Demand Elasticity Im Profitability on Zagreb-Dubrovnik Airline Route

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Punctuality Statistics Economic Regulation Group Aviation Data Unit

Punctuality Statistics Economic Regulation Group Aviation Data Unit Birmingham, Edinburgh, Gatwick, Glasgow, Heathrow, London City, Luton, Manchester, Newcastle, Stansted Full and Summary Analysis July 2006 Disclaimer The information contained in this report will be compiled from various sources and it will not be possible for the CAA to check and verify whether it is accurate and correct nor does the CAA undertake to do so. Consequently the CAA cannot accept any liability for any financial loss caused by the persons reliance on it. Contents Foreword Introductory Notes Full Analysis – By Reporting Airport Birmingham Edinburgh Gatwick Glasgow Heathrow London City Luton Manchester Newcastle Stansted Full Analysis With Arrival / Departure Split – By A Origin / Destination Airport B C – E F – H I – L M – N O – P Q – S T – U V – Z Summary Analysis FOREWORD 1 CONTENT 1.1 Punctuality Statistics: Heathrow, Gatwick, Manchester, Glasgow, Birmingham, Luton, Stansted, Edinburgh, Newcastle and London City - Full and Summary Analysis is prepared by the Civil Aviation Authority with the co-operation of the airport operators and Airport Coordination Ltd. Their assistance is gratefully acknowledged. 2 ENQUIRIES 2.1 Statistics Enquiries concerning the information in this publication and distribution enquiries concerning orders and subscriptions should be addressed to: Civil Aviation Authority Room K4 G3 Aviation Data Unit CAA House 45/59 Kingsway London WC2B 6TE Tel. 020-7453-6258 or 020-7453-6252 or email [email protected] 2.2 Enquiries concerning further analysis of punctuality or other UK civil aviation statistics should be addressed to: Tel: 020-7453-6258 or 020-7453-6252 or email [email protected] Please note that we are unable to publish statistics or provide ad hoc data extracts at lower than monthly aggregate level. -

Development Potentials of Low Cost Aviation in the Republic of Croatia

A. Vidović, S. Steiner, I. Štimac: Development Potentials of Low Cost Aviation in the Republic of Croatia ANDRIJA VIDOVIĆ, Ph.D. Traffic Planning E-mail: [email protected] Review SANJA STEINER, Ph.D. Accepted: Mar. 10, 2011 E-mail: [email protected] Approved: Nov. 15, 2011 University of Zagreb, Faculty of Transport and Traffic Sciences Vukelićeva 4, 10000 Zagreb, Croatia IGOR ŠTIMAC, M.Sc. E-mail: [email protected] Zagreb Airport Ltd. Pleso bb, 10000 Zagreb, Croatia DEVELOPMENT POTENTIALS OF LOW COST AVIATION IN THE REPUBLIC OF CROATIA ABSTRACT and the share of traditional companies was gradually reduced. The liberalization of the aviation market has enabled Functional organization and the associated traf- low-cost airlines to take over a significant share in the avia- fic and technological processes applied in low-cost tion market. Benefits of low-cost models are multiple, both airlines resulted in up to 50 percent lower operating for passengers and for secondary and regional airports, costs compared to traditional companies. Currently in which were neglected in the past and which record signifi- cant inflow of passengers with the arrival of low-cost airlines. Europe there are 58 low-cost airlines that operate and In the structure of the air traffic in the Republic of Croatia they generate 38 percent of total passenger traffic and in the last ten years, there has been a progressive growth of 23 percent of total Instrumental Flight Rules (IFR) op- foreign low-cost airline operations, which suggests a poten- erations. tial for the operation of a Croatian low-cost airline. -

Punctuality Statistics Economic Regulation Group Aviation Data Unit

Punctuality Statistics Economic Regulation Group Aviation Data Unit Birmingham, Edinburgh, Gatwick, Glasgow, Heathrow, London City, Luton, Manchester, Newcastle, Stansted Full and Summary Analysis June 2007 Disclaimer The information contained in this report has been compiled from various sources of data. CAA validates this data, however, no warranty is given as to its accuracy, integrity or reliability. CAA cannot accept liability for any financial loss caused by a person’s reliance on any of these statistics. No statistical data provided by CAA maybe sold on to a third party. CAA insists that they are referenced in any publication that makes reference to CAA Statistics. Contents Foreword Introductory Notes Full Analysis – By Reporting Airport Birmingham Edinburgh Gatwick Glasgow Heathrow London City Luton Manchester Newcastle Stansted Full Analysis With Arrival / Departure Split – By A Origin / Destination Airport B C – E F – H I – L M – N O – P Q – S T – U V – Z Summary Analysis FOREWORD 1 CONTENT 1.1 Punctuality Statistics: Heathrow, Gatwick, Manchester, Glasgow, Birmingham, Luton, Stansted, Edinburgh, Newcastle and London City - Full and Summary Analysis is prepared by the Civil Aviation Authority with the co-operation of the airport operators and Airport Coordination Ltd. Their assistance is gratefully acknowledged. 2 ENQUIRIES 2.1 Statistics Enquiries concerning the information in this publication and distribution enquiries concerning orders and subscriptions should be addressed to: Civil Aviation Authority Room K4 G3 Aviation Data Unit CAA House 45/59 Kingsway London WC2B 6TE Tel. 020-7453-6258 or 020-7453-6252 or email [email protected] 2.2 Enquiries concerning further analysis of punctuality or other UK civil aviation statistics should be addressed to: Tel: 020-7453-6258 or 020-7453-6252 or email [email protected] Please note that we are unable to publish statistics or provide ad hoc data extracts at lower than monthly aggregate level. -

Air Transport: Annual Report 2005

ANALYSIS OF THE EU AIR TRANSPORT INDUSTRY Final Report 2005 Contract no: TREN/05/MD/S07.52077 by Cranfield University Department of Air Transport Analysis of the EU Air Transport Industry, 2005 1 CONTENTS 1 AIR TRANSPORT INDUSTRY OVERVIEW......................................................................................11 2 REGULATORY DEVELOPMENTS.....................................................................................................19 3 CAPACITY ............................................................................................................................................25 4. AIR TRAFFIC........................................................................................................................................36 5. AIRLINE FINANCIAL PERFORMANCE............................................................................................54 6. AIRPORTS.............................................................................................................................................85 7 AIR TRAFFIC CONTROL ..................................................................................................................102 8. THE ENVIRONMENT ........................................................................................................................110 9 CONSUMER ISSUES..........................................................................................................................117 10 AIRLINE ALLIANCES .......................................................................................................................124 -

Annual Report 2010 66Th Annual General Meeting Berlin, June 2010

Giovanni Bisignani Director General & CEO International Air Transport Association Annual Report 2010 66th Annual General Meeting Berlin, June 2010 Promoting sustainable forest management. This paper is certified by the Forest Stewardship Council (FSC) and is cellulose based and recyclable. IATA Board of Governors 06 Simplifying the Business 30 Director General’s Message 08 Cost Efficiency 36 State of the Industry 10 Industry and Financial Services 40 Safety 16 Aviation Solutions 46 Security and Facilitation 20 IATA Membership 50 Regulatory and Public Policy 24 IATA Offices 52 Environment 26 Note: Unless specified otherwise, all dollar ($) figures in this annual report refer to US dollars (US$). Cautious optimism is returning. But challenges continue. We must rebuild the industry on a new and more resilient foundation. Safety, security, and environmental responsibility are the pillars of our industry, which we must constantly strengthen. Shocks and crises have exposed the weakness of the industry structure. The nearly $50 billion loss over the last decade is a blunt case for big change. Giovanni Bisignani 6 IATA Board of Governors as of 1 May 2010 Khalid Abdullah Almolhem Andrés Conesa Harry Hohmeister SAUDI ARABIAN AIRLINES AEROMEXICO SWISS Richard Anderson Enrique Cueto Mats Jansson DELTA AIR LINES LAN AIRLINES SAS Gerard Arpey Rob Fyfe Alan Joyce AMERICAN AIRLINES AIR NEW ZEALAND QANTAS David Bronczek Naresh Goyal Temel Kotil FEDEX EXPRESS JET AIRWAYS TURKISH AIRLINES Chew Choon Seng Peter Hartman Liu Shaoyong SINGAPORE AIRLINES KLM CHINA EASTERN AIRLINES Yang Ho Cho Pedro Heilbron Samer Majali KOREAN AIR COPA AIRLINES GULF AIR 7 Hussein Massoud Jean-Cyril Spinetta EGYPTAIR AIR FRANCE Wolfgang Mayrhuber Glenn Tilton LUFTHANSA UNITED AIRLINES Titus Naikuni Tony Tyler KENYA AIRWAYS CATHAY PACIFIC AIRWAYS Fernando Pinto José Viegas TAP PORTUGAL LAM-MOZAMBIQUE AIRLINES Calin Rovinescu Willie Walsh AIR CANADA BRITISH AIRWAYS Vitaly Saveliev AEROFLOT Tony Tyler Chairman IATA Board of Governors 8 Director General’s Message Airlines lost $9.9 billion in 2009. -

Traffic Statistics 2009

“Falcone e Borsellino Airport” TRAFFIC STATISTICS JAN-DIC 2009 DOMESTIC AND INTERNATIONAL COMMERCIAL TRAFFIC SCHEDULED AND NON SCHEDULED FLIGHTS A/C MOVEMENTS PASSENGERS PAX per MVT TRAFFIC JAN-DIC 46.780 4.350.563 93,00 % CHG 2008/09 + 3,88% - 1,62% -5,30% SCHEDULED FLIGHTS A/C MOVEMENTS PASSENGERS PAX per MVT TRAFFIC JAN-DIC 45.188 4.161.679 92,10 % CHG 2008/09 + 5,40% -0,42% -5,52% NON SCHEDULED FLIGHTS A/C MOVEMENTS PASSENGERS PAX per MVT TRAFFIC JAN-DIC 1.592 188.884 118,65 % CHG 2008/09 -26,19% -22,19% + 5,43% SCHEDULED AND NON SCHEDULED COMMERCIAL TRAFFIC DOMESTIC FLIGHTS A/C MOVEMENTS PASSENGERS PAX per MVT TRAFFIC JAN-DIC 40.820 3.651.227 89,45 % CHG 2008/09 + 9,63% + 1,83% -7,12% INTERNATIONAL FLIGHTS A/C MOVEMENTS PASSENGERS PAX per MVT TRAFFIC JAN-DIC 5.960 699.336 117,34 % CHG 2008/09 -23,57% - 16,39% + 9,39% Of which INTRA - EU 5.113 633.362 123,87 % CHG 2008/09 - 21,69% - 15,04% + 8,49% Of which EXTRA - EU 847 65.974 77,89 % CHG 2008/09 - 33,25% - 27,46% + 8,69% TOP SCHEDULED AIRLINES AIRLINE PASSENGERS %CHG 2008/09 A/C MOVEMENTS %CHG 2008/09 ALITALIA 821.329 -17,81% 8.133 -11,42% WIND JET 801.916 -4,12% 8.443 10,79% AIR ONE 678.325 -16,46% 8.024 -22,78% EASYJET 484.171 76,31% 3.974 89,33% MERIDIANA 434.992 -2,65% 7.792 26,70% RYANAIR 302.709 59,11% 2.041 63,67% AIR BERLIN 171.845 -11,90% 1.452 -9,36% BLU EXPRESS 163.817 N/S 1.676 N/S VOLARE 65.357 16,79% 659 8,03% TRANSAVIA.COM 41.555 16,99% 290 10,69% VUELING AIRLINES 38.245 59,93% 322 62,63% EUROFLY 33.628 -64,83% 366 -53,90% TUNIS AIR 19.512 -17,63% 414 -13,75% XL AIRWAYS FRANCE 17.069 128,35% 140 141,38% IBERIA 10.488 55,59% 158 75,56% N/S Not Significant TOP NON SCHEDULED AIRLINES AIRLINE PASSENGERS %CHG 2008/09 A/C MOVEMENTS %CHG 2008/09 AIR MEDITERRANEE 55.020 2,74% 299 2,40% EUROPE AIRPOST 32.999 -4,09% 295 -3,91% MISTRAL AIR 25.051 -45,44% 267 -46,81% TRAVEL SERVICE 8.820 N/S 51 N/S CESKOSLOVENSKE AER. -

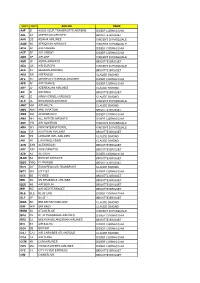

3Let 2Let Airline Name Aaf Zi Aigle Azur Transports

3LET 2LET AIRLINE NAME AAF ZI AIGLE AZUR TRANSPORTS AERIENS DIDIER CORNACCHIA AAL AA AMERICAN AIRLINES BRIGITTE BRIGUET AAR OZ ASIANA AIRLINES VINCENT DI PASQUALE AAW 8U AFRIQIYAH AIRWAYS VINCENT DI PASQUALE ACA AC AIR CANADA DIDIER CORNACCHIA ACF SF AIR ORIENT DIDIER CORNACCHIA ADH AP AIR ONE VINCENT DI PASQUALE ADR JP ADRIA AIRWAYS BRIGITTE BRIGUET AEA UX AIR EUROPA VINCENT DI PASQUALE AEE A3 AEGEAN AIRLINES BRIGITTE BRIGUET AEU 5W ASTRAEUS CLAUDE SIMOND AFL SU AEROFLOT RUSSIAN AIRLINES DIDIER CORNACCHIA AFR AF AIR FRANCE DIDIER CORNACCHIA AHY J2 AZERBAIJAN AIRLINES CLAUDE SIMOND AIC AI AIR INDIA BRIGITTE BRIGUET AIZ IZ ARKIA ISRAELI AIRLINES CLAUDE SIMOND ALK UL SRILANKAN AIRLINES VINCENT DI PASQUALE AMC KM AIR MALTA CLAUDE SIMOND AMV AMV AMC AVIATION BRIGITTE BRIGUET AMX AM AEROMEXICO DIDIER CORNACCHIA ANA NH ALL NIPPON AIRWAYS DIDIER CORNACCHIA ANE YW AIR NOSTRUM VINCENT DI PASQUALE ARA W3 ARIK INTERNATIONAL VINCENT DI PASQUALE AUA OS AUSTRIAN AIRLINES BRIGITTE BRIGUET AUI PS UKRAINE INTL AIRLINES CLAUDE SIMOND AVI A0 L'AVION ELYSAIR CLAUDE SIMOND AXN AXN ALEXANDAIR BRIGITTE BRIGUET AXY AXY AXIS AIRWAYS BRIGITTE BRIGUET AZA AZ ALITALIA DIDIER CORNACCHIA BAW BA BRITISH AIRWAYS BRIGITTE BRIGUET BBO BBO FLYBABOO BRIGITTE BRIGUET BCS QY EUROPEAN AIR TRANSPORT CLAUDE SIMOND BCY WX CITYJET DIDIER CORNACCHIA BEE BE FLYBEE BRIGITTE BRIGUET BEL SN SN BRUSSELS AIRLINES BRIGITTE BRIGUET BER AB AIR BERLIN BRIGITTE BRIGUET BIE BIE AIR MEDITERRANEE BRIGITTE BRIGUET BLE BLE BLUE LINE DIDIER CORNACCHIA BLF KF BLUE 1 BRIGITTE BRIGUET BMA BD BMI BRITISH -

00 Coverf NEW.Indd

NOVEMBER 2011 AIRLINE GROUND AGS SERVICES www.evaint.com LUFTHANSA: TURKISH GROUND AIR CARGO HANDLING IATA TRAINING: HANDS OFF SERVICES EYES HANDLING IN DIVERSITY OUT ENHANCING BUT IN CHARGE EXPANSION PICTURES OF AFRICA THE OFFERING CONTENTS | /07&.#&3 PUBLISHER/EDITOR CONTENTS +P.VSSBZ T: +44 (0)1992 424193 2 Handling update &KP!FWBJOUDPN 4 IT update HEAD OF FINANCE/ADMINISTRATION 6 Cargo update 4UFWF.VSSBZ T: +44 (0)1992 424193 8 Routes update &TUFWF!FWBJOUDPN 10 -VGUIBOTBIBOETPGGCVUlSNMZ SALES MANAGER .BY3BKB in charge on the ground T: +44 (0)208 668 1420 Jo Murray speaks to Nils Ecke, Vice President Product Management Airport & &NBY!FWBJOUDPN Passenger Services, and Oliver Widmann, Head of Commercial Airport Relations, Lufthansa, about the airline’s penchant for outsourcing the handling function and yet ADVERTISING SALES EXECUTIVE remaining firmly in charge of all the important parameters on the ground (SBDF)FXJUU T: +44 (0)208 660 2371 14 Turkish Ground Services: &HSBDF!FWBJOUDPN FZFJOHFYQBOTJPOBUIPNFBOEBXBZ Turkish Ground Services comprises more than 3,000 pieces of equipment and 6,000 INTERNATIONAL MEDIA AND Airline Ground Services CONFERENCE PRODUCER staff. It offers ramp, passenger and cargo handling services. Parveen Raja finds out more from Bayram Özçelik, General Manager of TGS T: +44 (0)208 660 9116 F: +44 (0)208 660 3008 16 /PSXFHJBOTUSJWJOHUPXBSETCFJOHMFBO &QBSWFFO!FWBJOUDPN Norwegian Air Shuttle is the second largest airline in Scandinavia, and has a route network that stretches across Europe into North Africa and the Middle -

IATA ANNUAL REVIEW 2012 Tony Tyler Director General & CEO

IATA ANNUAL REVIEW 2012 Tony Tyler Director General & CEO International Air Transport Association Annual Report 2012 68th Annual General Meeting Beijing, June 2012 Contents IATA Membership 2 Board of Governors 4 Director General’s message 6 The state of the industry 10 Feature: What is the benefit of global connectivity? Safety 18 Feature: How safe can we be? Security 22 Feature: Do I need to take my shoes off? Taxation & regulatory policy 26 Feature: What is right for the passenger? Environment 30 Feature: Can aviation biofuels work? Simplifying the Business 36 Feature: What’s on offer? Cost efficiency 42 Feature: Why does economic regulation matter? Industry settlement systems 48 Aviation solutions 52 Note: Unless specified otherwise, all dollar ($) figures refer to US dollars (US$). This review uses only 100% recycled paper (Cyclus Print) and vegetable inks. # IATA Membership as of 1 May 2012 ABSA Cargo Airline Air Nostrum Blue Panorama Donavia Adria Airways Air One Blue1 Dragonair Aegean Airlines Air Pacific bmi Dubrovnik Airline Aer Lingus Air Seychelles British Airways Egyptair Aero República Air Tahiti Brussels Airlines EL AL Aeroflot Air Tahiti Nui Bulgaria air Emirates Aerolineas Argentinas Air Transat C.A.L. Cargo Airlines Estonian Air Aeromexico Air Vanuatu Cargojet Airways Ethiopian Airlines Aerosvit Airlines Air Zimbabwe Cargolux Etihad Airways Afriqiyah Airways Aircalin Caribbean Airlines Euroatlantic Airways Aigle Azur Airlink Carpatair European Air Transport Air Algérie Alaska Airlines Cathay Pacific Eurowings Air Astana -

Punctuality Statistics Economic Regulation Group Aviation Data Unit

Punctuality Statistics Economic Regulation Group Aviation Data Unit Birmingham, Edinburgh, Gatwick, Glasgow, Heathrow, London City, Luton, Manchester, Newcastle, Stansted Full and Summary Analysis September 2005 Disclaimer The information contained in this report will be compiled from various sources and it will not be possible for the CAA to check and verify whether it is accurate and correct nor does the CAA undertake to do so. Consequently the CAA cannot accept any liability for any financial loss caused by the persons reliance on it. Contents Foreword Introductory Notes Full Analysis – By Reporting Airport Birmingham Edinburgh Gatwick Glasgow Heathrow London City Luton Manchester Newcastle Stansted Full Analysis With Arrival / Departure Split – By A Origin / Destination Airport B C – E F – H I – L M – N O – P Q – S T – U V – Z Summary Analysis FOREWORD 1 CONTENT 1.1 Punctuality Statistics: Heathrow, Gatwick, Manchester, Glasgow, Birmingham, Luton, Stansted, Edinburgh, Newcastle and London City - Full and Summary Analysis is prepared by the Civil Aviation Authority with the co-operation of the airport operators and Airport Coordination Ltd. Their assistance is gratefully acknowledged. 2 ENQUIRIES 2.1 Statistics Enquiries concerning the information in this publication and distribution enquiries concerning orders and subscriptions should be addressed to: Civil Aviation Authority Room K4 G3 Aviation Data Unit CAA House 45/59 Kingsway London WC2B 6TE Tel. 020-7453-6258 or 020-7453-6252 or email [email protected] 2.2 Enquiries concerning further analysis of punctuality or other UK civil aviation statistics should be addressed to: Tel: 020-7453-6258 or 020-7453-6252 or email [email protected] Please note that we are unable to publish statistics or provide ad hoc data extracts at lower than monthly aggregate level. -

Air Transport Industry

ANALYSIS OF THE EU AIR TRANSPORT INDUSTRY Final Report 2006 Contract no: TREN/05/MD/S07.52077 by Cranfield University Department of Air Transport Disclaimer and copyright: This report has been carried out for the Directorate-General for Energy and Transport in the European Commission and expresses the opinion of the organisation undertaking the contract TREN/05/MD/S07.52077. These views have not been adopted or in any way approved by the European Commission and should not be relied upon as a statement of the European Commission's or the Transport and Energy DG's views. The European Commission does not guarantee the accuracy of the information given in the report, nor does it accept responsibility for any use made thereof. Copyright in this report is held by the European Communities. Persons wishing to use the contents of this report (in whole or in part) for purposes other than their personal use are invited to submit a written request to the following address: EUROPEAN COMMISSION - DG ENERGY AND TRANSPORT - LIBRARY (DM28, 0/36) - B-1049 BRUSSELS E-MAIL (HTTP://EC.EUROPA.EU/DGS/ENERGY_TRANSPORT/CONTACT/INDEX_EN.HTM) Analysis of the EU Air Transport Industry, 2006 1 CONTENTS 1 AIR TRANSPORT INDUSTRY OVERVIEW........................................................................................9 2 REGULATORY DEVELOPMENTS.....................................................................................................15 2.1 GLOBAL DEVELOPMENTS....................................................................................................................15 -

G:\JPH Section\ADU CODELIST\Codelist.Snp

Codelist Economic Regulation Group Aircraft By Name By CAA Code Airline By Name By CAA Code By Prefix Airport By Name By IATA Code By ICAO Code By CAA Code Codelist - Aircraft by Name Civil Aviation Authority Aircraft Name CAA code End Month AEROSPACELINES B377SUPER GUPPY 658 AEROSPATIALE (NORD)262 64 AEROSPATIALE AS322 SUPER PUMA (NTH SEA) 977 AEROSPATIALE AS332 SUPER PUMA (L1/L2) 976 AEROSPATIALE AS355 ECUREUIL 2 956 AEROSPATIALE CARAVELLE 10B/10R 388 AEROSPATIALE CARAVELLE 12 385 AEROSPATIALE CARAVELLE 6/6R 387 AEROSPATIALE CORVETTE 93 AEROSPATIALE SA315 LAMA 951 AEROSPATIALE SA318 ALOUETTE 908 AEROSPATIALE SA330 PUMA 973 AEROSPATIALE SA341 GAZELLE 943 AEROSPATIALE SA350 ECUREUIL 941 AEROSPATIALE SA365 DAUPHIN 975 AEROSPATIALE SA365 DAUPHIN/AMB 980 AGUSTA A109A / 109E 970 AGUSTA A139 971 AIRBUS A300 ( ALL FREIGHTER ) 684 AIRBUS A300-600 803 AIRBUS A300B1/B2 773 AIRBUS A300B4-100/200 683 AIRBUS A310-202 796 AIRBUS A310-300 775 AIRBUS A318 800 AIRBUS A319 804 AIRBUS A319 CJ (EXEC) 811 AIRBUS A320-100/200 805 AIRBUS A321 732 AIRBUS A330-200 801 AIRBUS A330-300 806 AIRBUS A340-200 808 AIRBUS A340-300 807 AIRBUS A340-500 809 AIRBUS A340-600 810 AIRBUS A380-800 812 AIRBUS A380-800F 813 AIRBUS HELICOPTERS EC175 969 AIRSHIP INDUSTRIES SKYSHIP 500 710 AIRSHIP INDUSTRIES SKYSHIP 600 711 ANTONOV 148/158 822 ANTONOV AN-12 347 ANTONOV AN-124 820 ANTONOV AN-225 MRIYA 821 ANTONOV AN-24 63 ANTONOV AN26B/32 345 ANTONOV AN72 / 74 647 ARMSTRONG WHITWORTH ARGOSY 349 ATR42-300 200 ATR42-500 201 ATR72 200/500/600 726 AUSTER MAJOR 10 AVIONS MUDRY CAP 10B 601 AVROLINER RJ100/115 212 AVROLINER RJ70 210 AVROLINER RJ85/QT 211 AW189 983 BAE (HS) 748 55 BAE 125 ( HS 125 ) 75 BAE 146-100 577 BAE 146-200/QT 578 BAE 146-300 727 BAE ATP 56 BAE JETSTREAM 31/32 340 BAE JETSTREAM 41 580 BAE NIMROD MR.