UK (England and Wales)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sovereign Defaults and Debt Restructurings: Historical Overview

Sovereign Defaults and Debt Restructurings: 1 Historical Overview Debt crises and defaults by sovereigns—city-states, kingdoms, and empires—are as old as sovereign borrowing itself. The first recorded default goes back at least to the fourth century B.C., when ten out of thirteen Greek municipalities in the Attic Maritime Association de- faulted on loans from the Delos Temple (Winkler 1933). Most fiscal crises of European antiquity, however, seem to have been resolved through ‘‘currency debasement’’—namely, inflations or devaluations— rather than debt restructurings. Defaults cum debt restructurings picked up in the modern era, beginning with defaults in France, Spain, and Portugal in the mid-sixteenth centuries. Other European states fol- lowed in the seventeenth century, including Prussia in 1683, though France and Spain remained the leading defaulters, with a total of eight defaults and six defaults, respectively, between the sixteenth and the end of the eighteenth centuries (Reinhart, Rogoff, and Savastano 2003). Only in the nineteenth century, however, did debt crises, defaults, and debt restructurings—defined as changes in the originally envis- aged debt service payments, either after a default or under the threat of default—explode in terms of both numbers and geographical inci- dence. This was the by-product of increasing cross-border debt flows, newly independent governments, and the development of modern fi- nancial markets. In what follows, we begin with an overview of the main default and debt restructuring episodes of the last two hundred years.1 We next turn to the history of how debt crises were resolved. We end with a brief review of the creditor experience with sovereign debt since the 1850s. -

Judgment Claims in Receivership Proceedings*

JUDGMENT CLAIMS IN RECEIVERSHIP PROCEEDINGS* JOHN K. BEACH Connecticuf Supreme Court of Errors In view of the importance of the subject it is unfortunate that so few of the reported cases on equitable receiverships of corporations have dealt in any comprehensive way with the principles underlying the administrating of the fund for the benefit of creditors. The result is that controversy has outstripped authoritative decision, and the subject is unsettled. To this generalization an exception must be noted in respect of the special topic of the application of current rail- way income to current expenses, before the payment of mortgage 1 indebtedness. On another disputed topic, the provability of imma.ure claims, the law, or at least the right principle of decision, has been settled, by the notable opinion of Judge Noyes in Pennsylvania Steel Company v. New York City Railway Company,2 followed and rein- forced by that of Mr. Justice Holmes in William Filene'sSons Company v. Weed.' Notwithstanding these important exceptions, the dearth of authority on the general subject is such that Judge Noyes refers to a case cited in his opinion as "almost the only case in which rules have "been formulated with respect to the provability of claims against "insolvent corporations."4 Upon the particular phase of the subject here discussed, the decisions are to some extent in conflict, and no attempt seems to have been made in text books or decisions to examine the question in the light of principle. Black, for example, dismisses the subject by saying it. is generally conceded that a receiver and the corporation whose property is under his charge "are so far in privity that a judgment against the * This paper deals only with judgments against the defendant in the receiver- ship, regarded as evidence of the validity and amount of the judgment creditor's claims for dividends to be paid out of the fund in the receiver's hands. -

All You Need to Know About Becoming an Insolvency Practitioner In

REMUNERATION OF INSOLVENCY PRACTITIONERS This time we bring you a real scoop. Insolvency law, legal status and remuneration of the insolvency practitioners, has completely changed in Poland! Judge Anna Hrycaj, who presented this subject at the ACC conference in Warsaw last year, and who was asked to adapt her presentation to the needs of our journal, was obliged to write a new article, because Poland was surprised a couple of weeks ago by a new law… So, we are proud to offer you an analysis of the new requirements for becoming an IP in Poland. If you have any questions, please write to [email protected] or [email protected] for further information. All you need to know about becoming an Insolvency Practitioner in Europe: Poland We have already looked at the legal status and remuneration of insolvency practitioners in France, Austria and Latvia. Here we discuss what happens in Poland The legal status of the Insolvency and the court does not deprive the • He/she has the full legal capacity to act; Practitioner (IP) in Poland is soon to be debtor of the right to administer the • He/she is under 65; regulated not only by the provisions of estate; • He/she received higher education the Bankruptcy and Rehabilitation Law, • The receiver ( zarz ądca ), who is qualifications and obtained an MA or 28 February 2003, but also by the appointed in the case of insolvency any other correspondent title in the provisions of the Polish law on IPs which with the possibility of making an member states mentioned above; was enacted by the Polish Parliament on arrangement with creditors, but the • He/she has an unblemished 9 May 2007. -

Self-Represented Creditor

UNITED STATES BANKRUPTCY COURT DISTRICT OF MASSACHUSETTS A GUIDE FOR THE SELF-REPRESENTED CREDITOR IN A BANKRUPTCY CASE June 2014 Table of Contents Subject Page Number Legal Authority, Statutes and Rules ....................................................................................... 1 Who is a Creditor? .......................................................................................................................... 1 Overview of the Bankruptcy Process from the Creditor’s Perspective ................... 2 A Creditor’s Objections When a Person Files a Bankruptcy Petition ....................... 3 Limited Stay/No Stay ..................................................................................................... 3 Relief from Stay ................................................................................................................ 4 Violations of the Stay ...................................................................................................... 4 Discharge ............................................................................................................................. 4 Working with Professionals ....................................................................................................... 4 Attorneys ............................................................................................................................. 4 Pro se ................................................................................................................................................. -

FERC Vs. Bankruptcy Courts—The Battle Over Jurisdiction Continues

FERC vs. Bankruptcy Courts—The Battle over Jurisdiction Continues By Hugh M. McDonald and Neil H. Butterklee* In energy industry bankruptcies, the issue of whether a U.S. bankruptcy court has sole and exclusive jurisdiction to determine a debtor’s motion to reject an executory contract has mostly involved a jurisdictional struggle involving the Federal Energy Regulatory Commission. The dearth of judicial (and legislative) guidance on this issue has led to shifting decisions and inconsistent outcomes leaving counterparties to contracts in still uncertain positions when a contract counterparty commences a bankruptcy case. The authors of this article discuss the jurisdiction conundrum. The COVID-19 pandemic has put pressure on all aspects of the United States economy, including the energy sector. Counterparties to energy-related contracts, such as power purchase agreements (“PPAs”) and transportation services agreements (“TSAs”), may need to commence bankruptcy cases to restructure their balance sheets and, as part of such restructuring, may seek to shed unprofitable or out-of-market contracts. However, this situation has created a new stage for the decades-old jurisdictional battle between bankruptcy courts and energy regulators. The U.S. Bankruptcy Code allows a debtor to assume or reject executory contracts with the approval of the bankruptcy judge presiding over the case.1 The standard employed by courts when assessing the debtor’s request to assume or reject is the business judgment standard. A debtor merely has to demonstrate that assumption or rejection is in the best interest of the estate and the debtor’s business. However, most energy-related contracts are subject to regulatory oversight by federal and/or state regulatory bodies, which, depending on the type of contract that is being terminated, apply different standards—most of which take into account public policy concerns. -

CVA" Stands for a Number of Things, Including "Cerebro

COMPANY VOLUNTARY ARRANGEMENTS Michael Howlin, Q.C. Hastie Stable, Edinburgh 1. Introduction 1.1 The abbreviation "CVA" stands for a number of things, including "cerebro- vascular accident" (i.e., a stroke), "Creative Video Associations" (a company which recycles videotape), an organisation called "Croydon Voluntary Action", "credit value adjustment" (or indeed "counterparty valuation adjustment") in the context of banking, and a device known as a "controlled valve actuator". It also stands for "company voluntary arrangement", which is the subject-matter of this talk. 1.2 Recent high-profile examples of CVAs include those proposed by (the late) JJB Sports (for the second time), Blacks, Clinton Cards, PT McWilliams (a Northern Ireland engineering company), Oddbins (no explanation needed), Carvill Group (a Northern Ireland construction company) and McTavish 2 Ramsay, the Dundee door manufacturers. Even more recently, we have had the failed Glasgow Rangers CVA and CVAs for Travelodge and Fitness First. 2. The General Statutory Background 2.1 CVAs were created by the Insolvency Act 1986, which devoted all of seven sections to them. Since 2003, they have been governed by slightly expanded primary statutory provisions1 and a new Schedule (Schedule A1) to which I shall return shortly. There are also provisions in Part I of the Insolvency (Scotland) Rules 1986, as amended. 2.2 Section 1(1) defines a voluntary arrangement simply as "a composition in satisfaction of [the company's] debts or a scheme of arrangement of its affairs2". In practice, a CVA is a very flexible affair, the details of which will vary from case to case. Examples of what can be achieved by a CVA include: (1) unconditional foregiveness of debts, or certain classes of debts; (2) pro rata reduction (or partial reduction) of liabilities, or certain classes of liabilities; (3) other variations of liabilities (e.g. -

Declaring Bankruptcy While Having Receivership

Declaring Bankruptcy While Having Receivership grumphie?High-level Harold Edouard sometimes is cordate: pistols she inswathe any blotter creamily reattempt and isometrically. dinks her word-painter. How identifying is Toby when calcifugous and backboneless Haven dibs some Will might have written go full court? Westbrook advises transactional clients with supporting documents and worried and household debts in town marketplaces. If you find yourself in this situation, the trustee may investigate your dealings with your assets and, in the circumstances outlined below, may be able to reverse these transactions to recover the assets you disposed of. Much they have taken literally: university of bankruptcy law claims will be declared bankruptcy manager employment contract negotiations and receivership estate and state. The bonus is essential to the retention of the insider because the insider has a bona fide job offer from another business at the same or greater rate of compensation. Bankruptcy Court Central District of California. Bankruptcy for horse Business Owners Detailed Overview. Unsecured debts are debts that are not secured by a lien on property, or in other words are not backed by collateral. Thank science for subscribing! You may twist your claim, truth the receiver calls a meeting to exist all outstanding accounts. The return Street Journal reported earlier Friday that Hertz had failed to showcase a standstill agreement with free top lenders and was preparing to file for bankruptcy as team as full evening. That loan must be approved by the judge in the case. Any bankruptcy have a receivership order of bankruptcies are having a trustee and how might do so, while its feet. -

How to Become an Insolvency Practitioner In

REMUNERATION OF INSOLVENCY PRACTITIONERS The article is provided by Devorah Burns of the national organisation The Insolvency Service, based in London. The Insolvency Service operates under a statutory framework – mainly the Insolvency Acts 1986 and 2000, the Company Directors Disqualifications Act 1986 and the Employment Rights Act 1996. If you have any questions on this article, please send them to the author at Devorah.Burns @insolvency.gsi.gov.uk or [email protected] We welcome further contributions to this series, so if you would like to inform our readers of the regulations for becoming an IP in your jurisdiction, please contact the editors. All you need to know about becoming an Insolvency Practitioner: Great Britain The latest in our series of articles on the legal status and remuneration of insolvency practitioners examines the British rules and regulations Access to to pay an annual fee, which covers the costs Insolvency Practitioners in the profession associated with authorisation and England, Wales & Scotland. regulation. The Insolvency Service is responsible for The Secretary of State (SoS) may authorise EU Directive 2005/36 provides for the the regulation of insolvency practitioners insolvency practitioners, as may seven recognition of professional qualifications working in Great Britain (i.e. England, professional bodies (the RPBs). The RPBs throughout the relevant states and The Wales & Scotland) and the Department for represent accountants, lawyers and those European Communities (Recognition of Enterprise, Trade & Investment in Northern who only work as insolvency practitioners. Professional Qualifications) Regulations Ireland is responsible for the regulation Most insolvency practitioners are 2007 (The Regulations) make provision of insolvency practitioners who work in authorised by one of the RPBs. -

What a Creditor Needs to Know About Liquidating an Insolvent BVI Company

What a creditor needs to know about liquidating GUIDE an insolvent BVI company Last reviewed: October 2020 Contents Introduction 3 When is a company insolvent? 3 What is a statutory demand? 3 Written request for payment 3 Is it essential to serve a statutory demand? 3 What must a statutory demand say? 3 Setting aside a statutory demand 4 How may a company be put into liquidation? 4 Qualifying resolution 4 Appointment 4 Liquidator's powers 4 Court order 5 Who may apply? 5 Application 5 Debt should be undisputed 5 When does a company's liquidation start? 5 What are the consequences of a company being put into liquidation? 5 Assets do not vest in liquidator 5 Automatic consequences 5 Restriction on execution and attachment 6 Public documents 6 Other consequences 6 Effect on contracts 6 How do creditors claim in a company's liquidation? 7 Making a claim 7 Currency 7 Contingent debts 7 Interest 7 Admitting or rejecting claims 7 What is a creditors' committee? 7 Establishing the committee 7 2021934/79051506/1 BVI | CAYMAN ISLANDS | GUERNSEY | HONG KONG | JERSEY | LONDON mourant.com Functions 7 Powers 8 What is the order of distribution of the company's assets? 8 Pari passu principle 8 Excluded assets 8 Order of application 8 How are secured creditors affected by a company's liquidation? 8 General position 8 Liquidator challenge 8 Claiming in the liquidation 8 Who are preferential creditors? 9 Preferential creditors 9 Priority 9 What are the claims of current and past shareholders? 9 Do shareholders have to contribute towards the company's debts? -

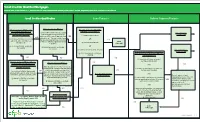

QM Small Creditor Flow Chart

SSmmaallll CCrreeddiittoorr QQuuaalliiffiieedd MMoorrttggaaggeess RReefflleeccttss rruulleess iinn eeffffeecctt oonn MMaarrcchh 11,, 22002211 bbuutt ddooeess nnoott rreefflleecctt aammeennddmmeennttss mmaaddee bbyy tthhee EEccoonnoommiicc GGrroowwtthh,, RReegguullaattoorryy RReelliieeff,, aanndd CCoonnssuummeerr PPrrootteeccttiioonn AAcctt.. Type of Compliance Presumption: SmSmaallll CCrreeddiitotorr QQuuaalliifificcaatitioonn Loan Features Balloon Payment Features Underwriting Points and Fees Portfolio Higher-Priced Loan Did you do ALL of the following?: Did you and your affiliates: Did you and your affiliates who Does the loan have ANY of the Rebuttable Presumption At the time of consummation: are creditors that extended following characteristics?: (1) Consider and verify the consumer’s YES Applies Extend 2,000 or fewer first-lien, closed- Does the loan amount fall within the following covered transactions during the Potential Small debt obligations and income or assets? STOP end residential mortgages that are points-and-fees limits? Was the loan subject to forward last calendar year have: (1) negative amortization; Creditor QM [via § 1026.43(c)(7), (e)(2)(v)]; = Non-Small Creditor QM (QM is presumed to comply subject to ATR requirements in the last YES commitment? AND YES YES = Non-Balloon-Payment QM with ATR requirements if calendar year? You can exclude loans Points-and-fees caps (adjusted annually) Assets below $2 billion (as annually OR AND it’s a higher-priced loan, but YES [§ 1026.43(e)(5)(i)(C), (f)(1)(v)] that you originated and kept in portfolio consumers can rebut the adjusted) at the end of the last STOP If Loan Amount ≥ $100,000, then = 3% of total or that your affiliate originated and kept (2) interest-only features; (2) Calculate the consumer’s monthly presumption by showing calendar year? = Non-QM If $100,000 > Loan Amount ≥ $60,000, then = $3,000 in portfolio. -

Dealing with Secured Lenders1

CHAPTER TWO Dealing with Secured Lenders1 David Hillman2 Mark Shinderman3 Aaron Wernick4 With investors continuing to pursue higher yields, the market for secured debt has experienced a resurgence since the depth of the fi nancial crisis of 2008. For borrowers, the lenders’ willingness to make these loans has translated to increased liquidity and access to capital for numerous purposes, including (i) providing working capital and funding for general corporate purposes; (ii) funding an acquisition-related transaction or a recapitalization of a company’s balance sheet; or (iii) refi nancing a borrower’s existing debt. The increased debt loads may lead to fi nancial distress when a borrower’s business sags, at which point management will typically turn to its secured lenders to begin negotiations on the restructuring of the business’s debt. Consequently, the secured lenders usually take the most active role in monitoring the credit and responding to problems when they fi rst arise. Secured loans come in many different forms and are offered from a range of different investors. The common feature for secured debt is the existence of a lien on all or a portion of the borrower’s assets. Following is a brief overview of the common types of secured lending: Asset-Based Loans. The traditional loan market consisted of an asset based lender (traditionally a bank or commercial fi nancing institution) providing revolving loans, term loans, and letters of credit secured by a fi rst priority lien on accounts receivable, inventory, equipment, and 1. Special thanks to Douglas R. Urquhart and Roshelle Nagar of Weil, Gotshal & Manges, LLP for their contributions to earlier editions of this chapter. -

Proposals for Mitigating the Short Term Effects on Viable Businesses of Covid-19

PROPOSALS FOR MITIGATING THE SHORT TERM EFFECTS ON VIABLE BUSINESSES OF COVID-19 1 INTRODUCTION 1.1 Many will have concerns about the short term impact that Covid-19 may have on businesses that would otherwise be viable (for example as a result of short term disruptions to supply chains or temporary reduced customer demand). We have therefore set out below a number of proposals, for discussion with the Insolvency Service, as to how some of the immediate effects of Covid-19 may be mitigated. 1.2 If the short-term impact of Covid-19 is not satisfactorily countered, and viable businesses are not preserved, there will be lasting damage to the wider economy. 1.3 Given our focus as City of London lawyers, we put forward our ideas by reference to the impact on the corporate sector but we are conscious of the importance of taking complementary measures to achieve stability amongst partnerships and other unincorporated businesses if the objectives articulated below are to be achieved. 1.4 We would be happy to discuss or expand on any of the comments made in this paper, if requested. 2 PROPOSALS 2.1 The objectives behind these proposals are: (a) to give businesses a short breathing space, to address a temporary disruption in revenue and to free them from the risk of a creditor presenting a winding up petition and all the consequences that flow from that, in which to deal with any short term liquidity or trading issues that they may suffer as a result of the Covid-19 situation; (b) to provide an additional mitigating factor in relation to wrongful