Annual Report 2017 -18 of PFRDA

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

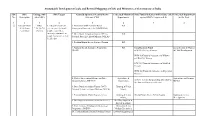

Sustainable Development Goals and Revised Mapping of Csss and Ministries of Government of India

Sustainable Development Goals and Revised Mapping of CSSs and Ministries of Government of India SDG SDG Linkage with SDG Targets Centrally Sponsored /Central Sector Concerned Ministries/ State Funded Schemes (with Scheme code) Concerned Department No. Description other SDGs Schemes (CSS) Departments against SDG's Targets (col. 4) in the State 1 2 3 4 5 6 7 8 ① End poverty in SDGs 1.1 By 2030, eradicate 1. Mahatma Gandhi National Rural RD all its forms 2,3,4,5,6,7,8, extreme poverty for all Employment Guarantee Act (MGNREGA) everywhere 10,11,13 people everywhere, currently measured as 2. Deen Dayal Antyodaya Yojana (DAY) - RD people living on less than National Rural Livelihood Mission (NRLM) $1.25 a day 3. Pradhan Mantri Awaas Yojana - Gramin RD 4. National Social Assistance Programme RD Social Security Fund Social Secuity & Women (NSAP) SSW-03) Old Age Pension & Child Development. WCD-03)Financial Assistance to Widows and Destitute women SSW-04) Financial Assistance to Disabled Persons WCD-02) Financial Assistance to Dependent Children 5. Market Intervention Scheme and Price Agriculture & Agriculture and Farmers Support Scheme (MIS-PSS) Cooperation, AGR-31 Scheme for providing debt relief to Welfare the distressed farmers in the state 6. Deen Dayal Antyodaya Yojana (DAY)- Housing & Urban National Urban Livelihood Mission (NULM) Affairs, 7. Pradhan Mantri Awaas Yojana -Urban Housing & Urban HG-04 Punjab Shehri Awaas Yojana Housing & Urban Affairs, Development 8. Development of Skills (Umbrella Scheme) Skill Development & Entrepreneurship, 9. Prime Minister Employment Generation Micro, Small and Programme (PMEGP) Medium Enterprises, 10. Pradhan Mantri Rojgar Protsahan Yojana Labour & Employment Sustainable Development Goals and Revised Mapping of CSSs and Ministries of Government of India SDG SDG Linkage with SDG Targets Centrally Sponsored /Central Sector Concerned Ministries/ State Funded Schemes (with Scheme code) Concerned Department No. -

Atal Pension Yojana (APY)1 – Details of the Scheme

Atal Pension Yojana (APY) 1 – Details of the Scheme 1. Introduction 1.1 The Government of India is extremely concerned about the old age income security of the working poor and is focused on encouraging and enabling them to join the National Pension System (NPS). To address the longevity risks among the workers in unorganised sector and to encourage the workers in unorganised sector to voluntarily save for their retirement, who constitute 88% of the total labour force of 47.29 crore as per the 66th Round of NSSO Survey of 2011-12, but do not have any formal pension provision, the Government had started the Swavalamban Scheme in 2010-11. However, coverage under Swavalamban Scheme is inadequate mainly due to lack of guaranteed pension benefits at the age of 60. 1.2 The Government announced the introduction of universal social security schemes in the Insurance and Pension sectors for all Indians, specially the poor and the under-privileged, in the Budget for the year 2015-16. Therefore, it has been announced that the Government will launch the Atal Pension Yojana (APY), which will provide a defined pension, depending on the contribution, and its period. The APY will be focussed on all citizens in the unorganised sector, who join the National Pension System (NPS) administered by the Pension Fund Regulatory and Development Authority (PFRDA). Under the APY, the subscribers would receive the fixed minimum pension of Rs. 1000 per month, Rs. 2000 per month, Rs. 3000 per month, Rs. 4000 per month, Rs. 5000 per month, at the age of 60 years, depending on their contributions, which itself would be based on the age of joining the APY. -

Pension Reforms in India

• Cognizant 20-20 Insights Pension Reforms in India Pension reforms are yet to benefit a large section of the Indian population. Significant changes on the policy and regulatory fronts, better marketing and better pricing of products can give this sector a much-needed boost. Executive Summary and cost-effective products are available to the population for creating a retirement corpus. Life expectancy has shot up in recent decades. When public pension systems were first estab- lished, people could typically look forward to only Background of Pension Reforms a few years of retirement if any. Today, globally, India does not have a universal social security sys- the probability of a newborn boy surviving until tem. A large number of India’s elderly are not cov- age 65 is over 80%; the figure is over 90% for ered by any pension scheme. Pension reforms and a girl child. Aging populations are “a high-class” a pension system with greater reach will not only problem, said U.S. President Bill Clinton in his ensure citizens’ welfare in their golden years but 1999 State of the Union address. He continued: will also help the central and state governments “It’s the result of something wonderful: the fact cut their future liabilities. With these broad objec- that we are living a lot longer.” Nevertheless, tives in mind, the government of India set up an there is no denying that aging populations pose expert committee in 1998 to devise a new pension significant challenges for economic, social and system for India. Project Oasis, which was chaired health policies in general and pension systems in by S.A. -

ABSOLUTELY PREPARED at HOME NFLAT Class: IX Topic: Financial Inclusion & Pension Scheme Subject: NFLAT Content Contribute To

NFLAT Class: IX Topic: Financial Inclusion & Pension Scheme Subject: NFLAT Content Contribute to Provident Fund The employee provident fund and pension fund are established under the Employees Provident Fund’s and Miscellaneous Provisions Act, 1952 (EPF Act) and schemes framed thereunder. Both employer and employee are required to contribute to the provident fund and the pension fund. The rate of contribution is 12% of the basic wages, dearness allowance and retaining allowance (if any). Out of the 12%, 8.33% is deposited to the pension fund and 3.67% is deposited to the provident fund. For a few notified establishments this rate was brought down to 10% by a notification of the Government of India in the year 1997 (1997 Notification). These include establishments employing less than 20 employees, sick industries, and jute industries. National pension system NPS is a government-sponsored pension scheme. It was launched in January 2004 for government employees. However, in 2009, it was opened to all sections. The scheme allows subscribers to contribute regularly in a pension account during their working life. On retirement, subscribers can withdraw a part of the corpus in a lumpsum and use the remaining corpus to buy an annuity to secure a regular income after retirement. Pradhan Mantri Jan Dhan Yojana Pradhan Mantri Jan Dhan Yojana (PMJDY, translation: Prime Minister's People's Wealth Scheme) is a financial inclusion program of the Government of India open to Indian citizens (minors of age 10 and older can also open an account with a guardian to manage it), that aims to expand affordable access to financial services such as bank accounts, remittances, credit, insurance and pensions. -

Frequently Asked Questions on National Pension System – All Citizens Model

FREQUENTLY ASKED QUESTIONS ON NATIONAL PENSION SYSTEM – ALL CITIZENS MODEL What is National Pension System? NPS is an easily accessible, low cost, tax-efficient, flexible and portable retirement savings account. Under the NPS, the individual contributes to his retirement account and also his employer can also co-contribute for the social security/welfare of the individual. NPS is designed on Defined contribution basis wherein the subscriber contributes to his account, there is no defined benefit that would be available at the time of exit from the system and the accumulated wealth depends on the contributions made and the income generated from investment of such wealth. The greater the value of the contributions made, the greater the investments achieved, the longer the term over which the fund accumulates and the lower the charges deducted, the larger would be the eventual benefit of the accumulated pension wealth likely to be. Contributions + Investment Growth – Charges = Accumulated Pension Wealth (Individual contribution as well as co-contribution from Employers) Who can Join NPS? Any citizen of India, whether resident or non-resident, subject to the following conditions: Individuals who are aged between 18 – 60 years as on the date of submission of his/her application to the POP/ POP-SP. The citizens can join NPS either as individuals or as an employee-employer group(s) (corporates) subject to submission of all required information and Know your customer (KYC) documentation. After attaining 60 years of age, you will not be permitted to make further contributions to the NPS accounts. Can an NRI open an NPS account? Yes, a NRI can open an NPS account. -

Atal Pension Yojana)

Available online at www.worldscientificnews.com WSN 29 (2016) 124-134 EISSN 2392-2192 A Case Study with Overview of Pradhan Matri Jan Dhan Yojana (Atal Pension Yojana) Dr. Rajesh K. Yadav1,a, Mr. Sarvesh Mohania2,b 1Associate Professor, School of Banking and Commerce, Jagaran University, Bhopal, M.P., India 2Assistant Professor, School of Banking and Commerce, Jagaran University, Bhopal, M.P., India a,bE-mail address: [email protected] , [email protected] ABSTRACT The study finds that existing channels of banking industry are very well utilized but due to lack of attractive features, Atal Pension Yojana is still not accepted by larger public. There is requirement of essential changes in the basic features related to amount of pension, tax exemption and claim settlement. Atal Pension Yojana is still favorable investment for those who are willing to contribute small but for longer duration for their pension funds. It is considered as landmark move by government of India towards pensioned society from pension less society. The Union government is eager to ensure financial security for unorganized sector workers, numbering over 410 million, in their old age. To tackle the prolonged existence risks among the workers in unorganized sector and to push the workers in unorganized sector to willingly save for their retirement. Atal Pension Yojana was introduced on 1st June 2015, under the promising Pradhan Mantri Jan Dhan Yojana with the aim to provide financial support of pension to all the citizen of India with motto of “Jan-Dhan se Jan Surakhsha”. The study is based on secondary data collected from different websites and IRDA Journals. -

State Finances Audit Report of the Comptroller and Auditor General of India

State Finances Audit Report of the Comptroller and Auditor General of India for the year ended 31 March 2020 Government of Chhattisgarh Report No. 03 of the year 2021 Table of Contents Paragraph Page No. No. Preface -- vii Executive Summary -- ix Chapter I: Overview Profile of the State 1.1 1 Gross State Domestic Product of the State 1.1.1 1 Basis and Approach to State Finances Audit Report 1.2 3 Report Structure 1.3 4 Overview of Government Accounts Structure 1.4 4 Budgetary Processes 1.5 7 Snapshot of Finances 1.5.1 7 Snapshot of Assets and liabilities of the Government 1.5.2 8 Fiscal Balance: Achievement of deficit and total debt targets 1.6 9 Compliance with Provisions of State FRBM Act 1.6.1 9 Medium Term Fiscal Policy Statement 1.6.2 10 Deficit and Surplus 1.6.3 11 Trends of Deficit/Surplus 1.6.4 12 Deficits after examination in Audit 1.6.5 13 Chapter II: Finances of the State Introduction 2.1 15 Sources and Application of Funds 2.2 15 Resources of the State 2.3 17 Receipts of the State 2.3.1 17 Revenue Receipts 2.3.2 18 Trends and growth of Revenue Receipts 2.3.2.1 18 State’s Own Resources 2.3.3 19 Own Tax Revenue 2.3.3.1 20 State Goods and Services Tax (SGST) 2.3.3.2 21 Non-Tax Revenue 2.3.33 22 Central Tax Transfers 2.3.3.4 22 Grants-in-Aid from Government of India 2.3.3.5 23 Fourteenth Finance Commission Grants 2.3.3.6 24 Capital Receipts 2.3.3.7 24 State’s performance in mobilization of resources 2.3.4 25 Application of Resources 2.4 25 Growth and composition of expenditure 2.4.1 26 Revenue Expenditure 2.4.2 28 Major Changes in Revenue Expenditure 2.4.2.1 29 Committed Expenditure 2.4.2.2 29 Undercharged Liability under National Pension System 2.4.2.3 31 Page i State Finances Audit Report for the Year ended 31 March 2020 Table of Contents Paragraph Page No. -

Insights Pt 2019 Exclusive (Government Schemes)

INSIGHTS PT 2019 EXCLUSIVE (GOVERNMENT SCHEMES) May 2018 – January 2019 • www.insightsonindia.com www.insightsias.com INSIGHTS PT 2019 EXCLUSIVE (GOVERNMENT SCHEMES) Table of Contents MINISTRY OF HEALTH AND FAMILY WELFARE ................................................................... 6 1.Menstrual Hygiene for Adolescent Girls Schemes ................................................................................. 6 2.Mission Indradhanush ......................................................................................................................... 6 3.Ayushman Bharat–PM Jan Arogya Yojana ............................................................................................ 7 4.Pradhan Mantri Swasthya Suraksha Yojana (PMSSY) ............................................................................ 8 MINISTRY OF AGRICULTURE & FARMERS WELFARE ...................................................... 10 1.National Agricultural Higher Education Project (NAHEP) ..................................................................... 10 2.Pradhan Mantri Fasal Bima Yojana ..................................................................................................... 10 3.Online Portal “ENSURE” ..................................................................................................................... 11 4.Pradhan Mantri Annadata Aay SanraksHan Abhiyan (PM-AASHA) ...................................................... 12 MINISTRY OF SKILL DEVELOPMENT & ENTREPRENEURSHIP ...................................... 13 -

Employee Pensions in India

Employee pensions in India Current practices, challenges and prospects December 2015 KPMG.com/in © 2015 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Table of contents Introduction An overview of employer pension plans in India Comparative analysis of EPF, NPS and SAF Factors impacting growth of employee pensions in India An international perspective on pension practices Survey results – KPMG in India’s Employer pension plans survey, 2015 Industry voices Conclusion © 2015 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. © 2015 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Introduction The increasing life expectancy coupled with the gradual disappearance of the extended family system, makes it imperative for India to design a robust pension system to avoid impoverishment in old-age and accompanying social distress. The current scenario in India is marked by low and insufficient pension coverage. Timely and smart policy interventions, when a majority of the Indian population is still young, can help avert an impending pension crisis. It is important for all the key stakeholders such as the government, regulators, employees and employers to engage in a focused and constructive discussion to explore new ways to broaden and deepen pension coverage in India. -

National Pension System (NPS) – Secure Your Future by Investing in NPS and Enjoy Attractive TAX Benefits Over and Above Section 80C Limit

National Pension System (NPS) – Secure your Future by investing in NPS and enjoy attractive TAX benefits over and above section 80C limit Information on NPS for Corporate Employees For more information on NPS, please visit: - https://www.npscra.nsdl.co.in/ - Click > Corporate Sector 1 Index S.No. Topic Page No 1 About NPS 3 2 NPS account 3-4 3 Tax benefits under NPS Corporate Sector Model 4 4 Contribution Towards NPS 4-6 5 Non-Fulfilment of required contribution criteria and implication 6-7 6 Investment of Funds under NPS 7-11 7 Distribution of Scheme 11 8 Back office Management 11 9 Fund Management 11 10 Annuity Service 11 11 Channelization of Funds 12 12 Process of Joining & Exiting NPS 12-15 13 Partial Withdrawal from NPS Account 15 14 Exit from NPS (Closure of NPS account) 15-16 15 Investment in Annuity 16 16 Death Proceedings 17 17 To view NPS account balance/ Statement of Transaction. 17 19 Query resolution process, TAT for various processes & escalation matrix 18 2 About NPS 1. What is NPS? National Pension System (NPS) is an investment cum pension scheme initiated by Government of India to provide old age security and pension of all citizen of India. The NPS was rolled out for all citizens of India on May 01, 2009. The Scheme is regulated by Pension Fund Regulatory and Development Authority (PFRDA). 2. What is NPS Corporate Model? NPS Corporate Model was launched by the regulator to facilitate Employees working with various organizations to on-board NPS through their Employer – Employee relationship. -

Government of India National Pension System

National Pension System (NPS) is a contributory pension system (iii) From F.Y. 2015-16, subscriber is being allowed tax deduction (quarterly alert), Withdrawal. b) Email alerts on: Subscriber whereby contributions from subscribers along with matching in addition to the deduction allowed under Sec. 80CCD(1) for registration, Credit/Debit of units in the subscriber account, contributions from respective governments as an employer, are contribution in his NPS account subject to maximum of Rs. Change in subscriber details, nomination details and any other collected and accumulated in an individual pension account of the 50,000/- under Sec. 80CCD 1(B). At present, At the time of exit, activity related to subscriber details, Grievance log & Resolution, employee. NPS uses a system of Government/ Autonomous the amount utilized for purchase of annuity is tax exempted. From Withdrawal. c) Centralized Grievance Management System st Bodies’ Nodal offices, a Central Recordkeeping Agency (CRA) and 1 April, 2016, 40% of the total accumulated corpus under NPS (CGMS) with a pre- determined turnaround time for resolution of designated Pension Funds (PFs), as specified by the respective has been made tax free. grievances related to different services. d) Periodic consolidated regulations to achieve synergy and maximum efficiency in Safety: Regulated by the Pension Fund Regulatory & SOT (Statement of Transactions). e) Subscriber operations. Development Authority (PFRDA) and introduced by the awareness programmes at various locations and centers. f) Government of India & respective states. Subscriber can update his/her mobile no & email id by login in NPS is mandatory to all employees joining services of Central Transparency: Through online access to your pension account CRA system through his I-Pin. -

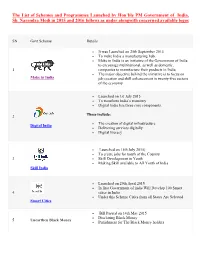

The List of Schemes and Programmes Launched by Hon'ble PM Government of India, Sh. Narendra Modi in 2015 and 2016 Follows As

The List of Schemes and Programmes Launched by Hon’ble PM Government of India, Sh. Narendra Modi in 2015 and 2016 follows as under alongwith concerned available logos SN Govt Scheme Details It was Launched on 25th September 2014 To make India a manufacturing hub. Make in India is an initiative of the Government of India to encourage multinational, as well as domestic, 1 companies to manufacture their products in India. The major objective behind the initiative is to focus on Make in India job creation and skill enhancement in twenty-five sectors of the economy Launched on 1st July 2015 To transform India’s economy Digital India has three core components. These include: 2 The creation of digital infrastructure Digital India Delivering services digitally Digital literacy Launched on 15th July 2015) To create jobs for youth of the Country 3 Skill Development in Youth Making Skill available to All Youth of India Skill India Launched on 29th April 2015 In first Government of india Will Develop 100 Smart 4 cities in India Under this Scheme Cities from all States Are Selected Smart Cities Bill Passed on 14th May 2015 Disclosing Black Money 5 Unearthen Black Money Punishment for The Black Money holders SN Govt Scheme Details Namami Gange Project or Namami Ganga Yojana is an ambitious Union Government Project which integrates the efforts to clean and protect the Ganga river in a comprehensive manner. It its maiden budget, the government announced Rs. 2037 Crore towards this mission. 6 The project is officially known as Integrated Ganga Conservation Mission project or ‘Namami Ganga Namami Gange Yojana’.