Dish TV (DSTV.BO) Initiation of Coverage Initiating with Buy: Satellite Success

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

A Channel Guide

Intelsat is the First MEDIA Choice In Africa Are you ready to provide top media services and deliver optimal video experience to your growing audiences? With 552 channels, including 50 in HD and approximately 192 free to air (FTA) channels, Intelsat 20 (IS-20), Africa’s leading direct-to- home (DTH) video neighborhood, can empower you to: Connect with Expand Stay agile with nearly 40 million your digital ever-evolving households broadcasting reach technologies From sub-Saharan Africa to Western Europe, millions of households have been enjoying the superior video distribution from the IS-20 Ku-band video neighborhood situated at 68.5°E orbital location. Intelsat 20 is the enabler for your TV future. Get on board today. IS-20 Channel Guide 2 CHANNEL ENC FR P CHANNEL ENC FR P 947 Irdeto 11170 H Bonang TV FTA 12562 H 1 Magic South Africa Irdeto 11514 H Boomerang EMEA Irdeto 11634 V 1 Magic South Africa Irdeto 11674 H Botswana TV FTA 12634 V 1485 Radio Today Irdeto 11474 H Botswana TV FTA 12657 V 1KZN TV FTA 11474 V Botswana TV Irdeto 11474 H 1KZN TV Irdeto 11594 H Bride TV FTA 12682 H Nagravi- Brother Fire TV FTA 12562 H 1KZN TV sion 11514 V Brother Fire TV FTA 12602 V 5 FM FTA 11514 V Builders Radio FTA 11514 V 5 FM Irdeto 11594 H BusinessDay TV Irdeto 11634 V ABN FTA 12562 H BVN Europa Irdeto 11010 H Access TV FTA 12634 V Canal CVV International FTA 12682 H Ackermans Stores FTA 11514 V Cape Town TV Irdeto 11634 V ACNN FTA 12562 H CapeTalk Irdeto 11474 H Africa Magic Epic Irdeto 11474 H Capricorn FM Irdeto 11170 H Africa Magic Family Irdeto -

Global Pay TV Fragments

Global pay TV fragments The top 503 pay TV operators will reach 853 million subscribers from the 1.02 billion global total by 2026. The top 50 operators accounted for 64% of the world’s pay TV subscribers by end-2020, with this proportion dropping to 62% by 2026. Pay TV subscribers by operator ranking (million) 1200 1000 143 165 38 45 800 74 80 102 102 600 224 215 400 200 423 412 0 2020 2026 Top 10 11-50 51-100 101-200 201+ Excluded from report The top 50 will lose 20 million subscribers over the next five years. However, operators beyond the top 100 will gain subscribers over the same period. Simon Murray, Principal Analyst at Digital TV Research, said: “Most industries consolidate as they mature. The pay TV sector is doing the opposite – fragmenting. Most of the subscriber growth will take place in developing countries where operators are not controlled by larger corporations.” By end-2020, 13 operators had more than 10 million pay TV subscribers. China and India will continue to dominate the top pay TV operator rankings, partly as their subscriber bases climb but also due to the US operators losing subscribers. Between 2020 and 2026, 307 of the 503 operators (61%) will gain subscribers, with 13 showing no change and 183 losing subscribers (36%). In 2020, 28 pay TV operators earned more than $1 billion in revenues, but this will drop to 24 operators by 2026. The Global Pay TV Operator Forecasts report covers 503 operators with 726 platforms [132 digital cable, 116 analog cable, 279 satellite, 142 IPTV and 57 DTT] across 135 countries. -

Maximising Availability of International Connectivity in Developing Countries: Strategies to Ensure Global Digital Inclusion Acknowledgements

REGULATORY AND MARKET ENVIRONMENT International Telecommunication Union Telecommunication Development Bureau Place des Nations Maximising Availability CH-1211 Geneva 20 OF INTERNATIONAL CONNECTIVITY Switzerland www.itu.int IN DEVELOPING COUNTRIES: STRATEGIES TO ENSURE GLOBAL DIGITAL INCLUSION ISBN: 978-92-61-22491-2 9 7 8 9 2 6 1 2 2 4 9 1 2 Printed in Switzerland Geneva, 2016 INCLUSION GLOBAL DIGITAL TO ENSURE STRATEGIES CONNECTIVITY IN DEVELOPING COUNTRIES: OF INTERNATIONAL AVAILABILITY MAXIMISING Telecommunication Development Sector Maximising availability of international connectivity in developing countries: Strategies to ensure global digital inclusion Acknowledgements The International Telecommunication Union (ITU) would like to thank ITU experts Mike Jensen, Peter Lovelock, and John Ure (TRPC) for the preparation of this report. This report was produced by the ITU Telecommunication Development Bureau (BDT). ISBN: 978-92-61-22481-3 (paper version) 978-92-61-22491-2 (electronic version) 978-92-61-22501-8 (EPUB) 978-92-61-22511-7 (MOBI) Please consider the environment before printing this report. © ITU 2016 All rights reserved. No part of this publication may be reproduced, by any means whatsoever, without the prior written permission of ITU. Table of Contents 1 Introduction and background 1 2 The dynamics of international capacity provision in developing countries 2 2.1 The Global context 2 2.2 International capacity costs 3 2.3 Global transit 4 3 International connectivity provision 5 3.1 Ways and means of enabling international -

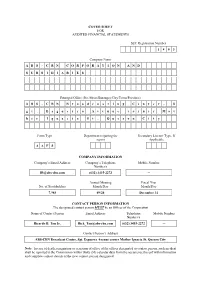

COVER SHEET for AUDITED FINANCIAL STATEMENTS SEC Registration Number 1 8 0 3 Company Name A

COVER SHEET FOR AUDITED FINANCIAL STATEMENTS SEC Registration Number 1 8 0 3 Company Name A B S - C B N C O R P O R A T I O N A N D S U B S I D I A R I E S Principal Office (No./Street/Barangay/City/Town/Province) A B S - C B N B r o a d c a s t i n g C e n t e r , S g t . E s g u e r r a A v e n u e c o r n e r M o t h e r I g n a c i a S t . Q u e z o n C i t y Form Type Department requiring the Secondary License Type, If report Applicable A A F S COMPANY INFORMATION Company’s Email Address Company’s Telephone Mobile Number Number/s [email protected] (632) 3415-2272 ─ Annual Meeting Fiscal Year No. of Stockholders Month/Day Month/Day 7,985 09/24 December 31 CONTACT PERSON INFORMATION The designated contact person MUST be an Officer of the Corporation Name of Contact Person Email Address Telephone Mobile Number Number/s Ricardo B. Tan Jr. [email protected] (632) 3415-2272 ─ Contact Person’s Address ABS-CBN Broadcast Center, Sgt. Esguerra Avenue corner Mother Ignacia St. Quezon City Note: In case of death, resignation or cessation of office of the officer designated as contact person, such incident shall be reported to the Commission within thirty (30) calendar days from the occurrence thereof with information and complete contact details of the new contact person designated. -

Emerging Competition Dynamics in Regional Pay-Tv Markets

Emerging competition dynamics in regional pay-tv markets Tatenda Zengeni and Genna Robb he recent public outcry in Zimbabwe, Zambia and Ni- rights to broadcast Germany’s Bundesliga football games geria over a decision by Multichoice to increase its across the continent starting in August this year.9 T subscription fees points again to the competition is- sues that characterise the pay-tv market in the continent. Due Similarly, US internet-based content provider Netflix has an- to high prices, subscribers in Zimbabwe have resorted to nounced its entry into South Africa and is expected to start 10 buying decoders and paying their subscription in South Afri- broadcasting in 2016. The entry of Netflix is likely to chal- ca, which is relatively cheaper.1 In Zambia, Multichoice lenge Multichoice which currently holds exclusive rights to (DSTV) subscribers launched a campaign on social media broadcast some top American TV shows which are also calling on subscribers to boycott the new prices.2 The federal screened by Netflix. Although Netflix is entering the market High Court in Lagos Nigeria ordered Multichoice not to effect using an internet-based model, its proven ability to provide the increase in its subscription fees in April 2015 following some of the top content means that consumers are present- two cases submitted against it by subscribers.3 Multichoice is ed with an alternative which is potentially more tailored to the by far the largest provider of pay-tv in the continent. specific needs of customers who prefer to only watch certain programmes and not a bouquet of channels. -

APPROVED by the Annual General Shareholders' Meeting of OJSC

APPROVED by the Annual General Shareholders’ Meeting of OJSC Rostelecom June 14, 2012 Minutes #1 dated June 18, 2012 ANNUAL REPORT FOR THE LONG-DISTANCE AND INTERNATIONAL TELECOMMUNICATIONS OPEN JOINT STOCK COMPANY ROSTELECOM BASED ON YEAR 2011 RESULTS President of OJSC Rostelecom s/s A. Yu. Provorotov Chief Accountant of OJSC Rostelecom s/s R.A. Frolov April 27, 2012 Moscow, 2012 ANNUAL REPORT CONTENTS OJSC ROSTELECOM AT A GLANCE ............................................................................................................. 4 THE CHAIRMAN’S STATEMENT ..................................................................................................................... 5 THE PRESIDENT’S MESSAGE ........................................................................................................................ 6 CALENDAR OF 2011 EVENTS ......................................................................................................................... 8 THE COMPANY’S POSITION IN THE INDUSTRY ......................................................................................... 10 THE COMPANY AND THE BOARD OF DIRECTORS’ REVIEW OF THE YEAR 2011 ................................ 15 GUARANTEE OF HIGH QUALITY COMMUNICATION SERVICES ........................................................... 16 DEVELOPING RETAIL RELATIONSHIPS .................................................................................................. 17 RUSSIAN OPERATORS MARKET ............................................................................................................. -

Annual Report 2016 About This Report

Annual Report 2016 About this Report This Annual Report was pre-approved by Rostelecom’s Board of Directors on 15 May 2017, Minutes No. 19 dated 15 May 2017. This Report has been prepared by PJSC Rostelecom (“Rostelecom” or the “Company”) and its subsidiaries (jointly, the “Group”), in line with Note 9 Subsidiaries to the Company’s consolidated financial statements prepared under the International Financial Reporting Standards (“IFRS”) for the year ended 31 December 2016. DISCLAIMER This Report contains certain “forward- » plans to improve the Company’s corporate » risks associated with changes in looking statements regarding future events”, governance practices; the political, economic and social as defined by the US federal securities laws, » the Company’s future position in environment in Russia and macroeconomic which are, therefore, regulated by these the telecommunications market and changes; laws, which provide for no liability for any act the outlook for the market segments in » risks associated with Russian laws, done or omitted in good faith. Such forward- which the Company operates; legislative reforms and taxation, including looking statements regarding future events » economic outlook and industry trends; laws, regulations, decrees and resolutions include (but are not limited to) the following: » potential regulatory changes and governing the Russian telecommunications assessments of the impact any laws or industry, activities related to placement » estimates of future operational and financial regulations may have on the -

GSM Technology, the Internet and Communication for Development: an Evaluation of the Interactivity of Broadcast Programmes on Nigerian Television Stations"

International Journal of Education and Research Vol. 1 No. 10 October 2013 GSM technology, The Internet and Communication for Development: An evaluation of the interactivity of broadcast Programmes on Nigerian Television stations" Rashidat Hassan Olawale Ganiyu Hassan Media and Film Department Lagos State Radio Services Faculty of Art Radio Lagos Eko FM University of Winchester Lagos State Nigeria Tel: +447572959970 Tel: +2347956729941 Email:[email protected] Email: [email protected] Abstract The Democratic-Participant theory and the Development media theory were attempts at addressing the obvious limitations of the original four theories of the press, as regards the developing nations. One common denominator in the principles of these theories as given by McQuail is the need for people at all levels to participate in the process of bringing about development through the use of effective communication. In Nigeria, the advent of the GSM technology and the internet has opened a lot of channel for interactivity in broadcast content. This chapter will focus on how these new media have turn around the packaging of broadcast content, with particularly focus to interactivity in television programming. Keywords Television, Communication for Development, Mobile phone, Internet and Interactivity 1. GSM AND THE INTERNET IN NIGERIA :Historical perspective 1.1 GLOBAL SYSTEM FOR MOBILE COMMUNICATIONS (GSM) August 7, 2013 marks exactly twelve years since Nigeria joined the rest of the world in acquiring the GSM, before then, access to telephone was the exclusive preserve of the rich and privileged few in the society.Adegbite (2013) Prior this historic breakthrough, the total available telephone lines in the country before GSM were below 500,000 which are grossly inadequate for the over 130 million population of the country. -

Remote Control Preset Codes (AVR-X4700H) AVR

AVR CBL/SAT group TV group VCR/PVR group BD/DVD group Audio group Remote Control Preset Codes (AVR-X4700H) AVR D Denon 73347 CBL/SAT group CBL P Pace 01376, 01877, 01060, 01068 CBL/PVR Combination A AT&T 00858 Philips 02174 B Bright House 01376, 01877 B Bright House 01376, 01877 Pioneer 01877 C Cable One 01376, 01877 Cable & Premiere 02174 Cablevision 01376, 01877 C Wireless 01068 R RCN 01376 Charter 01376, 01877 Cable One 01376, 01877 Rogers 01877 Cisco 01877 Cablevision 01376, 01877 S Samsung 01877, 01060, 02015, 02174 Comcast 01376, 01877 Charter 01376, 01877 Scientific 01877, 00858 Cox 01376, 01877 Cisco 01877, 00858, 02378 Atlanta Freebox 01976 Com Hem 02015 Shaw 01376 F Insight 01376, 01877 Comcast 01376, 01877 Stofa 02015 I Knology 01877 Cox 01376, 01877 Suddenlink 01376, 01877 K Mediacom 01376, 01877 D Daeryung 01877 T Telewest 01068 M Motorola 01376 F Freebox 01976 Thomson 02174 Pace 01877 I Insight 01376, 01877 Time Warner 01376, 01877 P Pioneer 01877 K KabelBW 02174 V Verizon 02378 Rogers 01877 Knology 01877 Videotron 01877 R Samsung 01877 M Mediacom 01376, 01877 Virgin Media 01060, 01068 S VTR 01376 Scientific Motorola 01376, 00858, 02378 Atlanta 01877 N NTL 01060, 01068 W WideOpenWest 01877 Shaw 01376 O Ono 01068 Z Ziggo 02015 Suddenlink 01376, 01877 Optus 01060 T Time Warner 01376, 01877 1 AVR CBL/SAT group TV group VCR/PVR group BD/DVD group Audio group V Videotron 01877 B Bell ExpressVu 00775 G Galaxis 00879 VTR 01376 Black Diamond 01284 General Satellite 01176 W WideOpenWest 01877 Boshmann 01631 GOI 00775 British Sky -

Download Spotlight

SPOTLIGHT Telco Mergers and Acquisitions Strategic Backgrounds, Use Cases and Future Developments This publication or parts there of may only be reproduced or copied with the prior written permission of Detecon International GmbH. Published by Detecon International GmbH. www.detecon.com Strategic Backgrounds, Use Cases and Future Developments I Detecon SPOTLIGHT Content What is it all about? 2 Telco M&A Trends 4 Summary 14 The Authors 15 The Company 16 Footnotes 17 05/2019 1 Detecon SPOTLIGHT I Telco Mergers and Acquisitions What is it all about? For years, we at Detecon have been actively supporting our clients in acquiring and integrating other organizations within the telecommunications industry. Thereby, our consultants have been observing worldwide transaction trends and mergers & acquisitions activities (M&A) in the global telecommunication markets. This “Telco Mergers and Acquisitions Spotlight” will highlight these observations from the past year and provide strategic insights into the most recent market developments, present selected use cases and explain the underlying rationale of those mergers. Finally, it will provide an outlook for possible M&A activities in 2019 and beyond. Mergers and acquisitions can be a valuable lever in building new digital business models or facilitating digital transformation. Furthermore, they are commonly used to generate growth, create synergies and reduce risk through diversification. Hence, it is not surprising that during a time characterized by increasing market uncertainty, the year 2018 has seen fewer transactions than in previous years. However, it was a record year for high-value M&A deals which can be seen in a comparison between 2017 and 2018 (Figure 1: Average deal value ($bn), 3Q17 vs. -

Remote Control Codes

Remote Control Codes DVD VCR/DVR CBL/SAT 1. While holding down the REMOTE MODE button 123 REMOTE MODE GAME/TV AUX1 AUX2 that you want to enter the code, press the DVD VCR STANDBY 456 TAPE TUNER CD [STANDBY] button. CD TV 789 CDR/MD On Integra products, button names are capitalized. For PHONO CABLE +10 0 example, “Remote Mode” button and “Display” button. SAT 2. Use the number buttons to enter the 4-digit remote control code. Note: • Remote control codes cannot be entered for the [RECEIVER] and [DOCK] REMOTE MODE buttons. Codes de télécommande Códigos de control remoto 1. Maintenez enfoncé le bouton REMOTE MODE 1. Mientras mantiuene pulsado el botón REMOTE auquel vous voulez attribuer un code et appuyez sur MODE para el que desea entrar el código, pulse el le bouton [STANDBY]. botón [STANDBY]. 2. Entrez les 4 chiffres du code de télécommande avec 2. Utilice los botones de número para introducir el les boutons numériques. código de 4 dígitos para control remoto. Remarque: Nota: • Il est impossible d’entrer des codes de • Los códigos del control remoto no se pueden entrar télécommande pour les boutons [RECEIVER] et para los botones [RECEIVER] y [DOCK] [DOCK] REMOTE MODE. REMOTE MODE. Codici del telecomando Fernbedienungscodes 1. Mentre tenete premuto il pulsante REMOTE MODE 1. Halten Sie die änderungsbedürftige REMOTE per il quale volete inserire il codice, premete il MODE-Taste gedrückt, während Sie die pulsante [STANDBY]. [STANDBY]-Taste betätigen. 2. Utilizzate i pulsanti numerici per inserire il codice di 2. Geben Sie mit den Zifferntasten den 4-stelligen telecomando a 4 cifre. -

Parliament Rsa Joint Committee on Ethics And

PARLIAMENT RSA JOINT COMMITTEE ON ETHICS AND MEMBERS' INTERESTS REGISTER OF MEMBERS' INTERESTS 2013 Abrahams, Beverley Lynnette ((DA-NCOP)) 1. SHARES AND OTHER FINANCIAL INTERESTS No Nature Nominal Value Name of Company 100 R1 000 Telkom 100 R2 000 Vodacom 2. REMUNERATED EMPLOYMENT OUTSIDE PARLIAMENT Nothing to disclose. 3. DIRECTORSHIP AND PARTNERSHIPS Directorship/Partnership Type of Business Klip Eldo's Arts Arts 4. CONSULTANCIES OR RETAINERSHIPS Nothing to disclose. 5. SPONSORSHIPS Nothing to disclose. 6. GIFTS AND HOSPITALITY Nothing to disclose. 7. BENEFITS Nothing to disclose. 8. TRAVEL Nothing to disclose. 9. LAND AND PROPERTY Description Location Extent House Eldorado Park Normal House Eldorado Park Normal 10. PENSIONS Nothing to disclose. Abram, Salamuddi (ANC) 1. SHARES AND OTHER FINANCIAL INTERESTS No Nature Nominal Value Name of Company 2 008 Ordinary Sanlam 1 300 " Old Mutual 20 PLC Investec Unit Trusts R47 255.08 Stanlib Unit Trusts R37 133.56 Nedbank Member Interest R36 898 Vrystaat Ko -operasie Shares R40 000 MTN Zakhele 11 Ordinary Investec 2. REMUNERATED EMPLOYMENT OUTSIDE PARLIAMENT Nothing to disclose. 3. DIRECTORSHIP AND PARTNERSHIPS Nothing to disclose. 4. CONSULTANCIES OR RETAINERSHIPS Nothing to disclose. 5. SPONSORSHIPS Nothing to disclose. 6. GIFTS AND HOSPITALITY Nothing to disclose. 7. BENEFITS Nothing to disclose. 8. TRAVEL Nothing to disclose. 9. LAND AND PROPERTY Description Location Extent Erf 7295 Benoni +-941sq.m . Ptn 4, East Anglia Frankfurt 192,7224ha Unit 5 Village View Magaliessig 179sq.m. Holding 121 RAH 50% Int. in CC Benoni +-1,6ha Stand 20/25 Sandton 542sq.m. Unit 21 Benoni 55sq.m. Erf 2409 Benoni 1 190sq.m.