Case No COMP/M.1741-MCI Worldcom/Sprint REGULATION

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SCHEDULE 14A INFORMATION (Rule 14A-101) INFORMATION REQUIRED in PROXY STATEMENT Proxy Statement Pursuant to Section 14(A) of the Securities Exchange Act of 1934

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 SCHEDULE 14A INFORMATION (Rule 14a-101) INFORMATION REQUIRED IN PROXY STATEMENT Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 Filed by the Registrant Filed by a party other than the Registrant Check the appropriate box: Preliminary Proxy Statement Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) Definitive Proxy Statement Definitive Additional Materials Soliciting Material under §240. 14a-12 WEX INC. (Name of Registrant as Specified In Its Charter) (Name of Person(s) Filing Proxy Statement, if other than the Registrant) Payment of Filing Fee (Check the appropriate box): No fee required. Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 (1) Title of each class of securities to which transaction applies: (2) Aggregate number of securities to which transaction applies: (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): (4) Proposed maximum aggregate value of transaction: (5) Total fee paid: Fee paid previously with preliminary materials. Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. (1) Amount Previously Paid: (2) Form, Schedule or Registration Statement No.: (3) Filing Party: (4) Date Filed: Table of Contents WEX INC. -

Growth of the Internet

Growth of the Internet K. G. Coffman and A. M. Odlyzko AT&T Labs - Research [email protected], [email protected] Preliminary version, July 6, 2001 Abstract The Internet is the main cause of the recent explosion of activity in optical fiber telecommunica- tions. The high growth rates observed on the Internet, and the popular perception that growth rates were even higher, led to an upsurge in research, development, and investment in telecommunications. The telecom crash of 2000 occurred when investors realized that transmission capacity in place and under construction greatly exceeded actual traffic demand. This chapter discusses the growth of the Internet and compares it with that of other communication services. Internet traffic is growing, approximately doubling each year. There are reasonable arguments that it will continue to grow at this rate for the rest of this decade. If this happens, then in a few years, we may have a rough balance between supply and demand. Growth of the Internet K. G. Coffman and A. M. Odlyzko AT&T Labs - Research [email protected], [email protected] 1. Introduction Optical fiber communications was initially developed for the voice phone system. The feverish level of activity that we have experienced since the late 1990s, though, was caused primarily by the rapidly rising demand for Internet connectivity. The Internet has been growing at unprecedented rates. Moreover, because it is versatile and penetrates deeply into the economy, it is affecting all of society, and therefore has attracted inordinate amounts of public attention. The aim of this chapter is to summarize the current state of knowledge about the growth rates of the Internet, with special attention paid to the implications for fiber optic transmission. -

Top 100 for 1H 2015

` Top 100 for 1H 2015 Securities Class Action Services, LLC Published: September 28, 2015 Executive Summary ISS Securities Class Action Services tracked 61 settlements for the first half of 2015, up from from 53 settlements seen duringthe first half of 2014. Out of the 61 settlement agreements, five settlements ranked in the ISS Securities Class Action Services Top 100 for 1H 2015, which amounted for a 450 percent increase in settlement funds when compared to the same period in the previous year. The cases identified include: › American International Group, Inc. (2008) (S.D.N.Y.), which brought the highest settlement fund($900 million for approximately 200 eligible securities). › Bear Stearns Mortgage Pass-Through Certificates › IndyMac Mortgage Pass-Through Certificates (Individual & Underwriter Defendants) › Activision Blizzard, Inc. › Federal National Mortgage Association (Fannie Mae) (2008) Out of the five settlements, four were filed in the federal courts during the midst of the financial credit crisis, while one was filed in the state court relating to the company’s private sale transaction. Two of the five were alleged violating Rule 10b-5 of the Securities and Exchange Act of 1934 (Employment of Manipulative and Deceptive Practices) while three were alleged violations of the Securities Act of 1933 (Civil Liabilities on Account of False Registration Statement). Two of the five settlements relate to Generally Accepted Accounting Principles and have restated their financial during the relevant periods. Of the five settlements, two were identified in the S&P Index. One SEC initiated settlement placed in the Top 30 SEC Disgorgement amounting to $200 Million. The Securities Class Action Services Tentative Settlement Pipeline stands $17.3 Billion as of 31 July 2015. -

The Great Telecom Meltdown for a Listing of Recent Titles in the Artech House Telecommunications Library, Turn to the Back of This Book

The Great Telecom Meltdown For a listing of recent titles in the Artech House Telecommunications Library, turn to the back of this book. The Great Telecom Meltdown Fred R. Goldstein a r techhouse. com Library of Congress Cataloging-in-Publication Data A catalog record for this book is available from the U.S. Library of Congress. British Library Cataloguing in Publication Data Goldstein, Fred R. The great telecom meltdown.—(Artech House telecommunications Library) 1. Telecommunication—History 2. Telecommunciation—Technological innovations— History 3. Telecommunication—Finance—History I. Title 384’.09 ISBN 1-58053-939-4 Cover design by Leslie Genser © 2005 ARTECH HOUSE, INC. 685 Canton Street Norwood, MA 02062 All rights reserved. Printed and bound in the United States of America. No part of this book may be reproduced or utilized in any form or by any means, electronic or mechanical, including photocopying, recording, or by any information storage and retrieval system, without permission in writing from the publisher. All terms mentioned in this book that are known to be trademarks or service marks have been appropriately capitalized. Artech House cannot attest to the accuracy of this information. Use of a term in this book should not be regarded as affecting the validity of any trademark or service mark. International Standard Book Number: 1-58053-939-4 10987654321 Contents ix Hybrid Fiber-Coax (HFC) Gave Cable Providers an Advantage on “Triple Play” 122 RBOCs Took the Threat Seriously 123 Hybrid Fiber-Coax Is Developed 123 Cable Modems -

Designated Agents for Local Exchange Carriers

Designated Agents for Local Exchange Carriers Document Processor Document Processor 321 Communications, Inc. Access Point, Inc. InCorp Services, Inc. Illinois Corporation Service Company 2501 Chatham Rd., Ste. 110 801 Adlai Stevenson Dr. Springfield IL 62704-7100 Springfield IL 62703-4261 Lisa Brown John Petrakis 321 Communications, Inc. Access2Go, Inc. Regulatory and Tax Consultants 4700 N. Prospect Rd. 3483 Satellite Blvd., Ste. 202 Peoria Heights IL 61616 Duluth GA 30096-5800 Document Processor Document Processor ACN Communication Services, Inc. 360networks (USA) inc. C T Corporation System C T Corporation System 208 S. LaSalle St. 208 S. LaSalle St. Chicago IL 60604 Chicago IL 60604 Doug Forster Document Processor ACN Communication Services, Inc. AboveNet Communications, Inc. Technologies Management, Inc. d/b/a AboveNet Media Networks PO Drawer 200 Illinois Corporation Service Company Winter Park FL 32790-0200 801 Adlai Stevenson Dr. Springfield IL 62703-4261 James W. Broemmer Jr Adams Telephone Co-Operative Robert Sokota PO Box 217 AboveNet Communications, Inc. Golden IL 62339 d/b/a AboveNet Media Networks 360 Hamilton Blvd. James W. Broemmer Jr White Plains NY 10601 Adams TelSystems, Inc. PO Box 217 Robert Neumann Golden IL 62339 Access Media 3, Inc. 900 Commerce Dr., Ste. 200 Gary Pieper Oak Brook IL 60523 Advanced Integrated Technologies Inc. PO Box 51 Brian McDermott Columbia IL 62236 Access Media 3, Inc. Synergies Law Group, PLLC Mark Lammert 1002 Parker St. Advanced Integrated Technologies Inc. Falls Church VA 22046 Compliance Solutions Inc. 740 Florida Central Pkwy., Ste. 2028 Document Processor Longwood FL 32750 Access One, Inc. Corporation Service Company Ronald Dougherty 422 N. -

Akamai Technologies, Inc. (Exact Name of Registrant As Speciñed in Its Charter) Delaware 04-3432319 (State Or Other Jurisdiction of (I.R.S

SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 10-K FOR ANNUAL AND TRANSITION REPORTS PURSUANT TO SECTIONS 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 (Mark One) ¥ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Ñscal year ended December 31, 2001 or n TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File number 0-27275 Akamai Technologies, Inc. (Exact Name of Registrant as SpeciÑed in Its Charter) Delaware 04-3432319 (State or other Jurisdiction of (I.R.S. Employer Incorporation or Organization) IdentiÑcation No.) 500 Technology Square, Cambridge, MA 02139 (Address of Principal Executive OÇces) (Zip Code) Registrant's Telephone Number, including area code: (617) 444-3000 Securities registered pursuant to Section 12(b) of the Act: None. Securities registered pursuant to Section 12(g) of the Act: Common Stock, $.01 par value Indicate by check mark whether the registrant: (1) has Ñled all reports required to be Ñled by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to Ñle such reports), and (2) has been subject to such Ñling requirements for the past 90 days. Yes ¥ No n Indicate by check mark if disclosure of delinquent Ñlers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant's knowledge, in deÑnitive proxy or information statement incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. -

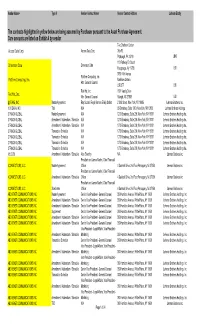

The Contracts Highlighted in Yellow Below Are Being Assumed by Purchaser Pursuant to the Asset Purchase Agreement. Cure Amounts Are Listed on Exhibit a by Vendor

Vendor Name+ Type II Vendor Contact Name Vendor Contact Address Lehman Entity The contracts highlighted in yellow below are being assumed by Purchaser pursuant to the Asset Purchase Agreement. Cure amounts are listed on Exhibit A by vendor. Two Chatham Center Access Data Corp. Access Data Corp. 24th FL Pittsburgh, PA 15219 LBHI 110 Parkway Dr. South Dimension Data Dimension Data Hauppauge, Ny 11788 LBI 3760 14th Avenue Platform Computing, Inc. Platform Computing, Inc. Markham Ontario Attn: General Counsel L3R 3T7 LBI Red Hat, Inc. 1801 Varsity Drive Red Hat, Inc. Attn: General Counsel Raleigh, NC 27606 LBI @STAKE, INC Master Agreement Ray Scutari, Royal Hansen, Emily Sebert 2 Wall Street, New York, NY 10005 Lehman Brothers, Inc. 1010 DATA, INC Trial N/A 65 Broadway, Suite 1010, New York, NY 10006 Lehman Brothers Holdings 2 TRACK GLOBAL Master Agreement N/A 1270 Broadway, Suite 208, New York, NY 10001 Lehman Brothers Holdings Inc. 2 TRACK GLOBAL Amendment / Addendum / Schedule N/A 1270 Broadway, Suite 208, New York, NY 10001 Lehman Brothers Holdings Inc. 2 TRACK GLOBAL Amendment / Addendum / Schedule N/A 1270 Broadway, Suite 208, New York, NY 10001 Lehman Brothers Holdings Inc. 2 TRACK GLOBAL Transaction Schedule N/A 1270 Broadway, Suite 208, New York, NY 10001 Lehman Brothers Holdings Inc. 2 TRACK GLOBAL Transaction Schedule N/A 1270 Broadway, Suite 208, New York, NY 10001 Lehman Brothers Holdings Inc. 2 TRACK GLOBAL Transaction Schedule N/A 1270 Broadway, Suite 208, New York, NY 10001 Lehman Brothers Holdings Inc. 2 TRACK GLOBAL Transaction Schedule N/A 1270 Broadway, Suite 208, New York, NY 10001 Lehman Brothers Holdings Inc. -

UNITED STATES SECURITIES and EXCHANGE COMMISSION Washington, D.C

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 13F Report for the Calendar Year or Quarter Ended December 31, 1999 ------------------- Check here if Amendment: / /; Amendment Number: ______ This Amendment (Check only one.): / / is a restatement. / / adds new holdings entries. Institutional Investment Manager Filing this Report: Name: U.S. Bancorp ------------ Address: 601 Second Avenue South ----------------------- Minneapolis, MN 55402-4302 -------------------------- Form 13F File Number: 28- 551 --- The institutional investment manager filing this report and the person by whom it is signed hereby represent that the person signing the report is authorized to submit it, that all information contained herein is true, correct and complete, and that it is understood that all required items, statements, schedules, lists, and tables, are considered integral parts of this form. Person signing this Report on Behalf of Reporting Manager: Name: Merita D. Schollmeier --------------------- Title: Vice President -------------- Phone: 651-205-2030 ------------ Signature, Place, and Date of Signing: /s/ Merita D. Schollmeier St. Paul, MN 2/11/00 - ------------------------- ------------ ------- Information contained on the attached Schedule 13(f) is provided solely to comply with the requirements of Section 13(f) of the Securities Exchange Act of 1934 and Regulations promulgated thereunder. It is the position of U.S. Bancorp, that for any purpose other than Schedule 13-F, it is not an institutional investment manager and does not, in fact, exercise investment discretion with regard to any securities held in a fiduciary or agency capacity by any subsidiary or trust company. Report Type (Check only one.): /X/ 13F HOLDINGS REPORT. (Check here if all holdings of this reporting manager are reported in this report.) / / 13F NOTICE. -

2016 Takeover Law & Practice

Wachtell, Lipton, Rosen & Katz Takeover Law and Practice 2016 This outline describes certain aspects of the current legal and economic environment relating to takeovers, including mergers and acquisitions and tender offers. The outline topics include a discussion of directors’ fiduciary duties in managing a company’s affairs and considering major transactions, key aspects of the deal-making process, mechanisms for protecting a preferred transaction and increasing deal certainty, advance takeover preparedness and responding to hostile offers, structural alternatives and cross-border transactions. Particular focus is placed on recent case law and developments in takeovers. This edition reflects developments through mid-March 2016. © March 2016 Wachtell, Lipton, Rosen & Katz All rights reserved. Takeover Law and Practice TABLE OF CONTENTS Page I. Current Developments ..............................................................................1 A. Executive Summary ............................................................ 1 B. M&A Trends and Developments ........................................ 2 1. Deal Activity ........................................................... 2 2. Hostile and Unsolicited M&A ................................ 4 3. Private Equity Trends ............................................. 4 4. Acquisition Financing ............................................. 7 a. Investment Grade Acquisition Financing..................................................... 7 b. Leveraged Acquisition Financing ............... 7 5. Shareholder -

NASD Notice to Members 99-46

Executive Summary $250, and two or more Market NASD Effective July 1, 1999, the maximum Ma k e r s . Small Order Execution SystemSM (S O E S SM ) order sizes for 336 Nasdaq In accordance with Rule 4710, Nas- Notice to National Market® (NNM) securities daq periodically reviews the maxi- will be revised in accordance with mum SOES order size applicable to National Association of Securities each NNM security to determine if Members Dealers, Inc. (NASD®) Rule 4710(g). the trading characteristics of the issue have changed so as to warrant For more information, please contact an adjustment. Such a review was 99-46 ® Na s d a q Market Operations at conducted using data as of March (203) 378-0284. 31, 1999, pursuant to the aforemen- Maximum SOES Order tioned standards. The maximum Sizes Set To Change SOES order-size changes called for Description by this review are being implemented July 1, 1999 Under Rule 4710, the maximum with three exceptions. SOES order size for an NNM security is 1,000, 500, or 200 shares, • First, issues were not permitted to depending on the trading characteris- move more than one size level. For Suggested Routing tics of the security. The Nasdaq example, if an issue was previously ® Senior Management Workstation II (NWII) indicates the categorized in the 1,000-share maximum SOES order size for each level, it would not be permitted to Ad v e r t i s i n g NNM security. The indicator “NM10,” move to the 200-share level, even if Continuing Education “NM5,” or “NM2” displayed in NWII the formula calculated that such a corresponds to a maximum SOES move was warranted. -

BEA Systems, Inc

BEA AT A GLANCE FINANCIAL PERFORMANCE (as of and for the period ended July 31, 2004) Q2 Total Revenue $262.3 million – 7% increase over last year’s quarter Q2 License Revenue $116.3 million Q2 License/Services Mix 44.3% /55.7% Q2 Customer Support $113.5 million – 78% of services revenue, 25% year over year growth Q2 Operating Margin (a) 19.5% (GAAP Operating Margin 17.9%) Q2 EPS (a)(b) $0.08 (GAAP EPS $0.07) Deferred Revenues $261 million – Down approx. $7 million from Q1 05 Current Cash and Restricted Cash $1.58 billion Q2 Operating Cash Flow $57.2 million – 27th consecutive quarter of positive operating cash flow Days’ sales outstanding 71 days (a) Adjusted to exclude amortization of acquired intangible assets and goodwill; employer payroll taxes on stock options; net gains or losses on investments in equity securities and other non-recurring charges. (b) Amounts presented on a pro forma basis, assuming a tax rate of 30 percent. Background on BEA Systems BEA is the world's leading application infrastructure software company with more than 15,000 customers around the world, including the majority of the Fortune Global 500. Companies turn to BEA to help them evolve their existing enterprise software applications from inflexible, redundant, legacy architectures to highly responsive, mature Web infrastructures. Services Oriented Architecture (SOA) is an industry movement that is transforming IT to an efficient, more responsive function and is improving overall IT economics. SOA enables the service- driven enterprise to efficiently service its constituents – customers, employees, partners—and accelerates the service response time of the business. -

SEC News Digest, August 2, 2000

SEC NEWS DIGEST Issue 2000-147 August 2000 COMMISSION ANNOUNCEMENTS CORRECTION Press Release 2000-106 which appeared in the August issue of the Digest included The correct address is an inaccurate EDGAR filing web site address https//www edgarfiling sec.gov INVESTMENT COMPANY ACT ARK FUNDS ET AL An order has been issued on an application filed by ARK Funds et al for an order under Section 17b of the Investment Company Act exempting applicants from Section of four series of The 17a of the Act The order permits the proposed reorganizations Govett Funds Inc with and into four series of ARK Funds Because of certain Act IC-24587 affiliations applicants may not rely on Rule 17a-8 under the Rel July 31 SELF-REGULATORY ORGANIZATIONS IMMEDIATE EFFECTWENESS OF PROPOSED RULE CHANGE proposed rule change filed by the Municipal Securities Rulemaking Board consisting of technical amendments to MSRB Rules G-8 and G-15 SR-MSRB-00-9 has become Publication of effective under Section 9b3A of the Securities Exchange Act of 1934 34- the proposal is expected in the Federal Register during the week of August Rel 43090 APPROVAL OF PROPOSED RULE CHANGE The Commission approved proposed rule change SR-CBOE-99-35 submitted by the orders Chicago Board Options Exchange relating to facilitation crosses of index options Publication of the order in the Federal Register is expected during the week of August Rel 34-43099 DELISTJNGS GRANTED An order has been issued granting the application of the New York Stock Exchange to $.01 strike from listing and registration Dyersburg