DB-Half Cover Wrap.Qxp

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Q2 2013 Preqin Private Equity Benchmarks: All Private Equity Benchmark Report

Preqin Private Equity Benchmarks: All Private Equity Benchmark Report As of 30th June 2013 alternative assets. intelligent data. Preqin Private Equity Benchmarks: All Private Equity Benchmark Report As of 30th June 2013 Report Produced on 12th March 2014 This publication is not included in the CLA Licence so you must not copy any portion of it without the permission of the publisher. All rights reserved. The entire contents of the report are the Copyright of Preqin Ltd. No part of this publication or any information contained in it may be copied, transmitted by any electronic means, or stored in any electronic or other data storage medium, or printed or published in any document, report or publication, without the express prior written approval of Preqin Ltd. The information presented in the report is for information purposes only and does not constitute and should not be construed as a solicitation or other offer, or recommendation to acquire or dispose of any investment or to engage in any other transaction, or as advice of any nature whatsoever. If the reader seeks advice rather than information then he should seek an independent fi nancial advisor and hereby agrees that he will not hold Preqin Ltd. responsible in law or equity for any decisions of whatever nature the reader makes or refrains from making following its use of the report. While reasonable efforts have been used to obtain information from sources that are believed to be accurate, and to confi rm the accuracy of such information wherever possible, Preqin Ltd. Does not make any representation or warranty that the information or opinions contained in the report are accurate, reliable, up-to-date or complete. -

Deal Flow Report 2018 Idaho

2018 IDAHO DEAL FLOW REPORT Deal Flow Report Presented by Deal Flow Opening Notes The Idaho Technology Council is pleased to present the 2018 Idaho Deal Flow Report! This is our fifth annual report, showcasing many of the companies that are starting, growing, and thriving in Idaho. The report confirms that Idaho continues to experience rapid growth and to be one of the best places in the country to do business! The data collected demonstrates the strong Idaho economy which is driving a demand for more talent and supports increased capital investment. Presenting Sponsor Hosting Sponsor In 2018, Idaho was recognized as the fastest growing state in the country. Idaho’s businesses are receiving increased attention and investment dollars from capital providers within the state and from around the country. More venture capital, private equity and angel funds are coming to Idaho to find new investment opportunities in Idaho companies. We want to recognize the many capital providers, service providers, and supporters of the Idaho entrepreneurial ecosystem, and especially the entrepreneurs and innovators who make Idaho such a great place! The most rewarding trend that we’ve seen over the last five years is the Sponsors reinvestment into the local economy by the entrepreneurs who have successful built and sold their business and used a portion of the funds to reinvest into the next generation of entrepreneurs and businesses. This trend is propelling Idaho’s growth even further and we believe it is key to Idaho’s future success. Community Venture Sponsors We would like to thank the members of this year’s Deal Flow Committee, and the various sponsors who supported our efforts, and congratulate the companies whose transactions are featured in this year’s report. -

A Big Bet on Game-Changing ADHD Treatment

20131202-NEWS--0001-NAT-CCI-CN_-- 11/27/2013 4:21 PM Page 1 CRAIN’S® NEW YORK BUSINESS VOL. XXIX, NO. 48 WWW.CRAINSNEWYORK.COM DECEMBER 2-8, 2013 PRICE: $3.00 Ice,Ice, ice,ice, maybemaybe Now-or-never vote on Bronx GOAL: Ice center CEO and hockey legend armory rink plan Mark Messier says the $275 million complex tests new norms will reap economic for development benefits for the Bronx. BY THORNTON MCENERY If there is one word in real estate circles that conveys the new poli- tics of commercial development in New York, it is Kingsbridge. The name of a long-shuttered Bronx armory, it connotes a semi- nal moment in the annals of city projects. Just as the failed Westway highway proposal of the 1970s and ’80s showed the power of environ- mentalism to kill a project, Kings- bridge did so for the cause of so- called living-wage jobs. In two weeks, almost four years to the day after a mall planned for the cavernous armory was defeat- ed by Bronx politicians, the final chapter in the Kingsbridge politi- cal saga is expected to be written. Having rejected the mall plan for See KINGSBRIDGE on Page 45 buck ennis A big bet on game-changing ADHD treatment deluxe version that will be released heart and lungs. the game,with a control group,is set Brain-to-computer interface tracks kids’ commercially for 8- to That,at least,is the idea.The chil- to begin on the Upper West Side focus; clinical study in city set to launch 12-year-olds next sum- dren, who play for 20 minutes with children at the Hallowell Cen- mer by Waltham,Mass.- three times a week,are part of ter, which specializes in treating at- based startup Atentiv. -

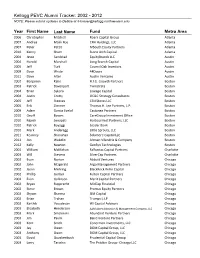

Kellogg PEVC Alumni Tracker: 2002 - 2012 NOTE: Please Submit Updates to Debbie at [email protected]

Kellogg PEVC Alumni Tracker: 2002 - 2012 NOTE: Please submit updates to Debbie at [email protected] Year First Name Last Name Fund Metro Area 2006 Christopher Mitchell Roark Capital Group Atlanta 2007 Andrea Malik Roe CRH Holdings, LLC Atlanta 2007 Peter Pettit MSouth Equity Partners Atlanta 2010 Kenny Shum Stone Arch Capital Atlanta 2004 Jesse Sandstad EquityBrands LLC Austin 2004 Harold Marshall Long Branch Capital Austin 2005 Jeff Turk Council Oak Investors Austin 2009 Dave Wride 44Doors Austin 2011 Dave Alter Austin Ventures Austin 2002 Benjamin Kahn H.I.G. Growth Partners Boston 2003 Patrick Davenport Twinstrata Boston 2004 Brian Sykora Lineage Capital Boston 2004 Justin Crotty OC&C Strategy Consultants Boston 2005 Jeff Steeves CSN Stores LLC Boston 2005 Erik Zimmer Thomas H. Lee Partners, L.P. Boston 2009 Adam Garcia Evelof Castanea Partners Boston 2010 Geoff Bowes CareGroup Investment Office Boston 2010 Rajesh Senapati HarbourVest Partners, LLC Boston 2010 Patrick Boyaggi Leader Bank Boston 2010 Mark Anderegg Little Sprouts, LLC Boston 2011 Kearney Shanahan Solamere Capital LLC Boston 2012 Jon Wakelin Altman Vilandrie & Company Boston 2012 Kelly Newton GenSyn Technologies Boston 2003 William McMahan Falfurrias Capital Partners Charlotte 2003 Will Stevens SilverCap Partners Charlotte 2002 Evan Norton Abbott Ventures Chicago 2002 John Fitzgerald Argo Management Partners Chicago 2002 Jason Mehring BlackRock Kelso Capital Chicago 2002 Phillip Gerber Fulton Capital Partners Chicago 2002 Evan Gallinson Merit Capital Partners -

Private Equity Investment in the Landscape Industry February 2016 PRIVATE EQUITY INVESTMENT in the LANDSCAPE INDUSTRY

Private Equity Investment in the Landscape Industry February 2016 PRIVATE EQUITY INVESTMENT IN THE LANDSCAPE INDUSTRY PRIVATE EQUITY INVESTMENT IN THE LANDSCAPE INDUSTRY Index To our clients and friends ........................................................................... 2 Private Equity Investment in the Landscape Industry ................... 3 A Survey of Private Equity Investment ................................................. 4 Recent Transactions ...................................................................................... 4 International Activity .................................................................................... 5 Transaction Structures ................................................................................. 5 Valuation Trends ............................................................................................. 6 How Private Equity Approaches Business Development .............. 6 Typical Targets ................................................................................................ 7 Conclusion .......................................................................................................... 8 Table 1 – Private Equity Investment in the Landscape Industry and Related .......................................................................... 9 Table 2 – Private Equity Investment in the Landscape Industry and Related – Exits ........................................................ 11 Private Equity Terminology ................................................................... -

Falcons Acquisition Corp

FOR IMMEDIATE RELEASE Investor Group to Acquire Financial Guaranty Insurance Company for $2.16 Billion from General Electric Capital Corporation New York, NY, August 4, 2003 -- An investor group consisting of The PMI Group, Inc. (“PMI”), The Blackstone Group (“Blackstone”), The Cypress Group (“Cypress”) and CIVC Partners L.P. (“CIVC”), collectively the “Investor Group,” announced today that it has signed a definitive agreement to acquire Financial Guaranty Insurance Company (“FGIC”) from General Electric Capital Corporation (“GE”) in a transaction valued at approximately $2.16 billion. FGIC is a leading triple-A rated monoline bond insurer with approximately $202 billion of insured par outstanding. FGIC provides financial guaranty policies for public finance and structured finance obligations issued by clients in both the public and private sectors. Financial guaranty insurance policies written by FGIC generally guaranty payment when due of the principal and interest on the guaranteed obligation. On completion of the transaction, FGIC will operate as an independent company. PMI will be the largest shareholder in FGIC with 42% ownership. Blackstone and Cypress will each own 23%. CIVC will own 7% of the new company and GE will maintain approximately a 5% stake. The purchase price will be funded with approximately $1.44 billion of equity, $225 million of senior debt, $235 million of mandatorily convertible participating preferred equity held by GE and a pre- closing dividend of approximately $260 million. In highlighting the growth plan for FGIC, the Investor Group noted that the Company will continue to be a leading participant in its core municipal bond market business and that FGIC’s strong platform will be the base for expansion into markets it does not currently serve, including certain areas of the municipal bond market, the structured finance market, and the international bond markets. -

2019 ACG Richmond Investor Profile Report Print Ready

PRESENTED BY ® 2019 ACG RICHMOND VIGINIA CAPITAL CONNECTION Investor Profile Report PRESENTED BY THE JEFFERSON HOTEL OCTOBER 2-3, 2019 Glossary Business Description: All investments by industry: A description of the firm’s primary type, Graph of transactions by industry, represented in preferences and location. PitchBook is an the PitchBook Platform. This breakdown is based impartial information provider on primary industries of the portfolio/serviced and will remove promotional language. companies. Assets under management (AUM): Specific to Lender Profiles The amount of money that the investor manages Total debt financings: for clients based on number of currently-managed The number of entities identified by PitchBook that funds. received debt financing from the firm in the last five years. Active private equity investments: The number of active companies in the investor’s Target debt financing amount: current portfolio identified by PitchBook in the Preferred amount of debt typically provided by last five years. This includes add-on transactions. the firm in a transaction. Total private equity investments: Specific to Service Provider Profiles The total number of companies in the investor’s Total transactions: portfolio, identified by PitchBook in the last five The number of transactions identified by years. This includes add-on transactions. PitchBook that the firm has provided service on in the last five years. Target EBITDA: Preferred EDITDA range targeted for investment. Total companies serviced: The number of unique companies the firm has Target revenue: provided service to in the last five years, identified Preferred revenue range targeted for investment. by PitchBook. Preferred investment amount: Total investors serviced: Preferred investment amount range that the firm The number of unique investors identified by typically invests in PitchBook that the firm has provided service to in a transaction. -

76988 IVCA AR08.Indd

ENGAGE :: 2008 IVCA ANNUAL REPORT The IVCA – the nation’s leading regional private equity association – will continue to work tirelessly for our industry to position us for success ahead. “ - IVCA Chairman Danny” Rosenberg DEAR MEMBERS :: I am pleased to present the Illinois Venture as early as possible and, with its strong students of color for summer internships. Capital Association’s annual report for 2008. relationships with both political parties, The association also helped establish the IVCA is well-positioned to work as the Women in Venture and Private Equity Despite the global economic turmoil, the a trusted partner on a variety of issues. organization and hosted its fi rst event. IVCA posted another very successful year – Further, we launched IVCA Member thanks to the active involvement of our • Events – The IVCA delivered another full Contribution series to highlight the many members and the tireless efforts of our slate of activities. Among them were several charitable efforts led by IVCA members. professional team of Maura O’Hara, Penny programs that continue to strengthen: Cate and Kathy Pyne. With the challenges the Midwest Venture Summit, the annual Undoubtedly, a number of challenges lie currently facing us, our industry needs the CFO Summit, and our signature Annual ahead for our industry. However, be IVCA more than ever to help us speak with Awards Dinner, which honored Kevin assured that as we manage through the one voice on critical issues. Evanich, Dick Thomas and Keith Crandell. current economic problems, the IVCA – the nation’s leading regional private equity Specifi cally, the 2008 highlights included: • Education – The IVCA launched a very association – will continue to work tirelessly successful four-event program, the IVCA • Legislative – We hosted a series of to position our industry for continued Toolkit Series, which focuses on industry legislative dinners with key lawmakers success. -

DENVER CAPITAL MATRIX Funding Sources for Entrepreneurs and Small Business

DENVER CAPITAL MATRIX Funding sources for entrepreneurs and small business Sixth Edition Introduction Denver Economic Development & Opportunity (DEDO) Definitions is pleased to release this sixth edition of the Denver Venture Capital – Venture capital is capital provided by investors to Capital Matrix. small businesses and start-up firms that demonstrate possible high- growth opportunities. Venture capital investments have a potential for This publication is designed as a tool to assist business considerable loss or profit and are generally designated for new and owners and entrepreneurs with discovering the myriad speculative enterprises that seek to generate a return through a of capital sources in and around the Mile High City. potential initial public offering or sale of the company. The Denver Capital Matrix provides a comprehensive Angel Investor – An angel investor is a high net worth individual active in directory of financing sources, from traditional bank venture financing, typically participating at an early stage of growth. lending, to venture capital firms, private equity firms, angel Private Equity – Private equity is an individual or consortium of investors investors, mezzanine sources and more. and funds that make investments directly into private companies or Small businesses provide the greatest opportunity for job initiate buyouts of public companies. Private equity is ownership in private companies that is not listed or traded on public exchanges. This is creation today. Yet, a lack of needed financing often prevents considered an illiquid and long-term investment. businesses from implementing expansion plans and adding payroll. Through this updated resource, DEDO strives to help Mezzanine Financing – Mezzanine financing is a hybrid of debt and connect businesses to equity financing that is typically used to finance the expansion of start- up and expansion capital so that they can thrive in existing companies. -

Private Equity INSIDER 2 Blackstone, Carlyle in Line for Biggest-Manager Throne

JANUARY 26, 2011 Calpers Seeks Bids for Hefty Fund Interests 2 LARGEST FUND MANAGERS Calpers is pitching more than $800 million of private equity fund stakes on the secondary market. 3 NASBIC Extends Membership Reach The $226 billion pension system began showing the offering to prospective buy- ers in the last week or so via UBS, working under the codename Project Alpha. A 3 StepStone Ponders Secondary Offering sale is expected to take place quickly, perhaps in a matter of weeks. 4 Morgan Stanley Chips Away at Target Project Alpha is likely to rank among the biggest secondary-market sales of early 2011. For a portfolio of its size, however, it contains a small number of positions — 4 CIVC Shortfall Made Official an estimated five or six buyout-fund interests of up to $250 million each. 4 China Specialist Shifts to Co-Investing The pledges are weighted heavily toward large vehicles from well-known manag- ers, with sources pointing to Blackstone Group, Carlyle Group, Kohlberg Kravis Rob- 5 Bank Street Maps Marketing Route erts and TPG as fitting the profile for shops whose funds might be in the mix. That said, the specific identities of the underlying managers remain unclear. 5 Constitution Opts for Dual Pitches So what is Calpers’ motivation? Potential pricing appears attractive, with stakes 5 LGV Pitch Enters Second Round See UBS on Page 5 6 Matrix Folds Placement Efforts Jefferies’ Reshaping Fund-Placement Division 7 FUND-RAISING ACTION Jefferies & Co. is restructuring its placement-agent unit while starting a sepa- rate division to raise capital for clients’ distressed-asset and special-situations vehicles. -

As Venture Capital and Private Equity Activity Has Grown in Michigan, So Has the Number of Firms Active in the State

20130311-SUPP--0024-NAT-CCI-CD_-- 3/4/2013 4:00 PM Page 1 VENTURE CAPITAL AND PRIVATE EQUITY IN THE STATE As venture capital and private equity activity has grown in Michigan, so has the number of firms active in the state. Here’s an alphabetical list of venture capital and private equity firms that are either based or active in Michigan. The information is based on interviews with principals at the firms, as well as databases and industry organizations. Fund, location Investment focus Top executive(s) Representative investments Fund size The Anderson Consumer products, industrial, Cory Gaffney, Tom Gaffney Hastings Manufacturing N/A Group, media, property, retail and Barry Shapiro, partners LLC, Michigan Wheel Bloomfield Hills Marine, TecArt Inc. Apjohn Biotechnology, health care, Mina Patel Sooch and Donald ProNAi Therapeutics, $15 million Ventures,* medical devices, Parfet, co-founders and general RenaMed Biologics Kalamazoo pharmaceuticals partners Arboretum Health care, life sciences, Jan Garfinkle, Tim Petersen Arbor Metrix, Fidelis $235 million and Ventures,* medical devices, medical and Paul McCreadie, managing Senior Care, Tangent an estimated Ann Arbor instruments, medical directors Medical $118 million left ** technologies Aria Ventures, Diversified Jeff Sloan, founder HorseShow.com, BizHub, N/A Birmingham Hoscomm Systems Arsenal Venture IT, communications, energy, Jason Rottenberg, Christopher Bioformix Inc., Arctic N/A Partners,* Winter power, industrial and Fountas and John Trbovich, Sand Technologies Inc. Park, Fla. (locally -

Private Equity Deskbook Mid-Year Update 2008

Private Equity Deskbook Mid-Year Update 2008 2008 © Probitas Partners Contents Introduction ......................................................................... 1 The Perfect Storm: The Credit Cycle & Private Equity .................................................................... 2 The Market for Buying Companies .................................. 2 Defaults & Bankruptcies ..................................................... 4 Fundraising & Distressed Investing ............................... 9 “The Best & the Brightest” .............................................. 11 The Venture Capital Market: No Exit .......................... 13 The Secondary Market ..................................................... 14 Conclusion ........................................................................... 18 Funds in or Coming to Market ....................................... 20 Introduction Probitas Partners is a leading independent knowledge, innovation and solutions provider to private markets clients. It has three integrated global practices that include placement of alternative investment products, portfolio management and liquidity management. These services are offered by a team of employee owners dedicated to leveraging the firm’s vast knowledge and technical resources to provide the best results for its clients. probity ¯¯˘ n. [from Latin probitas: good, proper, honest.] adherence to the highest principles, ideals and character. On an ongoing basis, Probitas Partners offers research and investment tools on the alternative investment