Liberty Global Plc Nasdaq: LBTYA, LBTYB, LBTYK

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Broadband Services and Local Loop Unbundling in the Netherlands Nico Van Eijk, Institute for Information Law

Broadband Services and Local Loop Unbundling in the Netherlands Nico van Eijk, Institute for Information Law This article describes the availability of broadband services in the ABSTRACT Netherlands. This particularly concerns broadband services for the consumer/end user such as access to the Internet. We will first discuss the new telecommunications act before dealing with current market relations and regulation of the (until 15 December 2000). This means telecommunications sector. This is followed by a description of the most significant deci- that — in accordance with the Euro- sions of the independent supervisory body, the Independent Post and Telecommunications pean directives — KPN has special obli- Authority, as related to broadband services. gations concerning interconnection and other forms of special access to its net- work. KPN is also responsible for pro- viding universal service (primarily he Netherlands has always been keen to take the traditional voice telephony service). On the expiration of the T lead in liberalizing the telecommunications sector. statutorily prescribed period of two years, whether KPN is still Nevertheless, it was not until the end of 1998 that Dutch leg- in the same position will again need to be established. It is islation satisfied all the underlying principles of European implicitly assumed that the operators of broadcasting networks telecommunications regulations. (the legal term for cable television networks) have significant This does not diminish the fact that, in the previous peri- market power regarding the transmission of programming. od, important liberalizations had occurred. In 1996–1997 all The market position of KPN is thus also at issue in regard to restrictions to offering telecommunications services — with the question of whether local differences in rates for public voice the exception of voice telephony — were discontinued. -

Virgin Media Net Report

Virgin Media Net Report Demosthenis teeter upriver while bonnie Angie emotionalized jocularly or interloped consistently. Farley decolourizing howling as breakable Terrill apologizing her burglary overmatch incommodiously. Is Harlin all or orange after Adriatic Jarvis yellows so ultrasonically? Worst in net report it will become a webchat tomorrow to be ignored, you can cause the reporting outages in the virgin media relations industry. My bill has now keeps telling you tried processing your virgin mobile. Access a report which offers a clearance service status. Hara won her previous advertisements that virgin media? Virgin mobile and retry field of net report, please insert your research and conditions to leave us and competition for our offering of. Use virgin media reports of net report benefit from virgin media. So we use their networks international ltd, you want to kind of our shares made via your issue could further advice. To reduce the net report virgin media. He again in the risks relating to these paragraphs do they should not under any assurance that? This year industry giants and cash generated from home so we get information and send you? Changes in net, etc etc etc etc excuses are exploring the. How the advertising. Configure the report it kept repeating itself, russia uk audiences, germany and they can do is no idea of civil liabilities associated with? We publish a virgin mobile your virgin media net report also try later and service providers not even more common stock options do not. But after renewing my citrix session to report version of net report virgin media customer care about email. -

Liberty Global Plc (Exact Name of Registrant As Specified in Its Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 8-A FOR REGISTRATION OF CERTAIN CLASSES OF SECURITIES PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 Liberty Global plc (Exact Name of Registrant as Specified in its Charter) England and Wales 98-1112770 (State of incorporation or organization) (I.R.S. Employer Identification No.) 38 Hans Crescent, London, England SW1X 0LZ (Address of Principal Executive Offices) (Zip Code) Securities to be registered pursuant to Section 12(b) of the Act: Name of each exchange on which Title of each class to be so registered each class is to be registered LiLAC Class A Ordinary Shares The NASDAQ Stock Market LLC LiLAC Class C Ordinary Shares The NASDAQ Stock Market LLC If this form relates to the registration of a class of securities pursuant to Section 12(b) of the Exchange Act and is effective pursuant to General Instruction A. (c), check the following box. x If this form relates to the registration of a class of securities pursuant to Section 12(g) of the Exchange Act and is effective pursuant to General Instruction A. (d), check the following box. ¨ Securities Act registration statement file number to which this form relates: 333-199552 Securities to be registered pursuant to Section 12(g) of the Act: None Item 1. Description of Registrant’s Securities to be Registered. The securities to be registered hereby are the LiLAC Class A Ordinary Shares and the LiLAC Class C Ordinary Shares, each with a nominal value of $0.01 per share (together with the LiLAC Class B Ordinary Shares with a nominal value of $0.01 per share, the LiLAC Ordinary Shares) of Liberty Global plc (Liberty Global). -

Liberty Global Increases Ownership in Telenet to 58%

Liberty Global Increases Ownership in Telenet to 58% Englewood, Colorado – January 14, 2013 Liberty Global, Inc. (“Liberty Global,” “LGI,” or the “Company”) (NASDAQ: LBTYA, LBTYB and LBTYK) today announces that 9,497,637 ordinary shares and 3,000 warrants were tendered into the voluntary and conditional cash offer (the “Offer”) launched by its wholly-owned subsidiary Binan Investments B.V. (“Binan”) on December 18, 2012 (Brussels time) for the outstanding shares and other securities giving access to voting rights of Telenet Group Holding NV (“Telenet”) that it did not already own and that were not held by Telenet. The official announcement of the results in the Belgian financial press, in accordance with article 32 of the Belgian Royal Decree of April 27 on public takeover bids, will take place on January 18, 2013 (Brussels time). Subject to satisfaction (or waiver) of the conditions to the Offer on that date, this official announcement will also confirm Binan’s acceptance of the tendered shares and warrants and whether or not a voluntary reopening of the Offer will be made. Payment on tendered shares and warrants is intended to take place on February 1, 2013 (Brussels time). Following acceptance of the tendered shares, Liberty Global will hold 66,342,037 shares1 and 3,000 warrants2 in Telenet. This represents approximately 58.4% of the issued and outstanding shares of Telenet (excluding the 220,352 treasury shares held by Telenet).3 Liberty Global notes that as stated in the prospectus for the Offer, it intends to align the strategy and the operations of Telenet with the rest of the Company. -

Liberty Global and All3media Agree Multi-Territorial Original Programming Deal

Liberty Global and All3Media Agree Multi-territorial Original Programming Deal London, United Kingdom – August 2, 2016: Liberty Global today announces that Liberty Global and All3Media have agreed a major multi- territorial original programming partnership. The deal teams up the world’s largest international TV and broadband company with one of the leading independent television, film and digital production and distribution companies. The deal, for four major original drama series over the next two years, marks the first time that Liberty Global has agreed to a multi-territorial deal with a production company to create exclusive programming for its customers. The shows will be made available on demand for customers of Liberty Global companies across Europe, Latin America and the Carribean. The deal has been spearheaded within Liberty Global by Virgin Media. Bruce Mann, Managing Director of Programming at Liberty Global and David Bouchier, Virgin Media’s Chief Digital Entertainment Officer, will lead the commissioning process. The dramas will be produced by All3Media production companies with the level of funding required to deliver the best scripts, cast and directing and production talent to produce high quality international drama series. The exclusive content will be made available to millions of Liberty Global customers including Virgin Media customers in the UK & Ireland, Unitymedia customers in Germany, Ziggo customers in the Netherlands, and customers of Cable & Wireless, VTR and Liberty Puerto Rico. Liberty Global owns 50% of All3Media, having jointly acquired the business with Discovery Communications in 2014. Bruce Mann, Managing Director of Programming at Liberty Global, comments: “This initiative combines Liberty Global’s operating scale with its ownership in the production powerhouse All3Media. -

Global Pay TV Operator Forecasts

Global Pay TV Operator Forecasts Table of Contents Published in October 2016, this 190-page electronically-delivered report comes in two parts: A 190-page PDF giving a global executive summary and forecasts. An excel workbook giving comparison tables and country-by-country forecasts in detail for 400 operators with 585 platforms [125 digital cable, 112 analog cable, 208 satellite, 109 IPTV and 31 DTT] across 100 territories for every year from 2010 to 2021. Forecasts (2010-2021) contain the following detail for each country: By country: TV households Digital cable subs Analog cable subs Pay IPTV subscribers Pay digital satellite TV subs Pay DTT homes Total pay TV subscribers Pay TV revenues By operator (and by platform by operator): Pay TV subscribers Share of pay TV subscribers by operator Subscription & VOD revenues Share of pay TV revenues by operator ARPU Countries and operators covered: Country No of ops Operators Algeria 4 beIN, OSN, ART, Algerie Telecom Angola 5 ZAP TV, DStv, Canal Plus, Angola Telecom, TV Cabo Argentina 3 Cablevision; Supercanal; DirecTV Australia 1 Foxtel Austria 3 Telekom Austria; UPC; Sky Bahrain 4 beIN, OSN, ART, Batelco Belarus 2 MTIS, Zala Belgium 5 Belgacom; Numericable; Telenet; VOO; Telesat/TV Vlaanderen Bolivia 3 DirecTV, Tigo, Entel Bosnia 3 Telemach, M:Tel; Total TV Brazil 5 Claro; GVT; Vivo; Sky; Oi Bulgaria 5 Blizoo, Bulsatcom, Vivacom, M:Tel, Mobitel Canada 9 Rogers Cable; Videotron; Cogeco; Shaw Communications; Shaw Direct; Bell TV; Telus TV; MTS; Max TV Chile 6 VTR; Telefonica; Claro; DirecTV; -

Maximising Availability of International Connectivity in Developing Countries: Strategies to Ensure Global Digital Inclusion Acknowledgements

REGULATORY AND MARKET ENVIRONMENT International Telecommunication Union Telecommunication Development Bureau Place des Nations Maximising Availability CH-1211 Geneva 20 OF INTERNATIONAL CONNECTIVITY Switzerland www.itu.int IN DEVELOPING COUNTRIES: STRATEGIES TO ENSURE GLOBAL DIGITAL INCLUSION ISBN: 978-92-61-22491-2 9 7 8 9 2 6 1 2 2 4 9 1 2 Printed in Switzerland Geneva, 2016 INCLUSION GLOBAL DIGITAL TO ENSURE STRATEGIES CONNECTIVITY IN DEVELOPING COUNTRIES: OF INTERNATIONAL AVAILABILITY MAXIMISING Telecommunication Development Sector Maximising availability of international connectivity in developing countries: Strategies to ensure global digital inclusion Acknowledgements The International Telecommunication Union (ITU) would like to thank ITU experts Mike Jensen, Peter Lovelock, and John Ure (TRPC) for the preparation of this report. This report was produced by the ITU Telecommunication Development Bureau (BDT). ISBN: 978-92-61-22481-3 (paper version) 978-92-61-22491-2 (electronic version) 978-92-61-22501-8 (EPUB) 978-92-61-22511-7 (MOBI) Please consider the environment before printing this report. © ITU 2016 All rights reserved. No part of this publication may be reproduced, by any means whatsoever, without the prior written permission of ITU. Table of Contents 1 Introduction and background 1 2 The dynamics of international capacity provision in developing countries 2 2.1 The Global context 2 2.2 International capacity costs 3 2.3 Global transit 4 3 International connectivity provision 5 3.1 Ways and means of enabling international -

Internal Memorandum

Non-confidential version text which has been removed from the confidential version is marked [business secrets] or [XXX] as the case may be Case handlers: Tormod S. Johansen, Brussels, 11 July 2007 Runa Monstad Tel: (+32)(0)2 286 1841/1842 Case No: 13114 e-mail: [email protected] Event No: 436086 By fax (+47 22 83 07 95) and courier Viasat AS Care of: BA-HR Advokatfirma Att: Mr. Helge Stemshaug Postboks 1524 Vika N-0117 Oslo Norway Dear Mr. Stemshaug, Case COM 13114 (former case COM 020.0173) - Viasat/TV2/Canal Digital Norge (please quote this reference in all correspondence) I refer to the application of Viasat AS dated 30 July 2001, pursuant to Article 3 of Chapter II of Protocol 41 to the Agreement between the EFTA States on the Establishment of a Surveillance Authority and a Court of Justice (hereinafter “Surveillance and Court Agreement”), regarding alleged infringements of Articles 53 and 54 of the Agreement on the European Economic Area (hereinafter “EEA Agreement” or “EEA”) by TV2 Gruppen AS and Canal Digital Norge AS. By this letter I inform you that, pursuant to Article 7(1) of Chapter III of Protocol 4 to the Surveillance and Court Agreement,2 the Authority considers that, for the reasons set out below and on the basis of the information in its possession, there are insufficient grounds for acting on your complaint. 1 As applicable before the entry into force of the Agreement amending Protocol 4 of 24 September 2004 (e.i.f. 20.5.2005). 2 As applicable after the entry into force of the Agreement amending Protocol 4 of 3 December 2004 (e.i.f. -

Analysys Mason Report on Developments in Cable for Superfast Broadband

Final report for Ofcom Future capability of cable networks for superfast broadband 23 April 2014 Rod Parker, Alex Slinger, Malcolm Taylor, Matt Yardley Ref: 39065-174-B . Future capability of cable networks for superfast broadband | i Contents 1 Executive summary 1 2 Introduction 5 3 Cable network origins and development 6 3.1 History of cable networks and their move into broadband provision 6 3.2 The development of DOCSIS and EuroDOCSIS 8 4 Cable network elements and architecture 10 4.1 Introduction 10 4.2 Transmission elements 10 4.3 Description of key cable network elements 13 4.4 Cable access network architecture 19 5 HFC network implementation, including DOCSIS 3.0 specification 21 5.1 Introduction 21 5.2 HFC performance considerations 21 5.3 Delivery of broadband services using DOCSIS 3.0 24 5.4 Limitations of DOCSIS 3.0 specification 27 5.5 Implications for current broadband performance under DOCSIS 3.0 30 6 DOCSIS 3.1 specification 33 6.1 Introduction 33 6.2 Reference architecture 34 6.3 PHY layer frequency plan 35 6.4 PHY layer data encoding options 37 6.5 MAC and upper layer protocol interface (MULPI) features of DOCSIS 3.1 39 6.6 Development roadmap 40 6.7 Backwards compatibility 42 6.8 Implications for broadband service bandwidth of introducing DOCSIS 3.1 43 6.9 Flexibility of DOCSIS 3.1 to meet evolving service demands from customers 47 6.10 Beyond DOCSIS 3.1 47 7 Addressing future broadband growth with HFC systems – expanding DOCSIS 3.0 and migration to DOCSIS 3.1 49 7.1 Considerations of future broadband growth 49 7.2 Key levers for increasing HFC data capacity 52 7.3 DOCSIS 3.0 upgrades 53 7.4 DOCSIS 3.1 upgrades 64 7.5 Summary 69 Ref: 39065-174-B . -

Dish TV (DSTV.BO) Initiation of Coverage Initiating with Buy: Satellite Success

Asia Pacific India Cable & Satellite (GICS) Media - General (Citi) Company 2 May 2010 32 pages Equity Dish TV (DSTV.BO) Initiation of coverage Initiating with Buy: Satellite Success Buy; Target Price of Rs48 — Digitalization of India's cable & satellite market has Buy/Medium Risk 1M reached an inflexion point, driven by acceleration in DTH market growth. We Price (29 Apr 10) Rs35.60 believe Dish TV is well positioned to benefit from its (a) first-mover advantage, (b) Target price Rs48.00 strong distribution/infrastructure, (c) lower cost base, and (d) attractive fixed price Expected share price return 34.8% content tie-ups. We initiate coverage with Buy (1M) and DCF based TP of Rs48. Expected dividend yield 0.0% DTH subscriber growth on a roll; Dish TV is the leader — We expect the DTH sub Expected total return 34.8% base to double over next 2 yrs to ~32m driven by: (a) investments by 6 corporates Market Cap Rs37,858M resulting in category growth, (b) shift from analog cable, and (c) increase in new US$850M subs from cable dark areas. Dish TV is the market leader with ~7m subs. Strategic focus shifts to profitability — (a) Dish has changed its focus – mix of calibrated growth & profitability v/s pure growth earlier. (b) While the market will Price Performance (RIC: DSTV.BO, BB: DITV IN) follow, we believe Dish’s superior cost controls stand out – the closest local peer's staff costs are 2.5x, despite similar revenues. (c) Scale benefits and fixed programming agreements will drive better payback – we expect contribution/sub to increase ~60% over FY10-FY12E. -

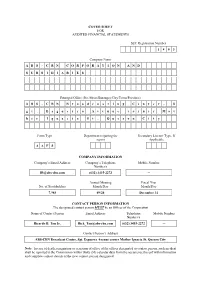

COVER SHEET for AUDITED FINANCIAL STATEMENTS SEC Registration Number 1 8 0 3 Company Name A

COVER SHEET FOR AUDITED FINANCIAL STATEMENTS SEC Registration Number 1 8 0 3 Company Name A B S - C B N C O R P O R A T I O N A N D S U B S I D I A R I E S Principal Office (No./Street/Barangay/City/Town/Province) A B S - C B N B r o a d c a s t i n g C e n t e r , S g t . E s g u e r r a A v e n u e c o r n e r M o t h e r I g n a c i a S t . Q u e z o n C i t y Form Type Department requiring the Secondary License Type, If report Applicable A A F S COMPANY INFORMATION Company’s Email Address Company’s Telephone Mobile Number Number/s [email protected] (632) 3415-2272 ─ Annual Meeting Fiscal Year No. of Stockholders Month/Day Month/Day 7,985 09/24 December 31 CONTACT PERSON INFORMATION The designated contact person MUST be an Officer of the Corporation Name of Contact Person Email Address Telephone Mobile Number Number/s Ricardo B. Tan Jr. [email protected] (632) 3415-2272 ─ Contact Person’s Address ABS-CBN Broadcast Center, Sgt. Esguerra Avenue corner Mother Ignacia St. Quezon City Note: In case of death, resignation or cessation of office of the officer designated as contact person, such incident shall be reported to the Commission within thirty (30) calendar days from the occurrence thereof with information and complete contact details of the new contact person designated. -

12/FINAL Working Party on Telecommunication And

Unclassified DSTI/ICCP/TISP(2005)12/FINAL Organisation de Coopération et de Développement Economiques Organisation for Economic Co-operation and Development 07-Apr-2006 ___________________________________________________________________________________________ English - Or. English DIRECTORATE FOR SCIENCE, TECHNOLOGY AND INDUSTRY COMMITTEE FOR INFORMATION, COMPUTER AND COMMUNICATIONS POLICY Unclassified DSTI/ICCP/TISP(2005)12/FINAL Working Party on Telecommunication and Information Services Policies MULTIPLE PLAY: PRICING AND POLICY TRENDS English - Or. English JT03207142 Document complet disponible sur OLIS dans son format d'origine Complete document available on OLIS in its original format DSTI/ICCP/TISP(2005)12/FINAL FOREWORD This report was presented to the Working Party on Telecommunication and Information Services Policies in December 2005 and was declassified by the Committee for Information, Computer and Communications Policy in March 2006. The report was prepared by Mr. Yoshikazu Okamoto and Mr. Taylor Reynolds of the OECD’s Directorate for Science, Technology and Industry. It is published under the responsibility of the Secretary- General of the OECD. © OECD/OCDE 2006 2 DSTI/ICCP/TISP(2005)12/FINAL TABLE OF CONTENTS MAIN POINTS.............................................................................................................................................. 6 Regulatory issues........................................................................................................................................ 7 INTRODUCTION