Table of Contents

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Oil Refining in Mexico and Prospects for the Energy Reform

Articles Oil refining in Mexico and prospects for the Energy Reform Daniel Romo1 1National Polytechnic Institute, Mexico. E-mail address: [email protected] Abstract: This paper analyzes the conditions facing the oil refining industry in Mexico and the factors that shaped its overhaul in the context of the 2013 Energy Reform. To do so, the paper examines the main challenges that refining companies must tackle to stay in the market, evaluating the specific cases of the United States and Canada. Similarly, it offers a diagnosis of refining in Mexico, identifying its principal determinants in order to, finally, analyze its prospects, considering the role of private initiatives in the open market, as well as Petróleos Mexicanos (Pemex), as a placeholder in those areas where private enterprises do not participate. Key Words: Oil, refining, Energy Reform, global market, energy consumption, investment Date received: February 26, 2016 Date accepted: July 11, 2016 INTRODUCTION At the end of 2013, the refining market was one of stark contrasts. On the one hand, the supply of heavy products in the domestic market proved adequate, with excessive volumes of fuel oil. On the other, the gas and diesel oil demand could not be met with production by Petróleos Mexicanos (Pemex). The possibility to expand the infrastructure was jeopardized, as the new refinery project in Tula, Hidalgo was put on hold and the plan was made to retrofit the units in Tula, Salamanca, and Salina Cruz. This situation constrained Pemex's supply capacity in subsequent years and made the country reliant on imports to supply the domestic market. -

Climate and Energy Benchmark in Oil and Gas Insights Report

Climate and Energy Benchmark in Oil and Gas Insights Report Partners XxxxContents Introduction 3 Five key findings 5 Key finding 1: Staying within 1.5°C means companies must 6 keep oil and gas in the ground Key finding 2: Smoke and mirrors: companies are deflecting 8 attention from their inaction and ineffective climate strategies Key finding 3: Greatest contributors to climate change show 11 limited recognition of emissions responsibility through targets and planning Key finding 4: Empty promises: companies’ capital 12 expenditure in low-carbon technologies not nearly enough Key finding 5:National oil companies: big emissions, 16 little transparency, virtually no accountability Ranking 19 Module Summaries 25 Module 1: Targets 25 Module 2: Material Investment 28 Module 3: Intangible Investment 31 Module 4: Sold Products 32 Module 5: Management 34 Module 6: Supplier Engagement 37 Module 7: Client Engagement 39 Module 8: Policy Engagement 41 Module 9: Business Model 43 CLIMATE AND ENERGY BENCHMARK IN OIL AND GAS - INSIGHTS REPORT 2 Introduction Our world needs a major decarbonisation and energy transformation to WBA’s Climate and Energy Benchmark measures and ranks the world’s prevent the climate crisis we’re facing and meet the Paris Agreement goal 100 most influential oil and gas companies on their low-carbon transition. of limiting global warming to 1.5°C. Without urgent climate action, we will The Oil and Gas Benchmark is the first comprehensive assessment experience more extreme weather events, rising sea levels and immense of companies in the oil and gas sector using the International Energy negative impacts on ecosystems. -

The Journey Continues

The Magazine of Volume 67 Moran Towing Corporation November 2020 The J our ney Continu es In Moran’s New Training Programs, Boots, Books, and Technology Redouble a Shared Vision of Safety PHOTO CREDITS Page 25 (inset) : Moran archives Cover: John Snyder, Pages 26 –27, both photos: marinemedia.biz Will Van Dorp Inside Front Cover: Pages 28 –29: Marcin Kocoj Moran archives Page 30: John Snyder, Page 2: Moran archives ( Fort marinemedia.biz Bragg ONE Stork ); Jeff Thoresen ( ); Page 31 (top): Dave Byrnes Barry Champagne, courtesy of Chamber of Shipping of America Page 31 (bottom): John Snyder, (CSA Environmental Achievement marinemedia.biz Awards) Pages 32 –33: John Snyder, Page 3 : Moran archives marinemedia.biz Pages 5 and 7 –13: John Snyder, Pages 3 6–37, all photos: Moran marinemedia.biz archives Page 15 –17: Moran archives Page 39, all photos: John Snyder, marinemedia.biz Page 19: MER archives Page 40: John Snyder, Page 20 –22: John Snyder, marinemedia.biz marinemedia.biz; Norfolk skyline photo by shutterstock.com Page 41: Moran archives Page 23, all photos: Pages 42 and 43: Moran archives Will Van Dorp Inside Back Cover: Moran Pages 24 –25: Stephen Morton, archives www.stephenmorton.com The Magazine of Volume 67 Moran Towing Corporation November 2020 2 News Briefs Books 34 Queen Mary 2: The Greatest Ocean Liner of Our Time , by John Maxtone- Cover Story Graham 4 The Journey Continues Published by Moran’s New Training Programs Moran Towing Corporation Redouble a Shared Vision of Safety The History Pages 36 Photographic gems from the EDITOR-IN-CHIEF Grandone family collection Mark Schnapper Operations REPORTER John Snyder 14 Moran’s Wellness Program Offers Health Coaching Milestones DESIGN DIRECTOR Mark Schnapper 18 Amid Continued Growth, MER Is 38 The christenings of four new high- Now a Wholly Owned Moran horsepower escort tugs Subsidiary People Moran Towing Corporation Ship Call Miles tones 40 50 Locust Avenue Capt. -

Integrating Into Our Strategy

INTEGRATING CLIMATE INTO OUR STRATEGY • 03 MAY 2017 Integrating Climate Into Our Strategy INTEGRATING CLIMATE INTO OUR STRATEGY • 03 CONTENTS Foreword by Patrick Pouyanné, Chairman and Chief Executive Officer, Total 05 Three Questions for Patricia Barbizet, Lead Independent Director of Total 09 _____________ SHAPING TOMORROW’S ENERGY Interview with Fatih Birol, Executive Director of the International Energy Agency 11 The 2°C Objective: Challenges Ahead for Every Form of Energy 12 Carbon Pricing, the Key to Achieving the 2°C Scenario 14 Interview with Erik Solheim, Executive Director of UN Environment 15 Oil and Gas Companies Join Forces 16 Interview with Bill Gates, Breakthrough Energy Ventures 18 _____________ TAKING ACTION TODAY Integrating Climate into Our Strategy 20 An Ambition Consistent with the 2°C Scenario 22 Greenhouse Gas Emissions Down 23% Since 2010 23 Natural Gas, the Key Energy Resource for Fast Climate Action 24 Switching to Natural Gas from Coal for Power Generation 26 Investigating and Strictly Limiting Methane Emissions 27 Providing Affordable Natural Gas 28 CCUS, Critical to Carbon Neutrality 29 A Resilient Portfolio 30 Low-Carbon Businesses to Become the Responsible Energy Major 32 Acquisitions That Exemplify Our Low-Carbon Strategy 33 Accelerating the Solar Energy Transition 34 Affordable, Reliable and Clean Energy 35 Saft, Offering Industrial Solutions to the Climate Change Challenge 36 The La Mède Biorefinery, a Responsible Transformation 37 Energy Efficiency: Optimizing Energy Consumption 38 _____________ FOCUS ON TRANSPORTATION Offering a Balanced Response to New Challenges 40 Our Initiatives 42 ______________ OUR FIGURES 45 04 • INTEGRATING CLIMATE INTO OUR STRATEGY Total at a Glance More than 98,109 4 million employees customers served in our at January 31, 2017 service stations each day after the sale of Atotech A Global Energy Leader No. -

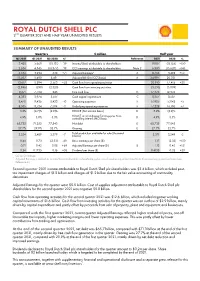

Shell QRA Q2 2021

ROYAL DUTCH SHELL PLC 2ND QUARTER 2021 AND HALF YEAR UNAUDITED RESULTS SUMMARY OF UNAUDITED RESULTS Quarters $ million Half year Q2 2021 Q1 2021 Q2 2020 %¹ Reference 2021 2020 % 3,428 5,660 (18,131) -39 Income/(loss) attributable to shareholders 9,087 (18,155) +150 2,634 4,345 (18,377) -39 CCS earnings attributable to shareholders Note 2 6,980 (15,620) +145 5,534 3,234 638 +71 Adjusted Earnings² A 8,768 3,498 +151 13,507 11,490 8,491 Adjusted EBITDA (CCS basis) A 24,997 20,031 12,617 8,294 2,563 +52 Cash flow from operating activities 20,910 17,415 +20 (2,946) (590) (2,320) Cash flow from investing activities (3,535) (5,039) 9,671 7,704 243 Free cash flow G 17,375 12,376 4,383 3,974 3,617 Cash capital expenditure C 8,357 8,587 8,470 9,436 8,423 -10 Operating expenses F 17,905 17,042 +5 8,505 8,724 7,504 -3 Underlying operating expenses F 17,228 16,105 +7 3.2% (4.7)% (2.9)% ROACE (Net income basis) D 3.2% (2.9)% ROACE on an Adjusted Earnings plus Non- 4.9% 3.0% 5.3% controlling interest (NCI) basis D 4.9% 5.3% 65,735 71,252 77,843 Net debt E 65,735 77,843 27.7% 29.9% 32.7% Gearing E 27.7% 32.7% Total production available for sale (thousand 3,254 3,489 3,379 -7 boe/d) 3,371 3,549 -5 0.44 0.73 (2.33) -40 Basic earnings per share ($) 1.17 (2.33) +150 0.71 0.42 0.08 +69 Adjusted Earnings per share ($) B 1.13 0.45 +151 0.24 0.1735 0.16 +38 Dividend per share ($) 0.4135 0.32 +29 1. -

Statoil Business Update

Statoil US Onshore Jefferies Global Energy Conference, November 2014 Torstein Hole, Senior Vice President US Onshore competitively positioned 2013 Eagle Ford Operator 2012 Marcellus Operator Williston Bakken 2011 Stamford Bakken Operator Marcellus 2010 Eagle Ford Austin Eagle Ford Houston 2008 Marcellus 1987 Oil trading, New York Statoil Office Statoil Asset 2 Premium portfolio in core plays Bakken • ~ 275 000 net acres, Light tight oil • Concentrated liquids drilling • Production ~ 55 kboepd Eagle Ford • ~ 60 000 net acres, Liquids rich • Liquids ramp-up • Production ~34 koepd Marcellus • ~ 600 000 net acres, Gas • Production ~130 kboepd 3 Shale revolution: just the end of the beginning • Entering mature phase – companies with sustainable, responsible development approach will be the winners • Statoil is taking long term view. Portfolio robust under current and forecast price assumptions. • Continuous, purposeful improvement is key − Technology/engineering − Constant attention to costs 4 Statoil taking operations to the next level • Ensuring our operating model is fit for Onshore Operations • Doing our part to maintain the company’s capex commitments • Leading the way to reduce flaring in Bakken • Not just reducing costs – increasing free cash flow 5 The application of technology Continuous focus on cost, Fast-track identification, Prioritised development of efficiency and optimisation of development & implementation of potential game-changing operations short-term technology upsides technologies SHORT TERM – MEDIUM – LONG TERM • Stage -

Oil for As Long As Most Americans Can Remember, Gasoline Has Been the Only Fuel They Buy to Fill up the Cars They Drive

Fueling a Clean Transportation Future Chapter 2: Gasoline and Oil For as long as most Americans can remember, gasoline has been the only fuel they buy to fill up the cars they drive. However, hidden from view behind the pump, the sources of gasoline have been changing dramatically. Gasoline is produced from crude oil, and over the last two de- cades the sources of this crude have gotten increasingly di- verse, including materials that are as dissimilar as nail polish remover and window putty. These changes have brought rising global warming emissions, but not from car tailpipes. Indeed, tailpipe emissions per mile are falling as cars get more efficient. Rather, it is the extraction and refining of oil that are getting dirtier over time. The easiest-to-extract sources of oil are dwindling, and the oil industry has increasingly shifted its focus to resources that require more energy-intensive extraction or refining methods, resources that were previously too expensive and risky to be developed. These more challenging oils also result Yeulet © iStock.com/Cathy in higher emissions when used to produce gasoline (Gordon 2012). The most obvious way for the United States to reduce the problems caused by oil use is to steadily reduce oil con- sumption through improved efficiency and by shifting to cleaner fuels. But these strategies will take time to fully im- plement. In the meantime, the vast scale of ongoing oil use Heat-trapping emissions from producing transportation fuels such as gasoline are on the rise, particularly emissions released during extracting and refining means that increases in emissions from extracting and refin- processes that occur out of sight, before we even get in the car. -

Special Anniversary Issue Moran’S Mexican Debut Is up and Running Milestones

The Magazine of Volume 63 Moran Towing Corporation November 2010 Special Anniversary Issue Moran’s Mexican Debut Is Up and Running Milestones 34 miles north of Ensenada, tug’s motion, thereby preventing snap-loads and Mexico, in Pacific waters breakage. This enables the tug to perform opti- just off the Mexican Baja, mally, at safe working loads for the hawser, under Moran’s SMBC joint ven- a very wide range of sea state and weather condi- ture (the initials stand for tions. The function is facilitated by sensors that Servicios Maritimos de Baja continuously detect excess slack or tension on the California) has been writ- line, and automatically compensate by triggering 15ing a new chapter in the company’s history. either spooling or feeding out of line in precise- SMBC, a joint venture with Grupo Boluda ly the amounts necessary to maintain a pre-set Maritime Corporation of Spain, has been operat- standard of tension. ing at this location since 2008. It provides ship To a hawser-connected tug and tanker snaking assist, line handling and pilot boat services to over the crests of nine-foot swells, this equipment LNG carriers calling at Sempra LNG’s Energia is as indispensable as a gyroscope is to a rocket; its Costa Azul LNG terminal. stabilizing effect on the motion of the lines and SMBC represents a new maritime presence in vessels gives the mariners complete control. North American Pacific coastal waters. Each of its As part of this capability, upper and lower load tugs bears dual insignias on its stacks: the Moran ranges can be digitally selected and monitored “M” and Boluda’s “B”. -

Energy Assurance Daily, June 22, 2010

ENERGY ASSURANCE DAILY Tuesday Evening, June 22, 2010 Major Developments Update: Federal Judge Blocks Government-Imposed Deepwater Drilling Moratorium A U.S. District Judge blocked the federal government's six-month moratorium on deepwater drilling, saying it seemed clear "that the federal government had been pressed by what happened on the Deepwater Horizon into an otherwise sweeping confirmation that all Gulf deepwater drilling activities put us all in a universal threat of irreparable harm." Numerous service companies had asked the judge to reject the moratorium, saying the government had imposed it arbitrarily. The Obama Administration said it would immediately appeal the decision. http://www.washingtonpost.com/wp-dyn/content/article/2010/06/22/AR2010062200237.html?wpisrc=nl_natlalert BP Recovers About 25,830 Barrels of Oil at Site of Blown-Out Well in Gulf of Mexico June 21 BP collected about 15,560 barrels of oil, flared approximately 10,270 barrels of oil, and flared about 52.2 million cubic feet of natural gas on June 20 via its dual collection system at the blown-out MC252 well in the Gulf of Mexico, the company said on its website. http://www.bp.com/extendedsectiongenericarticle.do?categoryId=40&contentId=7061813 Update: U.S. CSB to Investigate Deepwater Horizon Explosion The U.S. Chemical Safety Board (CSB) plans to investigate the root causes of the April 20 explosion onboard the Deepwater Horizon rig in the Gulf of Mexico. The CSB expects to include the key investigators who were involved in its investigation of the March 23, 2005 explosion at BP’s Texas City refinery. -

Mexico's Deep Water Success

Energy Alert February 1, 2018 Key Points Round 2.4 exceeded expectations by awarding 18 of 29 (62 percent) of available contract areas Biggest winners were Royal Dutch Shell, with nine contract areas, and PC Carigali, with seven contract areas Investments over $100 billion in Mexico’s energy sector expected in the upcoming years Mexico’s Energy Industry Round 2.4: Mexico’s Deep Water Success On January 31, 2018, the Comisión Nacional de Hidrocarburos (“CNH”) completed the Presentation and Opening of Bid Proposals for the Fourth Tender of Round Two (“Round 2.4”), which was first announced on July 20, 2017. Round 2.4 attracted 29 oil and gas companies from around the world including Royal Dutch Shell, ExxonMobil, Chevron, Pemex, Lukoil, Qatar Petroleum, Mitsui, Repsol, Statoil and Total, among others. Round 2.4 included 60% of all acreage to be offered by Mexico under the current Five Year Plan. Blocks included 29 deep water contract areas (shown in the adjacent map) with an estimated 4.23 billion Barrel of Oil Equivalent (BOE) of crude oil, wet gas and dry gas located in the Perdido Fold Belt Area, Salinas Basin and Mexican Ridges. The blocks were offered under a license contract, similar to the deep water form used by the CNH in Round 1.4. After witnessing the success that companies like ENI, Talos Energy, Inc., Sierra and Premier have had in Mexico over the last several years, Round 2.4 was the biggest opportunity yet for the industry. Some of these deep water contract areas were particularly appealing because they share geological characteristics with some of the projects in the U.S. -

The Future of Pemex: Return to the Rentier-State Model Or Strengthen Energy Resiliency in Mexico?

THE FUTURE OF PEMEX: RETURN TO THE RENTIER-STATE MODEL OR STRENGTHEN ENERGY RESILIENCY IN MEXICO? Isidro Morales, Ph.D. Nonresident Scholar, Center for the United States and Mexico, Baker Institute; Senior Professor and Researcher, Tecnológico de Monterrey March 2020 © 2020 by Rice University’s Baker Institute for Public Policy This material may be quoted or reproduced without prior permission, provided appropriate credit is given to the author and Rice University’s Baker Institute for Public Policy. Wherever feasible, papers are reviewed by outside experts before they are released. However, the research and views expressed in this paper are those of the individual researcher(s) and do not necessarily represent the views of the Baker Institute. Isidro Morales, Ph.D “The Future of Pemex: Return to the Rentier-State Model or Strengthen Energy Resiliency in Mexico?” https://doi.org/10.25613/y7qc-ga18 The Future of Pemex Introduction Mexico’s 2013-2014 energy reform not only opened all chains of the energy sector to private, national, and international stakeholders, but also set the stage for Petróleos Mexicanos (Pemex) to possibly become a state productive enterprise. We are barely beginning to discern the fruits and limits of the energy reform, and it will be precisely during Andrés Manuel López Obrador’s administration that these reforms will either be enhanced or curbed. Most analysts who have justified the reforms have highlighted the amount of private investment captured through the nine auctions held so far. Critics of the reform note the drop in crude oil production and the accelerated growth of natural gas imports and oil products. -

GIIGNL Annual Report Profile

The LNG industry GIIGNL Annual Report Profile Acknowledgements Profile We wish to thank all member companies for their contribution to the report and the GIIGNL is a non-profit organisation whose objective following international experts for their is to promote the development of activities related to comments and suggestions: LNG: purchasing, importing, processing, transportation, • Cybele Henriquez – Cheniere Energy handling, regasification and its various uses. • Najla Jamoussi – Cheniere Energy • Callum Bennett – Clarksons The Group constitutes a forum for exchange of • Laurent Hamou – Elengy information and experience among its 88 members in • Jacques Rottenberg – Elengy order to enhance the safety, reliability, efficiency and • María Ángeles de Vicente – Enagás sustainability of LNG import activities and in particular • Paul-Emmanuel Decroës – Engie the operation of LNG import terminals. • Oliver Simpson – Excelerate Energy • Andy Flower – Flower LNG • Magnus Koren – Höegh LNG • Mariana Ortiz – Naturgy Energy Group • Birthe van Vliet – Shell • Mika Iseki – Tokyo Gas • Yohei Hukins – Tokyo Gas • Donna DeWick – Total • Emmanuelle Viton – Total • Xinyi Zhang – Total © GIIGNL - International Group of Liquefied Natural Gas Importers All data and maps provided in this publication are for information purposes and shall be treated as indicative only. Under no circumstances shall they be regarded as data or maps intended for commercial use. Reproduction of the contents of this publication in any manner whatsoever is prohibited without prior