Falcons Acquisition Corp

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Neuberger Berman/New Jersey Custom Investment Fund II (“NB/NJ Custom Fund II”)

Agenda Item 5a CHRIS CHRISTIE DEPARTMENT OF THE TREASURY Governor DIVISION OF INVESTMENT P.O. BOX 290 KIM GUADAGNO TRENTON, NJ 08625-0290 ANDREW P. SIDAMON-ERISTOFF Lt. Governor State Treasurer January 20, 2012 MEMORANDUM TO: The State Investment Council FROM: Timothy Walsh Director SUBJECT: Proposed Investment in Neuberger Berman/New Jersey Custom Investment Fund II (“NB/NJ Custom Fund II”) The New Jersey Division of Investment (“Division”) is proposing an investment of $200 million in Neuberger Berman/New Jersey Custom Investment Fund II (“NB/NJ Custom Fund II”). This memorandum is presented to the State Investment Council (the “Council”) pursuant to N.J.A.C. 17:16- 69.9. As part of NJDOI’s separate account mandate to achieve attractive risk adjusted returns while promoting economic benefits within the State of New Jersey and Northeast region, staff and SIS are recommending a commitment to NB/NJ Custom Fund II. A report of the Investment Policy Committee (“IPC”) summarizing the details of the proposed investment is attached. Division Staff and its private equity consultant, Strategic Investment Solutions, undertook extensive due diligence on the proposed investment in accordance with the Division’s Alternative Investment Due Diligence Procedures. As part of its due diligence process, staff determined that the fund has not engaged a third-party solicitor (a "placement agent") in connection with New Jersey’s potential investment. We will work with representatives of the Division of Law and outside counsel to review and negotiate specific terms of the legal documents to govern the investment. In addition, the proposed investment must comply with the Council’s regulation governing political contributions (N.J.A.C. -

Q2 2013 Preqin Private Equity Benchmarks: All Private Equity Benchmark Report

Preqin Private Equity Benchmarks: All Private Equity Benchmark Report As of 30th June 2013 alternative assets. intelligent data. Preqin Private Equity Benchmarks: All Private Equity Benchmark Report As of 30th June 2013 Report Produced on 12th March 2014 This publication is not included in the CLA Licence so you must not copy any portion of it without the permission of the publisher. All rights reserved. The entire contents of the report are the Copyright of Preqin Ltd. No part of this publication or any information contained in it may be copied, transmitted by any electronic means, or stored in any electronic or other data storage medium, or printed or published in any document, report or publication, without the express prior written approval of Preqin Ltd. The information presented in the report is for information purposes only and does not constitute and should not be construed as a solicitation or other offer, or recommendation to acquire or dispose of any investment or to engage in any other transaction, or as advice of any nature whatsoever. If the reader seeks advice rather than information then he should seek an independent fi nancial advisor and hereby agrees that he will not hold Preqin Ltd. responsible in law or equity for any decisions of whatever nature the reader makes or refrains from making following its use of the report. While reasonable efforts have been used to obtain information from sources that are believed to be accurate, and to confi rm the accuracy of such information wherever possible, Preqin Ltd. Does not make any representation or warranty that the information or opinions contained in the report are accurate, reliable, up-to-date or complete. -

Capital Markets

U.S. DEPARTMENT OF THE TREASURY A Financial System That Creates Economic Opportunities Capital Markets OCTOBER 2017 U.S. DEPARTMENT OF THE TREASURY A Financial System That Creates Economic Opportunities Capital Markets Report to President Donald J. Trump Executive Order 13772 on Core Principles for Regulating the United States Financial System Steven T. Mnuchin Secretary Craig S. Phillips Counselor to the Secretary Staff Acknowledgments Secretary Mnuchin and Counselor Phillips would like to thank Treasury staff members for their contributions to this report. The staff’s work on the report was led by Brian Smith and Amyn Moolji, and included contributions from Chloe Cabot, John Dolan, Rebekah Goshorn, Alexander Jackson, W. Moses Kim, John McGrail, Mark Nelson, Peter Nickoloff, Bill Pelton, Fred Pietrangeli, Frank Ragusa, Jessica Renier, Lori Santamorena, Christopher Siderys, James Sonne, Nicholas Steele, Mark Uyeda, and Darren Vieira. iii A Financial System That Creates Economic Opportunities • Capital Markets Table of Contents Executive Summary 1 Introduction 3 Scope of This Report 3 Review of the Process for This Report 4 The U.S. Capital Markets 4 Summary of Issues and Recommendations 6 Capital Markets Overview 11 Introduction 13 Key Asset Classes 13 Key Regulators 18 Access to Capital 19 Overview and Regulatory Landscape 21 Issues and Recommendations 25 Equity Market Structure 47 Overview and Regulatory Landscape 49 Issues and Recommendations 59 The Treasury Market 69 Overview and Regulatory Landscape 71 Issues and Recommendations 79 -

SRGL 2011 Information Statement

Scottish Re Group Limited P.O. Box HM 2939 Crown House, Second Floor 4 Par-la-Ville Road Hamilton HM 08, Bermuda May 11, 2011 Dear Scottish Re Group Limited Shareholder: You are cordially invited to attend the Extraordinary General Meeting of Shareholders of Scottish Re Group Limited (the “Company”), to be held at the Fairmont Hamilton Princess Hotel, 76 Pitts Bay Road, Pembroke HM 11 Bermuda HM CX, on June 8, 2011, at 9:00 a.m., Bermuda time. The enclosed Notice of Extraordinary General Meeting of Shareholders to be held on June 8, 2011 (the “Notice”) and information statement describe fully the formal business to be transacted at the Extraordinary General Meeting. At this important meeting, you will be asked to consider and vote upon proposals (i) to approve, authorize and adopt the Agreement and Plan of Merger, dated as of April 15, 2011 (as amended or supplemented, the “Merger Agreement”), by and among the Company, SGRL Acquisition, LDC (“SRGL LDC”), Benton Street Partners I, L.P. (“Benton I”), Benton Street Partners II, L.P. (“Benton II”), Benton Street Partners III, L.P. (“Benton III” and, together with Benton I and Benton II, “Benton”) and SRGL Benton Ltd. (“Merger Sub”) and the plan of merger referred to in Section 233(3) of the Companies Law (2010 Revision), as amended (the “Plan of Merger”), and the merger contemplated thereby, (ii) to make certain amendments to the Company’s Amended and Restated Articles of Association (amended and restated by Special Resolutions passed on March 2, 2007) (the “Proposed Amendments”) and (iii) to approve and adopt certain resolutions relating to the foregoing proposals (the “Resolutions”). -

Deal Flow Report 2018 Idaho

2018 IDAHO DEAL FLOW REPORT Deal Flow Report Presented by Deal Flow Opening Notes The Idaho Technology Council is pleased to present the 2018 Idaho Deal Flow Report! This is our fifth annual report, showcasing many of the companies that are starting, growing, and thriving in Idaho. The report confirms that Idaho continues to experience rapid growth and to be one of the best places in the country to do business! The data collected demonstrates the strong Idaho economy which is driving a demand for more talent and supports increased capital investment. Presenting Sponsor Hosting Sponsor In 2018, Idaho was recognized as the fastest growing state in the country. Idaho’s businesses are receiving increased attention and investment dollars from capital providers within the state and from around the country. More venture capital, private equity and angel funds are coming to Idaho to find new investment opportunities in Idaho companies. We want to recognize the many capital providers, service providers, and supporters of the Idaho entrepreneurial ecosystem, and especially the entrepreneurs and innovators who make Idaho such a great place! The most rewarding trend that we’ve seen over the last five years is the Sponsors reinvestment into the local economy by the entrepreneurs who have successful built and sold their business and used a portion of the funds to reinvest into the next generation of entrepreneurs and businesses. This trend is propelling Idaho’s growth even further and we believe it is key to Idaho’s future success. Community Venture Sponsors We would like to thank the members of this year’s Deal Flow Committee, and the various sponsors who supported our efforts, and congratulate the companies whose transactions are featured in this year’s report. -

A Big Bet on Game-Changing ADHD Treatment

20131202-NEWS--0001-NAT-CCI-CN_-- 11/27/2013 4:21 PM Page 1 CRAIN’S® NEW YORK BUSINESS VOL. XXIX, NO. 48 WWW.CRAINSNEWYORK.COM DECEMBER 2-8, 2013 PRICE: $3.00 Ice,Ice, ice,ice, maybemaybe Now-or-never vote on Bronx GOAL: Ice center CEO and hockey legend armory rink plan Mark Messier says the $275 million complex tests new norms will reap economic for development benefits for the Bronx. BY THORNTON MCENERY If there is one word in real estate circles that conveys the new poli- tics of commercial development in New York, it is Kingsbridge. The name of a long-shuttered Bronx armory, it connotes a semi- nal moment in the annals of city projects. Just as the failed Westway highway proposal of the 1970s and ’80s showed the power of environ- mentalism to kill a project, Kings- bridge did so for the cause of so- called living-wage jobs. In two weeks, almost four years to the day after a mall planned for the cavernous armory was defeat- ed by Bronx politicians, the final chapter in the Kingsbridge politi- cal saga is expected to be written. Having rejected the mall plan for See KINGSBRIDGE on Page 45 buck ennis A big bet on game-changing ADHD treatment deluxe version that will be released heart and lungs. the game,with a control group,is set Brain-to-computer interface tracks kids’ commercially for 8- to That,at least,is the idea.The chil- to begin on the Upper West Side focus; clinical study in city set to launch 12-year-olds next sum- dren, who play for 20 minutes with children at the Hallowell Cen- mer by Waltham,Mass.- three times a week,are part of ter, which specializes in treating at- based startup Atentiv. -

The-Cypress-Of-Charlotte-2019 0.Pdf

DISCLOSURE STATEMENT (Information Booklet) THE CYPRESS of Charlotte 3442 Cypress Club Drive Charlotte, North Carolina 28210 (704) 714-5500 June 1, 2019 THE CYPRESS OF CHARLOTTE MUST DELIVER A DISCLOSURE STATEMENT TO A PROSPECTIVE MEMBER PRIOR TO OR AT THE TIME A PROSPECTIVE MEMBER EXECUTES A MEMBERSHIP AGREEMENT (RESIDENCY AGREEMENT) TO PROVIDE CONTINUING CARE, OR PRIOR TO OR AT THE TIME A PROSPECTIVE MEMBER TRANSFERS ANY MONEY OR OTHER PROPERTY TO THE CYPRESS OF CHARLOTTE, WHICHEVER OCCURS FIRST. THE CYPRESS OF CHARLOTTE, LIKE ALL OTHER CONTINUING CARE FACILITIES IN THE STATE OF NORTH CAROLINA, IS SUBJECT TO AN ARTICLE CONCERNING REGISTRATION AND DISCLOSURE BY CONTINUING CARE FACILITIES (THE "ARTICLE"). REGISTRATION UNDER THE ARTICLE DOES NOT CONSTITUTE APPROVAL, RECOMMENDATION, OR ENDORSEMENT OF THE CYPRESS OF CHARLOTTE BY THE DEPARTMENT OF INSURANCE OR THE STATE OF NORTH CAROLINA, NOR DOES SUCH REGISTRATION EVIDENCE THE ACCURACY OR COMPLETENESS OF THE INFORMATION IN THIS DISCLOSURE STATEMENT. Unless earlier revised, The Cypress intends for this Disclosure Statement to remain effective until October 28, 2020. 816211 TABLE OF CONTENTS Page Introduction .................................................................................................................... 4 I. THE PEOPLE Overview ............................................................................................................ 5 The Cypress Group, LLC ................................................................................... 5 The Cypress of Charlotte, -

The Rise of Private Equity Media Ownership in the United States: a Public Interest Perspective

City University of New York (CUNY) CUNY Academic Works Publications and Research Queens College 2009 The Rise of Private Equity Media Ownership in the United States: A Public Interest Perspective Matthew Crain CUNY Queens College How does access to this work benefit ou?y Let us know! More information about this work at: https://academicworks.cuny.edu/qc_pubs/171 Discover additional works at: https://academicworks.cuny.edu This work is made publicly available by the City University of New York (CUNY). Contact: [email protected] International Journal of Communication 2 (2009), 208-239 1932-8036/20090208 The Rise of Private Equity Media Ownership in the United States: ▫ A Public Interest Perspective MATTHEW CRAIN University of Illinois, Urbana-Champaign This article examines the logic, scope, and implications of the influx of private equity takeovers in the United States media sector in the last decade. The strategies and aims of private equity firms are explained in the context of the financial landscape that has allowed them to flourish; their aggressive expansion into media ownership is outlined in detail. Particular attention is paid to the public interest concerns raised by private equity media ownership relating to the frenzied nature of the buyout market, profit maximization strategies, and the heavy debt burdens imposed on acquired firms. The article concludes with discussion of the challenges posed by private equity to effective media regulation and comparison of private equity and corporate media ownership models. The media sector in the United States is deeply and historically rooted in the capitalist system of private ownership. The structures and demands of private ownership foundationally influence the management and operation of media firms, which must necessarily serve the ultimate end of profitability within such a system. -

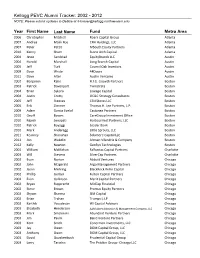

Kellogg PEVC Alumni Tracker: 2002 - 2012 NOTE: Please Submit Updates to Debbie at [email protected]

Kellogg PEVC Alumni Tracker: 2002 - 2012 NOTE: Please submit updates to Debbie at [email protected] Year First Name Last Name Fund Metro Area 2006 Christopher Mitchell Roark Capital Group Atlanta 2007 Andrea Malik Roe CRH Holdings, LLC Atlanta 2007 Peter Pettit MSouth Equity Partners Atlanta 2010 Kenny Shum Stone Arch Capital Atlanta 2004 Jesse Sandstad EquityBrands LLC Austin 2004 Harold Marshall Long Branch Capital Austin 2005 Jeff Turk Council Oak Investors Austin 2009 Dave Wride 44Doors Austin 2011 Dave Alter Austin Ventures Austin 2002 Benjamin Kahn H.I.G. Growth Partners Boston 2003 Patrick Davenport Twinstrata Boston 2004 Brian Sykora Lineage Capital Boston 2004 Justin Crotty OC&C Strategy Consultants Boston 2005 Jeff Steeves CSN Stores LLC Boston 2005 Erik Zimmer Thomas H. Lee Partners, L.P. Boston 2009 Adam Garcia Evelof Castanea Partners Boston 2010 Geoff Bowes CareGroup Investment Office Boston 2010 Rajesh Senapati HarbourVest Partners, LLC Boston 2010 Patrick Boyaggi Leader Bank Boston 2010 Mark Anderegg Little Sprouts, LLC Boston 2011 Kearney Shanahan Solamere Capital LLC Boston 2012 Jon Wakelin Altman Vilandrie & Company Boston 2012 Kelly Newton GenSyn Technologies Boston 2003 William McMahan Falfurrias Capital Partners Charlotte 2003 Will Stevens SilverCap Partners Charlotte 2002 Evan Norton Abbott Ventures Chicago 2002 John Fitzgerald Argo Management Partners Chicago 2002 Jason Mehring BlackRock Kelso Capital Chicago 2002 Phillip Gerber Fulton Capital Partners Chicago 2002 Evan Gallinson Merit Capital Partners -

Investment Committee Memorandum NB PA Co-Investment Fund LP

Investment Committee Memorandum NB PA Co-investment Fund LP Private Equity Asset Class February 25, 2020 Page 1 PA SERS Private Equity Investment Recommendation Investment Recommendation SERS’ Investment Office Staff recommend that the State Employees’ Retirement System Investment Committee, subject to further legal due diligence, interview Neuberger Berman Alternative Advisors, LLC (“Neuberger Berman”, “NB” or the “Firm”) at the February 25, 2020 Investment Committee Meeting to consider a potential investment of up to $200 million to a separately managed account named the NB PA Co-investment Fund LP (“the SMA”, or the “Partnership”). SERS has not previously held an investing relationship with Neuberger Berman. As this SMA has been directly negotiated to have a custom investment mandate for SERS, it is a fund of one and the proposed commitment will be the fund size. Furthermore, there is no firm closing schedule, but SERS has agreed to target completing legal due diligence and closing by June 30, 2020 should approval be attained. Investment Rationale Staff identified NB PA Co-investment Fund as a strong candidate for SERS’ capital commitment as it offers: ➢ SMA strategy represents meaningful step forward in achieving funding objectives set out in PPMAIRC report; ➢ Bespoke co-investment solution crafted to satisfy numerous SERS objectives; ➢ Partnership with a top performing co-investment intermediary; ➢ High level of coverage with SERS’ existing core PE managers determined by cross checking Neuberger Berman track record and reference calls with SERS’ PE managers. SERS will benefit from joining with Neuberger Berman’s existing capacity, relationship history and negotiating power; ➢ Extendibility of partnership to other parts of Neuberger Berman’s platform including secondaries and private credit. -

Private Equity Investment in the Landscape Industry February 2016 PRIVATE EQUITY INVESTMENT in the LANDSCAPE INDUSTRY

Private Equity Investment in the Landscape Industry February 2016 PRIVATE EQUITY INVESTMENT IN THE LANDSCAPE INDUSTRY PRIVATE EQUITY INVESTMENT IN THE LANDSCAPE INDUSTRY Index To our clients and friends ........................................................................... 2 Private Equity Investment in the Landscape Industry ................... 3 A Survey of Private Equity Investment ................................................. 4 Recent Transactions ...................................................................................... 4 International Activity .................................................................................... 5 Transaction Structures ................................................................................. 5 Valuation Trends ............................................................................................. 6 How Private Equity Approaches Business Development .............. 6 Typical Targets ................................................................................................ 7 Conclusion .......................................................................................................... 8 Table 1 – Private Equity Investment in the Landscape Industry and Related .......................................................................... 9 Table 2 – Private Equity Investment in the Landscape Industry and Related – Exits ........................................................ 11 Private Equity Terminology ................................................................... -

2019 ACG Richmond Investor Profile Report Print Ready

PRESENTED BY ® 2019 ACG RICHMOND VIGINIA CAPITAL CONNECTION Investor Profile Report PRESENTED BY THE JEFFERSON HOTEL OCTOBER 2-3, 2019 Glossary Business Description: All investments by industry: A description of the firm’s primary type, Graph of transactions by industry, represented in preferences and location. PitchBook is an the PitchBook Platform. This breakdown is based impartial information provider on primary industries of the portfolio/serviced and will remove promotional language. companies. Assets under management (AUM): Specific to Lender Profiles The amount of money that the investor manages Total debt financings: for clients based on number of currently-managed The number of entities identified by PitchBook that funds. received debt financing from the firm in the last five years. Active private equity investments: The number of active companies in the investor’s Target debt financing amount: current portfolio identified by PitchBook in the Preferred amount of debt typically provided by last five years. This includes add-on transactions. the firm in a transaction. Total private equity investments: Specific to Service Provider Profiles The total number of companies in the investor’s Total transactions: portfolio, identified by PitchBook in the last five The number of transactions identified by years. This includes add-on transactions. PitchBook that the firm has provided service on in the last five years. Target EBITDA: Preferred EDITDA range targeted for investment. Total companies serviced: The number of unique companies the firm has Target revenue: provided service to in the last five years, identified Preferred revenue range targeted for investment. by PitchBook. Preferred investment amount: Total investors serviced: Preferred investment amount range that the firm The number of unique investors identified by typically invests in PitchBook that the firm has provided service to in a transaction.