Newspace Strategy for Catalonia. Open in a New Window

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

RAÚL TORRES, CEO and Co-Founder of PLD Space

RAÚL TORRES, CEO and co-founder of PLD Space Raúl Torres, a 33-year-old Spanish businessman, is CEO and co-founder of PLD Space, the Spanish launcher company that will provide scientific and commercial access to space for small satellites and payloads. Raúl has a degree in Biological Sciences from the University of Alicante and has studies in Aerospace Engineering from the Polytechnic University of Valencia. In 2011, Raúl Torres founded, together with Raúl Verdú, PLD Space. The company closed its first initial investment round in 2013, with an investment of 1 million euros and with the participation of Business Angels and public institutions (CDTI). At the end of 2015, the Spanish Science Association honored both co-founders for their achievements in the field of space propulsion; PLD Space developed from scratch and tested in its private facilities, located at the Teruel airport, the first reusable liquid rocket engine in Europe fully dedicated to driving the small satellite industry. At the end of 2016, PLD Space closed a series A1 investment round of more than 6 million euros between public and private investment and with the corporate backing of the Spanish space company GMV as a technical investor and shareholder. In May 2018, PLD Space raised an investment round of 10 million euros with the participation of new investors such as the Spanish aeronautical firm ACITURRI and the venture capital fund JME, from José Manuel Entrecanales, CEO of Acciona. In April 2019, the recovery test of a demonstrator of the first stage of the MIURA 5 orbital launcher was carried out, in which the Army collaborated with the support from a Chinook helicopter. -

Revista De Aeronáutica Y Astronáutica, 902, Mayo 2021

NÚM. 902 2021 MAYO DOSIER: SEGURIDAD Y DEFENSA AEROESPACIAL Destacamento PAZNIC 00 Portada MAYO 2021.indd 1 14/4/21 11:17 CIEN AÑOS DEL CUARTEL «INFANTE Cien años del Cuartel «Infante Don Juan» DON JUAN» PATRIMONIO HISTÓRICO, Patrimonio histórico, artístico ARTÍSTICO Y DOCUMENTAL y documental prototípico PROTOTÍPICO Autor: Dirección de Asistencia al Personal del Ejército de Tierra 78 páginas Edición electrónica gratuita NIPO: 083-21-014-1 La Legión LA LEGIÓN 100 AÑOS, 100 IMÁGENES 100 años,100 imágenes Autor: Varios autores 1920 2020 342 páginas 25,00 euros ISBN: 978-84-9091-513-4 MINISTERIO DE DEFENSA USOS MILITARES DE LA INTELIGENCIA ARTIFICIAL, LA AUTOMATIZACIÓN Y LA ROBÓTICA (IAA&R) Autor: Centro Conjunto de Desarrollo de Conceptos Centro Usos militares de la inteligencia Conjunto de artificial, la automatización y la Desarrollo de Conceptos robótica (IAA&R) 180 páginas Edición electrónica gratuita Impresión bajo demanda: 10,00€ NIPO: 083-20-043-7 MINISTERIO DE DEFENSA DESVELANDO HORIZONTES. OBRA COMPLETA (3 VOLÚMENES) Autor: Varios autores 2292 páginas 75,00 euros NOVEDADES EDITORIALES NOVEDADES https://publicaciones.defensa.gob.es/ 256 nov editoriales.indd 736 25/3/21 7:41 revista de aeronáutica y astronáutica 355 NORMAS DE COLABORACIÓN Las colaboraciones con la Revista de Aeronáutica y Astronáutica se realizarán teniendo en cuenta las siguientes instrucciones: Director: • Los artículos deben tener relación, preferentemente, con temas de actualidad Coronel: Raúl M. Calvo Ballesteros [email protected] relacionados con la aeronáutica y el espacio, el Ejército del Aire y sus unidades, las Fuerzas Armadas en general y todos aquellos cuyo contenido sea conside- Consejo de Redacción: rado de interés por el consejo de redacción. -

Ficha España Maquetación 1 22/04/2020 16:45 Página 141

ficha españa_Maquetación 1 22/04/2020 16:45 Página 141 El Ejército del Aire cuenta ya con 7 aviones Airbus DS A400M (foto Julio Maíz). Presupuestos generales de Defensa SISTEMAS AÉREOS • El Consejo de Ministros autorizaba en diciembre de 2018 la modernización de la flota de los cazabombarderos Eurofighter Los últimos presupuestos para el Ministerio de Defensa (MD) para del Ejército del Aire por un importe de 1.030 millones de USD. el ejercicio 2019 presentados por el Gobierno socialista ascendían a Los trabajos está previsto que los realice Airbus Defence and 10.079 millones de millones de USD (moneda en que se darán todas Space (DS) en su planta de Getafe (Madrid). las cifras), teóricamente un 1,5% más que en 2018, que fueron de 9.934 millones. Aunque finalmente al no llegar a aprobarse las cuentas públicas, quedaron sin efecto, prologándose los de 2018 Planificación de compras y contratos realizados por el partido de centro-derecha PP. La propuesta incluía la partida destinada a la financiación del Centro Nacional de SISTEMAS TERRESTRES Inteligencia (CNI), que es de 337 millones, que antes dependía y su • Está en marcha el programa para reequipar al ET con un moder- presupuesto estaba asignado al Ministerio de Presidencia. Los no vehículo blindado 8x8, que sustituirá a los BMR M1, que a importantes gastos de la inteligencia española se habrían incremen- finales de 2019 la Dirección General de Armamento y Material tado en un 4,8%, respecto a los 321 millones que se le asignaron en (DGAM) se declaró desierto. Actualmente se contempla ya la 2018. -

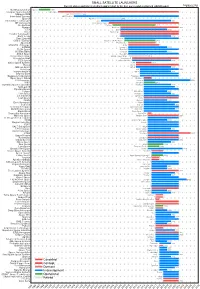

2019 Nano/Microsatellite Market Forecast, 9Th Edition

2019 NANO/MICROSATELLITE MARKET FORECAST, 9TH EDITION Copyright 2018, SpaceWorks Enterprises, Inc. (SEI) APPROVED FOR PUBLIC RELEASE. SPACEWORKS ENTERPRISES, INC., COPYRIGHT 2018. 1 Since 2008, SpaceWorks has actively monitored companies and economic activity across both the satellite and launch sectors 0 - 50 kg 50 - 250kg 250 - 1000kg 1000 - 2000kg 2000kg+ Custom market assessments are available for all mass classes NANO/MICROSATELLITE DEFINITION Picosatellite Nanosatellite Microsatellite Small/Medium Satellite (0.1 – 0.99 kg) (1 – 10 kg) (10 – 100 kg) (100 – 1000 kg) 0 kg 1 kg 10 kg 100 kg 1000 kg This report bounds the upper range of interest in microsatellites at 50 kg given the relatively large amount of satellite development activity in the 1 – 50 kg range FORECASTING METHODOLOGY SpaceWorks’ proprietary Launch Demand Database (LDDB) Downstream serves as the data source for all satellite market Demand assessments ▪ Planned The LDDB is a catalogue of over 10,000+ historical and Constellations future satellites containing both public and non-public (LDDB) satellite programs Launch Supply SpaceWorks newly updated Probabilistic Forecast Model (PFM) is used to generate future market potential SpaceWorks PFM Model ▪ The PFM considers down-stream demand, announced/planed satellite constellations, and supply-side dynamics, among other relevant factors Expert Analysis The team of expert industry analysts at SpaceWorks SpaceWorks further interprets and refines the PFM results to create Forecast accurate market forecasts Methodology at a Glance 2018 SpaceWorks forecasted 2018 nano/microsatellite launches with unprecedented accuracy – actual satellites launched amounted to just 5% below our analysts’ predictions. In line with SpaceWorks’ expectations, the industry corrected after a record launch year in 2017, sending 20% less nano/microsatellites to orbit than in 2018. -

Small Satellite Launchers

SMALL SATELLITE LAUNCHERS NewSpace Index 2020/04/20 Current status and time from development start to the first successful or planned orbital launch NEWSPACE.IM Northrop Grumman Pegasus 1990 Scorpius Space Launch Demi-Sprite ? Makeyev OKB Shtil 1998 Interorbital Systems NEPTUNE N1 ? SpaceX Falcon 1e 2008 Interstellar Technologies Zero 2021 MT Aerospace MTA, WARR, Daneo ? Rocket Lab Electron 2017 Nammo North Star 2020 CTA VLM 2020 Acrux Montenegro ? Frontier Astronautics ? ? Earth to Sky ? 2021 Zero 2 Infinity Bloostar ? CASIC / ExPace Kuaizhou-1A (Fei Tian 1) 2017 SpaceLS Prometheus-1 ? MISHAAL Aerospace M-OV ? CONAE Tronador II 2020 TLON Space Aventura I ? Rocketcrafters Intrepid-1 2020 ARCA Space Haas 2CA ? Aerojet Rocketdyne SPARK / Super Strypi 2015 Generation Orbit GoLauncher 2 ? PLD Space Miura 5 (Arion 2) 2021 Swiss Space Systems SOAR 2018 Heliaq ALV-2 ? Gilmour Space Eris-S 2021 Roketsan UFS 2023 Independence-X DNLV 2021 Beyond Earth ? ? Bagaveev Corporation Bagaveev ? Open Space Orbital Neutrino I ? LIA Aerospace Procyon 2026 JAXA SS-520-4 2017 Swedish Space Corporation Rainbow 2021 SpinLaunch ? 2022 Pipeline2Space ? ? Perigee Blue Whale 2020 Link Space New Line 1 2021 Lin Industrial Taymyr-1A ? Leaf Space Primo ? Firefly 2020 Exos Aerospace Jaguar ? Cubecab Cab-3A 2022 Celestia Aerospace Space Arrow CM ? bluShift Aerospace Red Dwarf 2022 Black Arrow Black Arrow 2 ? Tranquility Aerospace Devon Two ? Masterra Space MINSAT-2000 2021 LEO Launcher & Logistics ? ? ISRO SSLV (PSLV Light) 2020 Wagner Industries Konshu ? VSAT ? ? VALT -

The Annual Compendium of Commercial Space Transportation: 2017

Federal Aviation Administration The Annual Compendium of Commercial Space Transportation: 2017 January 2017 Annual Compendium of Commercial Space Transportation: 2017 i Contents About the FAA Office of Commercial Space Transportation The Federal Aviation Administration’s Office of Commercial Space Transportation (FAA AST) licenses and regulates U.S. commercial space launch and reentry activity, as well as the operation of non-federal launch and reentry sites, as authorized by Executive Order 12465 and Title 51 United States Code, Subtitle V, Chapter 509 (formerly the Commercial Space Launch Act). FAA AST’s mission is to ensure public health and safety and the safety of property while protecting the national security and foreign policy interests of the United States during commercial launch and reentry operations. In addition, FAA AST is directed to encourage, facilitate, and promote commercial space launches and reentries. Additional information concerning commercial space transportation can be found on FAA AST’s website: http://www.faa.gov/go/ast Cover art: Phil Smith, The Tauri Group (2017) Publication produced for FAA AST by The Tauri Group under contract. NOTICE Use of trade names or names of manufacturers in this document does not constitute an official endorsement of such products or manufacturers, either expressed or implied, by the Federal Aviation Administration. ii Annual Compendium of Commercial Space Transportation: 2017 GENERAL CONTENTS Executive Summary 1 Introduction 5 Launch Vehicles 9 Launch and Reentry Sites 21 Payloads 35 2016 Launch Events 39 2017 Annual Commercial Space Transportation Forecast 45 Space Transportation Law and Policy 83 Appendices 89 Orbital Launch Vehicle Fact Sheets 100 iii Contents DETAILED CONTENTS EXECUTIVE SUMMARY . -

Cuadernos De Estrategia 170. El Sector Espacial En España

Cuadernos de Estrategia 170 Instituto Español El sector espacial en España. de Estudios Evolución y perspectivas Estratégicos MINISTERIO DE DEFENSA Cuadernos de Estrategia 170 Instituto Español El sector espacial en España. de Estudios Evolución y perspectivas Estratégicos MINISTERIO DE DEFENSA CATÁLOGO GENERAL DE PUBLICACIONES OFICIALES http://publicacionesoficiales.boe.es/ Edita: SECRETARÍA GENERAL TÉCNICA http://publicaciones.defensa.gob.es/ © Autor y editor, 2014 NIPO: 083-14-236-5 (edición papel) NIPO: 083-14-235-X (edición libro-e) ISBN: 978-84-9091-006-1 (edición papel) ISBN: 978-84-9091-005-4 (edición libro-e) Depósito Legal: M-30595-2014 Fecha de edición: diciembre 2014 Imprime: Imprenta del Ministerio de Defensa Las opiniones emitidas en esta publicación son exclusiva responsabilidad de los autores de la misma. Los derechos de explotación de esta obra están amparados por la Ley de Propiedad Intelectual. Ninguna de las partes de la misma puede ser reproducida, almacenada ni transmitida en ninguna forma ni por medio alguno, electrónico, mecánico o de grabación, incluido fotocopias, o por cual- quier otra forma, sin permiso previo, expreso y por escrito de los titulares del © Copyright. En esta edición se ha utilizado papel 100% reciclado libre de cloro. ÍNDICE Página Introducción Vicente Gómez Domínguez Sinopsis ....................................................................................................................... 15 Resumen de los capítulos ...................................................................................... -

MIURA 5 the European and Reusable Microlauncher for Cubesats and Small Satellites Pablo Gallego, PLD Space, [email protected]

MIURA 5 The European and Reusable Microlauncher for CubeSats and Small Satellites Pablo Gallego, PLD Space, [email protected] PLD Space is the emerging spaceflight company of Europe aiming to PAYLOAD ACCOMMODATION provide affordable, flexible and fast access to space. Currently there are two launch vehicles under development: MIURA 1 and MIURA 5 MIURA 5 is equipped with a lightweight MIURA 1 –asoundingrocket–designedtoprovideaccesstothe carbon composite fairing with a volume big space environment and microgravity. Additionally, it serves as a enough to house a huge variety of possible technology demonstrator and flying test bed for MIURA 5. payload constellations underneath it. A MIURA 5 – a microlauncher – designed for delivering CubeSats and dedicated launch, a piggy-back launch or a small satellites into a low earth orbit. rideshare mission can easily be accommodated. The MIURA 5 payload adapter can support MIURA 5 CHARACTERISTICS almost all commercially available satellite deployment systems and CubeSat MIURA 5 is a two-stage launch vehicle. Its first dispensers. The customer is free to choose stage is propelled by five regeneratively cooled a system that best fits the payload needs. liquid engines which are designed and built in- house by PLD Space. The second stage is Payload Fairing propelled by a single engine of similar design. Nominal Payload 300 kg to 500 km Mass: SSO Vehicle Useable Length: 2.97 m Length: 25 m Useable Diameter: 1.65 m Diameter: 1.8 m Lift-Off Mass: 32.000 kg Stages: 2 + optional kick-stage Propellants: LOX / Kerosene Reusability: First Stage Dedicated Launch Piggy-Back Launch Rideshare Launch First Stage One satellite occupies the A main satellite and multiple Multiple satellites with equal entire payload capacity. -

WALLONIE ESPACE INFOS N 44 Mai-Juin 2009

WALLONIE ESPACE INFOS n°84 janvier-février 2016 WALLONIE ESPACE INFOS n°84 janvier-février 2016 Coordonnées de l’association Wallonie Espace Wallonie Espace WSL, Liege Science Park, Rue des Chasseurs Ardennais, B-4301 Angleur-Liège, Belgique Tel. 32 (0)4 3729329 Skywin Aerospace Cluster of Wallonia Chemin du Stockoy, 3, B-1300 Wavre, Belgique Contact: Michel Stassart, e-mail: [email protected] Le présent bulletin d’infos en format pdf est disponible sur le site de Wallonie Espace (www.wallonie-espace.be), sur le portal de l’Euro Space Center/Belgium, sur le site du pôle Skywin (http://www.skywin.be). SOMMAIRE : Thèmes : articles Mentions Wallonie Espace Page Correctif - Actualité : Sentinel-1B lancé le 22 avril par Soyouz (avec ULg, Thales Alenia Space 2 OUFTI-1) – Agence spatiale interfédérale de Belgique – Vingt ans pour Belgium , Amos, VitroCiset Wallonie Espace – Une Ardéchoise, pilote de CSL Belgium, Gillam, SABCA, Samtech, Sonaca, Spacebel, Techspace Aero, UCL, ULB, ULg, CSL, Euro Space Center, Skywin 1. Politique spatiale/EU + ESA: La « première » 2016 du DG de l’ESA – 5 Tableaux Budgets ESA – Compte-rendu Conférence sur la stratégie spatiale européenne : qui mène la danse dans le couple ESA-Commission européenne ? – A l’heure du Space 4.0 – Intérêt du Grand-Duché pour les ressources dans l’espace – La Corée du Nord exclue de la communauté spatiale ? 2. Accès à l'espace/Arianespace : Interview exclusive d’Alain SABCA, Techspace Aero, Thales 17 Charmeau (Airbus Safran Launchers) – Enquête de la Commission Alenia Space Belgium sur la prise de contrôle d’Arianespace – Duel Arianespace-SpaceX : c’est Ariane 5 qui gagne ! – Débuts, cette année, des lanceurs chinois de nouvelle génération – Tableau mondial des nouveaux lanceurs en préparation (avec des révélations !) WEI n°84 2016-01 - 1 WALLONIE ESPACE INFOS n°84 janvier-février 2016 3. -

ESPI Insights Space Sector Watch

ESPI Insights Space Sector Watch Issue 9 September 2020 THIS MONTH IN THE SPACE SECTOR… FOCUS: COVID-19, 2020 AND EUROPEAN PRIVATE SPACE INVESTMENTS ................................................ 1 POLICY & PROGRAMMES .................................................................................................................................... 2 Vega returns to flight with the new rideshare service .................................................................................. 2 NASA takes a first step towards commercial lunar mining......................................................................... 2 White House releases SPD-5 on cybersecurity .............................................................................................. 2 ESA selects Airbus for Copernicus CRISTAL mission .................................................................................. 3 Italy signs Declaration with NASA to cooperate on Artemis ....................................................................... 3 France boosts space through its national relaunch plan ............................................................................. 3 OHB to lead the Hera planetary defence mission ......................................................................................... 3 BDI proposes sea-based small launch platform for Germany .................................................................... 4 Update of the Artemis funding requirements ................................................................................................ -

The Future of the European Space Sector How to Leverage Europe’S Technological Leadership and Boost Investments for Space Ventures

The future of the European space sector How to leverage Europe’s technological leadership and boost investments for space ventures The future of the European space sector How to leverage Europe’s technological leadership and boost investments for space ventures Prepared for: The European Commission By: Innovation Finance Advisory in collaboration with the European Investment Advisory Hub, part of the European Investment Bank’s advisory services Authors: Alessandro de Concini, Jaroslav Toth Supervisor: Shiva Dustdar Contact: [email protected] Consultancy support: SpaceTec Partners © European Investment Bank, 2019. All rights reserved. All questions on rights and licensing should be addressed to [email protected] Disclaimer This Report should not be referred to as representing the views of the European Investment Bank (EIB), of the European Commission (EC) or of other European Union (EU) institutions and bodies. Any views expressed herein, including interpretation(s) of regulations, reflect the current views of the author(s), which do not necessarily correspond to the views of EIB, of the EC or of other EU institutions and bodies. Views expressed herein may differ from views set out in other documents, including similar research papers, published by the EIB, by the EC or by other EU institutions and bodies. Contents of this Report, including views expressed, are current at the date of publication set out above, and may change without notice. No representation or warranty, express or implied, is or will be made and no liability or responsibility is or will be accepted by EIB, by the EC or by other EU institutions and bodies in respect of the accuracy or completeness of the information contained herein and any such liability is expressly disclaimed. -

MIURA1: the Reusable Sounding Rocket. Recovery and Reusability Strategies

DOI: 10.13009/EUCASS2019-358 8TH EUROPEAN CONFERENCE FOR AERONAUTICS AND SPACE SCIENCES (EUCASS) MIURA1: The Reusable Sounding Rocket. Recovery and Reusability Strategies Mariagrazia Bibiano*, Francisco García+and Raul Torres§ * [email protected] + [email protected] § [email protected] PLD Space Calle Nicolás Copérnico 7, 03203 Elche, Spain Abstract Reusability in Launchers has been a topic of research and interest in the last years to improve the Access to Space. In Europe, PLD Space is one of the few companies betting in the concept of recovery and reusability in the launchers sector. With MIURA1, a sounding rocket and technology demonstrator of a microlauncher, PLD Space wants to demonstrate a potential recovery and reusability strategy for small launchers. MIURA1, designed to be used up to three times, is a liquid propellant rocket with the capability of carrying up to 100 kg of payload to an apogee of 120 km. Its recovery system is characterized by a deceleration system and a two-stage parachutes system. The sounding rocket will be launched from CEDEA Launch Site at the South of Spain in 2020 and will be recovered after splashdown at around 80 km (nominal case) from the Gulf of Huelva. MIURA1, after reaching apogee, will slow-down until it will reach handover conditions for the two- stage parachutes opening. The first-stage parachute, the drogue chute, will be opened at 5 km, while the second-stage parachute, the main chute, will be opened at 3 km. After splashdown, the sounding rocket and the parachutes system will be recovered by a tugboat and transported to the harbour.