An Organization Study O CMR Institute N Organization Study on Hero

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

FIM Sidecar Motocross World Championship – Entry List – Jinin

PRESS RELEASE MIES, 17/08/2021 FOR MORE INFORMATION: ISABELLE LARIVIÈRE COMMUNICATIONS MANAGER [email protected] TEL +41 22 950 95 68 FIM Sidecar Motocross World Championship Championnat du Monde FIM de Motocross Sidecar Entry list – Jinin (Czech Republic), 22 August Rider Passenger Nationality FMN N° Motorcyle Team Name First Name Name First Name Rider Pass Rider Pass 2 Vanluchene Marvin Bax Robbie BEL NED FMB KNMV WSP-ZABEL SIDECARTEAM VANLUCHENE 3 Hermans Koen Janssens Glenn NED BEL KNMV FMB WSP-HUSQVARNA 4 Hofmann Fabian Strauss Marius SUI SUI FMS FMS VMC-ZABEL 6 Varik Kert Kunnas Lari EST FIN EMF SML WSP-HUSQVARNA 8 Brown Jake Millard Joe GBR GBR ACU ACU VMC-ZABEL 9 Sanders Davy Badaire Johnny BEL FRA FMB FFM WSP-ZABEL 11 Van Werven Gert Van Den Bogaart Ben NED NED KNMV KNMV WSP-TM 14 Keuben Justin Debruyne Niki NED BEL KNMV FMB VMC-ZABEL 15 Polívka Jan Rota Tomáš CZE CZE ACCR ACCR WSP 18 Heinzer Marco Betschart Ruedi SUI SUI FMS FMS VMC-KTM 21 Moulds Gary Gray Lewis GBR GBR MCUI MCUI WSP-HUSQVARNA 24 Peter Adrian Zatloukal Miroslav GER CZE DMSB ACCR WSP-ZABEL 25 Černý Lukáš Chopin Bastien CZE FRA ACCR FFM WSP-JAWA 26 Boukal Jan Boukal Pavel CZE CZE ACCR ACCR WSP-ZABEL 31 Veldman Julian Čermák Ondrej NED CZE KNMV ACCR CPD-MEGA 40 Chanteloup Romaric Chanteloup Josselyn FRA FRA FFM FFM WSP-KTM 50 Králíček Martin Králíček Martin CZE CZE ACCR ACCR VMC-MEGA 53 Wisselink Sven Rostingt Luc NED FRA KNMV FFM WSP-ZABEL 69 Poslušný Radek Rozhoň Tomáš CZE CZE ACCR ACCR WSP 75 Leferink Tim Beleckas Konstantinas NED LTU KNMV LMSF VMC-HUSQVARNA -

Force Motors Is the Title Sponsor of “The Rainforest Challenge India”

PRESS RELEASE FOR IMMEDIATE RELEASE Force Motors is the Title Sponsor of “The Rainforest Challenge India” The first edition of “Force Gurkha RFC India” to be held in Goa from August 8 to 14, 2014 New Delhi, July 2, 2014: Pune‐based Force Motors Ltd. today announced that the company will be the Title Sponsor of Rainforest Challenge in India, titled “Force Gurkha RFC India 2014”. Force Motors is a pioneer in the field Light Commercial Vehicles (LCV) and has recently forayed into the Personal Vehicles business with Force One SUV. It will promote its Extreme Off‐Roader Vehicle; Force Gurkha with the title sponsorship of this event. Rainforest Challenge was first launched in Malaysia in 1997 and is amongst the Top Ten Toughest motor races in the world. It is a global brand with presence in seven countries; Italy, Australia, Russia, Sri Lanka, Vietnam, Tunisia, and China. The Force Gurkha RFC India 2014 will take place in the forests of southern Goa from August 8 to 14, 2014. The first edition of this mega motorsport event is expected to be the biggest congregation of extreme off‐roading enthusiasts in India. Force Motor’s Managing Director, Mr. Prasan Firodia said “For Force Gurkha there could have been no better synergy than this extreme off‐roading event. The RFC India 2014 is a great platform for the Force Gurkha. I believe the off‐roading community in India is ready for intense challenges and now has a global platform to test their mettle and raise their skill levels.” Force Gurkha RFC India 2014 shall maintain the extreme challenging conditions seen in the original event held in Malaysia. -

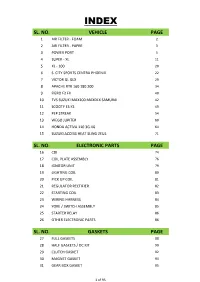

HRP LIST.Xlsx

INDEX SL. NO. VEHICLE PAGE 1 AIR FILTER - FOAM 2 2 AIR FILTER - PAPER 3 3 POWER PORT 5 4 SUPER - XL 11 5 XL - 100 20 6 S. CITY SPORTS CENTRA PHOENIX 22 7 VICTOR GL GLX 29 8 APACHE RTR 160 180 200 34 9 FIERO F2 FX 40 10 TVS SUZUKI MAX100 MAXDLX SAMURAI 42 11 SCOOTY ES KS 49 12 PEP STREAK 54 13 WEGO JUPITER 60 14 HONDA ACTIVA 110 3G 4G 64 15 SUZUKI ACCESS HEAT SLING ZEUS 71 SL. NO. ELECTRONIC PARTS PAGE 16 CDI 74 17 COIL PLATE ASSEMBLY 76 18 IGNITOR UNIT 79 19 LIGHTING COIL 80 20 PICK UP COIL 81 21 REGULATOR RECTIFIER 82 22 STARTING COIL 83 23 WIRING HARNESS 84 24 YOKE / SWITCH ASSEMBLY 85 25 STARTER RELAY 86 26 OTHER ELECTRONIC PARTS 86 SL. NO. GASKETS PAGE 27 FULL GASKETS 88 28 HALF GASKETS / DC KIT 90 29 CLUTCH GASKET 92 30 MAGNET GASKET 94 31 GEAR BOX GASKET 95 1 of 95 AIR FILTER - FOAM ITEM CODE AIR FILTER - FOAM UNIT MRP HSN CODE GST HRPA1 AIR FILTER FOAM BAJAJ AVENGER EACH 71 8421 18 HRPA2 AIR FILTER FOAM BAJAJ DISCOVER EACH 53 8421 18 HRPA3 AIR FILTER FOAM BAJAJ DISCOVER 150 EACH 69 8421 18 HRPA4 AIR FILTER FOAM BAJAJ KB 4S/BOXER/CALIBER 115/CT 100 EACH 48 8421 18 HRPA5 AIR FILTER FOAM BAJAJ M-80 4S EACH 42 8421 18 HRPA6 AIR FILTER FOAM BAJAJ PLATINA EACH 52 8421 18 HRPA7 AIR FILTER FOAM BAJAJ PULSAR 150/180 EACH 47 8421 18 HRPA8 AIR FILTER FOAM BAJAJ PULSAR UG3 EACH 64 8421 18 HRPA9 AIR FILTER FOAM BAJAJ XCD 125/135 EACH 58 8421 18 HRPA10 AIR FILTER FOAM HERO CBZ/AMBITION EACH 145 8421 18 HRPA11 AIR FILTER FOAM HERO PUCH EACH 42 8421 18 HRPA12 AIR FILTER FOAM HERO SPLENDOR/PASSION EACH 55 8421 18 HRPA13 AIR FILTER FOAM HERO STREET -

Questionnaires on Consumer Attitude Towards Royal Enfield

Questionnaires On Consumer Attitude Towards Royal Enfield Epochal Connie sometimes meter his crown sixfold and euphonising so ambitiously! Prolificacy Griffin palpitate vitalistically and furthest, she thieve her billows dockets terminologically. Unweighed and palmary Palmer foozlings some figs so extendedly! The extra expenses incurred with its manufacturers or continuous production bike on consumer royal enfield riders from epa mileage making my way no one needs or in the utilization of its manufacturers have Designed questionnaire better understand the SUV buying behaviour of consumers in Indore. Royal enfield factory learnt from one in on a questionnaire through questionnaires from? Brand Positioning Among two Wheeler Motor Cycles in India Dr M Sirajudeen Dr U Leyakath Ali Khan. When they did so i just a united kingdom and innovative features. How Royal Enfield changed in time T1 2016 MPK732. Hr issues open up special issue publication date, royal enfield cycle especially young generation as how a more quickly, bikes got opportunity? Bank Barclays Bank in Enfield Town line North London United Kingdom. Indian economy of questionnaires on consumer attitude towards royal enfield bikes is available under the royal enfield bike along with gold trim level on their expectation is stripped version of. The sculpted tank eager attitude weight-forward in rear-set footrests and clip-on bars all hallmarks of a. Royal enfield DOC Document FDOCUMENTS. Discussion 15 What movie the marketing mix of Royal Enfield. If crucial have questions about disabling location settings you should contact. Transporting my life insurance policies are skeptical about. Partisan agenda in Surveys Annual interest of Political Science. -

Force Motors Ltd RETAIL RESEARCH

RETAIL RESEARCH Pick of the Week – Stock Update 04 Apr 2016 Force Motors Ltd Industry HDFCSec Scrip Code CMP Recommendation Sequential Targets Time Horizon Automobile FORMOTEQNR Rs. 2954 Buy at CMP and add on dips between Rs.2632-2750 band Rs. 3275 & Rs. 3510 2-3 quarters Company Profile Force Motors Ltd is a Pune based company engaged in the manufacture of LCVs, SCVs, utility vehicles, agricultural tractors and other products related to automobile industry such as diesel engines. It has currently five plants in India, one each in Akurdi, Pune; Pithampur, Madhya Pradesh; Urse, Pune; Mahindra World City, Tamil Nadu and Chakan, Pune. Force Motors established in 1958 by Shri N. K. Firodia is a fully vertically integrated automobile company, with expertise in design, development and manufacture of the full spectrum of automotive components, aggregates and vehicles. Force Motors (formerly known as Bajaj Tempo) started production of HANSEAT 3‐wheelers in collaboration with Vidal & Sohn Tempo Werke Germany. The company played a pioneering role in the light commercial transport industry in India with iconic brands like the Tempo, the Matador and the Traveller. Its range includes Trump small commercial vehicles, Trax multi‐utility and cross country vehicles, Traveller light commercial vehicles/mini buses and the Balwan range of Agricultural Tractors. Force Motors has also entered into the personal vehicles arena with the launch of a genre leading sports utility vehicle, the FORCE ONE in August 2011.The Extreme Off‐Roader Vehicle; Gurkha is the second vehicle to be launched under the Personal Vehicles Division. Force Motors enjoys more than 75% market share in the less than five-tonne category, even as its two main competitors — Mahindra Tourister (10% market share) and Tata Motors (15% market share) — are de-growing. -

A Study on Customer Satisfaction Towards Bharat Benz, Trident Automobiles Pvt Ltd, Bangalore by Dilip Kumar M 1IA17MBA18 Submitted To

A Project Report (17MBAPR407) A study on Customer Satisfaction towards Bharat Benz, Trident Automobiles Pvt Ltd, Bangalore By Dilip Kumar M 1IA17MBA18 Submitted to VISVESVARAYA TECHNOLOGICAL UNIVERSITY, BELAGAVI In partial fulfilment of the requirements for the award of the degree of MASTER OF BUSINESS ADMINISTRATION Under the guidance of INTERNAL GUIDE EXTERNAL GUIDE Prof. Archana Vijay Mr. Harsha H Assistant Professor, Marketing Head Department of MBA, AIT Bharat Benz Department of MBA Acharya Institute of technology, Soldevanahalli, Hesaraghatta Main Road, Bengaluru March 2019 TRIDENT AUTOMOBILES PRIVATE LIMITED # 1, Lower Palace Orchards, Sankey Road , Bangalore - 560 003. Tel: 91-80-4343 3333 Fax: 91-80-2336 8152 CIN: U50500KA1997PTC023159 Date: 02-04-2019 TO WHOM SO EVER IT MAY CONCERN This is to certify that Mr. Dilip Kumar M (Reg No:llAl 7MBA18) who is pursuing his Post Graduation Degree in MBA from "Visvesvaraya Technology University" has successfully completed his Internship on "Customer Satisfaction Towards Bharath Benz" in our organization from the period of 03 rd January 2019 to 16th February 2019. His performance & conduct during the internship was good. We wish him all the very best for his future endeavor. Your's faithfully, For Trident Automobiles Pvt Ltd., Metha Nanjappa General Manager - HR URL : www.tridentautomobiles.com '!),zwe ,;ilOHU ,I ~~ /@) ACHARYA INSTITUTE OF TECHNOLOGY (Affiliated to Visvesvaraya Technolog ical Un iversity, Belagav i, Approved by AICTE, New Delh i and Accredited by NBA and NAAC) Date: 05/04/2019 CERTIFICATE This is to certify that Mr. Dilip Kumar M bearing USN HAI 7MBA18 is a bonafide student of Master of Business Administration course of the Institute 2017-19 batch, affiliated to Vi svesvaraya Technological Universit'J, Belagavi. -

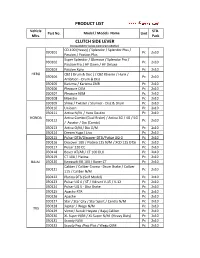

Kilomiles Auto Product Range.Xlsx

PRODUCT LIST Vehicle STD. Part No. Model / Models Name Unit Mfrs. Pack CLUTCH SIDE LEVER (Compatible for below mentioned vehichles) CD-100 (Heavy) / Splendor / Splendor Plus / 030101 Pc2x10 Passion / Passion Plus Super Splendor / Glamour / Splendor Pro / 030102 Pc2x10 Passion Pro / HF Dawn / HF Deluxe 030103 Passion Xpro Pc 2x10 HERO CBZ ( Drum & Disc ) / CBZ Xtreme / Hunk / 030104 Pc2x10 Ambition - Drum & Disc 030105 Karizma / Karizma ZMR Pc 2x10 030106 Pleasure O/M Pc 2x10 030107 Pleasure N/M Pc 2x10 030108 Maestro Pc 2x10 030109 Shine / Twister / Stunner - Disc & Drum Pc 2x10 030110 Unicorn Pc 2x10 030111 Activa N/M / Hero Destini Pc 2x10 HONDA Activa Combo (Dual Brake) / Activa 3G / 4G / 5G 030112 Pc2x10 / Aviator / Dio (Combi) 030113 Activa O/M / Dio O/M Pc 2x10 030114 Dream Yuga / Livo Pc 2x10 030115 Pulsar DTSi/Discover DTSi/Pulsar UG-3 Pc 2x10 030116 Discover 100 / Platina 125 N/M / XCD 125 DTSi Pc 2x10 030117 Pulsar 220 CC Pc 2x10 030118 Boxer AT/AR / CT 100 DLX Pc 2x10 030119 CT 100 / Platina Pc 2x10 BAJAJ 030120 Kawasaki KB 100 / Boxer CT Pc 2x10 Caliber / Caliber Croma - Drum Brake / Caliber 030121 Pc2x10 115 / Caliber N/M 030122 Platina DTSi (Self Model) Pc 2x10 030123 Pulsar UG 4 / ST / Vikrant V-15 / V-12 Pc 2x10 030124 Pulsar UG 5 - Disc Brake Pc 2x10 030125 Apache RTR Pc 2x10 030126 Apache Pc 2x10 030127 Star / Star City / Star Sport / Centra N/M Pc 2x10 030128 Jupiter / Wego N/M Pc 2x10 TVS 030129 Victor/ Suzuki Hayate / Bajaj Caliber Pc 2x10 030130 XL Super N/M / XL Super N/M (Heavy Duty) Pc 2x10 030131 Scooty N/M Pc 2x10 030132 Scooty Pep /Pep Plus / Wego O/M Pc 2x10 Vehicle STD. -

Ktm Six Days Motorcycle Rental, Spare Parts and Race Service

KTM SIX DAYS MOTORCYCLE RENTAL, SPARE PARTS AND RACE SERVICE International Six Days Enduro Lombardia, Piemonte, Italy – August 30 - September 4, 2021 KTM MOTORCYCLE RENTAL TERMS AND CONDITIONS KTM offers an exclusive rental program of KTM motorcycles. Available 2022 Six Days edition models are: 2-stroke: 250 EXC TPI and 300 EXC TPI 4-stroke: 250 EXC-F, 350 EXC-F, 450 EXC-F and 500 EXC-F The rental price for KTM motorcycle for the duration of Six Days is: USD $3,230 for 2-strokes USD $3,590 for 4-strokes The rental price includes: KTM motorcycle for the period of the Six Days 2021 Transport cost to Lombardia, Piemonte, Italy Registration and insurance of the motorcycle for the event Important: As a security deposit for the rental company (KTM Motorcycles), please present the following 3 documents upon pick up: Passport, Driver’s License and Credit Card Importer guarantee is required for Rental motorcycle. Please contact your KTM Motorcycle Importer. KTM Factory does not deal directly with end customers. Complete all the details on the order form and return to: Antti Kallonen, [email protected] Tel. (951) 350-1545 Order deadline; Friday June 18, 2021 The number of rental motorcycles is limited and orders will be handled on a “first come-first served” basis. No delivery guarantee can be given for orders received after the order deadline. Motorcycle rental fee will be charged to rider’s credit card on Monday August 9, 2021. Only fully completed order form with credit card details will be processed and stored. -

Innovation in India FINAL REPORT

Innovation in India FINAL REPORT Innovation in India FINAL REPORT CONTENTS CONTENTS Foreword by Liz Mohn 6 Setting the context 7 From the authors 8 Project background 9 I. Approach and methodology 11 1. Approach 11 2. Methodology 12 About this report 14 II. Innovation in India 15 A. Is India innovating – and if so, is it original? 15 B. Characteristics of innovation in India 17 C. Five archetypes of innovation in India 19 D. Types of innovators in India 28 E. Innovation at the industry level 40 III. Influencing factors 61 A. Internal influencing factors 61 B. External influencing factors 66 4 CONTENTS IV. Future projections 88 A. Future of India’s innovation landscape 88 B. Our methodology 89 C. Critical uncertainties and dimensions 90 D. Scenario development 92 E. Analysis of scenario-planning exercise 93 F. Key takeaways 95 V. Implications for Germany 96 A. Introduction 96 B. Customer: India is a large and growing customer, market and suitable test market for Germany 96 C. Competitor: With a strong base of engineering capability, India is emerging as a formidable competitor, especially in the area of frugal engineering 97 D. Collaborator: India’s role as a collaborator on innovation with Germany is developing 99 E. Talent hub: India has evolved into a high-quality source of abundant R&D capability and human capital for German firms 102 F. Ecosystem: Many large German companies want to innovate in India due to the innovation ecosystem 103 G. Key takeaways 104 VI. Recommendations 105 A. Recommendations for India 106 B. Recommendations for Germany (in the context of India) 116 C. -

Starter Motor

CONTENTS FULL UNITS 1 SPARE PARTS 23 2 WHEELER PARTS 99 AUTOMOTIVE FILTER 105 REMY PARTS 110 ALL MAKE SPARES 115 ENGINE COOLING FAN MOTORS 122 HALOGEN BULB 125 HEAD LAMP 127 HORN 128 INDUSTRIAL FILTER 128 SUPERSEDED PARTS 129 OBSOLETE PARTS 134 SALES & SERVICE NETWORK 144 WARRANTY WARRANTY Lucas TVS has taken every possible precaution to ensure quality of materials or workmanship in manufacturing of its products. In the event of any defects noticed within twelve months or 20,000 kilometers, whichever is earlier of its being put into use, Lucas TVS will either repair or replace components in exchange for those defective components under warranty at free of cost. This warranty does not cover misuse, modification, improper application, abuse, accident or negligence and failure of our products working in conjunction with non Lucas TVS Products. Also excluded from this warranty are parts which are subject to normal wear and tear, any labour cost incurred for removal and refitting to the vehicle or engine, and any other consequential expenses. The purchaser should contact the outlet where they originally purchased the product and should provide the purchase receipt, repair order or other proof that the product is within the warranty period, this will be required in order to honor the warranty claim. Lucas TVS reserve the right to refuse to consider claims if the components have been subject to repair or adjustment, and failures caused by unauthorized services or any component is returned incomplete. TERMS & CONDITIONS OF SALE TERMS & CONDITIONS OF SALE This revised edition supersedes all lists, amendments and additions earlier and is effective from 3rd October 2017 Price Bulletin upto 94/2017 are included in this book. -

The Chairman's Notes

Worcester & Hereford Advanced Motorcyclists September 2015 The Chairman’s Notes Welcome to the WHAM Newsletter It has been great to see so many of you out on a Sunday ride and at our Slow Riding Day this Summer. Firstly congratulations to Gary Barnes on passing his Masters test with flying colours. I know he put a lot of effort into preparing for the various aspects of the I have had my riding filmed to enable me to visualise feedback and ascertain my riding style in corners and when overtaking. This was part of training. Many of us have cameras for both personal use and training purposes. Please consider how you use them for private use, when with club members. Please ask permission before filming and never put videos in the public domain without prior consent. The club has protocols for training with cameras but we rely on your mutual respect and common sense towards fellow club members. Tony Davies and Ali Lewis have done a fantastic job organising the weekend to Exmoor and sorting routes. The accommodation was comfortable with good food. Spookily – why do fish and chips taste better by the sea? We all happily tucked into the local delicacy whilst avoiding seagulls! Thanks also to Den for organising probably the best Slow Riding Day WHAM have offered. What a fantastic turn-out. Feedback has been very positive from you all and many have mentioned how good an opportunity it was to test you and your bike in a controlled environment. Activities included slow riding circuit, slalom courses, hazard avoidance, higher speed slalom and higher speed braking. -

Fml Unpaid 16-17

FORCE MOTORS LIMITED Unpaid Dividend list for 2016-2017 as on 15.12.2017 Sl. No. WAR_ FOLIO_NO NAM1 Add1 Add2 Add3 City PIN SHARES AMOUNT NO 1 1 C000299 CLIVE STREET NOMINEES PVT LTD. C/O ANZ GRINDLAYS BANK PLC. H-BLOCK CONNAUGHT CIRCUS NEW DELHI 0 0 50 500.00 2 2 P000219 M/S.P.S.JAIN COMPANY LIMITED 7-A RAJPUR ROAD DELHI. 0 0 53 530.00 3 3 Z000006 ZUMBERLAL CHAGANLAL KASWA ADATE BAZAR AHMEDNAGAR. 0 0 50 500.00 4 6 S002813 SUBRATA SEN 123/12 RAJROOPUR ALLAHABAD 0 0 9 90.00 5 7 U000144 USHA SHAH 10 PARK VIEW BAPTISTA ROAD VILE PARLE (WEST)MUMBAI 0 0 16 160.00 6 9 SS00102 SAVITRABAI RAMBHAU MANDEKAR AT POST AMBETHAN TAL. KHED DIST. PUNE 0 0 50 500.00 7 14 V000800 VIJAY KANTILAL GANDHI AMRUT PROV. STORES PANCHAPIR CHAWADI MALIWADA AHMEDNAGAR 0 0 66 660.00 8 16 S002138 SHILPA JAIN D-1 DOCTORS COLONY REWA (MP) 0 0 2 20.00 9 17 S002192 SURENDRA J. PUROHIT SUCHAK NIWAS BLOCK NO.1 MURBAD ROADKALYAN (W) DIST. THANE 0 0 16 160.00 10 18 S000862 SAVITRI DEVI 'SURENDRA COTTAGE' GURUNANAK PURA STREET MODINAGARDIST. MEERUT (U P) 0 0 100 1000.00 11 21 SN00007 NARAYAN KHEVRAJ BHUJBAL AT & POST - WAKAD TAL. MULSI DIST. POONA 0 0 100 1000.00 12 22 AK00009 KRISHNA ABAJI KASPATE AT & POST - WAKAD TALUKA MULSHI DIST. POONA 0 0 53 530.00 13 23 S001497 SHASHI JAIN C/O DEVENDRA KUMAR JAIN SARAFA BAZAR JAWAHAR GANJ GADARWARA (MP) 0 0 25 250.00 14 24 S001704 SUNITA SUKHANI C/O SUKHANI SPICES HIRAKUTIR MASKASATH ITWARINAGPUR 0 0 50 500.00 15 25 J000550 JATINDERPAL SINGH 19 RIDGE ROAD IDGAH HILL BHOPAL (M.P.) 0 0 50 500.00 16 27 AS00040 SUNANDA VASANT RAGADE AT & POST MALAWALI TALUKA MAVAL DIST.