AKDOF KCHSU, Sharea Faisal, Karachi

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Topline Market Review P

Pakistan Weekly January 12, 2018 REP‐057 Topline Market Review Gains erode as profit taking ensues KSE‐100 Index +1.0 % WoW; Weekly net FIPI US$26mn Topline Research Best Local Brokerage House [email protected] Brokers Poll 2011-14, 2016-17 Tel: +9221‐35303330, Ext: 133 Topline Securities, Pakistan www.jamapunji.pk Best Local Brokerage House 2015-16 Index gains 1% in outgoing week as profit taking ensues Market Weekly Data KSE Volume & Value KSE‐100 Index 42,933.72 (Shares mn) Volume Value (US$mn) 330 150 1‐Week Change (%) 1.0% 260 Market Cap (Rs tn) 8.9 106 190 1‐Week Change (%) 0.2% 63 Market Cap (US$ bn) 80.6 120 1‐Week Change (%) 0.2% 50 20 18 18 18 18 18 ‐ ‐ 1‐Week Avg. Daily Vol (shares mn) 276.4 ‐ ‐ ‐ n n n n n aa aa aa aa aa J J J J J ‐ ‐ 1‐Week Avg. Daily Value (Rs bn) 12.2 ‐ ‐ ‐ 9 8 1‐Week Avg. Daily Value (US$ mn) 110.2 10 11 12 Source: PSX Source: PSX Outgoing week saw the culmination of the Santa Clause rally which commenced on December 20, 2017 and peaked on Jan 10, 2018 with a net gain of 14%. Since then index has had red two sessions correcting 2%/697pts, which has trimmed weekly gains to 1%/410pts with the index closing the week at 42,934pts level. Going forward, equities maybe further pressured as agitation movement by opposition parties begin on Jan 17 to protest against the Model Town. PtiitiParticipation idimproved siifitlignificantlyasprofitswerebkdbooked, average volumes idincreased 30% WWWoW whilevalue rose 44%. -

CONTENTS FUND INFORMATION Management Company Faysal Asset Management Limited Fund Information 2 Board of Directors of the Management Company Mr

Quarter and Nine months ended March 31, 2007 Quarter and Nine months ended March 31, 2007 CONTENTS FUND INFORMATION Management Company Faysal Asset Management Limited Fund Information 2 Board of Directors of the Management Company Mr. Farook Bengali, Chairman Mr. Salman Haider Sheikh, Chief Executive Officer Mission Statement 3 Mr. Hassan Mohamed Mahmood, Director Mr. Mohammad Iqbal, Director Mr. Shahid Waqar Mahmood, Director Mr. Feroz Rizvi, Director Report of the Directors of the Management Company 4 Mr. Iqbal Alimohamed, Director Mr. Aqeel Karim Dhedhi, Director CFO of the Management Company Statement of Assets and Liabilities 6 Mr. Muhammad Shakeel Musani Company Secretary of the Management Company Mr. M. Siddique Memon Income Statement 7 Audit Committee Mr. Iqbal Alimohamed, Chairman Mr. Mohammad Iqbal, Member Distribution Statement 8 Mr. Shahid Waqar Mahmood, Member Mr. Feroz Rizvi, Member Trustee Statement of Movement in Unit Holders’ Funds 9 Central Depository Company of Pakistan Limited 8th Floor, Karachi Stock Exchange Building, Stock Exchange Road, Karachi-74000 Cash Flow Statement 10 Bankers to the Fund Faysal Bank Limited MCB Bank Limited Bank Alfalah Limited Notes to the Financial Statements 11 Habib Metropolitan Bank Limited Atlas Bank Limited Bank of Punjab Limited Auditor A.F. Ferguson & Co., Chartered Accountants Legal Advisor Mohsin Tayebaly & Co. Barristers & Advocates, Corporate legal Consultants, 2nd Floor, Dime Centre, BC-4, Block-9, KDA-5, Clifton, Karachi. Registrar Gangjees Registrar Services (Pvt) Limited Room -

Distribution, Power and Networks in Financial Markets of Pakistan

SMALL CLUB A Small Club: Distribution, Power and Networks in Financial Markets of Pakistan No. 2021:3 PIDE Working Papers Nadeem Ul Haque Amin Hussain PIDE Working Papers No. 2021:3 A Small Club: Distribution, Power and Networks in Financial Markets of Pakistan Nadeem Ul Haque Vice-Chancellor, Pakistan Institute of Development Economics, Islamabad. and Amin Husain Doktorand, Uppsala University. PAKISTAN INSTITUTE OF DEVELOPMENT ECONOMICS ISLAMABAD 2021 Editorial Committee Idrees Khawaja Saman Nazir Shahid Mehmood Disclaimer: Copyrights to this PIDE Working Paper remain with the author(s). The author(s) may publish the paper, in part or whole, in any journal of their choice. Pakistan Institute of Development Economics Islamabad, Pakistan E-mail: [email protected] Website: http://www.pide.org.pk Fax: +92-51-9248065 Designed, composed, and finished at the Publications Division, PIDE. CONTENTS Page Abstract v 1. The Stock Market That Does Not Grow! 1 2. Corporate Governance Matters 2 3. Networks and Subnetworks 6 3.1. Shareholders Networks 6 3.2. Network of Families: Mahbubul Haq Redux 7 4. Corporate Governance: What Board Memberships Tell Us! 8 4.1. Independent Directors 10 4.2. The Opportunity to be a Director: A Small Club 11 5. Network Analysis of Board Members 12 5.1. A Small Club 12 6. Who Matters in Pakistani Corporations? 13 7. Conclusion 16 References 17 List of Tables Table 1. Shareholding Proportions in KSE 100 (Market Cap) 5 Table 2. Professional Experience of Directors 11 Table 3. Number of Directors in Each Category 11 Table 4. Characteristics of 20 Directors with Highest Betweenness Centrality 15 List of Figures Figure 1. -

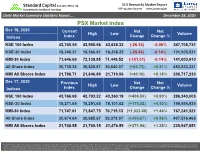

PSX Market Index

Standard Capital Securities (Pvt.) Ltd. SCS Research | Market Report Committed to intelligent investing REP-033 also log onto www.jamapunji.pk Daily Market Summary Statistics Report…. December 18, 2020 REP-033 also log onto PSX Market Indexwww.jamapunji.pk Dec 18, 2020 Current Net Net High Low Volume Indices Index Change Change % KSE 100 Index 43,740.55 43,955.56 43,638.33 (-26.14) -0.06% 247,708,731 KSE-30 Index 18,246.21 18,366.81 18,208.25 (-25.43) -0.14% 131,905,521 KMI-30 Index 71,646.60 72,139.95 71,449.52 (-101.01) -0.14% 141,003,610 All Share Index 30,738.36 30,825.87 30,640.07 (+63.72) +0.21% 482,533,331 KMI All Shares Index 21,788.71 21,846.89 21,719.06 (+40.16) +0.18% 208,717,230 Dec 17, 2020 Previous Net Net High Low Volume Indices Index Change Change % KSE 100 Index 43,766.69 43,793.22 43,360.19 (+406.50) +0.93% 286,340,005 KSE-30 Index 18,271.64 18,291.65 18,101.62 (+170.02) +0.93% 149,554,934 KMI-30 Index 71,747.61 71,847.75 70,715.13 (+1,032.48) +1.44% 167,241,521 All Share Index 30,674.64 30,685.67 30,378.97 (+295.67) +0.96% 497,516,465 KMI All Shares Index 21,748.55 21,769.15 21,476.59 (+271.96) +1.25% 239,947,851 Disclaimer: This report has been prepared by Standard Capital Securities (Pvt) Ltd. -

Capital Market

7 Capital Market 7.1 Introduction Pakistan’s capital market showed a mixed trend during FY01 (see Table7.1). The benchmark KSE- 100 index shed 10.1 percent since the beginning of FY01 and closed the year at 1366.4. This downturn can be attributed to a host of factors including the lack of concrete progress on privatization, uncertain investor confidence, the continuous depreciation of the Rupee and friction between SECP and the bourses. While equity market remained bearish, the corporate bond market showed encouraging movements. The growth in this market was encouraging, as ten new TFCs issues were floated during FY01 alone, compared to ten in the last five fiscal years. 7.2 Stock Market Performance The Karachi Stock Exchange (KSE) maintained Table 7.1: Key Indicators of Capital Market its dominance in the country (see Table 7.1). FY99 FY00 FY01 Karachi Stock Exchange Primary market activities in KSE remained KSE-100 index 1054.7 1520.7 1366.4 slow, as only four new companies (with paid up SBP General index 106.4 128.8 118.7 capital of Rs 3.6 billion), were listed during Paid up capital (billion Rs) 215.0 229.3 239.9 FY01. Similarly, only two companies were Turnover of shares (billion #) 25.5 48.1 29.2 floated on the Lahore stock exchange, of which Lahore Stock Exchange Hubco was already subscribed. Like the KSE- LSE-101 index 288.9 372.0 273.2 100 index, the LSE-101 also declined by 98.8 Turnover of shares (billion #) 9.8 16.4 7.8 Paid up capital (billion Rs) 186.9 207.7 226.2 points (26.5 percent) to 273.2 by end-FY01. -

Bulletin 21 Aug 07.FH10

July - August, 2007 Contents § Editors Corner ii § Abstract of the Bulletin 4 § Mutual Funds Development Pakistan Perspective 5 § Introduction to Mutual Fund Industry in Pakistan 8 § Prospects of Local Mutual Funds Industry 10 § Monetary Policy Statement July-December 2007 Key Features 12 § Monetary Policy Implications for the Banking Sector 14 § Trade Policy 2007-08 Highlights 15 § Performance of Microfinance Banks Operating in Pakistan 17 § Market Analysis 18 § Commercial Banks Listed on KSE at a Glance 22 § Book Reviews 23 § Pakistan Economy Key Economic Indicators 24 NBP Performance at a Glance July - August, 2007 Editors Corner Dear Readers, Pakistan celebrated 60 years of independence on August 14, 2007. The journey the nation has traversed during the last six decades has been both of achievement and difficulties. Each decade has had its challenges, success and disappointments. Various economic policies and planning processes have been pursued, giving a direction/determining the course of the economy. These policy changes have had far reaching economic consequences. Some have benefitted the economy and supported in the growth of the sub-sectors, while others have had unfavourable consequences for the different segments of the economy/population. The initial years were a period of adjustment for the new nation, with the government shouldering the task of settling the people and building an economic base. Considerable economic growth and development took place in the decade of the 60s, with significant increases in industrial and agricultural production and in the different sectors of the economy. This was despite many constraints and hurdles. It was a period when the public sector played a significant role of a facilitator and director, encouraging the private sector to come forward. -

Evidence from Equity Markets of Pakistan

Middle-East Journal of Scientific Research 13 (2): 241-247, 2013 ISSN 1990-9233 © IDOSI Publications, 2013 DOI: 10.5829/idosi.mejsr.2013.13.2.1894 Inevitability of Cross-Section Stock Returns: Evidence from Equity Markets of Pakistan Ahmad Raza Bilal, Muhammad Naveed, Noraini Bt. Abu Talib and Mohd Noor Azli Ali Khan Department of Management and Human Resource Development, Universiti Teknologi Malaysia, Skudai, Johar Bahru, Malaysia Abstract: In recent economic recession, portfolio theory progressively motivated banks to strategically concentrate on shareholders' investment returns. The analysis of the determinants of bank performance and their association with investment returns has become increasingly important. In presence of alternative investment opportunities of competitive market returns, bank stock performance is explored under depressed investment environment. For this research study, a sample of 16 banks listed at Karachi Stock Exchange was extracted on random basis. To calculate monthly stock returns, daily stock prices were used for a period of 2003-2010. Capital Asset Pricing Model (CAPM) was used to compute the expected bank stock returns. Results of performance metrics demonstrated insignificant correlation in movements of bank stock returns. Findings of this study suggested that in reflection of better market returns, banks tend to outperform for improvement of their shareholders' investment returns and value maximization. Key words: Stock returns Karachi Stock Exchange (KSE) CAPM Systematic Risk Market Returns INTRODUCTION value (NPV). Many stock exchanges around the world compute indices for specific sectors like banks and Karachi Stock Exchange (KSE) was established on financial institutions which are economic engines owing 18th September, 1947 just after independence of Pakistan to their mediator function between depository funds and with an initial capital of PKR 37 million. -

Daily Market Insights

DAILY MARKET INSIGHTS 4-Feb-2021 Change Index points KSE 100 INDEX PERFORMANCE OVERVIEW PKR % Change Closing KSE 100 Index (28) 46,906 Contributing shares Closing Price - Rs. Mari Petroleum Company Limited 104.93 7.34 60.40 1,533.98 Lucky Cement Limited 16.67 2.33 49.35 731.41 TRG Pakistan Limited (3.91) (3.17) (41.49) 119.41 KSE 100 INDEX VOLUMES Today 238 5 days average 338 304 14 days average Millions Source: https://formerdps.psx.com.pk/ & Calculations of Kifayah Investment Management Limited Top most buyer Top most seller PORTFOLIO INVESTMENT SUMMARY Mutual Funds Broker Proprietary Trading Amount (Net) 347,748,311 (276,388,859) Buying / Selling sector wise composition Oil and Gas Exploration Companies 22.53% 2.86% Cement 18.66% 10.43% Debt Market 17.35% 0.00% Technology and Communication 4.78% 39.13% All other Sectors 14.62% 32.24% Source: https://www.nccpl.com.pk/en/market-information/fipi-lipi/fipi-normal-daily FOREIGN PORTFOLIO INVESTMENT TREND Today 310 (199) 5 days average (73) 14 days average Millions Source: https://www.nccpl.com.pk/en/market-information/fipi-lipi/fipi-normal-daily & Calculations of Kifayah Investment Management Limited MATERIAL INFORMATION Disclosure of Interest by a Substantial Shareholder, sold 10,000 shares at the average Artistic Denim Mills Limited price of Rs. 134.09 each on 3 February 2021. Nishat Power Limited (NPL) a Subsidiary Company of Nishat Mills Limited and the Central Power Purchasing Agency (Guarantee) Limited have initialed “Master Nishat Mills Limited Agreement” and “PPA Amendment Agreement”. -

Akd of 2019.Fh10

Funds Managed by: AKD Investment Management Ltd. 1st Quarter Report September 30, 2019 (Un-audited) quarterly report OPPORTUNITY FUND INDEX TRACKER FUND CASH FUND AGGRESSIVE INCOME FUND AGGRESSIVEISLAMIC INCOME INCOME FUND FUND ISLAMIC STOCK FUND Partner with AKD Profit from the AKD Investment Experience Management Ltd. TABLETABLE OF OF CONTENTSCONTENTS 03 Corporate Information 04 Vision 05 Mission Statement 06 Report of the Directors of the Management Company 11 AKD Opportunity Fund - Financial Statements First Quarter FY20 37 AKD Index Tracker Fund - Financial Statements First Quarter FY20 63 AKD Cash Fund - Financial Statements First Quarter FY20 87 AKD Aggressive Income Fund - Financial Statements First Quarter FY20 115 AKD Islamic Income Fund - Financial Statements First Quater FY20 137 AKD Islamic Stock Fund - Financial Statements First Quarter FY20 MANAGEMENT COMPANY AKD Investment Management Limited 216-217, Continental Trade Centre, Block-8, Clifton, Karachi-74000 BOARD OF DIRECTORS OF THE MANAGEMENT COMPANY Chairman Mr. Abdul Karim Director & Chief Executive Officer Mr. Imran Motiwala Directors Ms. Anum Dhedhi Ms. Aysha Ahmed Mr. Ali Wahab Siddiqui Mr. Hasan Ahmed Mr. Saim Mustafa Zuberi CHIEF FINANCIAL OFFICER OF THE MANAGEMENT COMPANY Mr. Muhammad Munir Abdullah CHIEF OPERATING OFFICER AND COMPANY SECRETARY OF THE MANAGEMENT COMPANY Mr. Muhammad Yaqoob Sultan, CFA HEAD OF COMPLIANCE OF THE MANAGEMENT COMPANY Mr. Rashid Ahmed AUDIT COMMITTEE Mr. Ali Wahab Siddiqui (Chairman) Mr. Hasan Ahmed (Member) Mr. Saim Mustafa Zuberi (Member) Mr. Muhammad Yaqoob Sultan, CFA (Secretary) HUMAN RESOURCE AND REMUNERATION (HR & R) COMMITTEE CORPORATE Ms. Aysha Ahmed (Chairman) Mr. Abdul Karim (Member) Mr. Imran Motiwala (Member) Ms. Anum Dhedhi (Member) INFORMATION Mr. -

AKD Investment Management Ltd

Funds Managed by: AKD Investment Management Ltd. 1st Quarter Report September 30, 2010 (Un-audited) Partner with AKDIML, Benefit from our Experience AKD AKD AKD Income Fund Opportunity Fund Index Tracker Fund AKD Investment Management Ltd. AKD Opportunity Fund Financial Statements - First Quarter FY11 Contents 32 Fund Information 33 Fund Managers Report 36 Condensed Interim Statement of Assets and Liabilities 37 Condensed Interim Income Statement 38 Condensed Interim Distribution Statement 39 Condensed Interim Cash Flow Statement 40 Condensed Interim Statement of Movement in Unit Holders Fund 41 Notes to and Forming Part of the Condensed Interim Financial Statements AKD AKD Opportunity Fund Opportunity Fund MANAGEMENT COMPANY LEGAL ADVISER AKD Investment Management Limited Sattar & Sattar 216-217, Attorneys -at -law Continental Trade Centre, Block-8, 3rd Floor, UBL Building, Clifton, Karachi-74000 I.I. Chundrigar Road, Karachi TRUSTEE Central Depository Company REGISTRAR of Pakistan Limited Gangjees Registrar Services (Pvt.) Ltd. CDC House 99-B, Block-B 516, Clifton Centre, S.M.C.H.S., Main Shahra-e-Faisal, Karachi. Khayaban-e-Roomi, Kehkashan, Block-5, Clifton, Karachi. BANKERS Tel: 35375714 - 35836920. Bank Alfalah Limited Bank Al-Habib Limited DISTRIBUTORS Habib Metropolitan Bank Limited AKD Investment Management Limited KASB Bank Limited AKD Securities Limited MCB Bank Limited BMA Capital Management Limited Mybank Limited IGI Investment Bank Limited Standard Chartered Bank (Pakistan) Limited The Bank of Punjab The Bank of Punjab Accesss Financial Services (Private) Limited United Bank Limited Al-Falah Securities (Private) Limited Foundation Securities (Private) Limited AUDITORS Reliance Financial Products (Private) Limited KPMG Taseer Hadi & Co. Bulls & Bulls (Private) Limited Chartered Accountants Sheikh Sultan Trust Building No. -

Relationship Between Oil Prices and Stock Market Index

Global Journal of Management and Business Research: B Economics and Commerce Volume 16 Issue 6 Version 1.0 Year 2016 Type: Double Blind Peer Reviewed International Research Journal Publisher: Global Journals Inc. (USA) Online ISSN: 2249-4588 & Print ISSN: 0975-5853 Relationship between Oil Prices and Stock Market Index: A Case of Pak, India & China By Hafiz AbuBakar Usman, Muhammad Nadeem Iqbal & Muhammad Khizar Hayat Arid Agriculture University Abstract- Cost of oil affects the profit and loss of the organization as oil is immediate or circuitous expense of operation. In this way, the ascent in crude oil costs will be relied upon to bring about the decline in income, which brought about a decrease of prompt stock market index. The goal of the examination is to get precise answers of exploration inquiries said in particular settings of Pakistan, India and China. This paper utilized regression, Durbin Watson test and correlation analysis to discover the answers of exploration inquiries and goals. The time of study is 21 years (From Jan 1995 to June 2015 on the bases of month to month variations) of dependent and predictor variables. It could be seen that the model is superbly fitted to the regression. In all instances of these three stock trades there is sure relationship between oil costs and stock exchange 100 index. Keywords: oil prices, emerging market, stock market index, stock market return. GJMBR - B Classification : JEL Code : H54 RelationshipbetweenOilPricesandStockMarketIndexACaseofPakIndiaChina Strictly as per the compliance and regulations of: © 2016. Hafiz AbuBakar Usman, Muhammad Nadeem Iqbal & Muhammad Khizar Hayat. This is a research/review paper, distributed under the terms of the Creative Commons Attribution-Noncommercial 3.0 Unported License http://creative commons.org/licenses/by-nc/3.0/), permitting all non-commercial use, distribution, and reproduction in any medium, provided the original work is properly cited. -

Stock Price, Inflation, Karachi Stock Exchange, KSE 100

Microeconomics and Macroeconomics 2015, 3(4): 83-88 DOI: 10.5923/j.m2economics.20150304.01 The Impact of Inflation on Stock Prices: Evidence from Pakistan Ghulam Muhammad Qamri1,*, Muhammad Abrar Ul Haq2, Farheen Akram3 1Department of Economics, Nankai University, China 2School of Economics, Finance and Banking, University Utara Malaysia, Malaysia 3Department of Commerce, the Islamia University of Bahawalpur, Pakistan Abstract This empirical study design to investigate the association between stock price and inflation in Pakistan. Many previous studies around the globe examine the relationship between stock price and inflation and proposed different results, many of them found that there is positive link between inflation and stock price. On the other hand some studies realized the negative relationship between these two terms. This research is based on past ten years data of Karachi stock exchange (KSE 100) and the statistical results of this research shows that there is negative relationship between stock price and inflation. Furthermore, when prices of stock are low firms avoid to enter in capital market until the central bank provide alternate for firm’s plan to invest in capital market. Moreover, firm’s equity value is also hit by the startling inflation rate. Similarly tightening of monetary policy can reduce inflation and stock prices both as individuals will be left with less money to buy goods or buy stocks. Keywords Stock price, Inflation, Karachi Stock Exchange, KSE 100 Islamabad stock exchange (ISE). However, a Memorandum 1. Introduction of Understanding (MoU) was signed in Islamabad on 27 August 2015 to form Pakistan Stock Exchange, with the History has shown that the price of stocks and other assets merger of Karachi, Lahore and Islamabad stock exchanges.