FOR IMMEDIATE RELEASE for Further Information

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Retail Banking Announcement

Frequently asked questions 26 May 2021 What the repositioning of the HSBC USA Wealth and Personal Banking business means for our customers, here and abroad Why did HSBC take this action? In February 2020, we set out a plan to shift our business strategy in the United States to maximize the connection between our clients and our world-class international network. Our primary business will be a wholesale bank focused on the international needs of clients. We are renewing our emphasis on the US$5 trillion international wealth management opportunity from globally mobile and affluent individuals in the United States. Is HSBC exiting the United States? No, HSBC is not exiting its US business. We aim to be the leading international bank in the United States and are focused on what we do best – connecting Americans to a world of opportunity and bringing cross-border business and investment to the United States. We will continue to provide banking services not only to our wholesale banking clients, but also to our Premier, Jade and Private Banking customers. I have personal accounts at HSBC and I’m in the United States. How will these agreements affect me? Upon completion of the transactions, the accounts of in-scope customers will be transferred to Citizens or Cathay Bank. We thank those customers for their business and will ensure the transfer occurs with as minimum disruption as possible. Premier, Jade, Private Banking and other clients who will remain HSBC customers are in the process of being transitioned to one of our new 20-25 Wealth Centers. -

Cathay General Bancorp Contact: Heng W

FOR IMMEDIATE RELEASE For: Cathay General Bancorp Contact: Heng W. Chen 777 N. Broadway (626) 279-3652 Los Angeles, CA 90012 CATHAY GENERAL BANCORP AND ASIA BANCSHARES INC. COMPLETE MERGER LOS ANGELES – August 3, 2015 – Cathay General Bancorp (NASDAQ: CATY), the holding company for Cathay Bank, announced today that it completed its merger with Asia Bancshares, Inc. at the end of the day on July 31, 2015. As a result of the transaction, Asia Bancshares, Inc. has been merged with and into Cathay General Bancorp, and Asia Bank has been merged with and into Cathay Bank. The completion of the merger results in a combined financial institution with total assets of approximately $12.4 billion and deposits of approximately $9.8 billion, 57 branches operating in nine states, and a presence in three overseas locations. Under the terms of the merger, Cathay General Bancorp is issuing 2.58 million shares of its common stock and paying $57.0 million in cash for all of the issued and outstanding shares of Asia Bancshares stock, valuing the merger at approximately $139.9 million, based on Cathay General Bancorp’s closing price on July 31, 2015. Based on properly and timely submitted and accepted elections, the stock consideration of 3.2134 shares of Cathay common stock per share of Asia Bancshares was over-subscribed by Asia Bancshares shareholders and subject to proration. As a result, approximately 36% of the shares of Asia Bancshares that were subject to stock elections will receive cash consideration of $86.76 per share of Asia Bancshares. Asia Bancshares shareholders who elected cash and those shareholders who failed to submit elections on a timely basis will receive cash consideration of $86.76 per share of Asia Bancshares. -

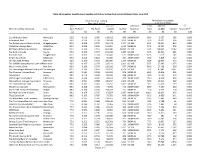

3A Expanded Small Business Lending

Table 3A Expanded. Small Business Lending Institutions in New York Using Call Report Data, June 2012 Small Business Lending Micro Business Lending (less than $ million) (less than $ 100k) Total Amount Institution Total Amount CC Name of Lending Institution City Rank TA Ratio1 TBL Ratio1 (1,000) Number Asset Size Rank (1,000) Number Amount/TA1 (1) (2) (3) (4) (5) (6) (7) (8) (9) (10) Catskill Hudson Bank Monticello 92.5 0.419 1.000 148,102 686 100M-500M 80.0 8,557 289 0.000 Adirondack Bank Utica 90.0 0.220 0.704 128,588 1,029 500M-1B 95.0 19,322 594 0.000 The Bridgehampton National Bank Bridgehampton 87.5 0.169 0.570 236,278 1,377 1B-10B 92.5 35,912 864 0.000 Watertown Savings Bank Watertown 85.0 0.208 0.690 105,854 1,012 500M-1B 87.5 14,901 596 0.000 NBT Bank, National Association Norwich 85.0 0.139 0.512 823,680 10,927 1B-10B 92.5 128,045 7,142 0.000 The Bank of Castile Castile 85.0 0.150 0.574 151,215 1,385 1B-10B 92.5 23,521 821 0.000 Riverside Bank Poughkeepsie 85.0 0.495 0.704 100,441 627 100M-500M 82.5 7,279 282 0.000 Empire State Bank Newburgh 85.0 0.414 0.864 66,385 431 100M-500M 70.0 3,038 237 0.000 Shinhan Bank America New York 82.5 0.197 0.307 189,889 1,175 500M-1B 82.5 18,025 494 0.001 The Suffolk County National Bank of RRiverhead 82.5 0.137 0.379 213,111 2,161 1B-10B 87.5 27,695 1,375 0.000 Woori America Bank New York 82.5 0.199 0.379 195,042 977 500M-1B 80.0 17,498 390 0.004 The Canandaigua National Bank and TCanandaigua 82.5 0.143 0.418 259,182 4,294 1B-10B 92.5 47,842 3,347 0.000 The Mahopac National Bank Brewster 82.5 -

FY 19 4Th Quarter & FYE Lender Ranking

LOS ANGELES DISTRICT OFFICE 7(a) and 504 Lender Ranking Report Fiscal Year 2019 - Q4 (10/1/18 - 9/30/19) 7(a) Loan Program 504 Loan Program 1 U.S. Bank, National Association 184 $23,757,600 67 Mega Bank 5 $1,672,000 1 CDC Small Business Finance Corporation* 94 $98,783,000 2 JPMorgan Chase Bank, National Association 174 $44,541,500 68 PCR Small Business Development*++ 5 $821,000 2 Business Finance Capital*++ 92 $109,382,000 3 Bank of Hope++ 167 $60,333,000 69 Poppy Bank 4 $8,690,000 3 California Statewide Certified Development* 84 $67,087,000 4 Wells Fargo Bank, National Association 155 $36,193,900 70 Wallis Bank 4 $7,542,000 4 Mortgage Capital Development Corporation 38 $39,865,000 5 First Home Bank 104 $22,494,000 71 BBVA USA 4 $5,926,300 5 Advantage Certified Development Corporation 15 $17,387,000 6 East West Bank++ 61 $33,406,500 72 Pacific Mercantile Bank 4 $4,927,000 6 Southland Economic Development Corporation 14 $14,297,000 7 Pacific City Bank++ 60 $50,311,500 73 Pacific Western Bank++ 4 $4,165,000 7 So Cal CDC++ 11 $22,780,000 8 CDC Small Business Finance Corporation* 55 $8,763,500 74 OneWest Bank, A Division of 4 $4,013,000 8 AMPAC Tri-State CDC, Inc. 10 $7,235,000 9 MUFG Union Bank, National Association 50 $75,482,600 75 IncredibleBank 4 $2,123,600 9 Coastal Business Finance++ 6 $3,666,000 10 Hanmi Bank++ 50 $30,864,000 76 Kinecta FCU++ 4 $862,000 10 Enterprise Funding Corporation 2 $2,980,000 11 Commonwealth Business Bank++ 47 $38,305,000 77 Montecito Bank & Trust++ 4 $503,900 11 San Fernando Valley Small Business Development++ 2 $1,046,000 12 Celtic Bank Corporation 44 $14,667,300 78 Meadows Bank 3 $5,091,000 12 Superior California Economic Development 1 $2,111,000 13 Independence Bank 40 $5,725,000 79 Banner Bank 3 $2,175,000 13 Capital Access Group, Inc. -

Investor Presentation November 2017

Investor Presentation November 2017 NASDAQ: RBB Forward‐Looking Statements Certain matters set forth herein (including the exhibits hereto) constitute forward‐looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including forward‐looking statements relating to the Company’s current business plans and expectations and our future financial position and operating results. These forward‐looking statements are subject to risks and uncertainties that could cause actual results, performance and/or achievements to differ materially from those projected. These risks and uncertainties include, but are not limited to, local, regional, national and international economic and market conditions and events and the impact they may have on us, our customers and our assets and liabilities; our ability to attract deposits and other sources of funding or liquidity; supply and demand for real estate and periodic deterioration in real estate prices and/or values in California or other states where we lend, including both residential and commercial real estate; a prolonged slowdown or decline in real estate construction, sales or leasing activities; changes in the financial performance and/or condition of our borrowers, depositors or key vendors or counterparties; changes in our levels of delinquent loans, nonperforming assets, allowance for loan losses and charge‐offs; the costs or effects of acquisitions or dispositions we may make, whether we are able to obtain any required governmental approvals in connection with -

2008 – December

DEPARTMENT OF FINANCIAL INSTITUTIONS SUMMARY OF PENDING APPLICATIONS AS OF DECEMBER 2008 APPLICATION TYPE PAGE NO. BANK APPLICATION NEW BANK 1 ACQUISITION OF CONTROL 2 CONVERSION TO STATE CHARTER 3 NEW BRANCH 3 NEW PLACE OF BUSINESS 8 NEW EXTENSION OFFICE 10 HEAD OFFICE RELOCATION 10 HEAD OFFICE REDESIGNATION 11 BRANCH OFFICE RELOCATION 11 PLACE OF BUSINESS RELOCATION 13 DISCONTINUANCE OF BRANCH OFFICE 13 DISCONTINUANCE OF PLACE OF BUSINESS 15 APPLICATION PURSUANT TO SECTION 772 16 INDUSTRIAL BANK APPLICATION CONVERSION TO STATE CHARTER 16 ACQUISITION OF CONTROL 16 NEW BRANCH 17 HEAD OFFICE RELOCATION 17 DISCONTINUANCE OF BRANCH 17 DISCONTINUANCE OF PLACE OF BUSINESS 17 CHANGE OF NAME 18 PREMIUM FINANCE COMPANY APPLICATION NEW PREMIUM FINANCE COMPANY 18 ACQUISITION OF CONTROL 19 MAIN OFFICE RELOCATION 20 FOREIGN (OTHER NATION) BANK APPLICATION NEW OFFICE 20 DISCONTINUANCE 20 FOREIGN (OTHER STATE) BANK APPLICATION NEW FACILITY 21 CREDIT UNION APPLICATION NEW CREDIT UNION 22 MERGER 22 NEW BRANCH OF FOREIGN (OTHER STATE) CREDIT UNION 23 TRANSMITTER OF MONEY ABROAD APPLICATION NEW TRANSMITTER 23 ACQUISITION OF CONTROL 23 VOLUNTARY SURRENDER OF LICENSE 24 1 BANK APPLICATION NEW BANK Filed: 2 Approved: 4 Opened: 1 AMERICAN CEDARS BANK 500 North Central Avenue, Glendale, Los Angeles County Correspondent: David E. Abshier LECG 550 South Hope Street, Suite 2150 Los Angeles, CA 90071 (213) 243-3700 Filed: 9/28/07 EL CAMINO BANK 20946 Devonshire Street, Chatsworth, Los Angeles County Correspondent: James H. Avery The Avery Company LLC P.O. Box 3009 San Luis Obispo, CA 93403 (805) 544-5477 Filed: 5/9/08 FORD GROUP BANK 3501 Jamboree Road, Newport Beach, Orange County Correspondent: Charles E. -

Discontinuance of Branch Office

DEPARTMENT OF BUSINESS OVERSIGHT SUMMARY OF PENDING APPLICATIONS AS OF AUGUST 2018 APPLICATION TYPE PAGE NO. BANK APPLICATION MERGER 1 ACQUISITION OF CONTROL 1 SALE / PURCHASE OF PARTIAL BUSINESS UNIT 2 APPLICATION FOR TRUST POWERS 2 NEW BRANCH 2 NEW FACILITY 3 HEAD OFFICE REDESIGNATION 3 BRANCH RELOCATION 3 DISCONTINUANCE OF BRANCH OFFICE 4 DISCONTINUANCE OF FACILITY 6 PREMIUM FINANCE COMPANY APPLICATION NEW PREMIUM FINANCE COMPANY 6 ACQUISITION OF CONTROL 8 VOLUNTARY SURRENDER OF LICENSE 8 FOREIGN (OTHER NATION) BANK APPLICATION NEW OFFICE 8 OFFICE RELOCATION 8 OFFICE DISCONTINUANCE 9 FOREIGN (OTHER STATE) BANK APPLICATION NEW FACILITY 9 CREDIT UNION APPLICATION MERGER 9 TRUST COMPANY APPLICATION DISCONTINUANCE OF BRANCH OFFICE 10 MONEY TRANSMITTER APPLICATION NEW TRANSMITTER 10 ACQUISITION OF CONTROL 11 1 BANK APPLICATION MERGER Filed: 1 Approved: 1 Effected: 2 Withdrawn: 1 AMERICAS UNITED BANK, Glendale, to merge with and into BANK OF SOUTHERN CALIFORNIA, NA, San Diego Effected: 8/1/18 COMMUNITY BANK, Pasadena, to merge with and into CITIZENS BUSINESS BANK, Ontario Filed: 4/6/18 Approved: 7/26/18 Effected: 8/10/18 FIRST AMERICAN INTERNATIONAL BANK, Brooklyn, New York, to merge with and into ROYAL BUSINESS BANK, Los Angeles, California Filed: 6/4/18 Approved: 8/14/18 MY BANK, BELEN, New Mexico, to merge with and into UNITED BUSINESS BANK, Walnut Creek, California Filed: 8/24/18 SOUTHWESTERN NATIONAL BANK, Houston, Texas, to merge with and into HANMI BANK, Los Angeles, California Filed: 6/25/18 Approved: 8/14/18 Withdrawn: 9/27/18 ACQUISITION -

2004 Outstanding 50 Asian Americans in Business Awards

Organizer: Sponsors: IBM . The New York Times . Verizon 2004 Outstanding Con Edison . McGraw-Hill . Fleet bank . Time Warner Colgate-Palmolive . BDO Siedman 50 Asian Americans in Planning Committee Chairman* and Members: Business Awards *Savio S. Chan, President & CEO, US China Partners, Inc. Mahesh Krishnamurti, Former Publisher/CFO, Worth Media James Y. Wohn, Senior Vice President, Fleet Bank June Jee, Director of Manhattan Community Affairs, Verizon Communications Walter Shay, Manager, Strategic Partnership, Con Edison John Kyriakides, Partner, BDO Seidman Jennifer Pauley, Assistant Director, Community Affairs, The New York Times V.M. Gandhi, President, New York Gold Company Thomas Chin, President, Accolade Technologies, LLC Govind Srivastava, CEO, Knowledge Resources, Inc. Message from the Event Chairman The Third Annual Outstanding 50 Asian Americans in Business Award Dinner provides a unique opportunity to pay tribute to those Asian American Entrepreneurs and professionals who demonstrate a commitment to making a difference in our community. Each year the Asian American Business Development Center takes this opportunity to honor outstanding, dedicated and well-deserving leaders in the New York tri-states areas. For 2004, some of the New York‘s best-known and well-respected executives are being recognized for their contributions. This year’s Pinnacle Award will be presented to Mr. Ted Teng, President and COO of Wyndham International. Mr. Teng has a distinguished career and is one of the SAVIO CHAN highest-ranking Asian executives from a publicly-traded company in the United Event Chairman States. He is recognized for his support and advocacy for the Asian community and has given his valuable time back to the community by serving on the various boards in many not-for-profit organizations. -

2018 Annual Report

TABLE OF CONTENTS 2 Company Profile 4 Vision, Mission, and Service Promise 5 Economic Report and Forecast 6 Message from the Chairman 8 Q&A with the President and CEO ABOUT 10 Products and Services THE 13 Financial Highlights 14 Operational Highlights COVER 20 Corporate Social Responsibility OUR LEAVES 22 Corporate Governance OF CHANGE 32 Consumer Protection 36 Table of Organization New thinking is leading the transformed business of Bank of 38 Board of Directors Commerce in a digitized industry. 51 Senior Executive Team The theme and design reflect our 55 Management Committees new approach to a seamless banking 57 Risk Management experience. The convergence of multiple digital tools and platforms in 68 Capital Management our digitized leaves reflects how the 72 Internal Audit Division Report brand empowers the customers of the future. 73 Statement of Management's Responsibility for Financial Statements 74 Audited Financial Statements ABOUT OUR PAPER 75 Report of Independent Auditors 78 Statements of Financial Position The 2018 Bank of Commerce Annual report cover and main pages were 80 Statements of Income printed on Tocatta paper certified 81 Statements of Comprehensive Income by the Forest Stewardship Council (FSC). The FSC certification ensures 82 Statements of Changes in Equity that materials come from responsibly 84 Statements of Cash Flows managed forests that provide environmental, social and 86 Notes to the Financial Statements economic benefits. Kodak Sonora process-free plates, 209 Senior Officers non-petroleum-based soy ink, and 212 Branch / ATM Directory a Heidelberg carbon neutral offset press were utilized in the printing 217 Annex A - Related Party Transactions of this report. -

Summary of Pending Application As of October 2006

DEPARTMENT OF FINANCIAL INSTITUTIONS SUMMARY OF PENDING APPLICATIONS AS OF OCTOBER 2006 APPLICATION TYPE PAGE NO. BANK APPLICATION NEW BANK 1 CONVERSION TO STATE CHARTER 6 MERGER 6 ACQUISITION OF CONTROL 7 PURCHASE PARTIAL BUSINESS UNIT 8 NEW BRANCH 8 NEW PLACE OF BUSINESS 15 NEW EXTENSION OFFICE 20 HEAD OFFICE RELOCATION 21 HEAD OFFICE REDESIGNATION 21 BRANCH OFFICE RELOCATION 21 PLACE OF BUSINESS RELOCATION 23 EXTENSION OFFICE RELOCATION 24 DISCONTINUANCE OF BRANCH OFFICE 24 DISCONTINUANCE OF PLACE OF BUSINESS 25 DISCONTINUANCE OF EXTENSION OFFICE 26 APPLICATION PURSUANT TO SECTION 3580 27 INDUSTRIAL BANK APPLICATION CONVERSION TO STATE CHARTER 27 NEW BRANCH 27 NEW PLACE OF BUSINESS 27 BRANCH OFFICE RELOCATION 28 PLACE OF BUSINESS RELOCATION 28 DISCONTINUANCE OF BRANCH OFFICE 28 PREMIUM FINANCE COMPANY APPLICATION NEW PREMIUM FINANCE COMPANY 29 ACQUISITION OF CONTROL 29 HEAD OFFICE RELOCATION 29 VOLUNTARY SURRENDER OF LICENSE 30 TRUST COMPANY APPLICATION NEW TRUST COMPANY 30 ACQUISITION OF CONTROL 30 FOREIGN (OTHER NATION) BANK APPLICATION NEW OFFICE 30 DISCONTINUANCE 31 ii SUMMARY OF PENDING APPLICATIONS AS OF OCTOBER 2006 APPLICATION TYPE PAGE NO. FOREIGN (OTHER STATE) BANK APPLICATION NEW FACILITY 31 RELOCATION 32 DISCONTINUANCE OF FACILITY 32 CREDIT UNION APPLICATION NEW CREDIT UNION 32 CONVERSION TO STATE CHARTER 32 MERGER 32 NEW BRANCH OF FOREIGN (OTHER STATE) CREDIT UNION 33 CHANGE OF NAME 33 TRANSMITTER OF MONEY ABROAD APPLICATION NEW TRANSMITTER 34 ACQUISITION OF CONTROL 34 BUSINESS AND INDUSTRIAL DEVELOPMENT CORPORATION APPLICATION CORPORATE OFFICE RELOCATION 35 1 BANK APPLICATION NEW BANK Filed: 10 Approved: 9 Opened: 2 Withdrawn: 1 1ST CAPITAL BANK 1 Lower Ragsdale Drive, City and County of Monterey Correspondent: Grace Wickersham Carpenter & Company 5 Park Plaza, Suite 950 Irvine, CA 92614 (949) 261-8888 Filed: 8/3/06 ACCESS BUSINESS BANK Vicinity of 184 Technology Drive, Irvine, Orange County Correspondent: Judi Stevens Mora J. -

FDIC Institution Listing ACTIVE AS of 3/25/2013

FDIC Institution Listing ACTIVE AS OF 3/25/2013 ‐ FOR UPDATES SEE SOURCE URL (below) Source: http://www2.fdic.gov/idasp/main.asp NAME ADDRESS CITY STATE ZIP WEBADDR 1st Advantage Bank 240 Salt Lick Road Saint Peters MO 63376 http://www.1stadvantagebank.com:80/ 1st Bank 120 Second Street, N.W. Sidney MT 59270 http://www.our1stbank.com:80/ 1st Bank & Trust 710 South Park Drive Broken Bow OK 74728 http://www.1stbankandtrust.com:80/ 1st Bank of Sea Isle City 4301 Landis Avenue Sea Isle City NJ 08243 http://www.1stbankseaisle.com:80/ 1st Bank of Troy 212 South Main Street Troy KS 66087 https://secure.fbtroyks.com 1st Bank Yuma 2799 South 4th Avenue Yuma AZ 85364 http://www.1stbankyuma.com:80/ 1st Cameron State Bank 124 South Walnut Cameron MO 64429 http://www.1stcameron.com:80/ 1st Capital Bank 5 Harris Court, Building N, Suite #3 Monterey CA 93940 http://www.1stcapitalbank.com:80/ 1st Century Bank, National Association 1875 Century Park East, Suite 1400 Los Angeles CA 90067 http://www.1cbank.com:80/ 1st Colonial Community Bank 1040 Haddon Avenue Collingswood NJ 08108 http://www.1stcolonial.com:80/ 1st Commerce Bank 5135 Camino Al Norte, Suite 4 North Las Vegas NV 89031 http://www.1stcommercebank.com:80/ 1st Community Bank 407 Third Street Sherrard IL 61281 http://www.1stcommunitybanks.com:80/ 1st Constitution Bank 2650 Route 130 Cranbury NJ 08512 http://www.1stconstitution.com:80/ 1st Enterprise Bank 818 West Seventh Street, Suite 220 Los Angeles CA 90017 http://www.1stenterprisebank.com:80/ 1st Equity Bank 3956 West Dempster Street Skokie IL 60076 1st Equity Bank Northwest 1330 Dundee Road Buffalo Grove IL 60089 1st Financial Bank USA 331 North Dakota Dunes Boulevard Dakota Dunes SD 57049 http://www.1fbusa.com:80/ 1st Manatee Bank 12215 Us Highway 301 N Parrish FL 34219 http://www.1stmanatee.com:80/ 1st National Bank 730 East Main Street Lebanon OH 45036 http://www.bankwith1st.com:80/ 1st National Bank of South Florida 1550 North Krome Avenue Homestead FL 33030 http://www.1stnatbank.com:80/ 1st National Community Bank 16924 St. -

Cathay General Bancorp Annual Report 2018

Cathay General Bancorp Annual Report 2018 Form 10-K (NASDAQ:CATY) Published: March 1st, 2018 PDF generated by stocklight.com UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 10-K ☑ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 201 7 ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission file number 001-31830 Cathay General Bancorp (Exact name of Registrant as specified in its charter) Delaware 95-4274680 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 777 North Broadway, 90012 Los Angeles, California (Zip Code) (Address of principal executive offices) Registrant’s telephone number, including area code: (213) 625-4700 Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Common Stock, $.01 par value NASDAQ Global Select Market Warrants to purchase shares of Common Stock (expiring NASDAQ Global Select Market December 5, 2018) Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐ Indicate by check mark if the registrant is not required to file reports pursuan t to Section 13 or 15(d) of the Act. Yes ☐ No ☑ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.