FBR Capital Markets Conference Presentation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2010 Employment Report Career Management Center Visit the Career Management Center Online At

2010 Employment Report Career ManageMent Center Visit the Career Management Center online at www.gsb.columbia.edu/recruiters. Post positions online at www.gsb.columbia.edu/jobpost. reCruItIng at CoLumbia Business schooL Columbia Business School students continue to distinguish themselves with their ability to be nimble and flexible during a shifting economic and hiring landscape. employers report that Columbia MBas have the right mix of tangible business skills and social intelligence—enduring assets for any organization. the School’s focus on educating versatile business leaders who can excel in any environment is proven by a curriculum that bridges academic theory and real-world practice through initiatives like Columbia CaseWorks and the Master Class Program. the School’s cluster system and learning teams, as well as the Program on Social Intelligence, foster a team-oriented work ethic and an entrepreneurial mindset that makes creating and capturing opportunity instinctual. Students are able to add value to a wide range of organizations on day one, and the School’s extraordinary network of alumni, global business partners, and faculty members, along with its seamless integration with new York City, makes Columbia Business School stand out among its peers. the Career Management Center (CMC) works with hiring organizations across the public, private, and nonprofit sectors to develop effective and efficient recruiting strategies. recruiters can get to know the School’s talented students in a variety of ways, such as on-campus job fairs, prerecruiting functions, drop-in sessions, interviews, and educational presentations with student clubs, among other opportunities. Companies can also collaborate with the CMC to interview students closer to the time of hiring on an as-needed basis. -

Domestic and Global Commissions Report

Kentucky Retirement Systems Domestic and Global Commissions Report Quarter Ending: March 31, 2015 Kentucky Retirement Systems Domestic Equity - Common Stock Commissions Quarter Ended March 31, 2015 Broker/Account Shares Traded Commission Value of Trade Per Share % Cost of Trade ANCORA SECURITIES INC, JERSEY CITY 880 31 30,354 0.0350 0.1015% ASCENDIANT CAPITAL MARKETS, LLC, IRVINE 84,300 3,372 3,014,254 0.0400 0.1119% BAIRD, ROBERT W & CO INC, MILWAUKEE 98,265 3,359 4,322,425 0.0342 0.0777% BARCLAYS CAPITAL INC, JERSEY CITY 9,581 240 911,504 0.0250 0.0263% BARCLAYS CAPITAL LE, JERSEY CITY 1,362,283 138,958 65,135,774 0.1020 0.2133% BERNSTEIN SANFORD C & CO, NEW YORK 22,805 707 1,631,259 0.0310 0.0433% BMO CAPITAL MARKETS CORP, NEW YORK 3,725 112 139,954 0.0300 0.0798% BNY CONVERGEX, NEW YORK 21,920 718 737,082 0.0327 0.0974% BTIG LLC, SAN FRANCISCO 307,904 5,283 11,727,888 0.0172 0.0450% BUCKINGHAM RESEARCH GRP INC, BROOKLYN 18,990 573 710,704 0.0302 0.0806% CANACCORD GENUITY INC.NEY YORK 7,160 286 517,934 0.0400 0.0553% CITIGROUP GBL MKTS INC, NEW YORK 152,792 3,643 6,393,940 0.0238 0.0570% CITIGROUP GBL MKTS/SALOMON, NEW YORK 930,089 2,464 1,658,458 0.0026 0.1486% COWEN AND COMPANY LLC, NEW YORK 52,300 1,797 2,029,962 0.0344 0.0885% CRAIG HALLUM, MINNEAPOLIS 25,300 759 545,021 0.0300 0.1393% CREDIT SUISSE, NEW YORK (CSUS) 790,960 10,056 43,534,436 0.0127 0.0231% DEUTSCHE BK SECS INC, NY (NWSCUS33) 150,720 4,097 3,910,883 0.0272 0.1048% DOWLING & PARTNERS, JERSEY CITY 26,300 1,052 2,381,174 0.0400 0.0442% FBR CAPITAL MARKETS & CO, ARLINGTON -

Fees – for Plan Related Accounts That Do Not Indicate a Specific Outsid

March 23, 2017 ADP Inc. Re: Form 5500 Schedule C Information To Whom It May Concern: This correspondence is in response to your request dated January 13, 2017, regarding the Form 5500 Schedule C reporting requirements created by regulations issued by the Department of Labor (“DOL”) and its instructions and related guidance (“Schedule C”). We’ve been asked to provide certain information regarding direct or indirect compensation received by our mutual funds and affiliates or paid by our mutual funds to third parties in connection with the investment by the retirement plan clients of ADP Inc. (“Plan”) in our mutual funds for the Plan’s year ended 2016. As an initial matter, please note that the information contained in this response relates solely to reportable compensation, for purposes of Schedule C, received by Morgan Stanley Investment Management Inc. and its affiliated mutual fund service providers (“MSIM”) but does not purport to report compensation for third parties or for any banks or broker dealers that may be affiliated with MSIM. While we are happy to help coordinate inquiries to any other service provider for which the Plan may wish our assistance in contacting, please note we view the reporting of compensation received by such other entities to be beyond the scope of what MSIM is legally obligated to report for Schedule C purposes (as MSIM is not the ultimate recipient of such compensation). For direct or indirect compensation received by MSIM related to the Plan, we intend that all such compensation, as described as follows, is within the definition of Eligible Indirect Compensation (“EIC”) under Schedule C: • Management Fees – Morgan Stanley Investment Management Inc. -

Ellenoff Grossman & Schole

Ellenoff Grossman & Schole LLP Representative SPAC Initial Public Offering Transactions Areas of Practice Include: Far Point Acquisition Corp. Trinity Merger Corp. Fintech Acquisition Corp. III CORPORATE AND (NYSE:FPAC) (NASDAQ:TMCXU) (NASDAQ:FTAC) SECURITIES $632,500,000 $345,00,000 $345,000,000 PUBLIC OFFERING Credit Suisse and BofA Merrill Lynch B.Riley, FBR, Inc. Cantor Fitzgerald acted as joint book-running managers acted as the sole book-running manager acted as joint book-running managers in an initial public offering in an initial public offering in an initial public offering PRIVATE EQUITY/ VENTURE CAPITAL June 14, 2018 May 15, 2018 January 16, 2018 EG&S acted as counsel to Far Point EG&S acted as counsel to the underwriter EG&S acted as counsel to Fintech MERGERS AND ACQUISITIONS PRIVATE Nebula Acquisition Corp. CF Finance Acquisition Corp. (NASDAQ:CFFAU) Thunder Bridge Acquisition Ltd. INVESTMENT FUNDS (NASDAQ:NEBU.U) (NASDAQ:TBRGU) $225,000,000 $275,000,000 $258,000,00000 REAL ESTATE DEVELOPMENT & Deutsche Bank Securities and Cantor Fitzgerald & Co. Cantor Fitzgerald & Co. FINANCE Goldman Sachs & Co. LLC acted as the sole book-running manager acted as joint book-running managers acted as the sole book-running manager in an initial public offering in an initial public offering in an initial public offering COMMERCIAL LEASING January 16, 2018 December 12, 2018 June 21, 2018 EG&S acted as counsel to Nebula EG&S acted as counsel to CF Financey EG&S acted as counsel to Thunder Bridge BROKER-DEALER REGULATION INTERNATIONAL AND 1345 Avenue of the Americas New York, NY 10105-0302 DOMESTIC TAX phone (212) 370-1300 fax (212) 370-7889 www.egsllp.com Ellenoff Grossman & Schole LLP Representative SPAC Initial Public Offering Transactions Areas of Practice Include: . -

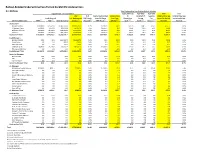

Bailout-Related Underwriting Fees Earned by GM IPO Underwriters

Bailout-Related Underwriting Fees Earned by GM IPO Underwriters $ in Millions Total Underwriting Fees Paid for Bailout Activities: Support from U.S. Government Equity Offerings TLGP Debt TLGP Debt Total % of Total % of Equity, Equity-Linked Underwriting to on Behalf of Issuance Underwriting Fees Underwriting Fees Funds Received U.S. Government TARP Funds Issued to Repay Fees from Recapitalize Issuing for Earned on Bailout Earned on Bailout GM IPO Underwriters TARP (1) TLGP (2) Other Borrowing Support(3) Received(4) TARP Funds(5) GM IPO(6)(7) Itself (5)(7) Bank (5)(7) Others (5)(7) Activities Activities Bookrunners Morgan Stanley $10,000.0 $25,075.0 $1,877,550.0 $1,912,625.0 1.4% $6,923.0 $36.9 $125.0 $68.5 $26.1 $256.5 8.3% JP Morgan Chase 25,000.0 39,679.0 898,442.8 963,121.8 3.6% 16,505.5 36.9 425.2 107.8 22.9 592.8 19.2% BofA Merrill Lynch 45,000.0 44,500.0 2,036,494.9 2,125,994.9 6.4% 36,200.0 22.5 690.3 73.9 67.6 854.2 27.7% Citigroup 50,000.0 64,600.0 1,642,169.0 1,756,769.0 7.1% 29,162.0 22.5 603.5 86.6 80.2 792.8 25.7% Bookrunners Total $130,000.0 $173,854.0 $6,454,656.7 $6,758,510.7 18.6% $88,790.5 $118.7 $1,844.0 $336.8 $196.7 $2,496.3 80.9% Lead Managers Barclays Capital $0.0 $0.0 $410,437.0 $410,437.0 0.0% $0.0 $22.5 $0.0 $0.0 $8.4 $30.9 1.0% Credit Suisse 0.0 0.0 1,500.0 1,500.0 0.0% 0.0 22.5 0.0 0.0 0.0 22.5 0.7% Deutsche Bank 0.0 0.0 500.0 500.0 0.0% 0.0 22.5 0.0 0.0 0.0 22.5 0.7% Goldman Sachs 10,000.0 21,235.0 558,072.5 589,307.5 1.4% 11,500.0 22.5 317.0 24.7 29.2 393.3 12.7% RBC Capital Markets 0.0 0.0 0.0 0.0 0.0% 0.0 -

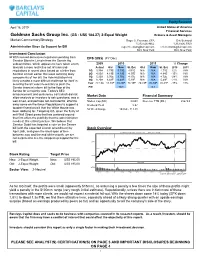

On Page 3 and Important Disclosures Beginning on Page 4 1

Equity Research April 16, 2010 United States of America Financial Services Goldman Sachs Group Inc. (GS - US$ 184.27) 2-Equal Weight Brokers & Asset Managers Market Commentary/Strategy Roger A. Freeman, CFA Eric Bertrand 1.212.526.4662 1.212.526.1369 Administration Steps Up Support for Bill [email protected] [email protected] BCI, New York BCI, New York Investment Conclusion With revised derivatives legislation pending from EPS (US$) (FY Dec) Senator Blanche Lincoln from the Senate Ag subcommittee, which appears to have taken a turn 2009 2010 2011 % Change towards a more restrictive set of rules and Actual Old New St. Est. Old New St. Est. 2010 2011 regulations in recent days based on a letter from 1Q 3.39A 3.79E 3.79E 4.01E N/A N/A 4.71E 12% N/A Senator Lincoln earlier this week outlining likely 2Q 4.93A 4.19E 4.19E 4.37E N/A N/A 4.94E -15% N/A components of her bill, the Administration has 3Q 5.25A 3.76E 3.76E 4.17E N/A N/A 4.72E -28% N/A likely created a more difficult challenge for itself in 4Q 8.20A 6.48E 6.48E 5.39E N/A N/A 5.49E -21% N/A securing the 60 votes necessary to push the Year 22.13A 18.28E 18.28E 18.15E 20.23E 20.23E 20.31E -17% 11% Senate financial reform bill to the floor of the P/E 10.1 9.1 Senate for a majority vote. -

Wallstreet's Otherbookvalue

Cover071607.qxd 7/11/07 2:52 PM Page 1 RBS Enters Commodities Fray Ex-Houlihan Lokey Bankers Set Up Shop Untapped Potential In Africa The insider’s guide to investment banking and capital markets July 16,2007/$25/www.iddmagazine.com Wall Street’s Other BookValue A novel idea: dealmakers cast aside Brooks Brothers jackets for book jackets 01_TOC071607.qxd 7/12/07 7:59 PM Page 1 IDD CONTENTS July 16, 2007 www.iddmagazine.com Vol. 73 No. 28 PRIVATE EQUITY 3 Ex-Houlihan Lokey Bankers Set Up Shop Small firm has plans for major growth in the next few years. By Joshua Hamerman COMMODITIES 4 RBS Enters the Commodities Fray Did other banks blow it by letting RBS get Sempra? By Dan Freed GLOBAL INVESTING 6 Untapped Potential in Africa Banking reform and a bounty of natural resources have investors paying attention. By Joshua Hamerman HEDGE FUNDS 8 SPAC Invaders While Blackstone stole the headlines, hedge fund GLG Partners used a backdoor method to achieve a public listing. By Ken MacFadyen WEEK ON THE STREET 10 Goldsmith Sells Out, Who’s Next? Firm seen helping Lazard’s new financial advisory division. By IDD Staff GLOBAL INVESTING 13 The Middle Market Finds China Midmarket dealmakers have debunked the misconception that there’s a size requirement for entry into China. By Danielle Fugazy PERSONNEL FILE 30 Credit Suisse Builds Out Financial Institutions Group REFERENCE 22 IPIPELINE 23 I IPOS COVER STORY 25 I WHO’S HOT 14 Wall Street’s 26 I AFTERMARKET Other Book Value 27 I SECURITIES IN REGISTRATION A novel idea: dealmakers cast 29 I EMPLOYMENT OPPORTUNITIES aside Brooks Brothers jackets for book jackets. -

4,500,000 Shares Common Stock Morgan Stanley Barclays Citigroup

TABLE OF CONTENTS The information in this preliminary prospectus supplement is not complete and may be changed. This preliminary prospectus supplement and the accompanying prospectus are not an offer to sell the securities, nor a solicitation of an offer to buy the securities, in any jurisdiction where an offer or sale thereof is not permitted. Filed Pursuant to Rule 424(b)(5) Registration No. 333-200152 SUBJECT TO COMPLETION, DATED MARCH 22, 2017 PRELIMINARY PROSPECTUS SUPPLEMENT (To Prospectus Dated December 3, 2014) 4,500,000 Shares Common Stock Cherry Hill Mortgage Investment Corporation is offering to the public 4,500,000 shares of its common stock, par value $0.01 per share. Our common stock is traded on the New York Stock Exchange, or the NYSE, under the symbol “CHMI.” On March 21, 2017, the last reported sale price of our common stock on the NYSE was $18.59 per share. There are restrictions on transfer and ownership of our common stock intended to, among other purposes, preserve our qualification as a real estate investment trust, or REIT, for U.S. federal income tax purposes. Please see the section entitled “Restrictions on Ownership and Transfer” in the accompanying prospectus. Investing in our common stock involves risk. See “Risk Factors” beginning on page S-3 of this prospectus supplement and in the documents incorporated by reference in this prospectus supplement and the accompanying prospectus. Per Share Total(1) Price to the public Underwriting discounts and commissions Proceeds to us (before expenses) (1) Assumes no exercise of the underwriters’ option to purchase additional shares. -

Top 50 Banking Employers

“For those hoping to climb the ladder of success, 2011 EDITION 2011 EDITION [Vault’s] insights are priceless.” — Money TOP 50 BANKING EMPLOYERS TOP 50 BANKING EMPLOYERS “Excellent.” — Library Journal GET INSIDE INFO ON: IN THIS GUIDE: Barclays Capital • Company overviews and Credit Suisse recent firm news Deutsche Bank • Info on the hiring process for each firm Evercore Partners • Inside info on workplace culture Goldman Sachs and compensation Greenhill & Co. • And much more! J.P. Morgan Lazard AT VAULT.COM: Moelis & Company • Employee surveys for VAULT GUIDE TO THE Morgan Stanley thousands of top employers UBS Investment Bank • Tens of thousands of top job And many more! listings TOP 50 www.vault.com BANKING About Vault.com, Inc. Vault.com is the source of employer and university rankings, ratings and insight for highly credentialed, in-demand candidates. Vault.com is organized EMPLOYERS GET THE INSIDE SCOOP ON THE BEST FIRMS TO WORK FOR IN THE BANKING industry by profession, industry, company and schools. Vault’s profiles, rankings and assessment tools deliver the insider perspective and career research candidates need to successfully match themselves to the best available job, employer and career opportunity. The Vault.com website features profiles on Carrier/Reference more than 4,500 employers, 4,000 universities and hundreds of industries $34.95 and professions including the law, finance, accounting and consulting sectors. Founded in 1996, Vault.com is the only career resource of its kind and attracts more than 1000 employer and recruiter advertisers, more than ® 1200 school and institutional subscribers and millions of individual visitors and members. -

Hearing on Legislation to Further Reduce Impediments to Capital Formation

Hearing on Legislation to Further Reduce Impediments to Capital Formation Statement of David Weild, Founder, Chairman & CEO of IssuWorks Holdings LLC, before the U.S. House of Representatives Financial Services Committee, Capital Markets and Government Sponsored Enterprises Subcommittee, October 23, 2013. [email protected] • (212) 705-8731 • www.IssuWorks.com 1 Contents Page Introduction 2 Specific responses to legislative proposals 3 Call for a JOBS Act 2 (Significant ways Congress can help the U.S. economy) 9 Conclusion: IPOs lead to job growth 13 Additional materials 15 About David Weild 17 About IssuWorks Holdings . 19 Hearing on Legislation to Further Reduce Impediments to Capital Formation © 2013 IssuWorks Holdings LLC, All Rights Reserved 2 Introduction Chairman Garrett, Ranking Member Maloney and members of the Subcommittee, thank you for inviting me to speak today about an issue of great importance to many Americans: “Legislation to Further Reduce Impediments to Capital Formation.” My name is David Weild. I am the Chairman & CEO of IssuWorks Holdings (“IssuWorks”), which was recently founded to develop technologies to improve capital formation in the public markets. I was formerly vice chairman of The NASDAQ Stock Market with responsibility for all of its listed companies, and I ran the equity new issues business of Prudential Securities, back when Prudential Securities was one of the ten largest underwriters of new issues equities in the United States. Improving access to equity capital in the United States is one of the most important needs for our economy. Access to equity capital fuels job growth and innovation, which, in turn, enables free markets to solve problems from poverty and unemployment to finding cures to cancer, global warming and many of the other challenges that this generation, and every other generation, will face. -

League Tables

GLOBAL FIXED INCOME LEAGUE TABLES First 3Q 2017 2 October 2017 FIRST 3Q 2017 MANAGER RANKINGS GLOBAL FIXED INCOME CONTENTS Bloomberg’s corporate bond database consists of more than 1.9 million active securities--including convertible bonds and preferred securities--along with more than 4.1 million matured, called or 1. Global market review retired bonds, covering over 24,000 unique issuers across more than 130 countries and 100 different currencies. 2. US market review 3. Canada market review LEAG<GO> for a full range of league tables 4. Latin America market review NIM<GO> for Bloomberg’s new issue monitor 5. EMEA market review 6. Asia market review Due to the dynamic nature of the Professional Service product, league table rankings may vary between this release 7. Table criteria and data found on the Bloomberg Professional Service. DATA SUBMISSIONS AND QUERIES Contact Phone Email North America Dean Psomaras +1 609 279 3449 [email protected] EMEA Dimitris Gogos +44 20 35258149 [email protected] Asia Pacific Shaili Mehta +91 22 61203770 [email protected] © 2017 Bloomberg Finance L.P. All rights reserved. Bloomberg Global Fixed Income | 1st 3Q 2017 Global Corporate Leveraged Finance: Quarterly Volume Corporate High Yield Bonds Global Fixed Income Review Global Sponsor-Led Loans 500 1st 3Q 2017 credited Corporate & Financial Bonds volume increased 0.46% to USD 3.4 Trln while deal count decreased 2.75% to 12,129 offerings year-on-year. Corporate Bonds volume decreased 0.26% year-on-year to USD 1.7 Trln while the 400 n n deal count increased 2.85% to 5,019. -

League Tables

GLOBAL FIXED INCOME LEAGUE TABLES FY 2016 FY 2016 MANAGER RANKINGS GLOBAL FIXED INCOME CONTENTS Bloomberg’s corporate bond database consists of more than 1.9 million active securities--including convertible bonds and preferred securities--along with more than 4.1 million matured, called or retired bonds, covering over 24,000 unique issuers across more than 130 countries and 100 1. Global market review different currencies. 2. US market review 3. Canada market review LEAG<GO> for a full range of league tables 4. Latin America market review NIM<GO> for Bloomberg’s new issue monitor 5. EMEA market review 6. Asia market review Due to the dynamic nature of the Professional Service product, league table rankings may vary between this release 7. Table criteria and data found on the Bloomberg Professional Service. DATA SUBMISSIONS AND QUERIES Contact Phone Email North America Dean Psomaras +1 609 279 3449 [email protected] EMEA Dimitris Gogos +44 20 3525 8149 [email protected] Asia Pacific Shaili Mehta +91 22 61203770 [email protected] © 2016 Bloomberg Finance L.P. All rights reserved. Bloomberg Global Fixed Income | FY 2016 Global Corporate Leveraged Finance: Quarterly Volume Corporate High Yield Bonds Global Fixed Income Review Global Sponsor-Led Loans 400 FY 2016 credited Corporate & Financial Bonds volume increased 2.08% to USD 4.1 Trln while deal count decreased 0.35% to 15,732 offerings year-on-year. Corporate Bonds volume increased 6.11% year-on-year to USD 2.1 Trln while the deal n n count decreased 4.38% to 6,270. Financial Bonds volume decreased 1.61% year-on-year to USD 2.1 Trln over 9,462 deals.