Commercial Banks

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Chinese in Hawaii: an Annotated Bibliography

The Chinese in Hawaii AN ANNOTATED BIBLIOGRAPHY by NANCY FOON YOUNG Social Science Research Institute University of Hawaii Hawaii Series No. 4 THE CHINESE IN HAWAII HAWAII SERIES No. 4 Other publications in the HAWAII SERIES No. 1 The Japanese in Hawaii: 1868-1967 A Bibliography of the First Hundred Years by Mitsugu Matsuda [out of print] No. 2 The Koreans in Hawaii An Annotated Bibliography by Arthur L. Gardner No. 3 Culture and Behavior in Hawaii An Annotated Bibliography by Judith Rubano No. 5 The Japanese in Hawaii by Mitsugu Matsuda A Bibliography of Japanese Americans, revised by Dennis M. O g a w a with Jerry Y. Fujioka [forthcoming] T H E CHINESE IN HAWAII An Annotated Bibliography by N A N C Y F O O N Y O U N G supported by the HAWAII CHINESE HISTORY CENTER Social Science Research Institute • University of Hawaii • Honolulu • Hawaii Cover design by Bruce T. Erickson Kuan Yin Temple, 170 N. Vineyard Boulevard, Honolulu Distributed by: The University Press of Hawaii 535 Ward Avenue Honolulu, Hawaii 96814 International Standard Book Number: 0-8248-0265-9 Library of Congress Catalog Card Number: 73-620231 Social Science Research Institute University of Hawaii, Honolulu, Hawaii 96822 Copyright 1973 by the Social Science Research Institute All rights reserved. Published 1973 Printed in the United States of America TABLE OF CONTENTS FOREWORD vii PREFACE ix ACKNOWLEDGMENTS xi ABBREVIATIONS xii ANNOTATED BIBLIOGRAPHY 1 GLOSSARY 135 INDEX 139 v FOREWORD Hawaiians of Chinese ancestry have made and are continuing to make a rich contribution to every aspect of life in the islands. -

Discontinuance of Branch Office

DEPARTMENT OF BUSINESS OVERSIGHT SUMMARY OF PENDING APPLICATIONS AS OF AUGUST 2018 APPLICATION TYPE PAGE NO. BANK APPLICATION MERGER 1 ACQUISITION OF CONTROL 1 SALE / PURCHASE OF PARTIAL BUSINESS UNIT 2 APPLICATION FOR TRUST POWERS 2 NEW BRANCH 2 NEW FACILITY 3 HEAD OFFICE REDESIGNATION 3 BRANCH RELOCATION 3 DISCONTINUANCE OF BRANCH OFFICE 4 DISCONTINUANCE OF FACILITY 6 PREMIUM FINANCE COMPANY APPLICATION NEW PREMIUM FINANCE COMPANY 6 ACQUISITION OF CONTROL 8 VOLUNTARY SURRENDER OF LICENSE 8 FOREIGN (OTHER NATION) BANK APPLICATION NEW OFFICE 8 OFFICE RELOCATION 8 OFFICE DISCONTINUANCE 9 FOREIGN (OTHER STATE) BANK APPLICATION NEW FACILITY 9 CREDIT UNION APPLICATION MERGER 9 TRUST COMPANY APPLICATION DISCONTINUANCE OF BRANCH OFFICE 10 MONEY TRANSMITTER APPLICATION NEW TRANSMITTER 10 ACQUISITION OF CONTROL 11 1 BANK APPLICATION MERGER Filed: 1 Approved: 1 Effected: 2 Withdrawn: 1 AMERICAS UNITED BANK, Glendale, to merge with and into BANK OF SOUTHERN CALIFORNIA, NA, San Diego Effected: 8/1/18 COMMUNITY BANK, Pasadena, to merge with and into CITIZENS BUSINESS BANK, Ontario Filed: 4/6/18 Approved: 7/26/18 Effected: 8/10/18 FIRST AMERICAN INTERNATIONAL BANK, Brooklyn, New York, to merge with and into ROYAL BUSINESS BANK, Los Angeles, California Filed: 6/4/18 Approved: 8/14/18 MY BANK, BELEN, New Mexico, to merge with and into UNITED BUSINESS BANK, Walnut Creek, California Filed: 8/24/18 SOUTHWESTERN NATIONAL BANK, Houston, Texas, to merge with and into HANMI BANK, Los Angeles, California Filed: 6/25/18 Approved: 8/14/18 Withdrawn: 9/27/18 ACQUISITION -

867625000.00

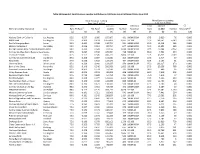

LOS ANGELES DISTRICT OFFICE Lender Ranking Report 7(a) and 504 Loan Programs Fiscal Year 2018 - 2nd Quarter (Year-to-Date) (10/01/2017 - 03/31/2018) 7(a) Loan Program 504 Loan Program 1 JPMorgan Chase Bank, N.A. 121 $41,772,500 60 New Omni Bank, N.A. 4 $515,000 1 BFC 40 $51,138,000 2 Wells Fargo Bank, N.A. 119 $69,180,200 61 Banner Bank 4 $433,400 2 CDC Small Business Finance Corp.* 38 $47,525,000 3 Bank of Hope 84 $38,633,900 62 Bank of the Sierra 3 $3,965,000 3 California Statewide CDC* 31 $39,779,000 4 U.S. Bank, N.A. 63 $10,094,700 63 Banc of California, N.A. 3 $3,842,000 4 Mortgage Capital Development Corp.* 12 $17,538,000 5 East West Bank 47 $17,093,000 64 Sunwest Bank 3 $2,910,000 5 Pacific West CDC 9 $9,152,000 6 Celtic Bank Corporation 34 $11,774,300 65 Premier Business Bank 3 $2,462,000 6 Southland Economic Development Corp. 7 $3,881,000 7 First Home Bank 33 $7,341,000 66 Mission Valley Bank 3 $840,900 7 So Cal CDC 6 $8,188,000 8 Harvest Small Business Finance, LLC 26 $33,353,400 67 MidFirst Bank 2 $5,746,000 8 AMPAC Tri-State CDC, Inc. 3 $4,317,000 9 Commonwealth Business Bank 25 $29,289,000 68 Crossroads Small Business Solutions, LLC 2 $4,053,000 9 Enterprise Funding Corp. 3 $2,439,000 10 MUFG Union Bank, N.A. -

3A Expanded Small Business Lending

Table 3A Expanded. Small Business Lending Institutions in California Using Call Report Data, June 2012 Small Business Lending Micro Business Lending (less than $ million) (less than $ 100k) Total Amount Institution Total Amount CC Name of Lending Institution City Rank TA Ratio1 TBL Ratio1 (1,000) Number Asset Size Rank (1,000) Number Amount/TA1 (1) (2) (3) (4) (5) (6) (7) (8) (9) (10) National Bank of California Los Angeles 95.0 0.537 1.000 187,467 431 100M-500M 67.5 3,020 76 0.000 BBCN Bank Los Angeles 92.5 0.309 0.424 1,557,424 9,537 1B-10B 97.5 168,741 6,149 0.000 Pacific Enterprise Bank Irvine 92.5 0.405 0.549 110,755 591 100M-500M 95.0 11,314 249 0.000 Mission Valley Bank Sun Valley 90.0 0.356 0.564 87,754 647 100M-500M 95.0 12,892 365 0.000 Borrego Springs Bank, National AssociLa Mesa 90.0 0.435 0.628 65,123 3,020 100M-500M 97.5 10,544 2,562 0.000 Community West Bank, National Asso Goleta 87.5 0.227 0.542 129,084 718 500M-1B 85.0 7,591 234 0.000 Tri Counties Bank Chico 87.5 0.173 0.545 436,723 3,804 1B-10B 97.5 43,955 2,289 0.000 Community Commerce Bank Claremont 87.5 0.358 0.687 103,416 365 100M-500M 67.5 2,717 57 0.000 Plaza Bank Irvine 87.5 0.328 0.502 127,075 484 100M-500M 52.5 2,193 61 0.000 Universal Bank West Covina 85.0 0.329 1.000 133,617 170 100M-500M 95.0 133,617 170 0.000 Bank of the Sierra Porterville 85.0 0.148 0.546 206,583 1,602 1B-10B 97.5 20,356 768 0.000 Seacoast Commerce Bank San Diego 82.5 0.363 0.574 57,144 315 100M-500M 30.0 409 16 0.000 Valley Business Bank Visalia 82.5 0.259 0.531 89,428 408 100M-500M 90.0 -

2020 to 12/31/2020

ILLINOIS DEPARTMENT OF FINANCIAL AND PROFESSIONAL REGULATION DIVISION OF BANKING BUREAU OF BANKS, TRUST COMPANIES AND SAVINGS INSTITUTIONS REGULATORY REPORT JB PRITZKER - Governor DEBORAH HAGAN - Secretary CHASSE REHWINKEL - Acting Director SUSANA SORIANO - Assistant Director REGULATORY REPORT FOR 1/1/2020 to 12/31/2020 The following regulatory actions were taken by or filed with the Illinois Department of Financial and Professional Regulation, Division of Banking, Bureau of Banks, Trust Companies and Savings Institutions during the above time period. The actions include those involving state chartered banks, foreign banking offices, corporate fiduciaries, foreign bank representative offices, state chartered savings banks and state chartered savings and loans. The Regulatory Report is published monthly by the Illinois Department of Financial and Professional Regulation, Division of Banking. Copies of this report are also available from our web site at www.idfpr.com Questions concerning the contents of this report may be addressed to the Corporate Activities Section at (217) 785-2900. APPLICATION FOR A CERTIFICATE OF AUTHORITY FOR A FOREIGN CORPORATE FIDUCIARY Name of Institution/Address Date/Status Anchorage Trust Company 12/11/2020 - Received 4901 South Isabel Place, Suite 200 Sioux Falls, SD 57108 Essex Savings Bank 11/30/2020 - Received 176 Westbrook Road, Suite 1 12/22/2020 - Accepted Essex, CT 06426 First Horizon Bank 12/22/2020 - Received 165 Madison Avenue, Suite 1400 Memphis, TN 38103 Seacoast Commerce Bank 10/26/2020 – Received 11939 Rancho Bernardo Road, Suite 200 San Diego, CA 92128 APPLICATION FOR LICENSE TO OPERATE A FOREIGN BANK REPRESENTATIVE OFFICE Name of Institution/Address Office Address Date/Status Colony Bank 145 E Willow Avenue 12/16/2020 - Received 115 South Grant Street Woodstock, Illinois 60098 Fitzgerald, GA 31750 Cromwell Holdings LLC One North Wacker Drive, Suite 3975 12/7/2020 - Received 255 Buffalo Way Chicago, Illinois 60606 12/29/2020 - Accepted P.O. -

CHSA HP2010.Pdf

The Hawai‘i Chinese: Their Experience and Identity Over Two Centuries 2 0 1 0 CHINESE AMERICA History&Perspectives thej O u r n a l O f T HE C H I n E s E H I s T O r I C a l s OCIET y O f a m E r I C a Chinese America History and PersPectives the Journal of the chinese Historical society of america 2010 Special issUe The hawai‘i Chinese Chinese Historical society of america with UCLA asian american studies center Chinese America: History & Perspectives – The Journal of the Chinese Historical Society of America The Hawai‘i Chinese chinese Historical society of america museum & learning center 965 clay street san francisco, california 94108 chsa.org copyright © 2010 chinese Historical society of america. all rights reserved. copyright of individual articles remains with the author(s). design by side By side studios, san francisco. Permission is granted for reproducing up to fifty copies of any one article for educa- tional Use as defined by thed igital millennium copyright act. to order additional copies or inquire about large-order discounts, see order form at back or email [email protected]. articles appearing in this journal are indexed in Historical Abstracts and America: History and Life. about the cover image: Hawai‘i chinese student alliance. courtesy of douglas d. l. chong. Contents Preface v Franklin Ng introdUction 1 the Hawai‘i chinese: their experience and identity over two centuries David Y. H. Wu and Harry J. Lamley Hawai‘i’s nam long 13 their Background and identity as a Zhongshan subgroup Douglas D. -

Investing in the Future of Mission-Driven Banks a Guide to Facilitating New Partnerships PUBLISHED BY

Federal Deposit Insurance Corporation Investing in the Future of Mission-Driven Banks A Guide to Facilitating New Partnerships PUBLISHED BY: Federal Deposit Insurance Corporation 550 17th Street, NW, Washington, D.C. 20429 877-ASK FDIC (877-275-3342) The Federal Deposit Insurance Corporation (FDIC) has taken steps to ensure that the information and data presented in this publication are accurate and current. However, the FDIC makes no express or implied warranty about such information or data, and hereby expressly disclaims all legal liability and responsibility to persons or entities that use or access this publication and its content, based on their reliance on any information or data included. The FDIC welcomes comments or suggestions about this publication or our Minority Depository Institutions (MDI) Program. Contact the MDI Program at [email protected]. When citing this publication, please use the following: Investing in the Future of Mission-Driven Banks, Federal Deposit Insurance Corporation, Washington, D.C. (October 2020), https://www.fdic.gov/mdi. Investing in the Future of Mission-Driven Banks A Guide to Facilitating New Partnerships Contents Executive Summary .......................................................................................................... 1 Overview ........................................................................................................................... 2 Minority Depository Institutions ................................................................................. 2 Community -

Department of Financial Institutions

DEPARTMENT OF BUSINESS OVERSIGHT SUMMARY OF PENDING APPLICATIONS AS OF MAY 2020 APPLICATION TYPE PAGE NO. BANK APPLICATION NEW BANKS 1 CONVERSION TO STATE CHARTERED BANK 1 MERGER 1 ACQUISITION OF CONTROL 1 APPLICATION FOR TRUST POWERS 2 NEW FACILITY 2 RELOCATION OF BRANCH 3 DISCONTINUANCE OF BRANCH OFFICE 3 DISCONTINUANCE OF FACILITY 5 PREMIUM FINANCE COMPANY APPLICATION NEW PREMIUM FINANCE COMPANY 5 TRUST COMPANY APPLICATION NEW TRUST COMPANY 6 FOREIGN (OTHER NATION) BANK APPLICATION NEW OFFICE 6 FOREIGN (OTHER STATE) BANK APPLICATION NEW OFFICE 6 CREDIT UNION APPLICATION MERGER 7 MONEY TRANSMITTER APPLICATION NEW TRANSMITTER 7 1 BANK APPLICATION NEW BANKS Approved: 1 LEGACY BANK Proposed location: Street address to be determined, Temecula, Riverside County Correspondent: James Hicken c/o Carpenter & Company, 2 Park Plaza, Suite 550, Irvine, CA 92614 Phone: 661-733-5099 Filed: 11/8/19 Approved: 5/13/20 CONVERSION TO STATE CHARTERED BANK Filed: 1 GOLDEN PACIFIC BANK, N.A., to convert to state-chartered bank under the name GOLDEN PACIFIC BANK Filed: 5/27/20 MERGER Approved: 1 OPUS BANK, Irvine, to merge with and into PACIFIC PREMIER BANK, Irvine Filed: 3/2/20 Approved: 4/2/20 ACQUISITION OF CONTROL Filed: 3 FRANCIS P. KAVANAUGH, to acquire control of FRIENDLY HILLS BANK Filed: 4/24/20 PATRIOT FINANCIAL PARTNERS III, L.P., PATRIOT FINANCIAL PARTNERS, GP III, L.P., PATRIOT FINANCIAL PARTNERS, GP III, LLC, PATRIOT FINANCIAL ADVISORS L.P., PATRIOT FINANCIAL ADVISORS, LLC, and MESSRS. W. KIRK WYCOFF, JAMES J. LYNCH AND JAMES F. DEUTSCH, to acquire control of PACIFIC MERCANTILE BANCORP Filed: 5/21/20 PATRIOT FINANCIAL PARTNERS, GP II, L.P., PATRIOT FINANCIAL PARTNERS II, L.P., PATRIOT FINANCIAL PARTNERS PARALLEL II, L.P., PATRIOT FINANCIAL PARTNERS GP II, LLC, PATRIOT FINANCIAL MANAGER LLC, PATRIOT FINANCIAL MANAGER, L.P., to acquire control of AVIDBANK HOLDINGS, INC. -

1 1St Bank Yuma 1St Capital Bank 1St Financial Bank USA 1St Security

1st Bank Yuma 1st Capital Bank 1st Financial Bank USA 1st Security Bank of Washington 1st Source Bank 21st Century Bank Academy Bank, National Association ACNB Bank ACS Association Adams Bank & Trust Affiliated Bank, National Association Affinity FCU Alaska USA FCU Albany Bank and Trust Company, National Association Alerus Financial, National Association Allegiance Bank Alliance Bank Alliance Community Bank Ally Bank Alpine Bank Altabank Altra FCU Alva State Bank & Trust Company Amarillo National Bank Amerant Bank, National Association Amerasia Bank American AG Credit, ACA American Bank & Trust American Bank Center American Bank of Baxter Springs American Bank of Commerce American Bank of the North American Bank, National Association American Bank, National Association American Business Bank American Community Bank & Trust American Continental Bank American Exchange Bank American Momentum Bank American National Bank American National Bank American National Bank of Minnesota American Plus Bank, National Association American River Bank American Riviera Bank American Savings Bank, FSB 1 American State Bank American State Bank America's Christian CU Ameris Bank ANB Bank Anchor State Bank Andover State Bank Aquesta Bank Arbor Bank Arcata Economic Development Corporation Arizona FCU Arkansas Capital Corporation Armstrong Bank Arvest Bank Assemblies of God CU Associated Bank, National Association Atlantic Capital Bank, National Association Atlantic Union Bank Austin Bank, Texas National Association Avid bank Avidia Bank Axos Bank BAC Community -

APPROVED BANKING INSTITUTIONS for ATTORNEY FIDUCIARY ACCOUNTS (Pursuant to 22 NYCRR Rule 1.15 (B)(1), Part 1300) *September 2021

The New York Lawyers’ Fund for Client Protection 119 Washington Avenue Albany, New York 12210 800-442-FUND APPROVED BANKING INSTITUTIONS FOR ATTORNEY FIDUCIARY ACCOUNTS (Pursuant to 22 NYCRR Rule 1.15 (b)(1), Part 1300) *September 2021 Please note, effective on April 1, 2021, the Administrative Board of the Courts approved rule changes proposed by the Lawyers' Fund which have expanded New York's Dishonored Check Notice Reporting Rule to include reporting of overdrafts on all attorney trust, special and escrow accounts. The new rules also prohibit attorneys from carrying overdraft protection on attorney trust, special and escrow accounts. To remain approved, banking institutions must update their written agreements with the Lawyers’ Fund to include overdraft reporting. Attorneys continuing to use these banking institutions should confirm with the banking institution that it has updated its written agreement to provide notice of dishonored/overdraft checks to the Lawyers’ Fund. Abacus Federal Savings Bank** Bank of Richmondville** ABN-AMRO, Bank N.V. Bank OZK (AR)** Access Federal Credit Union** Bank of Utica** Adirondack Trust Company** Bank on Buffalo (div. of CNB Bank)** Adirondack Bank, N.A.** Bank United, N.A. Alden State Bank ** Berkshire Bank** ALMA Bank ** Bethpage FCU** BNY Mellon, N.A. (PA) Alpine Capital Bank** Boston Safe Deposit & Trust Company (MA) Alternatives Federal Credit Union** Bridgehampton National Bank (BNB) Amalgamated Bank of New York Brooklyn Cooperative Federal Credit Union** Amerasia Bank** Brown Brothers Harriman & Co. American Community Bank** Canandaigua National Bank & Trust Co.** AmeriCU Federal Credit Union** Capital Communications, FCU Apple Bank for Savings ** Capital One Bank, N.A.** Ballston Spa National Bank Carthage Federal Savings Bank** Bank Hapoalim B.M. -

1409549000.00

LOS ANGELES DISTRICT OFFICE Lender Ranking Report 7(a) and 504 Loan Programs Fiscal Year 2017 - 3rd Quarter (YTD) (10/01/2016 - 06/30/2017) 7(a) Loan Program 504 Loan Program 1 WELLS FARGO BANK, N.A. 318 $115,135,500 60 UNITED PACIFIC BANK 5 $10,465,000 1 CDC SMALL BUS. FINANCE CORP.* 77 $105,778,000 2 JPMORGAN CHASE BANK, N.A. 223 $53,315,600 61 BANNER BANK 5 $311,900 2 BFC FUNDING 58 $94,157,000 3 BANK OF HOPE 117 $74,575,000 62 PACIFIC WESTERN BANK 4 $7,787,000 3 CALIFORNIA STATEWIDE CDC 54 $57,020,000 4 U.S. BANK, N.A. 101 $17,389,200 63 BANK OF SANTA CLARITA 4 $5,205,000 4 MORTGAGE CAP. DEV. CORP.* 24 $34,934,000 5 EAST WEST BANK 81 $33,597,000 64 COMMERCIAL BANK OF CALIFORNIA 4 $4,767,000 5 PACIFIC WEST CDC 20 $23,808,000 6 PACIFIC CITY BANK 64 $57,539,400 65 UNITED BUSINESS BANK, F.S.B. 4 $3,943,500 6 SOUTHLAND ECONOMIC DEV. CORP. 11 $6,643,000 7 COMMONWEALTH BUSINESS BANK 56 $46,866,000 66 MISSION VALLEY BANK 4 $3,213,100 7 AMPAC TRI-STATE CDC, INC. 9 $9,315,000 8 OPEN BANK 45 $42,370,500 67 CAPITAL BANK 4 $3,190,000 8 SO CAL CDC 9 $8,710,000 9 CELTIC BANK CORPORATION 41 $12,517,800 68 OPUS BANK 4 $1,100,000 9 COASTAL BUSINESS FINANCE 5 $3,023,000 10 FIRST HOME BANK 40 $12,546,000 69 THE BANCORP BANK 4 $878,000 10 ENTERPRISE FUNDING CORPORATION 3 $2,202,000 11 SEACOAST COMMERCE BANK 38 $38,164,300 70 PCR SMALL BUSINESS DEVELOPMENT* 4 $495,000 11 SUPERIOR CA ECONOMIC DEV. -

Yee Phong (Alan) Thian Chairman, President and CEO (626) 307-7559 David Morris Executive Vice President and CFO (714) 670-2488

Press Release For Immediate Release Contacts: Yee Phong (Alan) Thian Chairman, President and CEO (626) 307-7559 David Morris Executive Vice President and CFO (714) 670-2488 RBB Bancorp Completes Acquisition of Chicago-based Pacific Global Bank Los Angeles, CA, January 13, 2020 - RBB Bancorp (NASDAQ: RBB) and its subsidiaries, Royal Business Bank and RBB Asset Management Company (collectively referred to herein as “RBB” or the “Company”), announced today that it has completed its acquisition of PGB Holdings, Inc. and its wholly-owned subsidiary Pacific Global Bank based in Chicago, IL (collectively referred to herein as “Pacific Global Bank” or “PGB”). Principally serving the Chinese-American communities in Chicago, Pacific Global Bank has three branches located in the Chicago neighborhoods of Chinatown and Bridgeport, offering consumer and business banking and loan products and services. As part of the transaction, Pacific Global Bank has been merged into Royal Business Bank. The transaction brings RBB’s total assets to over $3.0 billion, based on information as of September 30, 2019. Alan Thian, CEO and Chairman of the Board of RBB, commented, “We are very pleased to welcome PGB’s customers and employees to RBB Bancorp. We plan to operate our Chicago branches as Pacific Global Bank, A Division of Royal Business Bank, until the system conversion near the end of March at which time we will operate the branches as Royal Business Bank. Following the system conversion in March, we plan to supplement the lending product offering by PGB with our mortgage, SBA 7A, small C&I and construction lending products.