FADA Releases August'21 Vehicle Retail Data

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Details of Vehicle Dealers

DETAILS OF VEHICLE DEALERS (BOTH SELF AND NON-SELF) AS ON 17.09.2020 BASED ON VAHAN DATABASE S NO RTO Code Dealer Name Address Maker Self/Non-self Vehicle Class 1 1 RANA MOTORS P.LTD NA DL-110054 MARUTI SUZUKI INDIA LTD Self Motor Car 2 1 M/S PAHWA AUTOSALES PVT LTD 26/24,26/25 SHAKTI NAGAR DL-110007 HYUNDAI MOTOR INDIA LTD Non-self Motor Car 3 1 BALAJI AUTO 31, SHAHZAD BAGH INDL AREA DELHI DL-110035 NA Non-self M-Cycle/Scooter 1275-1276 BARA BAZAR KASMERE GATE DELHI DL- 4 1 CARLTON MOTORS PVT LTD NA Non-self M-Cycle/Scooter 110006 5 1 RANA MOTORS NA DL-110054 MARUTI SUZUKI INDIA LTD Self Motor Car 6 2 Apra Auto India Pvt Ltd NA New Delhi DL- MARUTI SUZUKI INDIA LTD Self Motor Car 7 2 COMPETENT AUTOMOBILES CO. LTD. COMPETENT HOUSE, F-14, CP NEW DELHI DL-110001 NA Self Motor Car RIGH ROAD HONDA,40- 42 JANPATH, NEW DELHI DL- 8 2 BAS ENGINEER PVT. LIMITED HONDA CARS INDIA LTD Non-self Motor Car 110001 CAPITAL POINT, BABA KHARAT SINGH MARG, 9 2 ZENICA CARS INDIA PVT. LIMITED AUDI AG Non-self Motor Car CONNAUGHT PLACE DL-110001 HOTEL SAMRAT, LGF, KAUTILYA MARG, CHANAKYA 10 2 EXCLUSIVE MOTORS PVT. LIMITED BENTLEY MOTORS LIMITED Non-self Motor Car PURI DL-110001 HOTEL SAMRAT, LGF, KAUTILYA MARG CHANAKYA 11 2 EXCLUSIVE MOTORS PVT. LTD NA Non-self Motor Car PURI DL-110001 12 2 SILVER ARROW 50-B,CHANAKAYA PURI DL-110001 NA Non-self Motor Car 13 2 COMPETENT AUTOMOBILES CO. -

India Light Vehicle Sales Update

India Light Vehicle Sales Update May 2021 LMC Automotive LMC Automotive provides the highest quality global sales and production forecasts for Light Vehicles and Medium and Heavy commercial vehicles, along with forecasts of engine and transmission supply and demand. Recognised as leading experts in forecasting, LMC Automotive provides the automotive industry with strategic insights unavailable elsewhere. Our regular forecasting products include: Light Vehicle Sales Forecasts Light Vehicle Production Forecasts Light Vehicle Powertrain Forecast Automotive Market Updates and Forecasts (China, India and ASEAN) Global Light Vehicle Forecast Global Commercial Vehicle Forecast Hybrid & Electric Vehicle Forecasts Global Automotive Scenarios Service European Trade & Inventory Service LMC Automotive has offices worldwide, as well as representation through MarkLines in Tokyo and CARCON in São Paulo. More information on LMC Automotive and our forecasting services can be found at the end of this report or at www.lmc‐auto.com © LMC Automotive, 2021. All rights are reserved in all countries. While LMC Automotive endeavours to ensure the accuracy of the data, estimates and forecasts contained in this study, any decisions based on them (including those involving investment and planning) are at the client’s own risk. LMC Automotive can accept no liability regarding information, analysis and forecasts contained in the study. The subscriber to this service agrees that the information, computer models, or other materials provided in printed or electronic format in this service are owned by LMC Automotive and shall remain confidential within the subscribing organisation and shall not be disclosed, in whole or in part, to any third party without the prior written consent of LMC Automotive. -

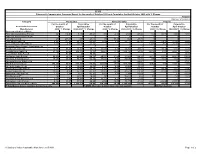

Segment/Subsegment Manufacturer 2020 % Change

SIAM Category & Company wise Summary Report for the month of October 2020 and Cumulative for April-October 2020 with % Change Report II (Number of Vehicles) Category Production Domestic Sales Exports For the month of Cumulative For the month of Cumulative For the month of Cumulative Segment/Subsegment October April-October October April-October October April-October Manufacturer 2020 % Change 2020-2021 % Change 2020 % Change 2020-2021 % Change 2020 % Change 2020-2021 % Change Passenger Vehicles (PVs)* FCA India Automobiles Pvt Ltd 961 116.93 5,182 -34.23 832 -2.58 2,593 -53.22 164 60.78 3,086 57.13 Fiat India Automobiles Pvt Ltd 0 - 0 - 0 - 0 - 0 - 0 - Force Motors Ltd 276 249.37 659 -24.43 330 69.23 668 -25.70 0 - 0 - Ford India Private Ltd 8,951 -37.54 49,301 -58.53 7,084 0.95 24,727 -41.93 1,837 -74.38 27,926 -64.66 General Motors India Pvt Ltd 5,639 -8.80 22,036 -52.26 0 - 0 - 5,075 -8.53 21,705 -52.45 Hindustan Motor Finance Corporation Ltd 0 - 0 - 0 - 0 - 0 - 0 - Honda Cars India Ltd 10,272 88.44 36,305 -45.22 10,836 8.25 35,700 -49.63 84 -85.34 1,118 -62.60 Hyundai Motor India Ltd 65,700 26.83 250,750 -38.13 56,605 13.19 219,130 -25.58 12,230 -10.07 44,271 -62.13 Isuzu Motors India Pvt Ltd 11 -92.09 44 -94.99 0 - 0 - 0 - 22 -66.67 Kia Motors India Pvt Ltd 22,936 68.13 86,504 164.74 20,621 61.25 67,588 154.31 4,213 127.73 20,819 796.98 Mahindra & Mahindra Ltd 19,203 20.62 70,928 -42.60 18,621 0.96 70,096 -42.78 796 -32.08 3,472 -58.92 Mahindra Electric Mobility Ltd 0 - 5 - 1 -93.75 1 -95.24 0 - 16 -77.14 Maruti Suzuki India Ltd -

Consolidated Approved Company List

Consolidated approved company list CONSOLIDATED APPROVED COMPANY LIST CONSOLIDATED APPROVED COMPANY NORMS STATE INSTITUTE ACTION UNIQUE COMPANY LIST CATEGORY ID CODE 3M INDIA LIMITED ELITE E00001 ABB INDIA LIMITED ELITE E00519 ACCENTURE SOLUTIONS PRIVATE ELITE EXCEPTION CATEGORY S05819 LIMITED CHANGE ADANI ENTERPRISES LIMITED ELITE E00002 (FORMERLY ADANI EXPORTS LIMITED) ADANI PORTS AND SPECIAL ECONOMIC ELITE E00003 ZONE LIMITED ADITYA BIRLA FINANCE LIMITED ELITE E00006 ADITYA BIRLA FINANCIAL SERVICES ELITE E00007 GROUP ADITYA BIRLA GROUP POWER PROJECTS ELITE E00008 ADITYA PHARMACARE PRIVATE LIMITED ELITE NAME E00011 (formerly ADITYA PHARMA PRIVATE CHANGE LIMITED) AKZO NOBEL INDIA LIMITED ELITE E00013 ALKALOIDA CHEMICAL COMPANY ZRT. ELITE E00014 ALKEM LABORATORIES LIMITED ELITE E00015 ALLAHABAD BANK ELITE E00016 AMARA RAJA BATTERIES LIMITED ELITE E00020 AMAZON DEVELOPMENT CENTRE (INDIA) ELITE CATEGORY S00220 PRIVATE LIMITED CHANGE AMBUJA CEMENTS LIMITED ELITE E00021 AMDOCS DEVELOPMENT CENTER INDIA ELITE CATEGORY S00230 LLP CHANGE AMERICAN EXPRESS(INDIA) PRIVATE ELITE CATEGORY S00236 LIMITED CHANGE ANDHRA BANK ELITE E00022 ANZ OPERATIONS AND TECHNOLOGY ELITE CATEGORY S00280 PRIVATE LIMITED CHANGE APOLLO HOSPITALS ENTERPRISE ELITE E00023 LIMITED CATEGORY S05823 ARVIND LIMITED ELITE CHANGE CATEGORY P01165 ASEA BROWN BOVERI(PABBL) ELITE CHANGE ASHOK LEYLAND LIMITED ELITE E00025 ASIAN PAINTS LIMITED ELITE E00026 ASSOCIATED BUILDING COMPANY ELITE E00027 ASSOCIATED CEMENT COS LIMITED ELITE E00028 (ACC LIMITED) ATOS INDIA PRIVATE LIMITED ELITE -

SML Isuzu Ltd., Honda R&D Ltd

DEPARTMENT OF MECHANICAL NAAC ‘A’ GRADE ENGINEERING NIRF RANKED AICTE APPROVED 1 PUNJABI UNIVERSITY, PATIALA Punjabi University Patiala, one of the premier institutions of higher educationinthenorthofIndia,wasestablishedonthe30thApril, 1962 under the Punjabi University Act 1961. University has been awarded ‘A’ Grade Status by the National Assessment and Accreditation Council (NAAC) Lush Green, Pollution Free Environment Spread over 600 acres of land 2 DEPARTMENT OF MECHANICAL ENGINEERING Department of Mechanical Engineering was established at Punjabi University Campus in the year 2003. 3 DEPARTMENT OF MECHANICAL ENGINEERING Why Mechanical Engineering? Mechanical Engineers & professionals work in nearly every industry such as commercial, industrial, military or scientific companies. Job opportunities are available in both Software and Mechanical, Automobile, Chemical, Civil, Electronics, Shipping, Marine, Railways, Aviation, Defense, Agricultural companies. One may also enter into Research and Development. 4 DEPARTMENT OF MECHANICAL ENGINEERING Job Opportunities for Mechanical Engineers Wide array of career possibilities. Govt. Jobs – DRDO, Defense, Atomic Energy, ONGC, NTPC, Energy Sector, Railways, Engineers India Ltd. etc. Aerospace, Automotive, Agricultural and Manufacturing. Important emerging areas, such as Nuclear Technology, Robotics, Biomedical Technology, Automation, Mechatronics. Any engineering industry, consulting and management. 5 DEPARTMENT OF MECHANICAL ENGINEERING Why Mechanical Engineering? HIGHER STUDIES -

India's Fuel Economy Benchmarks

INDIA’S FUEL ECONOMY BENCHMARKS How to make them work for an energy-efficient and climate-secure world Writers: Anumita Roychowdhury and Vivek Chattopadhyaya Research contribution: Swagata Dey Editor: Arif Ayaz Parrey Design and cover: Ajit Bajaj Layouts: Surender Singh Production: Rakesh Shrivastava and Gundhar Das The views/analysis expressed in this report/document do not necessarily reflect the views of Shakti Sustainable Energy Foundation. The Foundation also does not guarantee the accuracy of any data included in this publication nor does it accept any responsibility for the consequences of its use. © 2021 Centre for Science and Environment Material from this publication can be used, but with acknowledgement. Maps used in this document are not to scale. Citation: Anumita Roychowdhury and Vivek Chattopadhyaya 2021. India’s Fuel Economy Benchmarks: How to make them work for an energy-efficient and climate-secure world. Centre for Science and Environment, New Delhi Published by Centre for Science and Environment 41, Tughlakabad Institutional Area New Delhi 110 062 Phones: 91-11-40616000 Fax: 91-11-29955879 E-mail: [email protected] Website: www.cseindia.org Contents Why this study? 5 Summary of the review 7 Next steps 12 PART 1 19 1. Fuels, emissions and passenger cars 20 CO2 emissions trends in cars 20 Regulating fuel consumption 24 Adequacy of norms 26 Status of compliance 29 Raise the bar 30 Align with global trends 36 Next steps 37 2. Heavy-duty vehicle segment 41 Genesis of the HDV standards 41 Uncertainty around the standards 42 Next steps 44 3. Two-wheelers 46 Next steps 47 PART 2 49 4. -

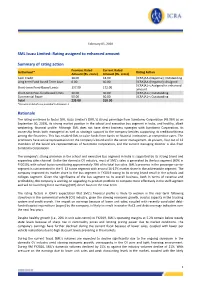

SML Isuzu Limited: Rating Assigned to Enhanced Amount Summary Of

February 05, 2020 SML Isuzu Limited: Rating assigned to enhanced amount Summary of rating action Previous Rated Current Rated Instrument* Rating Action Amount (Rs. crore) Amount (Rs. crore) Cash Credit 18.00 18.00 [ICRA]AA-(Negative); Outstanding Long term Fund based Term Loan 0.00 40.00 [ICRA]AA-(Negative); Assigned [ICRA]A1+; Assigned to enhanced Short-term Fund-Based Limits 137.00 172.00 amount Short-term Non-fund based limits 30.00 30.00 [ICRA]A1+; Outstanding Commercial Paper 50.00 50.00 [ICRA]A1+; Outstanding Total 235.00 310.00 *Instrument details are provided in Annexure-1 Rationale The rating continues to factor SML Isuzu Limited’s (SML’s) strong parentage from Sumitomo Corporation (43.96% as on September 30, 2019), its strong market position in the school and executive bus segment in India, and healthy, albeit weakening, financial profile. Although SML does not have direct business synergies with Sumitomo Corporation, its ownership lends both managerial as well as strategic support to the company besides supporting its creditworthiness among the financiers. This has enabled SML to raise funds from banks or financial institutions at competitive rates. The promoters have active representation on the company’s board and in the senior management. At present, four out of 12 members of the board are representatives of Sumitomo Corporation, and the current managing director is also from Sumitomo Corporation. The company’s strong presence in the school and executive bus segment in India is supported by its strong brand and expanding sales channel. Unlike the domestic CV industry, most of SML’s sales is generated by the bus segment (60% in FY2019), with school buses constituting approximately 70% of its total bus sales. -

'Bogus Package'

Follow us on: @TheDailyPioneer facebook.com/dailypioneer RNI No. TELENG/2018/76469 Established 1864 Published From ANALYSIS 7 MONEY 8 SPORTS 12 HYDERABAD DELHI LUCKNOW POWER UP THE SENSEX CRASHES AS INVESTORS VIRAT IS BEST AT BHOPAL RAIPUR CHANDIGARH RURAL ECONOMY GIVE THUMBS DOWN TO STIMULUS MOMENT: CHAPPELL BHUBANESWAR RANCHI DEHRADUN VIJAYAWADA *LATE CITY VOL. 2 ISSUE 218 HYDERABAD, TUESDAY MAY 19, 2020; PAGES 12 `3 *Air Surcharge Extra if Applicable NO GLIMPSE OF TARAK FROM RRR ON HIS B’DAY { Page 11 } www.dailypioneer.com ‘Bogus package’ KCR tears into Rs 20L-cr stimulus ence at Pragathi Bhavan here after the Cabinet meeting, KCR lashed out at Modi say- LOCK OPEN ing that the PM has treated n TELANGANA IS GREEN ZONE EXCEPT CONTAINMENT AREAS: CM States and state governments as beggars with his package. PNS n HYDERABAD announcements. Shops will be the state. They will follow KCR was furious at Modi Telangana back to work allowed to operate on alternate Covid-19 rules by sanitising imposing conditions on States Chief Minister K days, following odd-even rule. buses. Wearing of masks by even to avail the FRBM limit, Chandrasekhar Rao on n All offices will be n All commercial shops In containment areas, nothing passengers and staff would be increased from 3 per cent to 5 Monday declared that except open no restriction on will open,no malls, cinemas, will be allowed to open.” compulsory. In some situa- per cent. for containment areas, all other staff numbers Public transport, except tions, the state government "This is not the package areas in Telangana State are n Night curfew will Hyderabad Metro Rail, will be will retain control. -

FADA Releases July'21 Vehicle Retail Data

FEDERATION OF AUTOMOBILE DEALERS ASSOCIATIONS 804-805-806, Surya Kiran, 19, K G Marg New Delhi - 110 001 (INDIA) T +91 11 6630 4852, 2332 0095, 4153 1495 E [email protected] CIN U74140DL2004PNL130324 FOR IMMEDIATE RELEASE FADA Releases July’21 Vehicle Retail Data • Total vehicle retails for the month of July’21 rise by 34.12% on YoY basis. When compared to July’19 (a regular pre-covid month), recovery is visible as the deficit reduces to low double digits of -13.22%. • On YoY basis, all categories were in green with 2W up by 28%, 3W up by 83%, PV up by 63%, Tractor up by 7% and CV up by 166%. • After Tractors, PV for the first time shows strong numbers by clocking 24% growth when compared to pre-covid month of July’19. • FADA has been raising red flag about semi-conductor shortage since quite some time. The situation is now becoming grave with ever-increasing supply-side constraints. • rd The delta variant and a possibility of 3 wave continues to remain a threat for stable Auto Retails. 9th August’21, New Delhi: The Federation of Automobile Dealers Associations (FADA) today released Vehicle Retail Data for July’21. July’21 Retails Commenting on how July’21 performed, FADA President, Mr. Vinkesh Gulati said, “With entire country now open, July continues to see robust recovery in Auto Retails as demand across all categories remain high. The low base effect also continues to play its part. With all categories in green, CV’s continue to see increase in demand specially in M&HCV segment with the Government rolling out infrastructure projects in many parts of the country. -

Innovations 19.3

INNOVATIONS 19.3 1 SOFTWARE INNOVATIONS Manual selection of connection pins This Expert mode function allows the user to configure the connection to a system by manually selecting the communication pins on the OBD or Deutsch 9-pin cable. In this way, this function offers the user an alternative to the connection offered by the software in the most common communication protocols. Only available for V8 and higher devices. Countdown timer During the execution of some functionalities, it is necessary to wait a certain period of time until performing any operation. From this version, in this type of steps, Jaltest offers a countdown timer with the set time. 2 Improvement in the interaction with buttons in action steps Safety considerations in hybrid and electric vehicles (HEV) These instructions appear when selecting a hybrid model, a high voltage element control system and when selecting high voltage components in the wiring diagram configurations. These are very important safety considerations when working in hybrid and electric vehicles. 3 NEW DIAGNOSIS AND SYSTEM FUNCTIONALITIES Take into account that this document is only a summary of the most important information of this new version. For more information, please visit Jaltest Report. TRUCK AND BUS DAF For Euro 6 models, in PCI UDS engine management system, there are new functions such as the performance assessment of the turbo actuator. In the EAS4 Ecofit UL2 exhaust gas treatment system, the diesel particulate filter regeneration and AdBlue/DEF dosing are highlighted. Operation diagrams in the ECS-DC6, EAS3 and EAS4 exhaust gas treatment systems from the brand. 4 IVECO For Euro 6 models, in the EDC 17 CV41 engine management system, the component replacement for new system variants is highlighted. -

FADA Releases June'21 Vehicle Retail Data

FEDERATION OF AUTOMOBILE DEALERS ASSOCIATIONS 804-805-806, Surya Kiran, 19, K G Marg New Delhi - 110 001 (INDIA) T +91 11 6630 4852, 2332 0095, 4153 1495 E [email protected] CIN U74140DL2004PNL130324 FOR IMMEDIATE RELEASE FADA Releases June’21 Vehicle Retail Data Total vehicle retail for the month of June’21 rise by 22.62% YoY on a low base. When compared to June’19 (a regular pre-covid month), retails are still down by -28.32%. On YoY basis, all categories were in green with 2W up by 17%, 3W up by 22%, PV up by 43%, Tractor up by 14% and CV up by a massive 236% (on a very low base due to non-availability of BS-6 vehicles). Positive momentum from June carries forward to July. With Southern India opening up, we can expect further pickup in demand. While daily infection cases have been contained offering some respite from the debilitating second wave, however the new virus mutants and the impending 3rd wave continue to pose as risks on a longer term. FADA thanks the Government of India to bring entire Auto Retail under MSME. This will help the industry at a time when gears are down. 8th July’21, New Delhi: The Federation of Automobile Dealers Associations (FADA) today released Vehicle Retail Data for June’21. June’21 Retails Commenting on how June’21 performed, FADA President, Mr. Vinkesh Gulati said, “The month of June witnessed re-opening for most of the states except the ones in South. Due to this, the industry witnessed a high pent up demand which was stuck in the system because of statewide lockdowns. -

Meet with Farmers

OPINION, P6 COMPANIES, P4 INTERNATIONAL, P8 ASHOK GULATI EDITORIAL RECOVERY FROM COVID TECH KNOW Decentralise MSP RBI’s options narrow Oyo has close to $1 bn Canada plans digital tax as inflation and inflows procurement,PDS to both rise, will have to to fund regular ops: in 2022 on global giants deal with farm protests keep repo unchanged Agarwal to employees like Facebook, Google PUNE, WEDNESDAY, DECEMBER 2, 2020 FOLLOW US ON TWITTER & FACEBOOK. APP AVAILABLE ON APP STORE & PLAYSTORE WWW.FINANCIALEXPRESS.COM VOL. XI NO. 261, 16 PAGES, `6.00PUBLISHEDFROM:AHMEDABAD,BENGALURU,CHANDIGARH, CHENNAI,HYDERABAD,KOCHI,KOLKATA,LUCKNOW,MUMBAI, NEWDELHI,PUNE READ TO LEAD SENSEX: 44,655.44 ▲ 505.72 NIFTY: 13,109.05 ▲ 140.10 NIKKEI 225: 26,787.54 ▲ 353.92 HANG SENG: 26,567.68 ▲ 226.19 `/$: 73.67 ▲ 0.38 `/€: 88.26 ▲ 0.02 BRENT: $47.84 ▼ $0.04 GOLD: `48,314 ▼ `464 IN THE NEWS ICICI BANK CASE GROWTH PANGS DULL DIWALI ‘Oxford vaccine SC rejects Kochhar’s safe, no co-relation Revival doubts rise No festive cheer with side-effects’ plea on termination SERUM INSTITUTE OF India in Nov car sales on Tuesday denied charges Apex court rules ORDER, ORDER that a Covid trial volunteer on weaker Oct-Nov Pent-up demand 2%onayear-on-yearbasis.The suffered serious side effects her services were ■ The apex court said it five-day period of Diwali sales from a vaccine developed not governed by 'won't interfere with the Core sectors, power Trends in GST collections Core sector Power demand phase seen to be forMarutithisyearwasaround by AstraZeneca and Oxford Bombay HC order' FY 2019-20 FY 2020-21 (% change, y-o-y, in (in bn units) slowly petering out 40,000 units compared to University, saying that the any statute but were demand, auto/fuel (in ` crore) output of 8 infra 2019 2020 around39,000lastyearduring ■ It said the issue falls industries) vaccine is safe and immuno- 135 the same festival (last year purely contractual within the realm of a 10 genic, reports PTI.