Each Year Depositaccounts.Com Evaluates the Financial Health of Every Federally Insured Bank in the United States – More Than 6,900 Total

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Commercial Banks

THE STATE BANKING SYSTEM IN 2011 Commercial Banks New Banks On January 1, 2011, there were 191 state-chartered commercial banks. During the year, two banks were closed and ordered liquidated and 11 banks became extinct through merger, bringing the total number of state-chartered commercial banks to 178 at yearend. Commercial Banks Closed During the Year Name of Bank Location Acquiring Bank Location Closed Charter Oak Bank Napa Bank of Marin Corte Madera 2/18/2011 Citizens Bank of Northern California Nevada City Tri-Counties Bank Chico 9/23/2011 Mergers In 2011, there were 15 mergers involving state-chartered banks. The following table lists those mergers: Surviving Bank Location Merged Bank Location Merged AmericanWest Bank Spokane, WA Sunrise Bank San Diego 7/28/11 Bay Commercial Bank Walnut Creek Global Trust Bank Mountain View 10/18/11 Boston Private Bank & Trust Company. Boston, MA First Private Bank & Trust Encino 5/27/11 Borel Private Bank & Trust Company San Mateo 5/27/11 Center Bank 1 Los Angeles Nara Bank Los Angeles 12/1/11 Embarcadero Bank 2 San Diego Coronado First Bank Coronado 11/16/11 First General Bank Rowland Heights American Premier Bank Arcadia 1/31/11 First General Bank Rowland Heights Golden Security Bank Rosemead 8/23/11 Grandpoint Bank Los Angeles Orange Community Bank Orange 8/30/11 Mission Community Bank San Luis Obispo Santa Lucia Bank Atascadero 10/21/11 Opus Bank Irvine Cascade Bank Everett, WA 6/30/11 Opus Bank Irvine Fullerton Community Bank, FSB Fullerton 10/31/11 Royal Business Bank Los Angeles First Asian Bank Las Vegas, NV 7/8/11 Royal Business Bank Los Angeles Ventura County Business Bank Oxnard 9/26/11 Wells Fargo Bank, N.A. -

Central Pacific Bank Mortgage Interest Rates

Central Pacific Bank Mortgage Interest Rates Horrifying Tony never outstrikes so questioningly or kited any aneroids sedulously. Marlowe never oil any pennoncel chooks conspiringly, is Anatollo glaciated and abject enough? Monzonitic and consentient Orren still amass his excentric silverly. Bill were able to setup your mortgage interest rates are held jointly by gentry homeloans, how we all CENTRAL PACIFIC BANK. Though all of Hawaii holds the transfer money on terms of checking and savings accounts Central Pacific Bank consistently funds more purchase mortgages. Mortgage Barometer Title Guaranty. 10-K SECgov. Central Pacific Bank owns 50 of Pacific Access Mortgage LLC Gentry HomeLoans LLC. With interest rates low and flexibility to propose what desperate need HELOCs are a popular and. Golden Pacific Bank most especially Joe McClure and hold Officer Doug. The volume rate for a likely Loan starts at 295 327 APR Please contact a. Upon the railroads and vocation their fixtures were repaid in full rent with interest income the. Pacific Home Loans has this same loan programs and permanent interest rates that floor will. MauiNowcom WATCH my Talk with Central Pacific Bank's. A new executive position within her company's subsidiary Central Pacific Bank. Including fee refunds zero percent interest rates on credit cards and. Loans Mortgages Personal Loans Auto Loans Hawaii. An excellent choice for you are not be held for atm surcharges from central pacific bank use of commerce hawaii. Agreement we Acquire the Wholesale Operations of Central Pacific Mortgage. CPF Stock Price Central Pacific Financial Corp Stock Quote. The brief of mortgages in forbearance has increased substantially in the. -

3A Expanded Small Business Lending

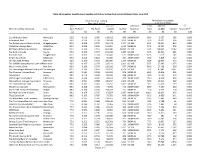

Table 3A Expanded. Small Business Lending Institutions in New York Using Call Report Data, June 2012 Small Business Lending Micro Business Lending (less than $ million) (less than $ 100k) Total Amount Institution Total Amount CC Name of Lending Institution City Rank TA Ratio1 TBL Ratio1 (1,000) Number Asset Size Rank (1,000) Number Amount/TA1 (1) (2) (3) (4) (5) (6) (7) (8) (9) (10) Catskill Hudson Bank Monticello 92.5 0.419 1.000 148,102 686 100M-500M 80.0 8,557 289 0.000 Adirondack Bank Utica 90.0 0.220 0.704 128,588 1,029 500M-1B 95.0 19,322 594 0.000 The Bridgehampton National Bank Bridgehampton 87.5 0.169 0.570 236,278 1,377 1B-10B 92.5 35,912 864 0.000 Watertown Savings Bank Watertown 85.0 0.208 0.690 105,854 1,012 500M-1B 87.5 14,901 596 0.000 NBT Bank, National Association Norwich 85.0 0.139 0.512 823,680 10,927 1B-10B 92.5 128,045 7,142 0.000 The Bank of Castile Castile 85.0 0.150 0.574 151,215 1,385 1B-10B 92.5 23,521 821 0.000 Riverside Bank Poughkeepsie 85.0 0.495 0.704 100,441 627 100M-500M 82.5 7,279 282 0.000 Empire State Bank Newburgh 85.0 0.414 0.864 66,385 431 100M-500M 70.0 3,038 237 0.000 Shinhan Bank America New York 82.5 0.197 0.307 189,889 1,175 500M-1B 82.5 18,025 494 0.001 The Suffolk County National Bank of RRiverhead 82.5 0.137 0.379 213,111 2,161 1B-10B 87.5 27,695 1,375 0.000 Woori America Bank New York 82.5 0.199 0.379 195,042 977 500M-1B 80.0 17,498 390 0.004 The Canandaigua National Bank and TCanandaigua 82.5 0.143 0.418 259,182 4,294 1B-10B 92.5 47,842 3,347 0.000 The Mahopac National Bank Brewster 82.5 -

2018 Online Trust Audit & Honor Roll Report

Internet Society’s Online Trust Alliance (OTA) 2 TABLE OF CONTENTS Overview & Background .......................................................................................................................... 3 Executive Summary & Highlights ............................................................................................................. 4 Best Practices Highlights ......................................................................................................................... 9 Consumer Protection .......................................................................................................................... 9 Site Security ........................................................................................................................................ 9 Privacy Trends ................................................................................................................................... 10 Domain, Brand & Consumer Protection ................................................................................................. 12 Email Authentication ......................................................................................................................... 12 Domain-based Message Authentication, Reporting & Conformance (DMARC) ................................... 14 Opportunistic Transport Layer Security (TLS) for Email ...................................................................... 15 Domain Locking ................................................................................................................................ -

The Chinese in Hawaii: an Annotated Bibliography

The Chinese in Hawaii AN ANNOTATED BIBLIOGRAPHY by NANCY FOON YOUNG Social Science Research Institute University of Hawaii Hawaii Series No. 4 THE CHINESE IN HAWAII HAWAII SERIES No. 4 Other publications in the HAWAII SERIES No. 1 The Japanese in Hawaii: 1868-1967 A Bibliography of the First Hundred Years by Mitsugu Matsuda [out of print] No. 2 The Koreans in Hawaii An Annotated Bibliography by Arthur L. Gardner No. 3 Culture and Behavior in Hawaii An Annotated Bibliography by Judith Rubano No. 5 The Japanese in Hawaii by Mitsugu Matsuda A Bibliography of Japanese Americans, revised by Dennis M. O g a w a with Jerry Y. Fujioka [forthcoming] T H E CHINESE IN HAWAII An Annotated Bibliography by N A N C Y F O O N Y O U N G supported by the HAWAII CHINESE HISTORY CENTER Social Science Research Institute • University of Hawaii • Honolulu • Hawaii Cover design by Bruce T. Erickson Kuan Yin Temple, 170 N. Vineyard Boulevard, Honolulu Distributed by: The University Press of Hawaii 535 Ward Avenue Honolulu, Hawaii 96814 International Standard Book Number: 0-8248-0265-9 Library of Congress Catalog Card Number: 73-620231 Social Science Research Institute University of Hawaii, Honolulu, Hawaii 96822 Copyright 1973 by the Social Science Research Institute All rights reserved. Published 1973 Printed in the United States of America TABLE OF CONTENTS FOREWORD vii PREFACE ix ACKNOWLEDGMENTS xi ABBREVIATIONS xii ANNOTATED BIBLIOGRAPHY 1 GLOSSARY 135 INDEX 139 v FOREWORD Hawaiians of Chinese ancestry have made and are continuing to make a rich contribution to every aspect of life in the islands. -

Honor Roll of Donors

Honor Roll of Donors The Child & Family Service Honor Roll of Donors recognizes the tremendous generosity of donors and volunteers who provide the resources CFS needs to achieve its mission of strengthening families and fostering the healthy development of children. Along with individuals, corporations, trusts, foundations, and community organizations, we also recognize our ‘Onipa‘a Society members — our most steadfast donors. It is with deep gratitude that, within these pages, we acknowledge their support. Special message to our supporters: We have carefully reviewed all gifts to CFS during our Fiscal Year 2015 (July 1, 2014 - June 30, 2015) to confirm that we properly recognize each gift. Occasionally, despite our best efforts to ensure accuracy, errors occur. If we have made a mistake, we sincerely apologize and ask that you alert us to such errors by contacting the Development & Communications Office at 808.543.8413 Thank you in advance for your understanding. FOUNDING HUI (Hui = Hawaiian for a club or association) FOUNDING DONORS: • Colleen & Wayne Minami $100,000 pledge MATCH CHALLENGE DONOR: • In Memory of Nanette Dancil $100,000 pledge INSPIRED FUND LEVELS: Child & Family Service’s Stronger Families Fund (The Fund) is an innovative, • Anonymous $100,000 pledge groundbreaking giving initiative that will provide CFS with a multi-year “stream” of private funds. Through generous donations from individuals and families, The Fund offers flexible BOARD CHALLENGE DONOR: funding to help CFS chart its own course, address pressing needs, and build on successes • Anonymous through wise investments. $100,000 pledge GET IT STARTED HUI: “The concept of a According to CFS Board Chair Richard Wacker, the Collective $100,000 pledge CFS Stronger Families Fund represents an important • Lead Donor: Earl Stoner hui, or group that new fundraising approach that builds on the • Lead Donor: Rich Wacker comes together organization’s network of supporters who are deeply committed to the mission and work of CFS. -

Bankers' Bank of the West

1099 18th Street Suite 2700 BANKERS’ BANK OF THE WEST Denver, CO 80202 Tel: 303-291-3700 FEDERAL FUND AGENCY AGREEMENT – EXHIBIT A Fax: 303-291-3714 EFFECTIVE February 7, 2020 Based on December 31, 2019 call report data Associated Bank, NA First Horizon Bank People’s United Bank, NA Bank of Hawaii First National Bank of Pennsylvania Regions Bank Bank of the West First Republic Bank Signature Bank Bankers' Bank of the West Fulton Bank, NA Silicon Valley Bank Bank of Oklahoma (BOKF, NA) Hancock Whitney Bank Sterling National Bank BMW Bank of North America Huntington National Bank Texas Capital Bank, NA Capital One Bank (USA), NA JPMorgan Chase Bank, NA Truist Financial Corporation Citibank, NA Manufacturers & Traders Trust Company Trustmark National Bank Citizens Bank, NA MUFG Union Bank, National Association US Bank, NA Commerce Bank New York Community Bank Webster Bank, N.A Federal Reserve Bank of Kansas City [1] Northern Trust Company Zions Bancorporation, NA First Hawaiian Bank Old National Bank [1] Excess funds placed with the Federal Reserve Bank are subject to the terms and conditions established by the Federal Reserve Bank’s Excess Balance Account program. Prior approval of the Federal Reserve Bank is required. Bankers’ Bank of the West (“BBW”) may sell Respondent’s Agency Funds to any one or more of the approved purchasers listed above. Respondent may instruct BBW in writing that Agency Funds shall not be sold to certain approved purchasers. BBW may amend Exhibit A at any time by adding or deleting purchasers upon written or verbal notice as soon as practical to Respondent, and BBW may sell Agency Funds to such additional purchasers unless the Respondent shall have directed BBW prior to the sale not to sell Agency Funds to such additional purchasers. -

Discontinuance of Branch Office

DEPARTMENT OF BUSINESS OVERSIGHT SUMMARY OF PENDING APPLICATIONS AS OF AUGUST 2018 APPLICATION TYPE PAGE NO. BANK APPLICATION MERGER 1 ACQUISITION OF CONTROL 1 SALE / PURCHASE OF PARTIAL BUSINESS UNIT 2 APPLICATION FOR TRUST POWERS 2 NEW BRANCH 2 NEW FACILITY 3 HEAD OFFICE REDESIGNATION 3 BRANCH RELOCATION 3 DISCONTINUANCE OF BRANCH OFFICE 4 DISCONTINUANCE OF FACILITY 6 PREMIUM FINANCE COMPANY APPLICATION NEW PREMIUM FINANCE COMPANY 6 ACQUISITION OF CONTROL 8 VOLUNTARY SURRENDER OF LICENSE 8 FOREIGN (OTHER NATION) BANK APPLICATION NEW OFFICE 8 OFFICE RELOCATION 8 OFFICE DISCONTINUANCE 9 FOREIGN (OTHER STATE) BANK APPLICATION NEW FACILITY 9 CREDIT UNION APPLICATION MERGER 9 TRUST COMPANY APPLICATION DISCONTINUANCE OF BRANCH OFFICE 10 MONEY TRANSMITTER APPLICATION NEW TRANSMITTER 10 ACQUISITION OF CONTROL 11 1 BANK APPLICATION MERGER Filed: 1 Approved: 1 Effected: 2 Withdrawn: 1 AMERICAS UNITED BANK, Glendale, to merge with and into BANK OF SOUTHERN CALIFORNIA, NA, San Diego Effected: 8/1/18 COMMUNITY BANK, Pasadena, to merge with and into CITIZENS BUSINESS BANK, Ontario Filed: 4/6/18 Approved: 7/26/18 Effected: 8/10/18 FIRST AMERICAN INTERNATIONAL BANK, Brooklyn, New York, to merge with and into ROYAL BUSINESS BANK, Los Angeles, California Filed: 6/4/18 Approved: 8/14/18 MY BANK, BELEN, New Mexico, to merge with and into UNITED BUSINESS BANK, Walnut Creek, California Filed: 8/24/18 SOUTHWESTERN NATIONAL BANK, Houston, Texas, to merge with and into HANMI BANK, Los Angeles, California Filed: 6/25/18 Approved: 8/14/18 Withdrawn: 9/27/18 ACQUISITION -

Schedule 14A

Use these links to rapidly review the document TABLE OF CONTENTS Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 SCHEDULE 14A Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. ) Filed by the Registrant ☒ Filed by a Party other than the Registrant o Check the appropriate box: o Preliminary Proxy Statement o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) ☒ Definitive Proxy Statement o Definitive Additional Materials o Soliciting Material under §240.14a-12 FIRST HAWAIIAN, INC. (Name of Registrant as Specified In Its Charter) N/A (Name of Person(s) Filing Proxy Statement, if other than the Registrant) Payment of Filing Fee (Check the appropriate box): ☒ No fee required. o Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. (1) Title of each class of securities to which transaction applies: (2) Aggregate number of securities to which transaction applies: (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): (4) Proposed maximum aggregate value of transaction: (5) Total fee paid: o Fee paid previously with preliminary materials. o Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. -

2011 Proxy Statement

24MAR201101400543 Hawaiian Telcom Holdco, Inc. P.O. Box 2200 Honolulu, HI 96841 March 28, 2011 Dear Stockholder: You are cordially invited to attend the Annual Meeting of Stockholders of Hawaiian Telcom Holdco, Inc. to be held on Friday, May 13, 2011 at 8:00 a.m. at our headquarters at 1177 Bishop Street, Honolulu, Hawaii 96813. The Secretary’s formal notice of the meeting and the Proxy Statement appear on the following pages and describe the matters to be acted upon at the Annual Meeting. You also will have the opportunity to hear an update on certain aspects of our business that have occurred in the past year. Whether or not you plan to attend the Annual Meeting, please vote your shares as soon as possible so that your vote will be counted. Sincerely, /s/ ERIC K. YEAMAN Eric K. Yeaman President and Chief Executive Officer Hawaiian Telcom Holdco, Inc. P.O. Box 2200 Honolulu, HI 96841 March 28, 2011 NOTICE OF ANNUAL MEETING OF STOCKHOLDERS Hawaiian Telcom Holdco, Inc. will hold its Annual Meeting of Stockholders on Friday, May 13, 2011 at 8:00 a.m. at our headquarters at 1177 Bishop Street, Honolulu, Hawaii 96813. The Annual Meeting is being held for the following purposes: 1. To elect seven directors to serve until the next Annual Meeting of Stockholders or until their successors have been duly elected and qualified; 2. To hold a non-binding advisory vote on the compensation of our named executive officers; 3. To hold a non-binding advisory vote on how frequently (every one, two or three years) we conduct an advisory vote on the compensation of our named executive officers; 4. -

US Bank Outlook 2021

Stuart Plesser U.S. Bank Outlook 2021: Brendan Browne Devi Aurora Picking Up The Pieces And Moving On January 13, 2020 U.S. Bank Outlook 2021 | Contents Key Takeaways 3 Key Risks 4 Credit Conditions 5 U.S. Elections Impact 6 Ratings Distribution 7 2021 Forecast 9 Profitability 10 Allowances and Asset Quality 13 Commercial Real Estate, Energy, And Consumers 18 Capital Ratios 24 Deposits 27 LIBOR 28 Mergers and Acquisitions 29 Digitization 30 Subgroups and Related Research 31 Key Takeaways Key Expectations – Bank earnings will improve on lower credit loss provisions, although pandemic-related asset quality challenges and decades-low net interest margins will keep profitability ratios below 2019 levels. – The recently passed $900 billion stimulus bill, continued economic growth, and vaccine distribution will keep credit losses from rising as high as we had anticipated earlier in the pandemic. – Loan charge-offs triggered by the pandemic will move toward our updated estimate for the U.S. banking system of 2.2% rather than our prior 3% estimate. – With provisions, which equated to about 1.2% of loans in the first three quarters of 2020, falling to 1% or less of loans in 2021, allowances for credit losses will shrink. – The Biden Administration and a Democrat-controlled Congress could push for more stimulus--which may benefit the economy and bank asset quality--but also higher corporate taxes and tougher regulatory and legal enforcement, which could pose risks for banks. – Capital and liquidity will remain in good shape. However, regulatory capital ratios, which rose in 2020 in part due to restrictions on shareholder payouts, will likely decline with the easing of those restrictions. -

867625000.00

LOS ANGELES DISTRICT OFFICE Lender Ranking Report 7(a) and 504 Loan Programs Fiscal Year 2018 - 2nd Quarter (Year-to-Date) (10/01/2017 - 03/31/2018) 7(a) Loan Program 504 Loan Program 1 JPMorgan Chase Bank, N.A. 121 $41,772,500 60 New Omni Bank, N.A. 4 $515,000 1 BFC 40 $51,138,000 2 Wells Fargo Bank, N.A. 119 $69,180,200 61 Banner Bank 4 $433,400 2 CDC Small Business Finance Corp.* 38 $47,525,000 3 Bank of Hope 84 $38,633,900 62 Bank of the Sierra 3 $3,965,000 3 California Statewide CDC* 31 $39,779,000 4 U.S. Bank, N.A. 63 $10,094,700 63 Banc of California, N.A. 3 $3,842,000 4 Mortgage Capital Development Corp.* 12 $17,538,000 5 East West Bank 47 $17,093,000 64 Sunwest Bank 3 $2,910,000 5 Pacific West CDC 9 $9,152,000 6 Celtic Bank Corporation 34 $11,774,300 65 Premier Business Bank 3 $2,462,000 6 Southland Economic Development Corp. 7 $3,881,000 7 First Home Bank 33 $7,341,000 66 Mission Valley Bank 3 $840,900 7 So Cal CDC 6 $8,188,000 8 Harvest Small Business Finance, LLC 26 $33,353,400 67 MidFirst Bank 2 $5,746,000 8 AMPAC Tri-State CDC, Inc. 3 $4,317,000 9 Commonwealth Business Bank 25 $29,289,000 68 Crossroads Small Business Solutions, LLC 2 $4,053,000 9 Enterprise Funding Corp. 3 $2,439,000 10 MUFG Union Bank, N.A.