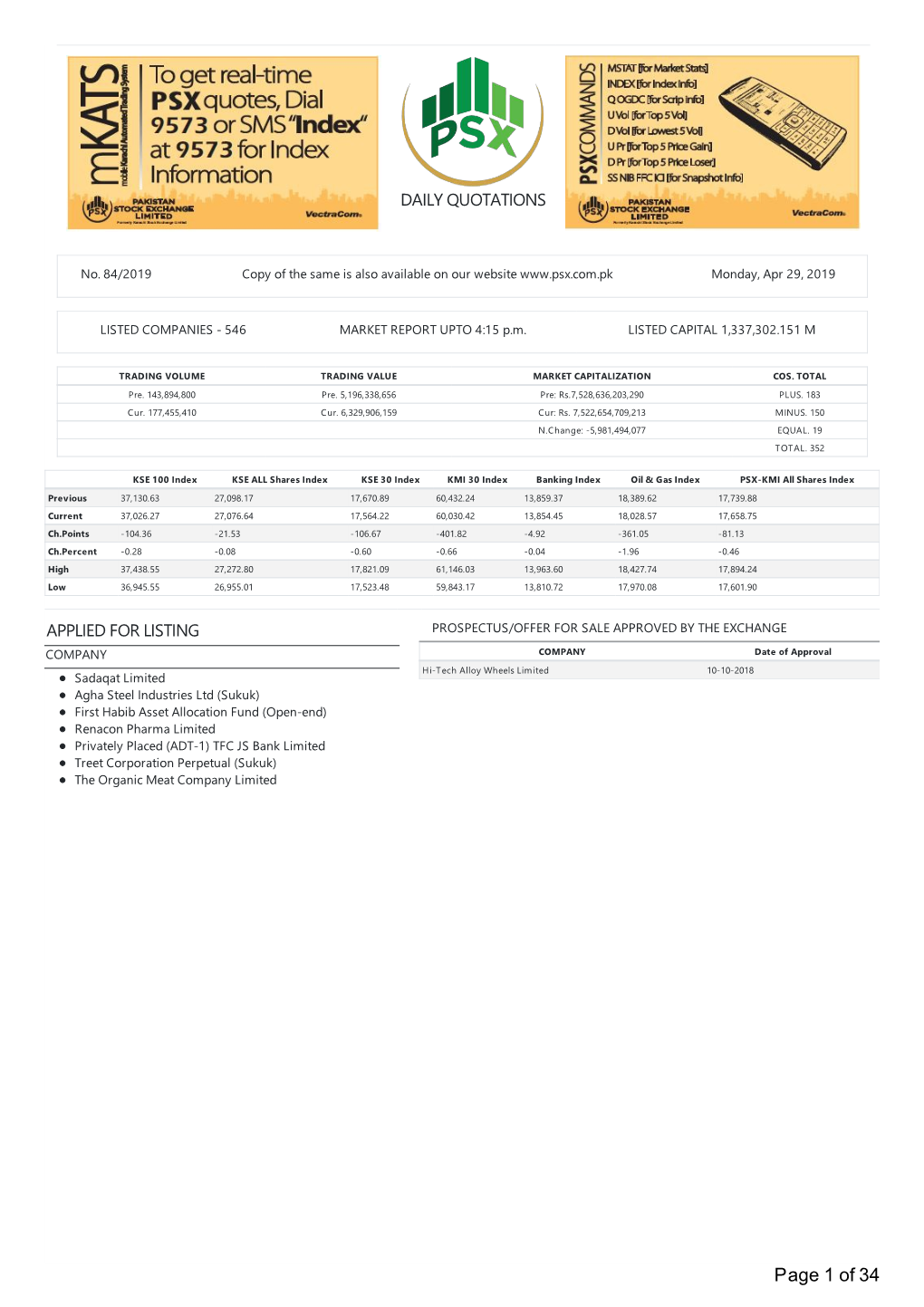

Daily Quotations Applied for Listing

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Role of Terrorist Events

International Journal of Disaster Recovery and Business Continuity Vol. 12, No. 1, (2021), pp. 1063-1075 Examination of Stock Markets Performance in Emerging Economies during Difficult Times: Role of Terrorist Events Dr. Ashfaq Ahmad Aamir Sohail Adil Riaz Farhad Hussain Iqra Ihsan Associate Professor, Hailey College of Commerce, University of the Punjab, Lahore. Email:[email protected] Lecturer Commerce, University of Sargodha (Sub Campus Bhakkar) [email protected] Lecturer Commerce, Government College University Faisalabad (Sub- Campus Hafiz Abad), Pakistan. , Ph.D. Scholar, Hubei University, China M.Com Scholar, Hailey College of Commerce, University of the Punjab, Lahore Abstract This study examines the effect of selected local and global terrorist events on Pakistan Stock Exchange by assessing KMI-30 and KSE-30 during the last decade. Data was collected for the daily closing stock prices of KMI-30 and KSE-30 for a period of 10 years (2010 to 2019). Twelve major terrorist events were selected from the South Asian Terrorism Portal (SATP) creating negative outcomes (deaths, injuries and other damages). Event study method was applied through estimation windows for Pre-Event, Event and Post-Event. Results indicate that the majority of the events have a significant impact on KSE-30 and KMI-30. More specifically the findings suggested that, Suicide attack on political offices, Attack on the Jamia masjid Madina, Twin suicide assaults at Parachinar, Assault on Army Public School, Paris, France bombing at bar, restaurant, theater and stadium, Self- destruction bombarding in Belgium, Suicide bombarding at Quetta’s Civil Hospital, Attack on Shrine of Lal Shahbaz and Attack on the political rally of the Balochistan Awami Party has significant effect on both markets. -

CFA Institute Research Challenge Hosted by CFA Society of Pakistan Institute of Business Administration – Karachi

CFA Institute Research Challenge hosted by CFA Society of Pakistan Institute of Business Administration – Karachi CFA Institute Research Challenge 2015-16 Institute of Business Administration (IBA) – Student Research This report is published for educational purposes only by [Oil & Gas Sector, Oil Marketing Company] Students competing in The CFA Institute Research Challenge. Pakistan Stock Exchange (PSX) Pakistan State Oil Date: 11/01/16 Current Price: 321.27 PKR/share Recommendation: BUY (33% upside) Ticker: PSO (PSX) Ticker: PSO PA (Bloomberg) PKR/USD: 105 Target Price: 428 PKR/share (4.08 USD) Market Profile Closing price (PKR) 321.27 PSO: Proxy for Pakistan’s economic revival 52-week price 283.75 - range (PKR) 415.40 We issue a BUY recommendation on Pakistan State Oil (PSO) with a one-year target price of PKR 428 using the Discounted Average daily Free Cash Flow to Firm (FCFF) and Relative Valuation Method. This offers a 33% upside from its closing price of PKR 321 volume (12M) 919,134 on January 11, 2016. PSO is one of the biggest and most liquid blue-chips on KSE with average daily volume being 0.34% As a % of shares of shares outstanding. Our investment thesis is based on PSO’s earnings growth, backed by volumes growth, outstanding 0.34% improving operating cash flows, and being a cheap blue-chip asset. PSO’s earnings growth is primarily driven by its volumetric sales growth during FY16-21 (CAGR: 12%) due to a changing energy mix, lower financing costs which will Dividend yield reduce over the years due to lower borrowings and positive operating cash flows. -

Topline Market Review P

Pakistan Weekly January 12, 2018 REP‐057 Topline Market Review Gains erode as profit taking ensues KSE‐100 Index +1.0 % WoW; Weekly net FIPI US$26mn Topline Research Best Local Brokerage House [email protected] Brokers Poll 2011-14, 2016-17 Tel: +9221‐35303330, Ext: 133 Topline Securities, Pakistan www.jamapunji.pk Best Local Brokerage House 2015-16 Index gains 1% in outgoing week as profit taking ensues Market Weekly Data KSE Volume & Value KSE‐100 Index 42,933.72 (Shares mn) Volume Value (US$mn) 330 150 1‐Week Change (%) 1.0% 260 Market Cap (Rs tn) 8.9 106 190 1‐Week Change (%) 0.2% 63 Market Cap (US$ bn) 80.6 120 1‐Week Change (%) 0.2% 50 20 18 18 18 18 18 ‐ ‐ 1‐Week Avg. Daily Vol (shares mn) 276.4 ‐ ‐ ‐ n n n n n aa aa aa aa aa J J J J J ‐ ‐ 1‐Week Avg. Daily Value (Rs bn) 12.2 ‐ ‐ ‐ 9 8 1‐Week Avg. Daily Value (US$ mn) 110.2 10 11 12 Source: PSX Source: PSX Outgoing week saw the culmination of the Santa Clause rally which commenced on December 20, 2017 and peaked on Jan 10, 2018 with a net gain of 14%. Since then index has had red two sessions correcting 2%/697pts, which has trimmed weekly gains to 1%/410pts with the index closing the week at 42,934pts level. Going forward, equities maybe further pressured as agitation movement by opposition parties begin on Jan 17 to protest against the Model Town. PtiitiParticipation idimproved siifitlignificantlyasprofitswerebkdbooked, average volumes idincreased 30% WWWoW whilevalue rose 44%. -

Habibmetro Modaraba Management (AN(AN ISLAMICISLAMIC FINANCIALFINANCIAL INSTITUTION)INSTITUTION)

A N N U A L R E P O R T 2017 1 HabibMetro Modaraba Management (AN(AN ISLAMICISLAMIC FINANCIALFINANCIAL INSTITUTION)INSTITUTION) 2 A N N U A L R E P O R T 2017 JOURNEY OF CONTINUOUS SUCCESS A long term partnership Over the years, First Habib Modaraba (FHM) has become the sound, strong and leading Modaraba within the Modaraba sector. Our stable financial performance and market positions of our businesses have placed us well to deliver sustainable growth and continuous return to our investors since inception. During successful business operation of more than 3 decades, FHM had undergone with various up and down and successfully countered with several economic & business challenges. Ever- changing requirement of business, product innovation and development were effectively managed and delivered at entire satisfaction of all stakeholders with steady growth on sound footing. Consistency in perfect sharing of profits among the certificate holders along with increase in certificate holders' equity has made FHM a sound and well performing Modaraba within the sector. Our long term success is built on a firm foundation of commitment. FHM's financial strength, risk management protocols, governance framework and performance aspirations are directly attributable to a discipline that regularly brings prosperity to our partners and gives strength to our business model which is based on true partnership. Conquering with the challenges of our operating landscape, we have successfully journeyed steadily and progressively, delivering consistent results. With the blessing of Allah (SWT), we are today the leading Modaraba within the Modaraba sector of Pakistan, demonstrating our strength, financial soundness and commitment in every aspect of our business. -

CONTENTS FUND INFORMATION Management Company Faysal Asset Management Limited Fund Information 2 Board of Directors of the Management Company Mr

Quarter and Nine months ended March 31, 2007 Quarter and Nine months ended March 31, 2007 CONTENTS FUND INFORMATION Management Company Faysal Asset Management Limited Fund Information 2 Board of Directors of the Management Company Mr. Farook Bengali, Chairman Mr. Salman Haider Sheikh, Chief Executive Officer Mission Statement 3 Mr. Hassan Mohamed Mahmood, Director Mr. Mohammad Iqbal, Director Mr. Shahid Waqar Mahmood, Director Mr. Feroz Rizvi, Director Report of the Directors of the Management Company 4 Mr. Iqbal Alimohamed, Director Mr. Aqeel Karim Dhedhi, Director CFO of the Management Company Statement of Assets and Liabilities 6 Mr. Muhammad Shakeel Musani Company Secretary of the Management Company Mr. M. Siddique Memon Income Statement 7 Audit Committee Mr. Iqbal Alimohamed, Chairman Mr. Mohammad Iqbal, Member Distribution Statement 8 Mr. Shahid Waqar Mahmood, Member Mr. Feroz Rizvi, Member Trustee Statement of Movement in Unit Holders’ Funds 9 Central Depository Company of Pakistan Limited 8th Floor, Karachi Stock Exchange Building, Stock Exchange Road, Karachi-74000 Cash Flow Statement 10 Bankers to the Fund Faysal Bank Limited MCB Bank Limited Bank Alfalah Limited Notes to the Financial Statements 11 Habib Metropolitan Bank Limited Atlas Bank Limited Bank of Punjab Limited Auditor A.F. Ferguson & Co., Chartered Accountants Legal Advisor Mohsin Tayebaly & Co. Barristers & Advocates, Corporate legal Consultants, 2nd Floor, Dime Centre, BC-4, Block-9, KDA-5, Clifton, Karachi. Registrar Gangjees Registrar Services (Pvt) Limited Room -

Distribution, Power and Networks in Financial Markets of Pakistan

SMALL CLUB A Small Club: Distribution, Power and Networks in Financial Markets of Pakistan No. 2021:3 PIDE Working Papers Nadeem Ul Haque Amin Hussain PIDE Working Papers No. 2021:3 A Small Club: Distribution, Power and Networks in Financial Markets of Pakistan Nadeem Ul Haque Vice-Chancellor, Pakistan Institute of Development Economics, Islamabad. and Amin Husain Doktorand, Uppsala University. PAKISTAN INSTITUTE OF DEVELOPMENT ECONOMICS ISLAMABAD 2021 Editorial Committee Idrees Khawaja Saman Nazir Shahid Mehmood Disclaimer: Copyrights to this PIDE Working Paper remain with the author(s). The author(s) may publish the paper, in part or whole, in any journal of their choice. Pakistan Institute of Development Economics Islamabad, Pakistan E-mail: [email protected] Website: http://www.pide.org.pk Fax: +92-51-9248065 Designed, composed, and finished at the Publications Division, PIDE. CONTENTS Page Abstract v 1. The Stock Market That Does Not Grow! 1 2. Corporate Governance Matters 2 3. Networks and Subnetworks 6 3.1. Shareholders Networks 6 3.2. Network of Families: Mahbubul Haq Redux 7 4. Corporate Governance: What Board Memberships Tell Us! 8 4.1. Independent Directors 10 4.2. The Opportunity to be a Director: A Small Club 11 5. Network Analysis of Board Members 12 5.1. A Small Club 12 6. Who Matters in Pakistani Corporations? 13 7. Conclusion 16 References 17 List of Tables Table 1. Shareholding Proportions in KSE 100 (Market Cap) 5 Table 2. Professional Experience of Directors 11 Table 3. Number of Directors in Each Category 11 Table 4. Characteristics of 20 Directors with Highest Betweenness Centrality 15 List of Figures Figure 1. -

PSX Market Index

Standard Capital Securities (Pvt.) Ltd. SCS Research | Market Report Committed to intelligent investing REP-033 also log onto www.jamapunji.pk Daily Market Summary Statistics Report…. December 18, 2020 REP-033 also log onto PSX Market Indexwww.jamapunji.pk Dec 18, 2020 Current Net Net High Low Volume Indices Index Change Change % KSE 100 Index 43,740.55 43,955.56 43,638.33 (-26.14) -0.06% 247,708,731 KSE-30 Index 18,246.21 18,366.81 18,208.25 (-25.43) -0.14% 131,905,521 KMI-30 Index 71,646.60 72,139.95 71,449.52 (-101.01) -0.14% 141,003,610 All Share Index 30,738.36 30,825.87 30,640.07 (+63.72) +0.21% 482,533,331 KMI All Shares Index 21,788.71 21,846.89 21,719.06 (+40.16) +0.18% 208,717,230 Dec 17, 2020 Previous Net Net High Low Volume Indices Index Change Change % KSE 100 Index 43,766.69 43,793.22 43,360.19 (+406.50) +0.93% 286,340,005 KSE-30 Index 18,271.64 18,291.65 18,101.62 (+170.02) +0.93% 149,554,934 KMI-30 Index 71,747.61 71,847.75 70,715.13 (+1,032.48) +1.44% 167,241,521 All Share Index 30,674.64 30,685.67 30,378.97 (+295.67) +0.96% 497,516,465 KMI All Shares Index 21,748.55 21,769.15 21,476.59 (+271.96) +1.25% 239,947,851 Disclaimer: This report has been prepared by Standard Capital Securities (Pvt) Ltd. -

Newsletter 74

Quarterly Newsletter Central Depository Company A RICH NATION Gems Mining Gold Mining Salt Mining Coal Mining Nature has bestowed Pakistan with generous treasures of size emeralds in South Asia. Recently, a 2500 year old earring gemstones which make Pakistan prominent in the mineral was found in France to have an emerald that originated most world. The world's most desired colored gemstones, such as likely in these Mingora mines. Sometimes locals have also Ruby, Emerald, Sapphire, Topaz, Aquamarine, Peridot, found this gemstone in the Swat River. Amethyst, Morganite, Zoisite, Spinel, Sphene, and Tourmaline, are found in Pakistan. The northern and northwestern parts of Being the sole depository in Pakistan, established and Pakistan are shrouded by the three world-famous mountain functioning since the last two decades, CDC has a scintillating ranges of Hindukush, Himalaya, and Karakorum. In these prominence in the Capital Market of Pakistan. It is undoubtedly mountains are found nearly all the minerals Pakistan currently a precious gemstone of the Capital Market infrastructure, with offers to the world market, including these precious gemstones. an excellent reputation and legacy of upholding the principles of reliability, trust and integrity. CDC’s perseverance to One of these enthusiastically glittering gems, Swat Emerald, is maintain and ensure complete investor confidence and its hexagonal in shape and has transparent, deep sea green colour. providence to stay abreast with technological advancement The Mingora mines in Swat Valley host some of the best, small makes it a unique gemstone of the Pakistan Capital Market. Head Office: Lahore Branch: CDC House, 99-B, Block ‘B’, S.M.C.H.S., Main Mezzanine Floor, South Tower, LSE Plaza, 19 Shahrah-e-Faisal, Karachi - 74400. -

Annual Report 2019 Managed and Controlled by Treet Holdings Limited

FIRST TREET MANUFACTURING MODARABA | Annual Report 2019 Managed and Controlled by Treet Holdings Limited ANNUAL REPORT 2019 TREET GROUP OF COMPANIES First Treet ftmm.com.pk Manufacturing Modaraba 1 2 02 34 Company Auditors’ Report to the Information Certificate-holders 35 03 Balance Directors’ Sheet Profile 36 06 Profit and Mission, Vision Loss Account Statements 37 07 Statement of Chairpersons’ Comprehensive Income Review 38 CONTENTS 08 Cash Flow Directors’ Statement Report 39 22 Statement of Changes in Directors’ Equity Report Urdu 40 23 Notes to the Statement of Ethics Financial Statements and Business Practices 79 28 Pattern of Statement of Compliance Certificate-holding with Code of Corporate Governance 80 Key Operating 31 Financial Data Independent Auditors’ Review Report 81 Notice of 13th Annual 32 Review Meeting Annual Shari’ah Advisor’s Report Company Information BOARD OF DIRECTORS: Dr. Mrs. Niloufer Qasim Mahdi Chairperson / Non-Executive Director Syed Shahid Ali Chief Executive Officer Syed Sheharyar Ali Non-Executive Director Mr. Imran Azim Non-Executive Director Mr. Munir Karim Bana Non-Executive Director Mr. Saulat Said Non-Executive Director Muhammad Shafique Anjum Non-Executive Director Dr. Salman Faridi Independent Director AUDIT COMMITTEE: Dr. Salman Faridi Chairman/Member Syed Sheharyar Ali Member Mr. Imran Azim Member Mr. Munir K. Bana Member Rana Shakeel Shaukat Secretary CHIEF ACCOUNTANTS: Mr. Sajjad Haider Khan Modaraba Mr. Muhammad Zubair Modaraba Company COMPANY SECRETARY: Rana Shakeel Shaukat EXTERNAL AUDITORS: -

Opportunities in the Development of Pakistan's Private Sector

Opportunities in the Development of Pakistan’s Private Sector AUTHOR Sadika Hameed 1616 Rhode Island Avenue NW | Washington, DC 20036 t. 202.887.0200 | f. 202.775.3199 | www.csis.org ROWMAN & LITTLEFIELD Lanham • Boulder • New York • Toronto • Plymouth, UK 4501 Forbes Boulevard, Lanham, MD 20706 t. 800.462.6420 | f. 301.429.5749 | www.rowman.com Cover photo: Shutterstock.com. ISBN 978-1-4422-4030-8 Ë|xHSLEOCy240308z v*:+:!:+:! SEPTEMBER 2014 A Report of the CSIS Program on Crisis, Conflict, and Cooperation Blank Opportunities in the Development of Pakistan’s Private Sector AUTHOR Sadika Hameed A Report of the CSIS Program on Crisis, Confl ict, and Cooperation September 2014 ROWMAN & LITTLEFIELD Lanham • Boulder • New York • Toronto • Plymouth, UK About CSIS For over 50 years, the Center for Strategic and International Studies (CSIS) has worked to develop solutions to the world’s greatest policy challenges. Today, CSIS scholars are providing strategic insights and bipartisan policy solutions to help decisionmakers chart a course toward a better world. CSIS is a nonprofi t or ga ni za tion headquartered in Washington, D.C. The Center’s 220 full-time staff and large network of affi liated scholars conduct research and analysis and develop policy initiatives that look into the future and anticipate change. Founded at the height of the Cold War by David M. Abshire and Admiral Arleigh Burke, CSIS was dedicated to fi nding ways to sustain American prominence and prosperity as a force for good in the world. Since 1962, CSIS has become one of the world’s preeminent international institutions focused on defense and security; regional stability; and transnational challenges ranging from energy and climate to global health and economic integration. -

An Evaluation of Investors' Behavior and Sentiments During Heavy Fluctuation in Stock Index; a Case Study of Pakistan Stock Exchange

Bahria University Journal of Management & Technology: Vol.3, No. 2 An evaluation of investors' behavior and sentiments during heavy fluctuation in stock index; A case study of Pakistan Stock Exchange 1Sumair Farooq, 2Dr. Syed Shabib ul Hassan 1,2 Department of Public Administration, University of Karachi ABSTRACT The role of stock exchange is highly dynamic regarding the capital mobilization in Pakistan and contributes an important role in overall financial sector of economy. The chief purpose of this article is to analyze the behavior and sentiment of investors during the heavy fluctuation in Stock Index at Pakistan Stock Exchange (PSX). The sentiment indexes for stock exchange selected for this research are Total Market Capitalization, Total Listed Capital - Rs., KSE-100" Index, KSE-30" Index, KMI-30 Index, PSX-KMI All Shares Index, New Companies Listed during the year, Listed Capital of New Companies - Rs., New Debt Instruments Listed during the year, Listed Capital of New Debt Instruments - Rs., Average Daily Turnover - Shares in million, Average value of daily turnover - Rs And Average Daily Turnover (Future). The indicators are analyzed by Correlation Analysis. The results prove that investor sentiment has positive effect on market returns. Keywords: Stock Exchange, Investor’s sentiments, Fluctuation, Average value of daily turnover, Market capitalization INTRODUCTION The sentiment of investors refers to common belief, mood and performance expectation of market. It is considered as an emotional factor that might have a direct impact on decision making of investors. The sentiments are rather irrational and based on some noisy information that doesn’t indicate the basic stock characteristics with limited experience of trading, skills or knowledge and might stimulate the investors for trading at illogical times or either led to under or overestimation of performance of stock (Neupane, Paudyal, & Thapa, 2014). -

Capital Market

7 Capital Market 7.1 Introduction Pakistan’s capital market showed a mixed trend during FY01 (see Table7.1). The benchmark KSE- 100 index shed 10.1 percent since the beginning of FY01 and closed the year at 1366.4. This downturn can be attributed to a host of factors including the lack of concrete progress on privatization, uncertain investor confidence, the continuous depreciation of the Rupee and friction between SECP and the bourses. While equity market remained bearish, the corporate bond market showed encouraging movements. The growth in this market was encouraging, as ten new TFCs issues were floated during FY01 alone, compared to ten in the last five fiscal years. 7.2 Stock Market Performance The Karachi Stock Exchange (KSE) maintained Table 7.1: Key Indicators of Capital Market its dominance in the country (see Table 7.1). FY99 FY00 FY01 Karachi Stock Exchange Primary market activities in KSE remained KSE-100 index 1054.7 1520.7 1366.4 slow, as only four new companies (with paid up SBP General index 106.4 128.8 118.7 capital of Rs 3.6 billion), were listed during Paid up capital (billion Rs) 215.0 229.3 239.9 FY01. Similarly, only two companies were Turnover of shares (billion #) 25.5 48.1 29.2 floated on the Lahore stock exchange, of which Lahore Stock Exchange Hubco was already subscribed. Like the KSE- LSE-101 index 288.9 372.0 273.2 100 index, the LSE-101 also declined by 98.8 Turnover of shares (billion #) 9.8 16.4 7.8 Paid up capital (billion Rs) 186.9 207.7 226.2 points (26.5 percent) to 273.2 by end-FY01.