Akd of 2019.Fh10

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

FACTSHEET - AS of 01-Oct-2021 Solactive GBS Pakistan Large & Mid Cap USD Index PR

FACTSHEET - AS OF 01-Oct-2021 Solactive GBS Pakistan Large & Mid Cap USD Index PR DESCRIPTION The Solactive GBS Pakistan Large & Mid Cap USD Index PR is part of the Solactive Global Benchmark Series which includes benchmark indices for developed and emerging market countries. The index intends to track the performance of the large and mid cap segment covering approximately the largest 85% of the free-float market capitalization in the Pakistani market. It is calculated as a pricereturn index in USD and weighted by free-float market capitalization. HISTORICAL PERFORMANCE 1,200 1,000 800 600 400 200 Jan-2008 Jan-2010 Jan-2012 Jan-2014 Jan-2016 Jan-2018 Jan-2020 Jan-2022 Solactive GBS Pakistan Large & Mid Cap USD Index PR CHARACTERISTICS ISIN / WKN DE000SLA8Y15 / SLA8Y1 Base Value / Base Date 1139 Points / 08.05.2006 Bloomberg / Reuters / .SPKLMCUP Last Price 347.48 Index Calculator Solactive AG Dividends Not included Index Type Price Return Calculation 8:00 am to 10:30 pm (CET), every 15 seconds Index Currency USD History Available daily back to 08.05.2006 Index Members 13 FACTSHEET - AS OF 01-Oct-2021 Solactive GBS Pakistan Large & Mid Cap USD Index PR STATISTICS 30D 90D 180D 360D YTD Since Inception Performance -11.24% -18.75% -20.18% -6.01% -14.20% -69.49% Performance (p.a.) - - - - - -7.42% Volatility (p.a.) 17.33% 14.90% 15.54% 17.78% 16.87% 23.20% High 391.47 429.41 459.90 459.90 459.90 1310.60 Low 343.18 343.18 343.18 343.18 343.18 250.61 Sharpe Ratio -4.42 -3.83 -2.37 -0.36 -1.11 -0.33 Max. -

Topline Market Review P

Pakistan Weekly January 12, 2018 REP‐057 Topline Market Review Gains erode as profit taking ensues KSE‐100 Index +1.0 % WoW; Weekly net FIPI US$26mn Topline Research Best Local Brokerage House [email protected] Brokers Poll 2011-14, 2016-17 Tel: +9221‐35303330, Ext: 133 Topline Securities, Pakistan www.jamapunji.pk Best Local Brokerage House 2015-16 Index gains 1% in outgoing week as profit taking ensues Market Weekly Data KSE Volume & Value KSE‐100 Index 42,933.72 (Shares mn) Volume Value (US$mn) 330 150 1‐Week Change (%) 1.0% 260 Market Cap (Rs tn) 8.9 106 190 1‐Week Change (%) 0.2% 63 Market Cap (US$ bn) 80.6 120 1‐Week Change (%) 0.2% 50 20 18 18 18 18 18 ‐ ‐ 1‐Week Avg. Daily Vol (shares mn) 276.4 ‐ ‐ ‐ n n n n n aa aa aa aa aa J J J J J ‐ ‐ 1‐Week Avg. Daily Value (Rs bn) 12.2 ‐ ‐ ‐ 9 8 1‐Week Avg. Daily Value (US$ mn) 110.2 10 11 12 Source: PSX Source: PSX Outgoing week saw the culmination of the Santa Clause rally which commenced on December 20, 2017 and peaked on Jan 10, 2018 with a net gain of 14%. Since then index has had red two sessions correcting 2%/697pts, which has trimmed weekly gains to 1%/410pts with the index closing the week at 42,934pts level. Going forward, equities maybe further pressured as agitation movement by opposition parties begin on Jan 17 to protest against the Model Town. PtiitiParticipation idimproved siifitlignificantlyasprofitswerebkdbooked, average volumes idincreased 30% WWWoW whilevalue rose 44%. -

CONTENTS FUND INFORMATION Management Company Faysal Asset Management Limited Fund Information 2 Board of Directors of the Management Company Mr

Quarter and Nine months ended March 31, 2007 Quarter and Nine months ended March 31, 2007 CONTENTS FUND INFORMATION Management Company Faysal Asset Management Limited Fund Information 2 Board of Directors of the Management Company Mr. Farook Bengali, Chairman Mr. Salman Haider Sheikh, Chief Executive Officer Mission Statement 3 Mr. Hassan Mohamed Mahmood, Director Mr. Mohammad Iqbal, Director Mr. Shahid Waqar Mahmood, Director Mr. Feroz Rizvi, Director Report of the Directors of the Management Company 4 Mr. Iqbal Alimohamed, Director Mr. Aqeel Karim Dhedhi, Director CFO of the Management Company Statement of Assets and Liabilities 6 Mr. Muhammad Shakeel Musani Company Secretary of the Management Company Mr. M. Siddique Memon Income Statement 7 Audit Committee Mr. Iqbal Alimohamed, Chairman Mr. Mohammad Iqbal, Member Distribution Statement 8 Mr. Shahid Waqar Mahmood, Member Mr. Feroz Rizvi, Member Trustee Statement of Movement in Unit Holders’ Funds 9 Central Depository Company of Pakistan Limited 8th Floor, Karachi Stock Exchange Building, Stock Exchange Road, Karachi-74000 Cash Flow Statement 10 Bankers to the Fund Faysal Bank Limited MCB Bank Limited Bank Alfalah Limited Notes to the Financial Statements 11 Habib Metropolitan Bank Limited Atlas Bank Limited Bank of Punjab Limited Auditor A.F. Ferguson & Co., Chartered Accountants Legal Advisor Mohsin Tayebaly & Co. Barristers & Advocates, Corporate legal Consultants, 2nd Floor, Dime Centre, BC-4, Block-9, KDA-5, Clifton, Karachi. Registrar Gangjees Registrar Services (Pvt) Limited Room -

OICCI CSR Report 2018-2019

COMBINING THE POWER OF SOCIAL RESPONSIBILITY Corporate Social Responsibility Report 2018-19 03 Foreword CONTENTS 05 OICCI Members’ CSR Impact 06 CSR Footprint – Members’ Participation In Focus Areas 07 CSR Footprint – Geographic Spread of CSR Activities 90 Snapshot of Participants’ CSR Activities 96 Social Sector Partners DISCLAIMER The report has been prepared by the Overseas Investors Chamber of Commerce and Industry (OICCI) based on data/information provided by participating companies. The OICCI is not liable for incorrect representation, if any, relating to a company or its activities. 02 | OICCI FOREWORD The landscape of CSR initiatives and activities is actively supported health and nutrition related initiatives We are pleased to present improving rapidly as the corporate sector in Pakistan has through donations to reputable hospitals, medical care been widely adopting the CSR and Sustainability camps and health awareness campaigns. Infrastructure OICCI members practices and making them permanent feature of the Development was also one of the growing areas of consolidated 2018-19 businesses. The social areas such as education, human interest for 65% of the members who assisted communi- capital development, healthcare, nutrition, environment ties in the vicinity of their respective major operating Corporate Social and infrastructure development are the main focus of the facilities. businesses to reach out to the underprivileged sections of Responsibility (CSR) the population. The readers will be pleased to note that 79% of our member companies also promoted the “OICCI Women” Report, highlighting the We, at OICCI, are privileged to have about 200 leading initiative towards increasing level of Women Empower- foreign investors among our membership who besides ment/Gender Equality. -

Distribution, Power and Networks in Financial Markets of Pakistan

SMALL CLUB A Small Club: Distribution, Power and Networks in Financial Markets of Pakistan No. 2021:3 PIDE Working Papers Nadeem Ul Haque Amin Hussain PIDE Working Papers No. 2021:3 A Small Club: Distribution, Power and Networks in Financial Markets of Pakistan Nadeem Ul Haque Vice-Chancellor, Pakistan Institute of Development Economics, Islamabad. and Amin Husain Doktorand, Uppsala University. PAKISTAN INSTITUTE OF DEVELOPMENT ECONOMICS ISLAMABAD 2021 Editorial Committee Idrees Khawaja Saman Nazir Shahid Mehmood Disclaimer: Copyrights to this PIDE Working Paper remain with the author(s). The author(s) may publish the paper, in part or whole, in any journal of their choice. Pakistan Institute of Development Economics Islamabad, Pakistan E-mail: [email protected] Website: http://www.pide.org.pk Fax: +92-51-9248065 Designed, composed, and finished at the Publications Division, PIDE. CONTENTS Page Abstract v 1. The Stock Market That Does Not Grow! 1 2. Corporate Governance Matters 2 3. Networks and Subnetworks 6 3.1. Shareholders Networks 6 3.2. Network of Families: Mahbubul Haq Redux 7 4. Corporate Governance: What Board Memberships Tell Us! 8 4.1. Independent Directors 10 4.2. The Opportunity to be a Director: A Small Club 11 5. Network Analysis of Board Members 12 5.1. A Small Club 12 6. Who Matters in Pakistani Corporations? 13 7. Conclusion 16 References 17 List of Tables Table 1. Shareholding Proportions in KSE 100 (Market Cap) 5 Table 2. Professional Experience of Directors 11 Table 3. Number of Directors in Each Category 11 Table 4. Characteristics of 20 Directors with Highest Betweenness Centrality 15 List of Figures Figure 1. -

National Clearing Company of Pakistan Limited 8Th Floor, Karachi Stock Exchange Building, Stock Exchange Road, Karachi

National Clearing Company of Pakistan Limited 8th Floor, Karachi Stock Exchange Building, Stock Exchange Road, Karachi NCCPL/CM/APRIL-19/12 April 19, 2019 Eligibility Review of Margin Eligible Securities – as per Approved Amendments in the NCCPL Regulations, 2015 Dear Clearing Members, This is with reference to NCCPL circular NCCPL/CM/APRIL-19/10 dated April 17, 2019 on approved amendments in the NCCPL Regulations, 2015 pertaining to Introduction of Category “B” of Margin Eligible Securities (“MES”). In this regard, in accordance with Schedule III of Chapter 12 of NCCPL Regulations, 2015 following changes will be applicable in MES Category A and Category B respectively effective from April 22, 2019: Haircut for MES category “A” and “B” Applicable Haircut on daily Applicable Haircut on daily VaR based Margin closing rate in Ready Market - closing rate in Ready Market- Bucket Category “A” Category “B” 00.00% to < 12.50% 15.00% 22.50% 12.50% to < 15.00% 17.50% 25.00% 15.00% to < 20.00% 22.50% 30.00% 20.00% to < 25.00% 27.50% 35.00% 25.00% to < 30.00% 32.50% 40.00% 30.00% to < 40.00% 42.50% 50.00% Greater than 40% 60.00% 60.00% Acceptable Quantity for MES category “A” and “B” Maximum No of shares in a Maximum No of shares in a VaR Based Margin symbol that may be deposited symbol that may be deposited Percentage as Collateral Category -A as Collateral Category -B VaR ≤ 20% 2% of Free-Float 1% of Free-Float VaR > 20% 0.5% of Free-Float 0.25% of Free-Float The above mention criteria of Category – B, Haircut and Acceptable quantity are not applicable on MTS and SLB Market. -

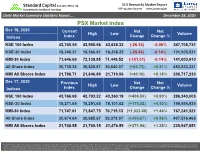

PSX Market Index

Standard Capital Securities (Pvt.) Ltd. SCS Research | Market Report Committed to intelligent investing REP-033 also log onto www.jamapunji.pk Daily Market Summary Statistics Report…. December 18, 2020 REP-033 also log onto PSX Market Indexwww.jamapunji.pk Dec 18, 2020 Current Net Net High Low Volume Indices Index Change Change % KSE 100 Index 43,740.55 43,955.56 43,638.33 (-26.14) -0.06% 247,708,731 KSE-30 Index 18,246.21 18,366.81 18,208.25 (-25.43) -0.14% 131,905,521 KMI-30 Index 71,646.60 72,139.95 71,449.52 (-101.01) -0.14% 141,003,610 All Share Index 30,738.36 30,825.87 30,640.07 (+63.72) +0.21% 482,533,331 KMI All Shares Index 21,788.71 21,846.89 21,719.06 (+40.16) +0.18% 208,717,230 Dec 17, 2020 Previous Net Net High Low Volume Indices Index Change Change % KSE 100 Index 43,766.69 43,793.22 43,360.19 (+406.50) +0.93% 286,340,005 KSE-30 Index 18,271.64 18,291.65 18,101.62 (+170.02) +0.93% 149,554,934 KMI-30 Index 71,747.61 71,847.75 70,715.13 (+1,032.48) +1.44% 167,241,521 All Share Index 30,674.64 30,685.67 30,378.97 (+295.67) +0.96% 497,516,465 KMI All Shares Index 21,748.55 21,769.15 21,476.59 (+271.96) +1.25% 239,947,851 Disclaimer: This report has been prepared by Standard Capital Securities (Pvt) Ltd. -

UNITED BANK LIMITED Company Total

ReportID : SH0935MRG ( 10D09 ) UNITED BANK LIMITED Page : 1 UserID : MANAGER Category of Shareholders Date : 25/11/2020 As On 30/09/2020 Particulrs No of Folio Balance Share Percentage DIRECTORS, CEO & CHILDREN 14 22376706 1.8279 BANKS, DFI & NBFI 20 24344420 1.9886 INSURANCE COMPANIES 21 66505081 5.4326 MUTUAL FUNDS 52 35731338 2.9188 GENERAL PUBLIC (LOCAL) 20762 57655106 4.7097 GENERAL PUBLIC (FOREIGN) 1263 14119519 1.1534 OTHERS 100 42069855 3.4366 FOREIGN COMPANIES 170 837596406 68.4210 GOVT. OWNED ENTITIES / BANKS 2 2201714 0.1799 JOINT STOCK COMPANIES 153 120512654 9.8444 PUBLIC SECTOR COMPANIES 1 118628 0.0097 CHARITABLE TRUSTS 15 947789 0.0774 MODARABAS 1 471 0.0000 Company Total 22574 1224179687 100.0000 ReportID : SH0935MRG ( 10D09 ) UNITED BANK LIMITED Page : 1 UserID : MANAGER Category of Shareholders Date : 25/11/2020 As On 30/09/2020 Folio No Name Code Balance Held Percentage 003228007618 ZAHEER SAJJAD 001 2537 0.0002 003277055802 WAJAHAT HUSAIN 001 377490 0.0308 003277061831 ZAMEER MOHAMMED CHOUDREY 001 2348870 0.1919 003277061832 SIR MOHAMMED ANWAR PERVEZ 001 12442568 1.0164 003277081132 ARSHAD AHMAD MIR 001 2500 0.0002 003277085442 HAIDER ZAMEER CHOUDREY 001 2000000 0.1634 003277085443 ABDUL KHALIQUE BHATTI 001 23595 0.0019 003277085445 UMAIR ZAMEER CHOUDREY 001 2000000 0.1634 004705092033 ZAMEER MOHAMMED CHOUDREY 001 55000 0.0045 006122001420 RIZWAN PERVEZ ( 00160 ) 001 44500 0.0036 006122007203 MOHAMMED YOUNUS SHEIKH 001 418962 0.0342 006122022251 ARSHAD MEHMOOD CHAUDHARY 001 2448940 0.2000 006122035865 NAEEM KHALIQUE 001 105872 0.0086 006122035873 MANZOOR KHALIQUE 001 105872 0.0086 000539002770 ENGLISH LEASING LIMITED 004 7 0.0000 001867000022 PAKISTAN KUWAIT INVESTMENT CO. -

Lt Gen Tariq Khan, HI (M) (Retd), Is Chief Executive & Managing

Lt Gen Tariq Khan, HI (M) (Retd) Lt Gen Tariq Khan, HI (M) (Retd), is Chief Executive & Managing Director of Fauji Fertilizer Company Limited, FFC Energy Limited and Fauji Fresh n Freeze Limited and also holds directorship on the Boards of following: Fauji Fertilizer Bin Qasim Limited Askari Bank Limited Fauji Foods Limited Philip Morris (Pakistan) Limited Fauji Meat Limited FFBL Foods Limited FFBL Power Company Limited Thar Energy Limited Pakistan Maroc Phosphore S.A. He is Chairman of Sona Welfare Foundation (SWF) and Fertilizer Manufacturers of Pakistan Advisory Council (FMPAC) and member of the Board of Governors of Foundation University, Islamabad. The General was commissioned in Pakistan Army in April1977 with the coveted Sword of Honour. During his illustrious service in the Army, he had been employed on various prestigious command, staff and instructional assignments including command of a Strike Corps. He is a graduate of Command and Staff College Quetta and National Defence University Islamabad. He also holds Master Degree in War Studies. He has served on the faculty of Command and Staff College Quetta and National Defence University Islamabad. Since his retirement, he is on the honorary faculty of renowned institutions including National Defence University as a senior mentor. The General possesses vast experience as adviser to the leading corporate entities. He has been awarded Hilal-e-Imtiaz (Military) and is also the first Pakistan Army General who has been conferred upon the U.S ‘Legion of Merit’ by the U.S Government for his meritorious services as a senior representative at U.S CENTCOM in Tampa, Florida. -

Shariah Compliance Screening Report

Al-Hilal Shariah Advisors December 2016 Shariah Compliance Screening Report INSIDE Key Highlights ......................................................................................................................................... 3 Shariah Compliant Companies ............................................................................................................... 5 Shariah Non - Compliant Companies ...................................................................................................... 7 Suspended & Delisted Companies………………………………………………………………………………………………….....9 Approved Islamic Banks & Windows for Placements ........................................................................... 10 Screening Guidelines for Equity Securities ........................................................................................... 11 Purification Guidelines .......................................................................................................................... 12 Al-Hilal Shariah Advisors (Pvt.) Limited. (Formerly Fortune Islamic (Pvt.) Limited) P a g e | 2 Al-Hilal Shariah Advisors (Pvt.) Limited. (Formerly Fortune Islamic (Pvt.) Limited) 27 April, 2017 KEY HIGHLIGHTS We have conducted Shariah compliance screening of 524 selected companies listed on the Pakistan Stock Exchange as per their latest financial statements (December’16), on the basis of the Shariah compliance screening mechanism approved by our Shariah Supervisory Council headed by Mufti Irshad Ahmad Aijaz. Following are the results for -

MSCI Pakistan IMI (USD)

MSCI Pakistan IMI (USD) The MSCI Pakistan Investable Market Index (IMI) is designed to measure the performance of the large, mid and small cap segments of the Pakistani market. With 16 constituents, the index covers approximately 99% of the free float-adjusted market capitalization in Pakistan. CUMULATIVE INDEX PERFORMANCE — GROSS RETURNS (USD) ANNUAL PERFORMANCE (%) (NOV 2010 – AUG 2021) MSCI Year MSCI Emerging MSCI Pakistan IMI Markets IMI ACWI IMI MSCI Pakistan IMI 2020 -3.90 18.78 16.81 2019 4.60 18.10 27.04 MSCI Emerging Markets IMI 314.71 300 MSCI ACWI IMI 2018 -29.46 -14.71 -9.61 2017 -24.18 37.28 24.58 2016 41.77 10.30 8.96 2015 -8.82 -13.55 -1.68 2014 21.51 -1.42 4.36 200 2013 37.44 -1.86 24.17 163.45 2012 34.80 19.08 17.04 151.92 2011 -10.19 -19.24 -7.43 100 50 Nov 10 Oct 11 Sep 12 Aug 13 Jun 14 May 15 Apr 16 Mar 17 Jan 18 Dec 18 Nov 19 Oct 20 Aug 21 INDEX PERFORMANCE — GROSS RETURNS (%) (AUG 31, 2021) FUNDAMENTALS (AUG 31, 2021) ANNUALIZED Since 1 Mo 3 Mo 1 Yr YTD 3 Yr 5 Yr 10 Yr Nov 30, 2010 Div Yld (%) P/E P/E Fwd P/BV MSCI Pakistan IMI -2.43 -10.66 7.17 -0.60 -8.27 -8.68 4.25 3.96 7.99 6.26 5.23 1.21 MSCI Emerging Markets IMI 2.47 -3.26 23.85 4.85 10.56 10.78 5.30 4.67 2.07 16.45 13.09 1.95 MSCI ACWI IMI 2.51 4.33 30.65 16.38 14.53 14.72 11.84 11.24 1.69 23.40 18.53 2.90 INDEX RISK AND RETURN CHARACTERISTICS (AUG 31, 2021) ANNUALIZED STD DEV (%) 2 SHARPE RATIO 2 , 3 MAXIMUM DRAWDOWN Turnover Since 1 3 Yr 5 Yr 10 Yr 3 Yr 5 Yr 10 Yr Nov 30, (%) Period YYYY-MM-DD (%) 2010 MSCI Pakistan IMI 12.00 30.98 26.66 23.18 -0.16 -0.25 0.27 0.26 69.36 2017-05-24—2020-03-26 MSCI Emerging Markets IMI 8.27 19.45 16.62 17.50 0.55 0.62 0.34 0.31 38.05 2018-01-26—2020-03-23 MSCI ACWI IMI 3.24 18.47 14.81 14.00 0.76 0.92 0.82 0.78 34.47 2020-02-12—2020-03-23 1 Last 12 months 2 Based on monthly gross returns data 3 Based on ICE LIBOR 1M The MSCI Pakistan IMI was launched on Dec 01, 2010. -

Pakistan Stock Exchange Limited BROKER to BROKER

Pakistan Stock Exchange Limited Stock Exchange Building, Stock Exchange Road, Karachi (Copy of the same is also available on our website www.psx.com.pk) Off Market Transactions PSX/N-557 Report For: April 30, 2021 BROKERS HAVE SUBSEQUENTLY REPORTED THE FOLLOWING TRANSACTIONS BROKER TO BROKER Member Code C o m p a n y Turnover of Shares Rate Nos. (+)223 (-)120 Jubilee General Ins. 213,183 40.000 Jubilee General Ins. 618,997 40.000 Jubilee General Ins. 861,954 40.000 Jubilee General Ins. 367,422 40.000 Jubilee General Ins. 173,742 40.000 T o t a l / Weighted Avg. Rate 2,235,298 40.000 (+)084 (-)117 Nat. Refinery 500 559.500 T o t a l / Weighted Avg. Rate 500 559.500 (+)117 (-)084 Nat. Refinery 500 560.000 T o t a l / Weighted Avg. Rate 500 560.000 (+)046 (-)050 Service Global Footw 30,000 57.000 T o t a l / Weighted Avg. Rate 30,000 57.000 (+)194 (-)050 Service Global Footw 100,000 58.000 T o t a l / Weighted Avg. Rate 100,000 58.000 (+)117 (-)108 Siddiqsons Tin Plate 1,000 14.200 T o t a l / Weighted Avg. Rate 1,000 14.200 Total Tunover 2,367,298 CROSS TRANSACTIONS BETWEEN CLIENT TO CLIENT & FINANCIAL INSTITUTIONS Member Code Nos. C o m p a n y Turnover of Shares Rate 019 TRG Pakistan Ltd. 300,000 160.000 T o t a l / Weighted Avg. Rate 300,000 160.000 Pakistan Stock Exchange Limited Stock Exchange Building, Stock Exchange Road, Karachi (Copy of the same is also available on our website www.psx.com.pk) Off Market Transactions PSX/N-557 Report For: April 30, 2021 CROSS TRANSACTIONS BETWEEN CLIENT TO CLIENT & FINANCIAL INSTITUTIONS Member Code Nos.