Statoil Business Update

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Unconventional Gas and Oil in North America Page 1 of 24

Unconventional gas and oil in North America This publication aims to provide insight into the impacts of the North American 'shale revolution' on US energy markets and global energy flows. The main economic, environmental and climate impacts are highlighted. Although the North American experience can serve as a model for shale gas and tight oil development elsewhere, the document does not explicitly address the potential of other regions. Manuscript completed in June 2014. Disclaimer and copyright This publication does not necessarily represent the views of the author or the European Parliament. Reproduction and translation of this document for non-commercial purposes are authorised, provided the source is acknowledged and the publisher is given prior notice and sent a copy. © European Union, 2014. Photo credits: © Trueffelpix / Fotolia (cover page), © bilderzwerg / Fotolia (figure 2) [email protected] http://www.eprs.ep.parl.union.eu (intranet) http://www.europarl.europa.eu/thinktank (internet) http://epthinktank.eu (blog) Unconventional gas and oil in North America Page 1 of 24 EXECUTIVE SUMMARY The 'shale revolution' Over the past decade, the United States and Canada have experienced spectacular growth in the production of unconventional fossil fuels, notably shale gas and tight oil, thanks to technological innovations such as horizontal drilling and hydraulic fracturing (fracking). Economic impacts This new supply of energy has led to falling gas prices and a reduction of energy imports. Low gas prices have benefitted households and industry, especially steel production, fertilisers, plastics and basic petrochemicals. The production of tight oil is costly, so that a high oil price is required to make it economically viable. -

Oil Refining in Mexico and Prospects for the Energy Reform

Articles Oil refining in Mexico and prospects for the Energy Reform Daniel Romo1 1National Polytechnic Institute, Mexico. E-mail address: [email protected] Abstract: This paper analyzes the conditions facing the oil refining industry in Mexico and the factors that shaped its overhaul in the context of the 2013 Energy Reform. To do so, the paper examines the main challenges that refining companies must tackle to stay in the market, evaluating the specific cases of the United States and Canada. Similarly, it offers a diagnosis of refining in Mexico, identifying its principal determinants in order to, finally, analyze its prospects, considering the role of private initiatives in the open market, as well as Petróleos Mexicanos (Pemex), as a placeholder in those areas where private enterprises do not participate. Key Words: Oil, refining, Energy Reform, global market, energy consumption, investment Date received: February 26, 2016 Date accepted: July 11, 2016 INTRODUCTION At the end of 2013, the refining market was one of stark contrasts. On the one hand, the supply of heavy products in the domestic market proved adequate, with excessive volumes of fuel oil. On the other, the gas and diesel oil demand could not be met with production by Petróleos Mexicanos (Pemex). The possibility to expand the infrastructure was jeopardized, as the new refinery project in Tula, Hidalgo was put on hold and the plan was made to retrofit the units in Tula, Salamanca, and Salina Cruz. This situation constrained Pemex's supply capacity in subsequent years and made the country reliant on imports to supply the domestic market. -

Climate and Energy Benchmark in Oil and Gas Insights Report

Climate and Energy Benchmark in Oil and Gas Insights Report Partners XxxxContents Introduction 3 Five key findings 5 Key finding 1: Staying within 1.5°C means companies must 6 keep oil and gas in the ground Key finding 2: Smoke and mirrors: companies are deflecting 8 attention from their inaction and ineffective climate strategies Key finding 3: Greatest contributors to climate change show 11 limited recognition of emissions responsibility through targets and planning Key finding 4: Empty promises: companies’ capital 12 expenditure in low-carbon technologies not nearly enough Key finding 5:National oil companies: big emissions, 16 little transparency, virtually no accountability Ranking 19 Module Summaries 25 Module 1: Targets 25 Module 2: Material Investment 28 Module 3: Intangible Investment 31 Module 4: Sold Products 32 Module 5: Management 34 Module 6: Supplier Engagement 37 Module 7: Client Engagement 39 Module 8: Policy Engagement 41 Module 9: Business Model 43 CLIMATE AND ENERGY BENCHMARK IN OIL AND GAS - INSIGHTS REPORT 2 Introduction Our world needs a major decarbonisation and energy transformation to WBA’s Climate and Energy Benchmark measures and ranks the world’s prevent the climate crisis we’re facing and meet the Paris Agreement goal 100 most influential oil and gas companies on their low-carbon transition. of limiting global warming to 1.5°C. Without urgent climate action, we will The Oil and Gas Benchmark is the first comprehensive assessment experience more extreme weather events, rising sea levels and immense of companies in the oil and gas sector using the International Energy negative impacts on ecosystems. -

Statoil ASA Statoil Petroleum AS

Offering Circular A9.4.1.1 Statoil ASA (incorporated with limited liability in the Kingdom of Norway) Notes issued under the programme may be unconditionally and irrevocably guaranteed by Statoil Petroleum AS (incorporated with limited liability in the Kingdom of Norway) €20,000,000,000 Euro Medium Term Note Programme On 21 March 1997, Statoil ASA (the Issuer) entered into a Euro Medium Term Note Programme (the Programme) and issued an Offering Circular on that date describing the Programme. The Programme has been subsequently amended and updated. This Offering Circular supersedes any previous dated offering circulars. Any Notes (as defined below) issued under the Programme on or after the date of this Offering Circular are issued subject to the provisions described herein. This does not affect any Notes issued prior to the date hereof. Under this Programme, Statoil ASA may from time to time issue notes (the Notes) denominated in any currency agreed between the Issuer and the relevant Dealer (as defined below). The Notes may be issued in bearer form or in uncertificated book entry form (VPS Notes) settled through the Norwegian Central Securities Depositary, Verdipapirsentralen ASA (the VPS). The maximum aggregate nominal amount of all Notes from time to time outstanding will not exceed €20,000,000,000 (or its equivalent in other currencies calculated as described herein). The payments of all amounts due in respect of the Notes issued by the Issuer may be unconditionally and irrevocably guaranteed by Statoil A6.1 Petroleum AS (the Guarantor). The Notes may be issued on a continuing basis to one or more of the Dealers specified on page 6 and any additional Dealer appointed under the Programme from time to time, which appointment may be for a specific issue or on an ongoing basis (each a Dealer and together the Dealers). -

Integrating Into Our Strategy

INTEGRATING CLIMATE INTO OUR STRATEGY • 03 MAY 2017 Integrating Climate Into Our Strategy INTEGRATING CLIMATE INTO OUR STRATEGY • 03 CONTENTS Foreword by Patrick Pouyanné, Chairman and Chief Executive Officer, Total 05 Three Questions for Patricia Barbizet, Lead Independent Director of Total 09 _____________ SHAPING TOMORROW’S ENERGY Interview with Fatih Birol, Executive Director of the International Energy Agency 11 The 2°C Objective: Challenges Ahead for Every Form of Energy 12 Carbon Pricing, the Key to Achieving the 2°C Scenario 14 Interview with Erik Solheim, Executive Director of UN Environment 15 Oil and Gas Companies Join Forces 16 Interview with Bill Gates, Breakthrough Energy Ventures 18 _____________ TAKING ACTION TODAY Integrating Climate into Our Strategy 20 An Ambition Consistent with the 2°C Scenario 22 Greenhouse Gas Emissions Down 23% Since 2010 23 Natural Gas, the Key Energy Resource for Fast Climate Action 24 Switching to Natural Gas from Coal for Power Generation 26 Investigating and Strictly Limiting Methane Emissions 27 Providing Affordable Natural Gas 28 CCUS, Critical to Carbon Neutrality 29 A Resilient Portfolio 30 Low-Carbon Businesses to Become the Responsible Energy Major 32 Acquisitions That Exemplify Our Low-Carbon Strategy 33 Accelerating the Solar Energy Transition 34 Affordable, Reliable and Clean Energy 35 Saft, Offering Industrial Solutions to the Climate Change Challenge 36 The La Mède Biorefinery, a Responsible Transformation 37 Energy Efficiency: Optimizing Energy Consumption 38 _____________ FOCUS ON TRANSPORTATION Offering a Balanced Response to New Challenges 40 Our Initiatives 42 ______________ OUR FIGURES 45 04 • INTEGRATING CLIMATE INTO OUR STRATEGY Total at a Glance More than 98,109 4 million employees customers served in our at January 31, 2017 service stations each day after the sale of Atotech A Global Energy Leader No. -

Future Supply of Oil and Gas from the Gulf of Mexico

Future Supply of Oil and Gas From the Gulf of Mexico U.S. GEOLOGICAL SUltyEY PROFESSIONAL PAPER 1294 Future Supply of Oil and Gas From the Gulf of Mexico By E. D. Attanasi and]. L. Haynes U.S. GEOLOGICAL SURVEY PROFESSIONAL PAPER 1294 An engineering-economic costing algorithm combined with a discovery process model to forecast long-run incremental costs of undiscovered oil and gas UNITED STATES GOVERNMENT PRINTING OFFICE, WASHINGTON : 1983 UNITED STATES DEPARTMENT OF THE INTERIOR JAMES G. WATT, Secretary GEOLOGICAL SURVEY Dallas L. Peck, Director Library of Congress Cataloging in Publication Data Attanasi, E. D. Future supply of oil and gas from the Gulf of Mexico. (U.S. Geological Survey professional paper ; 1294) Bibliography: p. 1. Petroleum in submerged lands Mexico, Gulf of. 2. Gas, Natural, in submerged lands Mexico, Gulf of. I. Haynes, J. (John), 1954- . II. Title. III. Series: Geological Survey professional paper ; 1294. TN872.A5A87 1983 553.2'8'0916364 83-600030 ____ ____________ For sale by the Superintendent of Documents, U.S. Government Printing Office Washington, D.C. 20402 CONTENTS Page Abstract 1 Introduction 1 Engineering-economic model 3 Methodology 3 Engineering data and assumptions 5 Field classification 5 Field design 6 Production schedules of oil and nonassociated gas wells 7 Economic assumptions and variables 8 Field development costs 8 Production costs and production related taxes 9 Assumptions for after-tax net present value calculations 10 Exploration costs 10 Industry behavior and market conditions 10 Forecasting future discoveries 11 Discovery process model 11 Estimated marginal cost functions for undiscovered recoverable oil and gas resources in the Gulf of Mexico 12 Conclusions and implications 16 References cited 16 Appendix A 17 Appendix B 20 ILLUSTRATIONS FIGURE 1. -

UCS TIGHT OIL.Indd

The Truth about Tight Oil Don Anair Amine Mahmassani Methane from Unconventional Oil Extraction Poses Significant Climate Risks July 2013 Since 2010, “tight oil”—oil extracted from hard- to-access deposits using horizontal drilling and hydraulic fracturing (fracking)—has dramatically changed the US oil industry, reversing decades of declining domestic oil production and reducing US oil imports (EIA 2015a). In 2015, tight oil comprised more than half of US oil produc- 10,000 feet to reach sedimentary rock and then sideways or tion, bringing total production close to 10 million barrels per horizontally for a mile or more. Next, a mixture of water, day—a peak not seen since the 1970s (see Figure 1). But this sand, and chemicals is pumped at high pressure into the wells sudden expansion has also led to an increase of global warm- to create fractures in the rocks, which frees the oil and gas ing emissions due, in large part, to methane—an extremely potent heat-trapping gas that is found in larger concentra- tions in tight oil regions. Although most of the emissions associated with the con- sumption of oil are a result of burning the finished fuel (for example, in a car or truck), the emissions from extracting, transporting, and refining oil add, on average, 35 percent to a fuel’s life cycle emissions. These “upstream” emissions can- not be overlooked when seeking to mitigate emissions from oil use overall. Recent scientific evidence highlights major gaps in our knowledge of these large and rising sources of global warming pollution (Caulton et al. -

Shell QRA Q2 2021

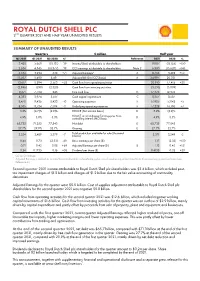

ROYAL DUTCH SHELL PLC 2ND QUARTER 2021 AND HALF YEAR UNAUDITED RESULTS SUMMARY OF UNAUDITED RESULTS Quarters $ million Half year Q2 2021 Q1 2021 Q2 2020 %¹ Reference 2021 2020 % 3,428 5,660 (18,131) -39 Income/(loss) attributable to shareholders 9,087 (18,155) +150 2,634 4,345 (18,377) -39 CCS earnings attributable to shareholders Note 2 6,980 (15,620) +145 5,534 3,234 638 +71 Adjusted Earnings² A 8,768 3,498 +151 13,507 11,490 8,491 Adjusted EBITDA (CCS basis) A 24,997 20,031 12,617 8,294 2,563 +52 Cash flow from operating activities 20,910 17,415 +20 (2,946) (590) (2,320) Cash flow from investing activities (3,535) (5,039) 9,671 7,704 243 Free cash flow G 17,375 12,376 4,383 3,974 3,617 Cash capital expenditure C 8,357 8,587 8,470 9,436 8,423 -10 Operating expenses F 17,905 17,042 +5 8,505 8,724 7,504 -3 Underlying operating expenses F 17,228 16,105 +7 3.2% (4.7)% (2.9)% ROACE (Net income basis) D 3.2% (2.9)% ROACE on an Adjusted Earnings plus Non- 4.9% 3.0% 5.3% controlling interest (NCI) basis D 4.9% 5.3% 65,735 71,252 77,843 Net debt E 65,735 77,843 27.7% 29.9% 32.7% Gearing E 27.7% 32.7% Total production available for sale (thousand 3,254 3,489 3,379 -7 boe/d) 3,371 3,549 -5 0.44 0.73 (2.33) -40 Basic earnings per share ($) 1.17 (2.33) +150 0.71 0.42 0.08 +69 Adjusted Earnings per share ($) B 1.13 0.45 +151 0.24 0.1735 0.16 +38 Dividend per share ($) 0.4135 0.32 +29 1. -

U.S.-Canada Cross- Border Petroleum Trade

U.S.-Canada Cross- Border Petroleum Trade: An Assessment of Energy Security and Economic Benefits March 2021 Submitted to: American Petroleum Institute 200 Massachusetts Ave NW Suite 1100, Washington, DC 20001 Submitted by: Kevin DeCorla-Souza ICF Resources L.L.C. 9300 Lee Hwy Fairfax, VA 22031 U.S.-Canada Cross-Border Petroleum Trade: An Assessment of Energy Security and Economic Benefits This report was commissioned by the American Petroleum Institute (API) 2 U.S.-Canada Cross-Border Petroleum Trade: An Assessment of Energy Security and Economic Benefits Table of Contents I. Executive Summary ...................................................................................................... 4 II. Introduction ................................................................................................................... 6 III. Overview of U.S.-Canada Petroleum Trade ................................................................. 7 U.S.-Canada Petroleum Trade Volumes Have Surged ........................................................... 7 Petroleum Is a Major Component of Total U.S.-Canada Bilateral Trade ................................. 8 IV. North American Oil Production and Refining Markets Integration ...........................10 U.S.-Canada Oil Trade Reduces North American Dependence on Overseas Crude Oil Imports ..................................................................................................................................10 Cross-Border Pipelines Facilitate U.S.-Canada Oil Market Integration...................................14 -

The Economic Impacts of the Gulf of Mexico Oil and Natural Gas Industry

The Economic Impacts of the Gulf of Mexico Oil and Natural Gas Industry Prepared For Prepared By Executive Summary Introduction Despite the current difficulties facing the global economy as a whole and the oil and natural gas industry specifically, the Gulf of Mexico oil and natural gas industry will likely continue to be a major source of energy production, employment, gross domestic product, and government revenues for the United States. Several proposals have been advanced recently which would have a major impact on the industry’s activity levels, and the economic activity supported by the Gulf of Mexico offshore oil and natural gas industry. The proposals vary widely, but for the purpose of this report three scenarios were developed, a scenario based on a continuation of current policies and regulations, a scenario examining the potential impacts of a ban on new offshore leases, and a scenario examining the potential impacts of a ban on new drilling permits approvals in the Gulf of Mexico. Energy and Industrial Advisory Partners (EIAP) was commissioned by the National Ocean Industry Association (NOIA) to develop a report forecasting activity levels, spending, oil and natural gas production, supported employment, GDP, and Government Revenues in these scenarios. The scenarios developed in this report are based solely upon government and other publicly available data and EIAP’s own expertise and analysis. The study also included profiles of NOIA members to demonstrate the diverse group of companies which make up the offshore Gulf of Mexico oil and natural gas industry as well as a list of over 2,400 suppliers to the industry representing all 50 states. -

Annual Report on Form 20-F ANNUAL REPORT /2012 Annual Report on Form 20-F

ANNUAL REPORT /2012 Annual Report on Form 20-F ANNUAL REPORT /2012 Annual Report on Form 20-F The Annual Report on Form 20-F is our SEC filing for the fiscal year ended December 31, 2012, as submitted to the US Securities and Exchange Commission. The complete edition of our Annual Report is available online at www.statoil.com/2012 © Statoil 2013 STATOIL ASA BOX 8500 NO-4035 STAVANGER NORWAY TELEPHONE: +47 51 99 00 00 www.statoil.com Cover photo: Ole Jørgen Bratland Annual report on Form 20-F Cover Page 1 1 Introduction 3 1.1 About the report 3 1.2 Key figures and highlights 4 2 Strategy and market overview 5 2.1 Our business environment 5 2.1.1 Market overview 5 2.1.2 Oil prices and refining margins 6 2.1.3 Natural gas prices 6 2.2 Our corporate strategy 7 2.3 Our technology 9 2.4 Group outlook 10 3 Business overview 11 3.1 Our history 11 3.2 Our business 12 3.3 Our competitive position 12 3.4 Corporate structure 13 3.5 Development and Production Norway (DPN) 14 3.5.1 DPN overview 14 3.5.2 Fields in production on the NCS 15 3.5.2.1 Operations North 17 3.5.2.2 Operations North Sea West 18 3.5.2.3 Operations North Sea East 19 3.5.2.4 Operations South 19 3.5.2.5 Partner-operated fields 20 3.5.3 Exploration on the NCS 20 3.5.4 Fields under development on the NCS 22 3.5.5 Decommissioning on the NCS 23 3.6 Development and Production International (DPI) 24 3.6.1 DPI overview 24 3.6.2 International production 25 3.6.2.1 North America 27 3.6.2.2 South America and sub-Saharan Africa 28 3.6.2.3 Middle East and North Africa 29 3.6.2.4 Europe and Asia -

Worldwide Operations and Locations March 2019

Worldwide Operations and Locations March 2019 Kuparuk Barents Alpine Prudhoe Bay Sea Aasta Hansteen UNITED STATES – ALASKA Heidrun Norwegian Trans-Alaska Pipeline System (TAPS) CANADA Sea NORWAY Clair Alvheim Anchorage Britannia Aberdeen Stavanger Surmont UNITED KINGDOM J-Area Greater Ekosk Area Montney North Sea Calgary NORTH AMERICA London Bakken East Irish Sea EUROPE Pacic Ocean UNITED STATES – Wyoming/ LOWER 48 Caspian Uinta Basin Sea Niobrara Beijing CHINA Bartlesville JAPAN Anadarko Basin Penglai Tripoli Houston Atlantic Ocean MIDDLE EAST Permian Basin LIBYA ASIA GOM Eagle Ford Doha Gulf of Mexico Qatargas 3 Pacic Ocean QATAR Panyu CAMBODIA South China Sea Exploration MALAYSIA Block G Production Block J KBB AFRICA Natuna Sea Exploration and Production COLOMBIA Indian Ocean Kuala Lumpur Major Pipeline Corridor SINGAPORE Key Development or Program INDONESIA Jakarta Java Sea Headquarters Bayu-Undan/Darwin LNG Key Oce Location SOUTH TIMOR-LESTE Timor Sea AMERICA Athena AUSTRALIA Australia Pacic LNG Brisbane CHILE Perth World’s Largest Independent E&P Company ConocoPhillips is the world’s largest independent exploration and production (E&P) company based on production and proved reserves. 2018 Production* 2018 Proved Reserves 2018 Production* 2018 Proved Reserves by region by region 1,283 MBOED 5.3 BBOE 2018 Resources The company explores for, produces, transports and markets crude oil, 40 BBOE bitumen, natural gas, natural gas liquids and liqueed natural gas on a 5% 34% Canada 22% Alaska 20% worldwide basis. Key focus areas include safely operating producing 15% Natural Gas 8% Non OECD Alaska 23% assets, executing major development projects and exploring for new North American Asia Pacic & Natural Gas resources in promising areas.