92.Pdf the Dawn

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Last Post Indian War Memorials Around the World

Last Post Indian War Memorials Around the World Introduction • 1 Rana Chhina Last Post Indian War Memorials Around the World i Capt Suresh Sharma Last Post Indian War Memorials Around the World Rana T.S. Chhina Centre for Armed Forces Historical Research United Service Institution of India 2014 First published 2014 © United Service Institution of India All rights reserved. No part of this publication may be reproduced or transmitted, in any form or by any means, without prior permission of the author / publisher. ISBN 978-81-902097-9-3 Centre for Armed Forces Historical Research United Service Institution of India Rao Tula Ram Marg, Post Bag No. 8, Vasant Vihar PO New Delhi 110057, India. email: [email protected] www.usiofindia.org Printed by Aegean Offset Printers, Gr. Noida, India. Capt Suresh Sharma Contents Foreword ix Introduction 1 Section I The Two World Wars 15 Memorials around the World 47 Section II The Wars since Independence 129 Memorials in India 161 Acknowledgements 206 Appendix A Indian War Dead WW-I & II: Details by CWGC Memorial 208 Appendix B CWGC Commitment Summary by Country 230 The Gift of India Is there ought you need that my hands hold? Rich gifts of raiment or grain or gold? Lo! I have flung to the East and the West Priceless treasures torn from my breast, and yielded the sons of my stricken womb to the drum-beats of duty, the sabers of doom. Gathered like pearls in their alien graves Silent they sleep by the Persian waves, scattered like shells on Egyptian sands, they lie with pale brows and brave, broken hands, strewn like blossoms mowed down by chance on the blood-brown meadows of Flanders and France. -

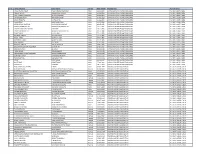

Sl. No. Name of Players Father Name Gender Date of Birth Member Unit

Sl. No. Name of Players Father Name Gender Date of Birth Member Unit PLAYER ID NO 1 VIKAS VISHNU PILLAY PILLAY VISHNU MANIKAM Male 20.11.1989 AIR INDIA SPORTS PROMOTION BOARD PL / AIR / 00042 / 2013 2 YOUSUF AFFAN MOHAMMED YOUSUF Male 29.12.1994 AIR INDIA SPORTS PROMOTION BOARD PL / AIR / 00081 / 2013 3 LALIT KUMAR UPADHYAY SATISH UPADHYAY Male 01.12.1993 AIR INDIA SPORTS PROMOTION BOARD PL / AIR / 00090 / 2013 4 SHIVENDRA SINGH JHAMMAN SINGH Male 09.06.1983 AIR INDIA SPORTS PROMOTION BOARD PL / AIR / 01984 / 2014 5 ARJUN HALAPPA B K HALAPPA Male 17.12.1980 AIR INDIA SPORTS PROMOTION BOARD PL / AIR / 01985 / 2014 6 JOGA SINGH HARJINDER SINGH Male 01.01.1986 AIR INDIA SPORTS PROMOTION BOARD PL / AIR / 01986 / 2014 7 GIRISH RAVAJI PIMPALE RAVAJI BHIKU PIMPALE Male 06.05.1983 AIR INDIA SPORTS PROMOTION BOARD PL / AIR / 01987 / 2014 8 VIKRAM VISHNU PILLAY MANIKAM VISHNU PILLAY Male 27.11.1981 AIR INDIA SPORTS PROMOTION BOARD PL / AIR / 01988 / 2014 9 VINAYA VAKKALIGA SWAMY B SWAMY Male 24.11.1985 AIR INDIA SPORTS PROMOTION BOARD PL / AIR / 01989 / 2014 10 VINOD VISHNU PILLAY MANIKAM VISHNU PILLAY Male 05.12.1988 AIR INDIA SPORTS PROMOTION BOARD PL / AIR / 01990 / 2014 11 SAMEER DAD KHUDA DAD Male 25.11.1978 AIR INDIA SPORTS PROMOTION BOARD PL / AIR / 01991 / 2014 12 PRABODH TIRKEY WALTER TIREKY Male 15.12.1985 AIR INDIA SPORTS PROMOTION BOARD PL / AIR / 01992 / 2014 13 BIMAL LAKRA MARCUS LAKRA Male 04.05.1980 AIR INDIA SPORTS PROMOTION BOARD PL / AIR / 01993 / 2014 14 BIRENDAR LAKRA MARCUS LAKRA Male 22.12.1985 AIR INDIA SPORTS PROMOTION BOARD -

Primo.Qxd (Page 1)

daily Vol No. 50 No. 38 JAMMU, SATURDAY, FEBRUARY 8, 2014 REGD.NO.JK-71/12-14 16 Pages ` 3.50 ExcelsiorRNI No. 28547/1992 Omar for benefits of innovations to ‘Aam Aadmi’ Shabir quits, resignation accepted by Governor Vice-President asks Scientists to be Police summons ex-Minister Minister acted like a sexual cognizant of social, ethical imperatives through SSP Jammu Nishikant Khajuria on conclusion of the 101st physics, space technology etc predator: Doctor Indian Science Congress, here have transformed our world as JAMMU, Feb 7: The five- today in the presence of Chief never before but at the same *Ministry strength down to 24 Fayaz Bukhari day Indian Science Congress Minister Omar Abdullah, time also carry with them con- arrested as soon as he appeared before in Jammu University conclud- Governor N N Vohra, Union siderable social and ethical Sanjeev Pargal SRINAGAR, Feb 7: The separatist leader's wife, on whose complaint the police. ed amid a call from Vice- Minister Farooq Abdullah and implications, which must be police have registered a case against former Minister of State for Health, “Let us see. If he didn't appear, only President Mohammad others. addressed,” he said adding that JAMMU, Feb 7: Minister of State Shabir Ahmad Khan, alleged that Minister acted like a sexual predator. then we will initiate other legal courses Hamid Ansari to the Scientists Expressing his concern over impact of social media networks for Health (Independent Charge) The doctor in her complaint alleges: "The Minister acted like sexual predator. I of action,'' -

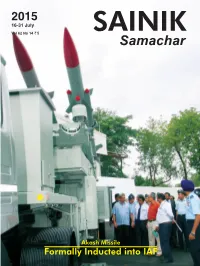

Download in PDF Format

In This Issue Since 1909 COVERIndian STORY Air Force Formally Inducts The Akash Missile 4 (Initially published as FAUJI AKHBAR) Vol. 62 No 14 25 Ashadha - 9 Shravana, 1937 (Saka) 16-31 July 2015 The journal of India’s Armed Forces published every fortnight in thirteen languages including Hindi & English on behalf of Ministry of Defence. It is not necessarily an organ for the expression of the Government’s defence policy. The published items represent the views of respective writers and correspondents. Editor-in-Chief CNS Reviews the Passage from Karwar Hasibur Rahman 8 12 Editor Editor (Features) Passing out Parade to Salalah Dr Abrar Rahmani Ehsan Khusro Coordination Business Manager Sekhar Babu Madduri Dharam Pal Goswami Our Correspondents DELHI: Dhananjay Mohanty; Capt DK Sharma; Manoj Tuli; Nampibou Marinmai; Wg Cdr Rochelle D’Silva; Col Rohan Anand; Wg Cdr SS Birdi, Ved Pal; ALLAHABAD: Gp Capt BB Pande; BENGALURU: Dr MS Patil; CHANDIGARH: Parvesh Sharma; CHENNAI: T Shanmugam; GANDHINAGAR: Wg Cdr Abhishek Matiman; GUWAHATI: Lt Col Suneet Newton; IMPHAL: Lt Col Ajay Kumar Sharma; JALANDHAR: Naresh Vijay Vig; JAMMU: Lt Col Manish Mehta; JODHPUR: Lt Col Manish Ojha; KOCHI: Cdr Sridhar E Warrier ; KOHIMA: Lt Col E Musavi; KOLKATA: 6 Defence Minister Inaugurates… Gp Capt TK Singha; LUCKNOW: Ms Gargi Malik Sinha; MUMBAI: Cdr Rahul 10 IAF in Rescue and Relief… Defence Pension Sinha; Narendra Vispute; NAGPUR: Wg Cdr Samir S Gangakhedkar; PALAM: Gp Adalat Held 16 Capt SK Mehta; PUNE: Mahesh Iyengar; SECUNDERABAD: MA Khan Shakeel; 11 To Build and Promote Military… SHILLONG: Gp Capt Amit Mahajan; SRINAGAR: Col NN Joshi; TEZPUR: Lt Col 14 Release of IMA Journal and… Sombith Ghosh; THIRUVANANTHAPURAM: Suresh Shreedharan; UDHAMPUR: 15 Naushera Ka Sher and his… Col SD Goswami; VISAKHAPATNAM: Cdr CG Raju. -

2016 Contested Spaces in Cities As Politicised As Jerusalem?

PROFILE HANNA BAUMANN DIVIDED CITY Hanna Baumann Can culture act as a bridge to connect groups who are in conflict? How do divided cities operate on a day to day basis? AndYEARBOOK how do people negotiate2016 contested spaces in cities as politicised as Jerusalem? Hanna Baumann [2012] has been fascinated by the subject of divided cities since she was young. Her PhD in Architecture will build on her undergraduate and Master’s research, which focused on the Israeli/Palestinian conflict as well as on work she has been doing in for the United Nations on minority cultural rights in conflict affected areas. Hanna showed an early interest in the intersection between culture and conflict. Growing up in what was then East Berlin, she was five when the Berlin Wall fell. “In some ways, it was a formative experience,” she says, “and was part of my interest in divided cities. Even after the Wall came down I could see the long-term effects on family and friends.” “I could feel the tension in the After graduating from Barnard, Hanna returned to the Middle streets of the old city, where East to work with Iraqi refugees in Jordan through the UNHCR. She then joined the humanitarian organisation ACTED in Jews and Muslims uneasily shared Jerusalem, working on agriculture, shelter and food security spaces holy to both groups,” projects. She says it was striking to see how in the Israel- Palestine context even seemingly innocuous activities like As an undergraduate at Barnard College, Columbia University, agriculture were deeply intertwined with questions of belonging she completed a dual major in Art History and the History of the and ownership. -

Remembering the 1945 Makran Tsunami

Remembering the 1945 Makran Tsunami Interviews with Survivors Beside the Arabian Sea Published in 2015 by United Nations Educational, Scientific and Cultural Organization (UNESCO), for its Intergovernmental Oceanographic Commission (IOC), 7 Place de Fontenoy, 75 352 Paris 07 SP, France. Produced by Indian Ocean Tsunami Information Centre (IOTIC), UNESCO/ IOC, UNESCO Office Jakarta, Jalan Galuh (II) No. 5, Kebayoran Baru, Jakarta 12110, Indonesia. www.iotic.ioc-unesco.org First Printing 2015 for UNESCO/IOC - UNESCAP Trust Fund for Tsunami, Disaster and Climate Preparedness in Indian Ocean and Southeast Asian Countries under project title: “Communicating the effects of the 1945 Makran tsunami to increase awareness and preparedness of tsunami hazards in the Makran region”. When citing this booklet please include its IOC series and number, IOC Brochure 2015-1, and designate UNESCO/IOC as its publisher. In addition, consider using each compiler’s names in full in case the last name is not a family name. The designation employed and the presentation of the material in this publication do not imply the expression of any opinion whatsoever on the part of the Secretariat of UNESCO, concerning the legal status of any country or territory, or its authorities, or concerning the delimitation of the frontiers of any country or territory. © UNESCO 2015 This booklet in pdf format may be downloaded free of charge at http://iotic.ioc- unesco.org/1945makrantsunami/1945-makran-tsunami-booklet.pdf. Also posted there are videos of some of the interviews, supporting information that includes geographic coordinates for many of the interviews, and scans of written records of the 1945 tsunami. -

STUDYBAY TECHNOLOGIES PRIVATE LIMITED June 2, 2020

STUDYBAY TECHNOLOGIES PRIVATE LIMITED June 2, 2020 STUDYBAY TIMES NATIONAL Ravi Shankar Prasad launches program “Responsible AI for Youth” National Program for the youth titled “Responsible AI for Youth” has been launched by the Union Minister for Electronics & Information Technology, Communications and Law & Justice, Ravi Shankar Prasad to empower the youth of India with appropriate new age tech mind-set, hence making them digitally ready for the future. The program has been rolled out by National e-Governance Division, Ministry of Electronics & IT in collaboration with Intel India, along with the support from Department of School Education and Literacy (DoSE&L), Ministry of Human Resource Development. National “Artificial Intelligence Portal” of India launched Union Minister for Electronics and IT, Law and Justice and Communications, Ravi Shankar Prasad has launched the National “Artificial Intelligence Portal” of India called “ai.gov.in”. It has been jointly developed by Ministry of Electronics and IT along with IT Industry. It would be responsible for sharing of resources like articles, investment funds in AI, startups, companies, resources and educational institutions related to AI, and hence will act as a one stop digital platform for AI related developments in India. GoI approves Rs 445 crore for Chhatisgarh to implement Jal Jeevan Mission The Government of India has approved Rs 445 crore for the implementation of Jal Jeevan Mission in Chhatisgarh in 2020-21. The Chhattisgarh government has prepared a roadmap to achieve 100% Functional Tap Water Connection (FHTC) by year 2023-24 under which it will provide tap connections to 20 lakh households out of the total of 45 lakh households in the State. -

Indian Army: the Most Secular Institutions in the Country

INDIAN ARMY: THE MOST SECULAR INSTITUTIONS IN THE COUNTRY Dr. Amjad Ali COGNIZABLE HISTORY It has been a widely held „myth‟ that Indian Army institutionalizes religion or caste. There are some regiments in Indian Army named after communities, and some named after regions as determined by the British rulers then. But this has a historical context and has continued as an inherited legacy. Thus, we have the Sikh regiment, the Marathas, the Jat, the Gorkhas etc. but this doesn't make any of these regiments exclusive for other communities or regions, like all other public institutions. So, it is no surprise to see a Mohammed Zaki commanding Garhwali troops or a Y N Sharma as commanding officer of the Grenadiers (which incidentally has Muslim soldiers) as head of the family, which is what a commanding officer is. It is common for a Zaki to felicitate the puja on Janmashtami, celebrating the birth of Lord Krishna, or for a Sharma to organise the namaz on Id Ul Fitr after Ramzan. It is further emphasized that Indian Army has maintained a strong secular tradition and does not believe in religion based discrimination. To the extent that strong opposition was raised over the proposal for so called „census‟ of Muslims in Indian Army. Several sections of Indian Army have also opposed the headcount on the basis of religion especially when the Sachar Panel had sought the data on Muslims share in Indian Army. Hence, there is no official report available in this regard. However, the strength of Muslim may be roughly around 2.50-3%, forming approximately 25-29000 personnel (CNN IBN). -

Personal Information Peer Abdul

PERSONAL PEER ABDUL HASEEB SHAH INFORMATION Department of Bioresources, University of Kashmir, Srinagar-J&K 190006, India. 0194-2950858 +91-9596528258 [email protected], [email protected] Sex:Male| Date of birth:23/03/1984| Nationality:Indian PRESENT POSITION Presently, I serve as DST-INSPIRE Faculty at the University of Kashmir, Srinagar. I completed my Ph.D. on the topic entitled “Structural and Functional studies of Multidrug Resistance Proteins of Pathogenic Candida.” After my thesis submission, I worked as a Post-doctoral research fellow at the School of Life Sciences, Jawaharlal Nehru University, New Delhi. Currently, I have started my independent research with a couple of ongoing national-level research projects. My research interests are focused mainly on understanding the basic biology, drug resistance, and regulation of membrane protein levels by various post-translational events in human pathogenic fungi, mostly belonging to the genus Candida. We also try to understand the drug resistance mechanisms adopted by different local clinical isolates of human pathogenic fungi. Besides research, I regularly teach various courses to Master’s level students at the University of Kashmir, Srinagar. In addition to research and teaching at university, I also serve as American Society for Microbiology (ASM) Young Ambassador to India, wherein we try to advance the knowledge about microbial sciences locally. ACADEMIC DETAILS 2016-Present DST-INSPIRE Faculty University of Kashmir, Srinagar-190006, India 2014-2015 Postdoctoral Research Fellow Jawaharlal Nehru University, New Delhi-110067 2008-2014 Ph. D. Life Sciences Jawaharlal Nehru University, New Delhi-110067 2006-2008 M. Sc. Biotechnology University of Kashmir 2003-2005 B. -

“Going to Wipe Their Tears”

“Going to Wipe their Tears” Pyarelal Compiled from ‘Mahatma Gandhi : The Last Phase’ by Mahendra Meghani First Published: December 2002 Printed and Published by Jitendra T. Desai Navajivan Mudranalaya, Ahmedabad-380 014 “Going to Wipe their Tears” INTRODUCTION The present book covers the last years of Mahatma Gandhi's life in which the results of all the experiments that he carried out throughout his career were put to their severest and final test. The author's writings in Young India and Harijan and several works on Mahatma Gandhi have well established him as a faithful and authoritative chronicler and interpreter of Gandhiji's life and philosophy. It is only in a detailed account of what Gandhiji did, how he did it and why he did it that a soul-stirring picture of his life and teaching can be found. The present work represents such an attempt by one who had the opportunity to know at first hand the events he has described and has the insight to interpret them correctly. What made Mahatma Gandhi almost unique among leaders of men was his capacity to harmonise widely different points of view so that they became contributory to the prosecution of the common goal. An outstanding instance of this was the way in which he dealt with his colleagues in the Congress organisation who differed from him. While holding to his own principle, he allowed his colleagues full scope to serve the country according to their light. As a result of this not only most intimate relations continued between them, but also those who differed from him ultimately came round and worked under his leadership. -

Islam and Politics

Islam and Politics Renewal and Resistance in the Muslim World Amit Pandya Ellen Laipson Editors Copyright © 2009 The Henry L. Stimson Center ISBN: 978-0-9821935-1-8 Cover photos: Father and son reading the Koran, Indonesia © 1996 Lindsay Hebberd/ Corbis; India elections © 2004 Amit Bhargava/Corbis Cover design by Free Range Studios Book design/layout by Nita Congress All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means without prior written consent from The Henry L. Stimson Center. The Henry L. Stimson Center 1111 19th Street, NW, 12th Floor Washington, DC 20036 Telephone: 202.223.5956 Fax: 202.238.9604 www.stimson.org Appendix 2: Experts Consulted Saadia Abbasi, Pakistan Muslim League-Nawaz Abdullah Abdullah, former Foreign Minister, Afghanistan Omar Khan Afridi, former Chief Secretary, North-West Frontier Province, Pakistan Shaista Jan Ahadi, Paktia Provincial Council, Afghanistan Anis Ahmad, Riphah International University, Pakistan Khurshid Ahmad, Institute of Policy Studies, Pakistan Shamshad Ahmad, former Foreign Secretary, Pakistan Khalil Ahmed, Tata Institute of Social Sciences, India Rafeeq Ahmed, Jamaat-e-Islami Hind, India Muhammad Akram, Oxford Centre for Islamic Studies, United Kingdom Mustapha Alani, Gulf Research Center, United Arab Emirates Mustafa Ali, African Council of Religions Leaders-Religions for Peace, Kenya Tahir Amin, Quaid-i-Azam University, Pakistan Tania Amir, Barrister-at-Law, Bangladesh Taharudin Piang Ampatuan, Major, Philippine Armed Forces; S. Rajaratnam -

Pmsss -2019-20

Prime Minister’s Special Scholarship Scheme- 2019-20 Provisional Allotment: Round 3 Department of Higher the Education, Ministry of Human Resource Development, Govt. of India is implementing Prime Minister`s Special Scholarship Scheme for J&K (PMSSS J&K) students from the academic year 2011. AICTE, being the implementing authority, awards scholarships to the candidates offered admission against supernumerary seats through online centralized counseling process under PMSSS. Supernumerary seats are created by University Grant Commission (UGC) in General Colleges and Universities; by AICTE in the approved Engineering Colleges (maximum of 04 seats per course) and 02 supernumerary seats in Pharmacy, Hotel Management, Architecture Colleges (for Architecture courses subject to clearance of NATA) and Agriculture colleges. 05 seats are created by Indian Nursing Council in each Nursing Institute. Accordingly, AICTE has invited online applications for admission under PMSSS for the AY 2019-20. Following candidates have been provisionally selected for admission based on merit and reservation policy of J&K Govt. It is hereby informed that the admission of the candidates is provisional and will be confirmed after the fulfilment of the specific eligibility criteria for the course as prescribed by the affiliating University/Institution and will be the responsibility of the concerned candidate. Candidates who have been allotted seats can download their allotment letter and welcome letter generated by the Head of the Institute just after receiving communication by AICTE. Candidate will have to report physically to the Institute on or before 14th August, 2019 positively along with all the original documents, failing which his/her admission shall be cancelled automatically.