Ambev's Beer Innovation Centre in Rio De Janeiro Will Be Powered By

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

VALE Teleconference and Webcast 1Q2013 Results Introduction

VALE Teleconference and webcast 1Q2013 Results April 25 Portuguese: 10:00 a.m. (Rio de Janeiro time) Introduction Operator: Good morning, ladies and gentlemen. Welcome to the Vale teleconference, in which the 1Q2013 results will be discussed. At this moment, all the participants are connected as listeners only. Subsequently, the questions and answers session will be open and the instructions to participate in such session will be provided. Should you required the assistance of an operators during the teleconference, just press asterisk [*] zero [0]. I should remind you that this teleconference is been recorded. The recording will be available at the company website, www.vale.com, investors section. Replay of the teleconference will be available at phone (55 11) 4688-6312, access code: 5002512 #. This teleconference has been simultaneously transmitted by Internet, being accessible both at the company site: www .vale.com, investors section, and at www.prnewswire.com.br. Before proceeding, I would like to clarify that possible statements likely to be made during this teleconference with regard to the Company prospects and businesses, as well as projections, consist of estimates based on the Administration expectations for the future of Vale. Such expectations are subject to macroeconomic conditions, market risks, and other factors. Our participants today are: • Mr. Murilo Ferreira – Chief Executive Officer (Diretor Presidente); • Mr. Luciano Siani – Executive Officer of Finance and Investors Relations (Diretor Executivo de Finanças e Relações com Investidores); • Mr. José Carlos Martins – Executive Officer of Ferrous Minerals Operations and Strategy (Diretor Executivo de Ferrosos e Estratégia); • Ms. Vânia Somavilla – Executive Director of Human Resources, Health and Safety, Sustainability, and Energy (Diretora Executiva de Recursos Humanos, Saúde e Segurança, Sustentabilidade e Energia); 1 • Mr. -

Report Overview of Wwf-Brazil Corporate Partnerships Fiscal Year 2018

REPORT BR CORPORATE PARTNERSHIPS REPORT OVERVIEW OF WWF-BRAZIL CORPORATE PARTNERSHIPS FISCAL YEAR 2018 WWF-Brazil – Corporate Partnerships Report – 2018 WWF-Brazil – Corporate Partnerships Report – 2018 For further information on specific partnerships, please contact WWF-BR Gabriela Yamaguchi ([email protected]) For any media enquiries, please contact Jair Oliveira ([email protected]) WWF is one of the world’s largest and most experienced independent conservation organizations, with over 5 million supporters and a global network active in more than 100 countries. WWF’s mission is to stop the degradation of the planet’s natural environment and to build a future in which humans live in harmony with nature, by conserving the world’s biological diversity, ensuring that the use of renewable natural resources is sustainable, and promoting the reduction of pollution and wasteful consumption. Published in July 2018 by WWF – World Wide Fund For Nature – Brazil (Formerly World Wildlife Fund), São Paulo, Brazil. Any reproduction in full or in part must mention the title and credit the above-mentioned publisher as the copyright owner. © Text 2018 WWF-BR All rights reserved. 2 WWF-Brazil – Corporate Partnerships Report – 2018 WWF-Brazil – Corporate Partnerships Report – 2018 TAKING BOLD COLLECTIVE ACTION The time to act is now. We have put in place a global conservation strategy that reflects the way the world is changing, meets the big environmental challenges of the age and helps us simplify, unite and focus our efforts for greater impact. WWF will continue to deliver locally in crucial ecoregions around the world, but sharpen our focus on six global goals – on wildlife, forests, oceans, water, climate and energy, and food – and three key drivers of environmental degradation – markets, finance and governance. -

Companhia Energética De Minas Gerais – Cemig Listed Company – Cnpj 17.155.730/0001-64 – Nire 31300040127

COMPANHIA ENERGÉTICA DE MINAS GERAIS – CEMIG LISTED COMPANY – CNPJ 17.155.730/0001-64 – NIRE 31300040127 MATERIAL ANNOUNCEMENT Cemig (Companhia Energética de Minas Gerais, listed and traded in São Paulo, New York and Madrid), in accordance with CVM Instruction 358 of Jan. 3, 2002 as amended, hereby reports to the Brazilian Securities Commission (CVM), the São Paulo Stock Exchange (B3) and the market as follows: Cemig’s affiliated company Transmissora Aliança de Energia Elétrica S.A. (‘Taesa’) has today published the following Material Announcement: “Transmissora Aliança de Energia Elétrica S.A. (B3: TAEE11) (“Taesa” or “Company”), pursuant to CVM Instruction No. 358, dated January 3, 2002, as amended, hereby announces that the Board of Directors, at a meeting held on this date, elected Mr. André Augusto Telles Moreira as Chief Executive Officer, Mr. Erik da Costa Breyer as Chief Financial and Investor Relations Officer, and Mr. Fábio Antunes Fernandes as Business and Ownership Interest Management Officer. Messrs. André Moreira, Erik Breyer and Fábio Fernandes will take office on November 16, 2020. Mr. Marco Antônio Resende Faria, who was temporarily cumulating the CEO position, will remain as Chief Technical Officer and temporarily as Chief Legal and Regulatory Officer, and the Company and its Board of Directors would like to thank him for the dedication and relevant services provided to the Company and its employees. Taesa also informs that Mr. Marcus Vinicius do Nascimento remains temporarily as Chief Implementation Officer. Mr. André Moreira has a degree in Electrical Engineering from Universidade Federal de Itajubá – MG (EFEI), with a Postgraduate degree in Quality from UNICAMP, an MBA from AmBev University, an MBA in Public and Private Company Management from FAAP, courses of Management at ESADE (Spain), IMD (Switzerland), MIT (USA) and of Board of Directors member from the Brazilian Corporate Governance Institute (IBGC). -

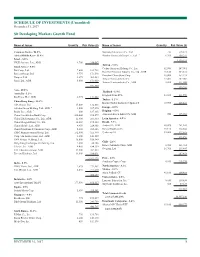

Schedule of Investments (Unaudited) Blackrock Advantage Emerging Markets Fund January 31, 2021 (Percentages Shown Are Based on Net Assets)

Schedule of Investments (unaudited) BlackRock Advantage Emerging Markets Fund January 31, 2021 (Percentages shown are based on Net Assets) Security Shares Value Security Shares Value Common Stocks China (continued) China Life Insurance Co. Ltd., Class H .................. 221,000 $ 469,352 Argentina — 0.0% China Longyuan Power Group Corp. Ltd., Class H ....... 52,000 76,119 (a) 313 $ 60,096 Globant SA .......................................... China Mengniu Dairy Co. Ltd.(a) ......................... 15,000 89,204 Brazil — 4.9% China Merchants Bank Co. Ltd., Class H ................ 36,000 275,683 Ambev SA ............................................. 236,473 653,052 China Overseas Land & Investment Ltd.................. 66,500 151,059 Ambev SA, ADR ....................................... 94,305 263,111 China Pacific Insurance Group Co. Ltd., Class H......... 22,000 90,613 B2W Cia Digital(a) ...................................... 20,949 315,188 China Railway Group Ltd., Class A ...................... 168,800 138,225 B3 SA - Brasil Bolsa Balcao............................. 33,643 367,703 China Resources Gas Group Ltd. ....................... 30,000 149,433 Banco do Brasil SA..................................... 15,200 94,066 China Resources Land Ltd. ............................. 34,000 134,543 BRF SA(a).............................................. 22,103 85,723 China Resources Pharmaceutical Group Ltd.(b) .......... 119,500 62,753 BRF SA, ADR(a) ........................................ 54,210 213,045 China Vanke Co. Ltd., Class A .......................... 67,300 289,157 Cia de Saneamento de Minas Gerais-COPASA .......... 52,947 150,091 China Vanke Co. Ltd., Class H .......................... 47,600 170,306 Duratex SA ............................................ 19,771 71,801 CITIC Ltd............................................... 239,000 186,055 Embraer SA(a).......................................... 56,573 90,887 Contemporary Amperex Technology Co. Ltd., Class A .... 1,700 92,204 Gerdau SA, ADR ...................................... -

José Marcos Treiger Investor Relations General Manager

José Marcos Treiger Investor Relations General Manager Investor Relations in Brazil Growth, Achievements and Challenges IR Magazine Latin America Conference November 8, 2000 Growth in Brazilian ADRs l Over 65 Brazilian ADRs as of September 2000; l 40 New Brazilian ADRs since 1995; l Brazilian ADRs account for 5% of all depositary receipts; l Brazilian ADRs account for 9% of ADR market trading volume; l Of the top 50 Depositary Receipts 6 are from Brazil: •Telebras Holding Company lTelecomunicações de Sao Paulo lEmbratel lTelesp Celular lTele Norte Leste Participações lTele Sudeste Celular Participações Brazilian ADRs on major U.S exchanges Aracruz Celulose Tele Centro Oeste Celular Part S.A. Brasil Telecom Participações S.A. Tele Leste Celular Participações S.A. Companhia Brasileira De Dist.-CBD Tele Nordeste Celular Participações S.A. Companhia de Bebidas Das Americas - AmBev Tele Norte Celular Participações S.A. Companhia Siderurgica Nacional-CSN Tele Norte Leste Participações S.A. Companhia Vale do Rio Doce - CVRD Tele Sudeste Celular Participações S.A. Companhia Paranaense de Energia - Copel Telebras Holding Company Copene Petroquimica Do Nordeste Telecomunicações de São Paulo - Telesp Embraer - Empresa Brasileira De Aeronaútica Telemig Celular Participações S.A. Embratel Participações S.A. Telesp Celular Participações S.A. Gerdau S.A. Ultrapar Participações S.A. Globo Cabo S.A. Unibanco - União De Bancos Brasileiros S.A. Petrobras - Petroleo Brasileiro S.A. Votorantim Celulose e Papel Tele Celular Sul Participações S.A. IBRI, ABRASCA, and ABAMEC: one common goal... Brazilian Association of Public Traded Companies Brazilian Investor Relations Institute Founded in 1971 Founded in June 1997 The interest of the Brazilian Investor Brazilian Association of Investment Community Professional Founded in 1970 Brazilian issuers: challenges and opportunities in the local market Challenges Opportunities l Reach U.S. -

Form 20-F Gerdau S.A

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 20-F REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR _ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Fiscal Year Ended December 31, 2019 OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 OR SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission file number 1-14878 GERDAU S.A. (Exact name of Registrant as specified in its charter) N/A (Translation of Registrant’s name into English) Federative Republic of Brazil (Jurisdiction of incorporation or organization) Av. Dra. Ruth Cardoso, 8,501 – 8° floor São Paulo, São Paulo - Brazil CEP 05425-070 (Address of principal executive offices) (Zip code) Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange in which registered Preferred Shares, no par value per share, each New York Stock Exchange represented by American Depositary Shares Securities registered pursuant to Section 12(g) of the Act: None Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None The total number of issued shares of each class of stock of GERDAU S.A. as of December 31, 2019 was: 573,627,483 Common Shares, no par value per share 1,146,031,245 Preferred Shares, no par value per share Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. -

Integrated Report 2018 Contents 06

INTEGRATED REPORT 2018 CONTENTS 06 42 Human capital 01 03 Message from 07 the Management 45 Reputational capital 02 08 06 Introduction 57 Intellectual capital 03 09 09 Itaúsa 64 Materiality 67 Summary of 04 GRI content 75 Independent 20 Value creation auditors' limited assurance report 05 77 Glossary 79 Corporate 27 Financial information capital MESSAGE 01 FROM THE MANAGEMENT We proceed in our pursuit of sustainable value creation to our stockholders and society, attentive to investment opportunities. 3 GRI Message from the Management As a holding company, our challenge is managing capital We have also strengthened the monitoring of the investees’ and investment portfolio efficiently, focused on the sus- performance and endeavored the best efforts so that com- tainable value creation to stakeholders. panies with a consolidated position in our portfolio are able to raise their profitability and efficiency levels and exert- in Due to its relevant weight in our results, Itaú Unibanco creasingly more discipline in the use of capital. remains our greatest asset – and will continue to do so. We are however attentive to other opportunities to Another concern of ours is ensuring that investees are increase our portfolio and bring attractive returns, and aligned with good practices in people management – and for exceeds Itaúsa’s cost of capital. We target well-established this reason we are part of the Personnel Committee, set up companies, with good cash generation, a consistent history at Itaú Unibanco and Duratex, and the People Committee, set of results, preferably that own recognized brands and up at Alpargatas. operate in sectors with low execution and regulatory risks. -

Food & Beverage

Equity Research October 18, 2019 Earnings Preview FOOD & BEVERAGE 3Q19: mixed results; the US and Argentina working in favor while BZ market disappointing Next week, the 3Q19 earnings season for the F&B sector begins. Overall, we expect to see companies more exposed to the domestic market still facing a weak consumer demand. In Target Price this context, we point out Ambev and M Dias Branco that, besides presenting reduction in Ticker YE20 TP Rating Mkt Cap* volume, should also show pressured margins due to higher costs related to the dollar appreciation, in our view. Regarding the animal protein companies, we expect positive figures ABEV3** 20.0 Market Perform 295,319 for companies exposed to the US beef market, such as JBS and Marfrig, due to higher JBSS3 33.0 Outperform 79,516 spreads and costs at comfortable levels. Brazilian meatpackers exposed to Argentinian market should also present positive figures on the back of exports to China. On the other BRFS3 45.0 Outperform 29,192 hand, companies more dependent on BZ exports might bring limited results since figures MDIA3 45.0 Market Perform 12,045 released by Secex frustrated initial expectations on beef, poultry and pork exports throughout the 3Q19. All considered, here follows below our estimates for the 3Q19 results to each MRFG3 10.0 Outperform 7,188 company separately. BEEF3 10.5 Outperform 3,943 Ambev (report date: Oct 25, pre market): Negative. We expect higher prices in Brazil and a *R$ Million; as of October 17; ** YE19 TP to be updated in the solid result in CAC to induce the consolidated top line that should reach R$ 11.5 bn, an 3Q19 report increment of 4% y/y in our estimates. -

This Is the Message

SCHEDULE OF INVESTMENTS (Unaudited) December 31, 2017 Sit Developing Markets Growth Fund Name of Issuer Quantity Fair Value ($) Name of Issuer Quantity Fair Value ($) Common Stocks - 94.8% Samsung Electronics Co., Ltd. 215 510,821 Africa/Middle East - 11.9% Shinhan Financial Group Co., Ltd. * 6,700 309,253 Israel - 3.0% 1,350,333 NICE Systems, Ltd., ADR 3,700 340,067 Taiwan - 7.4% South Africa - 8.9% Cathay Financial Holding Co., Ltd. 82,086 147,061 Bid Corp., Ltd. 7,600 184,718 Hon Hai Precision Industry Co., Ltd., GDR 21,148 132,824 Bidvest Group, Ltd. 9,775 171,548 President Chain Store Corp. 16,000 152,379 Naspers, Ltd. 1,675 464,064 Taiwan Semiconductor Co. 37,482 287,002 Sasol, Ltd., ADR 5,000 171,050 Taiwan Semiconductor Co., ADR 2,800 111,020 991,380 830,286 Asia - 69.0% Thailand - 1.0% Australia - 1.2% Bangkok Bank PCL 16,600 111,550 Rio Tinto, PLC, ADR 2,475 131,002 Turkey - 1.1% China/Hong Kong - 35.0% Kordsa Global Endustriyel Iplik A/S 60,900 123,126 AIA Group, Ltd. 15,600 132,688 Alibaba Group Holding, Ltd., ADR * 3,000 517,290 Europe - 0.9% Baidu, Inc., ADR * 800 187,368 Belgium - 0.9% China Construction Bank Corp. 320,000 294,577 Anheuser-Busch InBev NV,ADR 950 105,982 China Life Insurance Co., Ltd., ADR 12,900 201,369 Latin America - 9.8% China Mengniu Dairy Co., Ltd. 64,000 190,114 Brazil-5.3% China Mobile, Ltd., ADR 4,450 224,903 Ambev SA, ADR 40,425 261,145 China Petroleum & Chemical Corp., ADR 2,800 205,436 Banco Bradesco SA 15,176 154,866 CSPC Pharmaceutical Group, Ltd. -

Is It Time to Prepare for Growth? Consumption-Linked Stocks Seem Ready to Prosper

Is It Time to Prepare For Growth? Consumption-Linked Stocks Seem Ready to Prosper. We Are Fine-Tuning Our Portfolio. November 20, 2019 Strategy Team Lucas Tambellini, CNPI Jorge Gabrich, CNPI André Dibe Guilherme Reif +55-11-3073-3023 +55-11-3073-3048 +55-11-3073-3222 +55-11-3073-3066 [email protected] [email protected] [email protected] [email protected] Is It Time to Prepare For Growth? The market is already anticipating the data. Consumption-linked stocks are up 28% year to date while the Ibovespa is up by 20% for the same period. This group of stocks have been outperforming the benchmark since July 2019, when CAGED numbers were still in the 30k range. Investors are still increasing weight in these stocks, as commodities and non-consumption domestics appear to have a larger consensus. How we find our growth picks. We decided to look at metrics pertaining to companies’ operational potential (degree of operating leverage), operational performance (recent revenue growth), funding sources (cash generation), leverage (net debt to EV), relative valuation (price-to-book z-score) and investor sentiment (crowdedness index). Brazil Buy List changes. We are removing Petrobras (PETR4), which has appreciated by 53.9% since its inclusion, while the Ibovespa increased by 33.3% in the same period. We are also removing Vale (VALE3), -7.6% vs. +0.5%, to add Renner (LREN3) and Ambev (ABEV3). In this report we explore how best to Why Ambev and Renner? Both are highly resilient names (as we concluded in our “What If Winter Comes?” report), and they are linked to local economy. -

Evidenciação Do Passivo Ambiental: Uma Análise Comparativa Das Demonstrações Financeiras Apresentadas No Brasil E Nos Estados Unidos

III CNEG – Niterói, RJ, Brasil, 17, 18 e 19 de agosto de 2006 EVIDENCIAÇÃO DO PASSIVO AMBIENTAL: UMA ANÁLISE COMPARATIVA DAS DEMONSTRAÇÕES FINANCEIRAS APRESENTADAS NO BRASIL E NOS ESTADOS UNIDOS Suliani Rover (UFSC) - [email protected] José Alonso Borba (UFSC) - [email protected] RESUMO O presente artigo teve como objetivo a evidenciação das informações ambientais, principalmente passivos ambientais, nas Demonstrações Financeiras Padronizadas apresentadas à Comissão de Valores Mobiliários (CVM) e divulgadas no Brasil e nos Relatórios 20-F apresentados à Securities and Exchange Commission (SEC) e divulgados nos Estados Unidos, referentes ao período de 2002 a 2004. A metodologia utilizada consiste na pesquisa exploratória/descritiva. A coleta dos dados foi bibliográfica e documental e a abordagem do problema qualitativa e quantitativa. Foram realizadas análises de conteúdo nos relatórios das empresas que negociam American Depositor Receipts (ADR’s) na New York Stock Exchange (NYSE) e que são consideradas com potencial de poluição médio e alto, conforme dispõe a Lei nº10.165/2000. Os resultados encontrados demonstram que não há um padrão contábil para a evidenciação das informações ambientais. Além disso, percebe-se assimetria informacional entre os relatórios divulgados no Brasil e os relatórios divulgados nos Estados Unidos, o que afeta a qualidade, confiabilidade e a comparabilidade das informações disponibilizadas pelas empresas. Finalmente, constatou-se um gradativo aumento na divulgação das informações ambientais apresentadas pelas companhias durante o período. Palavras-chave: Contabilidade ambiental. Evidenciação ambiental. Passivos ambientais. ABSTRACT This article has the objective of disclosure the environmental information, with a focus on environmental liabilities, on the Demonstrações Financeiras Padronizadas given to Comissão de Valores Mobiliários (CVM) exposed in Brazil and on Forms 20-F stated to the Securities and Exchange Commission (SEC) in the United States, about the period around 2002 and 2004. -

HLF Institutional Emerging Markets Equity Portfolio Holdings

Institutional Emerging Markets Portfolio Holdings (as of June 30, 2021) Security Name Sector Country % of Net Assets 51job ADR Industrials China 0.67 AIA Group Financials Hong Kong 2.53 Airtac Industrials Taiwan 1.39 Alibaba Cons Discretionary China 2.85 Alibaba Group Holding Cons Discretionary China 1.48 Ambev ADR Cons Staples Brazil 1.07 Amorepacific Cons Staples South Korea 0.44 ASM Pacific Technology Info Technology Hong Kong 0.79 Astra International Cons Discretionary Indonesia 0.39 B3 Financials Brazil 0.74 Baidu Comm Services China 0.88 Banco Bradesco ADR Financials Brazil 1.30 Banco Santander Chile ADR Financials Chile 0.23 Bancolombia (Pref) ADR Financials Colombia 0.53 Bank Central Asia Financials Indonesia 0.77 Bank of Georgia Financials United Kingdom 0.19 Bank Rakyat Financials Indonesia 1.02 CD Projekt Comm Services Poland 0.40 China Tourism Group Duty Free Cons Discretionary China 0.99 Cia Brasileira de Distribuicao ADR Cons Staples Brazil 0.14 Coca-Cola HBC Cons Staples United Kingdom 1.99 Commercial International Bank GDR Financials Egypt 0.43 Copa Holdings Industrials Panama 0.40 Country Garden Services Industrials China 0.83 Coway Cons Discretionary South Korea 0.68 CSPC Pharmaceutical Group Health Care China 1.44 Discovery Holdings Financials South Africa 0.79 East African Breweries Cons Staples Kenya 0.15 Eclat Cons Discretionary Taiwan 1.66 ENN Energy Utilities China 1.65 EPAM Systems Info Technology United States 3.74 FEMSA ADR Cons Staples Mexico 1.25 Fuyao Glass Industry Group Cons Discretionary China 1.17 GF