Payment Systems in Emeap Economies

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Mobile Banking

Automated teller machine "Cash machine" Smaller indoor ATMs dispense money inside convenience stores and other busy areas, such as this off-premise Wincor Nixdorf mono-function ATM in Sweden. An automated teller machine (ATM) is a computerized telecommunications device that provides the customers of a financial institution with access to financial transactions in a public space without the need for a human clerk or bank teller. On most modern ATMs, the customer is identified by inserting a plastic ATM card with a magnetic stripe or a plastic smartcard with a chip, that contains a unique card number and some security information, such as an expiration date or CVVC (CVV). Security is provided by the customer entering a personal identification number (PIN). Using an ATM, customers can access their bank accounts in order to make cash withdrawals (or credit card cash advances) and check their account balances as well as purchasing mobile cell phone prepaid credit. ATMs are known by various other names including automated transaction machine,[1] automated banking machine, money machine, bank machine, cash machine, hole-in-the-wall, cashpoint, Bancomat (in various countries in Europe and Russia), Multibanco (after a registered trade mark, in Portugal), and Any Time Money (in India). Contents • 1 History • 2 Location • 3 Financial networks • 4 Global use • 5 Hardware • 6 Software • 7 Security o 7.1 Physical o 7.2 Transactional secrecy and integrity o 7.3 Customer identity integrity o 7.4 Device operation integrity o 7.5 Customer security o 7.6 Alternative uses • 8 Reliability • 9 Fraud 1 o 9.1 Card fraud • 10 Related devices • 11 See also • 12 References • 13 Books • 14 External links History An old Nixdorf ATM British actor Reg Varney using the world's first ATM in 1967, located at a branch of Barclays Bank, Enfield. -

Electronic Cash in Hong Kong

1 Focus THEME ity of users to lock their cards. Early in 1992, NatWest began a trial of Mondex in BY I. CHRISTOPHERWESTLAND. MANDY KWOK, ]OSEPHINESHU, TERENCEKWOK AND HENRYHO, HONG KONG an office complex in London with a 'can- UNIVERSITYOF SCIENCE&TECHNOLOGY. HONG KONG * teen card' known as Byte. The Byte trial is still continuing with more than 5,000 INTRODUCTION I teller cash for a card and uses it until that people using the card in two office res- Asian business has long had a fondness value is exhausted. Visa plans to offer a taurants and six shops. By December of for cash. While the West gravitated toward reloadable card later. 1993, the Mondex card was introduced on purchases on credit - through cards or a large scale. Sourcing for Mondex sys- installments - Asia maintained its passion HISTORY tem components involves more than 450 for the tangible. Four-fifths of all trans- Mondex was the brainchild of two NatWest manufacturers in over 40 countries. In actions in Hong Kong are handled with bankers - Tim Jones and Graham Higgins. October of 1994, franchise rights were sold cash. It is into this environment that They began technology development in to the Hong Kong and Shanghai Banking Mondex International, the London based 1990 with electronics manufacturers in the Corporation Limited to cover the Asian purveyor of electronic smart cards, and UK, USA and Japan. Subsequent market region including Hong Kong, China, In- Visa International, the credit card giant, research with 47 consumer focus groups dia, Indonesia, Macau, Philippines, are currently competing for banks, con- in the US, France, Germany, Japan, Hong Singapore and Thailand. -

Report – Made in PRD: the Changing Face of HK Manufacturers – Released in 2003

MADE IN Challenges & Opportunities for HK Industry Made in PRD Study is a Federation of Hong Kong Industries project. The Hong Kong Centre for Economic Research was commissioned to carry out this two-year Study. Published and printed in Hong Kong. HK$500 Published by Federation of Hong Kong Industries. Copyright © 2007 Federation of Hong Kong Industries. All rights reserved. No part of this publication may be reproduced or distributed in any form or by any means, or stored in a database or retrieval system, without the prior written permission of the Federation of Hong Kong Industries. Website : http://www.industryhk.org Contents 2 Foreword 8 Chapter 1 : Hong Kong and the Pearl and Yangtze River Deltas 28 Chapter 2 : Industrial Performance in Gunagdong and the Role of Hong Kong 42 Chapter 3 : Hong Kong-Funded Enterprises and Enterprises in Other Contractual Forms 56 Chapter 4 : The Characteristics of Product Sales 66 Chapter 5 : Guangdong and Hong Kong in Parternership 80 Chapter 6 : Business Environment of the PRD 94 Chapter 7 : Research & Development 110 Chapter 8 : Policy Recommendations 126 Glossary 128 Acknowledgements 1 Since China embarked on the historic economic reform Foreword programmes in late 1970s, the Pearl River Delta (PRD) has developed by leaps and bounds from a predominately rural region into one of the fastest growing, export- oriented industrial centres in the world. This spectacular transformation and the contributions that Hong Kong manufacturers had made to the process have been lucidly depicted in our study report – Made in PRD: The Changing Face of HK Manufacturers – released in 2003. -

Annual Report 2014 • Hong Kong Monetary Authority Page 5

2014 Annual Report Page 2 Hong Kong Monetary Authority The Hong Kong Monetary Authority (HKMA) is the government authority in Hong Kong responsible for maintaining monetary and banking stability. The HKMA’s policy objectives are • to maintain currency stability within the framework of the Linked Exchange Rate system • to promote the stability and integrity of the financial system, including the banking system • to help maintain Hong Kong’s status as an international financial centre, including the maintenance and development of Hong Kong’s financial infrastructure • to manage the Exchange Fund. The HKMA is an integral part of the Hong Kong Special Administrative Region Government but operates with a high degree of autonomy, complemented by a high degree of accountability and transparency. The HKMA is accountable to the people of Hong Kong through the Financial Secretary and through the laws passed by the Legislative Council that set out the Monetary Authority’s powers and responsibilities. In his control of the Exchange Fund, the Financial Secretary is advised by the Exchange Fund Advisory Committee. The HKMA’s offices are at 55/F, Two International Finance Centre, 8 Finance Street, Central, Hong Kong Telephone : (852) 2878 8196 Facsimile : (852) 2878 8197 E-mail : [email protected] The HKMA Information Centre is located at 55/F, Two International Finance Centre, 8 Finance Street, Central, Hong Kong and is open from 10:00 a.m. to 6:00 p.m. Monday to Friday and 10:00 a.m. to 1:00 p.m. on Saturday (except public holidays). The Centre consists of an Exhibition Area and a Library containing materials on Hong Kong’s monetary, banking and financial affairs and central banking topics. -

Neobank Varo on Serving Customers' Needs As P2P Payments See A

AUGUST 2021 Neobank Varo on serving customers’ needs as P2P payments see Nigerian consumers traded $38 million worth of bitcoin on P2P platforms within the past month a rapid rise in usage — Page 12 (News and Trends) — Page 8 (Feature Story) How P2P payments are growing more popular for a range of use cases, and why interoperability will be needed to keep growth robust — Page 16 (Deep Dive) © 2021 PYMNTS.com All Rights Reserved 1 DisbursementsTracker® Table Of Contents WHATʼS INSIDE A look at recent disbursements developments, including why P2P payments are becoming more valuable 03 to consumers and businesses alike and how these solutions are poised to grow even more popular in the years ahead FEATURE STORY An interview with with Wesley Wright, chief commercial and product officer at neobank Varo, on the rapid 08 rise of P2P payments adoption among consumers of all ages and how leveraging internal P2P platforms and partnerships with third-party providers can help FIs cater to customer demand NEWS AND TRENDS The latest headlines from the disbursements space, including recent survey results showing that almost 12 80 percent of U.S. consumers used P2P payments last year and how the U.K. government can take a page from the U.S. in using instant payments to help SMBs stay afloat DEEP DIVE An in-depth look at how P2P payments are meeting the needs of a growing number of consumers, how 16 this shift has prompted consumers to expand how they leverage them and why network interoperability is key to helping the space grow in the future PROVIDER DIRECTORY 21 A look at top disbursement companies ABOUT 116 Information on PYMNTS.com and Ingo Money ACKNOWLEDGMENT The Disbursements Tracker® was produced in collaboration with Ingo Money, and PYMNTS is grateful for the companyʼs support and insight. -

Study on the Implementation of Recommendation 97/489/EC

Study on the implementation of Recommendation 97/489/EC concerning transactions carried out by electronic payment instruments and in particular the relationship between holder and issuer Call for Tender XV/99/01/C FINAL REPORT – Part b) Appendices 20th March 2001 Study on the implementation of Recommendation 97/489/EC 1 APPENDICES Appendices 1. Methodology.................................................................................3 Appendices 2. Tables..........................................................................................28 Appendices 3. List of issuers and EPIs analysed and surveyed........................147 Appendices 4. General summary of each Work Package.................................222 Appendices 5. Reports country per country (separate documents) Study on the implementation of Recommendation 97/489/EC 2 Appendices 1 Methodology Study on the implementation of Recommendation 97/489/EC 3 Content of Appendices 1 1. Structure of the report ..............................................................................5 2. Route Map................................................................................................6 3. Methodology.............................................................................................7 4. Tools used..............................................................................................14 Study on the implementation of Recommendation 97/489/EC 4 1. The Structure of the Report The aims of the study were to investigate how far the 1997 Recommendation has been -

Information Technology in the Banking and Financial Sectors

INFORMATION TECHNOLOGY IN THE BANKING AND FINANCIAL SECTORS MARCH 25, 1996 BACKGROUND BREIFING PAPER OF THE TELECOMMUNICATIONS INFOTECHNOLOGY FORUM (please attribute any quotation) Information Technology in the Banking and Financial Services Sector Smartcards, banks and telephones A brief historical introduction; what this suggests about the future Banks first started using computers linked to telecommunications systems in a big way in the 1970s and 1980s, when local area networks allowed them to start automating accounts—and thus to introduce automatic teller machines (ATMs) which customers could use to find out how much money was in their accounts and make cash withdrawals. ATMs appeared to offer two things: — A competitive advantage: better service for customers. — Savings on staff costs, as tellers were replaced with machines. The first of these is undoubtedly true. A network of ATMs operating 24 hours a day takes the necessity out of planning when to get money for individuals—it is hard to imagine anyone accepting a bank without an ATM network for their day-to-day financial needs (though judging by the queues in some banks, some people do not seem to have realised quite what can be done with an ATM card). The second, however, has not really happened, at least in the way it was originally imagined. What has happened is that on the one hand staff have been freed up for other things—such as handling the huge array of financial services banks now offer compared with a couple of decades ago—and on the other IT has taken on a life of its own as banks think of new ways to wire themselves and their customers. -

Video on Showcase of Awarded Websites and Mobile Applications

Video on Showcase of Awarded Websites and Mobile Applications Most Favourite Websites 1. The Kowloon Motor Bus Company (1933) Limited [www.kmb.hk] 2. The University of Hong Kong [www.hku.hk] 3. The Chinese University of Hong Kong [www.cuhk.edu.hk] Most Favourite Mobile App 4. MTR Corporation Limited [MTR Mobile , iOS / Android] 5. Airport Authority Hong Kong [HKG My Flight , iOS / Android] 6. Hong Kong Blind Union [Searching & Exploring with Speech Augmented Map Information (SESAMI) , iOS] Designer Award 1. TheOrigo Ltd. 2. Palmary Solutions Company Limited 3. KanHan Technologies Limited Triple Gold Award 1. Arcotect Limited [www.arcotect.com] 2. Automated Systems Holdings Limited [www.asl.com.hk] 3. The Chinese University of Hong Kong [www.cuhk.edu.hk] 4. City University of Hong Kong [www.cityu.edu.hk/cityu] 5. City University of Hong Kong [www.cityu.edu.hk/cio] 6. Fish Marketing Organization [www.fmo.org.hk] 7. Freedom Communications Limited [www.freecomm.com/entxt_index.php] 8. The Hong Kong Council of Social Service [dsf.org.hk] 9. HKCSS - HSBC Social Enterprise Business Centre [www.sobiz.hk] 10. Information Technology Resource Centre Limited [itrc.hkcss.org.hk] 11. Hong Kong Council on Smoking and Health [www.smokefree.hk] 12. Hong Kong Cyberport Management Company Limited [www.cyberport.hk] 13. Hong Kong Institute of Vocational Education [it.vtc.edu.hk] 14. Hong Kong Lutheran Social, LC-HKS - Shek Kip Mei Lutheran Centre for the Blind [smartlink.hklcb.org/index2.php] 15. Hong Kong Note Printing Limited [www.hknpl.com.hk] 16. Health, Safety and Environment Office, The Hong Kong Polytechnic University [www.polyu.edu.hk/hseo] 17. -

Graduates Subsidy Programme 2021

Guidance Notes on Application for Green Employment Scheme: Graduates Subsidy Programme 2021 Preamble The purpose of Green Employment Scheme: Graduates Subsidy Programme 2021 (the Programme) is to provide subsidies to prospective employers of graduates of environment- related disciplines with a view to sustaining the provision of job opportunities for fresh graduates to work in environment-related areas as well as nurturing young people with environmental knowledge, talents and passion to meet the environmental needs of Hong Kong. Responsible Government Department 2. Environmental Protection Department (EPD) is responsible for the implementation of the Programme. Eligibility for the Programme 3. An applicant must be a holder of a valid business registration certificate and (a) has recently recruited an Eligible Graduate employee (see para.5 below) who reported duty on or after 1 April 2021; or (b) is in the process of recruiting; or (c) is planning to recruit at least one Eligible Graduate employee, to work on a full-time basis in an Eligible Job Place (see para.6 below). 4. An applicant without a valid business registration certificate and under the following circumstances will also be considered on a case-by-case basis: (a) Applicant registered in Company Registry with valid Company Registration Certificate; or (b) Applicant being a charitable institution under Section 88 of the Inland Revenue Ordinance; or (c) Applicant being an organization registered under the Societies Ordinance (Cap. 151). 5. An Eligible Graduate employee under the Programme must be: (a) a fresh graduate who has completed a Bachelor’s degree programme in a relevant environment-related subjectNote 1 from a Hong Kong higher education institution, or equivalent, in 2020 or 2021; (b) a Hong Kong Special Administrative Region (HKSAR) resident with a valid Hong Kong Identity Card; and Note 1 Environmental conservation, environmental science, environmental management, sustainable development or other subjects relevant to the duties of the Eligible Job Places. -

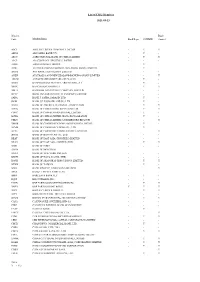

List of CMU Members 2021-08-18

List of CMU Members 2021-09-23 Member Bond Code Member Name Bank Repo CMUBID Connect ABCI ABCI SECURITIES COMPANY LIMITED - Y Y ABNA ABN AMRO BANK N.V. - Y - ABOC AGRICULTURAL BANK OF CHINA LIMITED - Y Y AIAT AIA COMPANY (TRUSTEE) LIMITED - - - ASBK AIRSTAR BANK LIMITED - Y - ACRL ALLIED BANKING CORPORATION (HONG KONG) LIMITED - Y - ANTB ANT BANK (HONG KONG) LIMITED - - - ANZH AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED - - Y AMCM AUTORIDADE MONETARIA DE MACAU - Y - BEXH BANCO BILBAO VIZCAYA ARGENTARIA, S.A. - Y - BSHK BANCO SANTANDER S.A. - Y Y BBLH BANGKOK BANK PUBLIC COMPANY LIMITED - - - BCTC BANK CONSORTIUM TRUST COMPANY LIMITED - - - SARA BANK J. SAFRA SARASIN LTD - Y - JBHK BANK JULIUS BAER AND CO. LTD. - Y - BAHK BANK OF AMERICA, NATIONAL ASSOCIATION - Y Y BCHK BANK OF CHINA (HONG KONG) LIMITED - Y Y CDFC BANK OF CHINA INTERNATIONAL LIMITED - Y - BCHB BANK OF CHINA LIMITED, HONG KONG BRANCH - Y - CHLU BANK OF CHINA LIMITED, LUXEMBOURG BRANCH - - Y BMHK BANK OF COMMUNICATIONS (HONG KONG) LIMITED - Y - BCMK BANK OF COMMUNICATIONS CO., LTD. - Y - BCTL BANK OF COMMUNICATIONS TRUSTEE LIMITED - - Y DGCB BANK OF DONGGUAN CO., LTD. - - - BEAT BANK OF EAST ASIA (TRUSTEES) LIMITED - - - BEAH BANK OF EAST ASIA, LIMITED (THE) - Y Y BOIH BANK OF INDIA - - - BOFM BANK OF MONTREAL - - - BNYH BANK OF NEW YORK MELLON - - - BNSH BANK OF NOVA SCOTIA (THE) - - - BOSH BANK OF SHANGHAI (HONG KONG) LIMITED - Y Y BTWH BANK OF TAIWAN - Y - SINO BANK SINOPAC, HONG KONG BRANCH - - Y BPSA BANQUE PICTET AND CIE SA - - - BBID BARCLAYS BANK PLC - Y - EQUI BDO UNIBANK, INC. -

What Is a Chip Card?

The Technology Is Ready Philip Andreae Philip Andreae & Associates Why are you Here • The globe is in migration to EMV • June 2003: Visa Canada announced its plans to migrate to chip • January 8, CTV W-5 documented the reality of debit card fraud • October 2005: Interac issued schedule for chip • American Express, MasterCard and JCB are ready to support the Canadian migration to chip The Time Has Come 2 What is a Chip Card? • A plastic credit card with an embedded computer chip containing a microcomputer –1976 a calculator in your card –Today the power of 1981 IBM PC –Tomorrow integrated with your body, PDA and Cell Phone? 3 History of Chip Cards a.k.a the Smart Card • 1968 German Inventors, • French Banks Jurgen Dethloff & Helmet Specifications 1977 Grotrupp German patent use of • Honeywell Bull plastic as a carrier for Microchips Produce First Cards 1978 • 1970 Japanese Inventor, • Payphone Cards 1983 Kunitake Arimura applied for • French Banking similar patent Pilot Begins 1984 • 1974 French Inventor, Roland • Used in TV 1990 Moreno patented the Smart Card • ETSI GSM SIM 1991 • 1978 Honeywell Bull proves • First ePurse in miniaturization of electronics Bulle, Switzerland 1992 • 1993 Work on EMV began • German Health Card 1993 • 1995 MasterCard Buys Mondex • First Combi Card 1997 • Mondex in Canada 1998 4 1984-1992 • France Banks elect to implement smart cards • Carte Bancaire develop chip application - B0’ • Merchants receive government incentives • Cardholders use PIN for both credit and debit • Domestic fraud down to 0.02% The World -

Smart Card Interfaces

Smart Card Interfaces Linking multiple devices and applications for an array of industries A smart card-based solution requires a reader infrastructure that is robust, reliable,certified and easy to deploy. That is why Gemplus offer world-class smart card enabling technologies for diverse segment markets. Markets and applications System integrators: Bank/Retailers: • ID programs • Payment • Healthcare • Loyalty • Network access control Telecom operators: • SIM smart card management Transport operators: • Payment • Physical access control OEMs: • Keyboard manufacturers • Point of sale terminal Corporations: manufacturers • Physical access control • PC manufacturers • PC and network • Set-top box manufacturers access control • Vending machine manufacturers Easy and secure e-transactions are more important than ever. GemPC range, meeting all the required standards of the computer industry and the banking world, offer Telecom, banking organizations, governments, enterprises and system integrators smart card interfaces to complete secure electronic applications for any type of PC. GemPC™ Range Product Interface OS Certification Benefits & Options Applications GemPC RS232 • Windows 98, • Microsoft • Customizable Serial/ USB Full Speed 98SE, Me, Windows® • Slim line USB (12 Mbps) 2000, XP for Hardware compact case USB & Serial Quality Labs • Tamper proof • Windows 95 (WHQL) OSR2 & NT4 • CCID for Serial (USB mode) • MacOS X, • EMV Linux (upon • PC/SC request) GemPC RS232 • Windows 98, • Microsoft • Transparent Twin USB Full Speed 98SE, Me, Windows®