Use of an Automobile: Tax Consequences

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sportz Sizing Chart Rev

Sportz Truck Tent Sizing Chart Sportz III Tailgate 55011 55022 55044 55055 55077 55099 55890 Sportz III Tailgate Camo 56011 56022 56044 - - - - Sportz Mid Size Quad SPORTZ FULL SIZE CREW Truck Size Full Size Long Bed Full Size Short Bed Compact Short Bed Step/Flare Sport Mid Size Short Bed Cab CAB Bed Size 96-98" 72-79" 72-74" 78-82" 72-78" 65" 68-70" Double/Model # 30951 or Double/Model # 30951 or Double/Model # 30951 or Mid Air Mattress Mid Size/Model #32000SP Mid Size/Model #32000SP Twin/Model # 30954 Twin/Model # 30954 Twin/Model # 30954 Twin/Model # 30954 Size/Model #32000SP T Chevrolet C/K * Chevrolet C/K * Chevrolet S-10 * Chevrolet Silverado* Dodge Dakota Short Bed* Dodge Dakota Quad Cab* GMC Sierra 1500 Crew Cab* R Chevrolet Silverado * Chevrolet Silverado * Chevrolet Colorado 6' Ford F-150 '96 & older* Dodge Dakota SLT Short* Toyota Tacoma (Yr 2005 anChevrolet Crew Cab* U Dodge Dakota * Dodge Ram 1500 * Chevrolet Canyon 6' Ford F-250 '96 & older* Dodge Dakota Sport Short* up for 60 inch box)* Ford Super Crew* C Dodge Dakota SLT * Dodge Ram 2500 * Ford Ranger XL * GMC Sierra 1500* Toyota T-100 * Nissan Titan Crew* K Dodge Dakota Sport * Ford F-150 * Ford Ranger XLT * Toyota Tacoma (Yr 2004 and Dodge Ram 1500 * Ford F-250 * GMC S-15 * up for 73.5 inch box)* M Dodge Ram 2500 * Ford F-250 Super Duty* GMC Sonoma * O Dodge Ram 3500 (^DRW) Ford F-350 Super Duty* Isuzu Hombre * D Ford F-150 * GMC Sierra 2500 Series* Jeep Camanche * E Ford F-250 * Nissan Titan* Mazda B 2000* L Ford F-250 Super Duty* Toyota Tundra * Mazda B 2500* Ford F-350 Super Duty* Mazda B 3000* N Ford F-350SD (^DRW) Mazda B 4000* A GMC Sierra * Mitsubishi Pick-up * M Nissan Titan* Nissan Frontier * E Toyota T-100 * Toyota Hilux* Toyota Tundra * Toyota Tacoma(before2004)* Nissan Frontier King Cab ('02 and Newer)* Models Not Applicable: * Indicates truck must be measured to determine long or short bed. -

Minivan Motoring, Or Why I Miss That Old Car Smell by Sam Patteson

e-Vision volume eight 1 Minivan Motoring, or Why I Miss that Old Car Smell by Sam Patteson It is very difficult to look “cool” while driving a minivan, and I never bothered to try. “Cool” is overrated anyway. What’s not overrated is the urban camouflage a minivan affords. “No one suspects the soccer mom,” Joe deadpanned as he rolled us a joint on the open door of the glove box. I had to agree as I pulled the van into the Shell station to gas up before our long trip to Charleston. I let the tank fill while I checked the various reservoir levels for brake fluid, antifreeze, power steering, and the like. As usual, I needed a quart of oil. Rednecks on last minute beer runs cruised through the parking lot as I returned from the store. Joe blasted Frampton Comes Alive through the open windows. Pete’s guitar had something to say, and the van was rocking. I poured the oil into the engine, slammed the hood home, and slid into the driver’s seat. I turned to quiz Joe on last minute preparations. We had planned this trip for months, and I didn’t want to forget anything. “Suitcases?” He turned to look back at the empty rear of the van. We had removed the back seats in favor of a twin-sized bed. Our suitcases nestled securely between the bed and the back door. “Check.” Pillows and blankets? “Check.” Wallet, money, keys? “Check.” Er… extras? “Check!” Joe coughed and handed me the joint. I took a deep drag and handed it back. -

Quantitative Study to Define the Relevant Market in the Passenger Car Sector by Frank Verboven, K.U

1 17 September 2002 Final Report _____________________ Frank Verboven _____________________ Catholic University of Leuven 1 This study has been commissioned by the Directorate General of Competition of the European Commission. Any views expressed in it are those of the author: they do not necessarily reflect the views of the Directorate General of Competition or the European Commission. 1 EXECUTIVE SUMMARY ....................................................................................................................3 1 INTRODUCTION.........................................................................................................................7 2 DEFINING THE RELEVANT MARKET .................................................................................8 2.1 COMPETITIVE CONSTRAINTS ..................................................................................................8 2.2 DEMAND SUBSTITUTION.........................................................................................................9 2.3 PRODUCT VERSUS GEOGRAPHIC MARKET............................................................................10 3 THE RELEVANT GEOGRAPHIC MARKET .......................................................................11 3.1 HISTORICAL EVIDENCE.........................................................................................................11 3.2 OBSTACLES TO CROSS-BORDER TRADE.................................................................................12 4 THE DEMAND FOR NEW PASSENGER CARS...................................................................14 -

Report to Congress

REPORT TO CONGRESS Effects of the Alternative Motor Fuels Act CAFE Incentives Policy PREPARED BY: U.S. Department of Transportation U.S. Department of Energy U.S. Environmental Protection Agency March 2002 Table of Contents Highlights.............................................................................................................................iii Executive Summary.............................................................................................................vi I. Introduction.....................................................................................................................1 II. Background.....................................................................................................................3 III. Availability of Alternative Fuel Vehicles.....................................................................13 IV. Availability and Use of Alternative Fuels....................................................................27 V. Analysis of the Effects on Energy Conservation and the Environment...................................................................................................37 VI. Summary of Findings and Recommendations............................................................49 Appendices.........................................................................................................................52 Appendix A: Summary of Federal Register Comments Appendix B: Listing of CAFE Fines Paid by Vehicle Manufacturers Appendix C: U.S. Refueling Site Counts by State -

Europe Swings Toward Suvs, Minivans Fragmenting Market Sedans and Station Wagons – Fell Automakers Did Slightly Better Than Cent

AN.040209.18&19.qxd 06.02.2004 13:25 Uhr Page 18 ◆ 18 AUTOMOTIVE NEWS EUROPE FEBRUARY 9, 2004 ◆ MARKET ANALYSIS BY SEGMENT Europe swings toward SUVs, minivans Fragmenting market sedans and station wagons – fell automakers did slightly better than cent. The only new product in an cent because of declining sales for 656,000 units or 5.5 percent. mass-market automakers. Volume otherwise aging arena, the Fiat the Honda HR-V and Mitsubishi favors the non-typical But automakers boosted sales of brands lost close to 2 percent of vol- Panda, was on sale for only four Pajero Pinin. over familiar sedans unconventional vehicles – coupes, ume last year, compared to 0.9 per- months of the year. In terms of brands leading the roadsters, minivans, sport-utility cent for luxury marques. European buyers seem to pro- most segments, Renault is the win- LUCA CIFERRI vehicles exotic cars and multi- Traditional European-brand gressively walk away from large ner with four. Its Twingo leads the spaces such as the Citroen Berlingo automakers dominate the tradi- sedans, down 20.3 percent for the minicar segment, but Renault also AUTOMOTIVE NEWS EUROPE – by 16.8 percent last year to nearly tional car, minivan and premium volume makers and off 11.1 percent leads three other segments that it 3 million units. segments, but Asian brands control in the upper-premium segment. created: compact minivan, Scenic; TURIN – Automakers sold 428,000 These non-traditional vehicle cat- virtually all the top spots in small, large minivan, Espace; and multi- more specialty vehicles last year in egories, some of which barely compact and large SUV segments. -

The Role of Attitude and Lifestyle in Influencing Vehicle Type Choice

UC Davis UC Davis Previously Published Works Title What type of vehicle do people drive? The role of attitude and lifestyle in influencing vehicle type choice Permalink https://escholarship.org/uc/item/2tr3n41k Journal Transportation Research Part A-Policy and Practice, 38(3) ISSN 0965-8564 Authors Choo, S Mokhtarian, Patricia L Publication Date 2004-03-01 Peer reviewed eScholarship.org Powered by the California Digital Library University of California WHAT TYPE OF VEHICLE DO PEOPLE DRIVE? THE ROLE OF ATTITUDE AND LIFESTYLE IN INFLUENCING VEHICLE TYPE CHOICE Sangho Choo Department of Civil and Environmental Engineering University of California, Davis Davis, CA 95616 voice: (530) 754-7421 fax: (530) 752-6572 e-mail: [email protected] and Patricia L. Mokhtarian Department of Civil and Environmental Engineering and Institute of Transportation Studies University of California, Davis Davis, CA 95616 voice: (530) 752-7062 fax: (530) 752-7872 e-mail: [email protected] Revised July 2003 Transportation Research Part A 38(3) , 2004, pp. 201-222 ABSTRACT Traditionally, economists and market r esearchers have been interested in identifying the factors that affect consumers’ car buying behaviors to estimate market share, and to that end they have developed various models o f vehicle type choice. However, they do not usually consider consumers’ tr avel attitudes, personality, lifestyle, and mobility as factors that may affect the vehicle type choice. The purpose of this study is to explore the relationship of such factors to individuals’ vehicle type choices, and to develop a disaggregate choice mo del of vehicle type based on these factors as well as typical demographic variables . -

All-New 2017 Chrysler Pacifica Named North American Utility Vehicle of the Year

All-new 2017 Chrysler Pacifica Named North American Utility Vehicle of the Year Panel of esteemed automotive experts select the Chrysler Pacifica as the 2017 North American Utility Vehicle of the Year 2017 marks only the second time a minivan has won the award, with FCA US minivans also receiving the honor in 1996 The all-new Chrysler Pacifica, the most awarded minivan of 2016, reinvents the minivan segment with an unprecedented level of functionality, versatility, technology and bold styling January 9, 2017 , Auburn Hills, Mich. - The all-new 2017 Chrysler Pacifica has been named the 2017 North American Utility of the Year by a panel of automotive experts. The award is unique and considered by many to be one of the world’s most prestigious based on its diverse mix of automotive journalists from the U.S. and Canada who serve as the voting jurors. The winners were announced at a news conference today at the North American International Auto Show in Detroit. “When we first introduced the 2017 Chrysler Pacifica just one year ago, we believed that we had created the perfect formula for today’s busy families,” said Tim Kuniskis, Head of Passenger Car Brands, Dodge, SRT, Chrysler and Fiat, FCA - North America. "But it’s the recognition from our customers and respected opinion leaders like the NACTOY jury that helps to reinforce Pacifica’s status in the marketplace as the no-compromises minivan, and highlights what a great job the entire team has done in developing, building and selling the all-new Pacifica and Pacifica Hybrid.” This is the 24th year of the awards. -

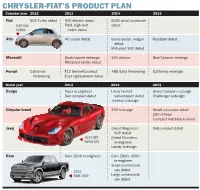

Rossover Lace R Minivan

20120903-NEWS--0017-NAT-CCI-AN_-- 8/28/2012 3:28 PM Page 1 SEPTEMBER 3, 2012 • 17 futurePRODUCTS>> CHRYSLER-FIAT With Fiat platforms, Chrysler gets an Italian-style makeover ETROIT — Over the next three years, Chrysler wheel-drive vehicles. It also has begun building proto- was introduced to North America on the 2013 Dodge Dart. Group will redesign most of its hottest-selling types of a new eight-speed automatic transmission for Its minivans, large sedans and coupes also are scheduled D vehicles on Fiat-derived platforms and install front-wheel-drive models. Both gearboxes will improve for redesigns on new platforms. The Viper is returning to new and more efficient automatic transmissions in a fuel economy. the lineup late this year with a new brand, SRT. majority of its vehicles. Meanwhile, Chrysler will introduce European diesel Fiat will add an electric version of the 500 this year and The changes are the results of Chrysler’s 2009 acquisi- engines in a few light-duty vehicles and roll out at least a small crossover, the 500X, in the 2015 model year. tion by Fiat S.p.A. two new gasoline engines for others. Here are Chrysler-Fiat’s product plans from company Chrysler is ramping up production of eight-speed au- Several of Chrysler’s compact and mid-sized vehicles and other sources. tomatic transmissions, which it will use for large rear- will be redesigned to ride on Fiat’s CUSW platform, which - Larry P. Vellequette CHRYSLER-FIAT’S PRODUCT PLAN Calendar year 2012 2013 2014 2015 Fiat 500 Turbo debut 500 electric debut 500X small crossover -

UNIVERSITY of CALIFORNIA RIVERSIDE Robust Passenger

UNIVERSITY OF CALIFORNIA RIVERSIDE Robust Passenger Vehicle Classification Using Physical Measurements From Rear View A Thesis submitted in partial satisfaction of the requirements for the degree of Master of Science in Electrical Engineering by Rajkumar Theagarajan June 2016 Thesis Committee: Dr. Bir Bhanu, Chairperson Dr. Matthew Barth Dr. Yingbo Hua Copyright by Rajkumar Theagarajan 2016 The Thesis of Rajkumar Theagarajan is approved: Committee Chairperson University of California, Riverside Table of Contents Introduction .............................................................................................................................................................. 1 Related works and our contribution ........................................................................................................... 3 Related works ........................................................................................................................................................ 3 Contributions of this paper .............................................................................................................................. 6 Technical approach ............................................................................................................7 Vehicle localization, Shadow analysis and Identifying features .....................................7 Detection of Moving Objects ...................................................................................7 Removal of Side-shadows ........................................................................................9 -

Non-Luxury Segment Topline Report

KELLEY BLUE BOOK BRAND WATCH: NON-LUXURY SEGMENT TOPLINE REPORT 1st Quarter 2019 WHAT IS BRAND WATCH TM? Brand Watch, a shopper perception study, reveals trends in vehicle consideration among new car consumers and provides insight into factors that influence purchase decisions. BRAND AND MODEL LEVEL BRAND-LEVEL STUDY PERCEPTION STUDY MODEL-LEVEL STUDY 135,000+ interviews 75,000+ interviews Since 2007 Since 2012 Captures brand and model Tracks 12 factors important Respondents are in-market consideration & familiarity to shoppers across all models for a new vehicle and and 6 segments recruited from KBB.com among new-car shoppers WHAT CAN BRAND WATCH TM DO? Identify key factors driving vehicle purchase decisions and measure OEM brand equity within and across segments OBJECTIVES/MEASURES What is important to How brands and models perform on How demographic consumers when shopping factors most important to shoppers for a new vehicle within and across segments groups differ BRAND WATCH: NON -LUXURY CONSIDERATION America’s love for SUVs shows no sign of slowing down. Almost two-thirds of new-car shoppers consider an SUV, despite a rising average transaction price (ATP) of $38K for midsize and $29K for compact SUV. In Q1, SUV sales increased 5% year-over-year (YoY). Still, cars are not dead. Despite a decline in consideration and sales, roughly 1 in 2 people put a car on their consideration list. WHAT ARE OVERALL SEGMENT PREFERENCES 64% AMONG NON-LUXURY 45% 24% 6% SHOPPERS? SUVs Cars Pickups Minivans WHICH BRANDS LEAD IN NON- WHICH MODELS ARE -

Chrysler Pacifica Hybrid Earns Top SUV/Minivan Honors in 2020 AAA Car Guide

10/9/2020 https://media.fcanorthamerica.com/print.do?id=21893 Contact: Darren Jacobs Kristin Starnes Chrysler Pacifica Hybrid Earns Top SUV/Minivan Honors in 2020 AAA Car Guide Chrysler Pacifica Hybrid Limited takes top spot in the 2020 AAA Car Guide SUV/Minivan category Pacifica Hybrid also scores top-three finish in AAA Car Guide Top 10 overall vehicle ratings AAA Car Guide recognizes top performers in AAA independent test-track and real-world evaluations of vehicles with the latest in safety technology Pacifica Hybrid is the first-ever hybrid minivan and delivers more than 80 miles per gallon equivalent (MPGe) in electric-only mode, an all-electric range of more than 30 miles and a total range of more than 500 miles August 3, 2020, Auburn Hills, Mich. - Chrysler Pacifica’s list of industry awards continues to grow, as the Pacifica Hybrid earns first-place honors in the 2020 AAA Car Guide SUV/Minivan category, in addition to finishing in the top three in this year’s AAA Car Guide Top 10 overall vehicle ratings. The latest honor takes Chrysler Pacifica’s growing list to more than 135 industry accolades, helping it maintain its place as the most awarded minivan four years in a row. The Pacifica Hybrid Limited earned high marks in the 2020 AAA Car Guide testing for its plug-in capability, range and fuel economy, large and comfortable passenger area, ample cargo space and smooth, seamless hybrid drivetrain. The Pacifica Hybrid earned a perfect 10 in the areas of advanced safety features and cargo capacity. -

Minicar Subcompact Compact Coupe Mid-Sized Convertible & Roadster Medium Minivan Small Minivan

AUTOMOTIVE NEWS EUROPE DATA MINICAR SUBCOMPACT Fiat maintained its minicar dominance with the Panda The Ford Fiesta, down 13% to 303,822, became on top and the 500 at No. 2. The new VW Up was the Europe’s best-selling subcompact model, ahead only model in the top 5 that increased sales, which of the VW Polo, which slipped 20% to 285,389. The helped it overtake the Renault Twingo to finish in Toyota Yaris, up 25% to 171,523, was the only mod- 3rd place. The Toyota Aygo ranked fifth. el in the top 5 that increased year-on-year sales. 2012 2011 % change 2012 2011 % change 1. Fiat Panda 184,772 188,383 -2 1. Ford Fiesta 303,822 349,406 -13 2. Fiat 500 146,617 155,756 -6 2. VW Polo 285,389 355,924 -20 3. VW Up 113,662 4,595 - 3. Opel/Vauxhall Corsa 263,428 313,841 -16 4. Renault Twingo 92,271 133,694 -31 4. Renault Clio 242,258 293,558 -17 5. Toyota Aygo 72,287 88,477 -18 5. Toyota Yaris 171,523 137,361 +25 Segment total 1,137,813 1,162,070 -2 Segment total 2,754,703 3,119,687 -12 COMPACT MID-SIZED The VW Golf was the best-selling compact in Eu- The VW Passat strengthened its leadership in the rope and the best-selling model overall. VW sold mid-sized segment, beating its closest rival by a combined 403,238 units of the sixth-genera- a 2-to-1 margin. VW sold 194,455 Passats while tion Golf, which debuted in 2008, as well as of the Opel/Vauxhall sold 95,095 units of the Insignia.