Earnings Call Transcript

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

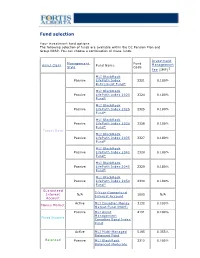

Fund Selection

Fund selection Y our investment fund options The following selection of funds are available within the DC Pension Plan and Group RRSP. You can choose a combination of these funds. Investment Management Fund Asset Class Fund Name Management Style Code Fee (IMF)1 MLI BlackRock Passive LifeP ath Index 2321 0.180% Retirement Fund* MLI BlackRock Passive LifeP ath Index 2020 2324 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2025 2325 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2030 2326 0.180% Fund* Target Date MLI BlackRock Passive LifeP ath Index 2035 2327 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2040 2328 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2045 2329 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2050 2330 0.180% Fund* Guaranteed 5-Y ear Guaranteed Interest N/A 1005 N/A Interest Account Account Active MLI Canadian Money 3132 0.100% Money Market Market Fund (MAM) Passive MLI Asset 4191 0.100% Management Fixed Income Canadian Bond Index Fund Active MLI Multi-Managed 5195 0.355% Balanced Fund Balanced Passive MLI BlackRock 2312 0.105% Balanced Moderate Index Fund Active MLI Canadian Equity 7011 0.210% Fund Canadian Passive MLI Asset 7132 0.100% Equity Management Canadian Equity Index Fund Active MLI U.S. Diversified 8196 0.375% Grow th Equity (Wellington) Fund U.S. Equity Passive MLI BlackRock U.S. 8322 0.090% Equity Index Fund* Active MLI MFS MB 8162 0.280% International Equity International Fund Equity Passive MLI BlackRock 8321 0.160% International Equity Index Fund* 1 IMFs shown do not include applicable taxes. -

NP Key Contacts.Pdf

IGP Network Partners: Key Contacts Region: Americas Country / Territory IGP Network Partner IGP Contact Email Type IGP Regional Coordinator Mr. Michael Spincemaille [email protected] Argentina SMG LIFE Mr. Nicolas Passet [email protected] Partner Brazil MAPFRE Vida S.A. Ms. Débora Nunes Santos [email protected] Partner Canada Manulife Financial Corporation Mr. Kajan Ramanathan [email protected] Partner Chile MAPFRE Chile Ms. Nathalie Gonzalez [email protected] Partner Colombia MAPFRE Colombia Ms. Ingrid Olarte Pérez [email protected] Partner Costa Rica MAPFRE Costa Rica Mr. Armando Sevilla [email protected] Partner Dominican Republic (Life) MAPFRE BHD Mrs. Alejandra Quirico [email protected] Partner Dominican Republic (Health) MAPFRE Salud ARS, S. A. Mr. Christian Wazar [email protected] Partner Ecuador MAPFRE Atlas * Mr. Carlos Zambrano [email protected] Correspondent El Salvador MAPFRE Seguros El Salvador S.A. Mr. Daniel Acosta González [email protected] Partner French Guiana Refer to France - - Partner Guadeloupe Refer to France - - Partner Guatemala MAPFRE Guatemala Mr. Luis Pedro Chavarría [email protected] Partner Honduras MAPFRE Honduras Mr. Carlos Ordoñez [email protected] Partner Martinique Refer to France - - Partner Mexico Seguros Monterrey New York Life Ms. Paola De Uriarte [email protected] Partner Nicaragua MAPFRE Nicaragua Mr. Dany Lanuza Flores [email protected] Partner Panama MAPFRE Panama Mr. Manuel Rodriguez [email protected] Partner Paraguay MAPFRE Paraguay Mr. Sergio Alvarenga [email protected] Partner Peru MAPFRE Peru Mr. Ramón Acuña Huerta [email protected] Partner Saint Martin Refer to France - - Partner Saint Barthélemy Refer to France - - Partner Saint Pierre & Miquelon Refer to France - - Partner United States Prudential Insurance Company of America Mr. -

Manulife Global Fund Unaudited Semi-Annual Report

Unaudited Semi-Annual Report Manulife Global Fund Société d'Investissement à Capital Variable for the six month period ended 31 December 2020 No subscription can be received on the basis of nancial reports. Subscriptions are only valid if made on the bases of the current prospectus, accompanied by the latest annual report and semi-annual report if published thereaer. SICAV R.C.S Luxembourg B 26 141 Contents Directors ..................................................................................................................................................... 1 Management and Administration ............................................................................................................. 2 Directors’ Report ........................................................................................................................................ 4 Statement of Net Assets ........................................................................................................................... 10 Statement of Changes in Net Assets ........................................................................................................ 15 Statement of Operations ........................................................................................................................... 20 Statistical Information ............................................................................................................................... 25 Statement of Changes in Shares ............................................................................................................. -

Deutsche Bank Securities Complaint

UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF NEW YORK SECURITIES AND EXCHANGE COMMISSION, 450 Fifth Street, N.W. Washington, D.C. 20549-0801, Plain tiff, COMPLAINT - against - DEUTSCHE BANK SECURITIES INC., 31 West 52nd Street New York, New York 10019, Defendant. Plaintiff Securities and Exchange Commission (the "Commission" or "SEC") alleges: NATURE OF THE ACTION 1. The Commission brings this action against defendant Deutsche Bank Securities Inc. ("Deutsche Bank" or "Defendant") to redress Deutsche Bank's violations of the Securities Act of 1933 ("Securities Act"), the Securities Exchange Act of 1934 ("Exchange Act"), and rules of NASD Inc. ("NASD") and the New York Stock Exchange, Inc. ("NYSE"). 2. From July 1999 through June 2001 (the "relevant period"), Deutsche Bank engaged in acts and practices that created and/or maintained inappropriate.influence by investment banking over research analysts, thereby creating conflicts of interest for its research analysts. Deutsche Bank failed to manage these conflicts in an adequate manner. During this time period, Deutsche Bank offered research coverage in order to gain investment banking business and receive investment banking fees. It also received over $1 million from other investment banks to provide research coverage of their investment banking clients, and made payments of approxiniately $10 million to other securities finns primarily for research coverage for its investment banking clients. In addition, Deutsche Bank compensated its research analysts based in part upon their contributions to Deutsche Bank's investment banking business. These relationships and activities constituted substantial conflicts of interest for Deutsche Bank's research analysts. 3. Deutsche Bank failed to establish and maintain adequate policies and procedures reasonably designed to manage these conflicts of interest. -

2018 Annual Report Fellow Shareholders, Governance and Shareholder Outreach

Manulife Financial Corporation Who Manulife Financial Corporation is Our five Portfolio Optimization we are a leading international financial strategic We are actively managing our priorities services group providing financial 1 legacy businesses to improve advice, insurance, as well as returns and cash generation while wealth and asset management reducing risk. solutions for individuals, groups, and institutions. We operate as John Hancock in the United States Expense Efficiency and Manulife elsewhere. We are getting our cost structure 2 into fighting shape and simplifying and digitizing our processes to position us for efficient growth. Accelerate Growth We are accelerating growth in our 3 highest-potential businesses. Our Digital, Customer Leader mission Decisions We are improving our customer 4 experiences, using digitization and made easierr. innovation to put customers first. Lives High-Performing Team made betterr. We are building a culture that 5 drives our priorities. Our Our Values represent how we Obsess Do the Values operate. They reflect our culture, about right thing inform our behaviours, and help define how we work together. customers Manulife Note: Growth in core earnings, assets under Core Earnings (C$ billions) management and administration (AUMA), and by the new business value are presented on a constant $5.6 billion exchange rate basis. numbers Total Company, Global Wealth and Asset Management (Global WAM), and Asia core earnings up 23%, 21%, and 20%, respectively, from 2017. 5.6 4.6 4.0 3.4 2.9 2014 2015 2016 2017 2018 Assets Under Management and Administration Net Income Attributed to Shareholders (C$ billions) (C$ billions) $1,084 billion $4.8 billion Over $1 trillion in AUMA. -

Demutualization Details

Demutualization Details 1. American Mutual Life – AmerUs- Indianapolis Life Insurance Company - Central Life Assurance - Central Life Assurance merged with American Mutual in 1994. American Mutual Life was renamed AmerUs Life Insurance Company in 1995. On September 20, 2000, it demutualized to become AmerUs Group. In 2001, the company merged with Indianapolis Life, which had also undergone a demutualization. Approximately 300,000 policyholders and heirs became entitled to receive $452 million in AmerUs Group common stock and $340 million in cash and policy credits. Distribution began on July 31, 2001. Eligible policyholders received a fixed component of 20 AmerUS common shares, as well as a variable component based on policy value. Those who elected to receive cash were compensate $26 per share entitlement. In the first year after the initial public offering, the price of an AmerUS common share increased 99%. The current value of AmerUS Group stock is approximately $45 per share. 2. Anthem Insurance - On July 31, 2002 Anthem Insurance Companies, Inc. completed its conversion from a mutual insurance company to a stock company, and became a wholly owned subsidiary of Anthem, Inc. Eligible policyholders and heirs became entitled to approximately 48 million shares of Anthem, Inc. common stock and cash totaling $2.06 billion. Compensation consisted of a fixed component of 21 Anthem common shares, as well as a variable component based on policy value. The shares were offered to the public at $36. In the first year after the initial public offering, the price of an Anthem common share increased 54%. 3. Equitable Life – Axa - In 1992 the Equitable Life Assurance Society of the United States demutualized and a new parent holding company, the Equitable Companies, was listed on the New York Stock Exchange. -

Credit Rating - Role in Modern Financial System

IRJC International Journal of Marketing, Financial Services & Management Research Vol.1 Issue 8, August 2012, ISSN 2277 3622 CREDIT RATING - ROLE IN MODERN FINANCIAL SYSTEM K.S.VENKATESWARA KUMAR*; S. HANUMANTHA RAO** *Assistant Professor, KLU Business School, K L University, Greenfields, Vaddeswaram, Guntur – 522502. **Assistant Professor, MBA Department, Vignan University, Vadlamudi, Guntur – 522213. ABSTRACT Credit rating business is a niche segment in the financial services arena. In the post-reforms era, with increased activity in the Indian Financial sector both existing and new companies are opting for finance from the capital market. The competition among firms for a slice of the savings cake has increased. Credit rating business in India is a sweet spot as it is on the cusp of robust growth potential, driven by three triggers: Strong capex cycle in Indian economy, lower penetration of corporate bond market and regulatory push due to implementation of Basel II norms. Credit rating helps in the development of financial markets. Credit rating is an investor service and a rating agency is expected to maintain the highest possible level of analytical competence and integrity. The analytical framework of rating deals with evaluation of both the business and financial risks associated with that entity. Besides qualitative aspects like management capabilities also play a considerable role in determining a rating. Credit ratings establish a link between risk & return. They thus provide a yardstick against which to measure the risk inherent in any instrument. Analytical framework of rating deals with evaluation of both the business & financial risks associated with that entity. The Reserve Bank of India liaises with SEBI, on the issue of rating agencies’ adherence to IOSCO Code of Conduct Fundamentals. -

Manulife's Investor Day 2017 in Hong Kong-Slides-Day 1

June 21, 2017 Hong Kong Agenda Time Speaker Presentation 9:05 am Donald Guloien Delivering on commitments, driving shareholder value & preparing for the future 9:20 am Roy Gori A compelling opportunity and clear priorities to win 9:40 am Steve Roder Commitment to shareholder value creation 10:10 am Q&A Session 10:45 am Roy Gori & Phil Witherington Executing on our Asia opportunity 11:30 am Q&A Session 11:55 am Various Labs 12:25 pm Lunch with Guest Speaker 1:40 pm Linda Mantia Driving Customer Centricity and Innovation 2:10 pm Q&A Session 2:25 pm Various Labs 3:05 pm Kai Sotorp A global wealth and asset management platform with solid growth momentum 3:35 pm Q&A Session 3:50 pm Various Labs Caution regarding forward-looking statements From time to time, MFC makes written and/or oral forward-looking statements, including in this presentation. In addition, our representatives may make forward-looking statements orally to analysts, investors, the media and others. All such statements are made pursuant to the “safe harbour” provisions of Canadian provincial securities laws and the U.S. Private Securities Litigation Reform Act of 1995. The forward-looking statements in this presentation include, but are not limited to, statements with respect to demographic and market trends and their expected benefit, core ROE expansion over the medium term and the drivers of such expansion, our expected dividend payout ratio, annual core earnings per share growth over the medium term and dividend growth over time. The forward-looking statements in this presentation -

S Ecurities Research Analyst

JOHN G. ULLMAN & ASSOCIATES, INC. – SECURITIES RESEARCH ANALYST John G. Ullman & Associates, Inc. has an incredible opportunity for entry level and experienced Securities Research Analysts to join our growing firm. We are a Registered Investment Advisor, Fee Only Wealth Management Firm. Our team is fully committed to serving clients as a unique, single source, for their financial needs. The firm is positioned to expand tremendously and these essential positions will plan a significant role in our strategic plans for growth. Role: Working from our Headquarters in Corning, NY, our Securities Research Analysts are part of a Securities Research Team now managing over $1 billion in stocks and bonds. Securities Research Analysts will develop, research, and present to the Investment Committee, new equity ideas that align with the firm’s balanced investment management philosophy. As a member of the Investment Committee, actively participate in buy, sell and hold discussions, including price points and size of the buy/sell recommendation. The research process includes relative and intrinsic analysis, as well as speaking with company representatives and others within the industry. Provide expertise to the Investment Committee on numerous areas of investment research, including macroeconomics effects and sector trends that may affect stocks, bonds, currencies, commodities and any other area in which a client may have a concern. Participate with asset allocation decisions, including cash levels, equity and bond exposure and any unique bond strategies. Assist the Trading Department with bond research as needed, especially the U.S. municipal market. Develop and maintain relationships to support and assist the firm’s financial advisors and client relationship managers with client investment needs. -

US Automotive Presentation to Detroit CFA Society

Global Securities Research January 13, 2014 Presentation to Detroit CFA Society US Automotive Colin Langan Analyst Tel: +212 713 9949 [email protected] This report has been prepared by UBS Securities LLC ANALYST CERTIFICATION AND REQUIRED DISCLOSURES BEGIN ON SLIDE 20 UBS does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. Presentation Outline • US auto sales outlook • US market share outlook • Europe auto sales outlook • Global auto sales outlook • Historical sector valuations • GM – Buy Thesis • VC – Buy Thesis • Ford – Buy Thesis • Auto dealers – Sell Thesis • Questions 1 2013 SAAR 15.5m; 2014 Forecast 16.0m We forecast 2014 SAAR of 16.0m and 2015 SAAR of 16.2m Our 2014 forecast implies ~3% y/y growth, slower than the ~11% CAGR over the last 4 years Our forecast is consistent with UBS econometric model forecast • U of M Index of Consumer Confidence (79% correlation) • Used Vehicle Pricing (45% correlation) US Auto Sales History and Forecast 20 20.0 17.3 17.1 16.9 16.9 16.9 16.8 16.6 16.5 18 16.2 18.0 16.1 16.1 16.0 15.5 15.5 15.5 15.4 15.1 15.1 15.1 15.0 14.9 14.7 14.5 14.5 14.4 16 14.2 16.0 13.9 13.9 13.8 13.2 13.0 12.9 12.7 14 12.3 14.0 12.1 11.6 11.2 10.8 10.5 10.4 12 10.4 12.0 10 10.0 8 8.0 6 6.0 4 4.0 2 2.0 - '75 '76 '77 '78 '79 '80 '81 '82 '83 '84 '85 '86 '87 '88 '89 -

Bestweek World's Largest Insurers

www.bestweek.com BESTWEEK BESTWEEKWeekly Insurance Newsletter January 2012 Weekly Insurance Newsletter Top Insurers Ranked by Assets, Net Premiums Aegon N.V. Chairman and Chief Executive: World’s Largest Insurers Alex Wynaendts Ranked by Non-Banking Assets Aegon is a public company specializing 2010 in life insurance, pensions and long- Total Non- term savings and investment products. Country of Banking Assets % It has 28,000 employees serving 40 AMB Company Name Domicile USD (000) Change* million clients in 20 countries. 1 Japan Post Insurance Co. Ltd. Japan 1,089,463,948 -5.26 www.aegon.com Wynaendts 2 Axa S.A. France 920,476,513 3.27 3 Allianz SE Germany 807,486,736 8.23 Allianz Societas Europae 4 MetLife Inc. US 730,906,000 35.53 Chairman and Chief Executive: 5 American International Group Inc. US 683,443,000 -19.37 Michael Diekmann 6 Aviva plc UK 572,208,859 4.45 Allianz is a public company specializing 7 Assicurazioni Generali S.p.A. Italy 559,858,937 -0.33 in property/casualty and life/health 8 Prudential Financial Inc. US 539,854,000 12.42 insurance, asset management and Nippon Life Insurance Co. Japan 527,095,201 6.20 banking. It has approximately 151,000 9 employees serving more than 76 mil- 10 Legal & General Group plc UK 501,063,918 9.03 lion clients in about 70 countries. Diekmann 11 National Mut Ins Fed of Agricultural Co-ops Japan 488,175,304 3.30 Rating: A.M. Best currently rates the financial strength of 12 Aegon N.V. -

Aftermarket Research Source Book

Aftermarket Research Source Book November 2020 Refinitiv Aftermarket research collections provide the most comprehensive offering in the marketplace, with over 30 million research reports from over 1,900 sources. This document provides an index of the available research sources across the following collections: Subscription / Investext® Collection Pay-Per-View (PPV) / Research Select and Market Research Collections Aftermarket Research Source Book - November 2020 2 New Contributors Added Year to Date 81 contributors from 34 countries have been added to the collection since the beginning of 2020 Australia 3 Ireland 1 South Africa 1 Brazil 1 Japan 4 South Korea 1 Canada 5 Kenya 2 Spain 2 Chile 1 Lebanon 1 Switzerland 1 China 4 Liechtenstein 1 Turkey 2 Colombia 1 Nigeria 4 United Arab Emirates 6 France 2 Peru 1 United Kingdom 5 Germany 1 Philippines 1 United States 11 Ghana 1 Russia 1 Uzbekistan 2 Hong Kong 6 Saudi Arabia 1 Vietnam 1 India 3 Singapore 2 Indonesia 1 Slovenia 1 Contributor Highlights Refinitiv is pleased to announce that BofA Global Research has joined the list of exclusive BofA Global Research contributors only accessible, by qualifying users, through our Aftermarket Research collection. • A team of 285 analysts covering approximately 3,100 companies in 24 global industries – one of the largest research providers worldwide and with more sector coverage than anyone else. • More coverage (2,832) in large- and mid-caps than bulge-bracket peers. • One of the largest producers of equity research with approximately 47,000 documents published in 2019. GraniteShares is an entrepreneurial ETF provider focused on providing innovative, cutting-edge alternative investment solutions.