Case M.7978 - VODAFONE / LIBERTY GLOBAL / DUTCH JV

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Vodafone Netherlands Calls on Clariba for BI Solutions

Clariba Customer Success Story Sending a clear signal to mobile customers Vodafone Netherlands calls on Clariba for BI solutions Connecting customers with the right product mix is a key objective for the Consumer Base Management (CBM) Team at Vodafone, a global leader in mobile telecommunications. By measuring the success of consumer focused marketing campaigns, understanding the customer lifecycle and identifying new prepaid and contract offerings, the CBM Team can target customers more effectively. However, this can only be achieved with timely and accurate information. The Company Vodafone Netherlands The Disconnect The CBM Team at Vodafone Netherlands recognized that their data collection Industry process made it difficult to access information due to the huge volume of customer Telecommunications data records (CDR). As a result of time-consuming report generation, the data presented to the management team was delivered too late and considered inac- Objectives curate, leaving decision-makers at Vodafone in the dark as to the success of their • Implement key reports within a marketing campaigns. maintainable BI solution Vodafone engaged Clariba to help them achieve the objective of centralizing and • Automate the report generation and automating their information gathering process. The CBM Team also identified distribution process the need for accurate information delivered cost-effectively and on time from one • Develop a management portal with trusted source to all relevant marketers and decision-makers. dashboard including key indicators The Clariba Difference Answering the Call • Customized BI solution based on Clariba collaborated with the CBM Team to implement a reliable BI solutionbased clear understanding of business requirements on the market leading BusinessObjects platform. -

Mediaconcentratie in Vlaanderen

MMediaconcentratieediaconcentratie iinn VVlaanderenlaanderen rapport 2009 VLAAMSE REGULATOR VOOR DE MEDIA Koning Albert II-laan 20,bus 21 1000 Brussel COLOFON Samenstelling, redactie en eindredactie: Stijn Bruyneel, Ingrid Kools en Francis Soulliaert Verantwoordelijke uitgever: Joris Sels, gedelegeerd bestuurder Koning Albert II-laan 20, bus 21 1000 Brussel Tel.: 02/553 45 04 Fax: 02/553 45 06 e-mail:[email protected] website: www.vlaamseregulatormedia.be Lay-out en druk: Digitale drukkerij Facilitair Management Vlaamse Overheid Depotnummer: D/2009/3241/429 Mediaconcentratie in Vlaanderen INHOUDSTAFEL Samenvatting ......................................................................................................................... 10 1 DE VLAAMSE MEDIASECTOR ............................................................................................... 13 1.1 RADIO ......................................................................................................................... 17 1.1.1 Contentleveranciers ........................................................................................................................ 17 1.1.2 Radio-omroeporganisaties ............................................................................................................. 18 1.1.2.1 Landelijke publieke radio-omroeporganisaties ........................................................ 18 1.1.2.2 Regionale publieke radio-omroeporganisaties ......................................................... 19 1.1.2.3 Wereldomroep .............................................................................................................. -

Advies Frequentieveiling 2019

Advies Openbaar Pagina 1 / 92 info @acm.nl | 070 722T 20 00 | F 070 722 23 55 Postbus 16326 |Haag 2500 BH Den Muzenstraat 41 | Haag 2511 WB Den www.acm.nl | www.consuwijzer.nl| Advies multibandveiling 2019 Den Haag, 9 april 2019 Zaaknummer: ACM/17/019954 Documentnummer: ACM/UIT/509860 Advies Openbaar Samenvatting Achtergrond In de aanloop naar de komende veiling van de 700, 1400 en 2100 MHz frequentiebanden1 eind 2019/begin 2020, en van de 3,5 GHz band die vanaf 2022 beschikbaar wordt gemaakt voor mobiele communicatie2, heeft het Ministerie van Economische Zaken en Klimaat (EZK) de ACM gevraagd advies uit te brengen3 over mogelijke maatregelen die tijdens de frequentieveiling genomen zouden 2 moeten worden om de concurrentie in de markt voor mobiele communicatie te waarborgen. / Maatregelen tijdens de veiling 92 Bij haar afbakening van de markt voor mobiele communicatiediensten komt de ACM tot de conclusie dat deze markt alle spraak-, SMS- en datadiensten omvat die op mobiele telefoons, tablets, laptops en andere apparaten kunnen worden gebruikt, ongeacht of ze over 2G, 3G of 4G geleverd worden, op basis van prepaid of postpaid, en aan consumenten of aan zakelijke eindgebruikers. In haar concurrentieanalyse concludeert de ACM dat de situatie op deze markt duidt op effectieve concurrentie. De ACM stelt vast dat KPN de grootste partij op deze markt is, maar dat KPN op deze markt niet beschikt over aanmerkelijke marktmacht (AMM). De ACM concludeert dat de mobiele markt een grote dynamiek kent, waarbij aanbieders reageren op elkaars proposities. Die dynamiek is in de afgelopen jaren toegenomen. Ook zijn de prijzen van mobiele communicatiediensten in de afgelopen jaren gedaald, ondanks de zeer hoge kwaliteit van de Nederlandse mobiele netwerken. -

Annex 4: Report from the States of the European Free Trade Association Participating in the European Economic Area

ANNEX 4: REPORT FROM THE STATES OF THE EUROPEAN FREE TRADE ASSOCIATION PARTICIPATING IN THE EUROPEAN ECONOMIC AREA 1. Application by the EFTA States participating in the EEA 1.1 Iceland European works The seven covered channels broadcast an average of 39.6% European works in 2007 and 42.2% in 2008. This represents a 2.6 percentage point increase over the reference period. For 2007 and 2008, of the total of seven covered channels, three channels achieved the majority proportion specified in Article 4 of the Directive (Omega Television, RUV and Syn - Vision TV), while four channels didn't meet this target (Sirkus, Skjár 1, Stöð 2 and Stöð 2 Bio). The compliance rate, in terms of numbers of channels, was 42.9%. European works made by independent producers The average proportion of European works by independent producers on all reported channels was 10.7% in 2007 and 12.6% in 2008, representing a 1.9 percentage points increase over the reference period. In 2007, of the total of seven identified channels, two channels exceeded the minimum proportion under Article 5 of the Directive, while three channels remained below the target. One channel was exempted (Syn - Vision TV) and no data was communicated for another one (Omega Television). The compliance rate, in terms of number of channels, was 33.3%. For 2008, of the total of seven covered channels, three exceeded the minimum proportion specified in Article 5 of the Directive, while two channels were below the target (Skjár 1 and Stöð 2 Bio). No data were communicated for two channels. -

Toekomst? Snelheid

Klaar voor de snelheid van de toekomst? Glasvezel in het buitengebied: zo geregeld. De voordelen van glasvezel Het bekendste voordeel is dat je de beschikking krijgt over razendsnel internet, maar glasvezel voor bedrijven kent nog meer voordelen. Zakelijk glasvezel is toekomstvast, stabiel, schaalbaar en door het open karakter kunnen meerdere aanbieders hun diensten aanbieden. Zakelijk glasvezel is toekomstvast Zakelijk glasvezel wordt geleverd met een standaard capaciteit van 1 Gbit/s. Dat wil zeggen dat je beschikt over een enorm groeipad, zowel qua diensten als qua snelheid. De hoge uploadsnelheid van glasvezel Glasvezel verbindingen zijn symmetrisch. Dat wil zeggen dat de upload snelheid gelijk is aan de download snelheid. Een enorm voordeel met name voor het werken in de cloud. Zakelijk glasvezel is modulair en schaalbaar De diensten die je wilt afnemen over het glasvezel zijn altijd modulair en schaalbaar. Dat wil zeggen dat meerdere diensten geleverd kunnen wor- den over dezelfde access en dat per dienst aangegeven kan worden wat de capaciteit of snelheid moet worden, eventueel aangevuld met keuzes in de overboeking of SLA. Ook add-ons als Pinnen over IP en Alarm over IP kunnen worden afgenomen. Zeer stabiel Zakelijke glasvezel verbindingen zijn stabiel en betrouwbaar en kennen een uptime garantie van 99,9% en hoger. De meeste bedrijven die de overstap naar glasvezel al gemaakt hebben kunnen beamen dat ze zelden of nooit last hebben van storingen of onderbrekingen. Dit heeft enorme voordelen voor je bedrijf. De medewerkers vinden het heerlijk om gebruik te kunnen maken van stabiele verbindingen waar ze op kunnen bouwen en ongehin- derd en ongestoord hun werk in hoog tempo kunnen doen. -

Global Pay TV Operator Forecasts

Global Pay TV Operator Forecasts Table of Contents Published in October 2016, this 190-page electronically-delivered report comes in two parts: A 190-page PDF giving a global executive summary and forecasts. An excel workbook giving comparison tables and country-by-country forecasts in detail for 400 operators with 585 platforms [125 digital cable, 112 analog cable, 208 satellite, 109 IPTV and 31 DTT] across 100 territories for every year from 2010 to 2021. Forecasts (2010-2021) contain the following detail for each country: By country: TV households Digital cable subs Analog cable subs Pay IPTV subscribers Pay digital satellite TV subs Pay DTT homes Total pay TV subscribers Pay TV revenues By operator (and by platform by operator): Pay TV subscribers Share of pay TV subscribers by operator Subscription & VOD revenues Share of pay TV revenues by operator ARPU Countries and operators covered: Country No of ops Operators Algeria 4 beIN, OSN, ART, Algerie Telecom Angola 5 ZAP TV, DStv, Canal Plus, Angola Telecom, TV Cabo Argentina 3 Cablevision; Supercanal; DirecTV Australia 1 Foxtel Austria 3 Telekom Austria; UPC; Sky Bahrain 4 beIN, OSN, ART, Batelco Belarus 2 MTIS, Zala Belgium 5 Belgacom; Numericable; Telenet; VOO; Telesat/TV Vlaanderen Bolivia 3 DirecTV, Tigo, Entel Bosnia 3 Telemach, M:Tel; Total TV Brazil 5 Claro; GVT; Vivo; Sky; Oi Bulgaria 5 Blizoo, Bulsatcom, Vivacom, M:Tel, Mobitel Canada 9 Rogers Cable; Videotron; Cogeco; Shaw Communications; Shaw Direct; Bell TV; Telus TV; MTS; Max TV Chile 6 VTR; Telefonica; Claro; DirecTV; -

Analysys Mason Report on Developments in Cable for Superfast Broadband

Final report for Ofcom Future capability of cable networks for superfast broadband 23 April 2014 Rod Parker, Alex Slinger, Malcolm Taylor, Matt Yardley Ref: 39065-174-B . Future capability of cable networks for superfast broadband | i Contents 1 Executive summary 1 2 Introduction 5 3 Cable network origins and development 6 3.1 History of cable networks and their move into broadband provision 6 3.2 The development of DOCSIS and EuroDOCSIS 8 4 Cable network elements and architecture 10 4.1 Introduction 10 4.2 Transmission elements 10 4.3 Description of key cable network elements 13 4.4 Cable access network architecture 19 5 HFC network implementation, including DOCSIS 3.0 specification 21 5.1 Introduction 21 5.2 HFC performance considerations 21 5.3 Delivery of broadband services using DOCSIS 3.0 24 5.4 Limitations of DOCSIS 3.0 specification 27 5.5 Implications for current broadband performance under DOCSIS 3.0 30 6 DOCSIS 3.1 specification 33 6.1 Introduction 33 6.2 Reference architecture 34 6.3 PHY layer frequency plan 35 6.4 PHY layer data encoding options 37 6.5 MAC and upper layer protocol interface (MULPI) features of DOCSIS 3.1 39 6.6 Development roadmap 40 6.7 Backwards compatibility 42 6.8 Implications for broadband service bandwidth of introducing DOCSIS 3.1 43 6.9 Flexibility of DOCSIS 3.1 to meet evolving service demands from customers 47 6.10 Beyond DOCSIS 3.1 47 7 Addressing future broadband growth with HFC systems – expanding DOCSIS 3.0 and migration to DOCSIS 3.1 49 7.1 Considerations of future broadband growth 49 7.2 Key levers for increasing HFC data capacity 52 7.3 DOCSIS 3.0 upgrades 53 7.4 DOCSIS 3.1 upgrades 64 7.5 Summary 69 Ref: 39065-174-B . -

Jaarverslag 2008 Telenet – De Kerncijfers

Dynamisch. Simpel. Shakes. Digitaal. JAARVERSLAG 2008 Telenet – de kerncijfers Vaste telefonieklanten Internetklanten x 1.000 x 1.000 187 235 286 364 455 548 629 301 413 528 624 735 883 985 2002 2003 2004 2005 2006 2007 2008 2002 2003 2004 2005 2006 2007 2008 iDTV-klanten Tripleplayklanten x 1.000 x 1.000 75 154 226 309 391 674 80 106 136 176 236 323 539 2003 2004 2005 2006 2007 2008* 2002 2003 2004 2005 2006 2007 2008* * inclusief 65.000 INDI-klanten * inclusief Interkabel-acquisitie Telenet Solutions Division Telenet Solutions Division Klantengroepen Productgroepen Andere Kleinhandel Openbare instellingen 7 % Capaciteit – 6 % Connectiviteit Andere huur van lijnen tussen 16 % 14 % bedrijfslocaties 34 % 37 % 19 % 21 % Internet 22 % 24 % Financiële instellingen Bedrijven Telefonie iDTV-penetratie Investeringen in miljoen euro 2008 71 %* 246 28 %* 23 % 2007 67 %* 209 14 % 2006 66 %* 206 * Percentage van investeringen besteed aan de aansluiting van nieuwe klanten op het netwerk en het 2006 2007 2008 vergemakkelijken van die installatie * Inclusief Interkabel-klanten Inkomsten Inkomsten per categorie, 2008 in miljoen euro Internet Analoge kabeltelevisie 24 % 34 % 11 % Digitale tv 10 % 21 % 307 502 681 738 814 932 1.019 Telenet 2002 2003 2004 2005 2006 2007 2008 Solutions Telefonie Telenet Solutions Division ARPU EBITDA (gemiddelde omzet per gebruiker) in miljoen euro in euro per maand 32,5 % Connectiviteit 29,4 % tussen 26,7 % bedrijfslocaties 83 230 299 337 367 443 506 2006 2007 2008 2002 2003 2004 2005 2006 2007 2008 Welcome to Telenet 28 14 3 Het woord van de CEO en de Voorzitter 7 14 Voorsprong op de markt 12 Een jaar lang innoveren 14 Vernieuwende partnerships voor verrassende producten 28 28 Blijvend competitief door innovatie 30 Investeringen in het netwerk creëren toegevoegde waarde 38 32 De klantenervaring verder verbeterd 38 Mensen op de eerste plaats 44 Bouwen aan een mooiere toekomst voor iedereen 2 Het woord van de CEO en de Voorzitter 3 Geachte lezer, Telenet mag om verschillende redenen met tevredenheid terugblikken op 2008. -

Vodafone Group and Liberty Global Announce Intention to Appoint Two Senior Executives for Their Proposed Netherlands Joint Venture

Vodafone Group and Liberty Global announce intention to appoint two senior executives for their proposed Netherlands joint venture Jeroen Hoencamp to be appointed Chief Executive and Ritchy Drost to be appointed Chief Financial Officer upon completion of transaction Denver, Colorado and London, United Kingdom ‐ 19 July 2016: Vodafone Group Plc (LSE: VOD) and Liberty Global plc (NASDAQ: LBTYA, LBTYB and LBTYK) today announced their intention to appoint Jeroen Hoencamp as Chief Executive and Ritchy Drost as Chief Financial Officer of the two companies’ proposed 50‐50 joint venture business combining Vodafone Netherlands and Ziggo*. The merger is subject to approval by the relevant competition authorities. Jeroen Hoencamp is currently the Chief Executive of Vodafone UK. A Dutch citizen, he has led Vodafone’s UK business since September 2013 and was previously Chief Executive of Vodafone Ireland. Before that, he spent 12 years in a number of senior executive roles (including Sales Director and Enterprise Business Unit Director) with Vodafone Netherlands. Earlier in his career he worked in senior marketing and sales positions with Canon Southern Copy Machines, Inc. in the USA and Thorn EMI/Skala Home Electronics in The Netherlands. He is a former officer in the Royal Dutch Marine Corps. In anticipation of the joint venture closing, Vodafone Group also announced that Jeroen Hoencamp will assume the position of Chief Executive of Vodafone Netherlands, effective 1 September 2016. Ritchy Drost is currently Chief Financial Officer of Ziggo, a position he has held since September 2015. Over a 17‐year career with Liberty Global he has held a number of senior management positions including Chief Financial Officer, European Broadband Operations and Managing Director and Chief Financial Officer of UPC Netherlands, Liberty’s predecessor Dutch cable operation. -

Sci-Fi Sisters with Attitude Television September 2013 1 LOVE TV? SO DO WE!

April 2021 Sky’s Intergalactic: Sci-fi sisters with attitude Television www.rts.org.uk September 2013 1 LOVE TV? SO DO WE! R o y a l T e l e v i s i o n S o c i e t y b u r s a r i e s o f f e r f i n a n c i a l s u p p o r t a n d m e n t o r i n g t o p e o p l e s t u d y i n g : TTEELLEEVVIISSIIOONN PPRROODDUUCCTTIIOONN JJOOUURRNNAALLIISSMM EENNGGIINNEEEERRIINNGG CCOOMMPPUUTTEERR SSCCIIEENNCCEE PPHHYYSSIICCSS MMAATTHHSS F i r s t y e a r a n d s o o n - t o - b e s t u d e n t s s t u d y i n g r e l e v a n t u n d e r g r a d u a t e a n d H N D c o u r s e s a t L e v e l 5 o r 6 a r e e n c o u r a g e d t o a p p l y . F i n d o u t m o r e a t r t s . o r g . u k / b u r s a r i e s # R T S B u r s a r i e s Journal of The Royal Television Society April 2021 l Volume 58/4 From the CEO It’s been all systems winners were “an incredibly diverse” Finally, I am delighted to announce go this past month selection. -

Roaming Available in These Countries

Roaming available in these countries Country Network Frequency Voice SMS Data A Anguilla Cable & Wireless 850 / 1800 / 1900 Y Y N Antigua & Barbuda Cable & Wireless 850 / 1800 / 1900 Y Y N Australia Telstra 900 / 1800 Y Y Y Vodafone Australia 900 / 1800 Y Y Y Azerbaijan Azerfone 900 / 1800 / 2100 Y Y Y B Bahrain STC Bahrain 1800 / 2100 Y Y Y Barbados Cable & Wireless 850 / 1800 / 1900 Y Y N Benin Telecel Benin 900 Y Y Y Bosnia & Herzegovina BH Telecom 900 / 1800 / 2100 Y Y Y B. Virgin Island Cable & Wireless 850 / 1800 / 1900 Y Y N C Cambodia Latelz 900 / 1800 Y Y N Canada Rogers/Fido 850 / 1800 / 2100 Y Y Y Bell Mobility 850 / 1900 Y Y Y China China Mobile 900 / 1800 Y Y Y Cayman Island Cable & Wireless 850 / 1800 / 1900 Y Y N CNMI Docomo Pacific 1900 Y Y Y (Saipan, Tinian & Rota) PTI Pacifica 850 Y Y Y Version dated June 2019 Roaming available in these countries Country Network Frequency Voice SMS Data Cruise Ship Wireless Maritime Service / 1900 Y Y Y AT&T Czech Republic Vodafone Czech Republic 900 / 1800 3G Y Y Y D Denmark TDC 900 / 1800 / 2100 Y Y Y Dominica Cable & Wireless 850 / 1800 / 1900 Y Y N F FSM FSM Telecom 900 Y Y N Fiji Digicel | Orange 900 Y Y N Finland Elisa Corp 900 / 1800 / 2100 Y Y Y France Orange 1800 Y Y Y French Polynesia Pacific Mobile 900 / 2100 Y Y Y G Germany Telekom D 900 / 1800 / 2100 Y Y Y Vodafone 900 / 1800 / 2100 Y Y Y Ghana Vodafone 900 Y Y Y Greece Vodafone - Panafon 900 / 1800 Y Y Y Grenada Cable & Wireless 850 / 1800 / 1900 Y Y N Guatemala Comcel 850 Y Y Y H Hong Kong Hutchison 900 / 1800 Y Y Y Version -

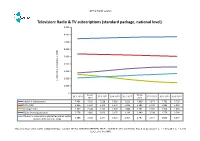

Television: Radio & TV Subscriptions (Standard Package, National Level) 9.000

OPTA Public version Television: Radio & TV subscriptions (standard package, national level) 9.000 8.000 7.000 6.000 5.000 4.000 3.000 2.000 number of subscriptionsof number x 1,000 1.000 0 31-12- 31-12- 30-9-2010 31-3-2011 30-6-2011 30-9-2011 31-3-2012 30-6-2012 30-9-2012 2010 2011 Total RTV subscriptions 7.454 7.500 7.538 7.590 7.623 7.669 7.677 7.702 7.730 Total cable 5.366 5.334 5.291 5.271 5.226 5.182 5.129 5.083 5.033 Analogue cable 2.587 2.448 2.265 2.095 1.888 1.741 1.592 1.504 1.434 Digital (+ analogue) cable 2.778 2.886 3.026 3.176 3.338 3.440 3.538 3.579 3.599 Other RTV subscriptions (digital terrestrial, digital 2.088 2.166 2.247 2.319 2.397 2.487 2.547 2.620 2.697 satellite, IPTV over DSL, FttH) Based on figures from CAIW, CANALDIGITAAL, COGAS, DELTA, KPN, REGGEFIBER, TELE2, T-MOBILE, UPC and ZIGGO. Based on questions 5_A_1_1 through 5_A_1_5 and 5_A_1_8 of the SMM. OPTA Public version Television: Churn based on radio & TV subscriptions (standard package, national level) 5% 4% 3% 2% % of number%of subscriptions 1% 0% 30-9-2010 31-12-2010 31-3-2011 30-6-2011 30-9-2011 31-12-2011 31-3-2012 30-6-2012 30-9-2012 Adds 3,1% 3,2% 3,1% 3,0% 3,3% 3,9% 3,8% 3,3% 3,2% Disconnects 2,7% 2,5% 2,8% 2,7% 2,9% 3,3% 3,4% 3,1% 3,0% Based on figures from CAIW, CANALDIGITAAL, COGAS, DELTA, KPN, REGGEFIBER, TELE2, UPC and ZIGGO.