Cathay General Bancorp Annual Report 2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

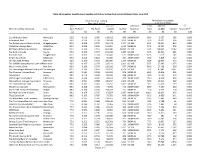

3A Expanded Small Business Lending

Table 3A Expanded. Small Business Lending Institutions in New York Using Call Report Data, June 2012 Small Business Lending Micro Business Lending (less than $ million) (less than $ 100k) Total Amount Institution Total Amount CC Name of Lending Institution City Rank TA Ratio1 TBL Ratio1 (1,000) Number Asset Size Rank (1,000) Number Amount/TA1 (1) (2) (3) (4) (5) (6) (7) (8) (9) (10) Catskill Hudson Bank Monticello 92.5 0.419 1.000 148,102 686 100M-500M 80.0 8,557 289 0.000 Adirondack Bank Utica 90.0 0.220 0.704 128,588 1,029 500M-1B 95.0 19,322 594 0.000 The Bridgehampton National Bank Bridgehampton 87.5 0.169 0.570 236,278 1,377 1B-10B 92.5 35,912 864 0.000 Watertown Savings Bank Watertown 85.0 0.208 0.690 105,854 1,012 500M-1B 87.5 14,901 596 0.000 NBT Bank, National Association Norwich 85.0 0.139 0.512 823,680 10,927 1B-10B 92.5 128,045 7,142 0.000 The Bank of Castile Castile 85.0 0.150 0.574 151,215 1,385 1B-10B 92.5 23,521 821 0.000 Riverside Bank Poughkeepsie 85.0 0.495 0.704 100,441 627 100M-500M 82.5 7,279 282 0.000 Empire State Bank Newburgh 85.0 0.414 0.864 66,385 431 100M-500M 70.0 3,038 237 0.000 Shinhan Bank America New York 82.5 0.197 0.307 189,889 1,175 500M-1B 82.5 18,025 494 0.001 The Suffolk County National Bank of RRiverhead 82.5 0.137 0.379 213,111 2,161 1B-10B 87.5 27,695 1,375 0.000 Woori America Bank New York 82.5 0.199 0.379 195,042 977 500M-1B 80.0 17,498 390 0.004 The Canandaigua National Bank and TCanandaigua 82.5 0.143 0.418 259,182 4,294 1B-10B 92.5 47,842 3,347 0.000 The Mahopac National Bank Brewster 82.5 -

2018 Annual Report

TABLE OF CONTENTS 2 Company Profile 4 Vision, Mission, and Service Promise 5 Economic Report and Forecast 6 Message from the Chairman 8 Q&A with the President and CEO ABOUT 10 Products and Services THE 13 Financial Highlights 14 Operational Highlights COVER 20 Corporate Social Responsibility OUR LEAVES 22 Corporate Governance OF CHANGE 32 Consumer Protection 36 Table of Organization New thinking is leading the transformed business of Bank of 38 Board of Directors Commerce in a digitized industry. 51 Senior Executive Team The theme and design reflect our 55 Management Committees new approach to a seamless banking 57 Risk Management experience. The convergence of multiple digital tools and platforms in 68 Capital Management our digitized leaves reflects how the 72 Internal Audit Division Report brand empowers the customers of the future. 73 Statement of Management's Responsibility for Financial Statements 74 Audited Financial Statements ABOUT OUR PAPER 75 Report of Independent Auditors 78 Statements of Financial Position The 2018 Bank of Commerce Annual report cover and main pages were 80 Statements of Income printed on Tocatta paper certified 81 Statements of Comprehensive Income by the Forest Stewardship Council (FSC). The FSC certification ensures 82 Statements of Changes in Equity that materials come from responsibly 84 Statements of Cash Flows managed forests that provide environmental, social and 86 Notes to the Financial Statements economic benefits. Kodak Sonora process-free plates, 209 Senior Officers non-petroleum-based soy ink, and 212 Branch / ATM Directory a Heidelberg carbon neutral offset press were utilized in the printing 217 Annex A - Related Party Transactions of this report. -

Summary of Pending Application As of October 2006

DEPARTMENT OF FINANCIAL INSTITUTIONS SUMMARY OF PENDING APPLICATIONS AS OF OCTOBER 2006 APPLICATION TYPE PAGE NO. BANK APPLICATION NEW BANK 1 CONVERSION TO STATE CHARTER 6 MERGER 6 ACQUISITION OF CONTROL 7 PURCHASE PARTIAL BUSINESS UNIT 8 NEW BRANCH 8 NEW PLACE OF BUSINESS 15 NEW EXTENSION OFFICE 20 HEAD OFFICE RELOCATION 21 HEAD OFFICE REDESIGNATION 21 BRANCH OFFICE RELOCATION 21 PLACE OF BUSINESS RELOCATION 23 EXTENSION OFFICE RELOCATION 24 DISCONTINUANCE OF BRANCH OFFICE 24 DISCONTINUANCE OF PLACE OF BUSINESS 25 DISCONTINUANCE OF EXTENSION OFFICE 26 APPLICATION PURSUANT TO SECTION 3580 27 INDUSTRIAL BANK APPLICATION CONVERSION TO STATE CHARTER 27 NEW BRANCH 27 NEW PLACE OF BUSINESS 27 BRANCH OFFICE RELOCATION 28 PLACE OF BUSINESS RELOCATION 28 DISCONTINUANCE OF BRANCH OFFICE 28 PREMIUM FINANCE COMPANY APPLICATION NEW PREMIUM FINANCE COMPANY 29 ACQUISITION OF CONTROL 29 HEAD OFFICE RELOCATION 29 VOLUNTARY SURRENDER OF LICENSE 30 TRUST COMPANY APPLICATION NEW TRUST COMPANY 30 ACQUISITION OF CONTROL 30 FOREIGN (OTHER NATION) BANK APPLICATION NEW OFFICE 30 DISCONTINUANCE 31 ii SUMMARY OF PENDING APPLICATIONS AS OF OCTOBER 2006 APPLICATION TYPE PAGE NO. FOREIGN (OTHER STATE) BANK APPLICATION NEW FACILITY 31 RELOCATION 32 DISCONTINUANCE OF FACILITY 32 CREDIT UNION APPLICATION NEW CREDIT UNION 32 CONVERSION TO STATE CHARTER 32 MERGER 32 NEW BRANCH OF FOREIGN (OTHER STATE) CREDIT UNION 33 CHANGE OF NAME 33 TRANSMITTER OF MONEY ABROAD APPLICATION NEW TRANSMITTER 34 ACQUISITION OF CONTROL 34 BUSINESS AND INDUSTRIAL DEVELOPMENT CORPORATION APPLICATION CORPORATE OFFICE RELOCATION 35 1 BANK APPLICATION NEW BANK Filed: 10 Approved: 9 Opened: 2 Withdrawn: 1 1ST CAPITAL BANK 1 Lower Ragsdale Drive, City and County of Monterey Correspondent: Grace Wickersham Carpenter & Company 5 Park Plaza, Suite 950 Irvine, CA 92614 (949) 261-8888 Filed: 8/3/06 ACCESS BUSINESS BANK Vicinity of 184 Technology Drive, Irvine, Orange County Correspondent: Judi Stevens Mora J. -

FDIC Institution Listing ACTIVE AS of 3/25/2013

FDIC Institution Listing ACTIVE AS OF 3/25/2013 ‐ FOR UPDATES SEE SOURCE URL (below) Source: http://www2.fdic.gov/idasp/main.asp NAME ADDRESS CITY STATE ZIP WEBADDR 1st Advantage Bank 240 Salt Lick Road Saint Peters MO 63376 http://www.1stadvantagebank.com:80/ 1st Bank 120 Second Street, N.W. Sidney MT 59270 http://www.our1stbank.com:80/ 1st Bank & Trust 710 South Park Drive Broken Bow OK 74728 http://www.1stbankandtrust.com:80/ 1st Bank of Sea Isle City 4301 Landis Avenue Sea Isle City NJ 08243 http://www.1stbankseaisle.com:80/ 1st Bank of Troy 212 South Main Street Troy KS 66087 https://secure.fbtroyks.com 1st Bank Yuma 2799 South 4th Avenue Yuma AZ 85364 http://www.1stbankyuma.com:80/ 1st Cameron State Bank 124 South Walnut Cameron MO 64429 http://www.1stcameron.com:80/ 1st Capital Bank 5 Harris Court, Building N, Suite #3 Monterey CA 93940 http://www.1stcapitalbank.com:80/ 1st Century Bank, National Association 1875 Century Park East, Suite 1400 Los Angeles CA 90067 http://www.1cbank.com:80/ 1st Colonial Community Bank 1040 Haddon Avenue Collingswood NJ 08108 http://www.1stcolonial.com:80/ 1st Commerce Bank 5135 Camino Al Norte, Suite 4 North Las Vegas NV 89031 http://www.1stcommercebank.com:80/ 1st Community Bank 407 Third Street Sherrard IL 61281 http://www.1stcommunitybanks.com:80/ 1st Constitution Bank 2650 Route 130 Cranbury NJ 08512 http://www.1stconstitution.com:80/ 1st Enterprise Bank 818 West Seventh Street, Suite 220 Los Angeles CA 90017 http://www.1stenterprisebank.com:80/ 1st Equity Bank 3956 West Dempster Street Skokie IL 60076 1st Equity Bank Northwest 1330 Dundee Road Buffalo Grove IL 60089 1st Financial Bank USA 331 North Dakota Dunes Boulevard Dakota Dunes SD 57049 http://www.1fbusa.com:80/ 1st Manatee Bank 12215 Us Highway 301 N Parrish FL 34219 http://www.1stmanatee.com:80/ 1st National Bank 730 East Main Street Lebanon OH 45036 http://www.bankwith1st.com:80/ 1st National Bank of South Florida 1550 North Krome Avenue Homestead FL 33030 http://www.1stnatbank.com:80/ 1st National Community Bank 16924 St. -

You in More Places ABOUT CATHAY GENERAL BANCORP Cathay General Bancorp Is the Holding Company for Cathay Bank

2006 ANNUAL REPORT 777 North Broadway, Los Angeles, California 90012 T: (213) 625-4700 F: (213) 625-1368 www.cathaybank.com you in more places ABOUT CATHAY GENERAL BANCORP Cathay General Bancorp is the holding company for Cathay Bank. Founded in 1962, Cathay Bank is committed to providing excellent bank- ing service to its communities. Our extended service network covers seven states in the country—Southern and Northern California, New York, Illinois, Massachusetts, Texas, Washington, and New Jersey. Overseas, we have offices in Hong Kong, Shanghai, and Taipei. Washington Massachusetts Illinois New York OUR SERVICE NETWORK New Jersey Northern California Southern California Texas Forward–Looking Statements This Annual Report contains forward-looking statements within the meaning of the applicable provisions of the Private Securities Litigation Reform Act of 1995 regarding management’s beliefs, projections, and assumptions concerning future results and events. These forward-looking statements may include, but are not limited to, such words as “believes,” “expects,” “anticipates,” “intends,” “plans,” “estimates,” “may,” “will,” “should,” “could,” “predicts,” “potential,” “continue,” or the negative of such terms and other comparable terminology or similar expressions. Forward-looking statements are not guarantees. They involve known and unknown risks, uncertainties, and other factors that may cause the actual results, performance, or achievements of Cathay General Bancorp to be materially different from any future results, performance, or -

One Vision. Many Facets

Cathay General Bancorp One Vision. Many Facets. 2016 Annual Report 777 North Broadway Los Angeles, CA 90012 T 213 625 4700 F 213 625 1368 www.cathaygeneralbancorp.com www.cathaybank.com 2016 Annual Report 19700_CAT-001_2016_AnnualReport_Cover_CS6_r1.indd 1 3/30/17 1:00 PM Forward-Looking Statements Our annual report includes forward-looking statements within the meaning of the applicable provisions of the Private Securities Litigation Reform Act of 1995 regarding management’s beliefs, projections, and assumptions concerning future results and events. We intend such forward-looking statements to be covered by the safe harbor for forward-looking statements in these provisions. All statements other than statements of historical fact are “forward-looking statements” for purposes of federal and state securities laws. Words such as “aims,” “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “hopes,” “intends,” “may,” “optimistic,” “plans,” “predicts,” “possible,” “potential,” “projects,” “seeks,” “shall,” “should,” “will,” and variations of these words and similar expressions are intended to identify these forward-looking statements. Forward-looking statements by us are based on estimates, beliefs, projections, and assumptions of management and are not guarantees of future performance. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our historical experience and our present expectations or projections. These and other factors are described in our Annual Report on Form 10-K (at Item 1A in particular) for the year ended December 31, 2016, which with a more detailed disclaimer under the caption “Forward-Looking Statements” is included with this annual report; in other reports filed with the Securities and Exchange Commission (the “SEC”); and in other filings we make with the SEC from time to time. -

Each Year Depositaccounts.Com Evaluates the Financial Health of Every Federally Insured Bank in the United States – More Than 6,900 Total

Each year DepositAccounts.com evaluates the financial health of every federally insured bank in the United States – more than 6,900 total. Each institution is graded on a number of factors, including capitalization, deposit growth, and loan to reserve ratios, in order to determine a comprehensive health score. From the list of 6,998 banks, DepositAccounts.com recognizes those who have shown exceptional fiduciary responsibility in its 2015 edition of the Top 200 Healthiest Banks in America… 1 Rank Name Location 1 California First National Bank Irvine, CA 2 CommerceWest Bank Irvine, CA 3 Oakworth Capital Bank Birmingham, AL 4 New OMNI Bank Alhambra, CA 5 Texas Security Bank Dallas, TX 6 Community Business Bank West Sacramento, CA 7 M.Y. Safra Bank New York, NY 8 Bank of Napa Napa, CA 9 Kingsley State Bank Kingsley, IA 10 Lighthouse Bank Santa Cruz, CA 11 Texan Bank Sugar Land, TX 12 Community Business Bank Cumming, GA 13 Farmers State Bank of Aliceville Westphalia, KS 14 Campbell County Bank Herreid, SD 15 Global Bank New York, NY 16 Citizens National Bank Wills Point, TX 17 First Texas Bank Lampasas, TX 18 Sabal Palm Bank Sarasota, FL 19 CBank Cincinnati, OH 20 Reynolds State Bank Reynolds, IL 21 Grand Ridge National Bank Grand Ridge, IL 22 Malaga Bank Palos Verdes Estates, CA 23 Chattahoochee Bank of Georgia Gainesville, GA 24 Mizuho Bank New York, NY 25 Americas United Bank Glendale, CA 26 Frontier Bank of Texas Elgin, TX 27 Midwest Heritage Bank West Des Moines, IA 28 Mason Bank Mason, TX 29 Hanover Community Bank Garden City Park, -

Pratt Center's Task 2 Research Report, Drafted

Chinatown Planning and Rezoning Study Draft Task 2 Report: Research and Analysis Table of Contents Introduction 1 Geography of Chinatown 1 What is an Ethnic Enclave? [sidebar] 1 Literature Review 4 Methodology 4 Demographics 4 Economic Development 5 Land Use and Zoning 7 Seward Park Urban Renewal Area 10 Housing 11 NYCHA 12 Climate Change and Resilience 12 East River Waterfront Esplanade 13 Significant Neighborhood Development Projects 14 Completed Actions 14 Proposed Actions 14 Projected/Speculated Development 16 Zoning and Land Use 20 Zoning 20 Zoning Context 20 Existing Zoning 22 BSA Decisions: Variances, Special Permits, and Appeals 30 Land Use 32 Land Use by Lot 32 Number of Floors 34 Bulk and Use Conformance with Zoning 36 Bulk (FAR) Conformance 36 Built FAR 37 Maximum Allowable FAR 38 Available FAR (Lots that are not Built Out) 39 Available FAR by Percent: Draft Study Area 40 Out of Bulk Conformance (Lots that are Overbuilt) 41 Page 1 of 4 Zoning and Land Use, con’t. Use Conformance 42 Out of Use Conformance 43 Renderings / Analytical Drawings 44 95 Baxter Street 45 208 Hester Street 46 53 Hester Street 47 Demographics 48 Population 48 Age 51 Household size 53 Housing overcrowding 54 Income, Poverty & Unemployment 55 Housing 56 Basic Indicators 56 # of Housing Units 56 Vacancy/Occupancy 56 Housing Density 57 Tenure 57 Seasonal Units 58 Housing Costs 59 Introduction 59 Rental Values (Median Contract Rent) 59 Rent Burdened Households 60 Local Rental Market 60 Housing Sales 63 Affordable and Subsidized Housing 64 Introduction 64 What -

Community Reinvestment Act Performance Evaluation

NEW YORK STATE BANKING DEPARTMENT CONSUMER SERVICES DIVISION One State Street New York, NY 10004 PUBLIC SUMMARY COMMUNITY REINVESTMENT ACT PERFORMANCE EVALUATION Date of Evaluation December 31, 2009 Institution: United Orient Bank 10 Chatham Square New York, New York 10038-1098 Note: This evaluation is not an assessment of the financial condition of this institution. The rating assigned does not represent an analysis, conclusion or opinion of the New York State Banking Department concerning the safety and soundness of this financial institution. TABLE OF CONTENTS Section General Information ......................................................................... 1 Overview of Institution’s Performance .............................................. 2 Performance Context ........................................................................ 3 Institution’s Profile Assessment Area Demographic & Economic Data Performance Standards and Assessment Factors .......................... 4 Loan-to-Deposit Analysis and Other Lending-Related Activities Assessment Area Concentration Distribution by Borrowers Characteristics Geographic Distribution of Loans Action Taken in Response to Written Complaints With Respect to CRA Additional Factors Glossary ........................................................................................... 5 i GENERAL INFORMATION This document is an evaluation of the Community Reinvestment Act (“CRA”) performance of United Orient Bank (“UOB”) prepared by the New York State Banking Department. The evaluation represents -

Cathay Opens Doors to Opportunity

Cathay opens doors to opportunity 2017 Annual Report More than half a century ago, we opened our doors at Cathay Bank to serve the growing Chinese American community in Los Angeles. We helped our customers put down new roots with cars and homes. We supported their businesses, which continue to sustain generations. We worked with them to cultivate communities united by a shared drive to create and build lives in Southern California. Over time, we’ve expanded along with our customers. Today, we’re a subsidiary of Cathay General Bancorp (NASDAQ: CATY), a publicly held bank holding company with more than $15.6 billion in assets. We have 65 branches across the United States as well as outposts in Hong Kong, Beijing, Shanghai, and Taipei. While the people we serve have evolved and changed, the spirit of what makes up our customers remains the same. Everyone believes in the power of initiative and perseverance. Each aims to achieve what’s possible. All strive to live their best lives. And we’re happy to work alongside them—providing the tools and services to get them where they want to go. Enriching your journey with hard work and heart Cathay Bank serves a wide array of customers, from individuals and businesses to employees, investors, and the communities in which we live. But one constant is that we serve each and every one with hard work and heart. Whether it is retail banking or wealth management, home loans or financing that helps grow commercial endeavors, Cathay strives to make each personal journey successful. -

Asia Bank, N.A. Charter Number: 18432

O LARGE BANK Comptroller of the Currency Administrator of National Banks Washington, DC 20219 Public Disclosure May 10, 2004 Community Reinvestment Act Performance Evaluation Asia Bank, N.A. Charter Number: 18432 135-34 Roosevelt Avenue Flushing, NY 11354 Office of the Comptroller of the Currency New York Metro-Manhattan-South 1114 Avenue of the Americas, Suite 3900 New York, NY 10036 NOTE: This document is an evaluation of this institution's record of meeting the credit needs of its entire community, including low- and moderate-income neighborhoods, consistent with safe and sound operation of the institution. This evaluation is not, and should not be construed as, an assessment of the financial condition of this institution. The rating assigned to this institution does not represent an analysis, conclusion, or opinion of the federal financial supervisory agency concerning the safety and soundness of this financial institution. Charter Number: 18432 Table of Contents OVERALL CRA RATING.......................................................................................................................................... 2 DEFINITIONS AND COMMON ABBREVIATIONS .................................................................................................. 3 DESCRIPTION OF INSTITUTION ............................................................................................................................ 7 SCOPE OF THE EVALUATION .............................................................................................................................. -

Order Approving the Merger of Bank Holding Companies -- Cathay

FRB Order No. 2015-19 July 16, 2015 FEDERAL RESERVE SYSTEM Cathay General Bancorp Los Angeles, California Order Approving the Merger of Bank Holding Companies Cathay General Bancorp (“Cathay Bancorp”), Los Angeles, California, has requested the Board’s approval under section 3 of the Bank Holding Company Act (“BHC Act”)1 to merge with Asia Bancshares, Inc. (“Asia Bancshares”), and thereby indirectly acquire its subsidiary bank, Asia Bank, National Association (“Asia Bank”), both of Flushing, New York. Following the proposed acquisition, Asia Bank would be merged into Cathay Bancorp’s subsidiary bank, Cathay Bank, Los Angeles, a state nonmember bank.2 Notice of the proposals, affording interested persons an opportunity to submit comments, has been published (80 Federal Register 12629 (2015)).3 The time for submitting comments has expired, and the Board has considered the proposal and all comments received in light of the factors set forth in section 3 of the BHC Act. Cathay Bancorp, with consolidated assets of approximately $11.9 billion, is the 104th largest insured depository organization in the United States, controlling approximately $8.8 billion in deposits.4 Cathay Bancorp controls Cathay Bank, which 1 12 U.S.C. § 1842. 2 The merger of Asia Bank into Cathay Bank is subject to the approval of the Federal Deposit Insurance Corporation (“FDIC”) pursuant to section 18(c) of the Federal Deposit Insurance Act (“Bank Merger Act”). 12 U.S.C. § 1828(c). The FDIC approved the bank merger on June 23, 2015. 3 12 CFR 262.3(b). 4 Asset data are as of March 31, 2015, and nationwide deposit-ranking data are as of December 31, 2014, unless otherwise noted.