Management's Discussion and Analysis Altice

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Immediate Report

January 13, 2015 Immediate Report Pelephone wins 4G tender Further to the Company's Immediate Report dated July 3, 2014 and to section 3.7.1 of the chapter on the description of the Company's business activities in the Company’s Quarterly Report for the period ended September 30, 2014, it is hereby announced that on January 12, 2015 the Company was informed by its subsidiary, Pelephone Communications Ltd ("Pelephone") that it took part in an online tender by the government to allocate fourth generation frequencies (LTE) to cellular operators with infrastructure, virtual operators and companies that are not existing cellular operators, subject to the qualifying conditions in the tender. In the tender Pelephone received 15 megahertz in the 1800 frequency band, at an overall cost of NIS 96 million. The results of the award are subject to approval by the Minister of Communications as stipulated in the tender terms. The fourth generation (4G) network is a cellular data network that facilitates surfing at higher speeds. In August 2014 the Ministry of Communications permitted operation of fourth generation networks in Israel with a bandwidth of 5 megahertz, while at the end of the frequencies tender the cellular companies would be able to operate the network with the full bandwidth they had available, within several weeks of completion of allocation of the frequencies. Today hundreds of thousands of devices supporting 4G are operating on the Pelephone network, which surf in those areas where LTE infrastructure has been deployed. Pelephone is in the middle of deploying the network throughout the country and will continue accelerated deployment over the coming months. -

Goodwill Impairment Test of the Cellular Segment June 30Th, 2019

Bezeq The Israel Telecommunication Corporation Limited Goodwill Impairment Test of the Cellular Segment June 30th, 2019 August 2019 14 Kreminitzky St., Tel Aviv 6789912 I Tel.: 03-5617801 I Fax: 077-3181607 Introduction and Limit of Liability • We were retained by Bezeq The Israel Telecommunication Corp. Ltd. (hereunder “Bezeq” and/or “Bezeq Group” and/or the ”Client”) to prepare a goodwill impairment test report (the “Report”) of the cellular business unit (hereunder: “Pelephone” and/or the “Cellular Segment”) as of June 30th, 2019. • The Report intended solely for the use of the Client and is . This Report may not be reproduced, in whole or in part, and the findings of this Report may not be used by a third party for any purpose, without our expressed written consent. Notwithstanding any of the above, this Report may be included in the Client’s financial statements of as of June. 30, 2017. • For the purpose of preparing this Report, we relied upon financial and other information including prospective financial information obtained from the Company and/or the Client and/or anyone on their behalf (the “Information”). We assumed that the Information is credible and therefore did not perform an independent audit of the information. In addition, nothing suggesting that the Information may be unreasonable has come to our attention. The Information has not been examined in an independent manner, and therefore this Report does not constitute a verification of the Information’s correctness, completeness and accuracy. If the case that the Information is not complete nor accurate or credible, the results of this valuation might change. -

Annual Report Permittee Name: City of Daly City

FY 2017-2018 Annual Report Permittee Name: City of Daly City Table of Contents Section Page Section 1 – Permittee Information ................................................................................................................................. 1-1 Section 2 – Provision C.2 Municipal Operations ......................................................................................................... 2-1 Section 3 – Provision C.3 New Development and Redevelopment ....................................................................... 3-1 Section 4 – Provision C.4 Industrial and Commercial Site Controls ......................................................................... 4-1 Section 5 – Provision C.5 Illicit Discharge Detection and Elimination ..................................................................... 5-1 Section 6 – Provision C.6 Construction Site Controls .................................................................................................. 6-1 Section 7 – Provision C.7 Public Information and Outreach .................................................................................... 7-1 Section 9 – Provision C.9 Pesticides Toxicity Controls ................................................................................................ 9-1 Section 10 – Provision C.10 Trash Load Reduction ................................................................................................... 10-1 Section 11 – Provision C.11 Mercury Controls .......................................................................................................... -

Menu! with in New Orleans

HOW DO YOU WANT YOUR STEAK? FEATURED DESSERT Weekly Specials Steak Lovers Uptown Entrees Semper Fi SouthsideCafe.net SOUTHSIDE HOMEMADE BREAD PUDDING All made with our tender, shredded ribeye steak! SOUTHERN FRIED STEAK 3154 Pontchartrain Dr. / Slidell, LA 70458 This classic New Orleans dessert is a Southside favorite! We STEAK NIGHT! Certified Angus Beef® Steak, breaded, golden fried and served serve it up with our rich & decadent Whiskey sauce. 4.99 BONFOUCA FRENCH DIP with your choice of country white or roast beef gravy. 13.99 ALL ENTREES SERVED WITH 2 SIDES 1/2 lb. of shredded ribeye & pepper jack cheese on toasted French Dine-In Only • COLESLAW • SWEET POTATO FRIES add 99¢ bread, with warm au jus for dipping . 12.99 Call For Carry-Out SOUTHSIDE SIRLOIN • MASHED POTATOES • STEAMED VEGGIES add 1.99 ® Our 8oz. center-cut Certified Angus Beef Sirloin is aged 21 days • POTATO SALAD • FRENCH ONION SOUP add 1.99 BLACK & BLEU POBOY for maximum tenderness and flavor. 23.99 1/2 lb. of shredded ribeye steak with bleu cheese & raw red onion • HOUSE SALAD • SOUP OF THE DAY 985-643-6133 Bonfouca French Dip on toasted French bread. 13.99 • FRENCH FRIES • 4 BEAN & TURKEY SOUP VEAL PARMESAN • HUSH PUPPIES (4) • CUP OF GUMBO Our paneed veal, topped with zesty marinara sauce and melted OPEN 7 DAYS A WEEK! • MAC & CHEESE • Chicken & Sausage RIBEYE PHILLY Provolone cheese over buttered toast. 15.99 1/2 lb. of shredded ribeye, sauteed Add roast beef debris; chili; or • Seafood add 1.99 Monday - Saturday | 11am - 10pm “Peaux” Boys onion, pepper, mushrooms & OPEN FACE ROAST BEEF bacon & sour cream 99¢ ea. -

Cellcom Israel Ltd

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 20–F ☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2020 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from___________ to __________________ OR ☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report ……………………………. Commission file number 001-33271 CELLCOM ISRAEL LTD. (Exact name of Registrant as specified in its charter and translation of Registrant’s name into English) ISRAEL (Jurisdiction of incorporation or organization) 10 Hagavish Street, Netanya 4250708, Israel (Address of principal executive offices) Liat Menahemi Stadler, 972-52-9989595 (phone), 972-98607986 (fax), [email protected], 10 Hagavish Street, Netanya 4250708, Israel (Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person) Securities registered or to be registered pursuant to Section 12(b) of the Act. Title of each class Trading Symbol Name of each exchange on which registered Ordinary Shares, par value NIS 0.01 per share (CEL) New York Stock Exchange (“NYSE”)*1 Securities registered or to be registered pursuant to Section 12(g) of the Act. None (Title of Class) Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act. None (Title of Class) * We voluntarily delisted our ordinary shares from the NYSE on February 8, 2021. -

The Training and Development of Principals in the Management of the Curriculum

THE TRAINING AND DEVELOPMENT OF PRINCIPALS IN THE MANAGEMENT OF THE CURRICULUM by ARUNACHELLAN DAYANUNDAN PADAYACHEE THESIS submitted in partial fulfilment of the requirements for the degree DOCTOR EDUCATIONIS in EDUCATIONAL MANAGEMENT in the FACULTY OF EDUCATION AND NURSING at the RAND AFRIKAANS UNIVERSITY PROMOTER : PROF BR GROBLER CO-PROMOTER : PROF TC BISSCHOFF FEBRUARY 1999 II THE TRAINING AND DEVELOPMENT OF PRINCIPALS IN THE MANAGEMENT OF THE CURRICULUM A D PADAYACHEE THE TRAINING AND DEVELOPMENT OF PRINCIPALS IN THE MANAGEMENT OF THE CURRICULUM A D PADAYACHEE PROMOTER: PROFESSOR B R GROBLER CO-PROMOTER: PROFESSOR T C BISSCHOFF ACKNOWLEDGEMENTS I wish to express my sincere, and heartfelt thanks and gratitude to: The Creator for his Divine intervention and for granting me the strength, courage and perseverance to complete this project.. My promoter of this thesis, Professor B R Grobler. My sincere appreciation and gratitude for his constructive criticism, encouragement, valuable support, insights and assistance and guidance throughout this study. My co-promoter, Professor T C Bisschoff for his constant encouragement and positive support and guidance throughout this research. Cyril Samuels, Roy Reddy and Raj Mestry for their commitment, hardwork, dedication, assistance, support and team work throughout our studies. My parents Mr and Mrs K A Padayachee for the fountain of inspiration which they provided in directing and leading me through life. My wife Umsha and my children Avashni, Trishanta and Dasevan for their patience, understanding and encouragement throughout my studies. My In-Laws, Mr and Mrs Pillay for their support and blessing during my studies. Rand Afrikaans University for their support and Mr JA Vermeulen, deputy rector for his assistance, encouragement and support. -

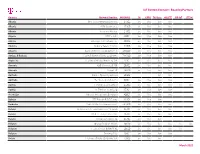

Network List Addendum

Network List Addendum IN-SITU PROVIDED SIM CELLULAR NETWORK COVERAGE COUNTRY NETWORK 2G 3G LTE-M NB-IOT COUNTRY NETWORK 2G 3G LTE-M NB-IOT (VULINK, (TUBE, (VULINK) (VULINK) TUBE, WEBCOMM) (VULINK, (TUBE, (VULINK) (VULINK) WEBCOMM) TUBE, WEBCOMM) WEBCOMM) Benin Moov X X Afghanistan TDCA (Roshan) X X Bermuda ONE X X Afghanistan MTN X X Bolivia Viva X X Afghanistan Etisalat X X Bolivia Tigo X X Albania Vodafone X X X Bonaire / Sint Eustatius / Saba Albania Eagle Mobile X X / Curacao / Saint Digicel X X Algeria ATM Mobilis X X X Martin (French part) Algeria Ooredoo X X Bonaire / Sint Mobiland Andorra X X Eustatius / Saba (Andorra) / Curacao / Saint TelCell SX X Angola Unitel X X Martin (French part) Anguilla FLOW X X Bosnia and BH Mobile X X Anguilla Digicel X Herzegovina Antigua and Bosnia and FLOW X X HT-ERONET X X Barbuda Herzegovina Antigua and Bosnia and Digicel X mtel X Barbuda Herzegovina Argentina Claro X X Botswana MTN X X Argentina Personal X X Botswana Orange X X Argentina Movistar X X Brazil TIM X X Armenia Beeline X X Brazil Vivo X X X X Armenia Ucom X X Brazil Claro X X X Aruba Digicel X X British Virgin FLOW X X Islands Australia Optus X CCT - Carribean Australia Telstra X X British Virgin Cellular X X Islands Australia Vodafone X X Telephone Austria A1 X X Brunei UNN X X Darussalam Austria T-Mobile X X X Bulgaria A1 X X X X Austria H3G X X Bulgaria Telenor X X Azerbaijan Azercell X X Bulgaria Vivacom X X Azerbaijan Bakcell X X Burkina Faso Orange X X Bahamas BTC X X Burundi Smart Mobile X X Bahamas Aliv X Cabo Verde CVMOVEL -

Iot Custom Connect - Roaming Partners

IoT Custom Connect - Roaming Partners Country Column1 Network Provider Column2MCCMNCColumn10 Column32G Column4GPRS Column53G Data Column64G/LTE Column7NB-IoT LTE-M Albania One Telecommunications sh.a 27601 live live live live Albania ALBtelecom sh.a. 27603 live live live live Albania Vodafone Albania 27602 live live live live Algeria ATM Mobilis 60301 live live live live Algeria Wataniya Telecom Algerie 60303 live live live live Andorra Andorra Telecom S.A.U. 21303 live live live live Anguilla Cable and Wireless (Anguilla) Ltd 365840 live live live live Antigua & Barbuda Cable & Wireless (Antigua) Limited 344920 live live live live Argentina Telefónica Móviles Argentina S.A. 72207 live live live live Armenia VEON Armenia CJSC 28301 live live live live Armenia Ucom LLC 28310 live live live live Australia SingTel Optus Pty Limited 50502 live live Australia Telstra Corporation Ltd 50501 live live live live Austria T-Mobile Austria GmbH 23203 live live live live live live Austria A1 Telekom Austria AG 23201 live live live live Azerbaijan Bakcell Limited Liable Company 40002 live live live live Bahrain STC Bahrain B.S.C Closed 42604 live live live Barbados Cable & Wireless Barbados Ltd. 342600 live live live live Belarus Belarusian Telecommunications Network 25704 live live live live Belarus Mobile TeleSystems JLLC 25702 live live live live Belarus Unitary Enterprise A1 25701 live live live Belgium Orange Belgium NV/SA 20610 live live live live live live Belgium Telenet Group BVBA/SPRL 20620 live live live live live Belgium Proximus PLC 20601 live live live live Bolivia Telefonica Celular De Bolivia S.A. 73603 live live live March 2021 IoT Custom Connect - Roaming Partners Country Column1 Network Provider Column2MCCMNCColumn10 Column32G Column4GPRS Column53G Data Column64G/LTE Column7NB-IoT LTE-M Bosnia and Herzegovina PUBLIC ENTERPRISE CROATIAN TELECOM Ltd. -

Mobile Video Production "Flypack" SPECIFICATIONS

SPECIFICATIONS Mobile Video Production "Flypack" CONFIDENTIAL DESIGN INFORMATION - Unauthorized use, reproduction or dissemination of this document is strictly prohibited. TABLE OF CONTENTS 1. VIDEO DESIGN AND SUPPORT A. HD Recorder B. HD Rack Monitoring C. Utility Monitor D. Program and Multiview Monitors E. HD Switching and Routing a. Video Control 2 ME Surface b. Video Switcher 2 ME c. Redundant Power Supply for Switcher d. Rack Mount System for Switcher and Control Surface e. Aux 16x1 Control Panels F. HD Scan convergence 2. CAMERAS A. HD PTZ Video Cameras B. HD PTZ Video Controller 3. TRIPODS A. Camera Support B. Heads and Arms C. Tripod Legs and Accessories 4. AUDIO DESIGN AND SUPPORT A. Audio and Mixer Processing B. Production Speakers & Processing C. Audio Embedder D. Audio Distribution E. Intercom Systems a. Wired Specs b. Wireless Specs c. UHF 2-Audio Channel Wireless Synthesized Base Station d. UHF 2-Audio Channel Wireless Synthesized Transceiver 2 CONFIDENTIAL DESIGN INFORMATION - Unauthorized use, reproduction or dissemination of this document is strictly prohibited. 5. CUSTOM REMOTE CASE SYSTEM A. Fly Pack Case B. Fly Pack Accessory Case C. Tripod Cases D. Utility Support E. Other Rackmount Items 6. CABLE MANAGEMENT A. Specialty Cables 7. POWER MANAGEMENT A. Power Distro B. UPS Backup 8. ENGINEERING A. Networking B. IO Panels C. Sub IO Panel D. Intercom Diagram E. Video Diagram F. Audio Diagram G. Switcher Dimensions H. Flypack Model I. Assembly 3 CONFIDENTIAL DESIGN INFORMATION - Unauthorized use, reproduction or dissemination of this document is strictly prohibited. 1. VIDEO DESIGN AND SUPPORT A. HD Recorder Blackmagic HyperDeck Studio Pro Quantity: 4 SSD recorder is a broadcast HD based solid state deck that includes 3G-SDI and HDMI connections so you can work in all SD and HD formats up to 1080p30. -

The 14Th Workshop on Mobile Computing

ACM HotMobile 2013: The 14th Workshop on Mobile Computing Systems & Applications Feb 26-27, 2013 Jekyll Island, Georgia, USA General Chair Sharad Agarwal, Microsoft Research, US Program Chair Alexander Varshavsky, AT&T Labs, US Poster & Demo Chair Nilanjan Banerjee, University of Maryland, US Student Volunteer Chair Souvik Sen, HP Labs, US Publicity Chair Andreas Bulling, Lancaster University, UK Web Chair Christos Efstratiou, University of Cambridge, UK Sponsored by ACM, ACM SIGMOBILE, Microsoft Research, Telefonica, AT&T Labs, Google The Association for Computing Machinery 2 Penn Plaza, Suite 701 New York New York 10121-0701 ACM COPYRIGHT NOTICE. Copyright © 2013 by the Association for Computing Machinery, Inc. Permission to make digital or hard copies of part or all of this work for personal or classroom use is granted without fee provided that copies are not made or distributed for profit or commercial advantage and that copies bear this notice and the full citation on the first page. Copyrights for components of this work owned by others than ACM must be honored. Abstracting with credit is permitted. To copy otherwise, to republish, to post on servers, or to redistribute to lists, requires prior specific permission and/or a fee. Request permissions from Publications Dept., ACM, Inc., fax +1 (212) 869-0481, or [email protected]. For other copying of articles that carry a code at the bottom of the first or last page, copying is permitted provided that the per-copy fee indicated in the code is paid through the Copyright Clearance Center, 222 Rosewood Drive, Danvers, MA 01923, +1-978-750-8400, +1-978-750-4470 (fax). -

Designing the Future of the 5G Revolution

DESIGNING THE FUTURE OF THE 5G REVOLUTION NOVEMBER 17-18, 2020 VIRTUAL EXPO Mobile 5G Innovation Israel event, initiated by the Israel Export Institute and the Foreign Trade Administration at the Ministry of Economy and Industry is our first biggest virtual Mobile Technology Expo. The virtual Expo will be held on November 17-18, 2020 and will stay LIVE till January! This event will include Israel’s leading companies presenting the latest technology for: 5G, MEC, Connected Car, XR, IoT, Smart City, Smart Home, Telehealth, Industry 4.0, AI & Machine Learning, Big Data & Analytics, FinTech and much more. We invite you to join us and schedule 1:1 meetings with the most innovative companies in Israel. Contents The Israel Export & International Cooperation Institute 3 The Foreign Trade Administration 4 Index by Company 5 Index by Category 17 Company Profiles 25 Contents 2 The Israel Export & International Cooperation Institute ISRAEL EXPORT INSTITUTE The Israel Export & International Cooperation Institute, supported by member firms, private sector bodies and the government of Israel, advances business relationships between Israeli exporters and overseas businesses and organizations. By providing a wide range of export-oriented services to Israeli companies and complementary services to the international business community, the Institute helps build successful joint ventures, strategic alliances and trade partnerships. The IEICI’s High Tech Department is the leader in business matching between the more than 1,500 companies in the Israeli high tech industry and worldwide business partners at all levels. It has a proven ability to identify and match suitable potential business partners, organize one-on-one business meetings, and is a focal point for contacts with the government as well as with industry. -

Please Scroll Down for Article

This article was downloaded by: [University of Pennsylvania] On: 11 February 2009 Access details: Access Details: [subscription number 906869828] Publisher Routledge Informa Ltd Registered in England and Wales Registered Number: 1072954 Registered office: Mortimer House, 37-41 Mortimer Street, London W1T 3JH, UK Psychotherapy Research Publication details, including instructions for authors and subscription information: http://www.informaworld.com/smpp/title~content=t713663589 The Multitheoretical List of Therapeutic Interventions (MULTI): Initial report Kevin S. McCarthy a; Jacques P. Barber a a Center for Psychotherapy Research, University of Pennsylvania, Philadelphia, PA, USA First Published:January2009 To cite this Article McCarthy, Kevin S. and Barber, Jacques P.(2009)'The Multitheoretical List of Therapeutic Interventions (MULTI): Initial report',Psychotherapy Research,19:1,96 — 113 To link to this Article: DOI: 10.1080/10503300802524343 URL: http://dx.doi.org/10.1080/10503300802524343 PLEASE SCROLL DOWN FOR ARTICLE Full terms and conditions of use: http://www.informaworld.com/terms-and-conditions-of-access.pdf This article may be used for research, teaching and private study purposes. Any substantial or systematic reproduction, re-distribution, re-selling, loan or sub-licensing, systematic supply or distribution in any form to anyone is expressly forbidden. The publisher does not give any warranty express or implied or make any representation that the contents will be complete or accurate or up to date. The accuracy of any instructions, formulae and drug doses should be independently verified with primary sources. The publisher shall not be liable for any loss, actions, claims, proceedings, demand or costs or damages whatsoever or howsoever caused arising directly or indirectly in connection with or arising out of the use of this material.