INDEX FACT SHEET INDONESIA STOCK EXCHANGE January 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report 2018 Laporan Tahunan 2018

Inovasi dan Digitalisasi: Menciptakan Nilai untuk Tumbuh Secara Berkelanjutan Innovation and Digitalization: Creating Value to Sustain Growth PT Astra International Tbk Laporan Tahunan 2018 Annual Report Laporan Tahunan 2018 Annual Report Innovation and Digitalization: Creating Value to Sustain Growth Amidst challenges in the economy and business throughout 2018, Astra Group maintained the sustainability of its business by continuing to build its capabilities focusing on four core areas: continuous innovation, developing globally oriented employees, being an agile organization, and being a partner of choice. Also, in the face of massive, rapid and unpredictable changes in the business landscape, Astra Group has stepped-up its digitalization initiatives to drive more effective business processes, optimize market penetration capability, and introduce various innovations and new services on digital platforms. By building digital capabilities while continuing to encourage the creation of added value for its customers, employees, business partners, shareholders and the people of Indonesia, Astra Group moves forward in its strategic journey towards the Pride of the Nation. Laporan Tahunan 2018 Annual Report ASTRA 1 Highlights Management Reports Company Profile Human Capital Management Discussion and Analysis Corporate Governance Corporate Social Responsibility Consolidated Financial Statements 2018 Inovasi dan Digitalisasi: Menciptakan Nilai untuk Tumbuh Secara Berkelanjutan Di tengah berbagai tantangan perekonomian dan bisnis sepanjang tahun -

State-Owned Enterprise Governance and Privatization Program

Completion Report Project Number: 32517 Loan Number: 1866 November 2008 Indonesia: State-Owned Enterprise Governance and Privatization Program CURRENCY EQUIVALENTS Currency Unit – rupiah (Rp) At Appraisal At Program Completion (28 February 2000) (7 October 2005) Rp1.00 = $0.000137 $0.000097 $1.00 = Rp7,305 Rp10,305 ABBREVIATIONS ADB – Asian Development Bank MOF – Ministry of Finance MSOE – Ministry of State-Owned Enterprises OECD – Organisation for Economic Co-operation and Development PPP – public-private partnership PSO – public service obligation SCI – statement of corporate intent SOE – state-owned enterprise TA – technical assistance NOTES (i) The fiscal year (FY) of the Government ends on 31 December. “FY” before a calendar year denotes the year in which the fiscal year ends. (ii) In this report, “$” refers to US dollars. Vice President C. Lawrence Greenwood, Jr., Operations Group 2 Director General A. Thapan, Southeast Asia Department (SERD) Director J. Ahmed, Governance, Finance, and Trade Division, SERD Team leader K.-P. Kriegsmann, Senior Financial Sector Specialist, SERD CONTENTS Page BASIC DATA i I. PROGRAM DESCRIPTION 1 II. EVALUATION OF DESIGN AND IMPLEMENTATION 2 A. Relevance of Design and Formulation 2 B. Program Outputs 3 C. Program Costs and Disbursements 10 D. Program Schedule 10 E. Implementation Arrangements 10 F. Conditions and Covenants 11 G. Related Technical Assistance 11 H. Consultant Recruitment and Procurement 12 I. Performance of Consultants, Contractors, and Suppliers 12 J. Performance of the Borrower and the Executing Agency 12 K. Performance of the Asian Development Bank 12 III. EVALUATION OF PERFORMANCE 13 A. Relevance 13 B. Effectiveness in Achieving Outcome 13 C. Efficiency in Achieving Outcome and Outputs 14 D. -

BAB I PENDAHULUAN 1.1. Profil Perusahaan 1.1.1 Gambaran

BAB I PENDAHULUAN 1.1. Profil Perusahaan 1.1.1 Gambaran Umum Perusahaan PT.Telekomunikasi Indonesia, Tbk adalah Perusahaan Perseroan (Persero) yang memiliki jaringan terbesar di Indonesia. Layanan telekomunikasi dan jaringan Telkom sangat luas dan beragam meliputi layanan dasar telekomunikasi domestik dan internasional, baik menggunakan jaringan kabel, nirkabel tidak bergerak (Code Division Multiple Access atau CDMA maupun Global System for Mobile Communication atau GSM) serta layanan interkoneksi antar operator penyedia jaringan. Sebagai BUMN, pemerintah Republik Indonesia merupakan pemegang saham mayoritas yang menguasai sebagian besar saham biasa perusahaan sedangkan sisanya dimiliki oleh Telkom. Untuk menghadapi tantangan dengan semakin meningkatnya kebutuhan akan mobilitas dan konektivitas tanpa putus, Telkom telah memperluas portofolio bisnisnya yang mencakup telekomunikasi, informasi, media dan edutainment (TIME). Dengan meningkatkan infrastruktur, memperluas teknologi Next Generation Network (NGN) dan memobilisasi sinergi di seluruh jajaran TELKOMGroup, Telkom dapat mewujudkan dan memberdayakan pelanggan ritel dan korporasi dengan memberikan kualitas, kecepatan, kehandalan dan layanan pelanggan yang lebih baik. Konsistensi Telkom dalam berinovasi telah berhasil memposisikan perusahaan sebagai salah satu perusahaan yang berdaya saing tinggi dan unggul dalam bisnis telekomunikasi. Telkom meluncurkan slogan baru, yaitu “The World in Your Hand”. Slogan tersebut menandakan bahwa, dengan adanya Telkom masyarakat diharapkan dapat merasakan -

Memberdayakan Keunggulan Internal Building up Our Natural Capabilities Building up Our Natural Capabilities

Laporan Tahunan Annual Report 2017 MEMBERDAYAKAN KEUNGGULAN INTERNAL BUILDING UP OUR NATURAL CAPABILITIES BUILDING UP OUR NATURAL CAPABILITIES The year 2017 is an important milestone as Astra commemorated the 60th year anniversary since it was first established in 1957. In Astra’s six decades of journey to aspire to “Prosper with the Nation”, Astra has transformed to become an Indonesian group company with more than 210,000 employees spread across more than 200 companies throughout Indonesia. Amid the various business challenges in 2017, Astra made breakthroughs by focusing on building our natural capabilities, such as our technical and non-technical competencies, solid company culture, established management system, wide network, strong customers’ trust and high value of Astra brand. The result was Astra generated outstanding operational and business performance in 2017. With this, Astra continue its course to reach its 2020 Goal, to be “Pride of the Nation”. 1 MEMBERDAYAKAN KEUNGGULAN INTERNAL Tahun 2017 merupakan tonggak penting perjalanan Astra yang telah mencapai usia 60 tahun sejak didirikan pada tahun 1957. Dalam perjalanan enam dasawarsa Astra dalam menginspirasi negeri sekaligus mewujudkan cita-cita “Sejahtera Bersama Bangsa”, Astra telah bertransformasi menjadi satu grup perusahaan di Indonesia yang menaungi lebih dari 210.000 karyawan yang tersebar di lebih dari 200 perusahaan di seluruh tanah air. Dalam menghadapi berbagai tantangan bisnis sepanjang tahun 2017, Astra melakukan terobosan-terobosan yang memfokuskan pada pendayagunaan kapabilitas internal berupa kompetensi teknikal dan non-teknikal yang mumpuni, budaya organisasi yang kokoh, sistem manajemen yang mapan, jaringan yang luas, kepercayaan pelanggan yang kuat dan brand value Astra yang tinggi. Hasilnya, Astra meraih kinerja operasional dan bisnis yang menggembirakan di tahun 2017. -

Nomor Surat Nama Perusahaan Kode Emiten Lampiran Perihal TEL.18/LP000/DCI-M20000004e11/2020 PT Telekomunikasi Indonesia (Persero

Go To English Page Nomor Surat TEL.18/LP000/DCI-M20000004e11/2020 Nama Perusahaan PT Telekomunikasi Indonesia (Persero) Tbk. Kode Emiten TLKM Lampiran 2 Laporan Informasi atau Fakta Material Keterbukaan Informasi atas Investasi PT Perihal Telekomunikasi Selular di PT Aplikasi Karya Anak Bangsa Dengan ini kami untuk dan atas nama perusahaan menyampaikan Laporan Informasi atau Fakta Material sebagai berikut: Nama Emiten atau Perusahaan Publik PT Telekomunikasi Indonesia (Persero) Tbk. Bidang Usaha Penyelenggara Jaringan dan Jasa Telekom Telepon (021) 5215109 Faksimili (021) 5220500 Alamat Surat Elektronik (email) [email protected] Tanggal Kejadian 16 November 2020 Jenis Informasi atau Fakta Material Keterbukaan Informasi atas Investasi PT Telekomunikasi Selular di PT Aplikasi Karya Anak Bangsa Uraian Informasi atau Fakta Material Pada tanggal 16 November 2020 di Jakarta PT Telekomunikasi Selular (“Telkomsel”) anak perusahaan dari PT Telkom Indonesia (Persero) Tbk (“Telkom”) dan PT Aplikasi Karya Anak Bangsa (“AKAB”) telah menandatangani perjanjian atas investasi senilai USD150 Juta. Investasi di AKAB dilakukan sebagai bentuk komitmen Telkomsel sebagai perusahaan telekomunikasi digital untuk memberikan layanan beyond connectivity. Telkom percaya kolaborasi ini dapat memberikan layanan dan solusi yang lebih baik kepada masyarakat dalam membangun ekosistem digital yang inklusif dan berkesinambungan. Dampak kejadian, informasi atau fakta Dengan Transaksi ini, terhitung sejak terpenuhinya segala material tersebut terhadap kegiatan syarat berdasarkan Perjanjian dan ditandatanganinya operasional, hukum, kondisi keuangan, dokumen terkait, maka Telkomsel akan memiliki investasi di atau kelangsungan usaha Emiten atau AKAB sebesar USD150 Juta. Perusahaan Publik Informasi Lain Telkomsel adalah anak perusahaan dari PT Telkom Indonesia (Persero) Tbk yang bergerak di bidang penyediaan layanan telekomunikasi selular dan produk-produk telekomunikasi digital. -

Mami 2102 (Eng)

MANULIFE DANA EKUITAS USD FEB 2021 Investment Objective Risk Classification Providing the participants with superior investment growth over the long-term by Risk classification is based on type of fund. investing the assets in a diversified portfolio of publicly listed Indonesian equities. Low Mid High Money Market Fixed Income Balanced Equity Fund Information Allocation Portfolio Inception Date :16 Oct 13 Equity :80 - 100 % Equity : 96.46% Fund Size :USD 19,971,111.44 Money Market :0 - 20 % Money Market : 3.54% Fund Currency : USD Type of fund : Equity Valuation : Daily Custodian Bank : Standard Chartered Bank Top 5 Holdings Sector Allocation 3) Annual Management Fee : 2.50% 1 Bank Central Asia 4) :USD 1.0196 2 Bank Rakyat Indonesia Financials Net Asset Value/Unit 33.46% 39.94% Bloomberg Code : MANDEKU IJ 3 Telkom Indonesia Persero Materials 4 Astra International Communication Services Performance Since Inception 5 Unilever Indonesia 12.19% 14.40% Other 1.280 Fund Performance 1.150 Performance in USD per (26/02/21) Since 1.020 1 mo 3 mo 6 mo YTD 1 yr 1) 1) 3 yr 5 yr Inception 1) 0.890 MDE (in USD) 3.52% 10.21% 19.43% 1.76% 9.52% -5.03% 1.09% 0.26% BM 2) 4.07% 9.67% 21.21% 2.05% 14.50% -3.20% 3.97% 0.78% 0.760 Yearly Performance 0.630 Total Fund Grow th : 1.96% 2020 2019 2018 2017 2016 2015 2014 2013 0.500 Oct-13 Jan-15 Mar-16 Jun-17 Sep-18 Nov-19 Feb-21 MDE (in USD) -7.61% 6.47% -12.26% 14.99% 10.85% -17.77% 23.71% n/a BM 2) -5.92% 6.13% -8.80% 19.57% 18.09% -21.35% 20.47% n/a Monthly Performance Last 3 Years Note 16.00% 1) Annualized (1 year = 365 days) and using compound method (for products that have been more than one year old 8.00% since inception). -

Corporate Presentation FY20 Results

Corporate Presentation FY20 Results PT Telkom Indonesia (Persero) Tbk May 2021 Disclaimer This document may contain forward-looking statements within the meaning of safe- harbor. Actual results could differ materially from projections, estimations or expectations. These may involve risks and uncertainties, and may cause actual results and development to differ substantially from those expressed or implied in the statements. The company does not guarantee that any action, which may have been taken in reliance of this document will bring specific results as expected. 2 FY20 Results Telkom in Brief FY20 Financial and Operational Results 3 Board of Directors CEO TELKOM GROUP DIRECTOR DIRECTOR DIRECTOR DIRECTOR RIRIEK HERI SUPRIADI HERLAN DIAN EDI ADRIANSYAH WIJANARKO RACHMAWAN WITJARA DIRECTOR DIRECTOR DIRECTOR DIRECTOR FM VENUSIANA R BUDI SETYAWAN FAJRIN AFRIWANDI TELKOM TELKOM Group WIJAYA RASYID CEO TELKOMSEL DIRECTOR DIRECTOR DIRECTOR DIRECTOR SETYANTO LEONARDUS WONG RACHEL GOH NUGROHO HANTORO WAHYU SOON NAM WASONO DIRECTOR DIRECTOR DIRECTOR Telkomsel HENDRI MULYA R. MUHARAM BHARAT ALVA SYAM PERBAWAMUKTI 4 Share Ownership 52.1% 47.9% Government Public Telkom Indonesia is listed at Indonesia Stock Exchange (Bloomberg: TLKM IJ) and New York Stock Exchange (TLK US) Total Shares 99,062,216,600 shares Market Capitalization Rp311Tn (USD21.6 Bn)* *as of April 28, 2021 5 FY20 Results Telkom in Brief FY20 Financial and Operational Results 6 FY20 Performance Highlights In FY20, Telkom recorded Rp136.5 trillion in Revenue, increased by 0.7% YoY, with EBITDA and Net Income grew by 11.2% YoY and 11.5% YoY, respectively. The strong performance was achieved during challenging situation due to COVID-19 pandemic. -

MNCS Compendium / III / September 2018 1

MNCS Compendium / III / September 2018 1 MNCS Compendium / III / September 2018 2 MNCS Compendium / III / September 2018 Contents 04 Kata Sambutan Direktur Utama Analisis Emiten MNC Group MNC Sekuritas 06 Analisis Makroekonomi 55 PT Adaro Energy Tbk 71 MNC College Wisnu Wardana 57 PT Astra International Tbk 99 PT MNC Land Tbk 10 Investment Strategy 59 PT Bank Central Asia Tbk 61 PT Bank Tabungan Negara Tbk 13 Bond Market Update 63 PT XL Axiata Tbk Appendixes 65 PT Gudang Garam Tbk 17 SGX Indonesia Equity Futures 67 PT Indofood CBP Sukses Makmur Tbk 103 MNCS Stock Universe 69 PT Japfa Comfeed Indonesia Tbk 104 Data Obligasi 75 PT Arwana Citramulia Tbk 105 Heat Map dan Nilai Tukar Analisis Sektoral 77 PT Blue Bird Tbk 106 Kalender Ekonomi 80 PT GMF Aero Asia Tbk 21 Sektor Consumer 107 Special Thanks 83 PT Buyung Poetra Sembada Tbk 24 Sektor Telecommunication 85 PT Hartadinata Abadi Tbk 27 Sektor Metal Mining 87 PT London Sumatra Indonesia Tbk 30 Sektor Automotive 89 PT Industri Jamu dan Farmasi 35 Sektor Banking Sidomuncul Tbk 38 Sektor Coal Mining 91 PT Waskita Beton Precast Tbk 41 Sektor Plantation 44 Sektor Construction 47 Sektor Cement 50 Sektor Property 53 HARA - Empowering Billions 94 Expert Talks Session Daniel Nainggolan 73 Expert Talks Session 97 Tips & Tricks from Investment Figure 102 Learn from Millenials Adrianto Djokosoetono Sukarto Bujung LastDay Production 3 MNCS Compendium / III / September 2018 Sambutan Direktur Utama MNCS Compendium Para nasabah MNC Sekuritas yang terhormat, Tidak terasa tahun 2018 akan segera berlalu. Semangat nasionalisme terasa semakin kental setelah Indonesia sukses menjadi tuan rumah dalam kompetisi olahraga Asian Games 2018. -

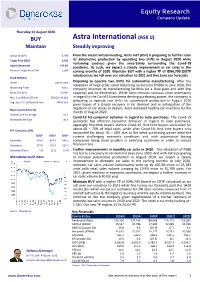

Astra International (ASII IJ) Maintain Steadily Improving

Equity Research Company Update Thursday,13 August 2020 BUY Astra International (ASII IJ) Maintain Steadily improving Last price (IDR) 5,400 From the recent virtual meeting, Astra Int’l (ASII) is preparing to further raise Target Price (IDR) 6,700 its automotive production by operating two shifts in August 2020 while remaining cautious given the uncertainty surrounding the Covid-19 Upside/Downside +24.1% pandemic. As such, we expect a steady improvement in car sales in the Previous Target Price (IDR) 5,600 coming months of 2020. Maintain BUY with a higher TP of IDR6,700 (SOTP valuation) as we roll over our valuation to 2021 and fine tune our forecasts. Stock Statistics Sector Automotive Preparing to operate two shifts for automotive manufacturing. After the relaxation of large-scale social distancing restrictions (PSBB) in June 2020, the Bloomberg Ticker ASII IJ company resumed its manufacturing facilities (at a slow pace and with low No of Shrs (mn) 40,484 capacity) and its dealerships. While Astra remains cautious amid uncertainty Mkt. Cap (IDRbn/USDmn) 218,611/14,811 in regard to the Covid-19 pandemic denting purchasing power, the company is preparing to operate two shifts for automotive production in August 2020 Avg. daily T/O (IDRbn/USDmn) 244.6/16.6 given hopes of a steady recovery in car demand and in anticipation of the Major shareholders (%) depletion of car stocks at dealers. Astra indicated healthy car inventory for the month of August 2020. Jardine Cycle & Carriage 50.1 Covid-19 hit consumer behavior in regard to auto purchases. The Covid-19 Estimated free float 49.9 pandemic has affected consumer behavior in regard to auto purchases, especially first-time buyers. -

Annu Al Report 2019

ANNUAL REPORT 2019 ANNUAL 1 ANNUAL REPORT 2019 Building on the initiatives of previous years, Telkomsel continued to expand and to enrich its digital business to shape the future through internal collaboration, synergies, and partnerships within the digital ecosystem at large. Telkomsel continued to expand and to enrich its digital business At the same time, Telkomsel strove to improve customer experience and satisfaction as key drivers of long-term success. (in billion rupiah) (in million) DIGITAL BUSINESS DATA USERS REVENUE 58,237 110.3 23.1% 3.5% DATA 50,550 LTE USERS 88.3 22.3% (in million) 61.3% DIGITAL SERVICES 7,687 29.0% 2019 63.9% DIGITAL 2018 BUSINESS 53.0% CONTRIBUTION 2 PT TELEKOMUNIKASI SELULAR IMPROVED MOMENTUM Telkomsel has successfully delivered growth and revenue from data supported by solid digital products and services offerings, as shown by TOTAL BTS improved momentum in 2019. 212,235 (in gigabyte) 12.2% CONSUMPTION/ 2019 DATA USER 3G/4G BTS 54.7% 5.2 161,938 16.7% 2018 3.4 (in terabyte) PAYLOAD 6,715,227 53.6% 3 ANNUAL REPORT 2019 Highlights of the Year 6 Key Performance Company 8 Financial Highlights at a Glance 9 Operational Highlights 10 2019 Event Highlights 52 Telkomsel in Brief 18 Awards & Accolades 53 Share Ownership History 23 ISO Certification 54 Organization Structure 54 Key Products & Services 56 Milestones Business Review Remarks from 60 Vision and Mission the Management 61 Corporate Strategy in Brief 62 Transformation Program 65 Marketing 26 Remarks from the President Commissioner 72 Digital Services 30 -

Corporate Presentation 1Q20 Results

Corporate Presentation 1Q20 Results PT Telkom Indonesia (Persero) Tbk July 2020 Disclaimer This document may contain forward-looking statements within the meaning of safe- harbor. Actual results could differ materially from projections, estimations or expectations. These may involve risks and uncertainties, and may cause actual results and development to differ substantially from those expressed or implied in the statements. The company does not guarantee that any action, which may have been taken in reliance of this document will bring specific results as expected. 2 1Q20 Results Telkom in Brief 1Q20 Financial and Operational Results Board of Directors CEO TELKOM GROUP DIRECTOR DIRECTOR DIRECTOR DIRECTOR RIRIEK HERI SUPRIADI HERLAN DIAN EDI ADRIANSYAH WIDJANARKO RACHMAWAN WITJARA DIRECTOR DIRECTOR DIRECTOR DIRECTOR FM VENUSIANA R BUDI SETYAWAN FAJRIN AFRIWANDI TELKOM TELKOM Group WIJAYA RASYID CEO TELKOMSEL DIRECTOR DIRECTOR DIRECTOR DIRECTOR SETYANTO LEONARDUS EDWARD YING RACHEL GOH RIRIN HANTORO WAHYU WIDARYANI WASONO DIRECTOR DIRECTOR DIRECTOR Telkomsel HENDRI MULYA R. MUHARAM BHARAT ALVA SYAM PERBAWAMUKTI 4 Share Ownership 52.1% 47.9% Government Public Telkom Indonesia is listed at Indonesia Stock Exchange (Bloomberg: TLKM IJ) and New York Stock Exchange (TLK US) Total Shares 99,062,216,600 shares Market Capitalization Rp302 Tn (USD21.7 Bn)* *as of Jun 30, 2020 5 1Q20 Results Telkom in Brief 1Q20 Financial and Operational Results 1Q20 Highlights Covid-19 pandemic has impacted all sectors, including in telecommunication. For Telkom, the degree of impact for each segment is different. Our well diversified revenue portfolios allow us to be less dependent on one particular segment IndiHome continued its strong momentum with revenue increased by 19.7% YoY to Rp5.1 trillion in 1Q20 driven by the increasing number of IndiHome subscribers Telkomsel's digital business grew by 16.3% YoY to Rp15.8 trillion and increased its contribution to total revenue progressively to 70.6% from 61.4% last year. -

ASIAN AUTOMOTIVE NEWSLETTER ISSUE 16, December 1999 a Bimonthly Newsletter of Developments in the Auto and Auto Components Markets

BDA Business Development Asia ASIA IS A BUSINESS IMPERATIVE NOW MORE THAN EVER ASIAN AUTOMOTIVE NEWSLETTER ISSUE 16, December 1999 A bimonthly newsletter of developments in the auto and auto components markets CONTENTS CHINA/HK INTRODUCTION .............................................. 1 Ami Doduco, a unit of Technitrol Company of CHINA / HONG KONG ................................. 1 the US and a global leader in electrical contacts, has INDIA ..................................................................... 2 agreed to acquire Tianjin Electrical Metal Works INDONESIA ........................................................ 2 (TEM), an electrical contacts business based in JAPAN ..................................................................... 3 Tianjin, from Tianjin XinHao Investment Devel- KOREA ................................................................... 3 opment Company. Ami Doduco has established a MALAYSIA ............................................................ 4 wholly-owned enterprise in Tianjin City and obtained SINGAPORE ........................................................ 5 all approvals necessary to manufacture and sell sil- THAILAND .......................................................... 5 ver-based electrical contact products used in the ap- VIETNAM ............................................................. 5 pliance, automotive and construction industries. (No- FOCUS: Fast Fit Market in Asia ....................... 6 vember 10, 1999) Daewoo Motor Co has opened three car component JV plants