Normalising Automobile Trade Between India and Pakistan: Concerns and Way Forward

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

World Bank Document

INTRODUCTION ______________________________________________________________________ The International Finance Corporation (IFC), part of the World Bank Group, is in the business of reducing Public Disclosure Authorized poverty and encouraging economic development in poorer countries through the private sector. IFC carries out this mandate primarily by investing in a wide variety of private projects in developing countries, always investing with other sponsors and financial institutions. These projects are selected first and foremost for their ability to contribute to economic growth and development. Obviously, to contribute effectively to development in the long run, IFC’s private sector projects must also be financially successful. Companies that are not financially viable clearly cannot contribute to development. IFC and its partners are, therefore, profit-seeking and take on the same risks as any private sector investor. Thus all IFC projects are screened not only for their likely contributions to development but also for the likelihood of their financial success. This screening, as it happens, is not simple. Projects have complicated effects on an economy and, more generally, on society as a whole. Usually, for example, projects directly create productive employment and better jobs in the business being financed. But employment effects are spread much more widely, as Public Disclosure Authorized increased business goes to suppliers or retailers and as new business is created elsewhere in the economy by employees spending their wages and salaries. There are many such effects, each difficult, if not impossible, to isolate from the investment. Because of these difficulties, most of these effects are not normally included in project analysis or decisionmaking but are nonetheless important in a development context. -

Companies Listed On

Companies Listed on KSE SYMBOL COMPANY AABS AL-Abbas Sugur AACIL Al-Abbas CementXR AASM AL-Abid Silk AASML Al-Asif Sugar AATM Ali Asghar ABL Allied Bank Limited ABLTFC Allied Bank (TFC) ABOT Abbott (Lab) ABSON Abson Ind. ACBL Askari Bank ACBL-MAR ACBL-MAR ACCM Accord Tex. ACPL Attock Cement ADAMS Adam SugarXD ADMM Artistic Denim ADOS Ados Pakistan ADPP Adil Polyprop. ADTM Adil Text. AGIC Ask.Gen.Insurance AGIL Agriautos Ind. AGTL AL-Ghazi AHL Arif Habib Limited AHSL Arif Habib Sec. AHSM Ahmed Spining AHTM Ahmed Hassan AIBL Asset Inv.Bank AICL Adamjee Ins. AJTM Al-Jadeed Tex AKDCL AKD Capital Ltd AKDITF AKD Index AKGL AL-Khair Gadoon ALFT Alif Tex. ALICO American Life ALNRS AL-Noor SugerXD ALQT AL-Qadir Tex ALTN Altern Energy ALWIN Allwin Engin. AMAT Amazai Tex. AMFL Amin Fabrics AMMF AL-Meezan Mutual AMSL AL-Mal Sec. AMZV AMZ Ventures ANL Azgard Nine ANLCPS Azg Con.P.8.95 Perc.XD ANLNCPS AzgN.ConP.8.95 Perc.XD ANLPS Azgard (Pref)XD ANLTFC Azgard Nine(TFC) ANNT Annoor Tex. ANSS Ansari Sugar APL Attock Petroleum APOT Apollo Tex. APXM Apex Fabrics AQTM Al-Qaim Tex. ARM Allied Rental Mod. ARPAK Arpak Int. ARUJ Aruj Garments ASFL Asian Stocks ASHT Ashfaq Textile ASIC Asia Ins. ASKL Askari Leasing ASML Amin Sp. ASMLRAL Amin Sp.(RAL) ASTM Asim Textile ATBA Atlas Battery ATBL Atlas Bank Ltd. ATFF Atlas Fund of Funds ATIL Atlas Insurance ATLH Atlas Honda ATRL Attock Refinery AUBC Automotive Battery AWAT Awan Textile AWTX Allawasaya AYTM Ayesha Textile AYZT Ayaz Textile AZAMT Azam Tex AZLM AL-Zamin Mod. -

Annual Report 2017 Oo Millat EQUIPMENT LIMITED

ti _w W 3 r I «L mf&k iV 4 *# tM 02 VISION ■ttMMvll. 03 MISSION 04 COMPANY INFORMATION 06 NOTICE OF ANNUAL GENERAL MEETING 10 SIX YEARS AT A GLANCE 12 DIRECTORS' REPORT TO THE SHAREHOLDERS 26 PATTERN OF SHAREHOLDING 29 AUDITORS'REPORT TO THE MEMBERS 30 BALANCE SHEET 32 PROFIT AND LOSS ACCOUNT 33 STATEMENT OF COMPREHENSIVE INCOME 34 STATEMENT OF CHANGES IN EQUITY 35 CASH FLOW STATEMENT 36 NOTESTO AND FORMING PART OF THE FINANCIAL STATEMENTS 61 PROXY FORM 63 ELECTRONIC TRANSMISSION CONSENT tllllAT EQUIPMENT IIMITED Vision Aspired to reach and sustain at ultimate heights of value and excellence in engineering. v Annual Report 2017 oO MIllAT EQUIPMENT LIMITED Mission To be a preferred choice for customers and suppliers, competing in the domestic and overseas markets by continuously delivering value on a long term basis through a high performance team driven by innovation and adherence to Health, Safety and Environmental standards benefiting all stake holders. Illlll Mllllll JIU1J1 0 cr> 3 <uD> III O ««< o ««< Annual Report 2017 *3 6 muAr EouimtNr unirED —r "l t !.V Company Information BOARD OF DIRECTORS COMPANY SECRETARY Sikandar Mustafa Khan (Chairman) Mian Muhammad Saleem Ahsan Imran Shaikh (Chief Executive) Latif Khalid Hashmi CHIEF FINANCIAL OFFICER Sohail Bashir Rana Mudassar Siddique - ACA Laeeq Uddin Ansari Mian Muhammad Saleem AUDITORS Syed Muhammad Irfan Aqueel A.F. Ferguson & Co. Chartered Accountants BOARD AUDIT COMMITTEE Latif Khalid Hashmi LEGAL ADVISORS Laeeq Uddin Ansari Asjad Saeed Sohail Bashir Rana Advocate & Legal Consultants Annual Report 2017 REGISTERED ADDRESS PRINCIPAL BANKERS 8.8 km Lahore Sheikhupura Road, Habib Bank Limited Shahdara, Lahore. -

Annual Report 2018

ANNUAL REPORT 2018 Lighten Your World WITH THE BATTERY THAT LASTS........ ContentsContents 02 Vision Statement 03 Mission Statement 04 Corporate Information 07 Notice of 17th AGM Pattern of Directors’ Report 12 28 Shareholding Ten Years’ Auditors’ Report 30 Performance 37 to the Members Statement of Statement of 40 Financial Position 41 Profit or Loss & Other Comprehensive Income Statement of Statement of 42 Changes in Equity 43 Cash Flows Notes to the Proxy Form 44 Financial Statements 67 ANNUAL REPORT 2018 01 VISION TO BE TOP QUALITY BATTERY PRODUCING COMPANY IN PAKISTAN. ANNUAL REPORT 02 2018 Millat Industrial Products Limited MIPL MISSION TO PRODUCE TOP QUALITY BATTERY BY USING SKILLED LABOR ON SOPHISTICATED MACHINES AND BY UTILIZING BEST AVAILABLE MATERIALS TO ENSURE ENTIRE SATISFACTION OF CUSTOMERS AND STAKEHOLDERS. ANNUAL REPORT 2018 03 Corporate Information BOARD OF DIRECTORS CHIEF FINANCIAL OFFICER Sikandar Mustafa Khan (Chairman) Zeeshan Yousaf Sohail Bashir Rana Latif Khalid Hashmi AUDITORS Laeeq Uddin Ansari Ilyas Saeed & Co. Mian Muhammad Saleem Chartered Accountants Ahsan Imran Shaikh PRINCIPAL BANKERS CHIEF EXECUTIVE Habib Bank Limited Raafey Zaman Durrani United Bank Limited National Bank of Pakistan Bank Alfalah Limited COMPANY SECRETARY Mian Muhammad Saleem ANNUAL REPORT 04 2018 Millat Industrial Products Limited MIPL REGISTERED ADDRESS FACTORY 8.8 K.M., Lahore, 49 K.M., Off Multan Road, Sheikhupura Bhai Pheru Distt. Kasur. Road, Shahdara, Lahore. Ph: 049-4540128, 4540528 Ph: 042-111 200 786 Fax: 049-4540328 WEBSITE EMAIL ADDRESS www.millatbatteries.com [email protected] ANNUAL REPORT 2018 05 Mr. Sikandar Mustafa Khan Chairman Mr. Sohail Bashir Rana Mr. Latif Khalid Hashmi Mr. -

Value-At-Risk and Expected Stock Returns: Evidence from Pakistan

The Lahore Journal of Economics 19 : 2 (Winter 2014): pp. 71–100 Value-at-Risk and Expected Stock Returns: Evidence from Pakistan Javed Iqbal* and Sara Azher** Abstract This study investigates whether exposure to downside risk, as measured by value-at-risk (VaR), explains expected returns in an emerging market, i.e., Pakistan. We find that portfolios with a higher VaR are associated with higher average returns. In order to explore the empirical performance of VaR at the portfolio level, we use a time series approach based on 25 size and book-to-market portfolios. Based on monthly portfolio data for October 1992 to June 2008, the results show that VaR has greater explanatory power than the market, size, and book-to-market factors. Keywords: Value-at-risk, emerging market, Fama-French factors. JEL classification: C32, G32. 1. Introduction The most important implications of the capital asset pricing model (CAPM) (see Sharpe, 1964; Lintner, 1969; Black, Jensen, & Scholes, 1972) are that (i) the expected return on a risky asset is linearly and positively related to its systematic risk, and (ii) only the asset’s beta captures cross- sectional variations in expected stock returns; other variables have no explanatory power. However, the empirical evidence of the last few decades suggests that many alternative risk and nonrisk variables are able to explain average stock returns. These include size (Banz, 1981), the ratio of book equity to market equity (Fama & French, 1992, 1993, 1995, 1996; Stattman, 1980; Rosenberg, Reid, & Lanstein, 1985; Chan, Hamao, & Lakonishok, 1991), the price/earnings ratio (Basu, 1977), leverage (Bhandari, 1988), liquidity (Pastor & Stambaugh, 2003), and value-at-risk (VaR) (Bali & Cakici, 2004; Chen, Chen, & Chen, 2010). -

Newsletter 81

Quarterly Newsletter Central Depository Company BOUNDLESS HUES OF NATURE Blue Shades of Determination The ocean blankets 71% of the Earth’s surface and is the habitat for countless creatures, corals, mammals and the like, thus ensuring that life on earth and underwater runs its respective course. In addition, the ocean provides a multitude of core benefits – food, medicine, climate regulation, oxygen regeneration – which are not only essential for sustaining the planet but also open avenues for economic growth and employment. Just as the ocean serves as an irreplaceable mammoth functioning as the driving engine of our environment, CDC serves as the driving engine of the Pakistan Capital Market, propelling the economic turbine of the country. The multifaceted organization renders unique and efficient services that are essential to all market players, re-engineering old practices and creating ease of doing business to uplift the functioning of Pakistan’s financial ecosystem. Head Office: Lahore Branch: CDC House, 99-B, Block ‘B’, S.M.C.H.S., Main Mezzanine Floor, South Tower, LSE Plaza, 19 Shahrah-e-Faisal, Karachi - 74400. Khayaban-e-Aiwan-e-Iqbal, Lahore-54000, Pakistan Tel: (92-21) 111-111-500 I Fax: (92-21) 34326031 Tel: (92-42) 36368000-3 I Fax: (92-42) 36368484-5 PSX Branch: Email: [email protected] Mezzanine Floor, Pakistan Stock Exchange Building, URL: www.cdcpakistan.com Stock Exchange Road, Karachi. Tel: (92-21) 32416774 I Fax: (92-21) 32444491 Customer Support Services: 0800 – 23275 (CDCPL) Islamabad Branch: Room # 410, 4th Floor, ISE Towers REIT Management For Overseas Callers: +92 (21) 34326038 Limited, 55-B, Jinnah Avenue, Blue Area, Islamabad. -

Appendix - II Pakistani Banks and Their Branches (December 31, 2008)

Appendix - II Pakistani Banks and their Branches (December 31, 2008) Allied Bank Ltd. Bhalwal (2) Chishtian (2) -Grain Market -Grain Market (743) -Noor Hayat Colony -Mohar Sharif Road Abbaspur 251 RB Bandla Bheli Bhattar (A.K.) Chitral Chungpur (A.K.) Abbottabad (4) Burewala (2) Dadu -Bara Towers, Jinnahabad -Grain Market -Pineview Road -Housing Scheme Dadyal (A.K) (2) -Supply Bazar -College Road -The Mall Chak Jhumra -Samahni Ratta Cross Chak Naurang Adda Johal Chak No. 111 P Daharki Adda Nandipur Rasoolpur Chak No. 122/JB Nurpur Danna (A.K.) Bhal Chak No. 142/P Bangla Danyor Adda Pansra Manthar Darband Adda Sarai Mochiwal Chak No. 220 RB Dargai Adda Thikriwala Chak No. 272 HR Fortabbas Darhal Gaggan Ahmed Pur East Chak No. 280/JB (Dawakhri) Daroo Jabagai Kombar Akalgarh (A.K) Chak No. 34/TDA Daska Arifwala Chak No. 354 Daurandi (A.K.) Attock (Campbellpur) Chak No. 44/N.B. Deenpur Bagh (A.K) Chak No. 509 GB Deh Uddhi Bahawalnagar Chak No. 76 RB Dinga Chak No. 80 SB Bahawalpur (5) Chak No. 88/10 R Dera Ghazi Khan (2) Chak No. 89/6-R -Com. Area Sattelite Town -Azmat Road -Dubai Chowk -Model Town -Farid Gate Chakwal (2) -Ghalla Mandi -Mohra Chinna Dera Ismail Khan (3) -Settelite Town -Talagang Road -Circular Road -Commissionery Bazar Bakhar Jamali Mori Talu Chaman -Faqirani Gate (Muryali) Balagarhi Chaprar Balakot Charsadda Dhamke (Faisalabad) Baldher Chaskswari (A.K) Dhamke (Sheikhupura) Bucheke Chattar (A.K) Dhangar Bala (A.K) Chhatro (A.K.) Dheed Wal Bannu (2) Dina -Chai Bazar (Ghalla Mandi) Chichawatni (2) Dipalpur -Preedy Gate -College Road Dir Barja Jandala (A.K) -Railway Road Dunyapur Batkhela Ellahabad Behari Agla Mohra (A.K.) Chilas Eminabad More Bewal Bhagowal Faisalabad (20) Bhakkar Chiniot (2) -Akbarabad Bhaleki (Phularwan Chowk) -Muslim Bazar (Main) -Sargodha Road -Chibban Road 415 ABL -Factory Area -Zia Plaza Gt Road Islamabad (23) -Ghulam Muhammad Abad Colony Gujrat (3) -I-9 Industrial Area -Gole Cloth Market -Grand Trunk Road -Aabpara -Gole Kiryana Bazar -Rehman Saheed Road -Blue Area ABL -Gulburg Colony -Shah Daula Road. -

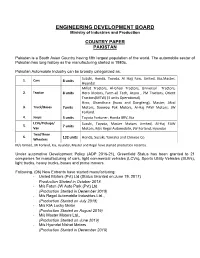

ENGINEERING DEVELOPMENT BOARD Ministry of Industries and Production

ENGINEERING DEVELOPMENT BOARD Ministry of Industries and Production COUNTRY PAPER PAKISTAN Pakistan is a South Asian Country having fifth largest population of the world. The automobile sector of Pakistan has long history as the manufacturing started in 1980s. Pakistan Automobile Industry can be broadly categorized as: Suzuki, Honda, Toyota, Al Hajj Faw, United, Kia,Master, 1. Cars 8 units Hyundai Millat Tractors, Al-Ghazi Tractors, Universal Tractors, 2. Tractor 8 units Hero Motors, Farm-all Tech, Arzoo , PM Tractors, Orient Tractors(MTW) (3 units Operational). Hino, Ghandhara (Isuzu and Dongfeng), Master, Afzal 3. Truck/Buses 7units Motors, Daewoo Pak Motors, Al-Haj FAW Motors, JW Forland. 4. Jeeps 3 units Toyota Fortuner, Honda BRV, Kia LCVs/Pickups/ Suzuki, Toyota, Master Motors Limited, Al-Haj FAW 5. 7 units Van Motors, M/s Regal Automobile, JW Forland, Hyundai Two/Three 6. 132 units Honda, Suzuki, Yamaha and Chinese Co. Wheelers M/s United, JW Forland, Kia, Hyundai, Master and Regal have started production recently. Under automotive Development Policy (ADP 2016-21), Greenfield Status has been granted to 21 companies for manufacturing of cars, light commercial vehicles (LCVs), Sports Utility Vehicles (SUVs), light trucks, heavy trucks, buses and prime movers. Following, (06) New Entrants have started manufacturing; - United Motors (Pvt) Ltd (Status Granted on:June 19, 2017) Production Started in October 2018 - M/s Foton JW Auto Park (Pvt) Ltd (Production Started in December 2018) - M/s Regal Automobile Industries Ltd.,, (Production Started on July 2018) - M/s KIA Lucky Motor (Production Started on August 2019) - M/s Master Motors Ltd., (Production Started on June 2019) - M/s Hyundai Nishat Motors (Production Started in December 2019) Most of other companies are in the process of establishing their manufacturing facilities. -

Final Septrum Oct 2018

Vision Millat to be a global group of companies, recognized for a range of quality products with innovative design capabilities. Mission To be market leader in agricultural tractors and machinery, building company’s image through innovation and competitiveness, grow by expanding market and investing into group companies, ensuring satisfaction to customers and stakeholders and to fullfill social obligations. Dear Customers This booklet is a brief introduction and customer friendly guide to Millat Tractors Limited and the wide range of products that we offer to match the farming and industrial needs of modern day users to help you understand and select our quality products which suits best your requirements. For Further Information Please Visit: URL: www.millat.com.pk E-mail: [email protected] [email protected] (For Corporate Customers Only.) [email protected] (For Gen.Sets, Forklift Truck and Prime Movers.) Or Call Now On: +92 42 111 200 786 +92 42 379 222 59 (For Corporate Customers Only.) +92 42 379 258 36 (For Gen.Sets, Forklift Truck and Prime Movers.) CONTENTS COMPANY MILESTONES AND BASIC INFO 1 LIST OF AWARDS RECEIVED 2-3 Chapter - 1 MILLAT Agricultural Tractors 4 MF 240 TRACTOR 5-6 MF 350 PLUS TRACTOR 7-8 MF 260 TRACTOR 9-10 MF 360 TRACTOR 11-12 MF 375 TRACTOR 13-14 MF 385 TRACTOR 15-16 MF 385-4WD TRACTOR 17-18 MF 455-4WD TRACTOR 19-20 Chapter - 2 MILLAT Tractor Attachments & Agri - Implements 22 FODDER HARVESTER 23 MILLAT JF 1000 AT 24 FODDER CHOPPERS 25 MASCHIO LAWN MOWER 26 MILLAT ROTARY SLASHER 27 MILLAT BROOMER 28 MILLAT -

Overview Association Major Players

Brief on Automotive Sector Overview The auto sector is considered the sixth largest manufacturing sector in Pakistan and is therefore of prime importance to the economy of Pakistan. Pakistan’s automotive industry started with an automobile plant set up by General Motors in 1949. To achieve 75 per cent local content levels, auto manufacturers started to look for local sourcing. They also started to provide auto parts manufacturers with technical assistance to ensure quality and uninterrupted supply, which led to the development of the auto vending industry. Pakistan automobile industry is the sixth largest manufacturing sub‐sector with annual contribution of 2.8 percent in GDP. Automotive sector still thrives to make significant contribution to the domestic economy in form of foreign investments, foreign exchange earnings, employment, and revenue generation. Association • Pakistan Automotive Manufacturers Association (PAMA) • Pakistan Association of Automotive Parts & Accessories Manufacturers (PAAPAM) Major Players Pak Suzuki Co. Ltd Atlas Honda Ltd. Indus Motor Co. Ltd. Plum Qingqi Motors Ltd. Honda Atlas Cars (Pakistan) Ltd. Fateh Motors Ltd. Sigma Motors Ltd. Ravi Automobile Pvt. Ltd. Ghandhara Industries Ltd. Sazgar Engineering Works Ltd. Ghandhara Nissan Ltd. Orient Automotive Industries Pvt. Ltd. Master Motor Corporation Ltd. Eiffel Industries Ltd. Millat Tractors Ltd. Yamaha Motor Pakistan Pvt. Ltd. Al-Ghazi Tractors Ltd. United Auto Industries Pvt. Ltd. Hyundai Nishat Motor Pvt. Ltd. Hinopak Motors Limited Ghandhara DF (Pvt) Ltd. Fuso Master Motor Pvt Ltd. Afzal Motors Pvt Ltd PM Auto Industries Daewoo Pak Motors (Pvt) Ltd. Al Haj FAW Motors (Pvt) Ltd. Al-Ghazi Tractors Ltd MTW Pak Assembling Industries (Pvt) Ltd. -

Pakistan's Automotive Industry: 3 N

PA K I S TA N I N S T I T U T E O F D E V E L O P M E N T E C O N O M I C S S R E P A P G 7 Pakistan's Automotive Industry: 3 N 1 A Case of Stalled Development I . o K N R O W Usman Qadir E D I P July 2016 PIDE Working Papers No. 137 Pakistan’s Automotive Industry: A Case of Stalled Development Usman Qadir Pakistan Institute of Development Economics, Islamabad PAKISTAN INSTITUTE OF DEVELOPMENT ECONOMICS ISLAMABAD 2016 Editorial Committee Dr Abdul Qayyum Head Dr Durr-e-Nayab Member Dr Anwar Hussain Secretary All rights reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means—electronic, mechanical, photocopying, recording or otherwise—without prior permission of the Publications Division, Pakistan Institute of Development Economics, P. O. Box 1091, Islamabad 44000. © Pakistan Institute of Development Economics, 2016. Pakistan Institute of Development Economics Islamabad, Pakistan E-mail: [email protected] Website: http://www.pide.org.pk Fax: +92-51-9248065 Designed, composed, and finished at the Publications Division, PIDE. CONTENTS Page Abstract v 1. Introduction 1 2. Pakistan’s Automotive Industry— Some Stylised Facts 2 2.1. Key Statistics 2 2.2. Market Shares 6 2.3. Key Characteristics of the Domestic Automotive Market 10 2.4. Institutional Framework 11 2.5. Trends in the Automotive Industry 17 3. Survey Methodology and Data 19 4. Analysis of Key Findings 21 4.1. -

Operating As an Open-End Equity Fund Since 1962, NI(U)T Is the Flagship Carrier of a Diversified Portfolio of Collective Investment

Operating as an Open-end Equity Fund Since 1962, NI(U)T is the flagship carrier of a diversified portfolio of Collective Investment Schemes managed by NITL with net assets of PKR 66.83 billion and 48,170 unit holders. TRUSTEE REPORT TRUSTEE REPORT TO THE UNIT HOLDERS Report of the Trustee pursuant to Regulation 41(h) and Clause 9 of Schedule V of the Non-Banking Finance Companies and Notified Entities Regulations, 2008 We, Central Depository Company of Pakistan Limited, being the Trustee of National Investment (Unit) Trust (the Fund) CORPORATE INFORMATION are of the opinion that National Investment Trust Limited being the Management Company of the Fund has in all material respects managed the Fund during the year ended June 30, 2016 in accordance with the provisions of the following: (i) Limitations imposed on the investment powers of the Management Company under the constitutive documents of the Fund; FUND NAME National Investment (Unit) Trust (ii) The pricing, issuance and redemption of units are carried out in accordance with the requirements of the constitutive NAME OF AUDITORS documents of the Fund; and KPMG Taseer Hadi & Co. Chartered Accountants (iii) The Non-Banking Finance Companies (Establishment and Regulations) Rules, 2003, the Non-Banking Finance LIST OF BANKERS Allied Bank Limited Companies and Notified Entities Regulations, 2008 and the constitutive documents of the Fund. Bank Al Falah Limited Bank Al Habib Limited Habib Bank Limited National Bank of Pakistan Sd/- NIB Bank Limited Summit Bank Limited Muhammad Hanif Jakhura