Handbook for Conservators of Adults

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Judgment Claims in Receivership Proceedings*

JUDGMENT CLAIMS IN RECEIVERSHIP PROCEEDINGS* JOHN K. BEACH Connecticuf Supreme Court of Errors In view of the importance of the subject it is unfortunate that so few of the reported cases on equitable receiverships of corporations have dealt in any comprehensive way with the principles underlying the administrating of the fund for the benefit of creditors. The result is that controversy has outstripped authoritative decision, and the subject is unsettled. To this generalization an exception must be noted in respect of the special topic of the application of current rail- way income to current expenses, before the payment of mortgage 1 indebtedness. On another disputed topic, the provability of imma.ure claims, the law, or at least the right principle of decision, has been settled, by the notable opinion of Judge Noyes in Pennsylvania Steel Company v. New York City Railway Company,2 followed and rein- forced by that of Mr. Justice Holmes in William Filene'sSons Company v. Weed.' Notwithstanding these important exceptions, the dearth of authority on the general subject is such that Judge Noyes refers to a case cited in his opinion as "almost the only case in which rules have "been formulated with respect to the provability of claims against "insolvent corporations."4 Upon the particular phase of the subject here discussed, the decisions are to some extent in conflict, and no attempt seems to have been made in text books or decisions to examine the question in the light of principle. Black, for example, dismisses the subject by saying it. is generally conceded that a receiver and the corporation whose property is under his charge "are so far in privity that a judgment against the * This paper deals only with judgments against the defendant in the receiver- ship, regarded as evidence of the validity and amount of the judgment creditor's claims for dividends to be paid out of the fund in the receiver's hands. -

Self-Represented Creditor

UNITED STATES BANKRUPTCY COURT DISTRICT OF MASSACHUSETTS A GUIDE FOR THE SELF-REPRESENTED CREDITOR IN A BANKRUPTCY CASE June 2014 Table of Contents Subject Page Number Legal Authority, Statutes and Rules ....................................................................................... 1 Who is a Creditor? .......................................................................................................................... 1 Overview of the Bankruptcy Process from the Creditor’s Perspective ................... 2 A Creditor’s Objections When a Person Files a Bankruptcy Petition ....................... 3 Limited Stay/No Stay ..................................................................................................... 3 Relief from Stay ................................................................................................................ 4 Violations of the Stay ...................................................................................................... 4 Discharge ............................................................................................................................. 4 Working with Professionals ....................................................................................................... 4 Attorneys ............................................................................................................................. 4 Pro se ................................................................................................................................................. -

Intermediate Elder Law Update

INTERMEDIATE ELDER LAW UPDATE Tuesday, November 1, 2016 New York City Wednesday, November 2, 2016 Westchester Wednesday, November 9, 2016 Buffalo/Amherst Thursday, November 10, 2016 Albany Wednesday, November 16, 2016 Long Island NYSBA Co-Sponsors: Elder Law and Special Needs Section Committee on Continuing Legal Education This program is offered for education purposes. The views and opinions of the faculty expressed during this program are those of the presenters and authors of the materials. Further, the statements made by the faculty during this program do not constitute legal advice. Copyright ©2016 All Rights Reserved New York State Bar Association Lawyer Assistance Program 1.800.255.0569 Q. What is LAP? A. The Lawyer Assistance Program is a program of the New York State Bar Association established to help attorneys, judges, and law students in New York State (NYSBA members and non-members) who are affected by alcoholism, drug abuse, gambling, depression, other mental health issues, or debilitating stress. Q. What services does LAP provide? A. Services are free and include: • Early identification of impairment • Intervention and motivation to seek help • Assessment, evaluation and development of an appropriate treatment plan • Referral to community resources, self-help groups, inpatient treatment, outpatient counseling, and rehabilitation services • Referral to a trained peer assistant – attorneys who have faced their own difficulties and volunteer to assist a struggling colleague by providing support, understanding, guidance, and good listening • Information and consultation for those (family, firm, and judges) concerned about an attorney • Training programs on recognizing, preventing, and dealing with addiction, stress, depression, and other mental health issues Q. -

UK (England and Wales)

Restructuring and Insolvency 2006/07 Country Q&A UK (England and Wales) UK (England and Wales) Lyndon Norley, Partha Kar and Graham Lane, Kirkland and Ellis International LLP www.practicallaw.com/2-202-0910 SECURITY AND PRIORITIES ■ Floating charge. A floating charge can be taken over a variety of assets (both existing and future), which fluctuate from 1. What are the most common forms of security taken in rela- day to day. It is usually taken over a debtor's whole business tion to immovable and movable property? Are any specific and undertaking. formalities required for the creation of security by compa- nies? Unlike a fixed charge, a floating charge does not attach to a particular asset, but rather "floats" above one or more assets. During this time, the debtor is free to sell or dispose of the Immovable property assets without the creditor's consent. However, if a default specified in the charge document occurs, the floating charge The most common types of security for immovable property are: will "crystallise" into a fixed charge, which attaches to and encumbers specific assets. ■ Mortgage. A legal mortgage is the main form of security interest over real property. It historically involved legal title If a floating charge over all or substantially all of a com- to a debtor's property being transferred to the creditor as pany's assets has been created before 15 September 2003, security for a claim. The debtor retained possession of the it can be enforced by appointing an administrative receiver. property, but only recovered legal ownership when it repaid On default, the administrative receiver takes control of the the secured debt in full. -

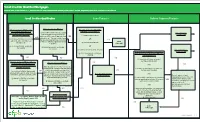

QM Small Creditor Flow Chart

SSmmaallll CCrreeddiittoorr QQuuaalliiffiieedd MMoorrttggaaggeess RReefflleeccttss rruulleess iinn eeffffeecctt oonn MMaarrcchh 11,, 22002211 bbuutt ddooeess nnoott rreefflleecctt aammeennddmmeennttss mmaaddee bbyy tthhee EEccoonnoommiicc GGrroowwtthh,, RReegguullaattoorryy RReelliieeff,, aanndd CCoonnssuummeerr PPrrootteeccttiioonn AAcctt.. Type of Compliance Presumption: SmSmaallll CCrreeddiitotorr QQuuaalliifificcaatitioonn Loan Features Balloon Payment Features Underwriting Points and Fees Portfolio Higher-Priced Loan Did you do ALL of the following?: Did you and your affiliates: Did you and your affiliates who Does the loan have ANY of the Rebuttable Presumption At the time of consummation: are creditors that extended following characteristics?: (1) Consider and verify the consumer’s YES Applies Extend 2,000 or fewer first-lien, closed- Does the loan amount fall within the following covered transactions during the Potential Small debt obligations and income or assets? STOP end residential mortgages that are points-and-fees limits? Was the loan subject to forward last calendar year have: (1) negative amortization; Creditor QM [via § 1026.43(c)(7), (e)(2)(v)]; = Non-Small Creditor QM (QM is presumed to comply subject to ATR requirements in the last YES commitment? AND YES YES = Non-Balloon-Payment QM with ATR requirements if calendar year? You can exclude loans Points-and-fees caps (adjusted annually) Assets below $2 billion (as annually OR AND it’s a higher-priced loan, but YES [§ 1026.43(e)(5)(i)(C), (f)(1)(v)] that you originated and kept in portfolio consumers can rebut the adjusted) at the end of the last STOP If Loan Amount ≥ $100,000, then = 3% of total or that your affiliate originated and kept (2) interest-only features; (2) Calculate the consumer’s monthly presumption by showing calendar year? = Non-QM If $100,000 > Loan Amount ≥ $60,000, then = $3,000 in portfolio. -

Creditor Control of Corporations Operating Receiverships Corporate Reorganizations Chester Rohrlich

Cornell Law Review Volume 19 Article 3 Issue 1 December 1933 Creditor Control of Corporations Operating Receiverships Corporate Reorganizations Chester Rohrlich Follow this and additional works at: http://scholarship.law.cornell.edu/clr Part of the Law Commons Recommended Citation Chester Rohrlich, Creditor Control of Corporations Operating Receiverships Corporate Reorganizations, 19 Cornell L. Rev. 35 (1933) Available at: http://scholarship.law.cornell.edu/clr/vol19/iss1/3 This Article is brought to you for free and open access by the Journals at Scholarship@Cornell Law: A Digital Repository. It has been accepted for inclusion in Cornell Law Review by an authorized administrator of Scholarship@Cornell Law: A Digital Repository. For more information, please contact [email protected]. CREDITOR CONTROL OF CORPORATIONS; OPERATING RECEIVERSHIPS; COR- PORATE REORGANIZATIONS* CHESTER RoHRmicnt A corporation is, on a smaller scale (in some instances on a larger scale), like the political state, in that beneath the cloak of its unity there is a continuous, at times active but more frequently passive, struggle for power among the various groups in interest. Some of these groups, such as the public that deals with it or the employees who work for it, have as yet achieved only the the barest minimum of legal right to control its destinies.' In the arena of the law, the traditional conflict is between the stockholders2 and the creditors. There is an increasing convergence of interest between these two groups as the former become more and more "investors" rather than entrepreneurs, and the latter less and less inclined, or able, to stand on the letter of their bond'3 both are in the last analysis dependent *This article is the substance of one of the chapters of the author's forthcoming book THE LAW AND PRACTICE OF CORPORATE CONTROL. -

UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT of NEW YORK for PUBLICATION ------X in Re: RICHARD HARTLEY Chapter 7 and KARA L

UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK FOR PUBLICATION --------------------------------------------------------X In re: RICHARD HARTLEY Chapter 7 and KARA L. HARTLEY, No. 09-37770 (CGM) Debtors. --------------------------------------------------------X JENNIFER ESPOSITO, Plaintiff, v. Adv. Pro. No. 10-9055 (CGM) RICHARD HARTLEY and KARA L. HARTLEY, Defendants. --------------------------------------------------------X APPEARANCES: DRAKE LOEB HELLER KENNEDY GOGERTY GABA & RODD, PLLC 555 Hudson Valley Avenue Suite 100 New Windsor, NY 12553 By: Stuart Kossar Attorneys for Plaintiff, Jennifer Esposito GREHER LAW OFFICES, P.C. 1161 Little Britain Road Suite B New Windsor, NY 12553 By: Warren Greher Attorney for the Defendants, Richard and Kara Hartley MEMORANDUM DECISION GRANTING PLAINTIFF’S MOTION FOR SUMMARY JUDGEMENT The plaintiff brings this adversary proceeding to except from discharge a judgment obtained against the defendants’ deli and catering business, Hartley’s Catering, Inc. (“Hartley’s Catering”). Because the defendants dissolved the corporation without giving plaintiff notice and opportunity to enforce her judgment against it, the defendants are jointly and severally liable for Page 1 of 12 on the judgment. The debt is non-dischargeable as property obtained by false pretenses, pursuant to section 523(a)(2)(A) and for failure to list the plaintiff in the petition pursuant to 523(a)(3). Background On November 13 2003, Hartley’s Catering was incorporated in the state of New York. Stmt. Material Facts ¶ 1. On February 21, 2008, the New York State Commission of the Division of Human Rights found Hartley’s Catering d/b/a Schlesinger’s Deli Depot, liable to the plaintiff in the amount of $300,000. Stmt. Material Facts ¶ 50. -

Overview of the Fdic As Conservator Or Receiver

September 26, 2008 OVERVIEW OF THE FDIC AS CONSERVATOR OR RECEIVER This memorandum is an overview of the receivership and conservatorship authority of the Federal Deposit Insurance Corporation (the “FDIC”). In view of the many and complex specific issues that may arise in this context, this memorandum is necessarily an overview, but it does give particular reference to counterparty issues that might arise in the case of a relatively large complex bank such as a significant regional bank and outlines elements of the FDIC framework which differ from a corporate bankruptcy. This memorandum has three parts: (1) background on the legal framework governing FDIC resolutions, highlighting changes and developments since the 1990s; (2) an outline of six distinctive aspects of the FDIC approach with comparison to the bankruptcy law provisions; and (3) a final section illustrating issues and uncertainties in the FDIC resolutions process through a more detailed review of two examples – treatment of loan securitizations and participations, and standby letters of credit.1 Relevant additional materials include: the pertinent provisions of the Federal Deposit Insurance (the "FDI") Act2 and FDIC rules3, statements of policy4 and advisory opinions;5 the FDIC Resolution Handbook6 which reflects the FDIC's high level description of the receivership process, including a contrast with the bankruptcy framework; recent speeches of FDIC Chairman 1 While not exhaustive, these discussions are meant to be exemplary of the kind of analysis that is appropriate in analyzing any transaction with a bank counterparty. 2 Esp. Section 11 et seq., http://www.fdic.gov/regulations/laws/rules/1000- 1200.html#1000sec.11 3 Esp. -

Beyond Guardianship: Toward Alternatives That Promote Greater Self-Determination

Beyond Guardianship: Toward Alternatives That Promote Greater Self-Determination National Council on Disability March 22, 2018 National Council on Disability (NCD) 1331 F Street NW, Suite 850 Washington, DC 20004 Beyond Guardianship: Toward Alternatives That Promote Greater Self-Determination National Council on Disability, March 22, 2018 Celebrating 30 years as an independent federal agency This report is also available in alternative formats. Please visit the National Council on Disability (NCD) website (www.ncd.gov) or contact NCD to request an alternative format using the following information: [email protected] Email 202-272-2004 Voice 202-272-2022 Fax The views contained in this report do not necessarily represent those of the Administration, as this and all NCD documents are not subject to the A-19 Executive Branch review process. National Council on Disability An independent federal agency making recommendations to the President and Congress to enhance the quality of life for all Americans with disabilities and their families. Letter of Transmittal March 22, 2018 President Donald J. Trump The White House 1600 Pennsylvania Avenue NW Washington, DC 20500 Dear Mr. President: The National Council on Disability (NCD) is pleased to submit its report, Beyond Guardianship: Toward Alternatives That Promote Greater Self-Determination for People with Disabilities, which provides a comprehensive review of guardianship against the backdrop of the civil rights advancements of individuals with disabilities in the past several decades. While people with a variety of disabilities may face guardianship, the burgeoning aging population in America has forced issues surrounding guardianship to the fore in national media coverage and policy debates in recent years, making NCD’s report a timely contribution to policy discussions. -

Liquidators, Receivers and Examiners Their Duties and Powers

Liquidators, Receivers and Examiners Their duties and powers A quick guide Introduction We have produced this information booklet to explain the powers, duties and responsibilities of liquidators, receivers and examiners under the Companies Acts. What are liquidations, receiverships and examinerships? The liquidation of a company is also known as ‘winding up’ a company. The process takes the company out of existence in an orderly way by paying debts from any available assets. Receivership is used by banks or other lenders to sell a company asset that was promised to them if the company failed to repay its loan as agreed. Examinership is a process that protects a company from its creditors (the people to whom it owes money) while efforts are being made to keep it running as a going concern. What are liquidators, receivers and examiners? A liquidator is the person who winds up a company. A receiver is the person who sells particular company assets on behalf of a lender. Where a loan is secured on a company’s entire business, a ‘receiver manager’ can be appointed as manager of the business during the receivership. Once a receiver raises enough money to pay back the debt, their job is finished. Liquidators, Receivers and Examiners Their duties and powers Examiners consider if a company can be saved and, if it can, they prepare the rescue plan. Who can act as liquidators, receivers or examiners? Liquidators, receivers and examiners do not need to have any specific qualifications under the law. However, they are usually practising accountants. To make sure that liquidators, receivers and examiners work independently of the company, they cannot be: • a director or employee of the company; or • a family member, partner or employee of a director. -

Credit Risk Retention Rules

DEPARTMENT OF THE TREASURY Office of the Comptroller of the Currency 12 CFR Part 43 Docket No. OCC-2013-0010 RIN 1557-AD40 FEDERAL RESERVE SYSTEM 12 CFR Part 244 Docket No. R-1411 RIN 7100-AD70 FEDERAL DEPOSIT INSURANCE CORPORATION 12 CFR Part 373 RIN 3064-AD74 FEDERAL HOUSING FINANCE AGENCY 12 CFR Part 1234 RIN 2590-AA43 SECURITIES AND EXCHANGE COMMISSION 17 CFR Part 246 Release No. 34-73407; File No. S7-14-11 RIN 3235-AK96 DEPARTMENT OF HOUSING AND URBAN DEVELOPMENT 24 CFR Part 267 RIN 2501-AD53 Credit Risk Retention AGENCIES: Office of the Comptroller of the Currency, Treasury (OCC); Board of Governors of the Federal Reserve System (Board); Federal Deposit Insurance Corporation (FDIC); U.S. Securities and Exchange Commission (Commission); Federal Housing Finance Agency (FHFA); and Department of Housing and Urban Development (HUD). ACTION: Final rule. SUMMARY: The OCC, Board, FDIC, Commission, FHFA, and HUD (the agencies) are adopting a joint final rule (the rule, or the final rule) to implement the credit risk retention requirements of section 15G of the Securities Exchange Act of 1934 (15. U.S.C. 78o-11), as added by section 941 of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the Act or Dodd-Frank Act). Section 15G generally requires the securitizer of asset- backed securities to retain not less than 5 percent of the credit risk of the assets collateralizing the asset-backed securities. Section 15G includes a variety of exemptions from these requirements, including an exemption for asset-backed securities that are collateralized exclusively by residential mortgages that qualify as “qualified residential mortgages,” as such term is defined by the agencies by rule. -

Fannie Mae and Freddie Mac in Conservatorship: Frequently Asked Questions

Fannie Mae and Freddie Mac in Conservatorship: Frequently Asked Questions Updated May 31, 2019 Congressional Research Service https://crsreports.congress.gov R44525 Fannie Mae and Freddie Mac in Conservatorship: Frequently Asked Questions Summary Fannie Mae and Freddie Mac are chartered by Congress as government-sponsored enterprises (GSEs) to provide liquidity in the mortgage market and promote homeownership for underserved groups and locations. The GSEs purchase mortgages, retain the credit risk (for a fee), and package them into mortgage-backed securities (MBSs) that they either keep as investments or sell to institutional investors. In the years following the housing and mortgage market turmoil that began around 2007, the GSEs experienced financial difficulty. By 2008, the GSEs’ financial condition had weakened, generating concerns over their ability to meet their combined obligations on $1.2 trillion in bonds and $3.7 trillion in MBSs that they had guaranteed at the time. In response, the Federal Housing Finance Agency (FHFA), the GSEs’ primary regulator, took control of them in a process known as conservatorship. Subject to the terms of the Senior Preferred Stock Purchase Agreements (PSPAs) between the U.S. Treasury and the GSEs, Treasury provided funds to keep the GSEs solvent. The GSEs initially agreed to pay Treasury a 10% cash dividend on funds received, and dividends were suspended for all other GSE stockholders. If the GSEs had enough profit at the end of the quarter, the dividend came out of the profit. When the GSEs did not have enough cash to pay their dividend to Treasury, they asked for additional cash to make the payment instead of issuing additional stock.