Q2 2013 Preqin Private Equity Benchmarks: All Private Equity Benchmark Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Enewsletter No. 481 | SECA | Swiss Private Equity & Corporate Finance

eNewsletter no. 481 Dear Reader 27 September 2017 Radiation both saves lives and kills lives. Marie Curie, who SECA discovered and named it, was its victim. Venture Capital Maria Salomea Sklodowska moved to France to study physics, as this was not possible in her native Poland, then under Russian Private Equity – Swiss News control. She worked with and married Pierre Curie, and the two Private Equity – Int. News won the Nobel prize in 1903. They managed to get it in Stockholm only in 1905, shortly after the birth of their second daughter. A year Corporate Finance later, Pierre died in a road accident. Marie Sklodowska Curie Mergers & Acquisitions continued doing basic research and succeeded in isolating radium. Management Buyout 1911 she was awarded the second Nobel prize, this time in chemistry, the only woman who ever got two Nobels. When WW1 Book of the Week broke out, she took her scientific knowledge to the battle field. She Jobs helped set up 20 mobile and 200 stationary units to x-ray wounded soldiers with the help of her daughter Irène. Agenda Nobody knew the long-term effects of radiation at the time. Marie Editor Sklodowska Curie remains a radiant figure after her death in 1934. Even her pens and papers are still radioactive and are kept in lead vaults. Toolbox Have a nice week with innovative scientists! Print Newsletter Maurice Pedergnana Send Newsletter to a Friend Download as PDF SECA Björn Böckenförde verstorben Am 8. September 2017 ist unser langjähriges SECA Vorstandsmitglied Björn Böckenförde aus einem erfüllten und glücklichen Leben gerissen worden. -

DENVER CAPITAL MATRIX Funding Sources for Entrepreneurs and Small Business

DENVER CAPITAL MATRIX Funding sources for entrepreneurs and small business. Introduction The Denver Office of Economic Development is pleased to release this fifth annual edition of the Denver Capital Matrix. This publication is designed as a tool to assist business owners and entrepreneurs with discovering the myriad of capital sources in and around the Mile High City. As a strategic initiative of the Denver Office of Economic Development’s JumpStart strategic plan, the Denver Capital Matrix provides a comprehensive directory of financing Definitions sources, from traditional bank lending, to venture capital firms, private Venture Capital – Venture capital is capital provided by investors to small businesses and start-up firms that demonstrate possible high- equity firms, angel investors, mezzanine sources and more. growth opportunities. Venture capital investments have a potential for considerable loss or profit and are generally designated for new and Small businesses provide the greatest opportunity for job creation speculative enterprises that seek to generate a return through a potential today. Yet, a lack of needed financing often prevents businesses from initial public offering or sale of the company. implementing expansion plans and adding payroll. Through this updated resource, we’re striving to help connect businesses to start-up Angel Investor – An angel investor is a high net worth individual active in and expansion capital so that they can thrive in Denver. venture financing, typically participating at an early stage of growth. Private Equity – Private equity is an individual or consortium of investors and funds that make investments directly into private companies or initiate buyouts of public companies. Private equity is ownership in private companies that is not listed or traded on public exchanges. -

Sustainable Food & Agtech Market Update

Sustainable Food & AgTech Market Update September 2019 Precision Software & Innovative Crop Science Sustainable Food Agriculture Sensing Farming About Greentech Capital Advisors Our mission is to empower companies and investors who are creating a more efficient and sustainable global infrastructure. We are purpose-built to ensure that our clients achieve success. We have deeply experienced bankers who are sector experts and understand our clients' industries and needs. We reach a vast global network of buyers, growth companies, asset owners and investors, and thereby provide clients with more ways to succeed through a deeper relationship network. We have directly relevant transaction experience which enables us to find creative structures and solutions to close transactions. We are an expert team of 75 professionals working seamlessly on our clients' behalf in New York, Zurich, and San Francisco and through a strategic partnership in Japan. Our team of experienced bankers provides conflict-free advice and thoughtful, innovative solutions. Greentech Capital Advisors / 1 Sustainable Food & AgTech September 2019 News Selected Business > Cargill, a provider of agricultural services, announced plans to shut down fresh Developments and frozen whole turkey production in November at its plant in Waco, TX, as a result of falling demand for the product (Food Dive) > Impossible Foods, a provider of meat alternatives, announced plans to sell their burger substitute at Gelson’s Markets, the first retail stores where Impossible Greentech’s Take: Foods -

Deal Flow Report 2018 Idaho

2018 IDAHO DEAL FLOW REPORT Deal Flow Report Presented by Deal Flow Opening Notes The Idaho Technology Council is pleased to present the 2018 Idaho Deal Flow Report! This is our fifth annual report, showcasing many of the companies that are starting, growing, and thriving in Idaho. The report confirms that Idaho continues to experience rapid growth and to be one of the best places in the country to do business! The data collected demonstrates the strong Idaho economy which is driving a demand for more talent and supports increased capital investment. Presenting Sponsor Hosting Sponsor In 2018, Idaho was recognized as the fastest growing state in the country. Idaho’s businesses are receiving increased attention and investment dollars from capital providers within the state and from around the country. More venture capital, private equity and angel funds are coming to Idaho to find new investment opportunities in Idaho companies. We want to recognize the many capital providers, service providers, and supporters of the Idaho entrepreneurial ecosystem, and especially the entrepreneurs and innovators who make Idaho such a great place! The most rewarding trend that we’ve seen over the last five years is the Sponsors reinvestment into the local economy by the entrepreneurs who have successful built and sold their business and used a portion of the funds to reinvest into the next generation of entrepreneurs and businesses. This trend is propelling Idaho’s growth even further and we believe it is key to Idaho’s future success. Community Venture Sponsors We would like to thank the members of this year’s Deal Flow Committee, and the various sponsors who supported our efforts, and congratulate the companies whose transactions are featured in this year’s report. -

View Whitepaper

INFRAREPORT Top M&A Trends in Infrastructure Software EXECUTIVE SUMMARY 4 1 EVOLUTION OF CLOUD INFRASTRUCTURE 7 1.1 Size of the Prize 7 1.2 The Evolution of the Infrastructure (Public) Cloud Market and Technology 7 1.2.1 Original 2006 Public Cloud - Hardware as a Service 8 1.2.2 2016 - 2010 - Platform as a Service 9 1.2.3 2016 - 2019 - Containers as a Service 10 1.2.4 Container Orchestration 11 1.2.5 Standardization of Container Orchestration 11 1.2.6 Hybrid Cloud & Multi-Cloud 12 1.2.7 Edge Computing and 5G 12 1.2.8 APIs, Cloud Components and AI 13 1.2.9 Service Mesh 14 1.2.10 Serverless 15 1.2.11 Zero Code 15 1.2.12 Cloud as a Service 16 2 STATE OF THE MARKET 18 2.1 Investment Trend Summary -Summary of Funding Activity in Cloud Infrastructure 18 3 MARKET FOCUS – TRENDS & COMPANIES 20 3.1 Cloud Providers Provide Enhanced Security, Including AI/ML and Zero Trust Security 20 3.2 Cloud Management and Cost Containment Becomes a Challenge for Customers 21 3.3 The Container Market is Just Starting to Heat Up 23 3.4 Kubernetes 24 3.5 APIs Have Become the Dominant Information Sharing Paradigm 27 3.6 DevOps is the Answer to Increasing Competition From Emerging Digital Disruptors. 30 3.7 Serverless 32 3.8 Zero Code 38 3.9 Hybrid, Multi and Edge Clouds 43 4 LARGE PUBLIC/PRIVATE ACQUIRERS 57 4.1 Amazon Web Services | Private Company Profile 57 4.2 Cloudera (NYS: CLDR) | Public Company Profile 59 4.3 Hortonworks | Private Company Profile 61 Infrastructure Software Report l Woodside Capital Partners l Confidential l October 2020 Page | 2 INFRAREPORT -

Profiles in Innovation: Artificial Intelligence

EQUITY RESEARCH | November 14, 2016 Artificial intelligence is the apex technology of the information era. In the latest in our Profiles in Innovation Heath P. Terry, CFA series, we examine how (212) 357-1849 advances in machine [email protected] learning and deep learning Goldman, Sachs & Co. have combined with more Jesse Hulsing powerful computing and an (415) 249-7464 ever-expanding pool of data [email protected] to bring AI within reach for Goldman, Sachs & Co. companies across Mark Grant industries. The development (212) 357-4475 [email protected] of AI-as-a-service has the Goldman, Sachs & Co. potential to open new markets and disrupt the Daniel Powell (917) 343-4120 playing field in cloud [email protected] computing. We believe the Goldman, Sachs & Co. ability to leverage AI will Piyush Mubayi become a defining attribute (852) 2978-1677 of competitive advantage [email protected] for companies in coming Goldman Sachs (Asia) L.L.C. years and will usher in a Waqar Syed resurgence in productivity. (212) 357-1804 [email protected] Goldman, Sachs & Co. PROFILESIN INNOVATION Artificial Intelligence AI, Machine Learning and Data Fuel the Future of Productivity Goldman Sachs does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html. -

A Big Bet on Game-Changing ADHD Treatment

20131202-NEWS--0001-NAT-CCI-CN_-- 11/27/2013 4:21 PM Page 1 CRAIN’S® NEW YORK BUSINESS VOL. XXIX, NO. 48 WWW.CRAINSNEWYORK.COM DECEMBER 2-8, 2013 PRICE: $3.00 Ice,Ice, ice,ice, maybemaybe Now-or-never vote on Bronx GOAL: Ice center CEO and hockey legend armory rink plan Mark Messier says the $275 million complex tests new norms will reap economic for development benefits for the Bronx. BY THORNTON MCENERY If there is one word in real estate circles that conveys the new poli- tics of commercial development in New York, it is Kingsbridge. The name of a long-shuttered Bronx armory, it connotes a semi- nal moment in the annals of city projects. Just as the failed Westway highway proposal of the 1970s and ’80s showed the power of environ- mentalism to kill a project, Kings- bridge did so for the cause of so- called living-wage jobs. In two weeks, almost four years to the day after a mall planned for the cavernous armory was defeat- ed by Bronx politicians, the final chapter in the Kingsbridge politi- cal saga is expected to be written. Having rejected the mall plan for See KINGSBRIDGE on Page 45 buck ennis A big bet on game-changing ADHD treatment deluxe version that will be released heart and lungs. the game,with a control group,is set Brain-to-computer interface tracks kids’ commercially for 8- to That,at least,is the idea.The chil- to begin on the Upper West Side focus; clinical study in city set to launch 12-year-olds next sum- dren, who play for 20 minutes with children at the Hallowell Cen- mer by Waltham,Mass.- three times a week,are part of ter, which specializes in treating at- based startup Atentiv. -

Global Cleantech 100

2020 GLOBALCLEANTECH100 Leading companies and themes in sustainable innovation Supported by: GLOBALCLEANTECH100 Contents Acknowledgements ........................................................ 3 Foreword .......................................................................5-7 How we select the Global Cleantech 100 ..................8-9 The Global Cleantech 100 in numbers ................. 10-11 The 2020 Global Cleantech 100 ............................ 12-21 Research Outlook ................................................... 22-23 Agriculture & Food .................................................. 24-26 Enabling Technologies............................................ 27-28 Energy & Power ....................................................... 29-32 Materials & Chemicals ............................................ 33-36 Resources & Environment ..................................... 37-40 Transportation & Logistics ..................................... 41-44 2019 graduates ....................................................... 45-47 About Cleantech Group ...............................................48 Meet the experts ..................................................... 49-50 2 January 2020 GLOBALCLEANTECH100 Acknowledgements We firstly wish to express our gratitude for the support of the Chubb Group of Insurance Companies, the headline sponsor of the 2020 Global Cleantech 100 program. The list would not have been possible without the 80 expert panelists (See pages 49-50) who gave up their time to provide input and opinion. -

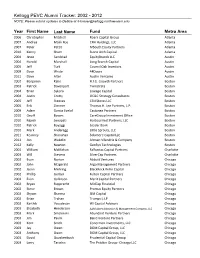

Kellogg PEVC Alumni Tracker: 2002 - 2012 NOTE: Please Submit Updates to Debbie at [email protected]

Kellogg PEVC Alumni Tracker: 2002 - 2012 NOTE: Please submit updates to Debbie at [email protected] Year First Name Last Name Fund Metro Area 2006 Christopher Mitchell Roark Capital Group Atlanta 2007 Andrea Malik Roe CRH Holdings, LLC Atlanta 2007 Peter Pettit MSouth Equity Partners Atlanta 2010 Kenny Shum Stone Arch Capital Atlanta 2004 Jesse Sandstad EquityBrands LLC Austin 2004 Harold Marshall Long Branch Capital Austin 2005 Jeff Turk Council Oak Investors Austin 2009 Dave Wride 44Doors Austin 2011 Dave Alter Austin Ventures Austin 2002 Benjamin Kahn H.I.G. Growth Partners Boston 2003 Patrick Davenport Twinstrata Boston 2004 Brian Sykora Lineage Capital Boston 2004 Justin Crotty OC&C Strategy Consultants Boston 2005 Jeff Steeves CSN Stores LLC Boston 2005 Erik Zimmer Thomas H. Lee Partners, L.P. Boston 2009 Adam Garcia Evelof Castanea Partners Boston 2010 Geoff Bowes CareGroup Investment Office Boston 2010 Rajesh Senapati HarbourVest Partners, LLC Boston 2010 Patrick Boyaggi Leader Bank Boston 2010 Mark Anderegg Little Sprouts, LLC Boston 2011 Kearney Shanahan Solamere Capital LLC Boston 2012 Jon Wakelin Altman Vilandrie & Company Boston 2012 Kelly Newton GenSyn Technologies Boston 2003 William McMahan Falfurrias Capital Partners Charlotte 2003 Will Stevens SilverCap Partners Charlotte 2002 Evan Norton Abbott Ventures Chicago 2002 John Fitzgerald Argo Management Partners Chicago 2002 Jason Mehring BlackRock Kelso Capital Chicago 2002 Phillip Gerber Fulton Capital Partners Chicago 2002 Evan Gallinson Merit Capital Partners -

Private Equity Benchmark Report

Preqin Private Equity Benchmarks: All Private Equity Benchmark Report As of 31st March 2014 alternative assets. intelligent data. Preqin Private Equity Benchmarks: All Private Equity Benchmark Report As of 31st March 2014 Report Produced on 9th October 2014 This publication is not included in the CLA Licence so you must not copy any portion of it without the permission of the publisher. All rights reserved. The entire contents of the report are the Copyright of Preqin Ltd. No part of this publication or any information contained in it may be copied, transmitted by any electronic means, or stored in any electronic or other data storage medium, or printed or published in any document, report or publication, without the express prior written approval of Preqin Ltd. The information presented in the report is for information purposes only and does not constitute and should not be construed as a solicitation or other offer, or recommendation to acquire or dispose of any investment or to engage in any other transaction, or as advice of any nature whatsoever. If the reader seeks advice rather than information then he should seek an independent fi nancial advisor and hereby agrees that he will not hold Preqin Ltd. responsible in law or equity for any decisions of whatever nature the reader makes or refrains from making following its use of the report. While reasonable efforts have been used to obtain information from sources that are believed to be accurate, and to confi rm the accuracy of such information wherever possible, Preqin Ltd. Does not make any representation or warranty that the information or opinions contained in the report are accurate, reliable, up-to-date or complete. -

Investment Holdings As of June 30, 2019

Investment Holdings As of June 30, 2019 Montana Board of Investments | Portfolio as of June 30, 2019 Transparency of the Montana Investment Holdings The Montana Board of Investment’s holdings file is a comprehensive listing of all manager funds, separately managed and commingled, and aggregated security positions. Securities are organized across common categories: Pension Pool, Asset Class, Manager Fund, Aggregated Individual Holdings, and Non-Pension Pools. Market values shown are in U.S. dollars. The market values shown in this document are for the individual investment holdings only and do not include any information on accounts for receivables or payables. Aggregated Individual Holdings represent securities held at our custodian bank and individual commingled accounts. The Investment Holdings Report is unaudited and may be subject to change. The audited Unified Investment Program Financial Statements, prepared on a June 30th fiscal year-end basis, will be made available once the Legislative Audit Division issues the Audit Opinion. Once issued, the Legislative Audit Division will have the Audit Opinion available online at https://www.leg.mt.gov/publications/audit/agency-search-report and the complete audited financial statements will also be available on the Board’s website http://investmentmt.com/AnnualReportsAudits. Additional information can be found at www.investmentmt.com Montana Board of Investments | Portfolio as of June 30, 2019 2 Table of Contents Consolidated Asset Pension Pool (CAPP) 4 CAPP - Domestic Equities 5 CAPP - International -

Investment Holdings As of December 31, 2017 Transparency of the Montana Investment Holdings

Investment Holdings As of December 31, 2017 Transparency of the Montana Investment Holdings The Montana Board of Investment’s holdings file is a comprehensive listing of all manager funds, separately managed and commingled, and aggregated security positions. Securities are organized across common categories: Pension Pool, Asset Class, Manager Fund, Aggregated Individual Holdings, and Non-Pension Pools. Market values shown are in U.S. dollars. The market value of the individual holdings does not necessarily correspond to the net asset value of the accounts in the financial reports. Aggregated Individual Holdings represent securities held at our custodian bank and individual commingled accounts. The Investment Holdings Report is unaudited and may be subject to change. Additional information can be found at http://www.investmentmt.com/ Montana Board of Investments | December 31, 2017 | 2 Table of Contents Consolidated Asset Pension Pool (CAPP) 4 CAPP - Domestic Equity 5 CAPP - International Equity 18 CAPP - Private Equity 32 CAPP - Natural Resources 34 CAPP - Private Real Estate 35 CAPP - TIPS 36 CAPP - Broad Fixed Income 37 CAPP - US Treasury & Agency 40 CAPP - Investment Grade Credit 42 CAPP - Mortgage Backed Securities 44 CAPP - High Yield Fixed Income 46 CAPP - Cash Equivalents 60 Short Term Investment Pool (STIP) 61 Trust Funds Investment Pool (TFIP) 63 State Fund 69 All Other Funds 73 End Notes 74 Glossary 75 Montana Board of Investments | December 31, 2017 | 3 CAPP Asset Class Holdings Security Name Market Value Domestic Equity 4,003,924,115 International Equity 2,041,108,151 Private Equity 1,158,087,065 Natural Resources 259,993,915 Real Estate 785,720,964 TIPS 384,132,519 Broad Fixed Income 249,766,393 US Treasury & Agency 1,083,499,322 Investment Grade Credit 376,018,338 Mortgage-Backed 463,393,123 High Yield 319,051,408 Cash Equivalents 176,742,322 Montana Board of Investments | December 31, 2017 | 4 Domestic Equity Manager Holdings Manager Name Market Value BlackRock (ETF and Commingled) 2,207,354,908 T.