37 Correspondence Analysis of Indonesian Retail

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Anthropological Science 110(2), 165-177, 2002 Preliminary

Anthropological Science 110(2), 165-177, 2002 Preliminary Observation of a New Cranium of •ôNH•ôHomoerectus•ôNS•ô (Tjg-1993.05) from Sangiran, Central Jawa Johan Arif1, Yousuke Kaifu2, Hisao Baba2, Made Emmy Suparka1, Yahdi Zaim1, and Takeshi Setoguchi3 1 Department of Geology, Institute of Technology Bandung, Indonesia 2 Department of Anthropology , National Science Museum, Tokyo 3 Department of Geology and Mineralogy , Faculty of Science, Kyoto University, Kyoto (Received October 5, 2001; accepted February 13, 2002) Abstract In May of 1993, a new well-preserved hominid skull was recovered from the Bapang (Kabuh) Formation of the Sangiran region, Central Jawa. In this paper, we provisionally describe the skull and compare it with •ôNH•ôHomo erectus•ôNS•ô.crania from Jawa and China. The new skull possesses a series of characteristic features of Asian •ôNH•ôH.erectus•ôNS•ô in overall size and shape of the vault, the expression of various ectocranial structures, and other details. Among three geographical and chronolog icalsubgroups of Asian •ôNH•ôH.erectus•ôNS•ô, the new skull shows affinities with the Jawanese Early Pleistocene subgroup (specimens from the Sangiran and Trinil regions), as expected from its provenance. •ôGH•ô Keywords•ôGS•ô: •ôNH•ôHomo erectus•ôNS•ô,human evolution, Indonesia, paleoanthropology Introduction In May of 1993, a new hominid skull of an adult individual was recovered from the Sangiran area, Central Jawa (Figs. 1 and 2). There is no formal specimen number for this skull. Sartono called it Skull IX, and Larick et al. (2001) provisionally la beledit as Tjg-1993.05. The discovery of the skull was first announced in academic meetings in the Netherlands (Sartono et al, 1995), Indonesia (Sartono and Tyler, 1993), and America (Tyler et al., 1994). -

Another Look at the Jakarta Charter Controversy of 1945

Another Look at the Jakarta Charter Controversy of 1945 R. E. Elson* On the morning of August 18, 1945, three days after the Japanese surrender and just a day after Indonesia's proclamation of independence, Mohammad Hatta, soon to be elected as vice-president of the infant republic, prevailed upon delegates at the first meeting of the Panitia Persiapan Kemerdekaan Indonesia (PPKI, Committee for the Preparation of Indonesian Independence) to adjust key aspects of the republic's draft constitution, notably its preamble. The changes enjoined by Hatta on members of the Preparation Committee, charged with finalizing and promulgating the constitution, were made quickly and with little dispute. Their effect, however, particularly the removal of seven words stipulating that all Muslims should observe Islamic law, was significantly to reduce the proposed formal role of Islam in Indonesian political and social life. Episodically thereafter, the actions of the PPKI that day came to be castigated by some Muslims as catastrophic for Islam in Indonesia—indeed, as an act of treason* 1—and efforts were put in train to restore the seven words to the constitution.2 In retracing the history of the drafting of the Jakarta Charter in June 1945, * This research was supported under the Australian Research Council's Discovery Projects funding scheme. I am grateful for the helpful comments on and assistance with an earlier draft of this article that I received from John Butcher, Ananda B. Kusuma, Gerry van Klinken, Tomoko Aoyama, Akh Muzakki, and especially an anonymous reviewer. 1 Anonymous, "Naskah Proklamasi 17 Agustus 1945: Pengkhianatan Pertama terhadap Piagam Jakarta?," Suara Hidayatullah 13,5 (2000): 13-14. -

The Pesantren in Banten: Local Wisdom and Challenges of Modernity

The Pesantren in Banten: Local Wisdom and Challenges of Modernity Mohamad Hudaeri1, Atu Karomah2, and Sholahuddin Al Ayubi3 {[email protected], [email protected], [email protected]} Faculty of Ushuluddin and Adab, State Islamic University SMH Banten, Jl. Jend. Sudirman No. 30, Serang, Indonesia1 Faculty of Syariah, State Islamic University SMH Banten, Jl. Jend. Sudirman No. 30, Serang, Indonesia2 Faculty of Ushuluddin and Adab, State Islamic University SMH Banten, Jl. Jend. Sudirman No. 30, Serang, Indonesia3 Abstract. Pesantrens (Islamic Boarding School) are Islamic educational institutions in Indonesia that are timeless, because of their adaptability to the development of society. These educational institutions develop because they have the wisdom to face changes and the ability to adapt to the challenges of modernity. During the colonial period, pesantren adapted to local culture so that Islam could be accepted by the Banten people, as well as a center of resistance to colonialism. Whereas in contemporary times, pesantren adapted to the demands of modern life. Although due to the challenges of modernity there are various variants of the pesantren model, it is related to the emergence of religious ideology in responding to modernity. The ability of pesantren in adapting to facing challenges can‘t be separated from the discursive tradition in Islam so that the scholars can negotiate between past practices as a reference with the demands of the age faced and their future. Keywords: pesantren, madrasa, Banten, a discursive tradition. 1. Introduction Although Islamic educational institutions (madrasa and pesantren) have an important role in the Muslim community in Indonesia and in other Muslim countries, academic studies that discuss them are still relatively few. -

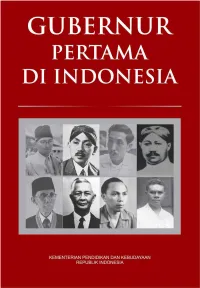

Teuku Mohammad Hasan (Sumatra), Soetardjo Kartohadikoesoemo (Jawa Barat), R

GUBERNUR PERTAMA DI INDONESIA GUBERNUR PERTAMA DI INDONESIA KEMENTERIAN PENDIDIKAN DAN KEBUDAYAAN REPUBLIK INDONESIA GUBERNUR PERTAMA DI INDONESIA PENGARAH Hilmar Farid (Direktur Jenderal Kebudayaan) Triana Wulandari (Direktur Sejarah) NARASUMBER Suharja, Mohammad Iskandar, Mirwan Andan EDITOR Mukhlis PaEni, Kasijanto Sastrodinomo PEMBACA UTAMA Anhar Gonggong, Susanto Zuhdi, Triana Wulandari PENULIS Andi Lili Evita, Helen, Hendi Johari, I Gusti Agung Ayu Ratih Linda Sunarti, Martin Sitompul, Raisa Kamila, Taufik Ahmad SEKRETARIAT DAN PRODUKSI Tirmizi, Isak Purba, Bariyo, Haryanto Maemunah, Dwi Artiningsih Budi Harjo Sayoga, Esti Warastika, Martina Safitry, Dirga Fawakih TATA LETAK DAN GRAFIS Rawan Kurniawan, M Abduh Husain PENERBIT: Direktorat Sejarah Direktorat Jenderal Kebudayaan Kementerian Pendidikan dan Kebudayaan Jalan Jenderal Sudirman, Senayan Jakarta 10270 Tlp/Fax: 021-572504 2017 ISBN: 978-602-1289-72-3 SAMBUTAN Direktur Sejarah Dalam sejarah perjalanan bangsa, Indonesia telah melahirkan banyak tokoh yang kiprah dan pemikirannya tetap hidup, menginspirasi dan relevan hingga kini. Mereka adalah para tokoh yang dengan gigih berjuang menegakkan kedaulatan bangsa. Kisah perjuangan mereka penting untuk dicatat dan diabadikan sebagai bahan inspirasi generasi bangsa kini, dan akan datang, agar generasi bangsa yang tumbuh kelak tidak hanya cerdas, tetapi juga berkarakter. Oleh karena itu, dalam upaya mengabadikan nilai-nilai inspiratif para tokoh pahlawan tersebut Direktorat Sejarah, Direktorat Jenderal Kebudayaan, Kementerian Pendidikan dan Kebudayaan menyelenggarakan kegiatan penulisan sejarah pahlawan nasional. Kisah pahlawan nasional secara umum telah banyak ditulis. Namun penulisan kisah pahlawan nasional kali ini akan menekankan peranan tokoh gubernur pertama Republik Indonesia yang menjabat pasca proklamasi kemerdekaan Indonesia. Para tokoh tersebut adalah Teuku Mohammad Hasan (Sumatra), Soetardjo Kartohadikoesoemo (Jawa Barat), R. Pandji Soeroso (Jawa Tengah), R. -

Exploring the History of Indonesian Nationalism

University of Vermont ScholarWorks @ UVM Graduate College Dissertations and Theses Dissertations and Theses 2021 Developing Identity: Exploring The History Of Indonesian Nationalism Thomas Joseph Butcher University of Vermont Follow this and additional works at: https://scholarworks.uvm.edu/graddis Part of the Asian History Commons, and the South and Southeast Asian Languages and Societies Commons Recommended Citation Butcher, Thomas Joseph, "Developing Identity: Exploring The History Of Indonesian Nationalism" (2021). Graduate College Dissertations and Theses. 1393. https://scholarworks.uvm.edu/graddis/1393 This Thesis is brought to you for free and open access by the Dissertations and Theses at ScholarWorks @ UVM. It has been accepted for inclusion in Graduate College Dissertations and Theses by an authorized administrator of ScholarWorks @ UVM. For more information, please contact [email protected]. DEVELOPING IDENTITY: EXPLORING THE HISTORY OF INDONESIAN NATIONALISM A Thesis Presented by Thomas Joseph Butcher to The Faculty of the Graduate College of The University of Vermont In Partial Fulfillment of the Requirements for the Degree of Master of Arts Specializing in History May, 2021 Defense Date: March 26, 2021 Thesis Examination Committee: Erik Esselstrom, Ph.D., Advisor Thomas Borchert, Ph.D., Chairperson Dona Brown, Ph.D. Cynthia J. Forehand, Ph.D., Dean of the Graduate College Abstract This thesis examines the history of Indonesian nationalism over the course of the twentieth century. In this thesis, I argue that the country’s two main political leaders of the twentieth century, Presidents Sukarno (1945-1967) and Suharto (1967-1998) manipulated nationalist ideology to enhance and extend their executive powers. The thesis begins by looking at the ways that the nationalist movement originated during the final years of the Dutch East Indies colonial period. -

Cover + Tulisan Prof Dudung, Religious

Adab-International Conference on Information and Cultural Sciences 2020 Yogyakarta, October 19th-22nd, 2020 ISSN: 2715-0550 RELIGIOUS MODERATION IN THE TRADITION OF CONTEMPORARY SUFISM IN INDONESIA Dudung Abdurahman A. Preface Islamic religious life in Indonesia has recently grown in diversity and massive differences. Therefore, efforts to seek religious moderation are carried out by various parties in order to find alternative methods, models or solutions for overcoming various symptoms of conflict, and finding a harmony atmosphere of the people in this country. The search for a model of religious moderation can actually be carried out on its potential in the realm of Islam itself. As is well known, the Islamic teaching system is based on the Quran and Hadith, then it becomes the Islamic trilogy: Aqidah (belief), Syari'ah (worship and muamalah), and Akhlak (tasawwuf). Each of these aspects developed in the thought of the scholars who gave birth to various ideologies and genres according to the historical and socio- cultural context of the Muslim community. Meanwhile, tasawuf or sufism is assumed to have more unique and significant potential for religious moderation, because Sufism which is oriented towards the formation of Islam is moderate, both in thought, movement and religious behavior in Muslim societies. The general significance of Sufism can be seen in its history in the spread of Islam to various parts of the world. John Renard, for example, mentions that Sufism plays a conducive role for the spread of Islam, because Sufism acts as a "mystical expression of the Islamic faith" (Renard, 1996: 307). Similarly, Marshall G.S. -

Islamic Law and Social Change

ISLAMIC LAW AND SOCIAL CHANGE: A COMPARATIVE STUDY OF THE INSTITUTIONALIZATION AND CODIFICATION OF ISLAMIC FAMILY LAW IN THE NATION-STATES EGYPT AND INDONESIA (1950-1995) Dissertation zur Erlangung der Würde des Doktors der Philosophie der Universität Hamburg vorgelegt von Joko Mirwan Muslimin aus Bojonegoro (Indonesien) Hamburg 2005 1. Gutachter: Prof. Dr. Rainer Carle 2. Gutachter: Prof. Dr. Olaf Schumann Datum der Disputation: 2. Februar 2005 ii TABLE OF RESEARCH CONTENTS Title Islamic Law and Social Change: A Comparative Study of the Institutionalization and Codification of Islamic Family Law in the Nation-States Egypt and Indonesia (1950-1995) Introduction Concepts, Outline and Background (3) Chapter I Islam in the Egyptian Social Context A. State and Islamic Political Activism: Before and After Independence (p. 49) B. Social Challenge, Public Discourse and Islamic Intellectualism (p. 58) C. The History of Islamic Law in Egypt (p. 75) D. The Politics of Law in Egypt (p. 82) Chapter II Islam in the Indonesian Social Context A. Towards Islamization: Process of Syncretism and Acculturation (p. 97) B. The Roots of Modern Islamic Thought (p. 102) C. State and Islamic Political Activism: the Formation of the National Ideology (p. 110) D. The History of Islamic Law in Indonesia (p. 123) E. The Politics of Law in Indonesia (p. 126) Comparative Analysis on Islam in the Egyptian and Indonesian Social Context: Differences and Similarities (p. 132) iii Chapter III Institutionalization of Islamic Family Law: Egyptian Civil Court and Indonesian Islamic Court A. The History and Development of Egyptian Civil Court (p. 151) B. Basic Principles and Operational System of Egyptian Civil Court (p. -

H. Bachtiar Bureaucracy and Nation Formation in Indonesia In

H. Bachtiar Bureaucracy and nation formation in Indonesia In: Bijdragen tot de Taal-, Land- en Volkenkunde 128 (1972), no: 4, Leiden, 430-446 This PDF-file was downloaded from http://www.kitlv-journals.nl Downloaded from Brill.com09/26/2021 09:13:37AM via free access BUREAUCRACY AND NATION FORMATION IN INDONESIA* ^^^tudents of society engaged in the study of the 'new states' in V J Asia and Africa have often observed, not infrequently with a note of dismay, tihe seeming omnipresence of the government bureau- cracy in these newly independent states. In Indonesia, for example, the range of activities of government functionaries, the pegawai negeri in local parlance, seems to be un- limited. There are, first of all and certainly most obvious, the large number of people occupying official positions in the various ministries located in the captital city of Djakarta, ranging in each ministry from the authoritative Secretary General to the nearly powerless floor sweepers. There are the territorial administrative authorities, all under the Minister of Interna! Affairs, from provincial Governors down to the village chiefs who are electecl by their fellow villagers but who after their election receive their official appointments from the Govern- ment through their superiors in the administrative hierarchy. These territorial administrative authorities constitute the civil service who are frequently idenitified as memibers of the government bureaucracy par excellence. There are, furthermore, as in many another country, the members of the judiciary, personnel of the medical service, diplomats and consular officials of the foreign service, taxation officials, technicians engaged in the construction and maintenance of public works, employees of state enterprises, research •scientists, and a great number of instruc- tors, ranging from teachers of Kindergarten schools to university professors at the innumerable institutions of education operated by the Government in the service of the youthful sectors of the population. -

The Partai Nasional Indonesia, 1963

THE PARTAI NASIONAL INDONESIA 1963-1965 J. Eliseo Rocamora Reputations once acquired are hard to shed. The stereotype of the Partai Nasional Indonesia (PNI) as an opportunist, conservative party composed of Javanese prijaji elements remains despite basic changes which occurred within the party in the later years of Guided Democracy. Tljis undifferentiated image of the PNI arose in the early 1950's and, for that time, it represented a fairly accurate, though limited, description. As the party began to change under the impetus of Guided Democracy politics and the push of internal party dynamics, Indonesian and foreign observers either disregarded the party alto gether or tended to seek explanations for these changes in outside factors." Thus, the PNI's "turn to the left," in the 1963 to 1965 period, was termed variously as: an opportunistic response to the increasingly leftist politics of Guided Democracy; the result of strong pressure from President Sukarno; or the work of PKI (Communist Party) infiltration of the party leadership. The fact that Djakarta's political cognoscenti-- journalists and intellectuals--continue to espouse and disseminate this interpreta tion reflects biases born of their own political attitudes and in volvement. A similarly-limited view of the PNI in Western academic literature is in part the result of the paucity of work on the Guided Democracy period and in part a consequence of an excessive concentra tion on a few actors at the center. The generally-accepted framework for analyzing Guided Democracy politics1--a three-sided triangle made up of Sukarno, the Army and the PKI--only explains certain facets of Indonesian politics, that is, the major battles for ideological and institutional predominance. -

Rewriting Indonesian History the Future in Indonesia’S Past

No. 113 Rewriting Indonesian History The Future in Indonesia’s Past Kwa Chong Guan Institute of Defence and Strategic Studies Singapore June 2006 With Compliments This Working Paper series presents papers in a preliminary form and serves to stimulate comment and discussion. The views expressed are entirely the author’s own and not that of the Institute of Defence and Strategic Studies The Institute of Defence and Strategic Studies (IDSS) was established in July 1996 as an autonomous research institute within the Nanyang Technological University. Its objectives are to: • Conduct research on security, strategic and international issues. • Provide general and graduate education in strategic studies, international relations, defence management and defence technology. • Promote joint and exchange programmes with similar regional and international institutions; and organise seminars/conferences on topics salient to the strategic and policy communities of the Asia-Pacific. Constituents of IDSS include the International Centre for Political Violence and Terrorism Research (ICPVTR), the Centre of Excellence for National Security (CENS) and the Asian Programme for Negotiation and Conflict Management (APNCM). Research Through its Working Paper Series, IDSS Commentaries and other publications, the Institute seeks to share its research findings with the strategic studies and defence policy communities. The Institute’s researchers are also encouraged to publish their writings in refereed journals. The focus of research is on issues relating to the security and stability of the Asia-Pacific region and their implications for Singapore and other countries in the region. The Institute has also established the S. Rajaratnam Professorship in Strategic Studies (named after Singapore’s first Foreign Minister), to bring distinguished scholars to participate in the work of the Institute. -

Daulat Ra'jat, Tahun Ke-4 No. 89, 28 Februari-10 Maret 1934

DAFTAR PUSTAKA Dokumen Administratie, “Penting dan Ringkas”, Daulat Ra’jat, Tahun ke-4 No. 89, 28 Februari-10 Maret 1934. A. Doeja, “Diatas Djalan ke Indonesia Merdeka”, Daulat Ra’jat, Tahun ke-4 No. 88, 20 Februari 1934. A. Doeja, “Tjita-Tjita Indonesia Merdeka”, Daulat Ra’jat, Tahun ke-3 No. 83, 30 Desember 1933. Arabindon Chose, “Sekedar Tentang Azas, Taktiek dan Strategie Perdjoangan Kita”, Daulat Ra’jat, Tahun ke-1 No. 3, 10 Oktober 1931. Dar-Tyb, “Kera’jatan dan Pimpinan dalam: Pergerakan Kemerdikaan Indonesia”, Daulat Ra’jat, Tahun ke-1 No. 4, 20 Oktober 1931. Dar-Tyb, “Kodrat Perdjoangan Indonesia Merdeka”, Daulat Ra’jat, Tahun ke-1 No. 10, 20 Desember 1931. Daulat Ra’jat, Tahun ke-1 No. 1, 20 September 1931. Daulat Ra’jat Tahun ke-1 No.1, 20 September 1931 sampai Tahun ke-3, 10 September 1934. Daulat Ra’jat, Tahun ke-4 No. 102, 20 Juli 1934. Daulat Ra’jat, Tahun ke-4 No. 107, 10 September 1934. Ismoe-Hadiwidjaja, “Indonesia-Merdeka”, Daulat Ra’jat, Tahun ke-1 No. 3, 10 Oktober 1931. Jr. A. D. Darwisj M. R., “Barat Bersombong Diri, Indonesia Menoentoet Kemerdekaannja”, Daulat Ra’jat, Tahun ke-2 No. 13, 20 Januari 1932. Jr. A. D. Darwisj M.R., “Minangkabau”, Daulat Ra’jat, Tahun ke-1 No. 9, 10 Desember 1931. Kanta-Atmaca c.s., “Makloemat: pada mendirikan CLUB PENDIDIKAN NASIONAL INDONESIA di Djakarta, Malang, Palembang, dan Soerabaja”, Daulat Ra’jat, Tahun ke-1 No. 1, 20 September 1931. 91 Loekman, “Intellectueelen-Kromo dan Kader-Kader Marhaen”, Daulat Ra’jat, Tahun ke-2 No. -

Kata Pengantar

KATA PENGANTAR Undang-Undang No. 43 Tahun 2009 tentang Kearsipan mengamanatkan Arsip Nasional Republik Indonesia (ANRI) untuk melaksanakan pengelolaan arsip statis berskala nasional yang diterima dari lembaga negara, perusahaan, organisasi politik, kemasyarakatan dan perseorangan. Pengelolaan arsip statis bertujuan menjamin keselamatan dan keamanan arsip sebagai bukti pertanggungjawaban nasional dalam kehidupan bermasyarakat, berbangsa dan bernegara. Arsip statis yang dikelola oleh ANRI merupakan memori kolektif, identitas bangsa, bahan pengembangan ilmu pengetahuan, dan sumber informasi publik. Oleh karena itu, untuk meningkatkan mutu pengolahan arsip statis, maka khazanah arsip statis yang tersimpan di ANRI harus diolah dengan benar berdasarkan kaidah-kaidah kearsipan sehingga arsip statis dapat ditemukan dengan cepat, tepat dan lengkap. Pada tahun anggaran 2016 ini, salah satu program kerja Sub Bidang Pengolahan Arsip Pengolahan I yang berada di bawah Direktorat Pengolahan adalah menyusun Guide Arsip Presiden RI: Sukarno 1945-1967. Guide arsip ini merupakan sarana bantu penemuan kembali arsip statis bertema Sukarno sebagai Presiden dengan kurun waktu 1945-1967 yang arsipnya tersimpan dan dapat diakses di ANRI. Seperti kata pepatah, “tiada gading yang tak retak”, maka guide arsip ini tentunya belum sempurna dan masih ada kekurangan. Namun demikian guide arsip ini sudah dapat digunakan sebagai finding aid untuk mengakses dan menemukan arsip statis mengenai Presiden Sukarno yang tersimpan di ANRI dalam rangka pelayanan arsip statis kepada pengguna arsip (user). Akhirnya, kami mengucapkan banyak terima kasih kepada pimpinan ANRI, anggota tim, Museum Kepresidenan, Yayasan Bung Karno dan semua pihak yang telah membantu penyusunan guide arsip ini hingga selesai. Semoga Allah SWT, Tuhan Yang Maha Esa membalas amal baik yang telah Bapak/Ibu/Saudara berikan.