Department of Financial Institutions

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Retail Banking Announcement

Frequently asked questions 26 May 2021 What the repositioning of the HSBC USA Wealth and Personal Banking business means for our customers, here and abroad Why did HSBC take this action? In February 2020, we set out a plan to shift our business strategy in the United States to maximize the connection between our clients and our world-class international network. Our primary business will be a wholesale bank focused on the international needs of clients. We are renewing our emphasis on the US$5 trillion international wealth management opportunity from globally mobile and affluent individuals in the United States. Is HSBC exiting the United States? No, HSBC is not exiting its US business. We aim to be the leading international bank in the United States and are focused on what we do best – connecting Americans to a world of opportunity and bringing cross-border business and investment to the United States. We will continue to provide banking services not only to our wholesale banking clients, but also to our Premier, Jade and Private Banking customers. I have personal accounts at HSBC and I’m in the United States. How will these agreements affect me? Upon completion of the transactions, the accounts of in-scope customers will be transferred to Citizens or Cathay Bank. We thank those customers for their business and will ensure the transfer occurs with as minimum disruption as possible. Premier, Jade, Private Banking and other clients who will remain HSBC customers are in the process of being transitioned to one of our new 20-25 Wealth Centers. -

Cathay General Bancorp Contact: Heng W

FOR IMMEDIATE RELEASE For: Cathay General Bancorp Contact: Heng W. Chen 777 N. Broadway (626) 279-3652 Los Angeles, CA 90012 CATHAY GENERAL BANCORP AND ASIA BANCSHARES INC. COMPLETE MERGER LOS ANGELES – August 3, 2015 – Cathay General Bancorp (NASDAQ: CATY), the holding company for Cathay Bank, announced today that it completed its merger with Asia Bancshares, Inc. at the end of the day on July 31, 2015. As a result of the transaction, Asia Bancshares, Inc. has been merged with and into Cathay General Bancorp, and Asia Bank has been merged with and into Cathay Bank. The completion of the merger results in a combined financial institution with total assets of approximately $12.4 billion and deposits of approximately $9.8 billion, 57 branches operating in nine states, and a presence in three overseas locations. Under the terms of the merger, Cathay General Bancorp is issuing 2.58 million shares of its common stock and paying $57.0 million in cash for all of the issued and outstanding shares of Asia Bancshares stock, valuing the merger at approximately $139.9 million, based on Cathay General Bancorp’s closing price on July 31, 2015. Based on properly and timely submitted and accepted elections, the stock consideration of 3.2134 shares of Cathay common stock per share of Asia Bancshares was over-subscribed by Asia Bancshares shareholders and subject to proration. As a result, approximately 36% of the shares of Asia Bancshares that were subject to stock elections will receive cash consideration of $86.76 per share of Asia Bancshares. Asia Bancshares shareholders who elected cash and those shareholders who failed to submit elections on a timely basis will receive cash consideration of $86.76 per share of Asia Bancshares. -

Commercial Banks

THE STATE BANKING SYSTEM IN 2011 Commercial Banks New Banks On January 1, 2011, there were 191 state-chartered commercial banks. During the year, two banks were closed and ordered liquidated and 11 banks became extinct through merger, bringing the total number of state-chartered commercial banks to 178 at yearend. Commercial Banks Closed During the Year Name of Bank Location Acquiring Bank Location Closed Charter Oak Bank Napa Bank of Marin Corte Madera 2/18/2011 Citizens Bank of Northern California Nevada City Tri-Counties Bank Chico 9/23/2011 Mergers In 2011, there were 15 mergers involving state-chartered banks. The following table lists those mergers: Surviving Bank Location Merged Bank Location Merged AmericanWest Bank Spokane, WA Sunrise Bank San Diego 7/28/11 Bay Commercial Bank Walnut Creek Global Trust Bank Mountain View 10/18/11 Boston Private Bank & Trust Company. Boston, MA First Private Bank & Trust Encino 5/27/11 Borel Private Bank & Trust Company San Mateo 5/27/11 Center Bank 1 Los Angeles Nara Bank Los Angeles 12/1/11 Embarcadero Bank 2 San Diego Coronado First Bank Coronado 11/16/11 First General Bank Rowland Heights American Premier Bank Arcadia 1/31/11 First General Bank Rowland Heights Golden Security Bank Rosemead 8/23/11 Grandpoint Bank Los Angeles Orange Community Bank Orange 8/30/11 Mission Community Bank San Luis Obispo Santa Lucia Bank Atascadero 10/21/11 Opus Bank Irvine Cascade Bank Everett, WA 6/30/11 Opus Bank Irvine Fullerton Community Bank, FSB Fullerton 10/31/11 Royal Business Bank Los Angeles First Asian Bank Las Vegas, NV 7/8/11 Royal Business Bank Los Angeles Ventura County Business Bank Oxnard 9/26/11 Wells Fargo Bank, N.A. -

The Chinese in Hawaii: an Annotated Bibliography

The Chinese in Hawaii AN ANNOTATED BIBLIOGRAPHY by NANCY FOON YOUNG Social Science Research Institute University of Hawaii Hawaii Series No. 4 THE CHINESE IN HAWAII HAWAII SERIES No. 4 Other publications in the HAWAII SERIES No. 1 The Japanese in Hawaii: 1868-1967 A Bibliography of the First Hundred Years by Mitsugu Matsuda [out of print] No. 2 The Koreans in Hawaii An Annotated Bibliography by Arthur L. Gardner No. 3 Culture and Behavior in Hawaii An Annotated Bibliography by Judith Rubano No. 5 The Japanese in Hawaii by Mitsugu Matsuda A Bibliography of Japanese Americans, revised by Dennis M. O g a w a with Jerry Y. Fujioka [forthcoming] T H E CHINESE IN HAWAII An Annotated Bibliography by N A N C Y F O O N Y O U N G supported by the HAWAII CHINESE HISTORY CENTER Social Science Research Institute • University of Hawaii • Honolulu • Hawaii Cover design by Bruce T. Erickson Kuan Yin Temple, 170 N. Vineyard Boulevard, Honolulu Distributed by: The University Press of Hawaii 535 Ward Avenue Honolulu, Hawaii 96814 International Standard Book Number: 0-8248-0265-9 Library of Congress Catalog Card Number: 73-620231 Social Science Research Institute University of Hawaii, Honolulu, Hawaii 96822 Copyright 1973 by the Social Science Research Institute All rights reserved. Published 1973 Printed in the United States of America TABLE OF CONTENTS FOREWORD vii PREFACE ix ACKNOWLEDGMENTS xi ABBREVIATIONS xii ANNOTATED BIBLIOGRAPHY 1 GLOSSARY 135 INDEX 139 v FOREWORD Hawaiians of Chinese ancestry have made and are continuing to make a rich contribution to every aspect of life in the islands. -

FY 19 4Th Quarter & FYE Lender Ranking

LOS ANGELES DISTRICT OFFICE 7(a) and 504 Lender Ranking Report Fiscal Year 2019 - Q4 (10/1/18 - 9/30/19) 7(a) Loan Program 504 Loan Program 1 U.S. Bank, National Association 184 $23,757,600 67 Mega Bank 5 $1,672,000 1 CDC Small Business Finance Corporation* 94 $98,783,000 2 JPMorgan Chase Bank, National Association 174 $44,541,500 68 PCR Small Business Development*++ 5 $821,000 2 Business Finance Capital*++ 92 $109,382,000 3 Bank of Hope++ 167 $60,333,000 69 Poppy Bank 4 $8,690,000 3 California Statewide Certified Development* 84 $67,087,000 4 Wells Fargo Bank, National Association 155 $36,193,900 70 Wallis Bank 4 $7,542,000 4 Mortgage Capital Development Corporation 38 $39,865,000 5 First Home Bank 104 $22,494,000 71 BBVA USA 4 $5,926,300 5 Advantage Certified Development Corporation 15 $17,387,000 6 East West Bank++ 61 $33,406,500 72 Pacific Mercantile Bank 4 $4,927,000 6 Southland Economic Development Corporation 14 $14,297,000 7 Pacific City Bank++ 60 $50,311,500 73 Pacific Western Bank++ 4 $4,165,000 7 So Cal CDC++ 11 $22,780,000 8 CDC Small Business Finance Corporation* 55 $8,763,500 74 OneWest Bank, A Division of 4 $4,013,000 8 AMPAC Tri-State CDC, Inc. 10 $7,235,000 9 MUFG Union Bank, National Association 50 $75,482,600 75 IncredibleBank 4 $2,123,600 9 Coastal Business Finance++ 6 $3,666,000 10 Hanmi Bank++ 50 $30,864,000 76 Kinecta FCU++ 4 $862,000 10 Enterprise Funding Corporation 2 $2,980,000 11 Commonwealth Business Bank++ 47 $38,305,000 77 Montecito Bank & Trust++ 4 $503,900 11 San Fernando Valley Small Business Development++ 2 $1,046,000 12 Celtic Bank Corporation 44 $14,667,300 78 Meadows Bank 3 $5,091,000 12 Superior California Economic Development 1 $2,111,000 13 Independence Bank 40 $5,725,000 79 Banner Bank 3 $2,175,000 13 Capital Access Group, Inc. -

Investor Presentation November 2017

Investor Presentation November 2017 NASDAQ: RBB Forward‐Looking Statements Certain matters set forth herein (including the exhibits hereto) constitute forward‐looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including forward‐looking statements relating to the Company’s current business plans and expectations and our future financial position and operating results. These forward‐looking statements are subject to risks and uncertainties that could cause actual results, performance and/or achievements to differ materially from those projected. These risks and uncertainties include, but are not limited to, local, regional, national and international economic and market conditions and events and the impact they may have on us, our customers and our assets and liabilities; our ability to attract deposits and other sources of funding or liquidity; supply and demand for real estate and periodic deterioration in real estate prices and/or values in California or other states where we lend, including both residential and commercial real estate; a prolonged slowdown or decline in real estate construction, sales or leasing activities; changes in the financial performance and/or condition of our borrowers, depositors or key vendors or counterparties; changes in our levels of delinquent loans, nonperforming assets, allowance for loan losses and charge‐offs; the costs or effects of acquisitions or dispositions we may make, whether we are able to obtain any required governmental approvals in connection with -

2008 – December

DEPARTMENT OF FINANCIAL INSTITUTIONS SUMMARY OF PENDING APPLICATIONS AS OF DECEMBER 2008 APPLICATION TYPE PAGE NO. BANK APPLICATION NEW BANK 1 ACQUISITION OF CONTROL 2 CONVERSION TO STATE CHARTER 3 NEW BRANCH 3 NEW PLACE OF BUSINESS 8 NEW EXTENSION OFFICE 10 HEAD OFFICE RELOCATION 10 HEAD OFFICE REDESIGNATION 11 BRANCH OFFICE RELOCATION 11 PLACE OF BUSINESS RELOCATION 13 DISCONTINUANCE OF BRANCH OFFICE 13 DISCONTINUANCE OF PLACE OF BUSINESS 15 APPLICATION PURSUANT TO SECTION 772 16 INDUSTRIAL BANK APPLICATION CONVERSION TO STATE CHARTER 16 ACQUISITION OF CONTROL 16 NEW BRANCH 17 HEAD OFFICE RELOCATION 17 DISCONTINUANCE OF BRANCH 17 DISCONTINUANCE OF PLACE OF BUSINESS 17 CHANGE OF NAME 18 PREMIUM FINANCE COMPANY APPLICATION NEW PREMIUM FINANCE COMPANY 18 ACQUISITION OF CONTROL 19 MAIN OFFICE RELOCATION 20 FOREIGN (OTHER NATION) BANK APPLICATION NEW OFFICE 20 DISCONTINUANCE 20 FOREIGN (OTHER STATE) BANK APPLICATION NEW FACILITY 21 CREDIT UNION APPLICATION NEW CREDIT UNION 22 MERGER 22 NEW BRANCH OF FOREIGN (OTHER STATE) CREDIT UNION 23 TRANSMITTER OF MONEY ABROAD APPLICATION NEW TRANSMITTER 23 ACQUISITION OF CONTROL 23 VOLUNTARY SURRENDER OF LICENSE 24 1 BANK APPLICATION NEW BANK Filed: 2 Approved: 4 Opened: 1 AMERICAN CEDARS BANK 500 North Central Avenue, Glendale, Los Angeles County Correspondent: David E. Abshier LECG 550 South Hope Street, Suite 2150 Los Angeles, CA 90071 (213) 243-3700 Filed: 9/28/07 EL CAMINO BANK 20946 Devonshire Street, Chatsworth, Los Angeles County Correspondent: James H. Avery The Avery Company LLC P.O. Box 3009 San Luis Obispo, CA 93403 (805) 544-5477 Filed: 5/9/08 FORD GROUP BANK 3501 Jamboree Road, Newport Beach, Orange County Correspondent: Charles E. -

Discontinuance of Branch Office

DEPARTMENT OF BUSINESS OVERSIGHT SUMMARY OF PENDING APPLICATIONS AS OF AUGUST 2018 APPLICATION TYPE PAGE NO. BANK APPLICATION MERGER 1 ACQUISITION OF CONTROL 1 SALE / PURCHASE OF PARTIAL BUSINESS UNIT 2 APPLICATION FOR TRUST POWERS 2 NEW BRANCH 2 NEW FACILITY 3 HEAD OFFICE REDESIGNATION 3 BRANCH RELOCATION 3 DISCONTINUANCE OF BRANCH OFFICE 4 DISCONTINUANCE OF FACILITY 6 PREMIUM FINANCE COMPANY APPLICATION NEW PREMIUM FINANCE COMPANY 6 ACQUISITION OF CONTROL 8 VOLUNTARY SURRENDER OF LICENSE 8 FOREIGN (OTHER NATION) BANK APPLICATION NEW OFFICE 8 OFFICE RELOCATION 8 OFFICE DISCONTINUANCE 9 FOREIGN (OTHER STATE) BANK APPLICATION NEW FACILITY 9 CREDIT UNION APPLICATION MERGER 9 TRUST COMPANY APPLICATION DISCONTINUANCE OF BRANCH OFFICE 10 MONEY TRANSMITTER APPLICATION NEW TRANSMITTER 10 ACQUISITION OF CONTROL 11 1 BANK APPLICATION MERGER Filed: 1 Approved: 1 Effected: 2 Withdrawn: 1 AMERICAS UNITED BANK, Glendale, to merge with and into BANK OF SOUTHERN CALIFORNIA, NA, San Diego Effected: 8/1/18 COMMUNITY BANK, Pasadena, to merge with and into CITIZENS BUSINESS BANK, Ontario Filed: 4/6/18 Approved: 7/26/18 Effected: 8/10/18 FIRST AMERICAN INTERNATIONAL BANK, Brooklyn, New York, to merge with and into ROYAL BUSINESS BANK, Los Angeles, California Filed: 6/4/18 Approved: 8/14/18 MY BANK, BELEN, New Mexico, to merge with and into UNITED BUSINESS BANK, Walnut Creek, California Filed: 8/24/18 SOUTHWESTERN NATIONAL BANK, Houston, Texas, to merge with and into HANMI BANK, Los Angeles, California Filed: 6/25/18 Approved: 8/14/18 Withdrawn: 9/27/18 ACQUISITION -

2004 Outstanding 50 Asian Americans in Business Awards

Organizer: Sponsors: IBM . The New York Times . Verizon 2004 Outstanding Con Edison . McGraw-Hill . Fleet bank . Time Warner Colgate-Palmolive . BDO Siedman 50 Asian Americans in Planning Committee Chairman* and Members: Business Awards *Savio S. Chan, President & CEO, US China Partners, Inc. Mahesh Krishnamurti, Former Publisher/CFO, Worth Media James Y. Wohn, Senior Vice President, Fleet Bank June Jee, Director of Manhattan Community Affairs, Verizon Communications Walter Shay, Manager, Strategic Partnership, Con Edison John Kyriakides, Partner, BDO Seidman Jennifer Pauley, Assistant Director, Community Affairs, The New York Times V.M. Gandhi, President, New York Gold Company Thomas Chin, President, Accolade Technologies, LLC Govind Srivastava, CEO, Knowledge Resources, Inc. Message from the Event Chairman The Third Annual Outstanding 50 Asian Americans in Business Award Dinner provides a unique opportunity to pay tribute to those Asian American Entrepreneurs and professionals who demonstrate a commitment to making a difference in our community. Each year the Asian American Business Development Center takes this opportunity to honor outstanding, dedicated and well-deserving leaders in the New York tri-states areas. For 2004, some of the New York‘s best-known and well-respected executives are being recognized for their contributions. This year’s Pinnacle Award will be presented to Mr. Ted Teng, President and COO of Wyndham International. Mr. Teng has a distinguished career and is one of the SAVIO CHAN highest-ranking Asian executives from a publicly-traded company in the United Event Chairman States. He is recognized for his support and advocacy for the Asian community and has given his valuable time back to the community by serving on the various boards in many not-for-profit organizations. -

A Comparison of Korean and Chinese American Banks in California*

한국지역지리학회지 제12 권 제 1 호 (2006) 154-171 The Financial Development of Korean Americans: A Comparison of Korean and Chinese American Banks in California* Hyeon-Hyo Ahn**, Yun-Sun Chung*** 미국에서의 한인 금융: 캘리포니아에서 한국계와 중국계 은행의 비교* 안현효**․ 정연선 *** 요약:본 논문은 캘리포니아의 중국계와 한국계의 양 소수민족은행을 비교하여 한국계 민족은행과 한국계 이민사회의 경제적 관계를 해명하고자 한다. 통상 미국 내 소수민족경제권의 경제적 성과 차이는 문화적 차이 또는 비공식금융의 기여로 설명되는 경우가 많으나 우리는 공식금융제도의 적극적 역할에 주목하여 금융제도와 소수민족경제의 관련성을 강조한다.,, 동시에 한국계 미국은행은 성장 수익성 은행전략 면에서 중국계 소수민족은행과 구분된다는 점을 중시하여, 은행전략 측면에서, 중국계와 한국계가 고객과의 장기적 거래를 중시하는 유사한 관계은행전략을 구사하지만, 은행의 대출분포와 예금분포는 서로 다르다는 점을 지적하였다. 이는 각 소수민족은행이 다른 경영성과를 낳는 이유가 된다. 한국계은행의 경우 대출구조가 사업대출 중심이며, 이자 낳지 않는 예금의 비중이 중국계 민족은행보다 상대적으로 높 은 사실이 한국계 소수민족은행이 높은 성장을 하게 된 배경이다. 따라서 관계은행전략이라는 개념만으로는 다수의 소 수민족은행의 차이를 설명할 수 없으므로, 본 연구는 한국계와 중국계의 이민사회 그 자체의 특수성에 주목하였다. 중 국계 미국인의 경우 인구구성의 이질성과 해외자본의 영향이, 한국계 미국인의 경우 동질적 인구 및 사업구성과 착 한 국계 미국인 금융기관의 경쟁력이 특징적이다. 주요어:소수민족은행, 한국계 미국은행 , 중국계 미국은행 , 관계은행 Abstract :By comparing to Chinese American banks, this research shows the uniqueness of Korean American banks. This article argues that instead of the cultural attributes and/or informal financial institutions, formal financial institutions, such as the ethnic banks studied here, are responsible for the business success of Asians abroad. However, ethnic banks have different development trajectories depending on their respective ethnic communities. Korean American banks are notably different from Chinese American banks in terms of growth, profitability, and banking strategies. -

867625000.00

LOS ANGELES DISTRICT OFFICE Lender Ranking Report 7(a) and 504 Loan Programs Fiscal Year 2018 - 2nd Quarter (Year-to-Date) (10/01/2017 - 03/31/2018) 7(a) Loan Program 504 Loan Program 1 JPMorgan Chase Bank, N.A. 121 $41,772,500 60 New Omni Bank, N.A. 4 $515,000 1 BFC 40 $51,138,000 2 Wells Fargo Bank, N.A. 119 $69,180,200 61 Banner Bank 4 $433,400 2 CDC Small Business Finance Corp.* 38 $47,525,000 3 Bank of Hope 84 $38,633,900 62 Bank of the Sierra 3 $3,965,000 3 California Statewide CDC* 31 $39,779,000 4 U.S. Bank, N.A. 63 $10,094,700 63 Banc of California, N.A. 3 $3,842,000 4 Mortgage Capital Development Corp.* 12 $17,538,000 5 East West Bank 47 $17,093,000 64 Sunwest Bank 3 $2,910,000 5 Pacific West CDC 9 $9,152,000 6 Celtic Bank Corporation 34 $11,774,300 65 Premier Business Bank 3 $2,462,000 6 Southland Economic Development Corp. 7 $3,881,000 7 First Home Bank 33 $7,341,000 66 Mission Valley Bank 3 $840,900 7 So Cal CDC 6 $8,188,000 8 Harvest Small Business Finance, LLC 26 $33,353,400 67 MidFirst Bank 2 $5,746,000 8 AMPAC Tri-State CDC, Inc. 3 $4,317,000 9 Commonwealth Business Bank 25 $29,289,000 68 Crossroads Small Business Solutions, LLC 2 $4,053,000 9 Enterprise Funding Corp. 3 $2,439,000 10 MUFG Union Bank, N.A. -

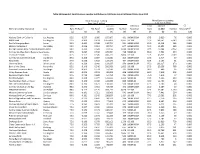

3A Expanded Small Business Lending

Table 3A Expanded. Small Business Lending Institutions in California Using Call Report Data, June 2012 Small Business Lending Micro Business Lending (less than $ million) (less than $ 100k) Total Amount Institution Total Amount CC Name of Lending Institution City Rank TA Ratio1 TBL Ratio1 (1,000) Number Asset Size Rank (1,000) Number Amount/TA1 (1) (2) (3) (4) (5) (6) (7) (8) (9) (10) National Bank of California Los Angeles 95.0 0.537 1.000 187,467 431 100M-500M 67.5 3,020 76 0.000 BBCN Bank Los Angeles 92.5 0.309 0.424 1,557,424 9,537 1B-10B 97.5 168,741 6,149 0.000 Pacific Enterprise Bank Irvine 92.5 0.405 0.549 110,755 591 100M-500M 95.0 11,314 249 0.000 Mission Valley Bank Sun Valley 90.0 0.356 0.564 87,754 647 100M-500M 95.0 12,892 365 0.000 Borrego Springs Bank, National AssociLa Mesa 90.0 0.435 0.628 65,123 3,020 100M-500M 97.5 10,544 2,562 0.000 Community West Bank, National Asso Goleta 87.5 0.227 0.542 129,084 718 500M-1B 85.0 7,591 234 0.000 Tri Counties Bank Chico 87.5 0.173 0.545 436,723 3,804 1B-10B 97.5 43,955 2,289 0.000 Community Commerce Bank Claremont 87.5 0.358 0.687 103,416 365 100M-500M 67.5 2,717 57 0.000 Plaza Bank Irvine 87.5 0.328 0.502 127,075 484 100M-500M 52.5 2,193 61 0.000 Universal Bank West Covina 85.0 0.329 1.000 133,617 170 100M-500M 95.0 133,617 170 0.000 Bank of the Sierra Porterville 85.0 0.148 0.546 206,583 1,602 1B-10B 97.5 20,356 768 0.000 Seacoast Commerce Bank San Diego 82.5 0.363 0.574 57,144 315 100M-500M 30.0 409 16 0.000 Valley Business Bank Visalia 82.5 0.259 0.531 89,428 408 100M-500M 90.0