Stoxx® Global Total Market Index

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Possibilities of Applying Markowitz Portfolio Theory on the Croatian Capital Market

POSSIBILITIES OF APPLYING MARKOWITZ PORTFOLIO THEORY ON THE CROATIAN CAPITAL MARKET Dubravka Pekanov Starčević, Ph.D. J. J. Strossmayer University of Osijek, Faculty of Economics in Osijek E-mail: [email protected] Ana ZRNIć, Ph.D. Student, J. J. Strossmayer University of Osijek, Faculty of Economics in Osijek E-mail: [email protected] Tamara Jakšić, BEcon, student J. J. Strossmayer University of Osijek, Faculty of Economics in Osijek E-mail: [email protected] POSSIBILITIES OF APPLYING MARKOWITZ PORTFOLIO THEORY ON THE CROATIAN CAPITAL... MARKOWITZ PORTFOLIO THEORY ON THE CROATIAN POSSIBILITIES OF APPLYING Abstract In order to achieve the maximum possible profit by taking the lowest possible risk, investors build a stock portfolio consisting of a specific number of stocks which, according to the principle of diversification, significantly reduce the risk of loss. To build a portfolio, in developed capital markets investors have used the Markowitz portfolio optimization model for many years that enables us to find an optimal risk-return trade-off by selecting certain stock combinations. Despite the development of the Zagreb Stock Exchange, i.e., the central trading venue in the Republic of Croatia, the Croatian capital market is still under- developed. It is characterized by numerous shortcomings such as low liquidity, lack of transparency, high stock price volatility and insufficient traffic. Accord- ingly, the aim of this paper is to provide an insight into the functioning of the Dubravka Pekanov Starčević • Ana Zrnić • Tamara Jakšić: Dubravka Pekanov Starčević • Ana Zrnić Tamara 520 Croatian capital market and to examine the possibility of building an optimal stock portfolio by using the Markowitz model. -

Global Pay TV Operator Forecasts

Global Pay TV Operator Forecasts Table of Contents Published in October 2016, this 190-page electronically-delivered report comes in two parts: A 190-page PDF giving a global executive summary and forecasts. An excel workbook giving comparison tables and country-by-country forecasts in detail for 400 operators with 585 platforms [125 digital cable, 112 analog cable, 208 satellite, 109 IPTV and 31 DTT] across 100 territories for every year from 2010 to 2021. Forecasts (2010-2021) contain the following detail for each country: By country: TV households Digital cable subs Analog cable subs Pay IPTV subscribers Pay digital satellite TV subs Pay DTT homes Total pay TV subscribers Pay TV revenues By operator (and by platform by operator): Pay TV subscribers Share of pay TV subscribers by operator Subscription & VOD revenues Share of pay TV revenues by operator ARPU Countries and operators covered: Country No of ops Operators Algeria 4 beIN, OSN, ART, Algerie Telecom Angola 5 ZAP TV, DStv, Canal Plus, Angola Telecom, TV Cabo Argentina 3 Cablevision; Supercanal; DirecTV Australia 1 Foxtel Austria 3 Telekom Austria; UPC; Sky Bahrain 4 beIN, OSN, ART, Batelco Belarus 2 MTIS, Zala Belgium 5 Belgacom; Numericable; Telenet; VOO; Telesat/TV Vlaanderen Bolivia 3 DirecTV, Tigo, Entel Bosnia 3 Telemach, M:Tel; Total TV Brazil 5 Claro; GVT; Vivo; Sky; Oi Bulgaria 5 Blizoo, Bulsatcom, Vivacom, M:Tel, Mobitel Canada 9 Rogers Cable; Videotron; Cogeco; Shaw Communications; Shaw Direct; Bell TV; Telus TV; MTS; Max TV Chile 6 VTR; Telefonica; Claro; DirecTV; -

Analysys Mason Report on Developments in Cable for Superfast Broadband

Final report for Ofcom Future capability of cable networks for superfast broadband 23 April 2014 Rod Parker, Alex Slinger, Malcolm Taylor, Matt Yardley Ref: 39065-174-B . Future capability of cable networks for superfast broadband | i Contents 1 Executive summary 1 2 Introduction 5 3 Cable network origins and development 6 3.1 History of cable networks and their move into broadband provision 6 3.2 The development of DOCSIS and EuroDOCSIS 8 4 Cable network elements and architecture 10 4.1 Introduction 10 4.2 Transmission elements 10 4.3 Description of key cable network elements 13 4.4 Cable access network architecture 19 5 HFC network implementation, including DOCSIS 3.0 specification 21 5.1 Introduction 21 5.2 HFC performance considerations 21 5.3 Delivery of broadband services using DOCSIS 3.0 24 5.4 Limitations of DOCSIS 3.0 specification 27 5.5 Implications for current broadband performance under DOCSIS 3.0 30 6 DOCSIS 3.1 specification 33 6.1 Introduction 33 6.2 Reference architecture 34 6.3 PHY layer frequency plan 35 6.4 PHY layer data encoding options 37 6.5 MAC and upper layer protocol interface (MULPI) features of DOCSIS 3.1 39 6.6 Development roadmap 40 6.7 Backwards compatibility 42 6.8 Implications for broadband service bandwidth of introducing DOCSIS 3.1 43 6.9 Flexibility of DOCSIS 3.1 to meet evolving service demands from customers 47 6.10 Beyond DOCSIS 3.1 47 7 Addressing future broadband growth with HFC systems – expanding DOCSIS 3.0 and migration to DOCSIS 3.1 49 7.1 Considerations of future broadband growth 49 7.2 Key levers for increasing HFC data capacity 52 7.3 DOCSIS 3.0 upgrades 53 7.4 DOCSIS 3.1 upgrades 64 7.5 Summary 69 Ref: 39065-174-B . -

The Port of Rijeka J. S. C. Supervisory Board Meeting Hasn't Been Held

Supervisory Board meeting hasn't been held, due to current situation with COVID-19 pandemic, therefore, set of financial reports for Zagreb Stock Exchange couldn’t be verified by members of the Supervisory Board. The investment public will be informed in time about Supervisory Board meeting and verification of reports. The Port of Rijeka j. s. c. LUKA RIJEKA d.d. Annual Report for the year ended 31 December 2020 This version of the Annual Report is a translation from the original, which was prepared in Croatian language. All possible care has been taken to ensure that the translation is an accurate representation of the original. However, in all matters of interpretation of information, views or opinions, the original language version of the Annual Report takes precedence over this translation. CONTENTS Page Management report for the year ended 31 December 2020 1 Statement of implementation of the corporate governance code 18 Statement of Management's responsibilities 21 Independent Auditors’ Report to the Shareholders of Luka Rijeka d.d. 22 Statement of comprehensive income 27 Statement of financial position 28 Statement of changes in equity 29 Statement of cash flows 31 Notes to the financial statements 32 - 83 Management report for the year ended 31 December 2020 LUKA RIJEKA GROUP MANAGEMENT REPORT FOR THE YEAR ENDED 31 DECEMBER 2020 LUKA RIJEKA D.D. Riva 1, HR-51 000 RIJEKA OIB: 92590920313 Rijeka, April 2021. 1 Management report for the year ended 31 December 2020 STRUCTURE OF LUKA RIJEKA GROUP The Group is comprised of the following companies: LUKA RIJEKA d.d. -

Svoj Ugled Izgradili Smo Na Projektiranju, Izgradnji I Održavanju

Svoj ugled izgradili smo na projektiranju, izgradnji i održavanju sustava tehničke zaštite i sigurnosti, parkirališnih rješenja i sustava, razvoju programskih aplikacija, sustava automatizacije i energetske učinkovitosti te njihovoj implementaciji u raznovrsne profesionalne programske aplikacije. Svoj uspjeh temeljimo na timu od stotinjak djelatnika od kojih je više od polovice diplomiranih inženjera. Naš tim sastoji se od mladih, kompetentnih i profesionalnih ljudi koji su predanim radom stekli značajna iskustva u razvoju, projektiranju i izvođenju kompleksnih projekata u Hrvatskoj i zemljama jugoistočne Europe što nas čini pouzdanim partnerom za širok raspon djelatnosti. MISIJA VIZIJA Unaprijediti poslovanje u segmentima zaštite i Postati vodeći sistem integrator na projektima sigurnosti, razvoja parkirališnih i programskih tehničke zaštite i sigurnosti, parkirališnih rješenja te automatizacije i energetske rješenja, programskih aplikacija te energetike i učinkovitosti upravljanja resursima u industriji i automatizacije u jugoistočnoj Europi i šire. zgradarstvu provođenjem tehnološki naprednih projekata temeljenih na integraciji različitih sustava u cjelovita i efikasna rješenja. TEHNIČKA ZAŠTITA I PARKING • Integracija sustava tehničke zaštite • Kontrola pristupa • Dojava požara • Plinodetekcija • Protuprovala • Videonadzor • Ozvučenje i multimedija • Integrirani sustavi nadzora i upravljanja • Upravljanje parkiralištima • Mehanička zaštita (rampe, sigurnosna vrata i sl.) • Sustavi uzbunjivanja stanovništva ENERGETIKA • Nadzor potrošnje -

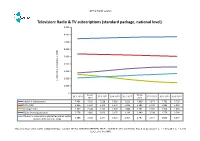

Television: Radio & TV Subscriptions (Standard Package, National Level) 9.000

OPTA Public version Television: Radio & TV subscriptions (standard package, national level) 9.000 8.000 7.000 6.000 5.000 4.000 3.000 2.000 number of subscriptionsof number x 1,000 1.000 0 31-12- 31-12- 30-9-2010 31-3-2011 30-6-2011 30-9-2011 31-3-2012 30-6-2012 30-9-2012 2010 2011 Total RTV subscriptions 7.454 7.500 7.538 7.590 7.623 7.669 7.677 7.702 7.730 Total cable 5.366 5.334 5.291 5.271 5.226 5.182 5.129 5.083 5.033 Analogue cable 2.587 2.448 2.265 2.095 1.888 1.741 1.592 1.504 1.434 Digital (+ analogue) cable 2.778 2.886 3.026 3.176 3.338 3.440 3.538 3.579 3.599 Other RTV subscriptions (digital terrestrial, digital 2.088 2.166 2.247 2.319 2.397 2.487 2.547 2.620 2.697 satellite, IPTV over DSL, FttH) Based on figures from CAIW, CANALDIGITAAL, COGAS, DELTA, KPN, REGGEFIBER, TELE2, T-MOBILE, UPC and ZIGGO. Based on questions 5_A_1_1 through 5_A_1_5 and 5_A_1_8 of the SMM. OPTA Public version Television: Churn based on radio & TV subscriptions (standard package, national level) 5% 4% 3% 2% % of number%of subscriptions 1% 0% 30-9-2010 31-12-2010 31-3-2011 30-6-2011 30-9-2011 31-12-2011 31-3-2012 30-6-2012 30-9-2012 Adds 3,1% 3,2% 3,1% 3,0% 3,3% 3,9% 3,8% 3,3% 3,2% Disconnects 2,7% 2,5% 2,8% 2,7% 2,9% 3,3% 3,4% 3,1% 3,0% Based on figures from CAIW, CANALDIGITAAL, COGAS, DELTA, KPN, REGGEFIBER, TELE2, UPC and ZIGGO. -

Opmaak 1 01-05-19 17:11 Pagina 1

Evolve_2_QSG_UK_URC7125_711733_RDN1010519.qxp_Opmaak 1 01-05-19 17:11 Pagina 1 ESPAÑOL ENGLISH HOW TO SET UP YOUR REMOTE HOW TO SET UP YOUR REMOTE A – SIMPLESET A – SIMPLESET KEY TABLE SimpleSet is a quick and easy way of setting up the remote to control the most popular brands of To set up your device ENGLISH each device type with only a few key presses, typically in under a minute per device. The first step is to select which device you are going to set up. The following is a list of Device Modes on the 1. Turn on your device (not on standby) and point the OFA remote towards it. remote control, and the Device types that can be set up on that mode: MAGIC: Used to set up POWER: 2. Hold down MAGIC until the LED under the device blinks twice. The LED your remote Power on/off under the current device will stay lit. 3. Press the MODE key repeatedly until the LED for the device you want to WATCH TV: Combines TV and URC7125 STB into one mode set up is lit. for TV viewing Device Mode Type of device 4. Hold down the digit for your brand and device as listed above (e.g. 6 for SIMPLE SET UP GUIDE MODE: Scroll through TV TV, HDTV, LED, LCD, Plasma, Projector Samsung TV). the devices your remote is set up to control STB Set Top Box, Satellite Receiver, Cable Converter, 5. The remote will send Power every 3 seconds until your device switches off. Freeview, DVB-T, IPTV, Media, Streamer 6. -

201 ,QWHUQDWLRQDO 9Aluation Handbook ,QGXVWU\ Cost of Capital

201,QWHUQDWLRQDO9aluation Handbook ,QGXVWU\ Cost of Capital Market Results Through0DUFK 2015 Duff & Phelps &RPSDQ\/LVW 1RWH 7KLV GRFXPHQW SURYLGHV D OLVW RI WKH FRPSDQLHV XVHG WR SHUIRUP WKH DQDO\VHV SXEOLVKHG LQ WKH ,QWHUQDWLRQDO 9DOXDWLRQ +DQGERRN ̰ ,QGXVWU\ &RVW RI &DSLWDO GDWD WKURXJK 0DUFK 7KHLQIRUPDWLRQ KHUHLQ LV VSHFLILF WR WKH KDUGFRYHU ,QWHUQDWLRQDO 9DOXDWLRQ +DQGERRN ̰,QGXVWU\ &RVW RI &DSLWDO GDWD WKURXJK 0DUFK DQG LV QRW DSSOLFDEOH WR DQ\ RWKHU ERRN XSGDWH RU GRFXPHQW Cover image: Duff & Phelps Cover design: Tim Harms Copyright © 2016 by John Wiley & Sons, Inc. All rights reserved. Published by John Wiley & Sons, Inc., Hoboken, New Jersey. Published simultaneously in Canada. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without either the prior written permission of the Publisher, or authorization through payment of the appropriate per-copy fee to the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923, (978) 750-8400, fax (978) 646-8600, or on the Web at www.copyright.com. Requests to the Publisher for permission should be addressed to the Permissions Department, John Wiley & Sons, Inc., 111 River Street, Hoboken, NJ 07030, (201) 748-6011, fax (201) 748-6008, or online at http://www.wiley.com/go/permissions. The foregoing does not preclude End-users from using the 2015 International Valuation Handbook ࣓ Industry Cost of Capital and data published therein in connection with their internal business operations. -

Case M.7978 - VODAFONE / LIBERTY GLOBAL / DUTCH JV

EUROPEAN COMMISSION DG Competition Case M.7978 - VODAFONE / LIBERTY GLOBAL / DUTCH JV Only the English text is available and authentic. REGULATION (EC) No 139/2004 MERGER PROCEDURE Article 6(1)(b) in conjunction with Art 6(2) Date: 03/08/2016 This is a provisional non-confidential version. The definitive non-confidential version will be published as soon as it is available. EUROPEAN COMMISSION Brussels, 03.08.2016 C(2016) 5165 final In the published version of this decision, some information has been omitted pursuant to Article PUBLIC VERSION 17(2) of Council Regulation (EC) No 139/2004 concerning non-disclosure of business secrets and other confidential information. The omissions are shown thus […]. Where possible the information omitted has been replaced by ranges of figures or a general description. To the notifying parties: Dear Sir/Madam, Subject: Case M.7978 -Vodafone / Liberty Global / Dutch JV Commission decision pursuant to Article 6(1)(b) in conjunction with Article 6(2) of Council Regulation No 139/20041 and Article 57 of the Agreement on the European Economic Area2 1 OJ L 24, 29.1.2004, p. 1 (the 'Merger Regulation'). With effect from 1 December 2009, the Treaty on the Functioning of the European Union ('TFEU') has introduced certain changes, such as the replacement of 'Community' by 'Union' and 'common market' by 'internal market'. The terminology of the TFEU will be used throughout this decision. 2 OJ L 1, 3.1.1994, p. 3 (the 'EEA Agreement'). Commission européenne, DG COMP MERGER REGISTRY, 1049 Bruxelles, BELGIQUE Europese Commissie, DG COMP MERGER REGISTRY, 1049 Brussel, BELGIË Tel: +32 229-91111. -

Investment Holdings As of June 30, 2019

Investment Holdings As of June 30, 2019 Montana Board of Investments | Portfolio as of June 30, 2019 Transparency of the Montana Investment Holdings The Montana Board of Investment’s holdings file is a comprehensive listing of all manager funds, separately managed and commingled, and aggregated security positions. Securities are organized across common categories: Pension Pool, Asset Class, Manager Fund, Aggregated Individual Holdings, and Non-Pension Pools. Market values shown are in U.S. dollars. The market values shown in this document are for the individual investment holdings only and do not include any information on accounts for receivables or payables. Aggregated Individual Holdings represent securities held at our custodian bank and individual commingled accounts. The Investment Holdings Report is unaudited and may be subject to change. The audited Unified Investment Program Financial Statements, prepared on a June 30th fiscal year-end basis, will be made available once the Legislative Audit Division issues the Audit Opinion. Once issued, the Legislative Audit Division will have the Audit Opinion available online at https://www.leg.mt.gov/publications/audit/agency-search-report and the complete audited financial statements will also be available on the Board’s website http://investmentmt.com/AnnualReportsAudits. Additional information can be found at www.investmentmt.com Montana Board of Investments | Portfolio as of June 30, 2019 2 Table of Contents Consolidated Asset Pension Pool (CAPP) 4 CAPP - Domestic Equities 5 CAPP - International -

Tele2 Strengthens Its Group Leadership Team with New CFO and CCO

Tele2 AB P.O.Box 62 SE 164 94 Kista, Sweden Telephone +46 8 562 000 60 www.tele2.com 2021-07-12 PRESS RELEASE Tele2 strengthens its Group Leadership Team with new CFO and CCO Stockholm – Tele2 AB (“Tele2”) (Nasdaq Stockholm: TEL2 A and TEL2 B) today announced that it is strengthening its Group Leadership Team by appointing Charlotte Hansson as EVP Group CFO and Hendrik de Groot as EVP Chief Commercial Officer. In addition, Stefan Backman, EVP Group General Counsel, has decided to leave Tele2. To strengthen its commercial and financial capabilities, with a special focus on convergence and online sales, Tele2 welcomes Charlotte Hansson and Hendrik de Groot to its Group Leadership Team. Charlotte Hansson appointed EVP Group CFO Starting January 10 2022, Charlotte Hansson assumes the role of EVP Group CFO and joins Tele2’s Group Leadership Team, reporting to CEO Kjell Johnsen. Charlotte brings broad experience from several industries, most recently as CFO of Systembolaget, the Government-owned Swedish alcohol retail chain. Before that, she was Group CFO at the Nasdaq listed global PR software and service company Cision, Group CFO of the Swedish facility management company Addici and also has a background at MTG. Charlotte currently sits on the board of Orexo, a Nasdaq Mid Cap listed med-tech company. – I am excited to welcome Charlotte to Tele2. Her extensive experience as CFO of companies from different industries will bring fresh perspectives and ideas to our business. Charlotte’s experiences from deep involvement in transformation journeys, for example towards e-commerce, will be essential as Tele2 focuses more and more on automation through online sales, says Kjell Johnsen, President and Group CEO of Tele2. -

Sergio Denicoli Dos Santos.Pdf

Universidade do Minho Instituto de Ciências Sociais al Sergio Denicoli dos Santos visão Digit ele tugal or A implementação da Televisão Digital ação da T Terrestre em Portugal tre em P erres A implement T os gio Denicoli dos Sant Ser 2 1 minho|20 U Junho de 2012 Universidade do Minho Instituto de Ciências Sociais Sergio Denicoli dos Santos A implementação da Televisão Digital Terrestre em Portugal Tese de Doutoramento em Ciências da Comunicação Especialidade de Sociologia da Comunicação e da Informação Trabalho realizado sob a orientação da Professora Doutora Helena Sousa Junho de 2012 Este estudo doutoral foi cofinanciado pelo Programa Operacional Potencial Humano (POPH/FSE), através da Fundação para a Ciência e a Tecnologia (FCT). Foi também desenvolvido no âmbito do projeto de investigação intitulado “A Regulação dos Media em Portugal: O Caso da ERC” (PTDC/CCI-COM104634/2008), financiado pela Fundação para a Ciência e a Tecnologia (FCT). iii AGRADECIMENTOS Escrever uma tese é mais do que uma incursão por um caminho científico. É uma experiência de vida, que envolve um grande crescimento pessoal. São anos e anos a investigar um objeto de estudo e ao fim descobrimos que o trabalho realizado não foi simplesmente um processo académico, mas sim uma grande jornada de autoconhecimento. Aprendemos a ser mais pacientes, mais disciplinados e mais críticos em relação a nós mesmos. Também nos tornamos mais críticos e questionadores em relação à sociedade, o que nos torna cidadãos exigentes, sobretudo no que diz respeito às esferas que envolvem o que estudamos. E foi guiado por uma sensibilidade democrática que realizei este estudo.