengthen 72 Glossary Our Foundation for Creating Value 30 Corporate Governance 48 Human Resources 50 The Environment 51 Communication with Stakeholders Editorial Policy SFH refers to “Guidance for Collaborative Value Disclaimer Creation” published by the Ministry of Economy, This annual report contains statements concerning the current plans, expectations, Trade and Industry when organizing and examining strategies and beliefs of the SFG. Any statements contained herein that are not historical matters to be listed in this report, in order to facts are forward-looking statements or pro forma information. Forward-looking statements may include̶but are not limited to̶words such as “believe,” “anticipate,” “plan,” “strategy,” make this report a starting point for dialogue with “expect,” “assume,” “forecast,” “predict,” “propose,” “intend” and “possibility” that describe shareholders and investors. future operating activities, business performance, events or conditions. Forward-looking statements, whether spoken or written, may also be included in other materials released to the public. -

Annual Report 2003 Report Annual

Ended March 31, 2003 Ended31, March Year Annual Report 2003 Annual Annual Report 2003 Ye ar Ended March 31 2003 Financial Highlights Sony Corporation and Consolidated Subsidiaries Year ended March 31 Yen in millions Dollars in except per share amounts and millions* except number of employeesPercent change per share amounts 2002 2003 2003/2002 2003 FOR THE YEAR Sales and operating revenue ¥7,578,258 ¥7,473,633 –1.4% $62,280 Operating income 134,631 185,440 +37.7 1,545 Income before income taxes 92,775 247,621 +166.9 2,064 Income before cumulative effect of accounting changes 9,332 115,519 +1,137.9 963 Net income 15,310 115,519 +654.5 963 Per share data: Income before cumulative effect of accounting changes —Basic ¥ 10.21 ¥ 125.74 +1,131.5% $ 1.05 —Diluted 10.18 118.21 +1,061.2 0.99 Net income —Basic 16.72 125.74 +652.0 1.05 —Diluted 16.67 118.21 +609.1 0.99 Cash dividends 25.00 25.00 0.21 AT YEAR-END Stockholders’ equity ¥2,370,410 ¥2,280,895 –3.8% $19,007 Total assets 8,185,795 8,370,545 +2.3 69,755 Number of employees 168,000 161,100 * U.S. dollar amounts have been translated from yen, for convenience only, at the rate of ¥120=U.S.$1, the approximate Tokyo foreign exchange market rate as of March 31, 2003. Please refer to pages 61 and 62 for detailed footnotes to the table above. Sony Corporation Annual Report 2003 Contents To Our Shareholders .