Atal Pension Yojana)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sustainable Development Goals and Revised Mapping of Csss and Ministries of Government of India

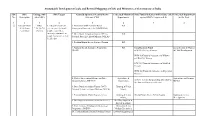

Sustainable Development Goals and Revised Mapping of CSSs and Ministries of Government of India SDG SDG Linkage with SDG Targets Centrally Sponsored /Central Sector Concerned Ministries/ State Funded Schemes (with Scheme code) Concerned Department No. Description other SDGs Schemes (CSS) Departments against SDG's Targets (col. 4) in the State 1 2 3 4 5 6 7 8 ① End poverty in SDGs 1.1 By 2030, eradicate 1. Mahatma Gandhi National Rural RD all its forms 2,3,4,5,6,7,8, extreme poverty for all Employment Guarantee Act (MGNREGA) everywhere 10,11,13 people everywhere, currently measured as 2. Deen Dayal Antyodaya Yojana (DAY) - RD people living on less than National Rural Livelihood Mission (NRLM) $1.25 a day 3. Pradhan Mantri Awaas Yojana - Gramin RD 4. National Social Assistance Programme RD Social Security Fund Social Secuity & Women (NSAP) SSW-03) Old Age Pension & Child Development. WCD-03)Financial Assistance to Widows and Destitute women SSW-04) Financial Assistance to Disabled Persons WCD-02) Financial Assistance to Dependent Children 5. Market Intervention Scheme and Price Agriculture & Agriculture and Farmers Support Scheme (MIS-PSS) Cooperation, AGR-31 Scheme for providing debt relief to Welfare the distressed farmers in the state 6. Deen Dayal Antyodaya Yojana (DAY)- Housing & Urban National Urban Livelihood Mission (NULM) Affairs, 7. Pradhan Mantri Awaas Yojana -Urban Housing & Urban HG-04 Punjab Shehri Awaas Yojana Housing & Urban Affairs, Development 8. Development of Skills (Umbrella Scheme) Skill Development & Entrepreneurship, 9. Prime Minister Employment Generation Micro, Small and Programme (PMEGP) Medium Enterprises, 10. Pradhan Mantri Rojgar Protsahan Yojana Labour & Employment Sustainable Development Goals and Revised Mapping of CSSs and Ministries of Government of India SDG SDG Linkage with SDG Targets Centrally Sponsored /Central Sector Concerned Ministries/ State Funded Schemes (with Scheme code) Concerned Department No. -

Atal Pension Yojana (APY)1 – Details of the Scheme

Atal Pension Yojana (APY) 1 – Details of the Scheme 1. Introduction 1.1 The Government of India is extremely concerned about the old age income security of the working poor and is focused on encouraging and enabling them to join the National Pension System (NPS). To address the longevity risks among the workers in unorganised sector and to encourage the workers in unorganised sector to voluntarily save for their retirement, who constitute 88% of the total labour force of 47.29 crore as per the 66th Round of NSSO Survey of 2011-12, but do not have any formal pension provision, the Government had started the Swavalamban Scheme in 2010-11. However, coverage under Swavalamban Scheme is inadequate mainly due to lack of guaranteed pension benefits at the age of 60. 1.2 The Government announced the introduction of universal social security schemes in the Insurance and Pension sectors for all Indians, specially the poor and the under-privileged, in the Budget for the year 2015-16. Therefore, it has been announced that the Government will launch the Atal Pension Yojana (APY), which will provide a defined pension, depending on the contribution, and its period. The APY will be focussed on all citizens in the unorganised sector, who join the National Pension System (NPS) administered by the Pension Fund Regulatory and Development Authority (PFRDA). Under the APY, the subscribers would receive the fixed minimum pension of Rs. 1000 per month, Rs. 2000 per month, Rs. 3000 per month, Rs. 4000 per month, Rs. 5000 per month, at the age of 60 years, depending on their contributions, which itself would be based on the age of joining the APY. -

ABSOLUTELY PREPARED at HOME NFLAT Class: IX Topic: Financial Inclusion & Pension Scheme Subject: NFLAT Content Contribute To

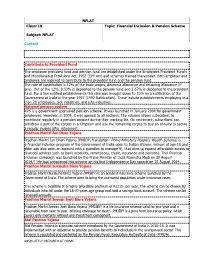

NFLAT Class: IX Topic: Financial Inclusion & Pension Scheme Subject: NFLAT Content Contribute to Provident Fund The employee provident fund and pension fund are established under the Employees Provident Fund’s and Miscellaneous Provisions Act, 1952 (EPF Act) and schemes framed thereunder. Both employer and employee are required to contribute to the provident fund and the pension fund. The rate of contribution is 12% of the basic wages, dearness allowance and retaining allowance (if any). Out of the 12%, 8.33% is deposited to the pension fund and 3.67% is deposited to the provident fund. For a few notified establishments this rate was brought down to 10% by a notification of the Government of India in the year 1997 (1997 Notification). These include establishments employing less than 20 employees, sick industries, and jute industries. National pension system NPS is a government-sponsored pension scheme. It was launched in January 2004 for government employees. However, in 2009, it was opened to all sections. The scheme allows subscribers to contribute regularly in a pension account during their working life. On retirement, subscribers can withdraw a part of the corpus in a lumpsum and use the remaining corpus to buy an annuity to secure a regular income after retirement. Pradhan Mantri Jan Dhan Yojana Pradhan Mantri Jan Dhan Yojana (PMJDY, translation: Prime Minister's People's Wealth Scheme) is a financial inclusion program of the Government of India open to Indian citizens (minors of age 10 and older can also open an account with a guardian to manage it), that aims to expand affordable access to financial services such as bank accounts, remittances, credit, insurance and pensions. -

Annual Report 2017 -18 of PFRDA

Annual Report 2017-18 This Report is in conformity with the format as per the Pension Fund Regulatory and Development Authority (Reports, Returns and Statements) Rules, 2015. 1 Annual Report 2017-18 3 4 Annual Report 2017-18 Table of Contents Statement of Goals and Objectives ......................................................................................................... 10 Objective ......................................................................................................................................................... 10 Vision ............................................................................................................................................................... 10 Chairman's Message .................................................................................................................................... 11 Members of the Board ................................................................................................................................. 13 Senior Management of the Authority ..................................................................................................... 14 Abbreviations................................................................................................................................................. 15 Part I Policies & Programmes.................................................................................................................................. 18 1.1 General Review of the Global Economic Scenario .................................................................... -

The List of Schemes and Programmes Launched by Hon'ble PM Government of India, Sh. Narendra Modi in 2015 and 2016 Follows As

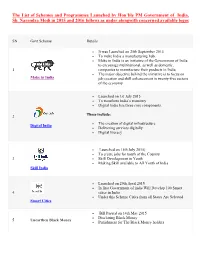

The List of Schemes and Programmes Launched by Hon’ble PM Government of India, Sh. Narendra Modi in 2015 and 2016 follows as under alongwith concerned available logos SN Govt Scheme Details It was Launched on 25th September 2014 To make India a manufacturing hub. Make in India is an initiative of the Government of India to encourage multinational, as well as domestic, 1 companies to manufacture their products in India. The major objective behind the initiative is to focus on Make in India job creation and skill enhancement in twenty-five sectors of the economy Launched on 1st July 2015 To transform India’s economy Digital India has three core components. These include: 2 The creation of digital infrastructure Digital India Delivering services digitally Digital literacy Launched on 15th July 2015) To create jobs for youth of the Country 3 Skill Development in Youth Making Skill available to All Youth of India Skill India Launched on 29th April 2015 In first Government of india Will Develop 100 Smart 4 cities in India Under this Scheme Cities from all States Are Selected Smart Cities Bill Passed on 14th May 2015 Disclosing Black Money 5 Unearthen Black Money Punishment for The Black Money holders SN Govt Scheme Details Namami Gange Project or Namami Ganga Yojana is an ambitious Union Government Project which integrates the efforts to clean and protect the Ganga river in a comprehensive manner. It its maiden budget, the government announced Rs. 2037 Crore towards this mission. 6 The project is officially known as Integrated Ganga Conservation Mission project or ‘Namami Ganga Namami Gange Yojana’. -

Material for Technical Evaluation Development of Folder on Various Schemes and Initiatives of Government of India 1. Properly De

Material for Technical Evaluation Development of folder on various schemes and initiatives of Government of India 1. Properly designed folder in the size(4 folds, 8 pages, size of one page = 4.13 x 9 inch) has to be submitted by your Agency latest by 10.30 AM on 04.05.2017 2. For technical evaluation by the Committee. Maximum of 4 layouts could be submitted before the Committee. 3. Kindly suggest an appropriate title for the folder. 4. Use appropriate infographics & photographs in the folder. 5. Properly designed folder has to be submitted in English only for technical evaluation. 6. The layouts should be sealed in envelope with name of the Agency clearly written on the envelope. The envelope should be addressed to Sh. V. Ravi Rama Krishna, Addl. Director General, DAVP, Soochna Bhawan, New Delhi- 110003. 7. Technical evaluation would start from 11.00 AM on 04.05.2017 in DAVP Conference Hall, 2nd Floor, Soochna Bhawan, CGO Complex, New Delhi-110003 8. Please confirm your participation on [email protected], latest by 4.30 PM on 03.05.2017 so that specific time slot could be given to each Agency. 9. Not more that 10 minutes would be given to each Agency for technical presentation. EMPOWERING THE POOR 1.Direct Benefit Transfer (DBT): Ensuring quick subsidy to the right beneficiary while eliminating middlemen & leakages- ` 36,500 Crore saved JAM (Jan Dhan, Aadhar& Mobile) transforming subsidy delivery mechanism through DBT PAHAL (Pratyaksh Hasthantarit Labh) is the world's largest Direct Benefit Transfer Scheme. 2. Skill Development Initiatives Deen Dayal Grameen Kaushalya Yojana (DDUGKY): Over 3.56 Lakh youth trained, and over 1.88 Lakh placed in jobs PM Kaushal Vikas Yojana (PMKVY): Over 19.65 lakh youth trained 3. -

National E-Governance Division Ministry of Electronics & Information Technology Govt

National e-Governance Division Ministry of Electronics & Information Technology Govt. of India No. N-21/15/2020-NeGD-MeitY Dated: 9th April 2021 Expression of Interest (EOI) for agent assisted service delivery of UMANG services on non-exclusive basis UMANG mobile app was dedicated to the nation by Hon’ble Prime Minister on 23rd Nov. 2017. UMANG provides single point access to 1,000+ services of Centre and 29 State Governments and 19000+ bill payment services through Mobile. UMANG has been downloaded ~4 Crore times and witnessing ~2-3 million transactions per day and ~30,000- 40,000 new user registrations per day. Having created UMANG Mobile App with vast number of services, NeGD, MeitY now wants to extend these services in ‘Assisted Mode’ to citizens not having smart phone or not able to use Mobile app on smart phones. NeGD is already providing UMANG services in ‘Assisted mode’ through CSCs and now wants to partner with more such entities. Accordingly NeGD seeks expression of interest from interested Indian companies/entities which are incorporated in India with majority stake with Indian citizens for providing select UMANG Services through agents or Human Assisted Platform on non- exclusive basis. Initial list of about ~500 such services is attached. The interested entities may submit their EOI proposal for consideration by NeGD to Neeraj Kumar, Director (UMANG), National e Governance Division (NeGD), 4th Floor, Electronics Niketan, CGO Complex, Lodhi Road, New Delhi-110003 and mail copy can be sent to [email protected] (Ph: 011-24303703). NeGD will scrutinize the received proposals and will come out with a Policy/RFP having suitable eligibility criterion and commercial conditions. -

Frequently Asked Questions - Atal Pension Yojana

Frequently Asked Questions - Atal Pension Yojana 1. What is pension? Why do I need it? A Pension provides people with a monthly income when they are no longer earning. Need for Pension: Decreased income earning potential with age. The rise of nuclear family-Migration of earning members. Rise in cost of living. Increased longevity. Assured monthly income ensures dignified life in old age. 2. What is Atal Pension Yojana? Atal Pension Yojana (APY), a pension scheme for citizens of India, is focused on the unorganised sector workers. Under the APY, guaranteed minimum pension of Rs. 1,000/- or 2,000/- or 3,000/- or 4,000 or 5,000/- per month will be given at the age of 60 years depending on the contributions by the subscribers. 3. Who can subscribe to APY? Any Citizen of India can join APY scheme. The following are the eligibility criteria:- (i) The age of the subscriber should be between 18 - 40 years. (ii) He / She should have a savings bank account/ post office savings bank account . 1 The prospective applicant may provide Aadhaar and mobile number to the bank during registration to facilitate receipt of periodic updates on APY account. Aadhaar needs to be provided at the time of enrolment. 4. For how many Years Government will co-contribute? The co-contribution of the Government of India is available for 5 years, i.e., from the Financial Year 2015-16 to 2019-20 for the subscribers, who join the scheme during the period from 1st June, 2015 to 31st March, 2016 and who are not covered by any Statutory Social Security Scheme and are not income tax payers. -

September 2019 Kurukshetra Compilation

Contents 1. Addressing Rural Poverty – Livelihood Development and Diversification ................ 1 2. Social Security Schemes for Social Development ......................................................... 1 3. RURAL HEALTH ........................................................................................................... 3 4. MAJOR GOVERNMENT INITIATIVES IN AGRICULTURE .................................... 5 5. Financial Inclusion: Major Initiatives ........................................................................... 7 6. MAKING ELECTRICITY SUSTAINABLE AND AVALIABLE TO ALL.................... 8 Kurukshetra Compendium September 2019 Addressing Rural Poverty – Livelihood Development and Diversification • The Government is taking various initiatives to accelerate growth in rural India thereby catalysing the growth of the Indian economy. • About 70 per cent of India resides in its villages. Undoubtedly, the growth of rural sector is central to the overall development of the country. • The Government has been investing in vital areas such as energy, electricity, health, women empowerment, agricultural initiatives and several social security schemes to build a strong foundation for the sustainable growth of India’s rural sector. • The last 4 years have seen a considerable stepping up of financial resources for improving rural infrastructure, diversifying livelihoods, reducing poverty and thereby improving the well-being of poor households in terms of allocation for Programmes of Department of Rural Development. Annual expenditure -

Schemes Having Scheme Management System

Schemes having MIS as on 15.09.2020 SNo. Ministry Name Scheme Name Scheme Code Benefit Type 1 Department of Agricultural Research and Education AgEdn - ICAR Emeritus Professor ASM63 Cash 2 Department of Agricultural Research and Education AgEdn - ICAR Emeritus Scientist A8MN1 Cash 3 Department of Agricultural Research and Education AgEdn - ICAR Junior Research A4AF1 Cash Fellowship 4 Department of Agricultural Research and Education AgEdn - ICAR National Professor And AXDCI Cash National Fellow 5 Department of Agricultural Research and Education AgEdn - ICAR Senior Research AB5OP Cash Fellowship 6 Department of Agricultural Research and Education AgEdn - India-Afghanistan Fellowship AQ20K Cash 7 Department of Agricultural Research and Education AgEdn - India-Africa Fellowship AR4YI Cash 8 Department of Agricultural Research and Education AgEdn - Merit Cum Means Scholarship A7N6H Cash 9 Department of Agricultural Research and Education AgEdn - National Talent Scholarship ALMOJ Cash PG 10 Department of Agricultural Research and Education AgEdn - National Talent Scholarship AN084 Cash UG 11 Department of Agricultural Research and Education AgEdn - Netaji Subhas ICAR A5IPK Cash International Fellowship 12 Department of Agricultural Research and Education AgEdn - Post Matric Scholarship AY4IO Cash 13 Department of Agricultural Research and Education AgEdn - Students READY AL11P Cash 14 Department of Agricultural Research and Education Agricultural Extension AWU5S In Kind 15 Department of Agricultural Research and Education AS_IVRI_Institute -

Paper Has Been Prepared

Integrating Biometric Authentication in India's Welfare Programs: Lessons from a Decade of Reforms Sandip Sukhtankar University of Virginia Paul Niehaus University of California, San Diego Karthik Muralidharan University of California, San Diego & NCAER India Policy Forum July 12–15, 2021 NCAER | National Council of Applied Economic Research NCAER India Centre, 11 Indraprastha Estate, New Delhi 110002 Tel: +91-11-23452698, www.ncaer.org NCAER | Quality . Relevance . Impact 2 India Policy Forum 2021 The findings, interpretations, and conclusions expressed are those of the authors and do not necessarily reflect the views of the Governing Body or Management of NCAER. Sandip Sukhtankar, Paul Niehaus, and Karthik Muralidharan 3 Integrating Biometric Authentication in India's Welfare Programs: Lessons from a Decade of Reforms* Sandip Sukhtankar University of Virginia Paul Niehaus University of California, San Diego Karthik Muralidharan University of California, San Diego & NCAER India Policy Forum July 12–15, 2021 Abstract India’s biometric unique ID Aadhaar has been at the forefront of the global revolution in digital identification, and India’s most significant investment in state capacity over the past decade. Yet, its application to social protection programs has been controversial. Proponents claim that the use of Aadhaar to identify and authenticate beneficiaries in these programs has led to considerable fiscal savings, while critics claim that it has led to denial of benefits to the marginalized and caused substantial harm. We review research on the use and impact of Aadhaar in social programs in India over the last decade. Our main takeaway from the review is that biometric authentication has reduced leakage in multiple settings, but its impact on beneficiaries depends crucially on the protocols and details of implementation. -

Government of India Ministry of Labour and Employment Lok Sabha Starred Question No. 276 to Be Answered on 31.12.2018 Welfare Of

GOVERNMENT OF INDIA MINISTRY OF LABOUR AND EMPLOYMENT LOK SABHA STARRED QUESTION NO. 276 TO BE ANSWERED ON 31.12.2018 WELFARE OF OUTSOURCED WORKERS †*276. SHRI AJAY NISHAD: Will the Minister of LABOUR AND EMPLOYMENT be pleased to state: (a)whether several works of public sector undertakings, Government and semi-Government departments and private companies are carried out through outsourcing; (b)if so, the details thereof; (c)the present mechanism to ensure compliance of social security/labour laws for the benefit of persons employed in outsourcing companies; (d)whether the Government has looked into the service conditions and welfare schemes for the workers engaged to carry out the outsourced works and if so, the details thereof; and (e)the steps being taken by the Government in this regard? ANSWER MINISTER OF STATE (IC) FOR LABOUR AND EMPLOYMENT (SHRI SANTOSH KUMAR GANGWAR) (a) to (e): A statement is laid on the Table of the House. * ******** STATEMENT REFERRED TO IN REPLY TO PART (a) TO (e) OF THE LOK SABHA STARRED QUESTION NO. 276 FOR ANSWER ON 31.12.2018 REGARDING WELFARE OF OUTSOURCED WORKERS BY SHRI AJAY NISHAD. (a) & (b): The establishments, whether Government or Private, in the Central and the State Sphere may outsource jobs/works based on their respective requirements. The General Financial Rules 2017 (GFR 2017) allow the Central Government establishments to outsource certain services. As each Ministry/Department is competent to procure services of outsourcing agencies at their level to meet seasonal or short-term requirements, the centralized data is not maintained in this regard. (c) to (e): In order to ensure compliance of the extant labour laws and the welfare provisions thereunder, the Centre and the State(s) have their own enforcement agencies.