S.No. NAME of APPLICANT IEC NO. 1 KRISHNA VANIJYA

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ISUZU MOTORS INDIA PRIVATE LIMITED, Chittoor Notification for Engagement of Apprentices Under Apprentices (Amendment) Act 1973

ISUZU MOTORS INDIA PRIVATE LIMITED, Chittoor Notification for engagement of Apprentices under Apprentices (Amendment) Act 1973 Isuzu Motors India Private Limited (SAPCHP000024), invites Online application from eligible Graduate & Diploma holders in Engineering (passed out during December 2018/2019/2020&2021), for undergoing one year Apprenticeship training under the Apprentices (Amendment) Act 1973. 1. A. Category I Graduate & Technician (Diploma) Apprentices:- S. No. Discipline Graduate Technician Monthly Stipend 1 Mechanical Engineering 20 50 Fix Pay: INR 10000 2 Automobile Engineering 20 50 >Attendance 3 Electrical & Electronics Engineering 10 25 Allowance: INR 4 Chemical Engineering 0 0 1500 (Maximum) > Special Allow: 0 25 5 Electronics Engineering INR 2000 (Paid Total 50 150 once in 6 Months) MINI MUM EDUCATIONAL QUALIFICATIONS: A. Category – I Graduate & Technician (Diploma) Apprentices:- • A degree in engineering or technology granted by statutory University. • A degree in engineering or technology granted by an Institutions empowered to grant such degrees by an Act of Parliament. • A Diploma in Engineering or technology granted by a State Council or Board of Technical Education established by a State Government in relevant discipline. • A Diploma in Engineering or Technology granted by a University in relevant discipline. II A. Only students of Andhra Pradesh State need to apply. III. AGE: Age limit will be followed as per Apprenticeship Rules. IV. RESERVATION OF VACANCIES: Guidelines under Apprentices Act on Reservation for SC/ST/OBC/PWD will be followed. Who are claiming reservation under SC/ST/OBC/PWD shall provide certificate as per Government standard format, failed which their claim for reservation will be considered as ‘General’ category only. -

AES (India) Engineering Ltd

AES (India) Engineering Ltd. Company Profile Copyright © AES (India) Engineering Ltd. 2019. All right reserved. Our Goal Contents Our goal is to provide high value added product and services to our 1. Our Goal customer with the best possible engineering solution through our technically competent team. 2. History This commitment is rooted in our corporate values and quality management system that is essential to our continual growth and 3. Who We Are success 4. Our Presence 5. Business Approach 6. Project Under taken 7. Application Based on Requirements Turnkey 8. Global Experience Engineering 7. Customers World wide 8. Customer In India Project Management Copyright © AES (India) Engineering Ltd. 2019. All right reserved. Our History Automotive Engineering Services Co., Ltd. is a Japanese engineering firm, who has been providing the practical solutions for production launching and renovation of projects for worldwide automakers. AES’s origin dates back to “Automotive Team” established in 1986, which started as a small team in a huge plant engineering house, Chiyoda Corporation. Over 30 years history, our business has been expanding to over 35 countries of the world and to various kinds of production with environmental solutions beyond the existing field. 1. Name Automotive Engineering Services Co., Ltd. 2. Start of Business June, 2004 (Only Name change ,Exp. since 1986) 3. Main Service Engineering services for automobile industries (Press/Body/Paint/General Assembly/Power train) 4. Address 12th Floor, 6-145, Hanasakicho , Nishi-ku , Yokohama , Japan 5. Global Reach Japan! India! Thailand! Copyright © AES (India) Engineering Ltd. 2019. All right reserved. Who We Are? AES India Engineering Limited Established on September 2005, (An ISO 9001 : 2015 Certified Company) is a leading Japanese engineering service provider. -

KPMG in India Contacts

1 Department of Industrial Department of Heavy Industries Policy and Promotion Automotive Sector Achievements Report 24th November 2016 MAKE IN INDIA Table of Contents 05 Policy 08 Initiatives & Skill Investments Development/ Job Creation 07 Fiscal Incentives 08 Innovation and R&D 3 Department of Industrial Policy and Promotion Ministry of Commerce and Department of Heavy Industry Industries Automotive Sector The automotive industry in India has been on a Government of India to promote innovation and growth trajectory with impressive spikes in R&D and create a favourable policy regime to sales, production, and exports over the last two make India a prominent manufacturing years. With an average production of around destination. 24 million vehicles annually and employer of The Automobile Mission Plan 2016 – 2026 over 29 million people (direct and indirect envisages creating India as one of the top three employment), the automotive sector in India is automobile manufacturing centres in the world one of the largest in the world. India is the with gross revenue of USD 300 billion by 2026. largest tractor manufacturer, 2nd largest two- wheeler manufacturer, 2nd largest bus Policy Initiatives & Investments manufacturer, 5th largest heavy truck Major Investments & FDI Inflows manufacturer, 6th largest car manufacturer and FDI Inflow 8th largest commercial vehicle manufacturer. The Automobile industry witnessed a USD 5.5 For every vehicle produced, direct and indirect billion of FDI inflow into the country during April employment opportunities are created with 2014 to March 2016. employment of 13 persons for each truck, 6 persons for each car and 4 for each three- Some of the major foreign investments are listed wheeler and one person for two-wheelers. -

SML Isuzu Ltd., Honda R&D Ltd

DEPARTMENT OF MECHANICAL NAAC ‘A’ GRADE ENGINEERING NIRF RANKED AICTE APPROVED 1 PUNJABI UNIVERSITY, PATIALA Punjabi University Patiala, one of the premier institutions of higher educationinthenorthofIndia,wasestablishedonthe30thApril, 1962 under the Punjabi University Act 1961. University has been awarded ‘A’ Grade Status by the National Assessment and Accreditation Council (NAAC) Lush Green, Pollution Free Environment Spread over 600 acres of land 2 DEPARTMENT OF MECHANICAL ENGINEERING Department of Mechanical Engineering was established at Punjabi University Campus in the year 2003. 3 DEPARTMENT OF MECHANICAL ENGINEERING Why Mechanical Engineering? Mechanical Engineers & professionals work in nearly every industry such as commercial, industrial, military or scientific companies. Job opportunities are available in both Software and Mechanical, Automobile, Chemical, Civil, Electronics, Shipping, Marine, Railways, Aviation, Defense, Agricultural companies. One may also enter into Research and Development. 4 DEPARTMENT OF MECHANICAL ENGINEERING Job Opportunities for Mechanical Engineers Wide array of career possibilities. Govt. Jobs – DRDO, Defense, Atomic Energy, ONGC, NTPC, Energy Sector, Railways, Engineers India Ltd. etc. Aerospace, Automotive, Agricultural and Manufacturing. Important emerging areas, such as Nuclear Technology, Robotics, Biomedical Technology, Automation, Mechatronics. Any engineering industry, consulting and management. 5 DEPARTMENT OF MECHANICAL ENGINEERING Why Mechanical Engineering? HIGHER STUDIES -

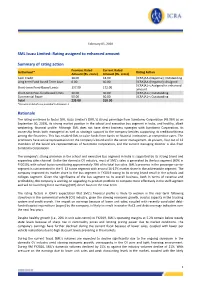

SML Isuzu Limited: Rating Assigned to Enhanced Amount Summary Of

February 05, 2020 SML Isuzu Limited: Rating assigned to enhanced amount Summary of rating action Previous Rated Current Rated Instrument* Rating Action Amount (Rs. crore) Amount (Rs. crore) Cash Credit 18.00 18.00 [ICRA]AA-(Negative); Outstanding Long term Fund based Term Loan 0.00 40.00 [ICRA]AA-(Negative); Assigned [ICRA]A1+; Assigned to enhanced Short-term Fund-Based Limits 137.00 172.00 amount Short-term Non-fund based limits 30.00 30.00 [ICRA]A1+; Outstanding Commercial Paper 50.00 50.00 [ICRA]A1+; Outstanding Total 235.00 310.00 *Instrument details are provided in Annexure-1 Rationale The rating continues to factor SML Isuzu Limited’s (SML’s) strong parentage from Sumitomo Corporation (43.96% as on September 30, 2019), its strong market position in the school and executive bus segment in India, and healthy, albeit weakening, financial profile. Although SML does not have direct business synergies with Sumitomo Corporation, its ownership lends both managerial as well as strategic support to the company besides supporting its creditworthiness among the financiers. This has enabled SML to raise funds from banks or financial institutions at competitive rates. The promoters have active representation on the company’s board and in the senior management. At present, four out of 12 members of the board are representatives of Sumitomo Corporation, and the current managing director is also from Sumitomo Corporation. The company’s strong presence in the school and executive bus segment in India is supported by its strong brand and expanding sales channel. Unlike the domestic CV industry, most of SML’s sales is generated by the bus segment (60% in FY2019), with school buses constituting approximately 70% of its total bus sales. -

Mahindra Treo Zor

www.commercialvehicle.in Volume 15 Issue 7 • April 2021 ` 120 Tata Ultra Sleek T. Series MAHINDRA TREO ZOR The scrappage policy n Industry reaction to scrappage policy n Interview: Rajaram Krishnamurthy /commercialvehicle @CVmagazine /cvmagazineindia /commercialvehicle.in Now read your favourite magazine wherever Available on PC... Mac... Tablet... you go... or any other handheld device! www.commercialvehicle.in Volume 15 Issue 7 • April 2021 ` 120 Tata Ultra Sleek T. Series MAHINDRA TREO ZOR The scrappage policy n Industry reaction to scrappage policy n Interview: Rajaram Krishnamurthy Available on Digital Platform Partners ` 120 Volume 15 Issue 7 • April 2021 Why would you subscribe to www.commercialvehicle.in ` 120 Volume 15 Issue 6 • March 2021 Commercial Vehicle? Here are www.commercialvehicle.in Tata Ultra Sleek T. Series The era of smart manufacturing MAHINDRA TREO ZOR Really Good DRIVING THE TATA ULTRA 2821.T (CONTAINER) 4 Reasons! 1 DELIVERED FREE TO YOUR DOOR 2 SAVE UP TO 25% ON COVER PRICE Industry reacts to the Union Budget n NEVER MISS AN ISSUE AGAIN n Real-time e-bus 3 Energy Start-Up Summit 2021 AND MOST IMPORTANT OF ALL, 4 A SERIOUSLY GOOD QUALITY MAGAZINE... n Interview: Rajaram Krishnamurthy n Industry reaction to scrappage policy The scrappage policyTHREE EASY WAYS TO SUBSCRIBE Online Call Post Next Gen Publishing Pvt. Ltd., 105-106, Trade World, B-Wing, 1st Floor, Visit at Kamala Mills Compound, Senapati Bapat Marg, 1http://secure.nextgenpublishing.in/ 2 +91 9321546598 3 Lower Parel (W), Mumbai - 400013. TO SUBSCRIBE Pay ` 3,000 for 3 years subscription Pay ` 1099 for 1 year subscription and save ` 1320 on the cover price and save ` 341 on the cover price International rate - 1 year USD 135 YOUR DETAILS (ALL DETAILS IN CAPITAL LETTERS) by air mail post Name: Mr/Ms .................................................................................................................................................................................................................................................. -

FADA Releases July'21 Vehicle Retail Data

FEDERATION OF AUTOMOBILE DEALERS ASSOCIATIONS 804-805-806, Surya Kiran, 19, K G Marg New Delhi - 110 001 (INDIA) T +91 11 6630 4852, 2332 0095, 4153 1495 E [email protected] CIN U74140DL2004PNL130324 FOR IMMEDIATE RELEASE FADA Releases July’21 Vehicle Retail Data • Total vehicle retails for the month of July’21 rise by 34.12% on YoY basis. When compared to July’19 (a regular pre-covid month), recovery is visible as the deficit reduces to low double digits of -13.22%. • On YoY basis, all categories were in green with 2W up by 28%, 3W up by 83%, PV up by 63%, Tractor up by 7% and CV up by 166%. • After Tractors, PV for the first time shows strong numbers by clocking 24% growth when compared to pre-covid month of July’19. • FADA has been raising red flag about semi-conductor shortage since quite some time. The situation is now becoming grave with ever-increasing supply-side constraints. • rd The delta variant and a possibility of 3 wave continues to remain a threat for stable Auto Retails. 9th August’21, New Delhi: The Federation of Automobile Dealers Associations (FADA) today released Vehicle Retail Data for July’21. July’21 Retails Commenting on how July’21 performed, FADA President, Mr. Vinkesh Gulati said, “With entire country now open, July continues to see robust recovery in Auto Retails as demand across all categories remain high. The low base effect also continues to play its part. With all categories in green, CV’s continue to see increase in demand specially in M&HCV segment with the Government rolling out infrastructure projects in many parts of the country. -

Innovations 19.3

INNOVATIONS 19.3 1 SOFTWARE INNOVATIONS Manual selection of connection pins This Expert mode function allows the user to configure the connection to a system by manually selecting the communication pins on the OBD or Deutsch 9-pin cable. In this way, this function offers the user an alternative to the connection offered by the software in the most common communication protocols. Only available for V8 and higher devices. Countdown timer During the execution of some functionalities, it is necessary to wait a certain period of time until performing any operation. From this version, in this type of steps, Jaltest offers a countdown timer with the set time. 2 Improvement in the interaction with buttons in action steps Safety considerations in hybrid and electric vehicles (HEV) These instructions appear when selecting a hybrid model, a high voltage element control system and when selecting high voltage components in the wiring diagram configurations. These are very important safety considerations when working in hybrid and electric vehicles. 3 NEW DIAGNOSIS AND SYSTEM FUNCTIONALITIES Take into account that this document is only a summary of the most important information of this new version. For more information, please visit Jaltest Report. TRUCK AND BUS DAF For Euro 6 models, in PCI UDS engine management system, there are new functions such as the performance assessment of the turbo actuator. In the EAS4 Ecofit UL2 exhaust gas treatment system, the diesel particulate filter regeneration and AdBlue/DEF dosing are highlighted. Operation diagrams in the ECS-DC6, EAS3 and EAS4 exhaust gas treatment systems from the brand. 4 IVECO For Euro 6 models, in the EDC 17 CV41 engine management system, the component replacement for new system variants is highlighted. -

Corporate Profile

SML ISUZU LIMITED Company Presentation Motilal Oswal Investor Conference 9th March, 2017 (Mumbai) Safe Harbor • This presentation and the accompanying slides (the “Presentation”), which have been prepared by the Company have been prepared solely for information purposes and do not constitute any offer, recommendation or invitation to purchase or subscribe for any securities, and shall not form the basis or be relied on in connection with any contract or binding commitment what so ever. No offering of securities of the Company will be made except by means of a statutory offering document containing detailed information about the Company. • This Presentation has been prepared by the Company based on information and data which the Company considers reliable, but the Company makes no representation or warranty, express or implied, whatsoever, and no reliance shall be placed on, the truth, accuracy, completeness, fairness and reasonableness of the contents of this Presentation. This Presentation may not be all inclusive and may not contain all of the information that you may consider material. Any liability in respect of the contents of, or any omission from, this Presentation is expressly excluded. • Certain matters discussed in this Presentation may contain statements regarding the Company’s market opportunity and business prospects that are individually and collectively forward-looking statements. Such forward-looking statements are not guarantees of future performance and are subject to known and unknown risks, uncertainties and assumptions -

SIAM: State of the Indian Automobile Industry

October 2014 Seoul State of the Indian Automobile Industry Latest Performance Review SIAM Society of Indian Automobile Manufacturers Performance & Growth A Presentation SIAM 2 Domestic Sales (number of vehicles) Passenger Vehicles : 2.5 Mn Commercial Vehicles : 0.63 Mn 2 Wheelers : 14.8 Mn 3 Wheelers : 0.48 Mn Industry Estimates Employment (Direct + Indirect) : 2 Mn+27 Mn Contribution to manufacturing GDP : 47.3% Investment from FY 09 - FY 14 : USD 13.5 Bn A SIAM Presentation Source: SIAM, IMACs 3 Segmentation: By Volume Segmentation: By Value Passenger Vehicles Commercial Vehicles (2,503,685) (632,738) 14% 3% 3% Three Wheelers (479,634) 51% 28% 19% 80% 2% Two Wheelers (14,805,481) Passenger Vehicles Commercial Vehicles Three Wheelers Two Wheelers A SIAM4 Presentation Source: SIAM SIAM Hindustan Motor Finance Fiat India Force General Motors India Corporation Volkswagen Automobiles, Motors 2.28 Ashok Leyland Ltd 0.06 India Pvt Ltd 0.42 0.11 0.02 1.62 Ford Hindustan Motors Toyota Kirloskar Motor India, Skoda Auto India 0.01 Tata Motors 5.36 3.29 0.58 5.84 Honda Cars India Renault India 7.04 1.68 Hyundai Motor India Nissan Motor 16.21 India 2.06 Isuzu Motors India 0.01 Mahindra & Mahindra Maruti Suzuki India 8.84 44.58 VECVs – Volvo 0.16 VECVs – Eicher AMW Motors Ashok Leyland 6.01 0.56 13.48 Force Motors 3.50 Isuzu Motors India 0.12 Mahindra & Mahindra 25.72 Tata Motors 47.40 Piaggio Vehicles SML Isuzu 1.03 2.04 Alto Swift Sl. Models Sep No 2014 (Sales Nos) Dzire Wagon R 1 Maruti Suzuki Alto 19,906 2 Maruti Suzuki Swift 17,265 Grand i10 -

Corporate Profile

SML ISUZU LIMITED Company Presentation B&K’s Annual Investor Conference 30th May, 2019 (Mumbai) Safe Harbor • This presentation and the accompanying slides (the “Presentation”), which have been prepared by the Company have been prepared solely for information purposes and do not constitute any offer, recommendation or invitation to purchase or subscribe for any securities, and shall not form the basis or be relied on in connection with any contract or binding commitment what so ever. No offering of securities of the Company will be made except by means of a statutory offering document containing detailed information about the Company. • This Presentation has been prepared by the Company based on information and data which the Company considers reliable, but the Company makes no representation or warranty, express or implied, whatsoever, and no reliance shall be placed on, the truth, accuracy, completeness, fairness and reasonableness of the contents of this Presentation. This Presentation may not be all inclusive and may not contain all of the information that you may consider material. Any liability in respect of the contents of, or any omissionfrom, this Presentation is expressly excluded. • Certain matters discussed in this Presentation may contain statements regarding the Company’s market opportunity and business prospects that are individually and collectively forward-looking statements. Such forward-looking statements are not guarantees of future performance and are subject to known and unknown risks, uncertainties and assumptions -

Investors Presentation AGM 2019

Welcome to Pricol Limited’s 8th Annual General Meeting 29 August 2019 Slide 1 Agenda Financial Performance FY 18‐19 & FY 19‐20 (Q1) New Business Wins Company Outlook FY 19‐20 Key Investments & New Plant Key Partnerships Slide 2 Financial Performance FY 18‐19 & FY 19‐20 (Q1) Slide 3 Standalone Financial Performance FY 18‐19: Operations . Pricol’s standalone revenue from operations grew by 10.30% and stood at INR 1297.90 crores in FY 18‐19 . However, Increase in raw material cost on account of electronics price surge, forex impact due to rupee weakening, fuel price surge and additional cost incurred for stock building for new plants as well as managing labour issues resulted in decrease in profit. Cash generation through operations is INR 73.99 crores in FY 18‐19 as against INR 74.46 crores in FY 17‐18. (In INR crores) Particulars FY 18‐19 FY 17‐18 FY 19‐20 Q1 Revenue from operations 1297.90 1176.71 303.06 (excluding excise duty) Profit / (Loss) before Tax 3.90 74.22 (4.40) (before exceptional item) EBITDA 91.22 107.46 25.16 % of Revenue 7.03% 9.13% 8.30% Slide 4 Standalone Financial Performance FY 18‐19: Total Revenue . Total revenue is INR 1383.91 crores in FY 18‐19, which includes the following: . Sale of land held as stock in trade to the tune of INR 11.84 crores . Sale of traded goods to the tune of INR 67.06 crores . Other income is to the tune of INR 5.93 crores .