Bulletin 21 Aug 07.FH10

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Introduction

INTRODUCTION Bank Alfalah Limited was incorporated in June 21st, 1997 as a public limited company under the Companies Ordinance 1984. Its banking operations commenced from November 1st, 1997. The bank is engaged in commercial banking and related services as defined in the Banking companies ordinance 1962. The Bank is listed on all the three stock exchanges of Pakistan. The Bank is engaged in banking services as described in the Banking Companies Ordinance, 1962 and is operating through 191 conventional banking branches, 32 Islamic banking branches and 7 overseas branches and 1 Offshore Banking Unit, with the registered office at B.A. Building, I.I. Chandigarh, Karachi. Since, its inception as the new identity of H.C.E.B after the privatization in 1997, the management of the bank has implemented strategies and policies to carve a distinct position for the bank in the market place. Strengthened with the banking of the Abu Dhabi Group and driven by the strategic goals set out by its board of management, the Bank has invested in revolutionary technology to have an extensive range of products and services. This facilitates their commitment to a culture of innovation and seeks out synergies with clients and service providers to ensure uninterrupted services to its customers. The bank perceived the requirements of customers and matches them with quality products and service solutions. During the past five years, bank has emerged as one of the foremost financial institution in the region endeavoring to meet the needs of tomorrow as well as today. To continually upgrade the quality of service to the customers, training of team members in all the integral aspects of banking, customer service and IT was specially focused. -

Annual Report 2011

SoneriBank Soneri B8nk Limited Regla11ered ortlce: Rupall House 241-242, - Upper Mall Scheme, Anand Road, Lahore - 54000, Pakistan Tel: (042) 35713101-04 Head Otnc:e: 90·8-C/11, Uberty Market, Gulberg Ill, LahcnJ • 54000, Pakistan Tal: (042) 35772362-65 Central Office: 51h FlOOr, AJ.Rahim Tower, 1.1. Chundrigar Road, Karachi ·74000, Pakistan J Tal: (021) 32439562-67 Webde: www.aonertbank.com 2417 Call C.ntre: 0800-00500 UAN: 111-80NERI Soneri Bank Limited nnnUHL REPORT 2U II An experience Beyond Banking Soneri Bank Limited R~~URl ~frO~T 2011 OUR MISSION To develop Soneri Bank into an aggressive and dynamic financial institution having the capabilities to provide personalized service to customers with cutting edge technology and a wide range of products, and during the process ensure maximum return on assets with the ultimate goal of serving the economy and the society. Soneri Bank Limited R~~URl ~frO~T 2011 Products and Services 07 Corporate Information 13 Board Committees 14 Management Committees 15 Key Performance Indicators 17 Six Years' Financial Summary 18 Six Years' Growth Summary 20 Six Years' Vertical Analysis 22 Six Years' Horizontal Analysis 24 Directors' Report to Shareholders 27 Statement of Value Addition 33 Statement of Internal Controls- by President 34 Statement of Internal Controls- by Chairman 35 Statement of Compliance with Best Practices of Code of Corporate Governance 36 Auditors' Review Report to The Members on Statement of Compliance with Best Practices of Code of Corporate Governance 38 Auditors' Report to The Members 39 Statement of Financial Position 40 Profit and Loss Account 41 Statement of Comprehensive Income 42 Cash Flow Statement 43 Statement of Changes in Equity 44 Notes to the Financial Statements 45 Shariah Advisor's Report 99 Notice of Annual General Meeting 101 Pattern of Shareholding 103 List of Branches 106 List of Foreign Correspondents 110 Soneri Bank Limited nnn ~Al ~Ero~r 2011 nnn~nl ~Ero~r 2011 As of 31 December 2011 Soneri Bank Limited was incorporated on September 28, 1991. -

12. BANKING 12.1 Scheduled Banks Operating in Pakistan Pakistani Banks

12. BANKING 12.1 Scheduled Banks Operating in Pakistan Pakistani Banks Public Sector Banks Nationalized Banks 1. First Women Bank Limited 2. National Bank of Pakistan Specialized Banks 1. Industrial Development Bank of Pakistan (IDBP) 2. Punjab Provincial Co-operative Bank Limited (PPCB) 3. Zarai Traqiati Bank Limited 4. SME Bank Ltd. Provincial Banks 1. The Bank of Khyber 2. The Bank of Punjab Private Domestic Banks Privatized Bank 1. Allied Bank of Pakistan Limited 2. Muslim Commercial Bank Limited 3. United Bank Limited 4. Habib Bank Ltd. Private Banks 1. Askari Commercial Bank Limited 2. Bank Al-Falah Ltd. 3. Bank Al-Habib Ltd. 4. Bolan Bank Ltd. 5. Faysal Bank Ltd. 6. KASB Bank Limited 7. Meezan Bank Ltd. 8. Metropolitan Bank Ltd 9. Prime Commercial Bank Ltd. 10. PICIC Commercial Bank Ltd. 11. Saudi-Pak Commercial Bank Limited 12. Soneri Bank Ltd. 13. Union Bank Ltd. Contd. 139 12.1 Scheduled Banks Operating in Pakistan Private Banks 14. Crescent Commercial Bank Ltd. 15. Dawood bank Ltd. 16. NDLC - IFIC Bank Ltd. Foreign Banks 1. ABN AMRO Bank NV 2. Al-Baraka Islamic Bank BSC 3. American Express Bank Ltd. 4. Citi Bank NA 5. Deutsche Bank AE 6. Habib Bank AG Zurich 7. Oman International Bank SAOG 8. Rupali Bank Ltd 9. Standard Chartered Bank Ltd. 10. The Bank of Tokyo-Mitsubishi Ltd. 11. The Hong Kong & Shanghai Banking Corporation Ltd. Source: SBP Note: Banks operating as on 30th June, 2004 140 12.2 State Bank of Pakistan - Assets of the Issue Department (Million Rupees) Last Day of June Particulars 2003 2004 2005 Total Assets 522,891.0 611,903.7 705,865.7 1. -

MONEY and CREDIT HIGHLIGHTS Stock As on End June (Rs Million) Items / Years 2006 2007 A

MONEY AND CREDIT HIGHLIGHTS Stock as on end June (Rs million) Items / Years 2006 2007 A. Components of Monetary Assets Currency in Circulation 740,390 840,181 Demand Deposits 1,085,665 2,643,778 Other Deposits 4,931 7,012 (M1)a 1,830,986 3,490,971 Time Deposits 1,380,418 366,872 Foreign Currency Deposits 195,501 207,312 Total Monetary Assets (M2)b 3,406,905 4,065,155 I. Public Sector Borrowing (Net) 833,686 926,530 - Budgetary Support 708,037 810,053 - Commodity Operation 107,762 98,552 - Effect of Zakat etc. (14,308) (14,269) - Privatization proceeds 37,657 37,657 II. Non-Government Sector 2,190,769 2,576,474 - Autonomous Bodies 36,979 58,148 - Private Sector (Net) 2,153,790 2,518,326 a. Private Sector 2,113,890 2,479,608 b. Public Sector Corporation 47,237 46,010 c. PSEs Special Accounts Debt (23,225) (23,478) Repayment with SBP d. Organization Institution 15,889 16,187 (SBP credit to NBFIs) III. Other Item (Net) (327,346) (422,223) IV. Domestic Credit 2,696,564 3,080,263 V. Foreign Assets (Net) 710,341 984,892 VI. Monetary Assets (M2)b 3,406,905 4,065,155 TABLE 5.1 COMPONENTS OF MONETARY ASSETS (Rs million) Stocks at end June (a) 2000 2001 2002 2003 2004 2005 2006 2007 (P) 1. Currency Issued 376,997 396,548 462,095 527,557 617,508 712,480 791,834 901,401 2. Currency held by SBP 1,851 1,905 1,865 2,565 2,960 3,107 3,005 3,148 3. -

Faysal Funds

Accounts forthe Quarter Ended September 30, 2008 FAYSAL BALANCED GROWTH FUND The Faysal Balanced Growth Fund (FBGF) is an open-ended mutual fund. The units of FBGF are listed on the Karachi Stock Exchange and were initially offered to the public on April 19, 2004. FBGFseeks to provide long-term capital appreciation with a conservative risk profile and a medium to long-term investment horizon. FBGF's investment philosophy is to provide stable returns by investing in a portfolio balanced between equities and fixed income instruments. Fund Information Management Company Faysal Asset Management Limited Board of Directors of the Management Company Mr. Khalid Siddiq Tirmizey, Chairman Mr. Salman Haider Sheikh, Chief Executive Officer Mr. Sanaullah Qureshi, Director Mr. Syed Majid AIi, Director Mr. Feroz Rizvi, Director CFO of the Management Company Mr. Abdul Razzak Usman Company Secretary of the Management Company Mr. M. Siddique Memon Audit Committee Mr. Feroz Rizvi, Chairman Mr. Sanaullah Qureshi, Member Mr. Syed Majid Ali, Member Trustee Central Depository Company of Pakistan Limited Suit #. M-13, 16, Mezzanine Floor, Progressive Plaza, Beaumont Road, Near PIDC House, Karachi. Bankers to the Fund Faysal Bank Limited MCB Bank Limited Bank Alfalah Limited Atlas Bank Limited The Bank of Punjab Auditors Ford Rhodes Sidat Hyder & Co., Chartered Accountants Legal Advisor Mohsin Tayebely & Co., 2nd Floor, Dime Centre, BC-4, Block-9, KDA-5, Clifton, Karachi. Registrars Gangjees Registrar Services (Pvt) Limited Room # 506, 5th Floor, Clifton Centre, Kehkashan Clifton - Karachi. Distributors Access Financial Services (Pvt.) Ltd. AKD Securities (Pvt.) Limited Faysal Asset Management Limited Faysal Bank Limited PICIC Commercial Bank Limited Reliance Financial Products (Pvt.) Limited Invest Capital & Securities (Pvt.) Limited Flow(Private) Limited IGI Investment Bank Limited Pak Oman Investment Bank Limited Alfalah Securities (Pvt) Limited JS Global Capital Limited t"''' e , FAYSAL BALANCED ~ . -

Topline Market Review P

Pakistan Weekly January 12, 2018 REP‐057 Topline Market Review Gains erode as profit taking ensues KSE‐100 Index +1.0 % WoW; Weekly net FIPI US$26mn Topline Research Best Local Brokerage House [email protected] Brokers Poll 2011-14, 2016-17 Tel: +9221‐35303330, Ext: 133 Topline Securities, Pakistan www.jamapunji.pk Best Local Brokerage House 2015-16 Index gains 1% in outgoing week as profit taking ensues Market Weekly Data KSE Volume & Value KSE‐100 Index 42,933.72 (Shares mn) Volume Value (US$mn) 330 150 1‐Week Change (%) 1.0% 260 Market Cap (Rs tn) 8.9 106 190 1‐Week Change (%) 0.2% 63 Market Cap (US$ bn) 80.6 120 1‐Week Change (%) 0.2% 50 20 18 18 18 18 18 ‐ ‐ 1‐Week Avg. Daily Vol (shares mn) 276.4 ‐ ‐ ‐ n n n n n aa aa aa aa aa J J J J J ‐ ‐ 1‐Week Avg. Daily Value (Rs bn) 12.2 ‐ ‐ ‐ 9 8 1‐Week Avg. Daily Value (US$ mn) 110.2 10 11 12 Source: PSX Source: PSX Outgoing week saw the culmination of the Santa Clause rally which commenced on December 20, 2017 and peaked on Jan 10, 2018 with a net gain of 14%. Since then index has had red two sessions correcting 2%/697pts, which has trimmed weekly gains to 1%/410pts with the index closing the week at 42,934pts level. Going forward, equities maybe further pressured as agitation movement by opposition parties begin on Jan 17 to protest against the Model Town. PtiitiParticipation idimproved siifitlignificantlyasprofitswerebkdbooked, average volumes idincreased 30% WWWoW whilevalue rose 44%. -

CONTENTS FUND INFORMATION Management Company Faysal Asset Management Limited Fund Information 2 Board of Directors of the Management Company Mr

Quarter and Nine months ended March 31, 2007 Quarter and Nine months ended March 31, 2007 CONTENTS FUND INFORMATION Management Company Faysal Asset Management Limited Fund Information 2 Board of Directors of the Management Company Mr. Farook Bengali, Chairman Mr. Salman Haider Sheikh, Chief Executive Officer Mission Statement 3 Mr. Hassan Mohamed Mahmood, Director Mr. Mohammad Iqbal, Director Mr. Shahid Waqar Mahmood, Director Mr. Feroz Rizvi, Director Report of the Directors of the Management Company 4 Mr. Iqbal Alimohamed, Director Mr. Aqeel Karim Dhedhi, Director CFO of the Management Company Statement of Assets and Liabilities 6 Mr. Muhammad Shakeel Musani Company Secretary of the Management Company Mr. M. Siddique Memon Income Statement 7 Audit Committee Mr. Iqbal Alimohamed, Chairman Mr. Mohammad Iqbal, Member Distribution Statement 8 Mr. Shahid Waqar Mahmood, Member Mr. Feroz Rizvi, Member Trustee Statement of Movement in Unit Holders’ Funds 9 Central Depository Company of Pakistan Limited 8th Floor, Karachi Stock Exchange Building, Stock Exchange Road, Karachi-74000 Cash Flow Statement 10 Bankers to the Fund Faysal Bank Limited MCB Bank Limited Bank Alfalah Limited Notes to the Financial Statements 11 Habib Metropolitan Bank Limited Atlas Bank Limited Bank of Punjab Limited Auditor A.F. Ferguson & Co., Chartered Accountants Legal Advisor Mohsin Tayebaly & Co. Barristers & Advocates, Corporate legal Consultants, 2nd Floor, Dime Centre, BC-4, Block-9, KDA-5, Clifton, Karachi. Registrar Gangjees Registrar Services (Pvt) Limited Room -

Prospectus, Especially the Risk Factors Given at Para 4.11 of This Prospectus Before Making Any Investment Decision

ADVICE FOR INVESTORS INVESTORS ARE STRONGLY ADVISED IN THEIR OWN INTEREST TO CAREFULLY READ THE CONTENTS OF THIS PROSPECTUS, ESPECIALLY THE RISK FACTORS GIVEN AT PARA 4.11 OF THIS PROSPECTUS BEFORE MAKING ANY INVESTMENT DECISION. SUBMISSION OF FALSE AND FICTITIOUS APPLICATIONS ARE PROHIBITED AND SUCH APPLICATIONS’ MONEY MAY BE FORFEITED UNDER SECTION 87(8) OF THE SECURITIES ACT, 2015. SONERI BANK LIMITED PROSPECTUS THE ISSUE SIZE OF FULLY PAID UP, RATED, LISTED, PERPETUAL, UNSECURED, SUBORDINATED, NON-CUMULATIVE AND CONTINGENT CONVERTIBLE DEBT INSTRUMENTS IN THE NATURE OF TERM FINANCE CERTIFICATES (“TFCS”) IS PKR 4,000 MILLION, OUT OF WHICH TFCS OF PKR 3,600 MILLION (90% OF ISSUE SIZE) ARE ISSUED TO THE PRE-IPO INVESTORS AND PKR 400 MILLION (10% OF ISSUE SIZE) ARE BEING OFFERED TO THE GENERAL PUBLIC BY WAY OF INITIAL PUBLIC OFFER THROUGH THIS PROSPECTUS RATE OF RETURN: PERPETUAL INSTRUMENT @ 6 MONTH KIBOR* (ASK SIDE) PLUS 2.00% P.A INSTRUMENT RATING: A (SINGLE A) BY THE PAKISTAN CREDIT RATING COMPANY LIMITED LONG TERM ENTITY RATING: “AA-” (DOUBLE A MINUS) SHORT TERM ENTITY RATING: “A1+” (A ONE PLUS) BY THE PAKISTAN CREDIT RATING AGENCY LIMITED AS PER PSX’S LISTING OF COMPANIES AND SECURITIES REGULATIONS, THE DRAFT PROSPECTUS WAS PLACED ON PSX’S WEBSITE, FOR SEEKING PUBLIC COMMENTS, FOR SEVEN (7) WORKING DAYS STARTING FROM OCTOBER 18, 2018 TO OCTOBER 26, 2018. NO COMMENTS HAVE BEEN RECEIVED ON THE DRAFT PROSPECTUS. DATE OF PUBLIC SUBSCRIPTION: FROM DECEMBER 5, 2018 TO DECEMBER 6, 2018 (FROM: 9:00 AM TO 5:00 PM) (BOTH DAYS INCLUSIVE) CONSULTANT TO THE ISSUE BANKERS TO THE ISSUE (RETAIL PORTION) Allied Bank Limited Askari Bank Limited Bank Alfalah Limited** Bank Al Habib Limited Faysal Bank Limited Habib Metropolitan Bank Limited JS Bank Limited MCB Bank Limited Silk Bank Limited Soneri Bank Limited United Bank Limited** **In order to facilitate investors, United Bank Limited (“UBL”) and Bank Alfalah Limited (“BAFL”) are providing the facility of electronic submission of application (e‐IPO) to their account holders. -

ANNUAL REPORT 2008 the Management Team Is Also Being Trained on Various Basel II Requirements

Contents Corporate Information......................................................................01 Director’s Report to the Shareholders........................................02 Statement of Compliance with the Code of Corporate Governance.......................................................07 Statement of Internal Control........................................................09 Notice of Annual General Meeting...........................................10 Review Report to the Members on Statement of the Compliance with Best Practices of Code of Corporate Governance...................................................................12 Auditor’s Report to Members.......................................................13 Balance Sheet......................................................................................15 Profit and Loss Account..................................................................16 Cash Flow Statement.......................................................................17 Statement Of Changes In Equity................................................18 Notes to Financial Statements.....................................................19 Six Years Key financial Data...........................................................62 Annexure - 1.........................................................................................63 Combined Pattern of CDC and Physical Share Holdings...................................................................64 Combined Pattern of CDC and Physical Share Holdings ..................................................................65 -

Distribution, Power and Networks in Financial Markets of Pakistan

SMALL CLUB A Small Club: Distribution, Power and Networks in Financial Markets of Pakistan No. 2021:3 PIDE Working Papers Nadeem Ul Haque Amin Hussain PIDE Working Papers No. 2021:3 A Small Club: Distribution, Power and Networks in Financial Markets of Pakistan Nadeem Ul Haque Vice-Chancellor, Pakistan Institute of Development Economics, Islamabad. and Amin Husain Doktorand, Uppsala University. PAKISTAN INSTITUTE OF DEVELOPMENT ECONOMICS ISLAMABAD 2021 Editorial Committee Idrees Khawaja Saman Nazir Shahid Mehmood Disclaimer: Copyrights to this PIDE Working Paper remain with the author(s). The author(s) may publish the paper, in part or whole, in any journal of their choice. Pakistan Institute of Development Economics Islamabad, Pakistan E-mail: [email protected] Website: http://www.pide.org.pk Fax: +92-51-9248065 Designed, composed, and finished at the Publications Division, PIDE. CONTENTS Page Abstract v 1. The Stock Market That Does Not Grow! 1 2. Corporate Governance Matters 2 3. Networks and Subnetworks 6 3.1. Shareholders Networks 6 3.2. Network of Families: Mahbubul Haq Redux 7 4. Corporate Governance: What Board Memberships Tell Us! 8 4.1. Independent Directors 10 4.2. The Opportunity to be a Director: A Small Club 11 5. Network Analysis of Board Members 12 5.1. A Small Club 12 6. Who Matters in Pakistani Corporations? 13 7. Conclusion 16 References 17 List of Tables Table 1. Shareholding Proportions in KSE 100 (Market Cap) 5 Table 2. Professional Experience of Directors 11 Table 3. Number of Directors in Each Category 11 Table 4. Characteristics of 20 Directors with Highest Betweenness Centrality 15 List of Figures Figure 1. -

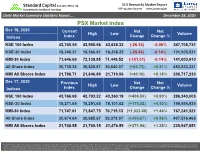

PSX Market Index

Standard Capital Securities (Pvt.) Ltd. SCS Research | Market Report Committed to intelligent investing REP-033 also log onto www.jamapunji.pk Daily Market Summary Statistics Report…. December 18, 2020 REP-033 also log onto PSX Market Indexwww.jamapunji.pk Dec 18, 2020 Current Net Net High Low Volume Indices Index Change Change % KSE 100 Index 43,740.55 43,955.56 43,638.33 (-26.14) -0.06% 247,708,731 KSE-30 Index 18,246.21 18,366.81 18,208.25 (-25.43) -0.14% 131,905,521 KMI-30 Index 71,646.60 72,139.95 71,449.52 (-101.01) -0.14% 141,003,610 All Share Index 30,738.36 30,825.87 30,640.07 (+63.72) +0.21% 482,533,331 KMI All Shares Index 21,788.71 21,846.89 21,719.06 (+40.16) +0.18% 208,717,230 Dec 17, 2020 Previous Net Net High Low Volume Indices Index Change Change % KSE 100 Index 43,766.69 43,793.22 43,360.19 (+406.50) +0.93% 286,340,005 KSE-30 Index 18,271.64 18,291.65 18,101.62 (+170.02) +0.93% 149,554,934 KMI-30 Index 71,747.61 71,847.75 70,715.13 (+1,032.48) +1.44% 167,241,521 All Share Index 30,674.64 30,685.67 30,378.97 (+295.67) +0.96% 497,516,465 KMI All Shares Index 21,748.55 21,769.15 21,476.59 (+271.96) +1.25% 239,947,851 Disclaimer: This report has been prepared by Standard Capital Securities (Pvt) Ltd. -

Standard Settlement Instructions

Treasury & Financial Institutions Group STANDARD SETTLEMENT INSTRUCTIONS BANK ALFALAH LTD. - PAKISTAN CONVENTIONAL BANKING S. No. CURRENCY BANK / COUNTRY ACCOUNT NO. SWIFT CODE 1. ACU Dollar Bank Alfalah Limited 0701-32029040 ALFHBDDH 2. ACU Dollar Habib Bank Limited 2624032800618 HABBBDDH 3. ACU Dollar Union Bank of India 01003 UBININBB 4. ACU Dollar ICICI Bank Ltd. 000408000491 ICICINBB 5. ACU Dollar Hatton National Bank Ltd., 054010065847 HBLILKLX Mashreqbank PSC, 6. ACU Dollar Mumbai, India 61050949 MSHQINBB 7. ACU Euro Hatton National Bank Ltd 54010066822 HBLILKLX 8. ACU Euro MashreqBank PSC, Mumbai 61049703 MSHQINBB Bank Alfalah Limited 9. ACU Euro Bangladesh, Dhaka 0701-01660001 ALFHBDDH 10. AUD Westpac Banking Corporation ALF0001976 WPACAU2S 11. Canadian Dollar Bank of Montreal Account Number: 31691056928 BOFMCAM2 CNY (Chinese Yuan) Standard Chartered Bank 12. RMB (Renminbi) (China) Limited, Account Number:501510476874 SCBLCNSXSHA 3996019616 13. Danish Krone Danske Bank DK7230003996019616 DABADKKK IBAN: DE24 5004 0000 0880 7182 01; 14. Euro Commerzbank, A.G. Account Number: 400880718201 COBADEFF IBAN: AT79 1100 0010 1161 8400; 15. Euro Unicredit Bank Austria AG Account Number: 01011618400 BKAUATWW Account Number: 1149245009; IBAN: 16. Euro National Bank of Pakistan DE27 501 30000 1149245001 NBPADEFF Account Number: 100100004291; IBAN: 17. Euro Intesa Sanpaolo SpA IT05Z0306940101100100004291 BCITITMM 18. Euro SCB, Frankfurt 018080105 SCBLDEFX 19. Japanese Yen National Bank of Pakistan 21063 NBPAJPJT 20. Pound National Westminster Bank IBAN: GB84NWBK60000404625528; Sort Sterling plc Code: 60-00-04 NWBKGB2L Pound 01707999001 21. Sterling Standard Chartered Bank IBAN: GB87 SCBL 6091 0417 0799 90 SCBLGB2L Alawwal Bank ( Formerly 31002231021 22. Saudi Riyal Saudi Hollandi Bank) IBAN # SA2150000000031002231021 AAALSARI 23. Saudi Riyal Banque Saudi Fransi IBAN # SA5655000000000705900137 BFSRSARI Singapore 24.