FADA Releases July'21 Vehicle Retail Data

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Details of Vehicle Dealers

DETAILS OF VEHICLE DEALERS (BOTH SELF AND NON-SELF) AS ON 17.09.2020 BASED ON VAHAN DATABASE S NO RTO Code Dealer Name Address Maker Self/Non-self Vehicle Class 1 1 RANA MOTORS P.LTD NA DL-110054 MARUTI SUZUKI INDIA LTD Self Motor Car 2 1 M/S PAHWA AUTOSALES PVT LTD 26/24,26/25 SHAKTI NAGAR DL-110007 HYUNDAI MOTOR INDIA LTD Non-self Motor Car 3 1 BALAJI AUTO 31, SHAHZAD BAGH INDL AREA DELHI DL-110035 NA Non-self M-Cycle/Scooter 1275-1276 BARA BAZAR KASMERE GATE DELHI DL- 4 1 CARLTON MOTORS PVT LTD NA Non-self M-Cycle/Scooter 110006 5 1 RANA MOTORS NA DL-110054 MARUTI SUZUKI INDIA LTD Self Motor Car 6 2 Apra Auto India Pvt Ltd NA New Delhi DL- MARUTI SUZUKI INDIA LTD Self Motor Car 7 2 COMPETENT AUTOMOBILES CO. LTD. COMPETENT HOUSE, F-14, CP NEW DELHI DL-110001 NA Self Motor Car RIGH ROAD HONDA,40- 42 JANPATH, NEW DELHI DL- 8 2 BAS ENGINEER PVT. LIMITED HONDA CARS INDIA LTD Non-self Motor Car 110001 CAPITAL POINT, BABA KHARAT SINGH MARG, 9 2 ZENICA CARS INDIA PVT. LIMITED AUDI AG Non-self Motor Car CONNAUGHT PLACE DL-110001 HOTEL SAMRAT, LGF, KAUTILYA MARG, CHANAKYA 10 2 EXCLUSIVE MOTORS PVT. LIMITED BENTLEY MOTORS LIMITED Non-self Motor Car PURI DL-110001 HOTEL SAMRAT, LGF, KAUTILYA MARG CHANAKYA 11 2 EXCLUSIVE MOTORS PVT. LTD NA Non-self Motor Car PURI DL-110001 12 2 SILVER ARROW 50-B,CHANAKAYA PURI DL-110001 NA Non-self Motor Car 13 2 COMPETENT AUTOMOBILES CO. -

Auto Sales Rev up in June As States Unlock Inventory Build-Up in Anticipation of Big July Offtake

Auto sales rev up in June as States unlock Inventory build-up in anticipation of big July offtake OUR BUREAU New Delhi, July 1 With States steadily unlock- ing, automobile companies are seeing a significant risein enquiries and bookings and stepped up dispatches to deal- ers in June. The country’s largest car- maker, Maruti Suzuki India (MSIL), on Thursday reported domestic sales soaring more than three and half times to units in May. So, did ‘City’ 1,59,561 units in the previous 1,24,280 units in June com- maker Honda Cars India dis- month. pared to 32,903 units in May. patching 4,767 units. Bajaj Auto also reported Similarly, Hyundai Motor In- factory-gate sales jumping dia (HMIL) reported sales MG, Kia retail sales up two-and-half times to 1,55,640 jumping 62 per cent to 40,496 MG Motor India said it retail units from 60,342 units in May. units in June compared with sales trebled to 3,558 units in 25,001 in May. June from 1,016 units in May. CVs, tractors too Tata Motors reported a Similarly, Kia India registered In the commercial vehicle and growth of 59 per cent to 24,110 retail sales of 15,015 units tractor segments, also, com- units from 15,181 in May. against 11,050 units in May. panies reported multi-fold Shailesh Chandra, President, “The last few weeks have jump in their sales on Passenger Vehicles Business shown signs of improved cus- monthly basis. Unit, Tata Motors, said, “The PV tomer sentiment, and we con- According to Mitul Shah, industry’s sequential growth tinue to be optimistic about Head of Research at Reliance momentum got adversely im- the future. -

Force Motors Is the Title Sponsor of “The Rainforest Challenge India”

PRESS RELEASE FOR IMMEDIATE RELEASE Force Motors is the Title Sponsor of “The Rainforest Challenge India” The first edition of “Force Gurkha RFC India” to be held in Goa from August 8 to 14, 2014 New Delhi, July 2, 2014: Pune‐based Force Motors Ltd. today announced that the company will be the Title Sponsor of Rainforest Challenge in India, titled “Force Gurkha RFC India 2014”. Force Motors is a pioneer in the field Light Commercial Vehicles (LCV) and has recently forayed into the Personal Vehicles business with Force One SUV. It will promote its Extreme Off‐Roader Vehicle; Force Gurkha with the title sponsorship of this event. Rainforest Challenge was first launched in Malaysia in 1997 and is amongst the Top Ten Toughest motor races in the world. It is a global brand with presence in seven countries; Italy, Australia, Russia, Sri Lanka, Vietnam, Tunisia, and China. The Force Gurkha RFC India 2014 will take place in the forests of southern Goa from August 8 to 14, 2014. The first edition of this mega motorsport event is expected to be the biggest congregation of extreme off‐roading enthusiasts in India. Force Motor’s Managing Director, Mr. Prasan Firodia said “For Force Gurkha there could have been no better synergy than this extreme off‐roading event. The RFC India 2014 is a great platform for the Force Gurkha. I believe the off‐roading community in India is ready for intense challenges and now has a global platform to test their mettle and raise their skill levels.” Force Gurkha RFC India 2014 shall maintain the extreme challenging conditions seen in the original event held in Malaysia. -

Force Motors Ltd RETAIL RESEARCH

RETAIL RESEARCH Pick of the Week – Stock Update 04 Apr 2016 Force Motors Ltd Industry HDFCSec Scrip Code CMP Recommendation Sequential Targets Time Horizon Automobile FORMOTEQNR Rs. 2954 Buy at CMP and add on dips between Rs.2632-2750 band Rs. 3275 & Rs. 3510 2-3 quarters Company Profile Force Motors Ltd is a Pune based company engaged in the manufacture of LCVs, SCVs, utility vehicles, agricultural tractors and other products related to automobile industry such as diesel engines. It has currently five plants in India, one each in Akurdi, Pune; Pithampur, Madhya Pradesh; Urse, Pune; Mahindra World City, Tamil Nadu and Chakan, Pune. Force Motors established in 1958 by Shri N. K. Firodia is a fully vertically integrated automobile company, with expertise in design, development and manufacture of the full spectrum of automotive components, aggregates and vehicles. Force Motors (formerly known as Bajaj Tempo) started production of HANSEAT 3‐wheelers in collaboration with Vidal & Sohn Tempo Werke Germany. The company played a pioneering role in the light commercial transport industry in India with iconic brands like the Tempo, the Matador and the Traveller. Its range includes Trump small commercial vehicles, Trax multi‐utility and cross country vehicles, Traveller light commercial vehicles/mini buses and the Balwan range of Agricultural Tractors. Force Motors has also entered into the personal vehicles arena with the launch of a genre leading sports utility vehicle, the FORCE ONE in August 2011.The Extreme Off‐Roader Vehicle; Gurkha is the second vehicle to be launched under the Personal Vehicles Division. Force Motors enjoys more than 75% market share in the less than five-tonne category, even as its two main competitors — Mahindra Tourister (10% market share) and Tata Motors (15% market share) — are de-growing. -

India Light Vehicle Sales Update

India Light Vehicle Sales Update May 2021 LMC Automotive LMC Automotive provides the highest quality global sales and production forecasts for Light Vehicles and Medium and Heavy commercial vehicles, along with forecasts of engine and transmission supply and demand. Recognised as leading experts in forecasting, LMC Automotive provides the automotive industry with strategic insights unavailable elsewhere. Our regular forecasting products include: Light Vehicle Sales Forecasts Light Vehicle Production Forecasts Light Vehicle Powertrain Forecast Automotive Market Updates and Forecasts (China, India and ASEAN) Global Light Vehicle Forecast Global Commercial Vehicle Forecast Hybrid & Electric Vehicle Forecasts Global Automotive Scenarios Service European Trade & Inventory Service LMC Automotive has offices worldwide, as well as representation through MarkLines in Tokyo and CARCON in São Paulo. More information on LMC Automotive and our forecasting services can be found at the end of this report or at www.lmc‐auto.com © LMC Automotive, 2021. All rights are reserved in all countries. While LMC Automotive endeavours to ensure the accuracy of the data, estimates and forecasts contained in this study, any decisions based on them (including those involving investment and planning) are at the client’s own risk. LMC Automotive can accept no liability regarding information, analysis and forecasts contained in the study. The subscriber to this service agrees that the information, computer models, or other materials provided in printed or electronic format in this service are owned by LMC Automotive and shall remain confidential within the subscribing organisation and shall not be disclosed, in whole or in part, to any third party without the prior written consent of LMC Automotive. -

A Study on Customer Satisfaction Towards Bharat Benz, Trident Automobiles Pvt Ltd, Bangalore by Dilip Kumar M 1IA17MBA18 Submitted To

A Project Report (17MBAPR407) A study on Customer Satisfaction towards Bharat Benz, Trident Automobiles Pvt Ltd, Bangalore By Dilip Kumar M 1IA17MBA18 Submitted to VISVESVARAYA TECHNOLOGICAL UNIVERSITY, BELAGAVI In partial fulfilment of the requirements for the award of the degree of MASTER OF BUSINESS ADMINISTRATION Under the guidance of INTERNAL GUIDE EXTERNAL GUIDE Prof. Archana Vijay Mr. Harsha H Assistant Professor, Marketing Head Department of MBA, AIT Bharat Benz Department of MBA Acharya Institute of technology, Soldevanahalli, Hesaraghatta Main Road, Bengaluru March 2019 TRIDENT AUTOMOBILES PRIVATE LIMITED # 1, Lower Palace Orchards, Sankey Road , Bangalore - 560 003. Tel: 91-80-4343 3333 Fax: 91-80-2336 8152 CIN: U50500KA1997PTC023159 Date: 02-04-2019 TO WHOM SO EVER IT MAY CONCERN This is to certify that Mr. Dilip Kumar M (Reg No:llAl 7MBA18) who is pursuing his Post Graduation Degree in MBA from "Visvesvaraya Technology University" has successfully completed his Internship on "Customer Satisfaction Towards Bharath Benz" in our organization from the period of 03 rd January 2019 to 16th February 2019. His performance & conduct during the internship was good. We wish him all the very best for his future endeavor. Your's faithfully, For Trident Automobiles Pvt Ltd., Metha Nanjappa General Manager - HR URL : www.tridentautomobiles.com '!),zwe ,;ilOHU ,I ~~ /@) ACHARYA INSTITUTE OF TECHNOLOGY (Affiliated to Visvesvaraya Technolog ical Un iversity, Belagav i, Approved by AICTE, New Delh i and Accredited by NBA and NAAC) Date: 05/04/2019 CERTIFICATE This is to certify that Mr. Dilip Kumar M bearing USN HAI 7MBA18 is a bonafide student of Master of Business Administration course of the Institute 2017-19 batch, affiliated to Vi svesvaraya Technological Universit'J, Belagavi. -

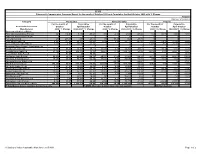

Segment/Subsegment Manufacturer 2020 % Change

SIAM Category & Company wise Summary Report for the month of October 2020 and Cumulative for April-October 2020 with % Change Report II (Number of Vehicles) Category Production Domestic Sales Exports For the month of Cumulative For the month of Cumulative For the month of Cumulative Segment/Subsegment October April-October October April-October October April-October Manufacturer 2020 % Change 2020-2021 % Change 2020 % Change 2020-2021 % Change 2020 % Change 2020-2021 % Change Passenger Vehicles (PVs)* FCA India Automobiles Pvt Ltd 961 116.93 5,182 -34.23 832 -2.58 2,593 -53.22 164 60.78 3,086 57.13 Fiat India Automobiles Pvt Ltd 0 - 0 - 0 - 0 - 0 - 0 - Force Motors Ltd 276 249.37 659 -24.43 330 69.23 668 -25.70 0 - 0 - Ford India Private Ltd 8,951 -37.54 49,301 -58.53 7,084 0.95 24,727 -41.93 1,837 -74.38 27,926 -64.66 General Motors India Pvt Ltd 5,639 -8.80 22,036 -52.26 0 - 0 - 5,075 -8.53 21,705 -52.45 Hindustan Motor Finance Corporation Ltd 0 - 0 - 0 - 0 - 0 - 0 - Honda Cars India Ltd 10,272 88.44 36,305 -45.22 10,836 8.25 35,700 -49.63 84 -85.34 1,118 -62.60 Hyundai Motor India Ltd 65,700 26.83 250,750 -38.13 56,605 13.19 219,130 -25.58 12,230 -10.07 44,271 -62.13 Isuzu Motors India Pvt Ltd 11 -92.09 44 -94.99 0 - 0 - 0 - 22 -66.67 Kia Motors India Pvt Ltd 22,936 68.13 86,504 164.74 20,621 61.25 67,588 154.31 4,213 127.73 20,819 796.98 Mahindra & Mahindra Ltd 19,203 20.62 70,928 -42.60 18,621 0.96 70,096 -42.78 796 -32.08 3,472 -58.92 Mahindra Electric Mobility Ltd 0 - 5 - 1 -93.75 1 -95.24 0 - 16 -77.14 Maruti Suzuki India Ltd -

Innovation in India FINAL REPORT

Innovation in India FINAL REPORT Innovation in India FINAL REPORT CONTENTS CONTENTS Foreword by Liz Mohn 6 Setting the context 7 From the authors 8 Project background 9 I. Approach and methodology 11 1. Approach 11 2. Methodology 12 About this report 14 II. Innovation in India 15 A. Is India innovating – and if so, is it original? 15 B. Characteristics of innovation in India 17 C. Five archetypes of innovation in India 19 D. Types of innovators in India 28 E. Innovation at the industry level 40 III. Influencing factors 61 A. Internal influencing factors 61 B. External influencing factors 66 4 CONTENTS IV. Future projections 88 A. Future of India’s innovation landscape 88 B. Our methodology 89 C. Critical uncertainties and dimensions 90 D. Scenario development 92 E. Analysis of scenario-planning exercise 93 F. Key takeaways 95 V. Implications for Germany 96 A. Introduction 96 B. Customer: India is a large and growing customer, market and suitable test market for Germany 96 C. Competitor: With a strong base of engineering capability, India is emerging as a formidable competitor, especially in the area of frugal engineering 97 D. Collaborator: India’s role as a collaborator on innovation with Germany is developing 99 E. Talent hub: India has evolved into a high-quality source of abundant R&D capability and human capital for German firms 102 F. Ecosystem: Many large German companies want to innovate in India due to the innovation ecosystem 103 G. Key takeaways 104 VI. Recommendations 105 A. Recommendations for India 106 B. Recommendations for Germany (in the context of India) 116 C. -

SML Isuzu Ltd., Honda R&D Ltd

DEPARTMENT OF MECHANICAL NAAC ‘A’ GRADE ENGINEERING NIRF RANKED AICTE APPROVED 1 PUNJABI UNIVERSITY, PATIALA Punjabi University Patiala, one of the premier institutions of higher educationinthenorthofIndia,wasestablishedonthe30thApril, 1962 under the Punjabi University Act 1961. University has been awarded ‘A’ Grade Status by the National Assessment and Accreditation Council (NAAC) Lush Green, Pollution Free Environment Spread over 600 acres of land 2 DEPARTMENT OF MECHANICAL ENGINEERING Department of Mechanical Engineering was established at Punjabi University Campus in the year 2003. 3 DEPARTMENT OF MECHANICAL ENGINEERING Why Mechanical Engineering? Mechanical Engineers & professionals work in nearly every industry such as commercial, industrial, military or scientific companies. Job opportunities are available in both Software and Mechanical, Automobile, Chemical, Civil, Electronics, Shipping, Marine, Railways, Aviation, Defense, Agricultural companies. One may also enter into Research and Development. 4 DEPARTMENT OF MECHANICAL ENGINEERING Job Opportunities for Mechanical Engineers Wide array of career possibilities. Govt. Jobs – DRDO, Defense, Atomic Energy, ONGC, NTPC, Energy Sector, Railways, Engineers India Ltd. etc. Aerospace, Automotive, Agricultural and Manufacturing. Important emerging areas, such as Nuclear Technology, Robotics, Biomedical Technology, Automation, Mechatronics. Any engineering industry, consulting and management. 5 DEPARTMENT OF MECHANICAL ENGINEERING Why Mechanical Engineering? HIGHER STUDIES -

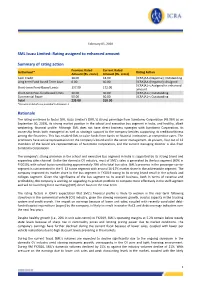

SML Isuzu Limited: Rating Assigned to Enhanced Amount Summary Of

February 05, 2020 SML Isuzu Limited: Rating assigned to enhanced amount Summary of rating action Previous Rated Current Rated Instrument* Rating Action Amount (Rs. crore) Amount (Rs. crore) Cash Credit 18.00 18.00 [ICRA]AA-(Negative); Outstanding Long term Fund based Term Loan 0.00 40.00 [ICRA]AA-(Negative); Assigned [ICRA]A1+; Assigned to enhanced Short-term Fund-Based Limits 137.00 172.00 amount Short-term Non-fund based limits 30.00 30.00 [ICRA]A1+; Outstanding Commercial Paper 50.00 50.00 [ICRA]A1+; Outstanding Total 235.00 310.00 *Instrument details are provided in Annexure-1 Rationale The rating continues to factor SML Isuzu Limited’s (SML’s) strong parentage from Sumitomo Corporation (43.96% as on September 30, 2019), its strong market position in the school and executive bus segment in India, and healthy, albeit weakening, financial profile. Although SML does not have direct business synergies with Sumitomo Corporation, its ownership lends both managerial as well as strategic support to the company besides supporting its creditworthiness among the financiers. This has enabled SML to raise funds from banks or financial institutions at competitive rates. The promoters have active representation on the company’s board and in the senior management. At present, four out of 12 members of the board are representatives of Sumitomo Corporation, and the current managing director is also from Sumitomo Corporation. The company’s strong presence in the school and executive bus segment in India is supported by its strong brand and expanding sales channel. Unlike the domestic CV industry, most of SML’s sales is generated by the bus segment (60% in FY2019), with school buses constituting approximately 70% of its total bus sales. -

Fml Unpaid 16-17

FORCE MOTORS LIMITED Unpaid Dividend list for 2016-2017 as on 15.12.2017 Sl. No. WAR_ FOLIO_NO NAM1 Add1 Add2 Add3 City PIN SHARES AMOUNT NO 1 1 C000299 CLIVE STREET NOMINEES PVT LTD. C/O ANZ GRINDLAYS BANK PLC. H-BLOCK CONNAUGHT CIRCUS NEW DELHI 0 0 50 500.00 2 2 P000219 M/S.P.S.JAIN COMPANY LIMITED 7-A RAJPUR ROAD DELHI. 0 0 53 530.00 3 3 Z000006 ZUMBERLAL CHAGANLAL KASWA ADATE BAZAR AHMEDNAGAR. 0 0 50 500.00 4 6 S002813 SUBRATA SEN 123/12 RAJROOPUR ALLAHABAD 0 0 9 90.00 5 7 U000144 USHA SHAH 10 PARK VIEW BAPTISTA ROAD VILE PARLE (WEST)MUMBAI 0 0 16 160.00 6 9 SS00102 SAVITRABAI RAMBHAU MANDEKAR AT POST AMBETHAN TAL. KHED DIST. PUNE 0 0 50 500.00 7 14 V000800 VIJAY KANTILAL GANDHI AMRUT PROV. STORES PANCHAPIR CHAWADI MALIWADA AHMEDNAGAR 0 0 66 660.00 8 16 S002138 SHILPA JAIN D-1 DOCTORS COLONY REWA (MP) 0 0 2 20.00 9 17 S002192 SURENDRA J. PUROHIT SUCHAK NIWAS BLOCK NO.1 MURBAD ROADKALYAN (W) DIST. THANE 0 0 16 160.00 10 18 S000862 SAVITRI DEVI 'SURENDRA COTTAGE' GURUNANAK PURA STREET MODINAGARDIST. MEERUT (U P) 0 0 100 1000.00 11 21 SN00007 NARAYAN KHEVRAJ BHUJBAL AT & POST - WAKAD TAL. MULSI DIST. POONA 0 0 100 1000.00 12 22 AK00009 KRISHNA ABAJI KASPATE AT & POST - WAKAD TALUKA MULSHI DIST. POONA 0 0 53 530.00 13 23 S001497 SHASHI JAIN C/O DEVENDRA KUMAR JAIN SARAFA BAZAR JAWAHAR GANJ GADARWARA (MP) 0 0 25 250.00 14 24 S001704 SUNITA SUKHANI C/O SUKHANI SPICES HIRAKUTIR MASKASATH ITWARINAGPUR 0 0 50 500.00 15 25 J000550 JATINDERPAL SINGH 19 RIDGE ROAD IDGAH HILL BHOPAL (M.P.) 0 0 50 500.00 16 27 AS00040 SUNANDA VASANT RAGADE AT & POST MALAWALI TALUKA MAVAL DIST. -

Electric Vehicle Conference 2021 Sector Report.Pdf

India Equity Research | Electric Vehicle Conference © May 23, 2021 Sector Report Emkay Electric Vehicle Conference Your success is our success Refer to important disclosures at the end of this report Decoding Electric Vehicle Disruption We organized our first ‘Electric Vehicle’ conference, featuring eminent speakers representing This report is solely produced by Emkay Global. The following person(s) are responsible for the production the entire EV value chain – Global & Indian OEMs, Government associations, Battery of the recommendation: manufacturers, Component suppliers, Sustainable mobility players and Charging infrastructure companies. We witnessed full-house participation with over 700 investor Raghunandhan N L [email protected] meetings over a period of two days. Across the value chain, the expectation of EV adoption +91 22 6624 2428 is high, and now the debate has shifted from “when” to “how fast”. Recent moves of firms across the value-chain on the product line-up and investment fronts, as well as their resolve Mumuksh Mandlesha to go ‘all electric’ have notably reset the expectations regarding the pace of EV adoption. The [email protected] key takeaways given below highlight initial signs of improving EV adoption: +91 22 6612 1334 OEMs: New products expected to drive adoption: Global OEMs already have a wide range Bhargava Perni of products, which are being introduced either directly (e.g., Mercedes Benz) or through [email protected] collaborations (e.g., GreenPower). In addition, almost all domestic OEMs and startups (e.g, +91 22 6624 2429 Ather) are also indigenously developing and launching products. These launches should drive the evolution of consumer profile from ‘early adopters’ and ‘technophile purchasers’ to ‘mass adopters’ over the medium- to longer term.