Sony Corporation: Reinventing Itself to Rediscover the Technological Edge Chatterji Dheeman

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Creativity Or Imitation:Japanese Success in VCR Technology Jeanine M

Lehigh University Lehigh Preserve Perspectives on business and economics Perspectives on Business and Economics 1-1-1989 Creativity or Imitation:Japanese Success in VCR Technology Jeanine M. Kasulis Lehigh University Follow this and additional works at: http://preserve.lehigh.edu/perspectives-v07 Recommended Citation Kasulis, Jeanine M., "Creativity or Imitation:Japanese Success in VCR Technology" (1989). Perspectives on business and economics. Paper 1. http://preserve.lehigh.edu/perspectives-v07/1 This Article is brought to you for free and open access by the Perspectives on Business and Economics at Lehigh Preserve. It has been accepted for inclusion in Perspectives on business and economics by an authorized administrator of Lehigh Preserve. For more information, please contact [email protected]. CREATIVITY OR IMITATION: JAPANESE SUCCESS IN VCR TECHNOLOGY Jeanine M. Kasulis Introduction corder (VCR), a popular electronics device found Until the late 1960s, U.S. industry enjoyed in two out of five American homes, was origin a preeminent position in technology and com ally invented as a broadcasting tool by a Cali manded a significant market share in the field fornia-based American firm named Ampex in for industrial and commercial products. Dur 1956 (Television and Video Almanac, 1988, p. ing the decades that have followed, however, 433). The invention evolved over the next two competitive strides by the Japanese have made decades into a product that could be used in stunning impacts on world and domestic mar the home; but Ampex in particular, and the kets alike. Superior Japanese performance has American electronics industry in general, fell been a growing concern in a wide array of out of competition. -

Sony Kabushiki Kaisha

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 20-F n REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 or ¥ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended March 31, 2010 or n TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from/to or n SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report: Commission file number 1-6439 Sony Kabushiki Kaisha (Exact Name of Registrant as specified in its charter) SONY CORPORATION (Translation of Registrant’s name into English) Japan (Jurisdiction of incorporation or organization) 7-1, KONAN 1-CHOME, MINATO-KU, TOKYO 108-0075 JAPAN (Address of principal executive offices) Samuel Levenson, Senior Vice President, Investor Relations Sony Corporation of America 550 Madison Avenue New York, NY 10022 Telephone: 212-833-6722, Facsimile: 212-833-6938 (Name, Telephone, E-mail and/or Facsimile Number and Address of Company Contact Person) Securities registered or to be registered pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange on Which Registered American Depositary Shares* New York Stock Exchange Common Stock** New York Stock Exchange * American Depositary Shares evidenced by American Depositary Receipts. Each American Depositary Share represents one share of Common Stock. ** No par value per share. Not for trading, but only in connection with the listing of American Depositary Shares pursuant to the requirements of the New York Stock Exchange. -

Sony Corporation – Restructuring Continues, Problems Remain

BSTR/361 IBS Center for Management Research Sony Corporation – Restructuring Continues, Problems Remain This case was written by Indu P, under the direction of Vivek Gupta, IBS Center for Management Research. It was compiled from published sources, and is intended to be used as a basis for class discussion rather than to illustrate either effective or ineffective handling of a management situation. 2010, IBS Center for Management Research. All rights reserved. To order copies, call +91-08417-236667/68 or write to IBS Center for Management Research (ICMR), IFHE Campus, Donthanapally, Sankarapally Road, Hyderabad 501 504, Andhra Pradesh, India or email: [email protected] www.icmrindia.org BSTR/361 Sony Corporation – Restructuring Continues, Problems Remain “Seven out of eight years, Sony has failed to meet its own initial operating profit forecast. This is probably the worst track record amongst most major exporters. That means that either management is not able to anticipate challenges … or they fail on execution almost every time. Either way, it does not reflect well on Sony’s management.”1 - Atul Goyal, Analyst, CLSA2, in January 2009. SONY IN CRISIS, AGAIN In May 2009, Japan-based multinational conglomerate, Sony Corporation (Sony) announced that it posted its first full year operating loss since 1995, and only its second since 1958, for the fiscal year ending March 2009. Sony announced annual loss of ¥ 98.9 billion3, with annual sales going down by 12.9% to ¥ 7.73 trillion. Sony also warned that with consumers worldwide cutting back on spending in light of the recession, the losses could be to the extent of ¥ 120 billion for the year ending March 2010 (Refer to Exhibit IA for Sony‘s five year financial summary and Exhibit IB for operating loss by business segment). -

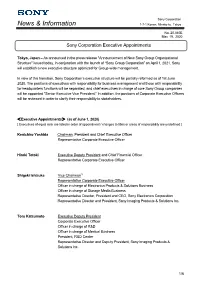

Exective Appointments

Sony Corporation News & Information 1-7-1 Konan, Minato-ku, Tokyo No. 20 -040E May 19, 2020 Sony Corporation Executive Appointments Tokyo, Japan – As announced in the press release "Announcement of New Sony Group Organizational Structure" issued today, in conjunction with the launch of “Sony Group Corporation” on April 1, 2021, Sony will establish a new executive structure optimized for Group-wide management. In view of this transition, Sony Corporation’s executive structure will be partially reformed as of 1st June 2020. The positions of executives with responsibility for business management and those with responsibility for headquarters functions will be separated, and chief executives in charge of core Sony Group companies will be appointed "Senior Executive Vice President." In addition, the positions of Corporate Executive Officers will be reviewed in order to clarify their responsibility to stakeholders. <Executive Appointments> (as of June 1, 2020) [ Executives of equal rank are listed in order of appointment / changes to titles or areas of responsibility are underlined ] Kenichiro Yoshida Chairman, President and Chief Executive Officer Representative Corporate Executive Officer Hiroki Totoki Executive Deputy President and Chief Financial Officer Representative Corporate Executive Officer Shigeki Ishizuka Vice Chairman*1 Representative Corporate Executive Officer Officer in charge of Electronics Products & Solutions Business Officer in charge of Storage Media Business Representative Director, President and CEO, Sony Electronics Corporation Representative Director and President, Sony Imaging Products & Solutions Inc. Toru Katsumoto Executive Deputy President Corporate Executive Officer Officer in charge of R&D Officer in charge of Medical Business President, R&D Center Representative Director and Deputy President, Sony Imaging Products & Solutions Inc. -

Employees 18

This document has been translated from the original document in Japanese (”Yukashouken Houkokusho”), which is legally required for Recruit Holdings as a listed company in Japan to support investment decisions by providing certain information about the Company for the fiscal year ended March 31, 2021 (“FY2020”), under Article 24, Paragraph 1 of the Financial Instruments and Exchange Act of Japan. The Japanese original document was filed to the Director-General of the Kanto Local Finance Bureau in Japan on June 18, 2021. Please refer to “Note Regarding Reference Translation” below as a general warning for this translation document. Document Name Annual Report translated from Yukashouken Houkokusho Filing Date June 18, 2021 Fiscal Year FY2020 (From April 1, 2020 to March 31, 2021) Company Name in English Recruit Holdings Co., Ltd. Title and Name of Hisayuki Idekoba Representative President, CEO and Representative Director of the Board Address of Head Office 8-4-17 Ginza, Chuo-ku, Tokyo, Japan (The above address is a registered headquarters. Actual headquarters operation is conducted in the Contact Location below) Telephone Number +81-3-6835-1111 Contact Person Junichi Arai Corporate Executive Officer Contact Location 1-9-2 Marunouchi, Chiyoda-ku, Tokyo, Japan Definition of Abbreviations In this document, the terms the “Company,” “Recruit Group,” “we,” and “our” refer to Recruit Holdings Co., Ltd. and its consolidated subsidiaries unless the context indicates otherwise. The “Holding Company” refers to Recruit Holdings Co., Ltd. (“Recruit Holdings”) on a standalone basis. The Company’s fiscal year starts on April 1 and ends on March 31 of each year. Accordingly, “FY2020” refers to the period from April 1, 2020 to March 31, 2021. -

Released in December 1957, the TR-63 Was Sony's First Pocket-Size Transistor Radio

Released in December 1957, the TR-63 was Sony's first pocket-size transistor radio. It's a 6-transistor superhet design with some interesting design features, including the use of Sony-manufactured NPN transistors in the circuit. Masaru Ibuka served with the Impe- used in schools and courts. much discussion, Sony's research labo- rial Navy Wartime Research Committee Following Ibuka's visionary 1952 ratory head, Mikato Kikuchi, suggested during World War 2, leaving in 1946 to trip to the USA to sign a licence with dropping Bells' preferred doping agent, join Akio Morita to form Tokyo Tsushin Western Electric, Sony acquired pat- indium, and substituting phosphorus Kogyo Kabushiki Kaisha, "Totsuko". ent rights for the transistor and subse- instead. When that didn't work, Morita Morita, a physics graduate, had served quently began manufacturing portable called for "more doping"! alongside Ibuka in the Research Com- radios in 1955. It soon paid off and Sony were able mittee, and their friendship laid the to produce the transistors used in their foundations for the international pow- Early difficulties first solid-state radios. Their TR-55 erhouse we now know simply as Sony. Sony preferred NPN transistors be- model, released in 1955, is now a rarity Tokyo Tsushin Kogyo's first prod- cause of their better high-frequency and the last one to be listed online some uct, a rice cooker, says a lot about the response but were initially unable to years ago had a price tag of $US1500. company. Japan had suffered massive produce working examples. One can only imagine the energy destruction during World War 2 due to NPN devices exploit the fact that invested by Sony to leap from Ibuka's bombing and people needed utensils to electrons move more quickly than licensing agreement to a marketable cook their staple food, which was rice. -

The Significance of Anime As a Novel Animation Form, Referencing Selected Works by Hayao Miyazaki, Satoshi Kon and Mamoru Oshii

The significance of anime as a novel animation form, referencing selected works by Hayao Miyazaki, Satoshi Kon and Mamoru Oshii Ywain Tomos submitted for the degree of Doctor of Philosophy Aberystwyth University Department of Theatre, Film and Television Studies, September 2013 DECLARATION This work has not previously been accepted in substance for any degree and is not being concurrently submitted in candidature for any degree. Signed………………………………………………………(candidate) Date …………………………………………………. STATEMENT 1 This dissertation is the result of my own independent work/investigation, except where otherwise stated. Other sources are acknowledged explicit references. A bibliography is appended. Signed………………………………………………………(candidate) Date …………………………………………………. STATEMENT 2 I hereby give consent for my dissertation, if accepted, to be available for photocopying and for inter-library loan, and for the title and summary to be made available to outside organisations. Signed………………………………………………………(candidate) Date …………………………………………………. 2 Acknowledgements I would to take this opportunity to sincerely thank my supervisors, Elin Haf Gruffydd Jones and Dr Dafydd Sills-Jones for all their help and support during this research study. Thanks are also due to my colleagues in the Department of Theatre, Film and Television Studies, Aberystwyth University for their friendship during my time at Aberystwyth. I would also like to thank Prof Josephine Berndt and Dr Sheuo Gan, Kyoto Seiko University, Kyoto for their valuable insights during my visit in 2011. In addition, I would like to express my thanks to the Coleg Cenedlaethol for the scholarship and the opportunity to develop research skills in the Welsh language. Finally I would like to thank my wife Tomoko for her support, patience and tolerance over the last four years – diolch o’r galon Tomoko, ありがとう 智子. -

Sony Corporation

SONY CORPORATION GRIFFIN CONSULTING GROUP Hao Tang Rahul Misra Ellie Shanholt April 2012 CONTENTS Executive Summary ..................................................................................................................... 3 Company Overview and History .............................................................................................. 4 Financial Analysis ........................................................................................................................ 6 Liquidity .................................................................................................................................... 6 Profitability ............................................................................................................................... 7 Operating Efficiency ................................................................................................................ 9 Stock Performance ................................................................................................................... 9 Segments and Locations ........................................................................................................ 12 Competitive Analysis ................................................................................................................ 14 Internal Rivalry: ..................................................................................................................... 14 Entry ........................................................................................................................................ -

Annual Report 2013 201 3 年

Annual Report 2013 201 3 年 3 月期 アニュアルレポート 2013年 3月期 ソニー株式会社 Annual Report 2013 Business and CSR Review Contents For further information, including video content, please visit Sony’s IR and CSR websites. Letter to Stakeholders: 2 A Message from Kazuo Hirai, President and CEO 16 Special Feature: Sony Mobile 22 Special Feature: CSR at Sony Business Highlights Annual Report 26 http://www.sony.net/SonyInfo/IR/financial/ar/2013/ 28 Sony Products, Services and Content 37 CSR Highlights 55 Financial Section 62 Stock Information CSR/Environment http://www.sony.net/csr/ 63 Investor Information Investor Relations http://www.sony.net/SonyInfo/IR/ Annual Report 2013 on Form 20-F Effective from 2012, Sony has integrated its printed annual http://www.sony.net/SonyInfo/IR/library/sec.html and corporate social responsibility (CSR) reports into Financial Services Business one report that provides essential information on related (Sony Financial Holdings Inc.) developments and initiatives. http://www.sonyfh.co.jp/index_en.html 1 Letter to Stakeholders: A Message from Kazuo Hirai, President and CEO 2 BE MOVED Sony is a company that inspires and fulfills the curiosity of people from around the world, using our unlimited passion for technology, services and content to deliver groundbreaking new excitement and entertainment to move people emotionally, as only Sony can. 3 Fiscal year 2012, ended March 31, 2013, was my first year as President and CEO of Sony. It was a year full of change that enabled us to build positive momentum across the Sony Group. Since becoming President, I visited 45 different Sony Group sites in 16 countries, ranging from electronics sales offices to manufacturing facilities, R&D labs, and entertainment and financial services locations. -

80 the MARKET Sony Corporation Is a Leading

THE MARKET a very small group of young peo- Sony Corporation is a leading man- ple with the energy and passion for ufacturer of audio, video, communi- unlimited creation. cations, and information technology This passion and creativity products for the consumer and pro- eventually led to the development of fessional markets. Additionally, the Sony’s Trinitron TV in 1968, which company’s music, motion picture, set the world standard for high television-production, game, and quality in home theater products. online businesses make Sony one of As a proponent of global oper- the most comprehensive entertain- ations based on a local presence, ment companies in the world. Morita set up manufacturing plants all over the world. Its Trinitron® ACHIEVEMENTS color television assembly plant Today, Sony employs almost 170,000 in San Diego, California, built in people worldwide, with almost 1972, was the first consumer elec- 22,000 working in the United States. tronics manufacturing facility built For fiscal year 2001, Sony Corpor- in the United States by a Japanese- ation had total sales of more than based company. $56.9 billion, with the electronics Morita’s deep confidence in segment making up more than two- another legendary Sony product, thirds of the revenues. the Walkman personal stereo, was Sony Electronics Inc. (SEL), the key factor in its ultimate formerly known as Sony Corpor- success. While retailers were ation of America, was established in initially resistant, the Walkman 1960 to oversee Sony’s sales and stereo’s compact size and excel- marketing activities in the United lent sound quality attracted con- States. -

Announcement of Executive Appointments and the New Management Team

April 26, 2019 Sony Financial Holdings, Inc. Announcement of Executive Appointments and the New Management Team Tokyo, April 26, 2019——At a Board of Directors’ meeting held today, Sony Financial Holdings Inc. (“SFH”) resolved candidates for election to the position of Directors and Audit & Supervisory Boad Members as stated below. These executive appointments are consistent with reinforcing the management structure to enhance the sustainable corporate value of the Sony Financial Group (“SFG”). We strengthen governance, centering on the Board of Directors at SFH, the holding company. The new executive appointments include outside directors, members of Sony Corporation’s management team, and people from SFH’s management team as directors of SFH. The presidents of the three main subsidiaries (Sony Life Insurance Co., Ltd., Sony Assurance Inc. and Sony Bank Inc.) are allowing them to dedicate themselves to the management of their businesses. Under the new management team, we aim to promote further growth among SFG’s individual businesses and manifest synergies across SFG. Following approval at the Ordinary Meeting of Shareholders, the election of the new management team is subject to the approval of the Board of Directors and the Audit & Supervisory Board, all of which are to be held on June 21, 2019. 1. Changes in Directors <As of June 21, 2019> (1) Resignation Name Current Position *The Position of President, Representative Director of Sony Tomoo Hagimoto Director Life Insurance Co., Ltd. continues. *The Position of President, Representative Director of Sony Atsuo Niwa Director Assurance Inc. continues. *The Position of President, Representative Director of Sony Yuichiro Sumimoto Director Bank Inc. -

Case Analysis.1

Management of Technology & Entrepreneurship (MTE) Technology Venturing & Entrepreneurship Sony Betamax Case Analysis GROUP 2 Patrick Hammer, Oliver Stampfli, Marcel Sutter, Thomas Thalmann, Donato Verardi [firstname.lastname]@epfl.ch Professor: Christopher L. Tucci Assistant: Farah Abdallah January 14, 2007 TSE - Sony Betamax - Case Analysis Group 2 Table of Content Summary of case report.................................................................... 2 Related topics and class sessions.................................................... 2 Format war (primary subject)............................................................................. 2 Customer needs............................................................................................... 2 Attacker’s advantage........................................................................................ 3 List of discussion questions.............................................................. 3 Brief answers..................................................................................... 3 Detailed answers............................................................................... 4 Recommendations.......................................................................... 10 Lessons learned.............................................................................. 10 Exhibits ............................................................................................11 Seven Key assets by Shapiro & Varian [6] [7] .................................................