US$2.6 Billion US$27.1 Billion Over US$5.7 Billion US

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

9193 Avolon AR 2019 WEB H

contents 1 2019 Highlights 2 Chairman’s Message 4 CEO’s Message 8 Leadership Front Cover The Avolon logo is populated with 10 Board of Directors icons that represent our values of Transparency, Respect, Insightfulness, Bravery 12 Journey to Investment Grade and Ebullience. 14 CARE 2019 16 Avolon and the Arts 18 2019 Industry Recognition & Awards Highlights 20 Celebration of Flight 22 Thought Leadership 24 Diversity & Inclusion 26 Graduate Programme 28 Avolon Aviation School Note Regarding Forward-Looking Statements 30 Our Fleet This document includes forward-looking statements, beliefs or opinions, including statements with respect to Avolon’s business, 32 CFO’s Statement financial condition, results of operations and plans. These forward-looking statements involve known and unknown risks and uncertainties, many of which are beyond our control and all of which 37 Consolidated Financial are based on our management’s current beliefs and expectations Statements about future events. Forward-looking statements are sometimes identified by the use of forward-looking terminology such as “believe,” “expects,” “may,” “will,” “could,” “should,” “shall,” “risk,” “intends,” “estimates,” “aims,” “plans,” “predicts,” “continues,” “assumes,” “positioned” or “anticipates” or the negative thereof, other variations thereon or comparable terminology or by discussions of strategy, plans, objectives, goals, future events or intentions. These forward- looking statements include all matters that are not historical facts. Forward-looking statements may and often -

Aircraft Leasing Refer to Important Disclosures at the End of This Report

Asian Insights SparX – Aviation Aircraft Leasing Refer to important disclosures at the end of this report DBS Group Research . Equity 10 February 2017 HSI : 23,575 Asian Lessors in the Ascendancy Asian lessors have, notably via acquisitions, muscled Analyst • Paul YONG CFA +65 6682 3712 in amongst the top players globally in recent years [email protected] [email protected] With 3 players now listed in HK and a myriad of Singapore Research Team Asian names linked with potential deals in this • space, the sector should continue to garner interest Backed by firm long-term secular growth in air passenger travel globally, we are positive on the prospects of aircraft leasing, which provides better • returns and earnings visibility compared to airlines Our top pick is BOC Aviation (BUY, TP HK$48.40) and we initiate coverage on China Aircraft Leasing Stocks • (CALC) with a BUY call and HK$11.60 TP Mkt 12-mth Price Cap Target Performance (%) Price 3 mth 12 mth Stable cash flows and returns attract Asian investors. HK$ US$m HK$ Rating Faced with lower growth and returns in other assets, and BOC Aviation 41.30 3,632 48.40 (2.6) NA BUY helped by cheaper cost of debt funding, we believe Asian CALCChina 9.23 733 11.60 (3.5) 61.9 BUY investors of all types – banks, insurance companies and even CDB Financial Leas 1.94 3,129 2.01* 0.0 NA NR family funds, are looking towards aircraft leasing assets to provide stable and predictable cash flows and returns. Closing price as of 9 Feb 2017 * Potential Target Source: DBS Bank Long-term air travel growth underpins prospects for aircraft leasing. -

Luxembourg As an Aspiring Platform for the Aircraft Engine Industry

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Koster, Peter Research Report Luxembourg as an aspiring platform for the aircraft engine industry EIKV-Schriftenreihe zum Wissens- und Wertemanagement, No. 13 Provided in Cooperation with: European Institute for Knowledge & Value Management (EIKV), Luxemburg Suggested Citation: Koster, Peter (2016) : Luxembourg as an aspiring platform for the aircraft engine industry, EIKV-Schriftenreihe zum Wissens- und Wertemanagement, No. 13, European Institute for Knowledge & Value Management (EIKV), Rameldange This Version is available at: http://hdl.handle.net/10419/147292 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen -

Global Leaders in Aviation Finance

Global Leaders in Aviation Finance kpmg.ie/aviation Why Ireland Choose KPMG Since the creation of Guinness Peat Aviation Based in Ireland, KPMG has been the leading adviser to the international leasing industry for over 30 years. We are (GPA) in the 1970’s, Ireland has been a globally recognised as the Aviation Finance and Leasing centre of excellence in aviation finance Centre of Excellence with an incomparable scale and depth and leasing, with an extensive number of of experience within the sector. skilled arrangers, managers and advisors We provide a range of audit, tax and advisory services and based here. More than half of the world’s can assist across a range of issues. No matter what stage leased aircraft are leased from Ireland. your company is at, we have the expertise to help you. Most significant transactions in the sector have involved Irish leasing companies. The KPMG Ireland is the leading transaction advisory industry looks set to grow further, with very firm in the global aviation finance market large orders being placed by Irish lessors. X We are the only professional services firm identified in the “AirFinance Power 30” list of companies that make an essential contribution to aviation finance. To qualify, The Irish Government’s ongoing commitment to maintaining all companies had to meet one test: if they went out of competitiveness is evidenced in the recent introduction of business would the market feel a significant loss? the ‘Aviation Act’, which came into force in July 2014. This Act, should enable investors to benefit from ‘Alternative A’ X We have the biggest concentration of aircraft leasing type protection in the Cape Town Convention. -

Msc Finance Dissertation

___________________________________________________________________________ MSc Finance Dissertation Research topic: ‘Aircraft leasing: A review of Ireland’s role in its past, present and future development’ ENDA DUNNE Submitted to the National College of Ireland, August 2019 ___________________________________________________________________________ Page | i Aircraft leasing: A review of Ireland’s role in its past, present and future development - Enda Dunne Abstract: This paper highlights various factors which contributed to the development of aircraft leasing both globally and in Ireland. It identifies and assesses the risks to the sector including to Irelands status as a leading global hub. This includes those risks posed by new market entrants, EU and OECD regulations, talent shortage, the climate change movement and financial incentives offered by foreign jurisdictions. These incentives are important to multinational corporations and it costs states little to offer these to lessors considering setting up or relocating there. This has been highlighted as a key concern by the industry representative body, Aircraft Leasing Ireland. The success of aircraft leasing has attracted several new market entrants, leading to increased competition as global investors search for yield in the face deteriorating margins in traditional markets such as equities and fixed income (Bollen, 2019). Global stock markets fluctuated throughout 2018/19 with fears of a global recession growing (Reuters/Bloomberg, 2019). Airline bankruptcies have increased (Thoppil, 2019) and others are struggling to refinance debt (Taylor, 2018), having a knock-on effect for aircraft lessors. The research shows that Ireland benefitted from being home to GPA under the leadership of Tony Ryan which led the development of aircraft leasing here. Growth in the sector owes much to consecutive Irish governments and government agencies creating a competitive fiscal environment. -

S/C/W/163 3 August 2000 ORGANIZATION (00-3257)

WORLD TRADE RESTRICTED S/C/W/163 3 August 2000 ORGANIZATION (00-3257) Council for Trade in Services DEVELOPMENTS IN THE AIR TRANSPORT SECTOR SINCE THE CONCLUSION OF THE URUGUAY ROUND PART ONE Note by the Secretariat This Note has been produced at the request of the Council for Trade in Services in the framework of the review of the Air Transport Annex which stipulates in paragraph 5 that "The Council for Trade in Services shall review periodically, and at least every five years, developments in the air transport sector and the operation of this Annex with a view to considering the possible further application of the Agreement in this sector.". The Secretariat has been asked through the Council for Trade in Services to update document S/C/W/59, dated 5 November 1998 and document S/C/W/129, dated 15 October 1999. This Note addresses both the economic and regulatory developments in the sector, in both a historical (1993) and contemporary (1999) framework. Since the Annex provides no definition of the sector, the paper tries to encompass all aspects of air transport and air transport-related services following the model of the former Secretariat document S/C/W/59 on the same subject examined during the exchange of information program in 1998. It largely draws on this document as well as on ICAO publications and in particular, the annual report "The World of Civil Aviation" (first edition, 1992). Additional professional sources such as IATA documents and press sources have also been used. As indicated during the Council session held on July 2000, the Council requested due to time constraints, that the document be in three parts. -

Asia Aviation Sector Aircraft Leasing: Asian Players Taking Flight 19

SECTOR BRIEFING number DBS Asian Insights DBS Group38 Research • April 2017 Asia Aviation Sector Aircraft Leasing: Asian Players Taking Flight 19 DBS Asian Insights SECTOR BRIEFING 38 02 Asia Aviation Sector Aircraft Leasing: Asian Players Taking Flight Paul Yong CFA Equity Analyst DBS Group Research [email protected] Singapore Research Team DBS Group Research [email protected] Produced by: Asian Insights Office • DBS Group Research go.dbs.com/research @dbsinsights [email protected] Goh Chien Yen Editor-in-Chief Jean Chua Managing Editor Geraldine Tan Editor Martin Tacchi Art Director 19 DBS Asian Insights SECTOR BRIEFING 38 03 04 Investment Summary 06 Global Air Traffic on Long-Term Growth Path 13 Aircraft Demand and Fleet Development 19 Aircraft Financing 24 Aircraft Leasing: Background 27 Strategies Commonly Employed by Top Lessors 32 Emergence of Aircraft Lessors in Asia Chinese Lessors to the Fore Japanese Lessors: Emerging Once More Other Non-Traditional Lessors Hong Kong’s Tycoons Join the Party Potential Transactions in Aviation Leasing Spac Draw of Aircraft Leasing 44 Valuations and Equity Picks 47 Key Risk Factors 50 Appendix Aircraft Leasing 101 What’s Driving the Popularity of Aircraft Leasing? Critical Success Factors for Aircraft Lessors Drivers of Aircraft Value DBS Asian Insights SECTOR BRIEFING 38 04 Investment Summary Rising global air ccording to the International Air Transport Association (IATA), global air passenger traffic passenger traffic rose 5.9% year-on-year in 2016 and is projected to grow 5.1% in 2017. Based on Boeing’s estimates, global revenue passenger kilometres (RPKs) will almost triple by 2035 to reach 17,093 billion passenger-kilometres A(p-km), which represents a compound annual growth rate (CAGR) of 4.8% for a 20-year growth period from 2015 to 2035. -

Aercap Holdings NV Dutch GAAP Annual Report For

AerCap Holdings N.V. Dutch GAAP Annual Report for the year ended December 31, 2012 1 INDEX TO ANNUAL REPORT AerCap Holdings N.V. Annual Report 2012, Amsterdam Annual Directors’ Report ..................................................... 3 Consolidated Financial Statements Consolidated Balance Sheets as of December 31, 2011 and 2012 ....................... 29 Consolidated Income Statements For the Years Ended December 31, 2011 and 2012 ........ 30 Consolidated Statements of Cash Flows For the Years Ended December 31, 2011 and 2012 . 31 Consolidated Statements of Changes in Shareholders’ Equity For the Years Ended December 31, 2011 and 2012 ............................................... 32 Notes to the Consolidated Financial Statements ................................... 33 Company Financial Statements Company Balance Sheets as of December 31, 2011 and 2012 ......................... 98 Company Income Statements For the Years Ended December 31, 2011 and 2012 ........... 99 Notes to the Company Financial Statements ..................................... 100 Other information Profit appropriation according to Articles of Association ............................. 104 Appropriation of year end results ............................................. 104 Auditor’s report .......................................................... 105 2 DIRECTORS’ REPORT Description of business We are an integrated global aviation company with a leading market position in aircraft leasing. It is our strategy to acquire aviation assets at attractive prices, lease the -

Security Analysis by Benjamin Graham and David L. Dodd

PRAISE FOR THE SIXTH EDITION OF SECURITY ANALYSIS “The sixth edition of the iconic Security Analysis disproves the adage ‘’tis best to leave well enough alone.’ An extraordinary team of commentators, led by Seth Klarman and James Grant, bridge the gap between the sim- pler financial world of the 1930s and the more complex investment arena of the new millennium. Readers benefit from the experience and wisdom of some of the financial world’s finest practitioners and best informed market observers. The new edition of Security Analysis belongs in the library of every serious student of finance.” David F. Swensen Chief Investment Officer Yale University author of Pioneering Portfolio Management and Unconventional Success “The best of the past made current by the best of the present. Tiger Woods updates Ben Hogan. It has to be good for your game.” Jack Meyer Managing Partner and CEO Convexity Capital “Security Analysis, a 1940 classic updated by some of the greatest financial minds of our generation, is more essential than ever as a learning tool and reference book for disciplined investors today.” Jamie Dimon Chairman and CEO JPMorgan Chase “While Coca-Cola found it couldn’t improve on a time-tested classic, Seth Klarman, Jim Grant, Bruce Greenwald, et al., prove that a great book can be made even better. Seth Klarman’s preface should be required reading for all investors, and collectively, the contributing editors’ updates make for a classic in their own right. The enduring lesson is that an understand- ing of human behavior is a critical part of the process of security analysis.” Brian C. -

The Aviation Industry Leaders Report 2019: Tackling Headwinds

The Aviation Industry Leaders Report 2019: Tackling headwinds www.aviationnews-online.com www.kpmg.ie/aviation GROWTH FRONTIERS NEW YORK 2019 16th-18th October 2019 Intercontinental New York Barclay, New York, USA Growth Frontiers Conference 40 under 40 & Aviation 100 Americas Awards Intercontinental New York Barclay, New York Intercontinental New York Barclay, New York 17th-18th October 2019 17th October 2019 For more information and bookings contact: [email protected] or call +44 (0) 1782 619 888 NEW-YORK-2019.indd 1 15/01/2019 10:07 NEW YORK CONTENTS 3 Foreword 4 Executive Summary 8 The State of the Aviation Industry 11 Regional optimism levels 28 Aviation Finance 46 Aircraft Market 54 Digital Transformation 56 Final Thoughts THE AVIATION INDUSTRY PRODUCTION AND ONLINE PUBLISHER LEADERS REPORT 2019 Dino D’Amore Aviation News Ltd [email protected] Registered in England & Wales: 7351543 EDITOR & AUTHOR CONFERENCES & EVENTS Registered address: Victoria Tozer-Pennington Louise Abbots Suite 1, First Floor, Parklands, 1 Lyme Drive, [email protected] [email protected] Trent Vale, Stoke-On-Trent, ST4 6NW CONTRIBUTORS Lauren Eldershaw VAT number: GB 102 4185 61 Tom Woods [email protected] Copyright 2019 Aviation News Ltd ADVERTISING & SPONSORSHIP ENQUIRIES SUBSCRIPTION ENQUIRIES Airline Economics (Print) ISSN 2045-7154 Philip Tozer-Pennington Annual subscription: Airline Economics (Online) ISSN 2045-7162 [email protected] £265 (+VAT where applicable) John Pennington All rights reserved. No part of this publication may be repro- Guy Helliker [email protected] duced by any means whatsoever without express permission of [email protected] the Publisher. -

Aviation Finance and Leasing

Aircraft involving financing arrangements, have the requisite expertise to deal with complex structures, including those involving Aviation finance cross-border elements and the particular challenges they present. Clearly however, these factors are and leasing not necessarily unique to Ireland. Similarities are discernible, for instance, in the legal and regulatory systems of Malta, Singapore and the Cayman Islands. All three jurisdictions have sophisticated common law based legal systems and By Conor Keaveny, Partner Malta is also an EU member state. Location and Sean Murray, Partner, Ireland can boast its European credentials but at the same time market its Dillon Eustace, Dublin, Ireland location as bridging the divide between the USA and Europe. Once again, however, Ireland does not necessarily enjoy a monopoly in this regard. The Cayman Islands can also present itself as an ideal reland has long been regarded as a jurisdictions) but include a stable and neutral jurisdiction in circumstances where leading jurisdiction for aviation sophisticated legal system, an “onshore” transactions involve an international finance and leasing. The jurisdiction and a very favourable taxation dimension and Cayman Islands law is development of the aviation sector in regime, together with other attractive frequently selected as the governing law for IIreland can be traced back to the 1970s features, such as membership of the agreements in international transactions. when the late Dr. Tony Ryan founded European Union (EU) and the Organisation Similarly, both Malta and Singapore claim Guinness Peat Aviation (GPA) in Shannon, for Economic Co-operation and their locations offer unique advantages. County Clare. Notwithstanding its failed Development, a favourable geographic Malta points to its Mediterranean location flotation in the early 1990s, GPA played a location, and the fact it is an English- as a natural hub for European, African and pivotal role in forging Ireland’s reputation as speaking jurisdiction with a well-educated Middle Eastern business activity. -

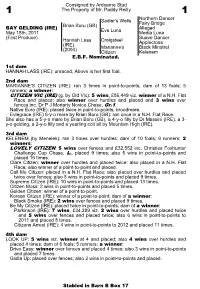

Consigned by Ardcarne Stud the Property of Mr. Paddy Reilly

Consigned by Ardcarne Stud 1 The Property of Mr. Paddy Reilly 1 Northern Dancer Sadler's Wells Brian Boru (GB) Fairy Bridge BAY GELDING (IRE) Alleged May 18th, 2011 Eva Luna Media Luna (First Produce) Suave Dancer Hannah Lass Craigsteel Applecross (IRE) Black Minstrel (2004) Marianne's Citizen Kelenem E.B.F. Nominated. 1st dam HANNAH LASS (IRE): unraced, Above is her first foal. 2nd dam MARIANNE'S CITIZEN (IRE): ran 3 times in point-to-points; dam of 13 foals; 5 runners; a winner: CITIZEN VIC (IRE) (g. by Old Vic): 5 wins, £86,449 viz. winner of a N.H. Flat Race and placed; also winner over hurdles and placed and 3 wins over fences inc. Dr P J Moriarty Novice Chase, Gr.1. Native Euro (IRE): placed twice in point-to-points; broodmare. Eviegrace (IRE) 6-y-o mare by Brian Boru (GB): ran once in a N.H. Flat Race. She also has a 5-y-o mare by Brian Boru (GB), a 4-y-o filly by Dr Massini (IRE), a 3- y-o gelding, a 2-y-o filly and a yearling colt all by Mountain High (IRE). 3rd dam KELENEM (by Menelek): ran 3 times over hurdles; dam of 10 foals; 9 runners; 2 winners: LOVELY CITIZEN: 5 wins over fences and £32,552 inc. Christies Foxhunter Challenge Cup Chase, L., placed 9 times; also 5 wins in point-to-points and placed 16 times. Clare Citizen: winner over hurdles and placed twice; also placed in a N.H. Flat Race; also winner of a point-to-point and placed.