Ceremony Commemorating the Centennial of the Federal Reserve Act

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Public Option in Housing Finance

The Public Option in Housing Finance Adam J. Levitin†* and Susan M. Wachter** The U.S. housing finance system presents a conundrum for the scholar of regulation because it defies description using the traditional regulatory vocabulary of command-and-control, taxation, subsidies, cap-and-trade permits, and litigation. Instead, since the New Deal, the housing finance market has been regulated primarily by government participation in the market through a panoply of institutions. The government’s participation in the market has shaped the nature of the products offered in the market. We term this form of regulation “public option” regulation. This Article presents a case study of this “public option” as a regulatory mode. It explains the public option’s rise as a governmental gap-filling response to market failures. The public option, however, took on a life of its own as the federal government undertook financial innovations that the private market had eschewed, in particular the development of the “American mortgage” — a long-term, fixed-rate fully amortizing mortgage. These innovations were trend-setting and set the tone for entire housing finance market, serving as functional regulation. The public option was never understood as a regulatory system due to its ad hoc nature. As a result, its integrity was not protected. Key parts of the system were privatized without a substitution of alternative regulatory measures. The consequence was a return to the very market failures that led to the public option in the first place, followed by another round of ad hoc public options in housing finance. This history suggests that an † Copyright © 2013 Adam J. -

The Federal Reserve Act of 1913

THE FEDERAL RESERVE ACT OF 1913 HISTORY AND DIGEST by V. GILMORE IDEN PUBLISHED BY THE NATIONAL BANK NEWS PHILADELPHIA Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis Copyright, 1914 by Ccrtttiois Bator Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis History of Federal Reserve Act History N MONDAY, October 21, 1907, the Na O tional Bank of Commerce of New York City announced its refusal to clear for the Knickerbocker Trust Company of the same city. The trust company had deposits amounting to $62,000,000. The next day, following a run of three hours, the Knickerbocker Trust Company paid out $8,000,000 and then suspended. One immediate result was that banks, acting independently, held on tight to the cash they had in their vaults, and money went to a premium. Ac cording to the experts who investigated the situation, this panic was purely a bankers’ panic and due entirely to our system of banking, which bases the protection of the financial solidity of the country upon the individual reserves of banks. In the case of a stress, such as in 1907, the banks fail to act as a whole, their first consideration being the protec tion of their own reserves. PAGE 5 Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis History of Federal Reserve Act The conditions surrounding previous panics were entirely different. -

Is Paper Money Just Paper Money? Experimentation and Variation in the Paper Monies Issued by the American Colonies from 1690 to 1775

NBER WORKING PAPER SERIES IS PAPER MONEY JUST PAPER MONEY? EXPERIMENTATION AND VARIATION IN THE PAPER MONIES ISSUED BY THE AMERICAN COLONIES FROM 1690 TO 1775 Farley Grubb Working Paper 17997 http://www.nber.org/papers/w17997 NATIONAL BUREAU OF ECONOMIC RESEARCH 1050 Massachusetts Avenue Cambridge, MA 02138 April 2012 Previously circulated as 'Is Paper Money Just Paper Money? Experimentation and Local Variation in the Fiat Paper Monies Issued by the Colonial Governments of British North America, 1690-1775: Part I." A preliminary version of this paper was presented at the Conference on "De-Teleologising History of Money and Its Theory," Japan Society for the Promotion of Science Research–Project 22330102, University of Tokyo, 14-16 February 2012. The author thanks the participants of this conference and Akinobu Kuroda for helpful comments. Tracy McQueen provided editorial assistance. The views expressed herein are those of the author and do not necessarily reflect the views of the National Bureau of Economic Research. NBER working papers are circulated for discussion and comment purposes. They have not been peer- reviewed or been subject to the review by the NBER Board of Directors that accompanies official NBER publications. © 2012 by Farley Grubb. All rights reserved. Short sections of text, not to exceed two paragraphs, may be quoted without explicit permission provided that full credit, including © notice, is given to the source. Is Paper Money Just Paper Money? Experimentation and Variation in the Paper Monies Issued by the American Colonies from 1690 to 1775 Farley Grubb NBER Working Paper No. 17997 April 2012, Revised April 2015 JEL No. -

Download (Pdf)

VOLUME 83 • NUMBER 12 • DECEMBER 1997 FEDERAL RESERVE BULLETIN BOARD OF GOVERNORS OF THE FEDERAL RESERVE SYSTEM, WASHINGTON, D.C. PUBLICATIONS COMMITTEE Joseph R. Coyne, Chairman • S. David Frost • Griffith L. Garwood • Donald L. Kohn • J. Virgil Mattingly, Jr. • Michael J. Prell • Richard Spillenkothen • Edwin M. Truman The Federal Reserve Bulletin is issued monthly under the direction of the staff publications committee. This committee is responsible for opinions expressed except in official statements and signed articles. It is assisted by the Economic Editing Section headed by S. Ellen Dykes, the Graphics Center under the direction of Peter G. Thomas, and Publications Services supervised by Linda C. Kyles. Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis Table of Contents 947 TREASURY AND FEDERAL RESERVE OPEN formance can improve investor and counterparty MARKET OPERATIONS decisions, thus improving market discipline on banking organizations and other companies, During the third quarter of 1997, the dollar before the Subcommittee on Capital Markets, appreciated 5.0 percent against the Japanese yen Securities and Government Sponsored Enter- and 0.8 percent against the German mark. On a prises of the House Committee on Banking and trade-weighted basis against other Group of Ten Financial Services, October 1, 1997. currencies, the dollar appreciated 1.4 percent. The U.S. monetary authorities did not undertake 96\ Theodore E. Allison, Assistant to the Board of any intervention in the foreign exchange mar- Governors for Federal Reserve System Affairs, kets during the quarter. reports on the Federal Reserve's plans for deal- ing with some new-design $50 notes that 953 STAFF STUDY SUMMARY were imperfectly printed, including the Federal Reserve's view of the quality and quantity of In The Cost of Implementing Consumer Finan- $50 notes currently being produced by the cial Regulations, the authors present results for Bureau of Engraving and Printing, the options U.S. -

August 26, 2005

LPB 150/16 REPORT ON DESIGNATION Name and Address of Property: Federal Reserve Bank of San Francisco, Seattle Branch 1015 Second Avenue Legal Description: LOTS 2, 3, 6 AND 7, BLOCK 12, TOWN OF SEATTLE, AS LAID OUT ON THE CLAIMS OF C.D. BOREN AND A. A. DENNY (COMMONLY KNOWN AS BOREN & DENNY’S ADDITION TO THE CITY OF SEATTLE) ACCORDING TO PLAT THEREOF RECORDED IN VOLUME 1 OF PLATS, PAGE 27, RECORDS OF KING COUNTY, EXCEPT THE EASTERLY 12 FEET THEREOF CONDEMNED IN DISTRICT COURT CASE NO. 7097 FOR SECOND AVENUE, AS PROVIDED BY ORDINANCE NO. 1107 OF THE CITY OF SEATTLE. At the public meeting held on March 2, 2016 the City of Seattle's Landmarks Preservation Board voted to approve designation of the Federal Reserve Bank of San Francisco, Seattle Branch at 1015 Second Avenue as a Seattle Landmark based upon satisfaction of the following standard for designation of SMC 25.12.350: C. It is associated in a significant way with a significant aspect of the cultural, political, or economic heritage of the community, City, state or nation; and D. It embodies the distinctive visible characteristics of an architectural style, or period, or a method of construction; and E. It is an outstanding work of a designer or builder; and F. Because of its prominence of spatial location, contrasts of siting, age, or scale, it is an easily identifiable visual feature of its neighborhood or the city and contributes to the distinctive quality or identity of such neighborhood or the City. DESCRIPTION The former Federal Reserve Bank of San Francisco, Seattle Branch, is located in Seattle’s Central Business District on the western side of the Second Avenue, between Spring and Madison Streets. -

Report on the Legal Protection of Banknotes in the European Union Member States

ECB EZB EKT BCE EKP REPORT ON THE LEGAL PROTECTION OF BANKNOTES IN THE EUROPEAN UNION MEMBER STATES November 1999 REPORT ON THE LEGAL PROTECTION OF BANKNOTES IN THE EUROPEAN UNION MEMBER STATES November 1999 © European Central Bank, 1999 Address Kaiserstrasse 29 D-60311 Frankfurt am Main Germany Postal address Postfach 16 03 19 D-60066 Frankfurt am Main Germany Telephone +49 69 1344 0 Internet http://www.ecb.int Fax +49 69 1344 6000 Telex 411 144 ecb d All rights reserved. Reproduction for educational and non-commercial purposes is permitted provided that the source is acknowledged. The views expressed in this paper are those of the author and do not necessarily reflect those of the European Central Bank. ISBN 92-9181-051-7 2 ECB Report on the legal protection of banknotes • November 1999 Contents EXECUTIVE SUMMARY 5 I. LEGAL PROTECTION OF EURO BANKNOTES 7 A. THE CRIMINAL APPROACH: COUNTERFEITING 7 1. The legal situation in the Member States 7 2. The desired legal situation 9 3. The risk of increased counterfeit activity 11 4. The possibilities of prevention – co-operation and co-ordination 12 5. The harmonisation of sanctions 18 6. The detention of counterfeit banknotes 18 B. THE CIVIL APPROACH: COPYRIGHT PROTECTION (COMPLEMENTARY TOOLS AND SETTING CRITERIA FOR LEGAL REPRODUCTIONS) 20 1. Copyright protection for euro banknotes 20 2. The use of the © sign on euro banknotes 22 3. The enforcement of copyright 23 4. The reproduction of euro banknotes 24 C. THE MATERIAL APPROACH: ANTI-COPYING DEVICES FOR REPRODUCTION EQUIPMENT 26 II. LEGAL ASPECTS OF FIDUCIARY CIRCULATION 28 A. -

Data Appendix

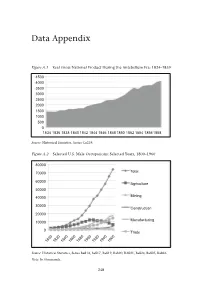

Data Appendix Figure A.1 Real Gross National Product During the Antebellum Era: 1834–1859 4500 4000 3500 3000 2500 2000 1500 1000 500 0 1834 1836 1838 1840 1842 1844 1846 1848 1850 1852 1854 18561858 Source: Historical Statistics, Series Ca219. Figure A.2 Selected U.S. Male Occupations: Selected Years, 1800–1960 80000 70000 Total 60000 Agriculture 50000 40000 Mining 30000 Construction 20000 Manufacturing 10000 0 Trade 1800 1820 1840 1860 1880 1900 1920 1940 1960 Source: Historical Statistics, Series Ba814, Ba817, Ba819, Ba820, BA821, Ba824, Ba825, Ba826. Note: In thousands. 248 Source Source Note Source Figure A.5 Figure A.4 Figure A.3 : ThisistheSchwert’sIndexofCommonStock. : HistoricalStatistics,SeriesAa36,Aa46, Aa56. : HistoricalStatistics,SeriesCh411. : HistoricalStatistics,SeriesCj979. 100000000 150000000 200000000 250000000 300000000 100000 120000 10 12 14 16 50000000 20000 40000 60000 80000 0 2 4 6 8 0 1802 0 U.S. PopulationforSelectedYears:1790–1990 Total NumberofU.S.BusinessFailures:1857–1997 1805 Stock IndexDuringtheAntebellumEra:1802–1870 1857 1790 1830 1860 1890 1920 1950 1990 1808 1863 1869 1811 1875 1814 1881 1817 1887 1820 1893 1823 1899 1826 1905 1829 1911 1832 1917 1835 1923 1838 1929 1841 1935 1941 1844 1947 1847 1953 1850 1959 1853 Total RuralPopulation Total UrbanPopulation Total Population Total 1965 1856 Data Appendix 1971 1859 1977 1862 1983 1865 1989 1995 1868 249 Note Source Note Source Figure A.8 up totheGreatDepression:1869–1929 Figure A.7 250 Source: Figure A.6 : ThisistheIndustrialsIndex. : ThisdataisfromGallman-Kuznetsestimationandin1929dollars. -

Statement / by Donald Kohn ... Before the Subcommittee On

Testimony Donald L. Kohn, Vice Chairman Federal Reserve independence Before the Subcommittee on Domestic Monetary Policy and Technology, Committee on Financial Services, U.S. House of Representatives, Washington, D.C. July 9, 2009 Chairman Watt, Ranking Member Paul, and other members of the Subcommittee, I appreciate the opportunity to discuss with you the important public policy reasons why the Congress has long given the Federal Reserve a substantial degree of independence to conduct monetary policy while ensuring that we remain accountable to the Congress and to the American people. In addition, I will explain why an extension of the Federal Reserve’s supervisory and regulatory responsibilities as part of a broader initiative to address systemic risks would be compatible with the pursuit of our statutory monetary policy objectives. I also will discuss the significant steps the Federal Reserve has taken recently to improve our transparency and maintain accountability. Independence and Accountability A well-designed framework for monetary policy includes a careful balance between independence and accountability. A balance of this type conforms to our general inclination as a nation to have clearly drawn lines of authority, limited powers, and appropriate checks and balances within our government; such a balance also is conducive to sound monetary policy. The Federal Reserve derives much of the authority under which it operates from the Federal Reserve Act. The act specifies and limits the Federal Reserve’s powers. In 1977, the Congress amended the act by establishing maximum employment and price stability as our monetary policy objectives; the Federal Reserve has no authority to establish different objectives. -

OIG-10-024 Audit of the Office of Comptroller of The

Audit Report OIG-10-024 Audit of the Office of the Comptroller of the Currency’s Fiscal Years 2009 and 2008 Financial Statements December 22, 2009 Office of Inspector General Department of the Treasury DEPARTMENT OF THE TREASURY WASHINGTON, D.C. 20220 OFFICE OF INSPECTOR GENERAL December 22, 2009 MEMORANDUM FOR JOHN C. DUGAN COMPTROLLER OF THE CURRENCY FROM: Michael Fitzgerald Director, Financial Audits SUBJECT: Audit of the Office of the Comptroller of the Currency’s Fiscal Years 2009 and 2008 Financial Statements I am pleased to transmit the attached audited Office of the Comptroller of the Currency (OCC) financial statements for fiscal years 2009 and 2008. Under a contract monitored by the Office of Inspector General, GKA, P.C. (GKA), an independent certified public accounting firm, performed an audit of the financial statements of OCC as of September 30, 2009 and 2008 and for the years then ended. The contract required that the audit be performed in accordance with generally accepted government auditing standards; applicable provisions of Office of Management and Budget Bulletin No. 07-04, Audit Requirements for Federal Financial Statements, as amended; and the GAO/PCIE Financial Audit Manual. The following reports, prepared by GKA, are incorporated in the attachment: • Independent Auditor’s Report on Financial Statements; • Independent Auditor’s Report on Internal Control over Financial Reporting; and • Independent Auditor’s Report on Compliance with Laws and Regulations In its audit of OCC’s financial statements, GKA found: • that the financial statements were fairly presented, in all material respects, in conformity with accounting principles generally accepted in the United States of America, • no matters involving internal control and its operations that are considered material weaknesses, and • no instances of reportable noncompliance with laws and regulations tested. -

The Problem of Predatory Lending: Price Lauren E

Maryland Law Review Volume 65 | Issue 3 Article 3 Decisionmaking and the Limits of Disclosure: The Problem of Predatory Lending: Price Lauren E. Willis Follow this and additional works at: http://digitalcommons.law.umaryland.edu/mlr Part of the Banking and Finance Commons, and the Property Law and Real Estate Commons Recommended Citation Lauren E. Willis, Decisionmaking and the Limits of Disclosure: The Problem of Predatory Lending: Price, 65 Md. L. Rev. 707 (2006) Available at: http://digitalcommons.law.umaryland.edu/mlr/vol65/iss3/3 This Article is brought to you for free and open access by the Academic Journals at DigitalCommons@UM Carey Law. It has been accepted for inclusion in Maryland Law Review by an authorized administrator of DigitalCommons@UM Carey Law. For more information, please contact [email protected]. MARYLAND LAW REVIEW VOLUME 65 2006 NUMBER 3 © Copyright Maryland Law Review 2006 Articles DECISIONMAKING AND THE LIMITS OF DISCLOSURE: THE PROBLEM OF PREDATORY LENDING: PRICE LAUREN E. WILLIS* INTRODUCTION ................................................. 709 I. PREDATORY LENDING AND THE HOME LOAN MARKET ...... 715 A. The Home Lending Revolution ........................ 715 1. The Twentieth Century Marketplace: Standardized Terms, Limited and Advertised Prices, and Low Risk. 715 2. The Brave New World of ProliferatingProducts, Price, and R isk ........................................ 718 3. Evidence of Predatory Home Lending ............... 729 B. A New Definition of Predatory Lending ................. 735 II. FEDERAL LAW REGULATING THE PRICING OF HOME- SECURED LOANS: DISCLOSURE AS PANACEA ................ 741 A. The Rational Actor Decisionmaker Model ............... 741 B. CurrentFederal Law .................................. 743 C. Even a Rational Actor Could Not Use the Federal Disclosures to Price Shop in Today's Marketplace ....... -

The Real Bills Views of the Founders of the Fed

Economic Quarterly— Volume 100, Number 2— Second Quarter 2014— Pages 159–181 The Real Bills Views of the Founders of the Fed Robert L. Hetzel ilton Friedman (1982, 103) wrote: “In our book on U.S. mon- etary history, Anna Schwartz and I found it possible to use M one sentence to describe the central principle followed by the Federal Reserve System from the time it began operations in 1914 to 1952. That principle, to quote from our book, is: ‘Ifthe ‘money market’ is properly managed so as to avoid the unproductive use of credit and to assure the availability of credit for productive use, then the money stock will take care of itself.’” For Friedman, the reference to “the money stock”was synonymous with “the price level.”1 How did American monetary experience and debate in the 19th century give rise to these “real bills” views as a guide to Fed policy in the pre-World War II period? As distilled in the real bills doctrine, the founders of the Fed under- stood the Federal Reserve System as a decentralized system of reserve depositories that would allow the expansion and contraction of currency and credit based on discounting member-bank paper that originated out of productive activity. By discounting these “real bills,”the short- term loans that …nanced trade and goods in the process of production, policymakers ful…lled their responsibilities as they understood them. That is, they would provide the reserves required to accommodate the “legitimate,” nonspeculative, demands for credit.2 In so doing, they The author acknowledges helpful comments from Huberto Ennis, Motoo Haruta, Gary Richardson, Robert Sharp, Kurt Schuler, Ellis Tallman, and Alexander Wolman. -

The Federal Reserve's Response to the 1987 Market Crash

PRELIMINARY YPFS DISCUSSION DRAFT | MARCH 2020 The Federal Reserve’s Response to the 1987 Market Crash Kaleb B Nygaard1 March 20, 2020 Abstract The S&P500 lost 10% the week ending Friday, October 16, 1987 and lost an additional 20% the following Monday, October 19, 1987. The date would be remembered as Black Monday. The Federal Reserve responded to the crash in four distinct ways: (1) issuing a public statement promising to provide liquidity as needed, “to support the economic and financial system,” (2) providing support to the Treasury Securities market by injecting in-high- demand maturities into the market via reverse repurchase agreements, (3) allowing the Federal Funds Rate to fall from 7.5% to 7.0%, and (4) intervening directly to allow the rescue of the largest options clearing firm in Chicago. Keywords: Federal Reserve, stock market crash, 1987, Black Monday, market liquidity 1 Research Associate, New Bagehot Project. Yale Program on Financial Stability. [email protected]. PRELIMINARY YPFS DISCUSSION DRAFT | MARCH 2020 The Federal Reserve’s Response to the 1987 Market Crash At a Glance Summary of Key Terms The S&P500 lost 10% the week ending Friday, Purpose: The measure had the “aim of ensuring October 16, 1987 and lost an additional 20% the stability in financial markets as well as facilitating following Monday, October 19, 1987. The date would corporate financing by conducting appropriate be remembered as Black Monday. money market operations.” Introduction Date October 19, 1987 The Federal Reserve responded to the crash in four Operational Date Tuesday, October 20, 1987 distinct ways: (1) issuing a public statement promising to provide liquidity as needed, “to support the economic and financial system,” (2) providing support to the Treasury Securities market by injecting in-high-demand maturities into the market via reverse repurchase agreements, (3) allowing the Federal Funds Rate to fall from 7.5% to 7.0%, and (4) intervening directly to allow the rescue of the largest options clearing firm in Chicago.