Oxfordshire Commercial Property Review 2003

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

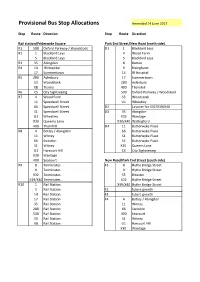

Provisional Bus Stop Allocations Amended 14 June 2017

Provisional Bus Stop Allocations Amended 14 June 2017 Stop Route Direction Stop Route Direction Rail station/Frideswide Square Park End Street/New Road (north side) R1 500 Oxford Parkway / Woodstock D1 1 Blackbird Leys R2 1 Blackbird Leys 4 Wood Farm 5 Blackbird Leys 5 Blackbird Leys R3 35 Abingdon 8 Barton R4 14 JR Hospital 9 Risinghurst 17 Summertown 14 JR Hospital R5 280 Aylesbury 17 Summertown S3 Woodstock 280 Aylesbury X8 Thame 400 Thornhill R6 CS City Sightseeing 500 Oxford Parkway / Woodstock R7 4 Wood Farm S3 Woodstock 11 Speedwell Street U1 Wheatley 66 Speedwell Street D2 Layover for X32/X39/X40 S1 Speedwell Street D3 35 Abingdon U1 Wheatley X32 Wantage X30 Queems Lane X39/X40 Wallingford 400 Thornhill D4 11 Butterwyke Place R8 4 Botley / Abingdon 66 Butterwyke Place 11 Witney S1 Butterwyke Place 66 Swindon S5 Butterwyke Place S1 Witney X30 Queens Lane U1 Harcourt Hill CS City Sightseeing X30 Wantage 400 Seacourt New Road/Park End Street (south side) R9 8 Terminates F1 8 Hythe Bridge Street 9 Terminates 9 Hythe Bridge Street X32 Terminates S5 Bicester X39/X40 Terminates X32 Hythe Bridge Street R10 1 Rail Station X39/X40 Hythe Bridge Street 5 Rail Station F2 future growth 14 Rail Station F3 future growth 17 Rail Station F4 4 Botley / Abingdon 35 Rail Station 11 Witney 280 Rail Station 66 Swindon 500 Rail Station 400 Seacourt S3 Rail Station S1 Witney X8 Rail Station U1 Harcourt Hill X30 Wantage Stop Route Direction Stop Route Direction Castle Street/Norfolk Street (west side) Castle Street/Norfolk Street (east side) E1 4 Botley -

A Tenelllent of Roger of Clujulor and Other Archaeological Investigations in Medieval North Oseney, Oxford

A Tenelllent of Roger of ClUJUlor and Other Archaeological Investigations in Medieval North Oseney, Oxford By ~1. R. R""IX I., "ith cOl1uibUlions by B. DLRII.\)"I. !\l. !\1J..IJ.oR,j.T. ~ll':,\IJ\, L. Au.!-.' and BOB "\'II~"'():,\ 'l\I\L\R\ .In mamlion ~, tJy o.yord .lrehlUol~f?U'al enil m 1989 90 ,"poud m,din:al and poJI."lldiLval bUlldlTlfij on Ill'o ft0nuif/'. on Holi"bwh Rou' and Oil SI. Thom ... ·j Simi, in I1ll wU"iring ""Jim! suburb if SI. JJlOmaJ"J. 0.11' mfdlRal hous, and parts if Ill. ollins U'''' dueom,d ftontillg onto Hol!"bUJh Rou . 1 rang' if ptTJonal mrdieml mtlo./u>ork and (oms (amt from WIt buildings. A slont'~/intd wain- chanml bttwetn two prOptT/ll., m~,' "PTt'fIIl all ,arly land boundal) flrrmng th, north suI, if proptr!Y gIV'" by RogtT if CUllmor W OSt710' .Ihbry. 17zt u'ater chamlll produad Q kad 5tal matnx l1I.scrihtd S'. Rogen. de. Comenort' Cl'ici+. 'J. .1 major rerOnJtrnctlO1l if the buildings U'(LI cam'td out in tJu 17tll ((!lIm:}'. 011 tflt St. ThomllJ'S Street frontage three 14th ·(mluT) bulldlllg~ U'tTt dueol.fTed, u'huh U'tTl rtbuilt In !hi 15th emluT). INTRODUCTION h(> ~il(, I:'\'arional Grid Reference SP 507062.' lies on the Thames floodplain on the we~t T side of Oxford Fi~. I ,', in the medie\'al suburb of St. Thomas's. The street plan is essen tially medieval, although it has been much altered by subsequent de\'e1opment. Sl. Thomas's Street formerly High Street St. -

Frideswide Square Is One of Oxford's Highest Profile

Frideswide Square Frequently Asked Questions Why are you doing this work? Frideswide Square is one of Oxford’s highest profile public areas and is a vital link between major road routes into the city. Tens of thousands of car, bus, cycle and pedestrians pass through each day and the area is also the destination for thousands of rail passengers. The county council is tackling what has been seen as a perennial problem for travellers coming into the city – our work will see improved journey times, far better facilities for pedestrians and cyclists and be part of a modern gateway for Oxford. We are investing in a better system for traffic and creating some excellent public space that is in keeping with nearby facilities such as the business school and future developments such as the revamped train station. The finished Fridewide Square will reflect the regeneration taking place in and around Oxford and the county as a whole. How much are you spending on this? £5.5million. This is a major investment into Oxford and just one of the pieces of work being done to ensure the city has the transport infrastructure to match its ambition to be a world class city. What does the work involve? There are two stages to the implementation of the project. The first stage of works, recently completed, involved reallocating parking from Becket Street to Osney Lane and St Thomas Street. There were also minor adjustments to the road layout at the junctions of Becket Street/Botley Road, Becket Street Osney Lane and Osney Lane/Hollybush Row. -

Worcester Street, Oxford Stage 3 Vulnerable Road User Audit Oxfordshire County Council

Worcester Street, Oxford Stage 3 Vulnerable Road User Audit Oxfordshire County Council 3 February 2015 Worcester Street, Oxford Stage 3 Road Safety Audit Notice This document and its contents have been prepared and are intended solely for Oxfordshire County Councils information and use in relation to a Stage 3 Vulnerable Road User Audit of proposals at the junction of Worcester Street, Hythe Bridge Street and George Street, Oxford. Atkins Highway & Transportation assumes no responsibility to any other party in respect of or arising out of or in connection with this document and/or its contents. This document has 20 pages including the cover. Document history Job number: 5126734 Document ref: Stage 3 VRU Audit Worcester Street Revision Purpose description Originated Checked Reviewed Authorised Date Rev 1.0 For Issue KF KF GB GB February 2015 Client signoff Client Oxfordshire County Council Project Worcester Street, Oxford Document title Stage 3 Vulnerable Road User Audit Job no. 5126734 Copy no. 001 Document Worcester Street Stage 3 VRU Audit reference Atkins Worcester Street | Version 1.0 | 3 February 2015 | 5126734 Worcester Street, Oxford Stage 3 Road Safety Audit Table of contents Chapter Pages 1. Introduction 4 Commission and Terms of Reference 4 Procedure 4 Issues 4 2. Scheme Description 5 Location 5 Scheme Description 5 Departure from Standards 5 Clarifications 5 3. Outstanding Issues Raised by the Stage 1&2 VRU Audits 6 4. Issues Raised by this Stage 3 VRU Audit 8 5. Vulnerable Road User Audit Team Statement 15 Appendices 16 Appendix A. List of Drawings and Documents Provided as Review Brief 17 Appendix B. -

Oxford Canal Heritage Trail Guide

Oxford Canal Heritage Trail Guide A city walk exploring the cultural and industrial heritage of the Oxford Canal Take a walk on a canal in the heart of the City of Oxford and discover a fascinating world outside of its dreaming spires! www.oxfordcanalheritage.org F O R D C X A O N E A L H T H L E I R A I T R A G E T Hythe Bridge 1 On the Heritage Trail The self-guided Oxford Canal Heritage Trail a thriving narrowboat community, canal is a linear walk along the Oxford Canal that locks, under ancient bridges along a green is approximately three miles (five kms) in corridor full of wildlife. On the trail you will total. You can begin either in Pocket Park learn why the canal was, and continues to just inside Hythe Bridge near the centre of be, so important, nationally as well as locally. Oxford City or at Ball’s Bridge in Wolvercote You will also find out why the canal was built, to the north of the city. There is the option who built it, who paid for it, and who pays of walking past Ball’s Bridge up to Duke’s for it now; the uses to which it was first put, Cut to complete the whole Trail although how its usefulness has changed overtime, you will have to return to near Balls Bridge how it could have been lost for ever, and the to get back into Oxford. However, unless the reasons for its revival. weather is poor, take your time and, whilst There is a large scale map of the Heritage you are walking, imagine the bustle of life on Trail at its start in Hythe Bridge Street this 200 year old canal when horses pulled (Ordnance Survey grid reference SU 508 working boats full of coal and other cargoes 064) and near the end of the trail at Ball’s to Oxford. -

Frideswide Square

43 8 REWLEY ROAD 42a FRIDESWIDE SQUARE - FUTURE IMPROVEMENTS Shelters 42 HYTHE BRIDGE STREET Beaver House 40 41 STATION ACCESS TRAFFIC MANAGEMENT, PHASE 1 39 1 to 2 Sunday 11 February 2018 - Friday 23 February 2018 Railway Station Access PH From Railway Station Exit temporary prohibition of left turn to 23 to 38 9a6 to 9 Frideswide Square. 3 to 5 Said Business School Key: Shelter PH Works area Hythe Bridge Street 10 Existing westbound bus stop to remain 1 Existing eastbound bus stop to remain Royal Vlora House 9 8 7 6 5 Youth Hostel 15 13 12 11 Oxford 14 Hotel 16 Traffic movements PARK END STREET FB 2a PARK END STREET LB S Gantry Park End Street PARK36 END PLACE 39 Cantay PH Botley Road Park End Place House 40 to 41 2 Frideswide Square LB TCBs 27 King Charles House 22 24 18 1 Hotel 3 1 The Lampl Hollybush Row Building 5 1 Vicarage 78 8 10 to 12 3 PH 14 to 19 12 to 18 Becket Street The Old Bakery 79a Club 5 Castle Mews 54 to 57 11 20 to 28 1 to 11 19 to 28 73 St Thomas's Church 1 to 9 79e (C of E) PH Bookbinders' 40 44 HOLLYBUSH ROW 22 20 59 23 The Kite 17 27 ST THOMAS' STREET 69 28 (PH) BECKET STREET Corner House 16 15 RUSSELL STREET 1 to 32 67 Single lane of Becket Jackson Cole House 1 MILL STREET 7 Street open to WOODBINE 60 to 61 1 to 44 23 southbound traffic only. -

Oxford 6 Worcester Street, Oxford, OX1 2BX T +44 (0)20 7629 7411 [email protected]

Oxford 6 Worcester Street, Oxford, OX1 2BX t +44 (0)20 7629 7411 [email protected] Directions to our Oxford office From London/M40 Follow the signs for M40 West/Oxford. Remain on the M40 until Junction 8. Keep left (signposted Oxford A40) on the M40 slip road on to the A40. Continue on the A40 until the roundabout and turn left on the A4165 Banbury Road. After about two miles Banbury Road joins Woodstock Road and becomes St Giles. Further on, by the traffic lights, turn right into Beaumont Street and then left into Worcester Street, the Boodle Hatfield offices will be found a short distance further on the left. To reach the nearest car park, continue down Worcester Street and into Hythe Bridge Street and then back on yourself into Park End Street. The nearest car park, Gloucester Green car park off Beaumont Street, can be accessed from the north via St Giles’, Beaumont Street and Gloucester Street. It can be accessed from the west via Hythe Bridge Street, Worcester Street, Beaumont Street and Gloucester Street. Alternatively continue down Worcester Street and into Hythe Bridge Street and then back on yourself into Park End Street which will take you to Worcester Street car park. From Birmingham/M40 Leave the M40 at Junction 9 (signposted Oxford A34). Follow A34 southbound until the Botley Interchange and turn onto the A420. Continue until the railway bridge and into Park End Street (car park on the left) and the Boodle Hatfield offices will be found a short distance further on in Worcester Street. -

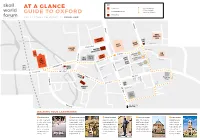

At a Glance Guide to Oxford

KEY AT A GLANCE Forum venues Circular walking tour of Oxford landmarks. Delegate Dinner colleges GUIDE TO OXFORD Journey time 50 minutes. Key locations TWEET YOUR EXPERIENCE AT #SKOLLWF Parks Road Saint Giles HARRIS MANCHESTER COLLEGE ASHMOLEAN KING’S MUSEUM ARMS WESTON Holywell Street BALLIOL LIBRARY Beaumont Street COLLEGE WORCESTER COLLEGE MACDONALD New College Lane RANDOLPH HOTEL WEST NEW WING Broad Street SHELDONIAN THEATRE COLLEGE OLD FIRE NEW BUS THEATRE Catte Street SAÏD STATION DIVINITY BODLEIAN Queen’s Lane STATION SCHOOL LIBRARY BUSINESS Worcester Street George Street Cornmarket Street EXETER SCHOOL Ship Street EAST WING New Inn Hall Street COLLEGE RADCLIFFE OXFORD Turl Street CAMERA Hythe Bridge Street OXFORD RAILWAY RETREAT STATION Saint Michael Street Park End Street Market Street Park End Street Street Merton SLUG AND New Road LETTUCE King Edward High Street Street H EXAMINATION Alfred Street o l Shoe Lane l SCHOOLS y b u s Magpie h R Lane o Queen Street TOWN w HALL MALMAISON Saint Aldate’s HOTEL Blue Boar Street CHRIST CHURCH O xp THE HEAD OF ens Road THE RIVER WALKING TOUR LANDMARKS Speedwell Street A b i n g d SHELDONIAN THEATRE BODLEIAN LIBRARY on RADCLIFFE CAMERA CHRIST CHURCH MARTYRS’ CROSS R Look down to see the site Designed by Sir Christopher Opened inTh 1602 and now o Built in 1749 to house the Originally founded by a a m d es where the Oxford Martyrs— Wren and built in 1668, it housing upwards St rof 11 million Radcliffe Science Library Cardinal Wolsey as eet THE HEAD Anglican bishops Hugh is one of the architectural volumes over 117 miles of andOF nowTHE RIVERa reading room Cardinal’s College in 1524. -

Exeter College Oxford

EXETER COLLEGE OXFORD A New Quad at Walton Street Archaeological Desk Based Assessment March 2013 Oxford Archaeological Janus House Osney Mead Oxford OX2 0ES tel: 01865 980 700 www.oxfordarchaeological.com Exeter College. Oxford 02.03.12 Client Name: Northcroft Client Ref No: Document Title: Exeter College Walton Street Quad Document Type: Archaeological Desk-based Assessment Issue Number: 3 National Grid Reference: SP 509 066 Planning Reference: OA Job Number: 4965 Site Code: Invoice Code: OXRUCOCO Receiving Museum: Museum Accession No: Prepared by: Ianto Wain Position: Head of HMS Date: 18th March 2013 Document File Location projects on server 1/ OXRUCOCO_Ruskin College Graphics File Location Server1\invoice codes Illustrated by Sarah Lucas Disclaimer: This document has been prepared for the titled project or named part thereof and should not be relied upon or used for any other project without an independent check being carried out as to its suitability and prior written authority of Oxford Archaeology being obtained. Oxford Archaeology accepts no responsibility or liability for the consequences of this document being used for a purpose other than the purposes for which it was commissioned. Any person/party using or relying on the document for such other purposes agrees, and will by such use or reliance be taken to confirm their agreement to indemnify Oxford Archaeology for all loss or damage resulting therefrom. Oxford Archaeology accepts no responsibility or liability for this document to any party other than the person/party by -

Castle and Periphery- Former Canal Basin Oxford

OXFORD HISTORIC URBAN CHARACTER ASSESSMENT HISTORIC URBAN CHARACTER AREA 14: CASTLE AND PERIPHERY- FORMER CANAL BASIN The HUCA is located within broad character Zone D: Castle and periphery. The broad character zone is defined by the extent of the Norman castle defences and includes part of the former canal basin located to the north. Summary characteristics • Dominant period: 20th century car park and 18th century canal arm. • Designations: None. • Archaeological Potential: Despite the significant impact caused by the construction of the canal the area has potential to preserve evidence for Late Saxon, medieval and post-medieval activity including a medieval ‘Hythe’ or landing place, the edge of the castle defences, related siege works and domestic settlement. There is also potential for canal infrastructure to survive below the modern car park. • Character: Predominantly modern transport infrastructure comprised of a surface car park with low retaining walls, elevated road, canal and towpath. • Spaces: The canal towpath provides a tranquil space alongside the canal, now largely used for leisure. The open car park preserves views of St Georges Tower, the Castle motte and Nuffield College. • Road morphology: Mixture of short sections of straight and sinuous routes; the medieval Hythe Bridge Street and Stockwell (Worcester Street) and later modern road Park End Street. The route of Stockwell (Worcester Street) was altered when Nuffield College was built. • Plot morphology: Large irregular plot. • The natural topography of the area is low lying on the Northmoor First Terrace adjacent to the Castle Mill Stream at a height of around 58m OD. • Survival of townscape elements: th o Part of 18 century canal. -

City of Streams and Spires a Self Guided Walk Along Oxford’S Waterways

City of streams and spires A self guided walk along Oxford’s waterways Folly Bridge and island © Webb Aviation www.webbaviation.co.uk Explore a fascinating network of rivers, streams and canals Discover how natural and manmade waterways have shaped the city Learn about the methods used to prevent flooding Find out how water has inspired Oxford’s industry, leisure and literature .discoveringbritain www .org ies of our land the stor scapes throug discovered h walks 2 Contents Introduction 4 Route overview 5 Practical information 6 Detailed route maps 8 Commentary 10 Credits 40 Further information 41 © The Royal Geographical Society with the Institute of British Geographers, London, 2012 Discovering Britain is a project of the Royal Geographical Society (with IBG) The digital and print maps used for Discovering Britain are licensed to the RGS-IBG from Ordnance Survey 3 City of streams and spires Explore Oxford’s fascinating network of waterways Introduction Did you know that the city of Oxford is built on a series of islands? This walk is an opportunity to explore an intricate network of waterways that are often overlooked by visitors to the city. Discover gushing mill streams and pic- turesque flood meadows, walk along an industrial canal and a working river, watch leisure boating and competitive rowing. Look for evidence in the names of neighbourhoods, streets, bridges and Pollarded trees at Rewley pubs giving clues to the watery history of Rory Walsh © RGS-IBG Discovering Britain this city. Discover why convicts from Oxford’s prison built many of Oxford’s canal, locks and other structures. -

University of Oxford - Finance Division

University of Oxford - Finance Division H O W T O F I N D U S From the town centre We are situated 5 -10 minutes from the town centre. From Cornmarket Street, walk down George Street and continue straight onto Hythe Bridge Street. By car From the A34 (ring road) come off at the Botley Interchange, and follow the A420, which becomes the Botley Road, and continue straight onto Hythe Bridge Street. From central Oxford, Hythe Bridge Street is accessed via Worcester Street, as George Street is blocked to traffic. The Finance Division is located in the west of Parking central Oxford on Hythe Bridge Street. We The nearest car parks are situated on occupy the ground floor of the black building, Worcester Street, and at Gloucester which is between the Saïd Business School Green, and there is also short-term and long- and the bridge over the canal. term parking at the train station. Seacourt (park & ride) is approximately a 15-minute walk from H ythe Bridge Street. On Arrival Please go to the main entrance of our building, By train and advise the receptionist you are visiting the Our office is a two-minute walk from the train station. We are situated at the corner of Finance Division of the University of Oxford. Rewley Road and Hythe Bridge Street. You will be let in to our offices via a double door, through which you will find our reception. By bus / coach Our receptionist will inform the relevant people The X90 and the Oxford Tube stop at of your arrival.